Midsection of businessman holding airplane tickets. horizontal shot.

Free legal consultation by phone:

8

While on a business trip, the employee acts on the instructions and in the interests of the employer. Accordingly, the employer is obliged to take all measures to ensure that the traveling employee does not suffer losses. Therefore, labor legislation includes several provisions that regulate compensation for employees on such trips (including the payment of daily allowances, even for a business trip of one day).

In particular, the organization is obliged to pay for accommodation during the specified period (even if the business trip lasts only one day: details of this option are here). This is a basic guarantee for the employee. However, when an organization pays for accommodation on a business trip, it follows a number of rules that you should know.

Determination of daily allowance

The official interpretation of the concept of “daily allowance” is in the ruling of the Supreme Court of the Russian Federation dated April 26, 2005 No. CAS 05-151. Per diem - funds necessary for the performance of work and accommodation of an employee at the place where the official assignment is carried out.

According to the Supreme Court, an employee is entitled to daily allowance when performing a task not at his permanent place of work and when he is forced to live outside his permanent place of residence.

In practice, an employee often receives a daily allowance only if the business trip lasted more than a day and he spent the night away from home. However, the Supreme Court decision No. 4357/12 dated September 11, 2012 states that the amount of time on a business trip is not related to the calculation of daily allowances. The court allowed enterprises to pay funds to an employee if he went on a business trip for less than a day, since this is reimbursement of his expenses, and not a benefit. In addition, according to Regulation No. 749, daily allowances do not depend on the expenses of a posted employee for housing and travel.

To confirm your daily allowance expenses, prepare your daily allowance calculation using an accounting certificate.

How to report a trip

Since 2015, the law has allowed not to formalize an official assignment. In this case, to confirm the total duration of the trip, you need to use travel tickets, boarding passes, hotel bills and other documents.

If the employee was unable to provide them, then you can request from the receiving company an official document confirming the work of the business traveler, with a seal and signatures.

Starting from 2021, it is allowed to use personal vehicles when traveling to and from a business trip. In this case, fuel receipts and a memo addressed to the manager are used as confirmation of the travel period.

Thus, the period of days for which daily allowance is paid on a business trip is documented by forms provided by the employee.

But the employee is not obliged to provide documents that would confirm the expenditure of daily allowances, and in general the very fact that they were used. By law, the employer must make this payment, but what the employee spends it on is his own business.

Per diem in a new way

Keep records in Kontur.Accounting - a convenient online service for calculating salaries, travel allowances, benefits and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

There is no limit on daily allowance; companies can set any amount, stipulating it in internal documents. Small businesses often limit their daily allowance to 700 rubles, because this amount is not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation). If the daily allowance is more, then personal income tax will have to be withheld from the excess amount. For foreign business trips, the tax-free daily allowance limit is 2,500 rubles.

From 2021, daily allowances above the limits are subject to insurance contributions. But there is no need to pay “injury” contributions from the daily allowance.

Example. The employee was on a business trip for 3 days and received a daily allowance of 1,000 rubles. During the days of his business trip he received 3,000 rubles. Only 3 * 700 = 2,100 rubles are not subject to contributions and personal income tax, and from the difference 3,000 - 2,100 = 900 rubles, you need to withhold personal income tax and pay insurance premiums.

Daily allowance for business trips abroad

An employee’s business trip can be carried out outside the country, and during this, he must also be given a daily allowance.

Payment standards for trains abroad

Daily allowance rates for business trips abroad are also established by the business entity independently. However, in these cases, if the organization belongs to the public sector, Government Resolution No. 812 should be taken into account, which establishes the maximum daily allowance for each country, expressed in US dollars.

Other companies, when establishing their own standards, can use the provisions of this act.

Attention! For personal income tax purposes and the calculation of insurance premiums, the standard is 2,500 rubles. In excess of this, amounts issued will be subject to taxes.

In what currency should I pay?

When deciding in what currency, daily allowances should be issued for business trips abroad, you should take into account the days when the employee will be in his home country, and the days when he will be traveling abroad.

The law establishes that for days spent on the territory of one’s own state, an employee receives daily allowance in rubles, and for days on a business trip abroad in the currency of the country where he is sent. It should be taken into account that on the day of departure from the country, daily allowances are calculated in foreign currency, and on the day of arrival - in rubles.

The company has the right in its regulatory documents to establish a different procedure for determining the currency of daily allowance.

Payment procedure

Payment of daily allowances can be made either directly in foreign currency or in rubles in the equivalent of the applicable currency. This issue is resolved by the company management independently.

