Why are reports submitted on paper?

At the moment, only VAT returns are required to be submitted exclusively electronically.

There are a fairly large number of taxpayers who provide reports on paper. All of them are not VAT payers. And everyone has their own reasons for giving up the old fashioned way. For some, the operator’s services are too expensive, some send a minimum number of reports and see no point in paying money for electronic delivery, and others fundamentally do not want to submit any other way.

Submitting reports electronically

Our article, of course, is not about renting through telecommunications channels, but it is impossible not to mention them.

Nowadays, the bulk of reporting is submitted electronically. It's simple, convenient, reliable and fast. True, it is quite expensive.

In order to “surrender electronically,” you need to conclude an agreement with the operator, receive an electronic signature key, and you can start.

A huge advantage is the fact that all report forms are always up to date and are updated automatically . In addition, after generating an electronic report, it is possible to check its indicators. If errors are detected, the program will show you exactly what needs to be corrected.

The response to accept the report comes from the inspectorate quite quickly; if there are errors, they are indicated in the tax report.

In addition, you can receive and send various documents electronically, respond to the requirements of the tax inspectorate, and conduct reconciliations.

Who can submit a report on paper

According to the general rule established by law, companies or individual entrepreneurs with fewer than 25 employees can submit a paper report . This means that if 24 employees are employed, then you can report on paper, if there are 25 or more, we send the report by email.

In addition, there are force majeure situations. For example, there is no Internet or the computer is broken, and you need to submit it urgently. In this case, if the number of employees is up to 25 people, the report can be submitted in paper form, even if previously reports were always submitted via telecommunication channels.

Who should submit the form

All policyholders must report under SZV-M Insurers are organizations and entrepreneurs who engage workers under employment contracts civil contracts with individuals , the remuneration for which is subject to insurance premiums . Persons who have worked for a short time, as well as those to whom no accruals were made during the reporting period, are also included in the form.

It happens that the organization has no employees and no GPC agreements have been concluded with any of the individuals. Is it necessary to report in this case using the SZV-M form? It must be taken into account that a legal entity cannot exist without a director , who is also an employee. Therefore, all organizations submit the form in question.

It is also necessary to report if the functions of a director are performed by a single founder, with whom an agreement has not been concluded. But only on the condition that the organization operates and the manager receives a salary.

The only situation when an organization may not submit an SZV-M is if it does not carry out activities, does not have employees, an agreement has not been concluded with the director, and he does not receive wages (PFR letter dated July 27, 2021 No. LCH-08-19 /10581).

The following types of business entities, if they do not have employees, do not submit the SZV-M form:

- individual entrepreneurs;

- arbitration managers;

- notaries and lawyers in private practice;

- peasant farms.

The procedure for filling out the SZV-M on paper

In order to fill out a paper report, you must first find an up-to-date form. This can be done on the Internet and is not difficult.

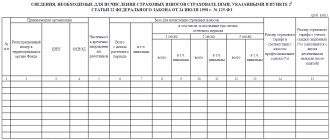

Drawing up a report on paper is no different from filling it out electronically . All 4 sections of the form are filled out, that is, the following is indicated:

- Information about the organization that compiled the report

- Month and year for which the report is submitted

- Information type. If the report is filled out for the first time for the specified period, then the information type is “outgoing”. A form with the information type “additional” or “cancellation” is used when correcting errors.

- Information about the organization's employees. SNILS and TIN of the employee are indicated

At the bottom of the report, the signature of the director, the seal of the organization and the date of submission of the form are indicated.

Submission deadlines

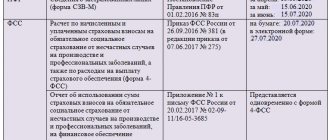

The reporting period for the SZV-M form is month . The deadline for submission is the 15th day of the month following the reporting month . As a general rule, if this date falls on a weekend, then the last day of the deadline is transferred to the next working day. The deadlines for submitting the form in 2021 are presented in the following table.

Table 1. Deadlines for submitting the SZV-M form in 2021

| Per month | Deadline |

| January | February 15, 2021 |

| February | March 15, 2021 |

| March | April 15, 2021 |

| April | May 17, 2021 (postponed) |

| May | June 15, 2021 |

| June | July 15, 2021 |

| July | August 16, 2021 (postponed) |

| August | September 15, 2021 |

| September | October 15, 2021 |

| October | November 15, 2021 |

| november | December 15, 2021 |

| December | January 15, 2022 |

Is it possible to submit the form in advance, that is, before the end of the month? Legislative norms do not prohibit such a delivery procedure. But this can only be done if you are confident that no new employees will appear in the organization before the end of the month. Otherwise, it will turn out that incomplete information .

Programs for generating and checking generated reports

Especially for those who submit reports on paper, the Pension Fund places on its website free programs for generating and checking reports. Such programs include “Documents PU-6” and PFR - POPD.

