Types of discrepancies between accounting and tax accounting

Tax accounting, for which discrepancies between accounting and tax accounting (accounting and tax accounting) are significant, is carried out by organizations that pay income tax.

Most often, the profit calculated according to the Tax Code of the Russian Federation differs from the accounting profit. To reflect in accounting and reporting the difference between the tax on accounting profits and the tax shown in the income tax return, PBU 18/02 “Accounting for calculations of corporate income tax” is used (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). By Order of the Ministry of Finance dated November 20, 2018 No. 236n, changes were made to PBU 18/02, which from 2021 all legal entities using PBU 18/02 are required to apply. You will find a detailed analysis of these changes with visual examples in ConsultantPlus. Get trial access to the system and proceed to the Typical Situation.

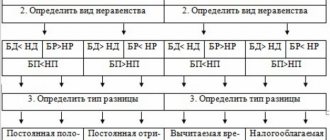

The differences between BU and NU are:

- permanent;

- temporary.

Permanent differences are income or expenses that:

- are accepted into the accounting system, but do not generate taxable profit either in the current period or in subsequent ones;

- are recognized in NU, but are not accepted for accounting either in the current period or in subsequent ones.

Permanent differences result in permanent tax expenses (PTR) or income (PIT). PNR, PND are equal to the corresponding constant difference multiplied by the income tax rate.

PNR means that the organization has an obligation to pay tax, that is, in the reporting period, income tax payments increase. IPA, on the contrary, that the organization will not make any part of the tax payment.

| Poland | HDPE |

| Profit tax according to NU > Tax on accounting profit | Profit tax according to NU < Tax on accounting profit |

| Income according to NU > Income according to accounting | Income according to NU < Income according to accounting |

| Expenses according to NU < Expenses according to accounting | Expenses according to NU > Expenses according to accounting |

Read about the rules for paying income tax in this article.

Temporary differences are income or expenses that are accepted for accounting in one period, and for tax purposes in another. From 2021, the concept of “temporary differences” has been clarified. Now this includes not only income and expenses, but also the results of operations that are not included in accounting profit (loss), but form the tax base for taxes in other reporting periods.

Temporary differences give rise to deferred taxes. In addition, Order No. 236n of the Ministry of Finance dated November 20, 2018 expanded the list of temporary differences.

Deferred tax is the amount of income tax that will increase or decrease the payment to the budget in subsequent reporting periods. There are two types of temporary differences. Their impact on income tax is disclosed in the table.

| Deductible temporary differences | Taxable temporary differences |

| Reduce income tax for the following periods | Increase the income tax for the following periods |

In the current period:

In the following periods:

| In the current period:

In the following periods:

|

| Form a deferred tax asset (DTA) | Form a deferred tax liability (DTL) |

| SHE = Deductible temporary differences × Income tax rate | IT = Taxable temporary differences × Income tax rate |

IT and IT are reduced and settled as deductible and taxable temporary differences decrease.

If all the income and expenses of the organization reflected in the accounting system correspond to the income and expenses accepted for tax purposes, then the tax calculated on the accounting profit (in accordance with paragraph 20 of PBU 18/02 it is called a conditional expense (in case of a loss - conditional income) for income tax), equal to the current income tax shown in the declaration.

If there are discrepancies, these 2 types of tax are related by the following formula:

TN = UR + ∆ONA – ∆ONO + PNR – PND,

where: TN - current income tax;

UR - conditional income tax expense (income);

∆ONA - change in ONA (ONA accrued in the reporting period - ONA repaid in the reporting period);

∆ONO - change in IT (ONO accrued in the reporting period - ONO repaid in the reporting period).

For detailed instructions on the application of PBU 18/02 in the event of permanent and temporary differences with examples of reflecting indicators in accounting and reporting, see K+. Get free access to the system and go to the Ready-made solution.

About income and expense registers for tax purposes, read the material “How to maintain tax accounting registers (sample)?”

Temporary and permanent differences. PBU 18/02

Accounting and tax accounting have different rules for recognizing profits. Therefore, accounting profit may differ from tax profit. The difference between these profits is formed from temporary and permanent differences (clause 3 “Accounting for calculations of corporate income tax” PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Temporary differences

So, accounting profit is different from tax profit. In this case, the conditional accounting profit tax (CAPT) will differ from the current profit tax reflected in the income tax return (TNP).

In order for the amount of income tax accrued in accounting to coincide with TNP, it is necessary to reflect the differences between URNP and TNP according to the rules of PBU 18/02 (clause 1 of PBU 18/02).

