What is the SZV-STAZH form

The SZV-STAZH form is filled out and submitted by the policyholders to the Pension Fund for all insured persons who are with the policyholder:

- in labor relations (including with whom labor contracts have been concluded)

- or who have entered into civil law agreements with him , the subject of which is the performance of work, the provision of services, under copyright contracts , in favor of the authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on the grant of rights use of works of science, literature, art, including remunerations accrued by rights management organizations on a collective basis in favor of the authors of works under agreements concluded with users, or with whom employment contracts and (or) civil law contracts have been concluded.

that is, the SZV-STAZH form is submitted by all legal entities and individual entrepreneurs.

Along with the SZV-STAZH form, you must submit the EDV-1 . When submitting reports electronically, forms SZV-STAZH and EDV-1 are generated in one file.

Form SZV-STAZH instead of the RSV-1 report

For 2021, the form was submitted for the first time after the abolition of the RSV-1 calculation, which included, among other things, information about the length of service of employees (subclause 10, clause 2, article 11 of the Federal Law of 04/01/1996 No. 27-FZ). The last time RSV-1 had to be submitted by February 15/20, 2017 (in paper/electronic form) for 2021.

The RSV-1 calculation was canceled after the transfer of the administration of insurance contributions from the pension fund to the tax office.

It turned out that the RSV-1 calculation was divided into two: in the first, the amounts of insurance premiums were removed, the data on the length of service was left - the report was called SZV-STAZH; secondly, for the amount of insurance premiums, policyholders report to the Federal Tax Service with a DAM report - data for the year must be submitted before January 30!

New SZV-TD report in 2021

The workload on accountants and personnel officers has increased - new reporting forms have appeared regarding the organization's employees. Among them is SZV-TD. The form was approved in the last days of 2021. The Pension Fund of the Russian Federation delayed until the last minute, but still issued a resolution establishing the form and procedure for filling out the SZV-TD (Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p).

Thus, the main question of what form to submit the report on has been resolved.

Let us recall that the purpose of this form is to update information about the work activities of employees contained in the Pension Fund database for the functioning of the electronic work record book system.

By what criteria is the obligation to submit a SVZ-TD determined? This form is submitted by those enterprises that have employees, and the need to submit it arises only if personnel changes were made in the reporting month.

The form must be submitted to the territorial body of the Pension Fund by the 15th day of the following month after the month in which personnel movements took place. For example, if a company hired two employees from February 3, 2021, then it will submit the SZV-TD for February until March 16, 2021 (since March 15 is a Sunday).

If there were no reasons to fill out the SZV-TD within a month, then there is no need to submit the form.

Important! The Pension Fund has provided for tightening the deadline for submitting SZV-TD from 2021. According to clause 1.8 of the resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p, starting from January 1, 2021, in case of hiring and dismissal of employees, the SZV-TD form will be expected from the organization on the next working day after the issuance of the personnel order.

It turns out that the form is issued by the employer only in cases of personnel changes. One of the reasons is the dismissal of an employee. Next, we will consider the features of this case.

What is the report for?

The SZV-STAZH report and the procedure for its formation were approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. In SZV-STAZH with the “initial” information type, you need to include all employees and performers (contractors) under civil contracts. Every year, such a report must be submitted to the Pension Fund authorities no later than March 1 of the year. See “SZV-STAZH: new reporting for all employers: 2017.”

Pension Fund bodies that have received SZV-STAZH reports will monitor the accrual of length of service of individuals to form their pension rights.

Fines for violations of reporting according to SZV-STAZH

If for some reason the SZV-STAZH report is not provided to the employee within the period prescribed by law, then this is a violation for which a fine of 30,000 to 50,000 rubles is provided for the company, from 1,000 to 5,000 rubles for the individual entrepreneur.

For policyholders who submit a report later than the deadline, they will be fined from 500 rubles for each employee. The same amount is charged for indicating erroneous information in the personal data about employees in the report.

You should be aware of the limitation on the number of employees for firms that report via the telecommunications system. For providing information on paper where the list of employees exceeds 25 people, the company will be fined 1,000 rubles.

Summarizing the above, we note that the policyholder needs to make changes to the personnel document flow.

