Cash order as a legal category

Expenditure cash order (RKO) as a separate legal category is enshrined in the Russian Federation by Resolution of the State Statistics Committee of August 18, 1998 No. 88. According to this legal act, RKO should be used by organizations to issue cash from the cash register.

RKOs are created in 1 copy, signed by the head of the organization, as well as the chief accountant or a person having the necessary authority. The name of the form of cash receipt order in accordance with Resolution No. 88 is KO-2. According to the OKUD classifier, it corresponds to number 0310002.

You can download the RKO form from the link.

ConsultantPlus experts have prepared step-by-step instructions for completing cash transactions:

If you do not have access to the K+ system, get a trial online access for free.

Is it necessary to issue a cash receipt order?

In accordance with information from the Ministry of Finance No. PZ-10/2012, Russian organizations have the right not to use forms of accounting documents contained in albums of unified forms of relevant sources. One of the albums of this type is included in the structure of Resolution No. 88, and it reflects the KO-2 form.

At the same time, in accordance with the same source, forms of documents that are approved by authorized structures on the basis of federal laws remain mandatory. Thus, in accordance with clause 4.1 of the Bank of Russia Directive No. 3210-U dated March 11, 2014, cash transactions must be formalized by business entities using cash outgoing orders corresponding to number 031002 according to the OKUD classifier, that is, exactly those provided for by Resolution No. 88.

In accordance with Art. 34 of the Law “On the Central Bank of the Russian Federation” dated July 10, 2002 No. 86, the Bank of Russia has the right to establish the procedure for conducting cash transactions for legal entities in general, as well as a simplified procedure for individual entrepreneurs and small businesses. Therefore, all taxpayers with the status of legal entities, entrepreneurs and small businesses are required to follow the provisions of Directive No. 3210-U. Thus, the legislation requires Russian organizations to use exactly the form of cash receipt order that is established by Resolution No. 88.

However, individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses or physical indicators characterizing a certain type of business activity, may not draw up cash documents and a cash book (clauses 4.1, 4.6 of Directive No. 3210-U) . Thus, if an entrepreneur takes into account the movement of business funds in the books of income (and expenses), then he may not formalize cash settlements.

Read more about cash discipline here.

When leave is granted according to the Labor Code of the Russian Federation

Laws equally respect the rights of women who give birth on their own, on an equal basis with those who adopt a baby. A pregnant woman has the right to take a break during the prenatal and postnatal period . Adopting a child under 3 months – for the leave necessary to care for the baby after the child joins the family. In all cases the woman’s job remains , and after the end of the break she has the right to resume work in the same position and with the appropriate salary level.

The requirement to provide pregnant women with leave is based on objective reasons:

- it is more difficult for an expectant mother to work in late pregnancy;

- she needs preparation for the birth of the baby;

- sometimes pregnancy occurs with complications and requires hospital conditions, or simply avoiding overload.

The law specifies the amount of time a mother can spend preparing for childbirth or caring for an infant. In order to be officially allowed to step away from work for a while at work, you should collect a package of documents.

Which sources of law provide a sample of filling out an expense cash order?

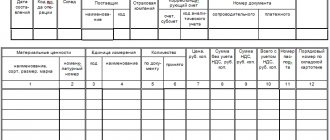

Filling out an expense cash order is not regulated by federal law. Resolution No. 88 provides brief instructions regarding the application and completion of the RKO form:

- the contents of the operation must be recorded in the “Base” line of the order;

- the “Attachment” line should reflect the list of attached documents.

Instruction No. 3210-U contains the following information on filling out cash receipts:

- The cashier checks for the signature of the chief accountant or accountant, and if they are absent, for the signature of the manager. When registering a cash settlement on paper, the signatures must match the sample.

- The correspondence of the cash amounts entered in figures with the amounts entered in words is checked.

- The cashier checks the presence of supporting documents listed in the cash register.

- Cash issuance is carried out by the cashier directly to the recipient specified in the cash settlement or power of attorney. The recipient is identified by an identification document, usually a passport. The cashier checks the information about the recipient of the money in the cash register with the information on the identity document.

- The recipient of the funds must sign the cash settlement; if the order is drawn up in electronic form, then it can be signed with an electronic signature.

Nuances of using consumables

When an expense order is used to issue money to a legal entity (for example, payment for goods or materials), you cannot simply enter its name as a recipient.

In the “Issue” column you need to write down your full name. employee of the supplier company who receives funds. Or, if it is still necessary to indicate the name of the company, then the following entry is allowed: “LLC Firm through A. A. Ivanov.” In this case, the details of the presented power of attorney are written in the “Appendix” column.

If a consumable is issued to deposit cash proceeds to the bank, then in the “Issue” column you cannot write phrases like “Revenue”, “Deposit of proceeds” or similar. Here you need to indicate your full name. the responsible employee who performs this action, and in the “Appendix” column - details of the announcement for cash delivery.

When issuing salaries to employees, you can issue a single expense order for the entire payment amount. In this situation, in the “Issue” column it is written – “To employees of the enterprise.” Information about the payroll is recorded in the “Base” column. The order fields “By”, “Received” and “Signature” must be left blank.

Basic rules for filling out a cash receipt order, examples

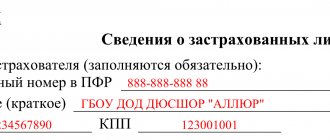

The sample filling out of the cash register must meet the following key criteria:

- if the enterprise does not have structural divisions, a dash should be placed in the corresponding paragraph of the form;

- the numbering of cash registers must correspond to the sequence established in the journal of registration of accounting documents (form KO-3, introduced by Decree No. 88);

- in the column “OKPO Code” information from state statistics is recorded;

- the date of drawing up the order must correspond to the date when the cash was issued from the cash desk;

- the amount is written in rubles using commas, for example 100.45 rubles;

- in the “Amount” column, the amount of money issued from the cash register is recorded in words, and the number of rubles should be indicated by a phrase starting with a capital letter, kopecks - by numbers;

- similarly to the rules formed for the “Amount” column, the “Received” column is filled in.

