This calculator calculates the amount of tax and the amount of advance tax payments in accordance with Chapter 30 of the Tax Code of the Russian Federation. Some articles of Chapter 30 on the basis of which the calculation was made are given below. The calculator is made in two versions: in the first, the user himself enters into the table the values of the residual value of the property on the specified date (to do this, click on the pencil picture in the rightmost column of the table), in the second, it is necessary to indicate only the full (replacement) value of the property, useful life , depreciation method and the number of depreciation charges already completed - the calculator will calculate the intermediate values of the residual value itself.

Calculation of payments for corporate property tax.

Residual value of fixed assets

| arrow_upward arrow_downward Date | arrow_upward arrow_downward Residual value of property |

Page Size:

Tax and reporting periods

The tax period for which the property tax of organizations is calculated is the calendar year (Clause 1, Article 379 of the Tax Code of the Russian Federation).

The reporting periods of the calendar year depend on the tax base (clause 2 of Article 379 of the Tax Code of the Russian Federation):

| The tax base | Reporting periods |

| calculated based on the average annual cost | I quarter, half year, 9 months |

| calculated based on the cadastral value | I quarter, II quarter, III quarter |

During established reporting periods, calculations for advance payments are provided to the tax authorities no later than 30 calendar days from the end of the corresponding reporting period (clause 2 of Article 386 of the Tax Code of the Russian Federation).

Working with the calculator

To start making calculations, you should know the tax rate for the property tax of legal entities.

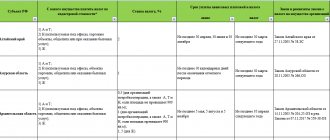

Let us clarify that tax rates are set at the regional level. This means that the rate is accepted by the representative bodies of the constituent entity of the Russian Federation within the limits established by Chapter 30 of the Tax Code of the Russian Federation.

Equally at the regional level, the following are also established:

- specific features of calculating the tax base;

- tax benefits;

- conditions for the application of benefits by business entities.

In relation to the calculator, this means that the tax rate and other indicators necessary for the calculation must be entered by the user himself - the taxpayer in accordance with Article 474 of the Tax Code of the Russian Federation, since not a single calculator is able to take into account all regional features.

In the windows specially designated for this, enter the residual value of all fixed assets on the balance sheet according to the following indicators:

- at the beginning of each month;

- at the end of the year.

The calculator has a separate window for each month. Thus, 13 indicators will need to be entered into 12 fields, two of which are for December.

After filling out all the fields, left-click on the “Calculate” button. The data obtained as a result of the calculation will be displayed in the table below.

Privileges

Taxpayers have the right to take advantage of the benefits enshrined in paragraph 3 of Art. 56, paragraph 2, art. 372 of the Tax Code of the Russian Federation. There are only two types of privileges:

- Federal benefits that apply throughout the country. This privilege can be used by all taxpayers who meet the stated requirements. Enshrined in Article 381 of the Tax Code of the Russian Federation.

- Regional relaxations, which are approved by the authorities of the constituent entities of Russia. The rules on benefits apply exclusively within a specific region.

Attention! If an organization applies a regional tax benefit, then it is necessary to follow the legislation of the constituent entity of the Russian Federation.

You can check the current regulations on the official website of the Federal Tax Service. If a specific type of benefit is not approved, abolished, or canceled for the corresponding calendar year, then you cannot use the privilege. You will have to calculate the tax in full.

Is it necessary to submit a calculation of advances on property?

Rules for calculating and paying property tax for legal entities, described in Chapter. 30 of the Tax Code of the Russian Federation, largely depend on the provisions of the legislation of the constituent entity of the Russian Federation in which the objects subject to this tax are located. The subject has the right to independently establish (clause 2 of Article 372 of the Tax Code of the Russian Federation):

- additional (in comparison with Article 381 of the Tax Code of the Russian Federation) benefits and rules for their application;

- the procedure for calculating the tax base for individual real estate objects;

- the amount of the rate (without going beyond its upper limits indicated in Article 380 of the Tax Code of the Russian Federation);

- the procedure for making tax payments (including the availability of advances for it);

- deadlines for paying both tax and advances (if they are introduced in the region).

