The property rights of the enterprise are extremely extensive. The company's capital can include both tangible and intangible objects, financial assets, and cash equivalents. To implement a company's activities, values that do not belong to it are often used. Such objects can be transferred under a leasing agreement. They must be reflected in accounting.

Is property recorded in off-balance sheet accounts subject ?

Purpose

According to PBU, an off-balance sheet account is used to summarize data on valuables that do not belong to the organization, but are in its use temporarily. These can be leased fixed assets, material assets in storage, in processing, property under leasing operations, etc. Based on such data, a “Certificate of Assets in Off-Balance Accounts” is compiled, which is attached to statistical reporting. An organization can create its form independently, provided that the document contains complete information about its financial position.

Economic essence

The term off-balance sheet liabilities is not entirely correct and does not reflect the essence, since in the literal sense, a liability is nothing more than debts that should be listed on the balance sheet in accounting. In fact, we are talking about assets that are designed to guarantee the proper execution of agreements on transactions with counterparties, and are taken into account outside the balance sheet.

A more relevant term in this case would be “off-balance sheet security of obligations.” The collateral subject to such accounting can be equipment, transport, bank guarantees, real estate, etc.

The specificity of the collateral is that during the period of use of the assets as a guarantor, the company cannot use them in other areas. As soon as the obligation is fulfilled in full and the legal relationship with the counterparty is actually resolved, as determined in the agreements, the asset is released from the encumbrance and remains with the entity. If there were violations of the execution of the transaction on the part of the executor, then the property acting as a guarantor will be transferred to the partner under the contract on the right of ownership.

Funds that are necessary to fulfill obligations cannot be used in other directions

An off-balance sheet obligation in common parlance is a deposit (pledge, advance) that is accepted by a partner for a time and remains either until the transaction is completed, or on an ongoing basis if the counterparty fails to fulfill its part of the contract.

Which account is off-balance sheet?

- 001 "Leased OS".

- 002 “Inventory and materials accepted for storage.”

- 003 “Materials in Processing”.

- 004 “Goods accepted for commission.”

- 005 “Equipment under installation.”

- 006 “Reporting forms”.

- 007 “Written off debt of debtors.”

- 008 "Received collateral".

- 009 “Issued collateral.”

- 010 “Wear and tear of OS.”

- 011 “OS for rent.”

Additionally can be used:

- 012 “Intangible assets received for use.”

- 013 “Central Banks received as collateral.”

- 014 “Contingent assets”.

- 015 “Contingent obligations”.

Equipment

Off-balance sheet accounts 001, 004 are used to display the movement of property. Article 001 includes data on objects handed over for use. Fixed assets are accounted for at the cost indicated in the documents (agreement, transfer and acceptance certificate, copies of the card). Correspondence is carried out according to lessors and inventory numbers. Settlements with the client are displayed under article 76: by debit - accrual of rent, by credit - receipt of funds.

Balances of the item “Equipment for installation” are used by contractors to show the movement of property that they have in the process of assembly. The breakdown is carried out by units at the prices specified in the acts. Acceptance of equipment is documented in form No. OS-15. The customer has it listed on account 07: DT08 KT 07. If previously recorded property is transferred, then an entry is made: DT 01 sub-counter “Installation”, KT 01 sub-counter “In warehouse”.

Fixed assets on the off-balance sheet account appear with the contractor. When the equipment arrives, posting DT005 is generated. Installation costs are displayed according to DT20 in correspondence with the corresponding cost items (10 “Materials”, 70 “Calculation of labor costs”, 23 “Auxiliary production”). For work performed, a third party issues an invoice: DT 62 CT 90-1. Upon completion of the work, these amounts are written off by posting DT90-2 KT 20. The cost of the finished object (construction) is formed as follows: DT62 KT90-1. The tax is calculated using standard posting: DT90-3 KT68. How to write off off-balance sheet accounts? They need to be financed. The basis for recording is an application for release of OS for installation. Transferred equipment that was not installed is not included in the volume of capital investments.