Temporary differences arise when expenses (income) are recognized both in accounting and tax accounting in the same amount, but in different periods (clause 8 of PBU 18/02).

If expenses are first recognized in accounting, and in subsequent periods - in tax accounting (or vice versa), then a deferred tax asset (DTA) must be recognized.

If expenses are first recognized in tax accounting, and in subsequent periods - in accounting (or vice versa), then a deferred tax liability (DTL) must be recognized.

What are the temporary differences?

Depending on the nature of the impact on taxable profit (loss), temporary differences are divided into deductible and taxable temporary differences.

Deductible temporary differences will presumably reduce the amount of income tax payable to the budget in the next reporting period or in subsequent reporting periods.

Taxable temporary differences will presumably increase the amount of income tax payable to the budget in the following reporting period or in subsequent reporting periods.

SHE, IT and temporary differences

If expenses are first recognized in accounting, and in subsequent periods - in tax accounting (or income is first recognized in tax accounting, and then in accounting), then a deductible temporary difference and a corresponding deferred tax asset (DTA) arise in accounting.

If expenses are first recognized in tax accounting, and in subsequent periods - in accounting (or income is first recognized in accounting and then in tax accounting), then a taxable temporary difference and a corresponding deferred tax liability (DTL) arise in accounting.

Deferred tax assets (DTA) in accounting

IT occurs, in particular, when:

- sale of a fixed asset (FPE) at a loss;

- carry forward tax losses;

- creating a reserve for vacation pay, if it is formed only in accounting.

Also, IT may arise if income from a transaction is recognized in tax accounting earlier than in accounting.

Due to the fact that expenses in accounting (income in tax accounting) are recognized earlier, in the period of the transaction the accounting profit is less than the tax profit.

IT for a specific operation is calculated using the formula:

SHE = The amount of accounting expenses that will be taken into account in tax accounting in the following periods X Profit tax rate (20%)

OR

SHE = The amount of tax revenue that will be taken into account in accounting in the following periods X Profit tax rate (20%).

In subsequent reporting (tax) periods, the situation will be the opposite.

When expenses are recognized in tax accounting (income in accounting), tax profit and TNP will be less than accounting profit and URI.

As expenses are recognized in tax accounting (income in accounting), they are repaid.

The amount by which it is repaid is calculated using the formula:

Amount by which IT is repaid = Amount of expenses previously recognized in accounting and written off in tax accounting in the current period X Income tax rate (20%)

OR

The amount by which it is repaid = The amount of income previously recognized in tax accounting and taken into account in accounting in the current period X Income tax rate (20%).

Thus, ONA is a special type of asset, the amount by which TNP is reduced in subsequent tax periods. And the URNP increases by the same amount (clause 14 of PBU 18/02).

They are accounted for in account 09 “Deferred tax assets”. Postings for the recognition and repayment of IT will be as follows:

Debit 09 Credit 68

— SHE is reflected;

Debit 68 Credit 09

— SHE is extinguished

Example 1 In 2021, an organization, according to accounting and tax records, received a loss from its core activities - 50,000 rubles. Based on the results of 2021, according to accounting and tax accounting data, a profit from core activities was received in the amount of 100,000 rubles. The organization decided to carry forward the loss in the amount of 50% of the tax base of the current period. In accounting, the carry forward of losses should be reflected as follows:

| Contents of operations | Debit | Credit | Sum, rub. | Primary document |

| Accounting entries 2021 | ||||

| Reflected loss from main activity | 99-1 | 90-9 | 50 000 | Accounting reference-calculation |

| Conditional income reflected on income tax | 68 | 99-2 | 10 000 | Accounting reference-calculation |

| Recognized as deferred tax asset | 09 | 68/ONA | 10 000 | Accounting reference-calculation |

| Accounting entries 2021 | ||||

| Profit from main activity | 90-9 | 99-1 | 100 000 | Accounting reference-calculation |

| Reflected conditional consumption on income tax | 99-2 | 68 | 20 000 | Accounting reference-calculation |

| Repaid deferred tax asset | 68/ONA | 09 | 10 000 | Accounting reference-calculation |

As a result of these operations, the balance on account 09 will be equal to zero, which confirms the correctness of the calculations and application of PBU 18/02.

Now let's give an example of selling a fixed asset at a loss.