Thus, the rules for calculating and paying tax by region may vary significantly. Therefore, before you start calculating advance payments for property taxes, you should find out whether they have been introduced in the region. Such a decision in a legislative document of a constituent entity of the Russian Federation will be equivalent to an indication that reporting periods for taxes have not been established. This allows you to use clause 3 of Art. 379 Tax Code of the Russian Federation. The absence of a reporting period entails the right of the taxpayer not to pay advances during the year.

Moreover, the region has the right to make such a decision not in relation to all taxpayers, but only for certain categories of them (clause 6 of Article 382 of the Tax Code of the Russian Federation).

If there is no decision not to establish reporting periods in the region, then the obligation to pay advances from the taxpayer is not removed. And until 2021, he also had the obligation to submit to the Federal Tax Service the calculation of advance payments in the prescribed form and on time.

You can read about the latest calculation of advance payments for property tax here.

Starting from 2021, there is no need to submit an advance calculation to the tax office, only an annual return. At the same time, the advances themselves must be calculated and paid as before.

Preparing for calculations

Let's distribute all property recorded in accounts 01 and 03 into 5 groups:

| № | Groups | A comment |

| I | Real estate for which the cadastral value has been determined | The cadastral value of objects is posted on the official website of Rosreestr (https://rosreestr.ru) |

| II | Real estate for which there is no cadastral valuation | Real estate recorded on the balance sheet for which there is no cadastral value |

| III | Objects exempt from taxation | The list is given in paragraph 4 of Art. 374 Tax Code of the Russian Federation |

| IV | Preferential objects | The list is given in Art. 381 Tax Code of the Russian Federation |

| V | Other | Property that does not fall into any of the above groups |

Once we have decided on the fixed assets, we will proceed to filling out the calculation.

How to calculate the tax base based on the average (average annual) cost

The concept of average cost is applicable only in relation to property available in the reporting period (clause 4 of article 376 of the Tax Code of the Russian Federation). For calculations over a year, it is called the annual average (annual average). But the principles for determining the average and annual average cost are the same. This calculation is made for all taxable objects as a whole, without singling out specific units from their list. Before its implementation, those that:

- is not considered an object for taxation (clause 4 of article 374 of the Tax Code of the Russian Federation);

- exempt from tax (Article 381 of the Tax Code of the Russian Federation);

- taxed on a different basis (Article 378.2 of the Tax Code of the Russian Federation);

- refers to capital investments in certain facilities made during the period from 01/01/2010 to 12/31/2024 (clause 6 of article 376 of the Tax Code of the Russian Federation).

IMPORTANT! From 01/01/2019, movable property is not subject to tax. See here for details.

The average (annual average) value of taxable property is calculated using information about its residual value, determined on the first day of each month of the billing period and on the first day of the month following this period. That is, the calculation will use the number of indicators of this value that is 1 greater than the number of months of the billing period. And by this number of indicators you will need to divide the sum of all residual value values involved in the calculation in order to obtain the average (annual average) value for the billing period.

For example, to calculate for the 1st quarter, 4 values of residual value will be required (we will denote them by letters):

- on January 01 - a;

- on February 1 - b;

- on March 01 - from;

- on April 01 - d.

Then the average cost for the 1st quarter will be determined by the formula:

Сср = (a + b + c + d) / 4.

Moreover, even if the property is missing on some date(s) or its residual value is zero, this indicator is still included in the calculation. That is, the amount of value also includes its zero value, and in the number corresponding to the number of indicators for the period, this unit with a zero value is also taken into account.

How to determine the residual value of fixed assets, see here.