Promptly transfer information to dismissed employees using the new SZV-STAZH form. Track differences in reporting for working employees, as well as those dismissed because. Errors on the form will result in monetary penalties. Rate the quality of the article. Your opinion is important to us:

Issuance of a SZV-STAZH certificate upon dismissal of an employee

On the last working day, the employer is obliged to hand over the work book to the employee and make the final payment to him. In addition, according to the norms of the Labor Code (Article 84.1), Federal Law-255 (Clause 3, Part 2, Article 4.1) and Federal Law-27 (Clause 4, Article 11), the employee must hand over documentation of his earnings and employment seniority The specified information is contained in the SZV-M and STAZH forms.

The employer’s obligation to issue the SZV-STAZH form to its employees is specified in clause 4 of Art. 11 Federal Law-27. It must be drawn up not only upon termination of an employment contract, but also upon termination of a civil law contract. The main thing is that the employer pays and accrues insurance premiums from the remuneration paid to the employee.

SZV-STAZH is a new form of recording the time an employee is in an employment relationship with the employer, during which insurance premiums were paid for him.

The employer must not only give the employee the SZV-STAZH form, but also confirm that such information was transmitted. This is necessary in case of inspection by regulatory authorities. One of the confirmation options is to issue a certificate in two copies and put a mark on one of them indicating receipt of the form by the employee (it remains in the custody of the employer).

Since the dismissed employee is given a set of documents at once, he can sign in a special journal for receiving them immediately. This will allow you to avoid unfounded claims from the labor inspectorate and other regulatory authorities.

For what period is it issued?

The SZV form includes information about the employee’s period of work with the specified employer for the period for which the certificate is provided (for example, for 2021).

When submitting SZV-STAZH to the Pension Fund in relation to dismissed employees from 2021, you must include information about the period of work from January 1, 2021 to the date of dismissal , since the Pension Fund of the Russian Federation has information for previous periods of the employee’s work. If the date of dismissal falls on December 31, 2021, then a dash is placed in column 14 of the form.

How to fill out SZV-M if an employee quits

A frequently asked question is whether dismissed employees are included in SZV-M? At the time of dismissal, the organization terminates the employment relationship with the employee. In the month of dismissal, the employee is included in the report, but in the next month - no longer.

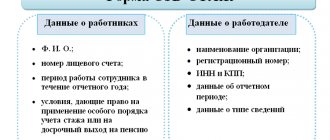

Let's take a closer look at the case of filling out a form when an employee resigns. Ivanov I.I. resigns on May 22, 2021. The accountant submits the report form for the month of May, including Ivanov I.I. The accountant of the organization GBOU DOD SDYUSSHOR "ALLUR" compiles SZV-M for May 2021. Let's fill out the report step by step.

Step 1. Fill in the organization’s data: registration number in the Pension Fund, name, INN, KPP.

Step 2. Specify the reporting period.

Step 3. Reflect the type.

Step 4. Submit information about the insured persons: personalized data, SNILS and TIN.

For June 2021, the accountant will no longer include this employee.

Types of SZV-STAZH

There are three types of SZV-STAZH:

- Original . This is a form that is submitted to insured persons for the first time during the reporting period.

- Complementary . Submitted if the original form data was not taken into account due to errors.

- Assignment of pension . Provided for insured persons who, in order to establish a pension, need to take into account work periods of the calendar year for which the deadline for reporting has not yet arrived.

What types of forms need to be filled out:

- in the original and supplementary - section 1, section 2 and section 3;

- in the form for assigning a pension - sections 1-5.

Three types of report

The report form provides that it can be compiled with one of three typical characteristics:

- Type “initial” – when information is submitted for the first time;

- “Additional” type – if the original data contained errors that did not allow the data to be distributed among the personal accounts of the insured persons;

- Type “appointment of pension” - if the insured person, in order to assign an insurance pension, needs to take into account the data of the reporting period (year), for which the SZV-STAZH form has not yet been submitted.

As you can see, this type of information as “Upon dismissal” does not exist. But does this mean that the SZV-STAZH form does not need to be issued to an employee when dismissing him? The answer to this question is given to us by the legislation on individual (personalized) accounting.

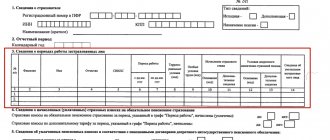

Filling procedure

The procedure for filling out the SZV-STAZH form is contained in Resolution of the Board of the Pension Fund of the Russian Federation No. 3p of 2021. The specified information can be filled out using a pen or on a computer. Marks and corrections are not allowed. You can use any ink color except green and red.

Since SZV-STAZH is also used for reporting, this form has three formats:

- “Initial” – for employees whose information is being transmitted for the first time.

- “Additional” , which is filled in when errors are detected in the previous version of the document.

- “Pension assignment” , if an employee retires from the company.

