Accounting for loans: what to do as an accountant in the event of receiving or issuing borrowed funds and accruing interest.

Resources transferred and returned by the borrower on the basis of a contractual agreement are not recognized as expense transactions when accounting for the lender.

If funds with interest are given to legal entities, then the entries used are made to account 58 “Financial investments”.

A sub-account “Provided loans” will be opened on it. In circumstances where the functioning of the organization involves the return of money, the accrued interest goes to account 91.1.

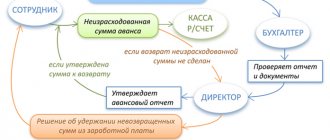

The conditions for transferring borrowed funds to an employee working at an enterprise require the use of account 73 (“Settlements with personnel for other transactions”). In relation to the type of funds, there are accounts 50 (Cash) and 51 (Current Account).

Thus, the combination of a borrowed amount with interest involves the following transactions:

- issuance: D 58 (73), subaccount “Provided loans”, Kr 51 (50);

- return: D 51 (50), Kr 58 (73).

If it is assumed that the company will withhold borrowed resources from the employee’s salary, then account 70 is used.

The wiring for these operations is as follows:

Refunds to employees: D 70, Kr 73.

Essence

Issuing a loan is a method of replenishing a company’s current account. The possibility of providing the service is stipulated in the Civil Code of the Russian Federation (Article 807). In the Civil Code, such a loan is defined from the perspective of the contract. It stipulates the transfer of a loan from the founder (employee, company, microfinance organization) to the current account in the form of money or material assets with generic characteristics. In this case, the company, represented by its representative, undertakes to return the transferred funds (things) within the agreed period.

If an enterprise (legal entity) is involved in the agreement, the paperwork is concluded in writing. The timing of the loan transfer and other terms of the transaction are reflected in the agreement, taking into account the requirements of the law. The transfer of money and material assets is carried out taking into account the payment of interest or without it.

Accounting for borrowed funds

Each organization has the right to provide a loan to another organization;

entries reflecting borrowed funds for individuals and legal entities have a number of differences. First of all, the condition is taken into account whether the loan provided is interest-bearing or is it issued without interest. The provision of a loan is regulated; the entries are given in the article by the Civil and Tax Codes of the Russian Federation, 402-FZ of December 6, 2011 “On Accounting” and PBU 19/02.

According to the current civil legislation, the loan agreement (postings - below) is drawn up in such a way that the lender provides the borrower with tangible or intangible assets, united by generic characteristics, under the conditions of mandatory return of the funds received (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The operation of issuing a loan (posting) is documented with appropriate primary accounting documents. The type of primary documentation depends on the type of assets loaned (clause 1 of Article 9 402-FZ).

Loans issued, transactions for which are formed as part of financial investments, must meet the following requirements (clause 2 of PBU 19/02):

- For a transaction, an agreement must be drawn up that secures the institution’s rights to make financial investments.

- Possible financial risks are calculated.

- There is the ability to generate profitability in the form of interest for the use of loaned assets in future periods.

Thus, to reflect borrowed tangible and intangible objects in the context of financial investments, account 58 “Financial investments”, subaccount 3 is used. If an interest-free loan is provided, such an operation will be reflected as part of expense accounting.

In the case where funds are lent to an individual, the accounting entries for the lending organization will be similar to those above. Interest must be reflected in Dt account 73 “Settlements with personnel for other operations”, subaccount 1.

How is a loan deposited into a current account?

The loan agreement is concluded with the participation of companies and citizens. The following options are possible:

- Depositing a loan from the founder to the current account or employee of the organization.

- Obtaining a loan from an MFO.

- Applying for a loan from another organization.

- Raising money from private individuals at interest and with a public offer.

The mentioned agreements are drawn up taking into account the current legislation regarding the conclusion of such agreements.

What to do with additional expenses

In addition to interest, borrowed money may be accompanied by additional expenses:

- To service cash flows (bank commission for obtaining a loan).

- Consulting and information services.

- Other costs.

