Report 6-NDFL: general concepts

The sixth income form contains a summary of data on all individuals who earned money from their tax agent, on tax deductions, the amount of taxes withheld and everything else that may affect the calculation of tax transfers to the treasury.

The deadline for submitting the annual form is the beginning of April, the next year after the reporting year. The information in the form is accumulated and submitted to the regulator on an accrual basis for each quarter. More information about the dates for filing 6-NDFL in 2021 is in the infographic below:

The report form itself is unified and approved by the regulator. The report includes two parts:

- General indicators.

- Dates and amounts of actual income received and income withheld.

Below we consider the basic requirements for filling out the form:

- General information. The report is based on information about recorded income paid to individuals from a tax agent, all required deductions, taxes paid according to tax registers

- Income. The 1C user must include in the report all income received by an individual during the reporting period.

- Deductions. The report must reflect the right to tax deductions of all possible options, as well as their actual provision.

- Personal income tax amount. The report contains the calculation and amount of income transferred to treasury accounts.

Reporting

The most frequently used reporting documents for personal income tax are: “2-NDFL” and “6-NDFL”. They are located in the “Salaries and Personnel” menu.

The 2-NDFL certificate is only necessary to obtain information and transfer it either to an employee or to the Federal Tax Service.

The formation of 6-NDFL relates to regulatory reporting and is submitted every quarter. Filling is done automatically.

Report 6-NDFL in 1C: how to generate it step by step

The machine fills out the data in the report on its own, provided that the initial information is entered correctly into the accounting registers.

In order to start working on drawing up a regulated 6-NDFL report in 1C, you should find a special functionality for this. It is placed in the reporting and references field in 1C-Reporting. Next, a step-by-step algorithm for your further actions is proposed so that the process takes you a minimum of time and is as correct as possible.

Step 1 – Use the create option to tell the machine to display a new working window.

Step 2 – In the list of report types, select the one you need by clicking on the command of the same name.

Step 3 – In the window that opens, enter the following information:

- the name of the required company, provided that the machine accompanies accounting procedures for several of them;

- deadlines for drawing up the reporting form;

- complete the stage by clicking on create.

There are cases where a company has branches that are part of the company and do not have their own separate balance sheet. In such a situation, the parent company needs to prepare a report separately for all branches and send them to the Federal Tax Service where they are actually located.

Step 4 – So that you can make calculations simultaneously for all available tax authorities where branches of your company are registered, use the creation switch for several tax authorities. Then follow the link from the tax authorities and tick off the list exactly where the divisions are registered and thus where the completed report form will be sent. The next step is to select and create fields. The machine understands your procedures as a call for the formation of separate calculations for each branch for a specific tax authority. It is recommended not to rely on automatic calculation and still double-check the numbers issued by the machine for each line.

Step 5 – Next you will need to enter the encoding where the report will go to the regulator. It is indicated in the title in the cell at the location (accounting) (code). All domestic companies put the 220th position here.

Step 6 – A separate copy of the calculation in Form 6-NDFL for the main office of the company and all its branches is created, provided that such creation is not specified automatically.

So, you select in the cell submitted to the tax authority (code) the desired option for registration with the tax office and then form the calculation using the filling command.

Setting up the program

Tax data

Before you start calculating personal income tax, as well as using most of the functionality, you need to configure it.

Select “Organizations” from the “Main” menu.

Select the organization you want to configure from the list and open its card. In the setup form, fill in the basic data and those located in the “Tax Inspectorate” subsection.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Setting up salary

In the “Salary and Personnel” menu, go to the “Salary Settings” item.

In the general settings, specify that payroll and personnel records will be kept in this program. Otherwise, the rest of the settings will simply not be displayed. Next, click on the “Salary Accounting Procedure” hyperlink.

In the list form, select the line corresponding to the organization whose settings you are making. The corresponding form will open in front of you. At the bottom of it, select “Setting up taxes and reports.”

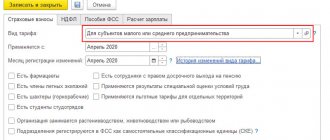

In the window that opens, go to the “Personal Income Tax” section and indicate how these deductions will be applied to you.

Next, go to the “Insurance Premiums” section and adjust these settings.

Now let's move on to setting up the types of income and deductions used when calculating personal income tax. To do this, in the “Salary and Personnel” menu, select the item we went to earlier – “Salary Settings”.

Go to the “Classifiers” section and click on the “Personal Income Tax” hyperlink.

Check that the data that opens is filled out correctly, especially the “Types of personal income tax” tab.

If necessary, you can also set up a list of payroll accruals and deductions. Return to the salary setup form and in the “Salary calculation” section, select the appropriate item. As a rule, in a typical configuration delivery there will already be data there.