When dismissing an employee, the certificate is filled out using the “Initial” form. It must be certified by the manager’s signature and seal (if any). The certificate is dated on the day of dismissal.

It is important to consider that the SZV-STAZH form should contain only individual information for the dismissed employee. Otherwise, the employer may be held liable for disclosing personal information.

The following fields should be filled in the SZV-STAZH certificate:

- Pension Fund registration number - indicates the company number that was assigned to it when registering as an employer.

- TIN of the employing company.

- The company's checkpoint (if the employer is registered as an individual entrepreneur, then the specified details are missing and dashes are entered in the column), if the employee worked in a separate division, then his checkpoint is indicated.

- Information type – the “X” icon is placed in the required type of form (in this case, “original”).

- In the column “Name of organization” the short name of the employing company is written in accordance with the constituent documents or the name of a separate division, or the full name of an individual entrepreneur.

- The column “Reporting period” indicates the year for which the SZV-STAZH form is provided.

- Full name of the person resigning.

- SNILS is the individual personal account number assigned to it.

- The period of work for the “Reporting period” specified earlier.

- Territorial working conditions (or special conditions, conditions for early retirement and additional data) - if there are conditions that affect the assignment of a pension, they are prescribed in this paragraph.

- Information about the dismissal of the insured person.

When preparing a certificate, you can use specialized accounting programs or draw it up based on a ready-made sample.

Dismissal of a pensioner

The last thing in the report is the approximate date of retirement of the employee - for those retiring. For those resigning, this is the last day of work.

SZV-STAZH when assigning a pension to an employee

When an employee is going to retire, he must write a statement in which, along with a request to be dismissed in connection with retirement, he asks to submit personalized accounting information to the Pension Fund of the Russian Federation. The SZV-STAZH form and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

For employees who are retiring, SZV-STAZH must be submitted to the Pension Fund within three calendar days from the date of submission of the application.

Deadline

The SZV-Experience report must be sent to the Pension Fund within three days after receiving an application from the employee to send information about the length of service to the Pension Fund.

SZV-STAZH report form - in what cases is it generated?

The consolidated reporting of SZV-STAZH contains complete changes in the insurance period of employees: sick periods, vacations, dismissal, retirement. The report is generated for all employees in the following cases:

- Employees were accrued and paid income under civil and labor contracts;

- Individuals were paid royalties;

- Settlements were made with FL under license agreements;

- The company has a single founder, who is also the CEO;

- Employees (other persons) are insured under the Social Insurance Fund, Pension Fund, Compulsory Medical Insurance program (i.e. the company made deductions from all income).

The information relates to part of the personalized reporting, which is used in the future to calculate the insurance pension of a potential pensioner.

Upon dismissal of an employee

When dismissing an employee, there is no need to submit a report early, however, you will still have to do it, since the certificate must be handed over to the employee.

SZV-STAZH upon dismissal of an employee

The procedure for passing SZV-STAZH upon dismissal of an employee depends on the reason for dismissal.

If an employee resigns due to retirement, the SZV-STAGE for it must be submitted to the Pension Fund within three calendar days from the date the employee submits the application. In column 7 SZV-STAGE for such an employee his last working day is indicated. (Clause 2.3.4 of the Procedure, approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p).

If an employee leaves in the middle of the year, the period of his work is indicated only in columns 6 and 7. From column 7 it will be clear that this employee no longer works for the company. For all working employees, column 7 will be December 31, the last day of the reporting year.

Deadline

Reports on retired employees (who are not retiring) are submitted in the general manner - before March 1 of the following reporting year.

When and to whom is required to report on SZV-STAZH

The RSV-1 report has been replaced by the alternative form SZV-STAZH, which is required to be submitted to organizations of all legal forms, individual entrepreneurs, in the case of hiring employees. The current reporting was approved by Resolution of the Pension Fund of the Russian Federation 11.01.17 No. 3n, which also established the procedure for its preparation.

The report is submitted annually, for the first time in 2021 and subsequently for subsequent reporting periods:

- no later than March 1 of the year following the reporting year;

- within 3 days, provided that the employee submits a retirement application to the accounting department;

- within 1 calendar month upon liquidation of the employer.

You can transfer prepared information using the SZV-STAZH form immediately as soon as all the information has been collected and verified by an accountant, without waiting for the deadline to expire. During the inspection process by the Pension Fund of Russia inspector, the company will receive confirmation of the successful completion of the report, or a notification of the necessary adjustment of the employee’s insurance data.