They will be reflected as other expenses regardless of the purpose and duration of the contract. To ensure correct accounting, the accounting employee makes the following entry:

- Debit 91.02 “Other expenses” Credit 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”.

The receipt of borrowed money into the company's accounts must be taken into account in accordance with the law, so that there is no confusion when repaying the debt and reporting it. Capital attracted from outside requires careful attention.

Subtleties of design

A common case is when an agreement is concluded with the founder of an enterprise. The advantage of this method is that such a deposit of a loan into a current account is not subject to taxation. If we are talking about difficulties in which a company participant is not able to help financially, the organization turns to special credit institutions.

Registration takes place in the following stages :

- Drawing up the text of the agreement. The loan term, amount, interest (if any) are specified here.

- Agreement agreement and signing.

- Transfer of funds to the borrower on the day specified in the agreement.

Interest-bearing loan

Let's consider an example - an organization took out a loan in the amount of 200,000 rubles from the founder Ernest Yakovlevich Golovanov at 8% per annum. The loan term is 1 year.

It is necessary to reflect the transactions of obtaining a loan, accruing interest, withholding personal income tax and paying interest and debt.

Getting a loan

To receive a loan, we will create a document “Receipt to the current account”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

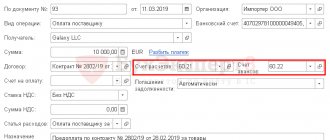

Select the operation “Receiving a loan from a counterparty”:

In the document we indicate:

- Organization and date.

- The founder who gives the loan.

- Loan amount.

- The settlement account is 66.03, since in this case the loan is short-term.

Let's look at the wiring:

According to Kt 66.03, a debt is formed to the founder.

The loan can also be obtained in cash. In this case, a document “Cash receipt” is created with the operation “Receipt of a loan from a counterparty”.

Calculation and accrual of interest on the loan

There is no separate document for calculating interest, so we will create a manual operation. Go to the section “Operations - Accounting - Operations entered manually”, click “Create - Operation”:

We indicate the posting Dt 91.02 Kt 66.04, as well as the amount of accrued interest for the month.

Accrued interest is reflected on the credit of account 66.04; we indicate the founder and the agreement as a subconto.

Interest for other months will be calculated in the same way.

Personal income tax on interest income

On accrued interest, personal income tax must be withheld from the founder in the amount of 13%.

To do this, we will create a manual operation with posting Dt 66.04 Kt 68.01:

The same entry will need to be entered monthly.

In addition, in order for personal income tax to be reflected in the reporting, you need to create a document “Personal income tax accounting transaction”. Go to the menu “Salaries and personnel - personal income tax - All documents on personal income tax”:

We create the document “Personal Tax Accounting Operation”:

In the document we indicate information about income calculated and withheld by personal income tax.

We create a document in the same way in other months.

Transfer of interest to the founder

To pay interest to the founder, we will create a document “Write-off from the current account” with the type of operation “Return of loan to counterparty”:

In the document we indicate:

- Organization and date.

- Founder and agreement.

- The amount of interest minus personal income tax.

- Type of payment “Payment of interest”.

- Settlement account 66.04.

Let's look at the wiring:

According to Dt 66.04, part of the interest to the founder was repaid.

In the following months, interest will be repaid in the same way.

Loan repayment

At the end of the loan term, the principal debt must be returned to the founder. To do this, we will create the document “Write-off from the current account”, the operation “Return of loan to counterparty”:

In the document we indicate:

- Organization and date.

- Founder and agreement.

- The amount of the principal debt.

- Type of payment “Debt repayment”.

- Settlement account 66.03.

Let's look at the wiring:

According to Dt 66.03, the debt to the founder was repaid.

How is money credited?

The loan is deposited directly into the company's bank account. The following paths are highlighted here:

- Registration of a transfer from the account of a citizen or organization that transfers money to the recipient’s bank account. The agreement between the parties specifies the details for the transaction.

- Through a self-service terminal (with the bank open).

- Transfer of funds at a branch of a financial institution. This is a classic method, which will also require bank details. This option is relevant in cases where the lender’s money is available in cash.