The program “Documents PU-6” allows you to generate, among other things, a SZV-M report. It’s worth mentioning right away that the program is quite simple, but requires very careful filling out of all information fields. To generate a report, you must enter all the data about the organization, and then about the employees of the enterprise. The program not only compiles a report in an up-to-date form, but also generates an upload file for transfer to the Pension Fund. The file must be checked in the PFR-POPD program. If all checks are successful, you can submit the form.

The so-called zero report

Is there a need to pass zero SZV-M in 2021? Not really!

The fact is that, as such, there cannot be a zero report in principle. If not a single person is included in the form, then submitting such an empty SZV-M does not make any sense. In addition, no one needs blank forms, since they do not contain information valuable for the purposes of personalized accounting.

The electronic format of SZV-M provides for filling out at least one line of the list of insured persons. It is impossible to send a report without the “Information about insured persons” block. Therefore, it will not be possible to submit a completely blank form.

Submitting a report in person or by proxy

Is the report generated and verified in every possible way? Now you can go “give up.”

To do this, print out the form in 2 copies, put the upload file on a flash drive and go to the Pension Fund branch.

If the report is submitted by the director of the organization or the individual entrepreneur himself, then there is no need to provide additional documents.

A power of attorney will be required if a representative, for example, an accountant, is submitting a report from an organization. A representative of an individual entrepreneur must submit a notarized power of attorney to the fund.

The Pension Fund specialist enters the upload file into his database and, if he finds no errors, makes a mark of delivery on the taxpayer’s copy. From this moment the report is considered sent.

Sending a report by mail

Another way to deliver a paper report to the Pension Fund is to send it by mail.

Sending a letter may take quite a long time. There is no need to worry about this, since the date of submission of the report will be considered the date the letter was sent by the taxpayer . That is, the form can be sent even on the last day of submission.

The algorithm of actions in case of sending by mail will be as follows:

- We print out the report in 2 copies, put a stamp, and sign it with the director. One of them can be immediately put into the folder with reports, since only one copy needs to be put in the envelope.

- We go to the nearest post office and pay for sending the letter. Our goal is to send a valuable letter with an inventory of the attachment. Where can I get this inventory? You can go to the post office while we’re standing in line and we’ll have time to fill it out. Or you can use services for generating similar documents on the Internet and come with a completed form ready to send. In the inventory, we must indicate the sender, that is, the name of the organization or individual entrepreneur, the address of sending the letter (branch of the Pension Fund), the name of the reports being sent and their quantity. Since our letter is valuable, we indicate the value in the inventory, you can put 1 ruble. The postal worker makes an acceptance mark on our copy of the inventory and issues a receipt for payment.

- We attach an inventory with a mark and a receipt to our copy of the report. The report has been submitted!

When sent by mail, the downloaded file is not transferred to the Pension Fund. Fund employees will enter the information received manually.

They do not accept PFR SZM on paper

This document reflects information about employees, in particular, about their full name, INN and SNILS.

Based on this information, the Pension Fund has the opportunity to monitor whether the employer has working pensioners. Having such information, the fund excludes the possibility of indexing the insurance pension of such persons in accordance with Art. 26.1 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

What are the possible ways to present a report?

In accordance with paragraph 2 of Art. 8 of Law No. 27-FZ, there are 2 ways to submit a report:

- on paper;

- in electronic form via telecommunication channels.

At the same time, the electronic method can be used by all policyholders.

How to submit certificates on paper: methods of sending and deadlines

Otherwise, the company may be fined 200 rubles due to violation of the rules for sending reports. If the required figure is met, then the form can be sent, and for this:

- It is advisable to send by a valuable letter with an inventory.

- The inventory can be drawn up in a ready-made form or freely.

- The recipient's details are indicated.

- Sender details.

- Name of attachment (SZV-M).

- Number of documents (in this case – one).

- Conditional assessment.

- Confirm the inventory with a stamp from the postal department with the date of dispatch.

Where to send

In this case, you should separate:

- Reporting on the amount of insurance premiums, which is submitted to the tax office.

- Personalized pension accounting (SZV-M).

Pension Fund's refusal to accept paper reports. what to do?

Since SZV-M is one of the youngest types of pension reporting, the main method of filing it is electronic. But in some cases, a more traditional paper version is also possible.

General information

After all, if for some reason the policyholder is not satisfied with submitting an electronic version of the SZV-M, then he can do this in paper form, but only if the company or company has less than 25 employees. In this case, there are several options for submitting a report:

- Bring it in and hand it in in person (this is done most often).

- Send by post.

How to send by mail

Before sending the report by mail, you must make sure that the number of employees in SZV-M at the time of sending will not exceed 25 people.

How do you submit reports to SZV on paper?

The law allows for the submission of paper reports for certain economic entities.

However, the Pension Fund of Russia recommends submitting reports in electronic format, as this simplifies the processing of reports and verification of correct completion. In electronic form If a legal entity has more than twenty-five employees, submitting reports in electronic format is not a recommendation, but an obligation.

