Field 101 in the payment order is an indicator of the taxpayer's status. Let's figure out what data to enter into it so that the payment reaches the addressee.

A payment order is a document that is a written order given to the bank by the account owner to make a payment in favor of a recipient. The current form of the payment order is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012 in Appendix 2, 3. The rules for filling out this form are regulated by Appendix 5 of Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013, as amended by Order of the Ministry of Finance dated April 5, 2017 N 58n, the main provisions of which came into force on October 2, 2021. The biggest difficulty for specialists is filling out field 101 on the payment slip.

What is indicated in field 101 of the payment slip?

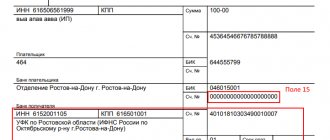

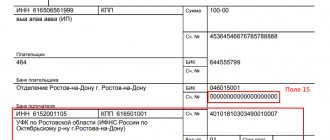

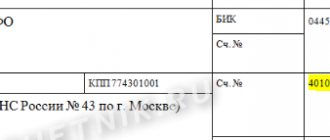

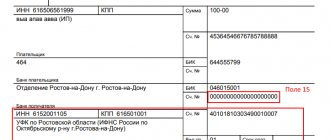

The field with code 101 is located in the upper right corner of the payment order. You need to enter a two-digit digital payer status code into it.

The payer can be: a legal entity, individual entrepreneur, individual, authority (for example, tax, customs, bailiff service, bank).

There are a total of 26 such codes, which can be used to determine who exactly fills out the payment order and on whose behalf the funds are transferred.

This information allows you to correctly identify the person transferring money to the budget and correctly carry out the complete transfer of money.

The need to fill out this indicator in column 101 has appeared since 2014.

Legal entity – “01”, individual entrepreneur – “09”, “14”

According to one opinion, individual entrepreneurs, when paying contributions for themselves, should put code “09” in field 101, and when paying contributions for employees, code “14”; organizations - code “01”. This opinion is based on the fact that the administration of insurance premiums has been transferred to the tax authorities, which, according to supporters of this point of view, makes it possible to put an equal sign between policyholders and taxpayers. The problem with this decision is that the current version of the Tax Code separates the concepts of “payer of insurance premiums” and “taxpayer”.

How to fill out the line?

In field 101, the status of the payer is entered - the person or body from which the non-cash money is transferred.

In this column you need to indicate two numbers - from 01 to 26.

This rule applies both when filling out a payment slip manually and when generating it in electronic format.

The decoding of taxpayer status codes for entering in field 101 is determined by Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on September 23, 2015).

Appendix 5 to the said order contains all the statuses.

Table with a breakdown of all payer statuses for field 101:

Compiler's indicators for individual entrepreneurs

An individual entrepreneur fills out the payer status in field 101 of the payment order when making a payment to a representative of the budget system.

That is, you need to fill out column 101 “Status of compiler” when transferring taxes, contributions, fees, duties, arrears, penalties and fines for arrears and other payments to the budget. In other cases, the IP field is left blank.

In this case, the individual entrepreneur can indicate one of the following statuses of the originator in the payment:

- 02 – if the entrepreneur acts as a tax agent, for example, when paying personal income tax for employees, VAT;

- 08 – for transfers to the budget, with the exception of payments administered by the tax office, that is, this code, for example, can be indicated by an individual entrepreneur when paying contributions to the Social Insurance Fund for injuries, state duties, which are supervised by any body other than the tax office;

- 09 – code is indicated by the individual entrepreneur when transferring funds to the Federal Tax Service (taxes, fees, contributions to compulsory medical insurance and compulsory medical insurance, VNIM, arrears, fines and penalties for arrears);

- 15 – The individual entrepreneur acts as a paying agent, drawing up a payment order for the transfer of funds received from individuals for the total amount with the register;

- 17 – if the individual entrepreneur acts as a participant in foreign economic activity (FEA);

- 18 – if an individual entrepreneur needs to transfer customs payments without being a declarant;

- 20 – the entrepreneur acts as a paying agent, drawing up an order for the transfer of funds for each individual;

- 28 – An individual entrepreneur acts as a participant in foreign trade activities and a recipient of international mail within the framework of such activities.

What code is used when paying personal income tax?

When paying personal income tax, field 101 “Compiler status” can be filled in using the following codes:

- 02 – if income tax is paid by an organization or individual entrepreneur who is the employer in relation to the individual for whom the personal income tax is transferred, that is, in this case the payer acts as a tax agent;

- 09 – if the tax is paid by the individual entrepreneur for himself;

- 10 – if the tax is paid by a notary engaged in private practice for himself;

- 11 – if the tax is paid by a private lawyer for himself;

- 12 – when transferring the tax amount by the head of the peasant farm for himself;

- 13 – if a payment order for the payment of personal income tax is filled out by an individual independently to transfer tax on his income;

- 26 – this status of the compiler is indicated in bankruptcy, when the personal income tax debt is repaid from the register of claims.