The listed points reflect problematic, controversial points common among Russian accountants who discuss certain examples of filling out cash receipts.

You can download the completed sample RKO-2 on our website.

Form T-60. Sample and Form 2021

Form T-60 is standard and in official language is called a note-calculation on granting leave to an employee. The T-60 calculation note is filled out immediately before granting an employee of the organization the next paid leave. This document includes all the necessary information used to calculate vacation pay, and it is on the basis of it that the employee receives the vacation funds due to him by law before going on vacation.

Attention! Vacation pay must be issued to an employee at least three days before the start of the vacation. If this condition is violated, the employee of the organization has the legal right to refuse to go on vacation. In addition, this may entail administrative penalties from regulatory authorities and fines.

and a note-calculation form for the provision of leave in the T-60 form

FILESDownload a blank form for a note-calculation on granting leave to an employee according to form T-60.doc filling out a note-calculation on granting leave to an employee according to form T-60.doc

Who fills out the T-60 calculation note

Form T-60 contains two large sections. The first includes personalized information about the employee and is filled out by a HR specialist. The second section is the main one and contains information about vacation accruals due to the employee. It is prepared by the company's accountant.

Documents serving as the basis for drawing up a settlement note

A vacation schedule drawn up in advance in the organization, an order from the company’s management to provide planned vacation to a particular employee, a payroll and cash settlements serve as documentary justification for drawing up a settlement note.

Before sending an employee on a planned vacation, the enterprise's personnel specialist must send him a notice of vacation, but no later than two weeks before it starts.

In turn, the future vacationer must put his signature under it, which will indicate that he agrees with the period and conditions of the annual planned paid leave.

Filling the front side of T-60

- This part of the document includes data on the full name of the organization in which the employee works with a mandatory indication of its organizational and legal status (CJSC, LLC, individual entrepreneur).

- Then, just below, enter the serial number of the document to be filled out for internal document flow and information relating to the employee personally: his full name, position, structural unit to which he belongs, as well as the personnel number assigned to him when hired.

- In the next line, it is necessary to indicate the period for which leave is granted (the employee’s length of service at the place of work) and the exact number of days of leave (according to the calendar) with a clear indication of the start and end dates of the leave.

- If an employee does not go on a planned paid vacation, but takes additional or educational leave, then this must be entered in the appropriate column with a mandatory indication of the number of calendar vacation days, as well as a link to the document that served as the basis for its provision (management order, etc. )

- At the end of the sheet there must be a signature of the official who filled out the document - in this case, a HR specialist.

Filling out the reverse side of the T-60 form

This section in the calculation note in form T-60 is the main one and includes all information regarding vacation pay due to the employee for the billing period.

The basis is information on income for the last 12 months of work at the enterprise. Opposite each specified month is written the amount accrued to the employee for this period. Then the total number of days for which vacation is calculated is entered and the average daily wage is calculated. View vacation pay calculations with examples.

The “Accrued” table includes all calculated accruals to the vacationer. In column number 8 (amount for vacation), you need to enter the result of multiplying the average daily earnings by the number of planned vacation days.

If there are any additional accruals due to the employee, they also need to be entered in the appropriate columns of the document. The total amount is entered in column 15, from which you then need to subtract the amount of income tax withheld and enter the resulting total in column 23 of this calculation.

The resulting amount will be the one that needs to be paid to the employee as vacation pay. This figure must be entered into the document both in numerical terms and necessarily in words. The accountant who made the calculations must put his signature at the bottom of the sheet with a transcript.

Thus, a calculation note in form T-60 is an internal document of the organization and is subject to mandatory accounting; its completion must fully reflect all information relating to the employee, including his personal data, as well as payments made to him in the reporting period . Based on this information, a detailed calculation of the vacation pay that the employee will receive when going on vacation is made.

assistentus.ru

How to fill out a cash order in banking

The instructions of the Bank of Russia dated July 30, 2014 No. 3352-U establish the forms of documents involved in cash transactions, which are mandatory for use by Russian credit institutions. Among these is an expense cash order, which is assigned the number 0402009 in OKUD. This document is generally similar to what is used by legal entities and individual entrepreneurs in the general case - in the KO-2 form. Instructions No. 3352-U also contain instructions for filling out the “banking” version of cash settlement services.

The wording contained in Directive No. 3352-U reflects the specifics of filling out form 0402009 in correlation with the requirements of banking legislation. For example, in the structure of this form there is a “Symbols” item, in which you need to enter parameters that record the assignment of monetary amounts to one or another category. There is no such item in the KO-2 form.

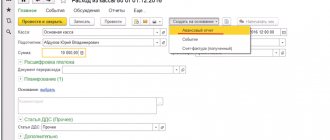

RKO: fill out online

You just need to enter the amount and basis of payment, select the expense item and recipient, and the system will automatically generate and number the document.

Fill out RKO online

Fill out the RKO online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

In MyWarehouse you can also download a complete list of expenditure orders for all time. This is convenient for reporting - the total amount of funds issued is immediately visible.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Results

The form of expense cash orders is approved by law and is mandatory for use by all business entities. An exception is made only for individual entrepreneurs - subject to a number of conditions. Banking organizations have their own form of cash settlement.

about the latest changes in the procedure for conducting cash transactions in the article “Procedure for conducting cash transactions in 2021.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.