Example 2 Since December 2013, a woodworking machine with an original cost of 122,000 rubles has been included in depreciable property. The useful life in accounting and tax accounting is 61 months. On May 20, 2021, the machine was sold for RUB 35,400. (including VAT - 5400 rubles). The amount of accrued depreciation from January 2014 to May 2021 (41 months) is 82,000 rubles. (linear method is used). No depreciation bonus was accrued. We will make the necessary calculations.

Financial result from the sale of the machine: loss of 10,000 rubles. (35,400 rub. - 5,400 rub. - (122,000 rub. - 82,000 rub.)).

Remaining useful life of the machine: 20 months. (61 months - 41 months).

Amount of loss subject to recognition in tax accounting monthly since June 2015: 500 rubles. (RUB 10,000 / 20 months).

Loss from the sale of fixed assets in the amount of RUB 10,000. is a deductible temporary difference.

Therefore, it is necessary to accrue a deferred tax asset (DTA) - 20% of the amount of the loss. As the loss is recognized in tax accounting, the accrued ITA will be repaid.

The following entries must be made in accounting.

As of the date of sale of the fixed asset (05/20/2017):

| Contents of operation | Debit | Credit | Amount, rub. | Primary document |

| The original cost of the machine has been written off | 01-2 “Disposal of fixed assets” | 01-1 “Fixed assets in operation” | 122 000 | Certificate of acceptance and transfer of fixed assets |

| The amount of depreciation written off | 02 “Depreciation of fixed assets” | 01-2 “Disposal of fixed assets” | 82 000 | Certificate of acceptance and transfer of fixed assets |

| The residual value of the machine is written off (RUB 122,000 - RUB 82,000) | 91-2 “Other expenses” | 01-2 “Disposal of fixed assets” | 40 000 | Certificate of acceptance and transfer of fixed assets |

| Reflects other income from sales | 62 “Settlements with buyers and customers” | 91-1 “Other income” | 35 400 | Purchase and sale agreement, Certificate of acceptance and transfer of fixed assets |

| VAT charged on sales | 91-2 “Other expenses” | 68-1 “Calculations for VAT” | 5400 | Invoice |

| Deferred tax asset accrued (RUB 10,000 x 20%) | 09 “Deferred tax assets” | 68-2 “Calculations for income tax” | 2000 | Accounting certificate-calculation |

| During the remaining useful life starting from the month (20 months) following the month of sale of the fixed asset (from June 2021 to January 2021) | ||||

| Deferred tax asset decreased (500 rub. x 20%) | 68-2 “Calculations for income tax” | 09 “Deferred tax assets” | 100 | Accounting certificate-calculation |

As a result of these operations, the balance on account 09 will be equal to zero, which confirms the correctness of the calculations and application of PBU 18/02.

Reflection of deferred tax liabilities (DTL) in accounting

IT arises if expenses for a business transaction are recognized in tax accounting earlier than in accounting. This is possible, for example, when applying bonus depreciation.

In addition, IT may appear if income is recognized in accounting earlier than in tax accounting. Thus, the cost of materials received during the liquidation of an operating system is reflected in accounting in income at the time the materials are accepted for accounting, and in tax accounting - on the date of drawing up the liquidation act (clause 13 of article 250, subclause 8 of clause 4 of article 271 of the Tax Code RF). Therefore, if work to liquidate an asset continues for a long time, then income in the form of the cost of materials in accounting may be recognized earlier than in tax accounting.

Due to the fact that expenses in accounting are recognized later (or income is recognized earlier), in the period of the transaction, accounting profit and the corresponding income tax return are greater than tax profit and consumer goods.

IT for a specific transaction (the amount of excess of URNP over consumer goods) is calculated using the formula:

IT = The amount of tax expenses that will be taken into account in accounting in the following periods X Profit tax rate (20%);

OR

IT = The amount of accounting income that will be taken into account in tax accounting in the following periods X Profit tax rate (20%).

In subsequent reporting (tax) periods, the situation will be the opposite.

When expenses are recognized in accounting (income in tax accounting), tax profit will be greater than accounting profit.

And as expenses are recognized in accounting (income in tax accounting), IT is repaid:

The amount for which the tax is repaid = The amount of expenses previously recognized in tax accounting and written off in accounting in the current period x Income tax rate (20%);

OR

The amount for which the tax is repaid = The amount of income previously recognized in accounting and taken into account in tax accounting in the current period x Income tax rate (20%).

Thus, IT is a special type of obligation, an amount by which in subsequent tax periods TNP will be greater than URNP (clause 15 of PBU 18/02).

IT is accounted for in account 77 “Deferred tax liabilities”.