EXAMPLE of calculating an advance payment of property tax at the average annual cost from ConsultantPlus : The Sigma trading organization applies a general taxation system. The organization's balance sheet contains property, the tax base for which is determined at the average annual cost. The tax rate according to regional legislation is 2.2%. Sigma does not have any property tax benefits. Residual value... Read the continuation of the example in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Calculation of property tax for legal entities

General filling requirements

Here are some features of filling out advance calculations:

- If there are no indicators, a dash is entered in the fields. The dash is drawn along the entire length of the field.

- Cost indicators are indicated in full rubles.

- All sheets indicate the checkpoint and tax identification number of the organization.

Letter No. BS-4-21/ [email protected] provides additional clarifications:

- the obligation to certify the declaration with the seal of a legal entity is excluded;

- The code for the type of economic activity according to the OKVED classifier has been excluded.

Let's consider the procedure for filling out the calculation sections (KND 1152028).

Procedure for filling out section 1

Section 1 is the last to be filled out - the final sheet. It reflects the amount of the advance payment to be paid to the budget at the place of provision. Filled out in the context of the corresponding codes according to OKTMO and KBK. The codes must comply with the following references:

- OKTMO code - directory OK 033-2013 (approved by Order of the Federal Agency for Technical Regulation and Metrology dated June 14, 2013 No. 159-st);

- KBK - instructions on the procedure for applying the budget classification of the Russian Federation (approved by Order of the Ministry of Finance of Russia No. 132n dated 06/08/2018).

The amount of the advance payment is indicated in line 030 of the calculation and is determined by summing the following lines for all sections:

Line 030 = (Section 2: 180 – 200) + (Section 3: 090 – 110).

Procedure for filling out section 2

This section reflects the tax base based on the residual value of assets.

To calculate property tax and to calculate the average annual value for the period, the residual value recorded on the balance sheet as of the 1st day of each month, starting from January 1, and at the end of the reporting period is included.

The formula for calculating property tax is:

To determine the number of months in the reporting period, the number of months in the period + 1 is taken into account. For example, when calculating for the first half of the year, the number of months will be 7 = (6 + 1).

The residual value of fixed assets as of the 1st day of each month is reflected in the calculation table (lines 020–110). Column 3 reflects the residual value of real estate, which is recognized as an object of taxation.

To fill it out correctly, you need to return to the 5 groups listed in the table above. The tabular part of the calculation indicates objects that are assigned to groups II, IV and V.

IMPORTANT!

Section 2 does not reflect tax-exempt real estate.

Procedure for filling out section 2.1

Section 2.1 is completed for real estate objects for which the cadastral value has not been determined. Taking into account our groups, these are those that were taken into account in group II. The tax base is the average annual cost.

Attention! Section 2.1 does not indicate real estate assets disposed of before the end of the reporting period. For example, when filling out the calculation for the first half of the year, section 2.1 is not completed in relation to real estate disposed of before July 1.

The value on line 050 corresponds to the residual value of the property as of the 1st day of the month following the month of completion of the previous reporting period. For example, when filling out a half-year calculation, the residual value as of July 1 is indicated.

Procedure for filling out section 3

For each property for which the cadastral value is determined, a separate sheet of Section 3 is filled out. Taking into account our groups, these are objects that are included in Group I.

The line with code 020 indicates the cadastral value of the asset as of January 1.

Nuances of determining the base for cadastral valuation

The tax base, depending on the cadastral valuation, arises in relation to immovable objects that have a very specific purpose (clause 1 of Article 378.2 of the Tax Code of the Russian Federation), after in a subject of the Russian Federation:

- the results of the assessment of such value were approved;

- a law was adopted on the procedure for forming the base for calculating tax on these objects;

- a list of objects subject to taxation from such a base is published no later than the beginning of the next year.

If all these conditions are met, the corresponding object in the coming year has the cadastral valuation approved for it at the beginning of this year as the basis for taxation. Throughout the year, the value of this base does not change (clause 15 of Article 378.2 of the Tax Code of the Russian Federation), but may decrease due to benefits introduced by regional law.