Off-balance sheet accounts in budgetary organizations

If the organization is classified as a budget organization, off-balance sheet values are recorded in it according to a simplified scheme - there is no need to keep corresponding records. When property is capitalized, the necessary entry is made in the debit of a certain off-balance sheet account. At the time of write-off, this entry is made against the loan. It is allowed to introduce additional off-balance sheet accounts for greater reliability of management accounting, naturally, indicating them when developing accounting policies.

So. Off-balance sheet accounts allow you to display information about property that is located on the territory of the enterprise, but does not belong to its property. Other data is also stored on the AP. Having off-balance sheet accounts during tax audits will allow you to avoid making unnecessary tax deductions. It is also a source of important information about the company's activities. The information allows you to track operations carried out by the enterprise.

Raw materials

Off-balance sheet accounts 002 – 004 are used to display the movement of materials.

The article “Inventory accepted for storage” is used to display the movement of valuables if:

- The company does not want to pay for materials. The paradox of the situation is that ownership transferred to the buyer at the time of transfer of goods and materials. Information that such materials are credited to off-balance sheet accounts must be provided to the seller in writing.

- Inventories were received from suppliers, which, according to the terms of the contract, cannot be spent.

Government institutions on account 002 can indicate unused property that has not yet been written off. Accounting is carried out at prices from acts. Analytics is carried out for all owners, types and storage locations.

Suppliers take into account paid for valuables left in storage, issued with receipts, but not taken out. In this case, the shipment is reflected by posting DT002. Only after the goods are collected can the account be closed. Most often, this cost item is used by companies that accept raw materials for trust storage. They do not receive real property; all transactions are displayed behind the balance sheet. As a result, the organization's net assets turn out to be significantly greater than those indicated in the documents.

Account 003 reflects data on the movement of customer-supplied raw materials at contract prices. Analytics is carried out by customers and types of materials. Processing costs are taken into account according to DT20. The cost of the products transferred to the seller is reflected by posting DT62 KT90-1. VAT is calculated as follows: DT90-3 KT68.

The article “Goods on commission” is used by commission agent organizations. Accounting is carried out at prices from the act in the context of types of goods and clients.

Off-balance sheet account 006 displays the movement of strict reporting forms - receipts, diplomas, certificates, subscriptions, tickets, coupons, etc. The list of documents is established by the organization. Analytics is carried out by storage location.

What are off-balance sheet accounts?

Off-balance sheet accounts (AB) are intended to store information about the objects used by the company. Their key feature is that the company does not have ownership rights to these objects. They are temporarily part of the company. Provided on the basis of various agreements. These objects may include:

- rented premises, warehouses;

- valuables transferred for safekeeping;

- raw materials accepted for processing;

- equipment adopted for the purpose of installation work.

How can a tenant account for leased objects (premises, equipment, other property) on off-balance sheet account 001?

The principle of property separation and off-balance sheet accounts

The organization of off-balance sheet accounts is based on the principle of property separation. It states that the accounting of an organization's assets should not coincide with the accounting of the assets of its owners, as well as the assets of other organizations under the care of this organization. The same principle applies not only to assets, but also to liabilities.

Objects temporarily included in the assets, provided under certain agreements, do not belong to the enterprise. However, during a certain period of time, it is the enterprise that is responsible for them, which means it must take them into account in a certain way. But such values cannot be mixed together with those owned by right of ownership within the same accounting accounts.

When and how to take into account inventories on off-balance sheet accounts ?

Off-balance sheet accounts are auxiliary accounts within the framework of accounting. They become relevant if you need to obtain information not contained in balance sheet accounts. This feature explains their name. Balances from off-balance sheet accounts will not be included in the balance sheet. They are displayed behind the total of this indicator. That is, they are recorded on the balance sheet.