Postings for recognition and repayment of IT will be as follows:

Debit 68 Credit 77

- IT is reflected;

Debit 77 Credit 68

— IT is extinguished.

Example 3 In January 2021, the organization installed a video surveillance system belonging to depreciation group III, costing 70,800 rubles. (including VAT – 10,800 rubles).

The useful life is set at 60 months. The depreciation rate is 1.6666% (1/60).

Depreciation in accounting for it will be accrued from February 2016.

The initial cost of the fixed asset in accounting will be 60,000 rubles. (70,800 - 10,800).

The monthly amount of accounting depreciation from February 2021 is 1000 rubles. (RUB 60,000 × 1.6666%).

Tax accounting in January 2021 will take into account the entire cost of equipment in the amount of 60,000 rubles.

There will be no expenses in accounting in January 2021, and in tax accounting the entire cost of the equipment will be written off.

In this regard, according to paragraphs 12, 15 of PBU 18/02, a taxable temporary difference (TDT) and a corresponding deferred tax liability (DTL) arise in the organization’s accounting, which is reflected as a credit to account 77 “Deferred tax liabilities” in correspondence with the debit Account 68 “Calculations for taxes and fees.”

Further, as depreciation is accrued, the resulting NVR and the corresponding IT are reduced (clause 18 of PBU 18/02). This is due to the fact that the amount of monthly depreciation deductions is recognized in accounting, but there will be no expenses in tax accounting.

That is, on the last day of each month IT decreases, which is reflected by an entry in the debit of account 77 and the credit of account 68.

The following entries must be made in the organization's accounting:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In January 2021 | ||||

| OS object accepted for accounting | 01 "Fixed assets" | 08 “Investments in non-current assets” | 60 000 | Certificate of acceptance and transfer of fixed assets |

| ONO formed (60,000 x 20%) | 77 | 68/income tax | 12 000 | Accounting certificate-calculation |

| Monthly from February 2021 for the duration of the OS use (60 months) | ||||

| Depreciation has been accrued on the asset | 20 (26) | 02 “Depreciation of Fixed Assets” | 1 000 | Accounting certificate-calculation |

| IT reduced (1000 x 20%) | 77 “Deferred tax liability” | 68/Income tax | 200 | Accounting certificate-calculation |

As a result of these operations, the balance on account 77 will be equal to zero, which confirms the correctness of the calculations and application of PBU 18/02.

Now let's give an example of using bonus depreciation.

Example 4 In January 2021, the organization purchased equipment belonging to depreciation group IV, costing RUB 1,416,000. (including VAT - 216,000 rubles). In the same month, the equipment was put into operation; depreciation will be accrued from February 2021. Useful life - 65 months, depreciation rate - 1.5385% (1/65).

According to the accounting policy, for groups III – VII, a depreciation bonus in the amount of 30% of the original cost is provided.

The reporting periods for corporate income tax are quarter, six months, and nine months. We will make the necessary calculations/

The initial cost of the fixed asset is RUB 1,200,000. (1,416,000 - 216,000).

Depreciation bonus - 360,000 rubles. (RUB 1,200,000 × 30%). This amount will be included in expenses in the month following the month of commissioning, i.e. February 2021.

The amount from which depreciation will be calculated in tax accounting is 840,000 rubles. (1,200,000 - 360,000).

Monthly amount of tax depreciation, from February 2021 - 12,923 rubles. (RUB 840,000 × 1.5385%).

The monthly amount of accounting depreciation starting from February 2017 is RUB 18,462. (RUB 1,200,000 × 1.5385%).

Then, in the organization’s accounting in the first month of depreciation (in January), the amount of expenses is 18,462 rubles, and in tax accounting in the same month expenses in the amount of 372,923 rubles will be recognized. (RUB 360,000 + RUB 12,923).

According to paragraphs 12, 15 of PBU 18/02, in January the following arise in the organization’s accounting:

- taxable temporary difference (TDT) - RUB 354,461. (RUB 372,923 – RUB 18,462) and

- the corresponding deferred tax liability (DTL) is RUB 70,892. (RUB 354,461 x 20%), which is reflected in the credit of account 77 “Deferred tax liabilities” in correspondence with the debit of account 68 “Calculations for taxes and fees”.

Further, in accordance with paragraph 18 of PBU 18/02, as depreciation is accrued (from March), the resulting NVR and the corresponding IT are reduced. Reason: the amount of monthly depreciation deductions recognized in accounting, i.e. 18,462 rubles, exceeds the amount of accrued depreciation in tax accounting (12,923 rubles). So, during the remaining period of using the OS, on the last day of each month, IT is reduced by 1108 rubles. ((18,462 rubles - 12,923 rubles) x 20%), which is reflected by the entry in the debit of account 77 and the credit of account 68.