How to fill out the cover page of the 6-NDFL report

Filling out the form requires the user to be attentive, but does not create inconvenience or extreme difficulties in the work. At the top, indicate in the checkpoint field the reason why your company or its branch was registered in the form of a code at the place of registration with the Federal Tax Service. The TIN involves adding information about the tax agent.

The machine, according to the regulations, has the initial calculation settings for the report, which means submitting the form for verification to the regulator for the first time in this reporting period. Therefore, the correction number contains a zero code.

Know that the machine sets the submission deadline (code) and tax period (year) automatically, pulling it from the initial form. The position of submission to the tax authority (code) involves specifying the encoding in the form of a four-digit number of the Federal Tax Service where your company is registered and where you regularly send all reports. The location (accounting) field (this also refers to the code) is where you enter all other places where the tax agent sent miscalculations.

The position of the code according to OKTMO involves telling the encoding machine of the municipality where your company with all its branches is actually located.

All of the above information on the company and its divisions, which are on a separate balance sheet, is recorded in the directory of organizations in the section of the general settings of the company. Everything else is pulled from the organization’s directory, like:

- initials of the tax agent;

- his contact details;

- Company name.

It may happen that there will be empty fields in the report and you do not have the technical ability to enter them manually. The machine informs the user about this by filling the cells with yellow. This only means one thing: the machine was not initially given the initial parameters so that it would involve them in 6-personal income tax. It is possible to correct the current situation by entering informative information into the accounting registers and updating the data through the functionality.

“Summary” certificate 2-NDFL

The form itself “Income Certificate (2-NDFL) for an employee” can be generated in the “Reporting, Certificates” section.

The document contains information about the income and personal income tax of the selected employee.

The “Summary” 2-NDFL certificate report contains information from which the 2-NDFL certificate is generated. The advantage of the report is that it generates data for all employees. With its help, you can check all the data on an employee’s income, personal income tax accruals and deductions, and applied deductions.

If necessary, you can set the selection in the “Settings” button.

If an error is detected, the user can make corrections in the program in a timely manner.

For example, a deduction to an employee was not provided, not closed, or was incorrectly indicated.

Go to the employee card - in the “Employees” directory and enter or correct the data on deductions in the “Income Tax” section.

In the section you can enter:

- new claim for standard deduction;

- notification of the tax authority about the right to deduction.

And also view all applications for employee deductions by clicking on the hyperlink of the same name.

Date of signing of the 6-NDFL report

The date of signature of the report is an explicit parameter and the machine automatically uses the date indicated in your PC. The calendar number that is assigned on the title page mainly directly affects the auto-filling of calculations according to the form algorithm specified by the developers. This refers to line 080 of the first section of the reporting form, informing the user about the amount of income not withheld by the tax agent

Similar information is pulled up from the machine’s accounting registers, inclusive of the date of signing your report.

Analysis of personal income tax by date of receipt of income

The report allows the user to obtain information about accrued and paid income, calculated and withheld personal income tax, etc. Information is displayed in the report by date and combined by month. Using the grouping icons " " and "-" you can collapse and expand data.

Information presented in this form is easier to verify and analyze. It makes it easy to spot errors.

Using the “Settings” button, you can set additional report generation parameters.

Set the setting type to “Advanced” and on the “Selection” tab add additional selection. Click the "Add selection" button and add the "Employee" field.

Set “Employee”, the condition “Equal” and in the “Value” field select an employee from the directory. In our example - Akopyan M.S.

Click "Close and Generate". The data in the report will be displayed in accordance with the selection condition.

If you often use the report, for convenience, you can select by employee in his header. Then, to select an employee, you don’t have to go into settings every time. To do this, in the selection line, click on the symbol “-” and select “In the report header”.

As a result of the setup, a selection field by employee appeared in the report header.

This setting applies to any report in 1C.

As with any other report, the user can analyze the data by looking at its transcript. Double-click on the cell value and select the “Registrar” field value.

As a result, a transcript will be displayed in the context of documents that made an entry in the register. Double-clicking on the name of the base document will open the document itself.

Features of filling out the first section of the 6-NDFL report

This section of the report shows the general indicators of the income of all individuals, as well as the calculated and paid income from it since the beginning of the year on a cumulative basis using the amount of deductions established at the legislative level. In a situation where there was a transfer of income to the treasury by the same company, but at different interest rates, the first section should be filled out line by line for each such percentage, in addition to positions 060-090.

The user must remember that the amounts of paid earnings are subject to income tax either partially or in full. All non-taxable income listed in the Tax Code of the Russian Federation should not be added here.

The amount of actual earnings received for work performed by an individual, that is, having a tax code of 2000, 2530, and all other material benefits, will refer to the last day of the month when the employer accrued such earnings. For all other types of income, a calendar date will be indicated, which implies such payment, indicated in the accounting documents for their calculation.