IMPORTANT! Information from the accounts in question does not affect financial performance. For this reason, they will not appear in the company's financial statements.

What are off-balance sheet accounts for?

Off-balance sheet accounts perform the following functions:

- Accounting for the availability of property and tracking transactions with it. Accounting may also concern objects that belong to the enterprise, but their value is written off as expenses.

- Collection of data necessary for the formation of explanations for the main balance sheet and financial statements.

- Control over the operation of property to which the enterprise does not have ownership rights.

- Control over the safety of the objects in question.

- Supporting role to monitor the execution of property papers without delays. In particular, documents are drawn up on the receipt of objects and their disposal.

- Full organization of accounting in this area.

Properly executed off-balance sheet accounts allow you to obtain all the data on objects that are located on the territory of the enterprise, but do not belong to it. Information is necessary to analyze the company's creditworthiness and determine its financial stability.

Example

The company carries out repair work under two contracts. The first organization sold the materials to the contractor, and the second paid for them. The raw materials were fully used in production. The cost of materials is 430 thousand rubles. (without VAT). The second organization transferred to the first customer-supplied raw materials in the amount of 787 thousand rubles. According to the report, materials worth 236.5 thousand rubles were used for production purposes. These operations will be reflected in the accounting system as follows:

- DT 10-1 KT 60 – 430,000 – capitalized materials.

- DT 20 KT 10-1 – 430,000 – raw materials are included in expenses.

- DT 003 - 787 000 - accounting for customer-supplied raw materials.

- KT 003 – 236,500 – the cost of consumed materials has been written off.

Standard operations on account 02

Any company has fixed assets - its own or leased. Therefore, almost everyone uses 02 account. There are typical accounting entries that occur most often.

| Wiring | The essence of the operation |

| Dt 02-1 Kt 02-2 | The amounts of depreciation of leased fixed assets that became property are reflected |

| Dt 02 Kt 01 | Depreciation accrued during use is written off |

| Dt 02 Kt 83 | Reduced depreciation as a result of markdown |

| Dt 02 Kt 79 | Reduced depreciation on fixed assets transferred to OP on a separate balance sheet |

| Dt 20 (25, 23, 26, 44, 91) Kt 02 | Accrued depreciation on fixed assets |

| Dt 79 Kt 02 | Depreciation was accrued for fixed assets of a separate division |

| Dt 83 Kt 02 | Increased depreciation as a result of revaluation of fixed assets |

| Dt 91 Kt 02 | Depreciation accrued by the lessor organization on leased fixed assets |

Use the cloud service Kontur.Accounting to automate the calculation and calculation of depreciation. Keep records, submit reports, pay salaries and calculate sick leave - 14 days free for all new users.

Cash

Off-balance sheet accounting accounts 007 – 009 reflect capital movements. The article “The debt of insolvent debtors is written off” contains data on the amounts attributed to the loss three years after the payment date. For the next five years, they are listed in account 007. After this period, it is impossible to collect the debt, even if the debtor’s financial situation changes. Receipts of payments are recorded by posting DT 51 (52) KT 91-1. Analytics is carried out for each client and debt.

Received (008) and issued (009) security for the fulfillment of obligations are recorded according to the amounts from payment documents and are written off as the debt is repaid. DT displays:

- bonds received/transferred to secure loans;

- bills of exchange used as a guarantee for shipments;

- purchased/sold options and warrants.

All guarantees received in the form of a letter from a guarantor or a deed for the transfer of valuables serve as security for payments. They are accounted for according to payment documents and are recorded in the debit of account 008.

It is worth dwelling on the funds that store owners take from financially responsible persons. Individuals must deposit money before receiving access to goods. These funds can be used or deposited. In the first case we are talking about a loan. The operation is formalized by posting DT 51 CT 66 (67). In the second case, there is a deposit: DT 51 CT 76. These entries are then debited from 008. When an employee leaves, the funds are returned to him. If the relationship was formalized in the form of a loan, then additional interest must be paid.