Liquidation of an organization

Upon liquidation of an enterprise, a report is submitted to:

- Within one month from the date when the interim liquidation balance sheet is approved.

- No later than the documents on the liquidation of the company will be transferred to the registering tax office.

- In case of bankruptcy - before the bankruptcy trustee’s report on the results of bankruptcy proceedings is submitted to the arbitration court.

SZV-STAZH upon liquidation of a company

The SZV-STAZH form is submitted to the pension fund at the end of the year. So, for 2019 you need to report before March 1, 2021 inclusive, for 2021 - before March 1, 2021 inclusive. But, if the organization is liquidated, SZV-STAZH must be submitted without waiting for the end of the year.

Companies that have decided to liquidate submit SZV-STAZH within one month after they approve the interim liquidation balance sheet, and no later than the day when documents are submitted to the Federal Tax Service to register the termination of activities

Example:

On February 9, 2021, the founders of Dynamics LLC at a general meeting decided to liquidate the Company.

On April 11, 2021, the accounting department of Dynamics LLC formed an interim liquidation balance sheet.

Dynamics LLC must submit the SZV-STAZH to the Pension Fund on May 10, 2021.

How to fill out SZV-STAZH when liquidating an LLC in 2021

SZV-STAZH includes all employees who worked under an employment or civil contract, not forgetting those employees who were fired during the year.

If a company is liquidated, SZV-STAZH must also include employees of the liquidation commission, regardless of the form of the agreement concluded with them.

The report is compiled for the period from January 1 of the year to the day of liquidation of the company. The day of liquidation of an organization is considered to be the day on which an entry about liquidation was made in the Unified State Register of Legal Entities (clause 9 of Article 63 of the Civil Code of the Russian Federation).

Let us recall that the SZV-STAZH form was approved in Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

In section 2, enter the calendar year for which you are submitting reports. In a separate block “Type of information”. put o. When liquidating, you need to select the original one.

In section 3, enter the details of employees and the period of their work.

If employees performed work under a civil contract and received remuneration for this, enter “AGREEMENT” in column 11. This is exactly how you need to enter information about the services of a liquidator. If the company has not yet paid for his work, indicate “NEOPLDOG” or “NEOPLAUT” in the column.

Sections 4 and 5 of the form should be left blank; these sections are for reporting on retired employees.

Enterprise reorganization

When reorganizing a company, a report is submitted to:

- Within one month from the date on which the transfer act (separation balance) is approved;

- No later than the registration documents of the company created during the reorganization process will be transferred to the tax office;

- No later than the company merged during the reorganization, submits documents to the Federal Tax Service on termination of activities and exclusion from the Unified State Register of Legal Entities.

Using this online service, you can submit all reports for employees via the Internet, generate payment slips, 4-FSS, Unified Settlement, submit any reports via the Internet, etc. (from 333 rubles/month). 30 days free. When you make your first payment (using this link) you get three months free.

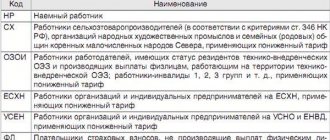

How to fill out SZV-STAZH when working part-time

Employees who work part-time under normal conditions at SZV-STAZH do not need to be allocated in any special way. It is enough to indicate in SZV-Experience: full name, SNILS and validity periods of employment contracts.

In the SZV-STAZH form, part-time work is reflected if the enterprise operates under special conditions and employees have the right to early retirement.

Where the SZV-STAZH form reflects data on part-time work

In section 3 of the SZV-STAZH report, you need to reflect the scope of work or the share of the rate in accordance with clause 2.3.6 of the Filling Out Procedure.

Information about part-time work reflects:

- or in column 8 “Territorial conditions (code)”. In this column, enter the code of territorial conditions and the share of the rate;

- or in column 9 “Special working conditions (code)”. In this column the special conditions code and the rate share are entered.

To indicate territory codes with special working conditions, you need to use the Classifier of parameters used when filling out information for maintaining individual (personalized) records. This Classifier is approved in the annex to the Procedure for filling out the SZV-STAZH.

Sample of filling out the SZV-TD form upon dismissal

In fact, all employers are required to submit a SZV-TD when dismissing an employee. This is a new reporting form, and therefore questions may arise when filling it out for the first time. See an example of filling out the SZV-TD form and report upon dismissal.