Depositing a loan into a current account (from the founder or another party) does not require any other manipulations. An exception is the preparation of financial statements. As soon as the funds are transferred, they become the disposal of the organization.

Posting accrued interest on loans issued

The interest benefit can be distributed to income from the target operation or to other income. This choice is prescribed in the company's statutory accounting documents.

Receipt of interest satisfies the following transactions:

- accrual: D 76, Kr 91-1 “Other income”;

- receipt of interest funds: D 50 (51), Kr 76.

Interest in kind

Receiving interest in kind will be reflected on the balance sheet only when it is generated:

- accrued interest in kind: D 76, Kr 91-1;

- payment of interest in the form of acquired property: D 41 (09, 10), Kr 76;

- accounting for tax on dividends in the form of acquired property: D 19, Kr 76.

Postings in accounting

In practice, the postings when a loan is deposited into a current account depend on the repayment period. If the agreement is concluded for a period of up to a year, account 66 is used, and when concluding an agreement for a period of more than a year, account 67 is used. The accounting entries are as follows:

- D50 K66 (67) - received an interest-free loan (in cash at the cash desk).

- D51 K50 - funds “entered” the company’s account.

The Tax Code of the Russian Federation (Articles 251 and 270) states that money transferred and received under a loan agreement is not taken into account from the point of view of expenses and profits.

Posting a loan in kind

The return of resources can occur in kind. Capital investments in the presented situation are equal to the value of assets given away by the enterprise for a certain period. The total value of the assets given up is calculated on the basis of similar assets under similar conditions.

If property is transferred as debt resources, then such transfer is not included in expenses. The in-kind form when transferring property from the paying company implies the accrual of VAT.

Transactions under such circumstances will reflect:

- calculation of the tax on personal income from the amount of resources: Debt 91-2, Credit 68, subaccount “Calculations for VAT”;

- return: Debt 51 (50), Credit 58-3 (76).

When returning resources in kind, the value of VAT on newly received property is determined by the operations carried out:

- accounting for VAT upon return (incoming property): Debt 19, Credit 58-3;

- subtracting input tax: Debt 68, subaccount “Calculations for VAT”, Credit 19.

In the last entry, input VAT is deducted for events where the operation of the enterprise is subject to VAT.

Examples of transactions with transactions on account 67

Example 1. Accounting for a long-term loan received from a bank

LLC "Vesna" received a loan from the bank OJSC "Osen" for 3 years in the amount of 2,500,000 rubles. Principal and interest are calculated monthly in equal installments at a rate of 13.5% per annum.

Table of transactions for account 67 - Long-term loan:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 2 500 000,00 | Obtaining a loan from OJSC "Osen" | Bank statement |

| 91.02 | 67 | 28 125,00 | The amount of interest on the loan for the month is reflected | Loan agreement, accounting certificate |

| 67 | 51 | 69 444,44 | Monthly principal payment | Payment order |

| 67 | 51 | 28 125,00 | Payment of interest | Payment order |

Example 2. Issue of a bond with a value higher than its par value

Let’s say an organization placed a bond on the secondary market worth 16,000 rubles, par value – 10,000 rubles. with a maturity of 24 months.

Posting table – Issue of a bond with a value greater than the par value:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 10 000 | Reflection of the nominal value of the bond | Bank statement |

| 51 | 98 | 6 000 | Cash above par is reflected in accounting | Bank statement |

| 98 | 91.01 | 250 | Every month | Accounting certificate-calculation |

If an interest-bearing loan is provided: entries under the interest agreement

Thus, when concluding an interest-bearing loan agreement, entries are made using special account 58 “Financial investments”, and a separate sub-account “Funds transferred for loan” should be opened for this accounting account.

| Contents of operation | Debit | Credit |

| Loan issued, accounting entries: | ||

| In cash | 58 | 50 "Cashier" 51 “Current accounts” 52 “Currency accounts” |

| In kind | 01 "Fixed assets" 10 “Materials, raw materials” 41 "Products" | |

| Repayment of borrowed funds | 50, 51, 52, 01, 10, 41 | 58 |