Low value fixed assets

Many taxpayers often include written-off fixed assets on their balance sheet, which, according to accounting rules, can be immediately attributed to expenses. We are talking here about fixed assets worth no more than 40,000 rubles (clause 5 of PBU 6/01).

For low-value property, the chart of accounts does not provide for special off-balance sheet accounts. Therefore, the organization has the right to independently add the corresponding account to its working chart of accounts. For example, you can take into account written-off fixed assets by opening account 012 “Accounting for low-value property.”

It is very important to keep written-off fixed assets off balance sheet while they are still usable. In this case, you can easily monitor the safety of property at the enterprise. When conducting an inventory, the values recorded in off-balance sheet accounts must also be reflected in the inventory lists.

Example of accounting for written-off fixed assets

Snezhinka LLC bought a photocopier. The cost of the device was 5,700 rubles, not subject to VAT. The company's accounting policy requires that low-value fixed assets be classified as expenses at a time, followed by the reflection of the property in off-balance sheet account 012.

The accountant of Snezhinka LLC will document business transactions with the following entries:

Debit 10 Credit 60 - 5,700 - photocopier was capitalized as part of inventories/

Debit 25 Credit 10 - 5,700 - cost of the photocopier written off as expenses/

Debit 012 - 5,700 - the photocopier is put on off-balance sheet accounting/

Three years later, the copier broke down and they decided to deregister it due to its unsuitability for work. The accountant made the following entry:

Credit 012 - 5,700.

Writing off the cost of an object

Account 010 is used to display information about the amount of depreciation of housing assets, external improvements, and fixed assets for non-profit organizations. Accrual is made at the end of the year. Upon disposal, amounts are written off to KT 010.

It is important to immediately clarify the difference between depreciation and amortization in the context of this operation. In the first case, fixed assets are accounted for on the balance sheet, and in the second - in an off-balance sheet account. Budgetary and non-profit organizations do not create value. Accordingly, they do not show depreciation on the balance sheet. For them, the cost of the OS is written off completely at the time of purchase. There is no income, and there is also no opportunity to stretch out expenses. In such cases, it is recommended to charge depreciation on the fixed assets once a year to account 010. This operation does not increase costs and does not reduce the base for calculating VAT, but it is beneficial to organizations that pay property tax. The basis for its calculation is the residual value of the asset. It is determined by the following formula:

Balance at the beginning of the year (01) – accrued depreciation (02) – depreciation (010).

How does depreciation work?

You need to start accruing depreciation from the first day of the month following the day when the fixed asset was accepted for accounting. We accepted the OS in August - we calculate depreciation from September.

Until the useful life expires, accruals cannot be stopped. Suspension of work or cessation of use of equipment is not a reason to stop accrual. Suspension is permitted only for conservation for a period of more than 3 months or for a restoration period of more than 12 months.

Accrual must be stopped from the first day of the month following the one in which the object was written off or its cost was fully paid off. That is, depreciation does not need to be charged on any fully depreciated fixed assets with zero residual value, even if your company continues to use them.

Depreciation for recording is calculated monthly in accordance with the method approved in the accounting policy for individual groups or fixed assets:

- linear;

- reducing balance;

- by the sum of the numbers of years of useful life;

- proportional to production volume.

For any method, the useful life is important - this is the period during which the depreciable object generates income. The organization determines the period when it accepts the asset for accounting. When repairing or improving equipment, the useful life is increased.

Leasing

The article “Fixed assets in lease” is used if, under the terms of the transaction, the property must be on the balance sheet of the tenant. Accounting is carried out for each object at contract prices. Leasing operations also appear here. The agreement specifies which party should credit the object to account 011. In both cases, the fixed assets are written off upon the return of the object. If the agreement stipulates that the property is accounted for on the lessee’s balance sheet, then the following entry is generated:

- DT08 KT76.