Example

Onegin and Co LLC has a staff of 47 people, of which 6 people are registered under GPC agreements. No personnel movements were made in January 2021. But in February two events happened at once:

- Purchasing department manager Larina T.D., working under an employment contract since 2021, wrote a letter of resignation on 02/04/2020, on the basis of which dismissal order No. 1/u dated 02/17/2020 was issued;

- a decision was made to terminate cooperation by agreement of the parties with employee Lensky V.V., with whom a GPC agreement was concluded in 2021, the termination agreement was drawn up on 02/24/2020.

The company has two employees leaving in February. However, the SZV-TD form must be filled out only for the manager Larina T.D.

Features of filling out the SZV-TD report upon dismissal:

1. The header of the form contains information about the employer Onegin and Co. LLC and about the resigning Larina T.D.

2. The date of submission of the application to continue maintaining the work record is marked - 01/15/2020.

3. Reporting period - 02 month and 2021.

4. The following is filled in with information about the last personnel record and the dismissal itself:

- in column 2 - the employee’s last working day;

- in column 3 - DISMISSAL - the type of personnel movement is indicated;

- Column 4 - “Manager, procurement department” - reflects the position and department;

- nothing is entered in column 5, since this information is required to be submitted only from 2021;

- in column 6 - the article of the Labor Code of the Russian Federation is indicated, which is the basis for dismissal (in our case, this is clause 3 of Article 77 of the Labor Code of the Russian Federation, since Larina wrote a letter of resignation of her own free will);

- columns 7-9 indicate the details of the dismissal order;

- Column 10 is not filled in, since there is no basis for filling it out.

The form was signed by director E. E. Onegin, with a completion date of 03/02/2020.

The form was sent to the territorial office of the Pension Fund of Russia in electronic form, since the number of employees at Onegin and Co LLC is more than 25 people.

Special reports for some categories

Part-timers

When considering which report is submitted to the Pension Fund when dismissing part-time workers and which is not, we focus on the SZV-TD form. It must be taken for all employees, not just the main ones. That is, you will have to submit information when dismissing both internal and external part-time workers. Moreover, if an internal part-time worker quits, but remains the main employee after that, you will still have to report on the termination of one of his employment contracts.

Foreigners

The employment of foreigners has features that differ depending on their status, reasons for staying in the Russian Federation, etc. But in all cases, when figuring out what reports to send to the Pension Fund when dismissing citizens of other countries, it is important not to forget about the need to notify the employment authority within three days. migration issues. Otherwise, the procedure for dismissal and submission of reports is the same as for Russians.

Pensioners

When dismissing pensioners, the same reports are submitted as when dismissing any other employees. Particular attention should be paid to preparing and sending the SZV-TD and SZV-STAZH forms to the Pension Fund, since the correctness of the calculation of the future pension depends on their correct submission.

Harmful and Beneficial

For persons working in harmful and dangerous working conditions, in the Far North, who have benefits, it is also important to have SZV-STAZH information in order, if necessary, to confirm the preferential length of service.

GPC Contractors

The question of what report needs to be submitted when dismissing an employee working under a GPC agreement is not entirely correct. Strictly speaking, such a person is not an employee. His work record is not kept, and there is no need to submit the SZV-TD. But some contributions for remuneration under contract agreements are paid, so it is necessary to hand over the RSV, SZV-M, SZV-STAZH forms to the employee.

How to hand over a report to those fired

The legislation does not explain exactly how the SZV-STAZH report must be handed over to the former employee upon dismissal: in person, by mail or electronically. In our opinion, you can use any of these options. The main thing is to have confirmation that the dismissal reports were provided. At the same time, there is no liability for failure to issue SZV-STAZH upon dismissal.

On the employee’s last day of work, pay him and give him:

- work book;

- a certificate of the amount of earnings in the form approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n;

- copies of information in the SZV-M form;

- a copy of information in the form SZV-STAZH;

- a copy of section 3 of the calculation of insurance premiums;

- other documents (upon written application from the employee).

Issuance of documents upon request of employees

Upon written request from the employee, the employer must issue the requested documents within three working days. These may be copies of orders for admission, transfers, dismissal, salary certificates, accrued and actually paid insurance contributions for compulsory pension insurance. Copies of work-related documents must be properly certified and provided to the employee free of charge.

Issuing a certificate to the employment service

A certificate from the employment service to receive unemployment benefits is issued no later than three working days from the date of receipt of the application from the employee. There is no unified form, but there is a recommended form for a certificate of average earnings.

If the certificate is not issued on time or is completed incorrectly, then when the employee goes to court, it is highly likely that the former employee will have to compensate for the lost benefits, as well as the amount of legal costs and moral damages.

