The presence of a vehicle (VV) significantly increases the owner’s potential: in speed and range of movement, in a variety of recreational places, in increasing business profitability. But in addition to additional opportunities, such property also imposes obligations, in particular, to pay the annual transport tax.

Let us remind you that when calculating the tax, the category of transport, its capacity and the regional tax rate are taken into account. Even for vehicles of one purpose, for example, for passenger cars, the owners of which are a fairly large percentage of our fellow citizens, the spread in tax amounts is quite large. The more expensive and more powerful the car, the greater the amount of tax that must be paid to its owner. At the same time, benefits are provided for socially important transport, as well as for car owners from the least protected segments of the population.

The presented material will be useful primarily to individuals. Of course, organizations also pay transport tax, but a legal entity, even if there is a benefit, is required to annually file a declaration indicating the reasons why payments have not been made. And for private owners, it is enough to enter the data once into the sample application for a tax benefit if they have rights to the privilege.

Why are there so many pages in the application?

Article 361.1 of the Tax Code of the Russian Federation establishes the declarative nature of the provision of transport tax benefits.

As a rule, preferential categories of taxpayers have benefits for several taxes at once. And the KND form 1150063 makes it possible to claim benefits for several taxes at once:

- transport;

- land;

- property

The taxpayer only needs to submit one such application, filling out only the required pages. Naturally, the title page must . Then everything depends on whether the applicant has a vehicle, land plot, apartment and/or residential building, as well as on the region of his residence. Thus, some regions, for example, do not provide transport tax benefits to large families or pensioners.

So:

- page 2 of the application - fill out for the provision of transport tax benefits;

- page 3 – on land;

- page 4 – on property tax.

there is no page numbering on the application form . Therefore, fill out only those pages for which there is an obligation to pay and at the same time benefits. Then the pages themselves are numbered.

If you are filling out an application for only one benefit, fill out 2 pages. If there are two benefits, then there will be 3 pages. If you need to fill out all three benefits, then fill out all the pages without exception.

Cancellation of transport tax

Much was written about the imminent abolition of this type of tax at the beginning of 2018; moreover, the Ministry of Transport and the President of the Russian Federation have repeatedly spoken out in support of its elimination. But so far things have not gone beyond intentions.

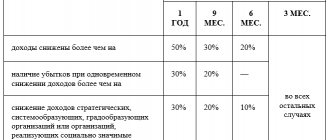

At the initiative of a number of deputies, on June 5, 2021, ]]>draft bill]]> No. 480908-7 “On amendments to the Tax Code of the Russian Federation regarding the abolition of transport tax” was submitted. To compensate for the shortfall in revenue, the document proposes an increase in fuel excise taxes. Hypothetically, this would solve at least two problems:

- reducing the tax burden for those who rarely use their vehicle;

- eliminating the problem of non-payment (the collection rate of this tax in the constituent entities of the Russian Federation does not exceed 50%).

However, the bill did not pass beyond preliminary consideration by the State Duma. On July 2, 2021, the relevant committee returned the project for revision. Thus, it is premature to talk about abolishing the tax. Read more about this in our article.

If 2 or more properties of the same category

As a rule, the benefit applies only to one taxpayer’s vehicle, one plot of land and one residential premises. But the beneficiary himself has the right to choose which of them to apply for the benefit. It is the selected object that needs to be included in the application for benefits.

Of course, if a 100% exemption can cover the tax on one vehicle, and the applicant owns a motorcycle and a car, then the car should be indicated. After all, there is less transport tax on a motorcycle.

As you know, only 6 acres of land are given preferential treatment. Which means:

- Having plots of land of 5 acres and 6 - it is more profitable to claim a benefit for the plot that is larger ;

- if both plots are equal or more than 6 acres, it doesn’t matter to which this benefit will be applied.

For residential premises owned by the taxpayer, the situation is the same . It is more profitable to apply for a benefit for premises with the maximum amount of tax payable.

Who benefits?

The laws provide many reasons for easing tax conditions. For example, federal laws do not consider some transport as a subject of taxation at all. For example, passenger cars for the disabled, medical aviation, rowing boats, fishing vessels. The list can still be continued, but it is much easier to look at paragraph 2 of Art. 358 Tax Code of the Russian Federation.

The transport tax is intended to replenish the regional budget, so benefits for it are the responsibility of local authorities. Here are the population groups receiving these benefits in most regions:

- citizens who suffered radiation sickness while working with nuclear installations (for example, Chernobyl survivors);

- large families;

- pensioners;

- heroes of the Soviet Union and the Russian Federation;

- disabled people of the first and second groups;

- veterans (disabled) of combat operations;

- representatives of a disabled child;

- labor veterans.

Excerpt from Article 358 of the Tax Code of the Russian Federation

Note! However, in some regions of Russia these benefits do not exist at all or, alternatively, they are reduced. A Moscow old-age pensioner cannot receive tax breaks on a car. Petersburg requires them to have a domestic car with a capacity of up to 150 horsepower.

Application in the program

The application can be completed using the software and printed. It is recommended to use the Courier New font with a height of 16-18 points.

You can use a free program for this from the Federal Tax Service of Russia Taxpayer Legal Entity.

“Taxpayer Legal Entity” will help you not only fill out the application form for property tax benefits, but also check that all fields are filled out correctly. In addition, if you subsequently want to change the object to which the benefit will apply, you will have a completed application where you just need to make changes to the object.