The wiring diagram is as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In January 2021 | ||||

| OS object accepted for accounting | 01 "Fixed assets" | 08 “Investments in non-current assets” | 1 200 000 | Certificate of acceptance and transfer of fixed assets |

| In February 2021 (first month of depreciation) | ||||

| Depreciation has been accrued on the asset | 20 (26,44 and etc.) | 02 “Depreciation of Fixed Assets” | 18 462 | Accounting certificate-calculation |

| IT is reflected | 68/Income tax | 77 “Deferred tax liability” | 70 892 | Accounting certificate-calculation |

| Monthly for the remaining life of the OS (64 months) | ||||

| Depreciation has been accrued on the asset | 20 (25 and etc.) | 02 “Depreciation of Fixed Assets” | 18 462 | Accounting certificate-calculation |

| IT has been reduced | 77 “Deferred tax liability” | 68/Income tax | 1 108 | Accounting certificate-calculation |

As a result of these operations, the balance on account 77 will be equal to zero, which confirms the correctness of the calculations and application of PBU 18/02.

Balance sheet

In the balance sheet ONA (debit balance of account 09) is reflected in line 1180 “Deferred tax assets”.

In the balance sheet, IT (credit balance of account 77) is reflected in line 1420 “Deferred tax liabilities.”

Income statement

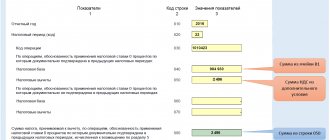

The financial results report must reflect the difference in turnover between accounts 09 and 77 for the reporting year.

Line 2430 “Change in deferred tax liabilities”

So, in line 2430 “Change in deferred tax liabilities” of the Statement of Financial Results, it is necessary to show the turnover on the credit of account 77 minus the debit turnover.

If the credit turnover on account 77 exceeds the debit turnover, then the indicator in line 2430 “Change in deferred tax liabilities” will be positive.

However, it is included in the report in parentheses.

When calculating net profit, it will be taken into account with a minus sign.

Line 2450 “Change in deferred tax assets”

In line 2450 “Change in deferred tax assets” of the Income Statement, you must show the turnover on the debit of account 09 minus the credit turnover on account 09.

If the credit turnover on account 09 exceeds the debit turnover, then the indicator in line 2450 “Change in deferred tax assets” will be negative.

In such a situation, it must be included in the report in parentheses.

When calculating net profit, it will be taken into account with a minus sign.

Constant differences

Permanent differences between accounting and tax profits arise if expenses (income) are recognized either only in accounting or only in tax accounting.

Thus, due to the difference in the recognition of income and expenses in accounting and tax accounting, accounting profit may not coincide with tax profit.

Then the conditional tax on accounting profit will not coincide with the current profit tax reflected in the income tax return.

In order for the amount of income tax accrued in accounting to coincide with the current income tax, it is necessary to generate differences according to the rules of PBU 18/02.

The difference between accounting and tax profit consists of temporary and permanent differences.

Permanent differences between accounting and tax profits arise if expenses (income) are recognized either only in accounting or only in tax accounting.

The presence of permanent differences entails the need to additionally charge or reduce the amount of income tax calculated on the basis of accounting profit.

Thus, a permanent difference is income (expense) reflected in the accounting accounts, which for tax purposes is not included in income (expenses).

At the same time, permanent differences mean those incomes (expenses) that are not included in the calculation of the tax base for income tax not only in the reporting period, but also in all subsequent periods.

Permanent differences may also arise in cases where any income (expense) is recognized solely for tax purposes.

However, these amounts are not reflected in accounting at all.

Due to the presence of such situations, the current income tax calculated according to tax accounting data will differ from the conditional tax on accounting income.

In this case, permanent tax liabilities (PNO) and permanent tax assets (PNA) arise.

Permanent tax liabilities (PNO) and permanent tax assets (PNA) are recognized in accounting when permanent differences arise.

PNO and PNA. When do they occur?

PNO arises if expenses for any operation can only be recognized in accounting, but they can never be taken into account in tax accounting.

This is, for example, the cost of property transferred free of charge, the cost of holding a banquet. Also, PNO may arise if income from any transaction is recognized only in tax accounting.

For example, the Tax Code of the Russian Federation provides for the inclusion in income when calculating income tax of the cost of goods, works (services) received free of charge (clause 8 of Article 250 of the Tax Code of the Russian Federation).

At the same time, accounting legislation does not provide for the reflection of the cost of such work (services) on accounting accounts.

Accordingly, an organization that received work (services) free of charge in the reporting period will have a permanent difference equal to the market value of these works (services) and PNO.

Due to the fact that expenses are recognized only in accounting (income - only in tax accounting), accounting profit is less than tax profit.

PNO is calculated using the formula:

PNO = Amount of expenses that are taken into account only in accounting x Income tax rate (20%)

OR

PNO = The amount of income that is taken into account only in tax accounting x Profit tax rate (20%).

PNA arises when expenses are reflected only in tax accounting.

For example, the state duty paid when purchasing a land plot that is not intended for sale is included in the cost of the plot in accounting, and is recognized as other expenses in tax accounting.

Also, PNA may arise if income from any transaction is recognized only in accounting.

Due to the fact that expenses are recognized only in tax accounting (income - only in accounting), accounting profit is greater than tax profit.

PNA is calculated using the formula:

PNA = Amount of expenses that are taken into account only in tax accounting X Income tax rate (20%)

OR

PNA = The amount of income that is taken into account only in accounting X Income tax rate (20%);

Reflection of PNO in accounting

Permanent tax liabilities are accounted for in accordance with the debit of account 99 “Profits and losses” in correspondence with the credit of account 68 “Calculations for taxes and fees”, a subaccount for accounting for calculations for income tax (clause 7 of PBU 18/02).

Accordingly, permanent tax assets are accounted for in the debit of account 68 “Calculations for taxes and fees”, a sub-account for accounting for calculations for income tax in correspondence with the credit of account 99 “Profits and losses”.

The postings will be like this:

Debit 99 subaccount “Fixed tax liabilities” Credit 68

— a permanent tax liability is reflected;

Debit 68 Credit 99 subaccount “Permanent tax assets”

— a permanent tax asset is reflected.

Reflection of PNO in financial statements

PNO and PNA are taken into account only in the month of the transaction (clause 7 of PBU 18/02), therefore they are not reflected in the balance sheet.

In the income statement, line 2421 “including permanent tax liabilities (assets)” indicates the difference between the debit turnover in the subaccount “ Fixed tax liabilities ” and the credit turnover in the subaccount “ Fixed tax assets” to account 99 “Profits and losses” .

Now let's give an example of accounting for PNA and PNO when purchasing a land plot.

Example 5 An organization received from its founder (with a 100% share in the authorized capital of the organization) non-refundable financial assistance in the amount of 1,000,000 rubles.

This operation should be reflected as follows:

Debit 51 Credit 91-1

- 1,000,000 rubles - funds received free of charge are recognized as part of other income.

Funds received free of charge from the founder are not included in the tax base for income tax (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). The following entries must be made in accounting:

Debit 68 subaccount “Permanent tax assets” Credit 99 subaccount “Permanent tax assets”

— 200,000 rub. (RUB 1,000,000 x 20%) - a permanent tax asset is reflected.

Example 6 An organization gave its employee a car. The residual value of the generous gift at the time of transfer was 300,000 rubles.

In accounting, the cost of the donated car is reflected as part of other expenses:

Debit 91-2 Credit 01

- 300,000 rubles - the residual value of the car donated to the employee is written off.

For profit tax purposes, the cost of gratuitously transferred property is not taken into account as expenses that reduce the tax base (Clause 16, Article 270 of the Tax Code of the Russian Federation).

Thus, in accounting in connection with the transfer of the car, a permanent difference and the corresponding PNO are formed. Accordingly, the following entries must be made in accounting:

Debit 68 Credit 99

Debit 99 subaccount “Permanent tax obligations”

Credit 68 subaccount “Permanent tax obligations”

— 60,000 rub. (RUB 300,000 x 20%) - reflects a permanent tax liability.

Example 7 The company purchased gift certificates: 12 pieces with a nominal value of 5,000 rubles. for transferring them to employees with the execution of gift agreements. Transactions for purchasing gift certificates and transferring them to employees should be reflected in accounting as follows:

Debit 60 Credit 71

— 60,000 rub. (RUB 5,000 x 12 pcs.) — gift certificates in the amount of 12 pieces were paid for through an accountable person;

Debit 50-3 subaccount “Cash documents” Credit 60

— 60,000 rub. — 12 gift certificates were capitalized;

Debit 91-2 subaccount “Other expenses” Credit 50-3 subaccount “Cash documents”

— 60,000 rub. — gift certificates were given to employees under gift agreements.