Also, on the day of dismissal, a Certificate of income and tax amounts of an individual (updated form 2-NDFL for hand-out). This certificate is issued upon a written application from the employee. The BukhSoft program will automatically generate 2-NDFL upon dismissal of an employee.

Results

It is the employer's responsibility to hand over copies of the SZV-M to employees upon dismissal. The SZV-M must be transferred to the dismissed employee on the day of dismissal. In this case, it is necessary to obtain written confirmation from him that the report has been received.

Sources: Law “On individual (personalized) registration in the compulsory pension insurance system” dated April 1, 1996 No. 27-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who submits the form and when

Employers must report on the SZV-STAZH form for 2019 by March 2, 2021 .

There are cases when it is necessary to submit this form at other times; all cases of reporting are summarized in the table:

| Basis/frequency | Term / per period |

| Annually , for all employees | no later than March 1 of the year following the reporting year |

| Assigning a pension to an employee | within three calendar days from the date the employee contacts the policyholder |

| Dismissal of an employee | on the day of dismissal, it is handed to the employee |

| At the request of the employee | within 5 working days issued to the employee |

| Liquidation of a legal entity | no later than one month from the date of approval of the interim liquidation balance sheet, no later than the day of submission of liquidation documents to the Federal Tax Service, for the period from January 1 of the current year to the date of liquidation |

| Reorganization of a legal entity | no later than one month from the date of approval of the transfer act (separation balance sheet), no later than the day of submission of documents on reorganization to the Federal Tax Service, for the period from January 1 of the current year to the date of reorganization |

| Merger of a legal entity with another legal entity | No later than the day of submission of documents to the tax authority for making an entry in the Unified State Register of Legal Entities on the termination of the activities of the merged legal entity, for the period from January 1 of the current year to the date of merger |

| Bankruptcy of the policyholder | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court |

| Termination of IP activities | no later than one month from the date of the decision to terminate activities as an individual entrepreneur, for the period from January 1 of the current year to the date of termination of activities |

| Termination of the insured-employer's status as a lawyer and the powers of a notary engaged in private practice | simultaneously with the submission of an application for deregistration as an insurer, for the period from January 1 of the current year to the date of termination of powers |

Self-employed persons do not submit the SZV-STAGE form

For individuals officially recognized as unemployed , the SZV-STAZH form is submitted by the employment service.

How to submit the form to the Pension Fund of Russia

SZV-STAZH can be sent via TKS or submitted on paper - in person, by mail or with a representative.

Policyholders who submit information for 25 people or more are required to report only according to the TKS. In this case, not only employees are considered, but also persons who have entered into civil contracts with the insured, payments under which are subject to insurance premiums.

Submission rules according to TKS :

- The document is signed by a strengthened CEP.

- The date of submission of information is considered to be the day when it was sent via TKS to the Pension Fund. This must be confirmed by a document from the EDF operator or the territorial body of the Pension Fund.

If the form is submitted on paper :

- Individual entrepreneurs put only a signature, organizations - a signature and seal (if available).

- Information on magnetic media can be attached to the paper form.

- If the form is sent by mail, then the day of submission is the date indicated on the postmark.

Fine for non-delivery

Upon dismissal, the SZV-STAZH certificate must be issued to employees on their last working day. This is the date of termination of the employment or civil contract.

If the employee is not given the specified certificate upon dismissal, then he has the right to complain against the employer to the Pension Fund. In this case, the company may be held liable in the form of a fine. Its size is 500 rubles. for each person who was not given the specified information.

To avoid a fine, you should always keep information confirming the fact that the form was handed over.

Thus, according to the new rules, the employee must be given a SZV-STAZH certificate upon dismissal. It contains information about the periods of work of the insured person with the employer. For failure to issue a certificate upon dismissal, an employee may be held accountable and the employer may be sentenced to a fine of 500 rubles. for each document not provided. The certificate is issued on the last working day along with the work book.

Normative base

Government Decree No. 590 of 04/26/2020 “On the specifics of the procedure and timing for the submission by policyholders to the territorial bodies of the Pension Fund of the Russian Federation of information on the labor activities of registered persons”

Resolution of the Board of the Pension Fund of the Russian Federation No. 83p of 02/01/2016 “On approval of the form “Information about insured persons” »

The volume of reporting submitted by an organization is growing every year, and it is becoming more and more difficult to remember which documents are required, in what order and within what time frame. To help HR officers and accountants figure out and not get confused what reports need to be submitted when dismissing an employee in 2021, we have collected all the information in a visual table: