An individual entrepreneur who needs funds for personal needs can take money from the cash register or transfer it from the individual entrepreneur’s account to his personal account. The owner of a legal entity does not have the right to perform such actions. You can legally satisfy your need for money by drawing up an interest-free loan agreement from your own enterprise. Current legislation does not prohibit this. It is important to know what tax consequences may accompany loan forgiveness to the founder.

The procedure for registering the issuance of borrowed funds to the founder

The Civil Code of the Russian Federation allows for issuing and receiving loans. One party to the transaction may be the founder, and the other – his own company. Moreover, both parties can act as both a lender and a borrower.

In a transaction where the founder acts as the borrower, it is important to comply with all legal rules:

- If a company is created by a group of people, it is necessary to obtain consent to issue borrowed funds from all founders. For this purpose, a council is assembled, the decision of which is documented in a special protocol. The document states the consent of the co-founders to issue a loan.

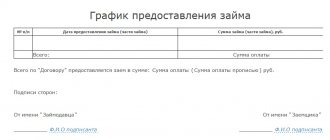

- The essential points of the agreement are preliminarily discussed: amount, terms, absence (presence) of interest for the use of borrowed funds, debt repayment schedule.

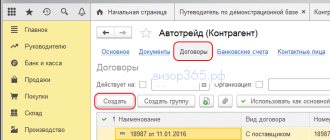

- A written agreement must be drawn up and signed by the borrower and the lender. In a situation where the borrower and lender are the same person, the agreement must be endorsed by an independent representative of the company. A chief accountant or financial director would be suitable for this role.

- After completing the documents, the founder receives money through the company's cash desk or by transfer to his current account.

Results

A creditor with the status of a legal entity can forgive its borrower, another company, the debt and interest on it at any time. It is important that this fact does not contain signs of donation. The forgiven debt increases the borrower's tax base on profits.

You can learn more about the specifics of corporate relations, the subject of which is a loan, in the articles:

- “Is an interest-free loan possible between legal entities?”;

- “The loan is provided in rubles, but issued in foreign currency: how to determine interest limits”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Debt write-off

A loan issued to the founder can be written off if it is repaid by the borrower or after the debt is forgiven. If the return of money is a standard procedure, then writing off (forgiveness) the debt has its own nuances of registration and tax consequences for both the borrower and the lender.

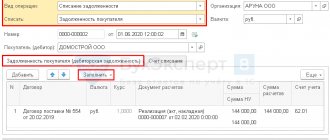

The return of the amount of money by the borrower of the company is reflected in the accounting by the following entries: Dt 50 (51) Kt 66, (67) - cash return to the cash desk (through the bank) of a short-term (long-term) loan.

Accounting for forgiven debt of an individual entrepreneur using the simplified tax system

In conclusion, we note that the amount of “forgiven” debt, a creditor organization that applies the simplified tax system with the object of taxation “income minus expenses,” does not have the right to include in expenses, since the write-off of these amounts is not provided for in the closed list of expenses listed in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated October 23, 2009 N 03-11-06/2/222, dated August 21, 2009 N 03-03-06/1/541).

To get an answer to your question, write it in the “Accountant Consultation” section.

Well, since it turns out that as a result of debt forgiveness, the debtor’s obligation is considered terminated, that is, repaid, then the creditor receives taxable income on the simplified tax system in the form of the amount of the forgiven debt. Example. The company shipped goods worth RUB 500,000 to the buyer using the simplified tax system.

There are no restrictions on the size of the share in the authorized capital or the organizational and legal form of the founder, an individual or legal entity. The transferred amount is also not limited by law.

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

The service generates a personal tax calendar for you. Takes into account the form of ownership, the presence of employees and the taxation system.

The creditor's silence, inaction, or failure to present demands for the provision of what is due cannot be considered debt forgiveness. When a creditor applies the simplified tax system, the amount of forgiven debt is not taken into account in expenses, regardless of the grounds for the debt and the reasons for forgiveness. This type of expense is not included in the closed list of expenses taken into account when calculating the single tax. When the debtor applies the simplified tax system, the amount of forgiven accounts payable is taken into account in the general manner as part of non-operating income.

Forgiveness of debt to the founder

Legislative norms allow debt forgiveness to any borrower, including the founder. The procedure for this procedure is regulated by Art. 405, and 417 of the Civil Code of the Russian Federation.

Such a transaction is sealed with a notice or agreement (agreement) on debt forgiveness. The documents must indicate on what basis the loan was received and what amount is forgiven to the borrower.

To write off a debt, you must have compelling reasons, supported by documents:

- deterioration in the health of the founder or members of his family;

- deterioration of financial situation;

- loss of a breadwinner;

- complete or partial destruction of housing due to natural disasters;

- other compelling reasons.

Once the debt forgiveness agreement has been drawn up, the borrower has no objections and signs it, the transaction must be reflected in the company's accounting and reporting.

Interest on a loan from the founder: you can forgive it, but you need to pay tax

07/21/2021 Author Creating a limited liability company is painstaking work and time. Having decided to establish a company, you need to delve into various details and nuances, study the rules of taxation, management of working capital, etc.

d. Often in such situations, competent legal assistance is needed.