In the latter case, the employee will have to independently contact the relevant institutions and exchange the money received for foreign currency.

How to take into account exchange rate differences

Exchange rate differences on a trip abroad may arise due to the fact that the Central Bank of Russia can set different exchange rates on the day the money is issued and on the day the advance report is submitted.

If a negative exchange rate difference is formed, it should be taken into account as part of the company’s other expenses, and a positive one – as part of other income.

An employee bought currency while on a trip

The organization may not issue the employee a daily allowance in foreign currency, but may give instructions to make the exchange independently upon arrival in the country of destination. The supporting document in this case is an exchange certificate from the bank, which indicates the exchange rate and the amount of the purchased currency. But expenses in foreign currency, for example, for a hotel, are already converted into rubles based on the established exchange rate of the Central Bank.

Withholding personal income tax and paying contributions from daily allowances

According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, personal income tax must be calculated and withheld on the nearest date of payment of cash income to the employee. Before this, management must approve the advance report (according to the letter of the Ministry of Finance of Russia dated January 14, 2013 No. 03-04-06/4-5). This is due to the fact that the employee, even before the advance report, may underuse the funds allocated to him on a business trip: the employee is obliged to return the excess. The opposite situation: the employee exceeded the allocated amount (for example, due to delays in work matters or simply overspent).

Money that is allocated to a posted employee for reporting purposes is not considered an economic benefit until the employee returns from a business trip and the subsequent approval of the expense report. Before payment, the employee must provide documents about the time of the business trip and attach receipts explaining the expenses.

Contributions from excess amounts must be paid before the 15th day of the next month (Federal Law of July 3, 2021 No. 243-FZ).

What payments are due to a posted employee?

During a business trip, an employee is entitled to two types of payments:

- average earnings for the number of days of absence from service;

- travel expenses.

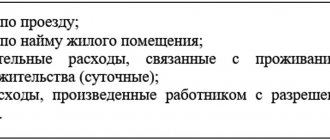

According to Art. 168 of the Labor Code of the Russian Federation, travel expenses include:

- expenses for travel to the destination;

- expenses related to housing;

- other expenses approved by the employer (for visas, payment for porter services at the station, taxi, cellular communications, etc.);

- daily allowance – i.e. additional expenses due to living away from home (food, public transport, etc.).

Payment of daily allowances for business trips in 2021 is carried out according to the standards established by the internal regulations of the employing company. The legislation sets the following limits:

- 700 rub. per day – for trips within Russia;

- 2.5 thousand rubles. – for overseas business trips.

Insurance premiums and income taxes are not charged on these amounts. If an organization sets a daily amount above the limit, it is obliged to transfer personal income tax and payments to extra-budgetary funds from the amount of the excess.

Proof of business purpose of travel

Keep records in Kontur.Accounting - a convenient online service for calculating salaries, travel allowances, benefits and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

In 2015, the list of documents confirming the business nature of a business trip changed. Now you don't need:

- Travel certificate;

- Service assignment;

- Report on the completion of a job assignment;

The company has the right to independently determine the document that describes the business part of the trip. The main purpose of an employee on a business trip can be stated in the business trip order, which is drawn up in form No. T-9; it is also not prohibited to create your own forms in accordance with the internal standards of the company.

You can request a written report from the employee on the results of the trip, if such a right is specified in the company’s internal documentation. In this case, familiarize employees with this local act.

To confirm the period of stay on a business trip, the employee is required to provide documents with travel dates (train ticket, plane boarding passes, etc.). If an employee went on a business trip in his own or official transport, he needs a service note (clause 7 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Payment for hotel accommodation

The legislation establishes the employer's obligation to pay losses incurred in connection with paying for a hotel on a business trip. But, in addition to this provision, the company can independently develop and adopt internal legal acts regulating the procedure for reimbursement of expenses.

The main provisions that make it possible to pay for accommodation on a business trip are:

- The dispatch of an employee on official business must be accompanied by the issuance of a work trip order. Such a document certifies the employee’s actions in the interests of the organization.

- Payment of expenses is carried out on the basis of documentation confirming accommodation. This is a prerequisite for compensation of such expenses.

- Legal entities have the right to set limits on the amounts possible for reimbursement. This rule is most typical for government agencies and is aimed at preserving budget funds. They set a minimum limit for their employees.

IMPORTANT! Budgetary organizations do not have the right to refuse to reimburse an employee for expenses incurred on a business trip. The existence of an order to go on a work trip and provide proof of residence, institutions are required to compensate for the costs.