Filling in when transferring VAT

If a payment order is filled out for the purpose of paying VAT, then the status of the originator can take on the following values:

- 01 – if the payment form for VAT transfer is filled out by an organization – a legal entity;

- 09 – if VAT is paid by an individual entrepreneur;

- 02 – if an organization or individual entrepreneur transfers VAT, acting as a tax agent.

For the taxpayer when paying taxes

If the payment is filled out for the purpose of paying taxes, then in field 101 one of the following statuses of the originator can be indicated:

- 01 – if the tax is paid by the organization;

- 02 – if the tax is transferred by a person acting as a tax agent, this applies to the transfer of personal income tax for employees, as well as VAT;

- 09 – if the tax payment is made by an individual entrepreneur;

- 10 – if the tax is paid by a private notary;

- 11 – tax payments by a private lawyer;

- 12 – tax payments by the head of the peasant farm;

- 13 – payment of taxes by an individual without the formation of an individual entrepreneur (citizen).

Insurance premiums for yourself and employees

Insurance premiums are transferred for employees by employers to the Federal Tax Service (pension, medical, temporary disability and maternity) and to the Social Insurance Fund (injuries), as well as individual entrepreneurs for themselves.

Depending on who fills out the payment order, the field to indicate the status of the originator may indicate:

- 01 – if contributions to the Federal Tax Service are transferred by the organization for employees;

- 08 – if the payment is made for the transfer of social contributions to the Social Insurance Fund for injuries (from NS and PZ);

- 09 – if insurance premiums to the Federal Tax Service are paid by individual entrepreneurs for themselves or for employees;

- 10 – payer – private notary;

- 11 – private lawyer;

- 12 – head of peasant farm;

- 13 – an individual pays insurance premiums on his own behalf.

Payments under writ of execution

When transferring withheld amounts from an individual’s income under a writ of execution in favor of a budgetary authority (bailiff service), it is necessary to indicate the compiler’s status code “19” in field 101.

State duties

The state duty is credited to the budget, so field 101 in the payment order must be filled in. Depending on who pays the state fee and to which government body, the status number of the compiler depends.

The transfer can be made by both an organization and an individual with or without the formation of an individual entrepreneur, as well as a person engaged in private practice, the head of a peasant farm.

Based on this, column 101 can be filled in with the following code;

- 01 – if the state duty is paid by a legal entity, it goes to the Federal Tax Service;

- 08 – if the duty is sent to structures other than the Federal Tax Service (the payer can be any person except an ordinary citizen);

- 09 – if the payment is transferred to the Federal Tax Service by an individual entrepreneur;

- 10 – the notary pays the state fee in favor of the Federal Tax Service;

- 11 – lawyer, payment is supervised by the Federal Tax Service;

- 12 – head of the peasant farm, payment is supervised by the Federal Tax Service;

- 13 – citizen – individual.

What to do if it is indicated incorrectly?

If money is transferred to the budgetary sector, then field 101 must be filled out.

You cannot leave the column empty or enter 0 in it.

The compiler status code is taken from Appendix 5 to Order No. 107n of the Ministry of Finance of Russia.

If this code is indicated incorrectly in the payment order, the money may not reach the recipient.

The result of such an error will be late payment of a tax, fee or contribution, which may, in turn, entail penalties and fines.

The Treasury will classify such a payment as unclear and will look into its purpose, which will take some time.

When filling out a payment slip, you can find out in different ways that the status in field 101 has been filled out incorrectly. You can receive an order back from the bank due to non-fulfillment, you can independently understand your mistake after sending the payment slip, you can after some time receive requests from the Federal Tax Service or the fund about the presence of arrears .

If it turns out that the status was indicated incorrectly in the payment order, then first you should request a reconciliation with the budgetary authority in whose favor the money was transferred.

If during the reconciliation it turns out that the money has not arrived, then you should write a statement to clarify the payment and the status of the originator in it.

The text is written in any form; there are no standard forms.

The application must be accompanied by documentation confirming the previously made payment - a copy of the payment order where the incorrect status is indicated, a copy of the bank statement where the debit transaction is indicated.

If the clarification is confirmed, the accrued penalties will be reversed.

Invalid payer status: procedure

All people make mistakes. They can also be done while filling out this document. What to do in this situation was clarified by the Federal Tax Service, which issued an explanatory letter No. SA-4-7/19125 dated October 10, 2016.

Based on the Tax Code of the Russian Federation, it describes in detail the procedure for the actions of a person paying tax in the event of an error when filling out a payment order. This point deserves special attention, since if an error is made, the recipient, represented by a government body, may not receive the funds intended for him, while the funds are written off from the taxpayer’s current account in full.

Late payment of taxes or delay beyond the established period leads to penalties and interest. To avoid this, you need to perform the following procedure, regulated by Art. 45 of the Tax Code of Russia:

- Before submitting a payment order, you must carefully study it again for any errors.

