How to issue money correctly

The procedure for issuing accountable amounts to employees consists of the following stages:

- The employee draws up an application from the accountable person for the issuance of money, which indicates the intended purpose of the funds, the amount and justification for the need for their use.

- The manager studies the employee’s written request, makes a decision and endorses the application.

- The appeal with the resolution is transferred to the cash desk of the institution, where the cashier creates an expenditure cash order and issues the money for reporting.

The employee is required to sign the cash receipt, count and check the cash issued.

Results

The current legislation no longer contains an unambiguous requirement for company employees to fill out applications to receive funds against an advance report: the issuance of money can also be issued by order of the manager. However, if your company has determined in a local regulation that accountable amounts are issued upon application, then this document must be correctly executed and endorsed by the manager.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to correctly formulate an employee

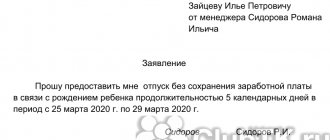

The appeal is drawn up in a single copy addressed to the head of the organization or to another responsible person with the appropriate authority. There is no unified form. A correct application on behalf of an employee contains information:

- Information about the applicant: full name of the employee, position and structural unit.

- The required amount for expenses.

- Justification for receiving money.

- The period within which it is planned to make the necessary expenses, events, trips.

- Date and signature with transcript.

The application must be submitted both in written (by hand) and electronic form. If you have prepared an electronic request, print it out, sign it and submit it to the director for approval.

This is what a sample application for reporting from an employee looks like:

| To the director of the Sports and Youth Sports School "gosuchetnik.ru" Ivanov Ivan Ivanovich from the deputy director on organizational work Klubina Inna Alexandrovna Statement I ask you to give me funds as an account for the organization and holding of the “School Anniversary” event, based on:

Total: 19,250.00 (Nineteen thousand two hundred fifty rubles 00 kopecks) rubles. For the period until March 16, 2020. Klubina /Klubina I.A./ 03/10/2020 I allow Director of SDYUSSHOR "gosuchetnik.ru" Ivanov /Ivanov I.I./ |

Updated expense reporting rules

From the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, it follows that employees are required to report on the amounts spent within three days from the date of expiration of the period for which the money was issued. Receipts confirming expenses must be attached to the completed expense report. As of July 1, 2019, the requirements for their details have been updated, and accountants are required to take these amendments into account in order to legally take expenses into account when taxing profits.

What you need to pay attention to:

- Almost no one issues a strict reporting form (SRF) on paper, and individual entrepreneurs and organizations providing repair, vehicle washing, and transportation services are required to issue clients checks or electronic strict reporting forms;

- in checks for a legal entity or individual entrepreneur, the name and TIN of the buyer, the amount of excise tax, the country of origin of the goods, and the customs declaration number must be specified;

- Receipts contain a breakdown of the goods and services purchased. This rule for generating checks applies to almost all sellers, with the exception of individual entrepreneurs on a patent or simplified tax system. But in this case, the employee describes in detail what he spent the accountable money on;

- expenses for which receipts were sent in electronic format, the employee has the right to print out. The exception is an electronic boarding pass for air travel. It should be printed out and an inspection mark must be placed on it so that the accountant accepts the paper as confirmation of the expense (see Letter of the Federal Tax Service of Russia dated 04/11/2019 N SD-3-3/ [email protected] ).

How to write to a manager

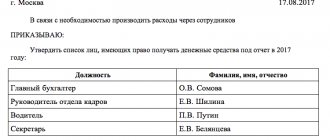

The director is the same accountable person as other employees. He is required to draw up an application for cash withdrawal, but its content is not significantly different.

The request is written not to the manager, but to the company. That is, in the upper right corner the name of the organization, full name and position of the manager are indicated. That's all. In the text, the manager does not request funds, but records the fact of their issuance. Then the purpose of the expenditure, the amount of cash and the reporting date are indicated.

Here is an approximate version of such an application for money report:

The director signs this request only once - there is no need to duplicate the signature of the director as a responsible and official. Then the accountant issues the visa, thereby confirming the issuance of cash from the cash register.

Rules for issuing accountable amounts in 2021

Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U regulates the procedure for conducting cash transactions. The essence of the innovations for 2021 is as follows:

- The grounds for issuing sums of money have expanded (clause 6.3 of the Instructions): now it is not only an application from the employee, but also an administrative document of the organization (usually an order).

- Expense and receipt orders are allowed to be issued electronically, and in this case, the recipient of the money signs the consumables using his electronic digital signature (if available), and receives the receipt order by email (clauses 5.1, 6.2 of the Instructions).

- The ban on receiving money from the cash register for employees who have not reported on previous advances has been lifted.

The changes are aimed at stimulating electronic document flow in companies and simplifying the rules for working with accountable amounts. Perhaps electronic receipts and consumables are relevant for a small number of companies, but the choice between an order and a statement and the ability to issue money to debtor employees are available to any organization.

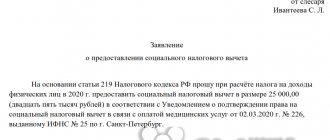

How to draw up to get money on the card

When you receive money by bank transfer to a bank card, it is not necessary to fill out an application. But it is not prohibited (for example, an accountant requires such a request for internal reporting). The form and content of the official appeal will not change: it is addressed to the manager, indicating the purpose and amount of expenses.

Instead of the phrase “Please give me cash,” write “Please transfer money to a bank card” and indicate in detail its details - the name of the bank, its INN, KPP and BIC, current and correspondent accounts.