Debit 91-2 subaccount “Other expenses” Credit 68/VAT

— 10,800 rub. (RUB 60,000 x 18%) – VAT is charged on the cost of gift certificates given to employees.

Expenses associated with the acquisition and transfer of certificates to employees are not taken into account when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation).

In accounting, a permanent tax liability will be reflected in the following entry:

Debit 99 subaccount “Permanent tax liability” Credit 68 subaccount “Calculations for income tax”

— 14,160 rub. ((RUB 60,000+RUB 10,800) x 20%) - a permanent tax liability has been accrued.

Since the cost of a gift in the form of a gift certificate exceeds 4,000 rubles, the accountant is obliged to withhold personal income tax from the amount exceeding the non-taxable standard (clause 28 of article 217 of the Tax Code of the Russian Federation):

Debit 70 Credit 68 subaccount “Personal Income Tax Payments”

— 1560 rub. (((5000 rubles - 4000 rubles) x 13%) x 12 people) - personal income tax is calculated on the income of each employee who received the certificate.

Accounting for deferred taxes, PNR and PND

| Description | Dt | CT |

| Contingent income tax expense accrued | 99 “Profits and losses”, subaccount “Conditional expense” | 68 “Calculations for taxes and fees” |

| Conditional income tax accrued | 68 “Calculations for taxes and fees” | 99 “Profits and losses”, subaccount “Conditional income” |

| SHE is reflected | 09 “Deferred tax assets” | 68 “Calculations for taxes and fees” |

| SHE reduced | 68 “Calculations for taxes and fees” | 09 “Deferred tax assets” |

| ONA is written off upon disposal of the corresponding asset | 99 "Profits and losses" | 09 “Deferred tax assets” |

| IT is reflected | 68 “Calculations for taxes and fees” | 77 “Deferred tax liabilities” |

| IT has been reduced | 77 “Deferred tax liabilities” | 68 “Calculations for taxes and fees” |

| IT is written off upon disposal of the corresponding asset (liability) | 77 “Deferred tax liabilities” | 99 "Profits and losses" |

| Reflected PND | 68 “Calculations for taxes and fees” | 99 "Profits and losses" |

| Reflected by the People's Republic of Poland | 99 "Profits and losses" | 68 “Calculations for taxes and fees” |

How to apply PBU 18/02 when receiving a loss in accounting and tax accounting is explained in detail in ConsultantPlus. Get trial access to the system and proceed to professional explanations.

Temporary differences on initial recognition of assets and liabilities.

In some situations, the carrying amount and tax value of a balance sheet item may differ upon initial recognition.

For example, a company may deduct a government grant from the original carrying amount of the asset or liability that appears on the balance sheet.

For tax purposes, such subsidies cannot be deducted when determining the tax value of a balance sheet item. In such circumstances, the carrying amount of the asset or liability will be less than its tax value.

Differences in the tax cost of an asset or liability resulting from the circumstances described above cannot be recognized as deferred tax assets or liabilities.

For example, the government may offer subsidies to small, medium and micro enterprises (SMMEs) in an attempt to assist these entrepreneurs in their efforts that contribute to increasing the country's GDP and creating jobs.

Let's assume that a particular subsidy is for infrastructure needs (office furniture, fixed assets and equipment, etc.). In these circumstances, although the carrying amount will be less than the tax cost of the asset, the corresponding deferred tax may not be recognised.

As mentioned earlier, deferred tax assets and liabilities should not be recognized to the extent that they arise from the initial recognition of an asset or liability in a transaction that is not a business combination and there is no effect on accounting or taxable profit at the time of the transaction.

The deferred tax liability will also not be recognized upon initial recognition of goodwill. Although goodwill may be treated differently in different tax jurisdictions, which may result in differences in the carrying and tax value of goodwill, IAS 12 does not allow the recognition of such a deferred tax liability.

Any impairment that a company must, for accounting purposes, recognize in respect of goodwill will again result in a temporary difference between its carrying amount and tax value.

However, if part of the goodwill is attributable to initial recognition, that part of the difference in tax and book value should not result in deferred tax because the initial deferred tax liability was not recognized.

Any future differences between the carrying amount and the tax value as a result of depreciation and the deduction of a portion of goodwill constitute a temporary difference for which a provision must be made.

Examples of discrepancies between accounting and tax accounting

Let's consider some situations in which certain discrepancies arise between the BU and NU.