The tax from the cadastral valuation will have to be calculated separately for each of these objects, applying appropriate coefficients that take into account:

- share of ownership - when the taxpayer is the owner of only part of the object, which has a cadastral valuation as the basis (clause 6 of Article 378.2 of the Tax Code of the Russian Federation);

- location share - when an object is located simultaneously in two (or several) constituent entities of the Russian Federation (clause 2 of Article 378.2 of the Tax Code of the Russian Federation).

An object included in the list of subjects subject to taxation from cadastral valuation (provided that it does not belong to the property of a foreign organization) will never be included in the base depending on the average (annual average) cost (clause 2 of Article 378.2 of the Tax Code of the Russian Federation ).

ConsultantPlus experts provided step-by-step instructions for calculating property tax from the cadastral value. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Don't miss deadlines

The reporting period for this tax is a quarter.

- For objects with a reflected book value, time goes “increasingly” - for 1 quarter, for half a year, for 9 months.

- For property with cadastral value, calculations are made quarterly.

Calculations and advance payments must be submitted no later than 30 days of the first month of the next quarter. If it coincides with a holiday or weekend, you are allowed to submit the invoice on the next working day.

Late deadlines are fraught with a fine: 200 rubles. for each report not submitted on time, and if the deadlines required by the tax authorities are violated, the organization may be fined 300-500 rubles.

IMPORTANT! Calculation of an advance payment is not a tax return, therefore responsibility for late filing occurs not under Article 119 of the Tax Code of the Russian Federation, but under clause 1 of Art. 126 of the Tax Code of the Russian Federation and Part 1 of Art. 15.6 Code of Administrative Offenses of the Russian Federation. The property tax return is submitted only at the end of the year.

At the end of the accounting year, you need to calculate the annual payment and subtract from it the amount already paid as advance payments. This is the number that will appear on your annual tax return.

Specifics of movable property

So, if movable property was registered as a fixed asset on January 1, 2013 or later, there is no need to pay tax on it. Let's highlight a few important points.

First, let's figure out what is hidden under the term “movable property”. With cars and other vehicles, everything is clear - these are definitely movable things. But inseparable improvements made by the tenant are still subject to tax. This is exactly what officials of the Russian Ministry of Finance think in their letter dated April 15, 2013 No. 03-05-05-01/12447. Indeed, in this case we are talking about large-scale reconstruction or modernization of real estate. And the company will not be able to take the improvements made with it.

Advertising structures and air conditioners (not being air conditioning systems)

building) are exempt from property tax. These are movable things. The same can be said about linear cable communication structures. When it comes to fire and security alarms, things are a little more complicated. If such objects are not an integral part of the building's engineering and technical support systems (that is, when moving them without causing disproportionate damage to the purpose of the real estate object is impossible), do not pay the tax. Otherwise, the tax will have to be calculated according to the general rules. These are the recommendations given in letters from the Ministry of Finance of Russia dated April 11, 2013 No. 03-05-05-01/11960 and dated March 27, 2013 No. 03-05-05-01/9648.

How to pay property tax in different situations

Calculation of tax at the negotiated price

Calculation of income and tax from the sale of real estate is based on the contract value (that is, the price reflected in the purchase and sale agreement), if:

- real estate was acquired before January 1, 2021 for any reason (purchase and sale, inheritance, donation, privatization, construction). In this situation, the sale price of the property does not matter at all. When calculating tax, the sales price is used in any case;

- the sale price of an apartment, room, house, cottage, land plot, etc., reflected in the contract, than the cadastral value multiplied by 0.7. The date of purchase of the property is not important;

- the sold property has a cadastral value (that is, it has NOT been determined by local authorities).

Indicators used in the calculation

Based on the above factors influencing the amount of payment, it should be noted the indicators used in the formulas (clause 8 of Article 408 of the Tax Code of the Russian Federation):

- KS (cadastral value) - the value of a property determined by the state - the cadastral chamber. Recorded in Rosreestr documents;

- IP (inventory value) is an expert assessment of real estate by BTI authorities, based on square meters of housing and used building materials. This is a kind of subjective assessment, significantly lower than market value;

- tax rates from the CC and IP, determined for each individual territory in accordance with the Tax Code of the Russian Federation, Article 406.