- DT01 KT08 - costs and cost of the received object are written off.

Lease of fixed assets: off-balance sheet accounting from the lessor

An organization can rent OS, or it can lease its own assets to other companies, entrepreneurs or individuals. The transfer of property for rent is confirmed by documents - for example, an acceptance certificate in any form, taking into account the requirements for mandatory details (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ) or unified forms OS-1, OS-1a , OS-1b (clause 1 of article 655 of the Civil Code of the Russian Federation).

If the lease agreement does not provide for the purchase of property by the tenant, then for the entire duration of the agreement, ownership of the fixed assets remains with the lessor (Articles 606, 608 of the Civil Code of the Russian Federation) and is taken into account on its balance sheet (clause 21 of the Methodology for accounting for fixed assets, approved by order of the Ministry of Finance RF dated October 13, 2003 No. 91n). Exception:

- lease of a company as a property complex - then the asset is taken into account on the balance sheet of the lessee;

- leasing - fixed assets may be on the balance sheet of one of the parties, depending on the terms of the agreement.

Leased property must be accounted for separately from its own fixed assets. If the agreement provides for the accounting of fixed assets on the lessor’s balance sheet, then the asset continues to be reflected in his account. 03 or 01, depending on whether the OS was originally purchased for rental or is another activity of the company.

The transfer of an object for rent is reflected by transactions, which you will learn about in the article “Accounting for the lease of fixed assets (nuances).”

If a leasing agreement is drawn up and, according to it, the transferred property should be taken into account on the lessee’s balance sheet, then the lessor’s asset should be reflected on the balance sheet - on the debit of the account. 011 “Assets leased out.” On this account, the lessor will take into account the fixed assets for the entire period of validity of the leasing agreement in the assessment established by such an agreement. Analytical accounting on the account. 011 is maintained for lessees and objects leased. At the end of the leasing agreement and the return of the asset, the lessor's accountant makes an entry on the credit account. 011. The returned asset itself is accounted for in the account. 01 or 03 or on account. 41, if its further resale is intended. Transactions for leasing a property complex are reflected in accounting in the same way.

For more information about the nuances of reflecting fixed assets transferred for leasing on the balance sheet of the lessor and the lessee, read the article “Operations under a leasing agreement in accounting.”

Example

The organization provided grain storage services. The contractual value of the transaction is 100 thousand rubles. The services are valued at 15 thousand rubles, the costs of the custodian are 10 thousand rubles. In the accounting system this operation is reflected as follows:

- DT002 - 100 thousand rubles. — grain accepted for storage.

- DT62 KT90/1 - 15 thousand rubles. - payment for the service has been received.

- DT90/2 KT20 (25, 26) - 10 thousand rubles. — the costs of the custodian are reflected.

- DT51 KT62 - 15 thousand rubles. — revenue is reflected.

- DT90/9 KT99 – 5 thousand rubles. — profit from the operation is identified.

- KT002 - 100 thousand rubles. — the grain was returned to the client.

Property on off-balance sheet accounts

The process of capitalizing large objects does not raise any questions. Problems begin when it is necessary to register and then write off OS worth up to 3,000 rubles, especially if we are talking about a government institution. In this case, you need to fill out a “Statement of issuance of goods and materials for the needs of the organization”, then all damage is taken into account on account 21.

Assets that cost more than 3,000 rubles are listed until disposal. It is enough to display the write-off on the CT of the off-balance sheet account. There is no need to create any additional wiring. Book value of objects up to 40 thousand rubles. after commissioning should be zero. For units that are valued between 3-40 thousand rubles, it is necessary to restore the original cost and depreciation.

Write-offs from the off-balance sheet account are carried out by decision of the commission on the basis of an act signed by the owner of the property and the manager. The entry is created for the amount of the original cost. The transfer of objects for use is formalized on the basis of an act by posting to account 21 with a simultaneous change in the responsible person.