How to confirm expenses on a business trip

Keep records in Kontur.Accounting - a convenient online service for calculating salaries, travel allowances, benefits and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

According to Decree of the Government of the Russian Federation dated July 29, 2015 No. 771, the actual time that an employee was on a business trip is determined based on the travel documents provided by the employee.

If the travel document is lost, the accounting department has the right to refuse compensation for its cost.

Example: A company employee lost his boarding pass for an airplane. He flew on a business trip for two days, paid for the ticket from his own money in hopes of compensation. The accounting department initially refused to pay him, since he did not have a document in his hands confirming that the flight had taken place. As a result, the employee had to go to the airport to request documents. confirming his flight.

Employees who go on a business trip using transport (personal, work or rented) are also entitled to compensation. For them, travel documents will be waybills, payment receipts, invoices, checks, etc.

In a budget institution

In pursuit of saving material resources, government agencies pay for accommodation on a business trip according to the lowest standards. Usually, this amount is no more than two thousand rubles per day.

To do this, the traveler must:

- In real estate accommodation, it is mandatory to draw up a document confirming the expenses incurred. A certificate may be submitted, confirmed by a cash receipt in the prescribed form. Its issuance certifies the fact of transfer of funds. The document must be drawn up in accordance with the requirements of Government Resolution No. 359 and contain the following details:

- Name of payment paper.

- Series and number.

- Name of the organization providing the services.

- Signature and seal of the organization.

The receipt must be printed using an automated system and contain the appropriate notes.

- Paid living expenses, certified by relevant papers and an application for compensation of expenses incurred, are submitted to the company’s accounting department.

Housing rental expenses are paid on the next salary or issued immediately after the receipt of the travel report. Payment for accommodation can be made before departure on a business trip in 2020, as an advance payment.

Refund of compensation in case of trip cancellation and force majeure

Keep records in Kontur.Accounting - a convenient online service for calculating salaries, travel allowances, benefits and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

If a planned business trip is cancelled, the employee can receive money for unused tickets. You can also get a refund of the amount spent on obtaining a visa except for the fee paid.

It is worth considering that when returning tickets, the airline in most cases returns only part of their cost (especially on cheap fares). In this case, the difference in the amount paid and the amount returned is usually justified as a fine for violation of transportation rights.

If force majeure occurs during the business trip itself (bad weather, flood, plane breakdown, etc.) and the employee cannot return home on time, then the company must provide him with daily allowance and pay for the necessary accommodation. In this case, the employee must put a stamp/mark on the travel document (certificate) with the actual date of departure. If a travel document is not provided for by the organization’s accounting policy, then a document confirming the fact that the employee was delayed through no fault of his own can be a certificate from the airport about the cancellation or delay of the flight.

The employee returned from a trip and left the same day

When an employee goes on a business trip, a situation may arise in which he returns from one trip in the morning and leaves for another in the evening.

The law does not prohibit doing this, although it does not establish exactly how this should be formalized. As a result, two methods can be used.

The first way is two different business trips. The employer must issue a full package of documents for a new trip - a business trip order, a travel certificate, a work assignment (both if necessary). With this design option, special attention must be paid to the daily allowance.

The employer must make this payment for each day of a business trip, including days on the road. The day on which both trips overlap is subject to double payment - since it is the final day of the previous trip and the first day of the next one. However, in this case, a dispute will likely arise with the tax authorities due to excess payments.

The second way is to combine trips. If it is immediately known that the employee will have to visit several places at once, then a full package of documents is drawn up for the business trip. All information is entered into it, destinations and goals are indicated separated by commas, and the total duration is indicated.

Attention! However, the law does not limit the duration of the trip, leaving it at the discretion of the company. Daily allowances are calculated and paid immediately for the entire duration of the trip. If during a business trip you will visit two or more countries, the trip is divided into segments, and the daily allowance for each is calculated based on the established standards for that country.

Travel payment procedure

The price for renting employees' living quarters or paying for a hotel room is taken into account in other expenses. You must have the appropriate document - price and length of stay, date of preparation, signature and position. In different cases, inspectors impose optional conditions.

Usually there are no hotels in the Unified State Register of Legal Entities. Tax officers look to see if the hotel’s TIN is in the Unified State Register of legal entities.

In the advance report, you must provide all the papers that confirm the expenses of the business trip. We are also talking about checks from the hotel. After approval by the employer and transfer to the accounting department, you will receive your funds in your hands. If the amount turns out to be less than you expected, coordinate this with your employer. He must provide a complete accounting statement of the settlement.