To put a company on its feet, a financial base is needed. The law establishes that the founder is obliged to deposit the authorized capital into the company's current account within 120 days. As practice shows, at the very beginning, the company's expenses exceed the available cash.

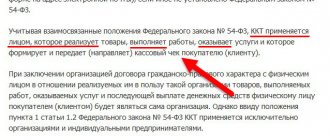

Which leads to the fact that the founder can make an interest-free loan. You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

When there is not enough initial capital to form and develop a company, the founder can make a gratuitous loan or take out an interest-bearing loan. Content: The lender has the right to demand the return of such funds, but can also forgive the debt. In this case, it is necessary to take into account some features.

What fate awaits the accrued but not paid interest to the lender when the debt is forgiven in order to increase net assets? Forgiving a debt is one way to end an obligation. This is stipulated both in current legislation and in judicial practice.

In cases where the return period is not established or determined by the contract

Tax consequences of loan forgiveness to the founder for the lender

The amount forgiven to the debtor is reflected in the accounting records as part of other expenses in the debit of account 91 “Other income and expenses.” The basis document for the accounting entry is the agreement (notice) on debt forgiveness. An interest-free loan is included in accounts receivable; the forgiveness procedure repays the amount and reduces the capital of the enterprise.

Important! When calculating income tax, funds transferred under loan agreements are not included in expenses. When a loan is forgiven, written off receivables are not recognized as an expense (Clause 16, Article 270 of the Tax Code of the Russian Federation).

This creates a permanent difference and a corresponding permanent tax liability. The accounting entry will reflect the PNO as follows: Dt 99 Kt 68 (income tax).

Is a loan considered income under the simplified tax system?

The economic situation in Russia is gradually stabilizing after another crisis.

Small and medium-sized businesses are also gradually moving towards development, while the majority of their representatives prefer to choose a simplified taxation system, where the income of an organization or individual entrepreneur is used for tax calculations.

But not all receipts to the cash register or to the current account are considered income; for example, loans are not. What is it Before dealing with the question of whether a loan is income under the simplified tax system, you need to understand what this taxation system is.

For the first time, a simplified taxation system appeared in Russia after the adoption of Federal Law No. 104 in 2002. It is a simplified tax system (or simply “simplified”), a special tax regime for small businesses that simplifies tax and accounting reporting, as well as reducing the tax burden on companies and individual entrepreneurs, those using it. Simplification can only be used by representatives of small businesses, and it is necessary that the organization or individual entrepreneur meets the following restrictions:

- lack of branches;

- income no more than 120 million rubles;

- share in other organizations is no more than 25%.

- the total cost of fixed assets does not exceed 150 million rubles;

- 100 or fewer employees;

Important!

The restrictions for the application of the simplified tax system established for 2021 are given.

Specific indicators change annually, usually the income limit for a business entity increases

Tax consequences of loan forgiveness for the borrower

When a debt is forgiven, the borrower-founder generates income that must be subject to personal income tax at a rate of 13%. Date of income – the date the debt is written off from the organization’s balance sheet.

Important! The payroll accountant should withhold from the founder 13% personal income tax on the amount of the forgiven debt and personal income tax on other income. The total amount of deductions should not exceed 50% of the income received.

If a tax agent cannot withhold personal income tax, he is obliged to notify the tax office and the taxpayer. To do this, a form in form 2-NDFL is submitted to the Federal Tax Service with the number 2 entered in the “Sign” field.

Insurance premiums are not charged on the amount of the forgiven debt, since the loan agreement is a section of civil law relations. The funds received from the loan become the property of the founder, and such transactions are not subject to insurance premiums.

Individual entrepreneurs using the simplified tax system include interest on loans issued in income

Free legal advice: All of Russia Quote from Sergei Lukyanenko’s book “The Glass Sea” (illustration for the book) Material about revenues that must be excluded when calculating the “simplified” tax. About how to reduce the “simplified” tax through contributions, sick leave, etc.

— in the topic “Reducing tax on the amount of insurance premiums.”

This article will discuss how not to count too much and correctly take into account all exceptional cases.

- if the income is received by an individual and is not related to entrepreneurship, there is no need to pay a “simplified” tax

An entrepreneur, despite his status, does not cease to be a person and can receive income that is not related to business.

For example, Ivanov I.I. sold a residential apartment. Despite the fact that Ivanov is an entrepreneur, the money received from the sale of housing has no relation to his business activities. Ivanov can also get a job as an employee - and his salary will also not be related to his status as an individual entrepreneur.

In these cases, entrepreneurs pay personal income tax - personal income tax, like ordinary citizens.

- if the property is not used in commercial activities and was acquired before the status of individual entrepreneur was obtained, the income from the sale may not be taken into account within the framework of the simplified tax system

If the property was purchased for personal use, its sale is not a business activity. Commercial real estate, the purchase costs of which

Sample agreement

Most often, if a decision is made to forgive an existing debt, an additional agreement is concluded between the parties to the loan agreement in the following form:

Thus, the presented document indicates the mutual agreement of the creditor and the debtor to forgive a debt in a certain amount that was incurred when a certain loan agreement was concluded between them.

The debt forgiveness agreement, as one of the existing legal norms for determining this action, does not have a clear form. Therefore, such a document can be concluded in any form, but only in writing.

.