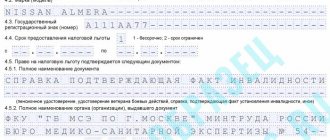

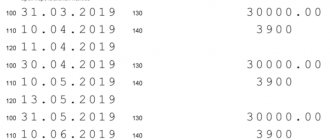

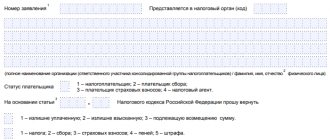

Sample filling

For correct completion, a sample of the finished document is provided.

Deviation from the order of filling is unacceptable. If there is an error, omission or correction, the application will be returned or the benefit will be denied.

Application in the taxpayer’s personal account

More and more people are registering on the website of the Russian Tax Service and have a personal taxpayer account there. This is the most convenient way to communicate with the tax authority. In this case, you do not need to print and there is no need to visit in person .

You only need:

- Enter the office.

- Click the “My Property” button.

- Indicate the desired object as preferential.

In this case, the system will ask you to fill out the fields in the same way as a paper application.

Rules for preparing the form for KND

The application for a tax benefit must be filled out by hand or on a computer. If data is entered manually, then it must be entered into the document with a black helium pen.

Expert opinion

Korolev Konstantin Georgievich

Practicing lawyer with 7 years of experience. Specialization: criminal law. More than 3 years of experience in document examination.

The form is drawn up in 1 copy without any blots. It is strictly prohibited to use proofreaders and other means to correct errors. If incorrect information is entered, the application must be rewritten.

For each type of data, the form has special fields with cells in which the corresponding numbers, letters and symbols must be entered.

Filling out the title page

The title page contains information in all fields, except for those about. The data is entered by the taxpayer personally or by his authorized representative.

The TIN column indicates the code assigned by the tax authority to a citizen who is registered as an individual entrepreneur. If a person is an ordinary individual, then in the TIN line he must indicate the number of his personal document.

Point No. 1 specifies the Federal Tax Service code, which was selected by the taxpayer when filling out the form. The tax office is assigned based on the registration or location of the property.

Point No. 2 indicates the taxpayer’s personal data without abbreviations, his information from his passport and information about the authority that issued the document.

Next, contact information is filled in on the title page. When specifying a phone number, spaces cannot be inserted, and all remaining cells must contain even dashes.

In paragraph No. 3, in the column with the phrase “The application was drawn up on...” you should indicate the number of completed pages of the document. In the next line you need to enter the total number of pages to be copied. These sheets prove the right of an individual to receive tax benefits legally due to him.

Point No. 4 clarifies the accuracy of all information filled out above. To do this, the person filling out the document must put the current date and signature. Below in the column with details, you should write down the data from your passport if the application is drawn up by a representative of the payer.

There is no signature or date on the title page if the document is filled out electronically and sent through the taxpayer’s personal account.

Application deadlines

There are no strict deadlines for submitting an application . Moreover, you may not submit it at all, thereby refusing benefits (if the Federal Tax Service has not applied them automatically).

But if you decide to exercise your right, then try to send the application before the tax office begins to generate payment requests. The optimal date is May 31 of the year following the billing year.

EXAMPLE

In 2021, you retired and became a member of the preferential category of citizens. Claim this by completing a Property Tax Relief Application by May 31, 2021.

Nothing bad will happen if you do it later. For example, you received a request for payment of property taxes, where there is no information about benefits. You have the right to submit an application within this period, but payment must still be made before December 1 to avoid penalties and fines.

Let's consider another option. You paid your property taxes in full and then learned that you are eligible for a benefit. Submit application KND 1150063, indicating the start date of your benefit, and additionally fill out form KND 1150058 for the return of the amount of overpaid (collected, subject to reimbursement) tax (fees, insurance premiums, penalties, fines).

All the proposed options are quite acceptable.

Read also

15.06.2018

Laws

This benefit is regulated by the following laws.

Tax Code of the Russian Federation: Articles 356 - 363.1 and such letters from the Federal Tax Service as:

- No. BS-2-11/666;

- No. BS-4-11/6174.

There are also letters from the Ministry of Finance such as No. 03-02-07/1-373.

The following federal laws also apply:

- dated 07/03/2016 No. 249-FZ (amendments to the Tax Code of the Russian Federation);

- dated November 8, 2007 No. 257-FZ (on roads in the Russian Federation);

- Decree of the Government of the Russian Federation of June 14, 2013 No. 504 (on payment for damage to highways).

Excerpt from Letter of the Federal Tax Service dated October 23, 2012 No. BS-2-11/ [email protected]

Benefits for citizens depend solely on local legislation. Regional authorities are guided by local tax laws and regulations regarding social support for certain categories of car owners.

Here are the general preferential conditions on Russian territory:

- either complete elimination of taxes or their reduction;

- The main reason for providing benefits is the objective need for them.

Note! The benefit is issued after the future beneficiary submits an application by coming to the regional inspectorate of the Federal Tax Service or by going to https://www.nalog.ru in his personal account (hereinafter referred to as “PA”).

You can submit your application in person or through the Federal Tax Service website

System "Plato"

The Platon system is benefits provided at the federal level for each transport facility for trucks weighing more than 12 tons.

To do this, you need to submit the following documents:

- statement;

- passport details;

- information “On payment of payment for damage to federal roads”;

- summary data from the accounting register.

Note! Letter No. BS-4-11/15777 of the Federal Tax Service dated August 2016 approved the recommended application templates.

Excerpt from Letter of the Federal Tax Service No. BS-4-11/15777