Permanent differences:

- Residual value of gratuitously transferred fixed assets - PNR.

- Excess of actual compensation for the use of personal vehicles over the limit established by the Tax Code of the Russian Federation - PNR.

- Excess of actual entertainment expenses and travel expenses over the limit established by the Tax Code of the Russian Federation - PNR.

- Income from gratuitous assistance of founders, whose share exceeds 50% (recognized in accounting as opposed to NU) is IPA.

- The amount of excess of the estimated value of fixed assets over their residual value when transferring these fixed assets as a contribution to the authorized capital (in this case, income on this difference is generated in the accounting system, which is not recognized in the tax accounting system) - PND.

Deductible temporary differences (TDD):

- Depreciation in BU in the current period is greater than in NU.

- In the current period, more commercial or administrative expenses were written off to cost in accounting than in accounting due to different methods.

- A loss from the sale of fixed assets is recognized immediately in the accounting system, and gradually in the accounting system over a period equal to the difference between the periods of useful and actual use.

- A loss that will reduce the income tax base in future periods.

Taxable temporary differences (TTD):

- Depreciation in accounting in the current period is less than in NU.

- The amount of interest on loans included in the accounting system in the cost of non-current assets, and in the NU - in expenses.

- The amount of shortage within the limits of natural loss norms, which in the accounting system is included in the actual cost of materials, and in the accounting system is attributed to expenses at a time.

Example

This year the organization incurred the following expenses:

- expenses for prizes for an advertising campaign - RUB 370,000;

- entertainment expenses - 180,000 rubles;

- labor costs - RUB 1,300,000.

Revenue amounted to 3,000,000 rubles. The income tax rate is 20%.

At the end of the previous year, a fixed asset worth RUB 240,000 was registered. SPI is equal to 5 years. In BU, depreciation is calculated using a linear method, while in NU, it is calculated using a non-linear method.

- The limit for standardized advertising expenses is 1% of revenue (clause 4 of Article 264 of the Tax Code of the Russian Federation): 1% × 3,000,000 = 30,000 rubles. Constant difference: 370,000 – 30,000 = 340,000 rubles.

- The limit for entertainment expenses is 4% of labor costs (clause 2 of Article 264 of the Tax Code of the Russian Federation): 4% × 1,300,000 = 52,000 rubles. Constant difference: 180,000 – 52,000 = 128,000 rubles.

- Depreciation accrued in accounting for the year: 240,000 / 5 = 48,000 rubles.

Depreciation accrued in NU for the year: 240,000 × 5.6 / 100 × 12 = 161,280 rubles.

Monthly depreciation rate = 5.6 (Article 259.2 of the Tax Code of the Russian Federation).

Taxable temporary difference: 161,280 – 48,000 = 113,280 rubles.

- Let's calculate the accounting profit: 3,000,000 – 370,000 – 180,000 – 1,300,000 – 48,000 = 1,102,000 rubles.

- Conditional income tax expense: 1,102,000 × 20% = RUB 220,400.

- PNR: (340,000 + 128,000) × 20% = 93,600 rub.

- IT:113,280 × 20%= 22,656 rub.

- Current income tax: 220,400 + 93,600 – 22,656 = 291,344 rubles.

Read about the nuances of developing an internal document establishing the rules for maintaining accounting and accounting records in the article “How to draw up an organization’s accounting policy (2021)?”

Permanent tax liability: postings

In October, Stok LLC awarded E.P. Rozhkin compensation in the amount of 2,700 rubles for using his own car for business purposes. Engine displacement - 2,300 cubic meters. cm.

According to legislative norms, only 1,500 rubles can be accepted as expenses in tax accounting.

Let's consider the entries for accrual of permanent tax liability.

Debit 26 Credit 73 2,700 - compensation accrued to Rozhkin.

Debit 73 Credit 50 2,700 - compensation was issued to Rozhkin from the cash register.

Debit 99 Credit 68,240 - reflected PNO ((2,700 - 1,500) x 20%).

Fill out and send reports to the Federal Tax Service on time and without errors with Kontur.Extern. 3 months of service are free for you!

Results

Discrepancies between accounting and NU arise due to different requirements of legislative acts governing these 2 types of accounting, as well as due to different approaches to accounting enshrined in accounting and tax accounting policies.

Differences between accounting and NU are reflected in accounting, which makes it possible to compare the conditional income tax expense (income), accrued from the amount of accounting profit, and the current profit tax, calculated according to the rules of NU.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.