Based on such dates of earnings received, you have the right to determine the required month of the tax period and the reporting period itself to include the earnings received by an individual. This requirement is completely similar to the preparation of certificates in form 2-NDFL.

For example, we can cite the case of income taxation at a 35 percent rate as a material benefit from savings for the use of borrowed funds. No tax deduction can be applied to such interest, and as a result, in line 020 you enter the amount of income accrued by you, and on line 040 enter the amount of calculated income tax.

Filling examples

Let's move on to consider filling out the 6-NDFL in 1C 8.3 ZUP in a number of situations.

Example 1. Salary in 6-NDFL

For December 2021, salaries were accrued in the amount of 25,000 rubles. and it is paid on January 10, 2021 by statement to the cashier . Personal income tax was calculated and withheld from her in the amount of 3,250 rubles:

The date when salary income is actually received is the last day of the month of its accrual. Therefore, salary income is 25,000 rubles. and personal income tax from it - 3,250 rubles. will appear as annual 6-personal income tax in Section 1 in lines 020 and 040 , respectively.

Due to the fact that the December salary will be issued in 2021 (01/10/2020), personal income tax will be withheld already in 2021. Therefore, line 070 in Section 1 for 2019 will not include personal income tax withheld from the salary:

Section 2 completed as indicated in the table:

Due to the fact that the planned transfer date ( line 120 ) falls in the 1st quarter of 2021, the block of December salaries and personal income tax from it will be reflected in Section 2 the 6-NDFL report for the 1st quarter. 2021

Example 2. Vacation pay in 6-NDFL

In June 2021, Vacation calculated vacation pay in the amount of RUB 4,778.20. and personal income tax from them - 621 rubles:

Payment of the accrued amount occurs on June 20, 2019 in a separate statement to the cashier :

The date on which vacation pay income is received corresponds to the date of their payment. Therefore, vacation pay (4,778.20 rubles) and the personal income tax calculated from them (621 rubles) will appear in the semi-annual 6-NDFL in Section 1 in lines 020 and 040 , respectively.

Due to the fact that personal income tax withholding from vacation pay occurs at the time of payment (06/20/2019), this amount will also be reflected in the semi-annual report 6-NDFL in line 070 of Section 1 .

Filling out Section 2 on vacation pay and personal income tax on them will be done as indicated in the table:

Due to the fact that the planned date of transfer ( line 120 ) falls on the 3rd quarter of 2021, the block with vacation pay and personal income tax withheld from them will fall into Section 2 6-NDFL report for 9 months of 2021.

Example 3. One-time bonus in 6-NDFL

In November 2021, for the same month, the document Bonus was awarded to employee D.M. Yolkin. The one-time bonus is calculated in the amount of 1,000 rubles. and personal income tax from it - 130 rubles:

On December 10, 2019, along with the salary for November 2021, the following bonus was paid:

and personal income tax is withheld from her - 130 rubles:

For subsequent correct registration of the date of receipt of income for a one-time Bonus, before accruing it, you should check that in its parameters on the Taxes, contributions, accounting tab, 2002 is selected as personal income tax Income Category field is set to Other income from work :

In the personal income tax code 2002 (Taxes and contributions - Types of personal income tax), the checkbox must be checked Corresponds to wages :

Only in this case, the date of its payment will be recorded as the date of receipt of income for a one-time Award .

Due to the fact that the date on which income in the form of a one-time Bonus is the date of its payment (December 10, 2019), the bonus amount is 1,000 rubles. and personal income tax from it - 130 rubles. will appear in the annual report 6-NDFL in Section 1 in lines 020 and 040, respectively.

Personal income tax on the premium will be withheld at the time of its payment (12/10/2019). Consequently, this amount will also be reflected in the annual report 6-NDFL in line 070 of Section 1 .

In Section 2, bonus blocks are filled in according to the rules described below:

Due to the fact that the planned deadline for the transfer of personal income tax ( line 120 ) falls on the last quarter of 2019, the block with the one-time Premium and the personal income tax withheld from it will be included in the annual report 6-NDFL in Section 2 .

See also video: The procedure for filling out Section 2 in 6-NDFL and the deadline for paying personal income tax on additional accrued vacations and sick leave

Adjustment of the 6-NDFL report in 1C

The first reporting section allows the user some freedom of action in the form of deleting or additionally entering a block of lines 010-050's. Using the functionality of the same name, you can implement this option.

You have the right to remove unnecessary lines by clicking on the cross marked in red next to the 010th line. You also have the opportunity to manually assign income taxable to tax in the agreement in order to eliminate cases of double taxation. You will see the results of the section on tax rates in fields 060 – 090. Anything that is not clear to you for any reason, you have the right to decipher for your understanding when using the functionality of the same name.