Objects worth up to 3,000 rubles are credited to budget off-balance sheet accounts at full price. The exceptions are library collections and real estate. OS is received according to primary documents confirming the commissioning of the unit. Internal movement is reflected by changing the person in charge and/or the storage location.

Procedure for maintaining off-balance sheet accounting

Maintaining off-balance sheet accounting ensures control over the use and safety of valuables that are in temporary possession of the institution, as well as timely and correct execution of the relevant accounting documentation and the organization of proper off-balance sheet accounting.

Off-balance sheet accounting is carried out in a simple form, avoiding spam, that is, amounts for transactions with assets taken off-balance sheet are reflected either as a debit or as a credit. There is no correspondence (double entry) regarding them.

Postings are compiled according to the following rule: the required amount is recorded either in Dt or in Ct. The same operation should not be carried out on the debit of one account and on the credit of another. On the off-balance sheet Dt, accounting records are formed for the receipt of property and the issuance of security, on the Kt - the disposal of valuables and the completion of security.

The balance at the beginning of the period (month) indicates the presence of one or another type of value that is accounted for in a certain account. The balance at the end of the month for the client is always in debit.

The debit balance at the end of the period determines the balance of funds formed at the reporting date.

Violations

Recording valuables in off-balance sheet accounts is usually not a hassle. It is maintained quite simply: receipt, issue or receipt of guarantees is reflected only in debit, and repayment of obligations - in credit. Off-balance sheet accounts do not correspond with each other. But even with such a simple scheme, companies do not pay enough attention to accounting. As a result, tax officials find errors in the documentation and fine organizations.

Art. 15 of the Code of Administrative Offenses of the Russian Federation establishes administrative liability for violating the rules of accounting, within the framework of which a fine of 2000-3000 rubles is imposed. Such violations include distortion of any reporting line by more than 10%. Art. 120 of the Tax Code of the Russian Federation additionally provides for liability for understatement of income items or the value of taxable items.

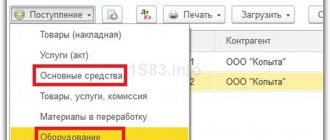

How to add off-balance sheet account 012 to the chart of accounts in 1C 8?

- New bans on UTII and PSN from 2021: read the amendments to the Tax Code

- How to notify employees about the transition to electronic work books?

- Form 57-T: in November you need to submit information on employee wages to Rosstat

- After conducting an audit, the Social Insurance Fund accrued the salary of the director who was on leave without pay: what to do?

- SZV-TD: a new report has been introduced, which policyholders will submit to the Pension Fund of Russia from 2021

- The government has approved indicators for calculating insurance premiums in 2021

- Electronic work books and a new monthly report from 2020: read the educational program from the Pension Fund of Russia

- New report to the Pension Fund on work books: is it necessary to reflect part-time workers?

- Amendments to personal income tax and insurance contributions: how payment rules and reporting will change in 2021

- Do I need to pay insurance premiums in the amount of 1% on the “excess amount” at the end of the year in order to reduce the individual entrepreneur’s tax on the simplified tax system (6%) for the year?

- Is it possible to combine UTII and simplified tax system when trading in 2020?

- Time sheet for 2021

- Amendments to the simplified tax system: how to now take into account certain types of income and expenses

- Can an organization have no employees if there is no activity?

- What is the maximum rate for an external part-time worker?

- The Social Insurance Fund reported when it is possible to confirm the main type of activity to establish the rate of contributions “for injuries”

- SZV-TD: a new report has been introduced, which policyholders will submit to the Pension Fund of Russia from 2021

- Is it possible to combine retail trade on UTII and retail trade of excisable goods on the simplified tax system in 2021?

- How to register and pay for a day off on December 31

- Work record book: can the date of dismissal and the date of acceptance to a new job coincide?