When is it compiled?

In order to be able to enter the correct data in the personal income tax return, the head of a large company or individual entrepreneur draws up an agreement for the issuance of accountable amounts, and some rules must be followed.

Such reporting is also required if it is necessary to separate an advance payment or any other payment from the total amount.

In most cases, the application must be supplemented with a separate document with a record of what calculations were made for the received accountable amounts.

This action is the fulfillment of the requirement of the Bank of the Russian Federation, set out in Directive No. 3210, in accordance with which accountable amounts can be issued only on the condition that the employee has fully repaid the debts on previously provided funds.

Registration requirements

As mentioned above, there are no clear requirements for the preparation of such documents, and enterprises themselves establish templates. However, any memo must be drawn up taking into account basic design rules, for example:

- The document must be drawn up on a sheet of A4 paper.

- When composing in Word, you need to use a font called Times New Roman.

- Font size should be 14 points.

- It is necessary to set the line spacing to 1.5.

- The date of the document must be indicated in Arabic numerals or letters and numbers.

- The title of the document can be located either in the middle of the sheet or near the border of the left margin.

Failure to comply with these basic requirements will lead to problems with any document. The paper can also be in writing. In such a situation, it is worth paying special attention to spelling errors and the general literacy of the text.

Read more about the rules for preparing official memos in accordance with GOST, as well as what requirements apply to their writing here.

In what cases is it prohibited to pay wages in cash?

Paying wages in cash is prohibited only when paying foreigners. The range of cash payments with foreigners is limited by Part 2 of Art. 14 Federal Law dated December 10, 2003 No. 173-FZ, and wages are not included in this list. The position that foreigners can only be paid wages in non-cash form was confirmed by the tax authorities in Letter No. 3N-4-17/15799 of the Federal Tax Service dated August 29, 2016.

Paying wages in cash to a foreign person is a violation of currency laws. Fine under Part 1 of Art. 15.25 of the Administrative Code of the Russian Federation will be 75-100% of the amount issued.

We recommend you the cloud service Kontur.Accounting. The program allows you to calculate, accrue and deposit employee salaries. In addition, the service will help you calculate and pay all taxes and contributions due from your salary and submit all reports on time.

Why is it more profitable for an employer to pay wages by bank transfer?

Typically, it is more profitable for companies to transfer wages to employee cards as part of a salary project. Firstly, making a non-cash transfer is easier than collecting employees and giving them cash. Secondly, the salary project provides a number of advantages to the company, for example, they do not charge a commission for transferring salaries or give a discount for servicing the current account. And when issuing cash, the employer will still have to spend money on a commission for withdrawing money.

Important! Unscrupulous entrepreneurs prohibit employees from even changing the bank where they receive their salary. It is illegal. Even if the company has a salary project in bank A, the employee can demand that the salary be transferred to his card in bank B.

The company's cash withdrawal costs should not in any way affect the employee's convenience in receiving their salary.

Peculiarities

The manager’s task is to prepare all documents for cash transfer in advance, several days before the planned bank financial transaction for cash withdrawal.

The deadline for reporting on funds already issued remains the same - three working days after the expiration of the period stated by the director in the application drawn up by the contractor.

The advance payment and expenses must be immediately confirmed by relevant documents, in accordance with Resolution No. 55 of the State Statistics Committee.

It is very important that the selected date is recorded in the documentation. The presence of all clearly defined specific points will avoid the need to fill in empty columns of the report with unnecessary information, in particular such as “Structural unit” and “personnel number”.

The manager can protect himself from any possible claims from the tax authorities by clarifying the established deadlines in the document and in the Regulations on Accountable Persons regarding employees working under a civil contract.

What kind of document?

An official memo is a business paper intended for use strictly within a specific enterprise, which is written regarding work issues and contains certain requests.

The note, as a rule, is intended for consideration by the head of the department where the employee is registered, and the decision as to whether to satisfy the employee’s request or not can be made not only by the immediate supervisor, but also by persons in charge of another department.

There is no finally approved sample note, so to this day they are guided by the standards adopted in the USSR.

They also refer to the All-Russian Classification of Management Activities (OKUD), which is freely available to everyone. OKUD was approved by state standard decree number 299, which came into force on November 30, 1993.

You will find samples of memos for all occasions in this article.

Not only a memo written on paper is allowed, but also an electronic form of this document. Although the employee has the right to draw up a note in a relatively free form, he is still obliged to take into account the general requirements and indicate the necessary information, regardless of the purpose for which it is concluded.

Long term

As mentioned earlier, the law does not stipulate a maximum period for using funds. It is only necessary that the deadline be indicated in the application itself. The note can be made by the director, accountant or the employee himself. Even if funds for travel expenses are issued for a year, no fines are provided for the company for such a long period.

It is important to remember that an employee cannot be given a new advance until he has reported on the old one. For example, an employee, having received money for six months, is in no hurry to draw up a report. If it is urgently necessary to send him on a business trip, then it is impossible to draw up a new report. It is also prohibited to require early reporting on the use of funds. The exception is the dismissal of an employee.

Let's assume that, besides the debtor, there is no one else to send on a business trip. Then the manager can take responsibility and issue a new advance to the employee. If inspectors discover such a scheme, they will fine the manager in the amount of 5,000 rubles, and the company - up to 50 thousand rubles. for violation of cash discipline. Therefore, it is better to avoid such situations.