When calculating tax according to the tax system, the following indicator values are used:

| 0,1% |

|

| 2% |

|

| 0,5% |

|

- deflator coefficient (CD) is used when calculating the mandatory payment for inventory value. In accordance with the order of the Ministry of Economic Development No. 595 dated October 30, 2018, CD = 1.518 in 2021;

- tax-free area provided for different types of residential premises, in accordance with Art. 403 of the Tax Code of the Russian Federation: apartment – 20 m², room – 10 m², house – 50 m². Local authorities have the right to adjust these indicators at their discretion;

- benefits provided by law, Art. 407 of the Tax Code of the Russian Federation. For some categories of citizens, regional authorities provide preferences. But, in any case, a tax benefit can be applied only to one taxable object of each type, in accordance with the choice of the owner who has the advantage;

- the reduction factor will no longer be used in 2021; it was used in the calculations for 2015-2017. (in the first year of transition it was 0.2; the second – 0.4; the third – 0.6);

- property ownership period coefficient, used if ownership arose or ceased within a year (number of months/12);

- When determining the amount of payment, the number of owners is taken into account.

Starting from 2021, not all given values are used in the calculations.

Who will make and submit payments?

According to the legislation of the Russian Federation, payers of property tax are those organizations in respect of which three conditions are met:

- ownership, temporarily, by power of attorney or part-time ownership of real estate and/or movable property included in the balance sheet before 2013, not included in depreciation groups 1 and 2;

- accounting of these property assets is carried out in accounts 01 “Fixed assets” or 03 “income investments in tangible assets”;

- all these assets are provided for by the corresponding article of the Tax Code (Article 374) and are not included in the list of exceptions.

ATTENTION! The specific person in the organization responsible for the calculation and timely payment of property tax is the founder of the trust management (Article 378 of the Tax Code of the Russian Federation).

Rules for calculating property tax

The tax base is the book value of the property subject to tax accounting. The average annual value of the residual value is taken into account, which must first be calculated according to the procedure established in the regulatory acts of the organization.

To find out the residual value, you need to subtract the depreciation amount from the original balance sheet estimate.

ST.rest. = ST.first – Ananum.

- ST.rest. – total residual value of property assets subject to taxation;

- ST.first – initial book value of assets;

- Ananum. – accrued depreciation.

And to calculate the average annual cost, you need to know the balance on the 1st day of the month, as well as the final cost at the end of the year. For this, the following principle applies:

ST.WED-year. = (ST.start.1 + ST.start.2 + … + ST.start.12 + ST.fin.) / 13

- ST.beginning 1-12 – residual value of property on the 1st day of each month;

- ST.fin. – residual value as of the 31st day of the last month of the year.

Then the tax base must be multiplied by the tax rate adopted in the region and by 100%.

Example of calculating advance payments

On the balance sheet of Metal-Service LLC there is equipment, the residual value of which as of January 1, 2021 is equal to 90,000 rubles. Every month the equipment is depreciated by 3,000 rubles. The tax rate is the maximum. Let's calculate the advance payment for the 1st quarter.

At the end of January 2021, the residual value of the equipment will be 90,000 – 3,000 = 87,000 rubles. at the end of February 2021 – 87,000 – 3000 = 84,000 rubles. and at the beginning of March - 84,000 - 3000 = 81,000 rubles. Let's find the average quarterly value of the asset, which will be the tax base: (90,000 + 87,000 + 84,000 + 81,000) / 4 = 85,500 rubles.

New procedure for applying benefits

From 2021, if a citizen has a tax benefit that was not previously taken into account when sending him a tax notice, it will be applied from the period in which he became entitled to this benefit (amendments to paragraph 3 of Article 361.1, paragraph 10 Article 396, paragraph 6 of Article 407 of the Tax Code of the Russian Federation). In this case, the tax authority will carry out a recalculation, reducing tax payments by the amount of such a benefit.