- If an error is detected, you must contact the tax authority office at the place of registration with an application to clarify the payer’s status. In addition to the set of documents, a copy of the original document is attached.

- It is recommended to reconcile tax payments with the Federal Tax Service, at the end of which a report should be drawn up and certified by both parties.

conclusions

The payment order contains many details that must be filled out. Field 101 contains information about the originator of the document. This code is filled in only for payments made to the budget.

At the legislative level, there are 26 statuses to be indicated in this column. It is necessary to choose the right status depending on who is transferring the money.

If the status is incorrectly indicated, the money may not reach the recipient, causing a debt.

In such cases, it is necessary to verify mutual settlements with the government agency where the money was sent, and if a debt is identified in connection with an unpaid payment, it is necessary to write a statement requesting clarification.

Consequences of incorrect execution of payment orders

An incorrectly completed payment order indicating erroneous details may result in liability for late payment. In sub. 4 p. 4 art. 45 of the Tax Code of the Russian Federation provides examples in which cases errors in payment documents do not allow the taxpayer’s obligation to independently calculate payments to be considered fulfilled:

- incorrect account number;

- There is an error in the name of the recipient's bank.

Other cases of erroneous filling out of payment slips are not grounds for refusal to credit payments. In such cases, a business entity has the right to contact the tax office to clarify payments.

Judicial practice also indicates that a decision in such situations will most likely be made in favor of the taxpayer (Resolution of the Federal Antimonopoly Service of the Moscow District dated 08/07/2009 No. KA-A41/7564-09 in the case under consideration No. A-41-10152/08) .

Periodic reconciliation with the tax inspectorate and extra-budgetary funds will allow you to identify possible errors in the preparation of payment documents, credit the required amounts on time and avoid further conflicts and misunderstandings with inspectors regarding the amount of arrears.

Controversial point

Now let's touch on the main controversial issue related to changes in payer status codes from January 1, 2021. So, as we have already said, the indicated changes are based on the draft order of the Ministry of Finance “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n. However, according to our information, as of January 1, 2021, this draft has not been approved, officially published and, accordingly, has not entered into force. And if so, then no changes have occurred in filling out field 101 of payment orders “Payer Status” and the following conclusions can be drawn:

- even after January 1, 2021, when paying all types of insurance premiums, code 08 must still be indicated as payer status;

- when paying insurance premiums for December 2021, as well as for months related to 2021 (January, February, March, etc.), the payer status must be indicated as 08;

- indicating code 08 when transferring insurance premiums does not entail the occurrence of arrears in contributions;

- banks do not have the right to demand that when paying insurance premiums to organizations from January 1, 2021, code 01 is indicated as the payer status.

Conditions for filling out the field by organization

When indicating your taxpayer status, you need to take into account some features. If insurance premiums are paid by individual entrepreneurs, lawyers, notaries, then the procedure is as follows:

- for employees, 01 is indicated (instead of 14, as was originally);

- Individual entrepreneur – 09, notary – 10, lawyer – 11.

If the organization’s account is opened in the largest bank in the country, then payment can be made through Internet banking. When transferring funds through Sberbank Online, filling out the payer status is mandatory.

More codes

As you can see, for insurance premiums, the status of the compiler can generally take the values “01”, “08”, “09” or “13”.

As for personal income tax, the status of the compiler should matter:

- “02” – tax agent preparer status;

- “13” is an ordinary individual.

In relation to the state duty, the status of the preparer in most cases will be “08”.

Please note that the status of the compiler of a fine depends on which authority administers this sanction - tax authorities, Social Insurance Fund, customs, etc.

Also see “Deciphering the abbreviations of payment basis codes in a payment order.”

Read also

02.01.2018

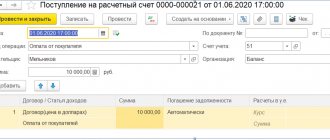

When is it necessary to indicate originator status on a payment order?

When generating a payment order, namely filling out the “101” field, you must be guided by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

This might also be useful:

- Deadline for submitting a declaration under the simplified tax system for 2021

- Property tax deductions in 2021

- Payment for negative environmental impact in 2020

- Declaration 3-NDFL 2021 for 2021

- Which OKVED code should be indicated in the reporting for 2021?

- Reduced insurance premium rates in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payment of taxes and contributions through the banking portal

Not all payments require filling out field 101. If payment for preschool services is expected, then an individual’s account is used and the column is filled in automatically.

To complete the payment procedure you need to perform a number of steps:

- Log in to the portal using your username and password.

- Go to the “Payments and Transfers” tab.

- Open “Transfer to organizations”, select the desired institution from the list or enter details to identify the organization.

- Specify the account from which payment will be made.

- Fill in the payer information (name and address). Leave field 101 blank.

- Specify the payment amount.

- Confirm the operation by entering the code from the SMS notification.