Disputes with the pension fund when submitting reports

The exception is the heads of farms (peasant farms), who annually submit a RSV-2 report for the previous reporting year before the first of March. The reporting form required for all policyholders is RSV-1.

We submit the report to SZV in electronic form

The unified report form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. The information is necessary to record the insured persons. We will tell you how to correctly submit the SZV-M through the Pension Fund website.

Who reports electronically?

Budgetary organizations are required to provide this type of reporting for hired employees. This should be done monthly, no later than the 15th day of the month following the reporting period. That is, for September, the company must report no later than October 15. If the deadline for submitting the SZV-M falls on a weekend or holiday, then the date is moved to the next working day.

An organization with an average headcount of 25 or more people is required to report electronically or fill out the SZV-M on the PFR website online.

The procedure for submitting reports to the Pension Fund on paper

Mandatory reporting documentation for individual entrepreneurs and organizations also includes forms for personalized accounting: All reports due for submission are submitted as part of one package of documents.

Only RSV-1 can be submitted separately, provided that the report is zero and does not contain individual information.

What is it? An employer must pay certain insurance contributions to the Pension Fund budget for each of its employees.

To work, install the application on your work computer and follow the software prompts. The procedure is simple: in the verification section you need to specify the path to the XML file with the report, the program will analyze it and indicate what needs to be corrected.

How to simplify reporting

We invite you to familiarize yourself with little tricks that will save time on the formation and delivery of SZV-M:

- When submitting a report on paper, take with you an electronic version of the report on a flash drive, in XML format. Many representatives of the Pension Fund began to demand an electronic form of the document. Of course, this is not necessary, but it will avoid unnecessary conflicts.

- The employer is obliged to report monthly in the SZV-M form not only to the Pension Fund, but also to employees. That is, monthly print out and issue statements to employees indicating that they are included in the list of insured persons.

To do this, download one of the programs presented for generating and sending reports on the official website of the Russian Pension Fund, in the “Free programs, forms and protocols” section.

The following applications are suitable for preparing the SZV-M form:

- “PU 6 Documents”;

- "Spu_orb";

- "PD SPU";

- "PsvRSV".

To determine which application is best suited specifically for your budget organization, consult with a Pension Fund specialist.

Online reporting via the website of the Pension Fund of the Russian Federation

To organize the sending of reports through the official website of the Pension Fund, it is necessary to conclude an agreement on electronic document management. Then specialists of the Pension Fund of the Russian Federation will carry out the difficult procedure of connection and registration.

Pension Fund.

- By connecting to the PF electronic document management system.

Report requirements:

- XML extension.

- UTF-8 encoding.

- The file name structure must have a strictly defined form.

How to submit a report:

- Fill in the form.

- Generate a report file.

- Check the correctness of filling using a special program or on the PF website.

- If errors are found, correct them.

- Provide an EDS.

- Send a file with a report to the Pension Fund.

If the electronic report is not sent, that is, its sending is not confirmed by the appropriate protocol from the Pension Fund, then:

- We need to check once again whether the report is filled out correctly and the SZV-M form file is generated.

- If everything is done correctly, then there is no need to resend.

- And you need to contact the Pension Fund for clarification.

Important: There is no penalty for violating this condition yet. But it is better to organize work in this area in advance. The most convenient way to register the issuance of statements for each employee is in a random journal, where you indicate the reporting period, the employee’s last name and initials, and the date of issue. The employee must sign for the form received.

- There is no information for reporting in the reporting period? In such a situation, for insurance, send a blank SZV-M form. Does the company expect long-term absence of employees? Then send a written request to representatives of the Pension Fund of the Russian Federation, with a detailed description of the circumstances.

The use of a paper form depends on the average number of employees.

Who can take the SZV-M on paper?

Submission of SZV-M on paper can be carried out by organizations and individual entrepreneurs whose average number of employees does not exceed 24 people for the previous reporting period.

It should be noted that the method of submitting SZV-M on paper does not affect the deadline for submitting the report, since for any format it is the same - before the 10th day of the month following the end of the reporting period (from 2017 - until the 15th day ). For comparison: for RSV-1 and 4-FSS, earlier deadlines for submitting paper forms are provided, in contrast to electronic ones.

How to submit SZV-M on paper?

The format of the SZV-M report is provided for by Resolution of the Board of the Pension Fund of the Russian Federation dated 02/01/2016 No. 83p.

The payer of insurance premiums is charged a fine in the amount of 5% of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month from the day established for submitting the calculation, but not more than 30% of the specified amount and not less than 1000 rub. As arbitration practice shows, the payer of insurance premiums will win a dispute if he presents a postal receipt, as well as an inventory of the contents, as documentary evidence of the fact that the payment was sent.

Source: https://vizitka-nf.ru/ne-prinimayut-szvm-pfr-na-bumazhnom-nositele/