Commission agreement

With the transfer of goods to the commission agent for sale, the principal does not lose ownership rights. Therefore, such valuables are transferred to off-balance sheet account 004 at the prices specified in the act. At the time of transfer, these figures are written off in full. The problem will arise if the organization reflects such goods on the balance sheet account. The tax authorities may qualify the agreement as an ordinary purchase and sale. If the goods are paid for by the consignor by a third-party supplier, then it will not be possible to prove the legality of the transaction even in court.

How to write off inventory items from an off-balance sheet account

Write-off of valuables is also carried out without correspondence. Since the structure of such an account is similar to the structure of the active balance sheet account, the expense of inventory and materials is always reflected on the right side, that is, on the loan. The basis for such a write-off depends on the specifics of the situation. For example, placing an asset on the balance sheet of an enterprise (when paying for products) or disposal of valuables as a result of their sale (for goods on commission), processing (for customer-supplied raw materials), return (for goods and materials in secondary storage), etc.

Inventory

The correctness of property tax calculation depends on the completeness of the information reflected in account 002. If the inspection reveals that an organization acquired fixed assets and unreasonably capitalized them into an off-balance sheet account, then the taxpayer will have to pay a fine and additional tax. Ownership rights are critical in such transactions. If an enterprise received an OS for rent, free use and capitalized it as 01 instead of 001, negative consequences in the form of inspections and fines will not be long in coming.

Nuances

Accounting for off-balance sheet accounts of government organizations follows a similar algorithm, but with specific features. Land plots received by the institution for free use are included in the balance sheet at cadastral value. An assessment will have to be carried out only if the object is located outside the Russian Federation. Off-balance sheet accounts in budget accounting display data on forms such as sick leave certificates. When a vehicle is disposed of, spare parts that were listed on 009 must be written off. Receipts (outflows) of funds are reflected in debit 17. Government organizations can write off receivables ahead of schedule if:

- the debtor was liquidated, and this fact is documented;

- The deadline for resuming the debt collection procedure has expired.

Off-balance sheet accounts with inventory items can now also contain information about the movement of valuables that are subject to write-off due to wear and tear or due to the impossibility of further use.

Lease of fixed assets: off-balance sheet accounting by the lessee

The company must account for the property accepted from the lessor separately from its own assets (clause 5 of PBU 1/08, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n). The property received is reflected in the debit of the account. 001 “Leased OS” in the valuation specified in the contract. Analytical accounting in this account is carried out by lessors, and by fixed assets - by inventory numbers of the lessor.

IMPORTANT! Leased operating systems located outside the Russian Federation should be reflected separately.

The return of the leased asset is reflected in the credit account. 001.

Similar entries are made in the case of concluding a leasing agreement with the condition that the asset remains on the balance sheet of the lessor: the lessee does not put the leased object on his balance sheet, but takes it into account. 001.

From January 1, 2022, lease transactions are accounted for in accordance with FAS 25/2018 “Lease Accounting”, approved. By Order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n. You can begin to apply the Standard earlier than the specified period by reflecting this fact in the accounting (financial) statements. Learn the procedure for applying the FSBU in ConsultantPlus by receiving free trial access to the system.

Conclusion

To record values that are in temporary use of the organization and do not belong to it, special off-balance sheet accounts are used. All capitalization transactions are displayed as a debit, and write-offs as a credit. If necessary, you can add off-balance sheet 1C accounts and keep records without violating the law. All cost items and subcontos are already built into the basic version of the program. Standard transactions and reporting are generated using standard documents. Amounts in such accounts are not included in the balance. Therefore, the net assets of leasing companies and organizations that accept large quantities of materials for storage are underestimated.

Results

Accounting for the balance of collateral for the obligations of an enterprise is an objective necessity caused by the variety of operations carried out in the existing economic conditions.

Correct reflection of off-balance sheet obligations will allow you to control transactions with the organization’s property, which is transferred for temporary possession to another party. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.