Report 6 personal income tax, when and how to submit

Personal income tax is a tax on personal income, which is withheld from such income as::

- When selling your property if it was owned for less than the required period

- When renting out your own property

- Winnings from the lottery or various competitions

- From salary

No tax is paid on:

- If a close relative gave or inherited any property

Even if a company is an intermediary, for example, it hires employees to work in another company, it will be considered a tax agent and is obliged to remit personal income tax on wages.

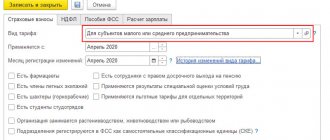

Report 6 Personal Income Tax is submitted by legal entities and individual entrepreneurs who have employees who receive wages. This report form is compiled quarterly on an accrual basis and submitted electronically in the month following the reporting month no later than the last day.

Important! If the report submission date falls on a weekend, it is submitted on the first working day.

The report itself consists of a title page and two sections.

- The first section reflects the amounts as a cumulative total of generalized indicators

- The second section contains the dates and amounts when the income was actually received and transferred, as well as the tax itself was paid

It is worth remembering that if an enterprise has separate divisions that have their own checkpoint, this type of report is submitted for each separate division separately, each to its own district where the structural division is registered.

***

So, we looked at the procedure for filling out line 060 of form 6-NDFL and told what it includes and how to fill it out correctly. If controversial situations arise, it is best to refer to letters from the tax authorities with clarifications.

You will find more information about calculating 6-personal income tax in the “personal income tax” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instructions for filling in general terms

- Cells must be filled in from left to right according to generally accepted rules;

- Cells that cannot be filled in are crossed out

- If you provide a report on paper, each section is printed on a separate sheet; double-sided printing is prohibited in this case

- For manual filling, you can use black, purple or blue ink;

- If the report is submitted on a computer, you must use Courier New font with a height of 16 - 18 points.

General information about the form

The deadlines for submitting quarterly reports are submitted within clearly defined deadlines by current legislation. Fill out the document based on analytical information from the registers.

- The form is composed from left to right. Empty cells must be filled with dashes. The document is signed by an entrepreneur or a person with appropriate authority.

- The first part is compiled on an accrual basis. It is necessary to compose each block at a separate rate in lines 10-50, cells from 60 to 90 are filled in with a cumulative total only in the first half of the document.

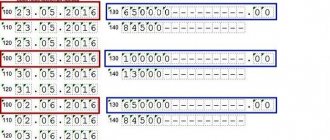

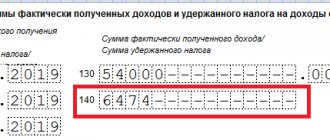

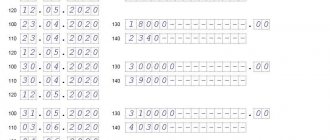

- The second part of the declaration indicates the indicators that were carried out strictly in the reporting quarter. Lines 100-140 are filled in according to the actual date and amount of income.

If an error is made when dismissing and hiring an employee during the reporting period, it is necessary to submit a calculation to the tax authority with clarification of the data.

Section 1, line 060 to fill out

To fill out the first section of 6NDFL at different rates, for example, foreign citizens worked for an employer whose tax rate is 30%, then lines 010-050 must be filled out for each rate separately. Income is summed up for all people, at this rate.

| Line, numbering | What is indicated |

| 010 | We set the tax rate that was used to calculate the tax |

| 020-050 | Based on the applied rate, these lines are filled in |

| 020-050 | Based on the applied rate, these lines are filled in. Line 020 real amount of accrued income, wages or other income received |

| 030 | This reflects the amount of tax deductions based on the number of children. In order for the accountant to give these deductions, you must provide the child’s birth certificate or a certificate from the educational institution stating that he is a full-time student. |

| 040 | Amount of calculated tax |

| 050 | The amount by which the tax agent reduces the calculated personal income tax |

| 060 | Number of employees who received income |

| 070 | Amount of tax withheld by the tax agent |

| 080 | The amount of tax that for any reason was not withheld by the agent |

| 090 | Tax refund to an individual |

Important! Line 060 tells us how many people received income in this quarter, and if in the same reporting period an employee quit and started working again, he is counted as one employee.

Lines 060-090 in the first section are filled in with a cumulative total, taking into account previous quarters.

How to fill out line 060 in 6-NDFL

Line 060 is filled in as follows:

- the number of individuals to whom the employer accrued income for the period is calculated;

- the resulting figure is entered in line 060.

However, there are a huge number of nuances that influence the formation of this figure. Let's look at some of them (all these clarifications were presented in letters from the tax authorities):

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- The person worked, then quit, and then within a year returned to the employer - in line 060 he is counted only once.

- A person works for one employer under several contracts - he will be included in line 060 only once.

- An employee receives payments from one employer at several tax rates - inclusion in the agreed line occurs again only once. Lines 010–050 in the 6-NDFL calculation are filled out separately for each rate, but lines starting from 060 are filled out once for the employer as a whole.

- An employee performs work under a civil contract or receives income from rental property - include this individual in line 060, and the amounts of income paid to him and withheld personal income tax in the remaining lines of the 6-NDFL calculation.

- The employee worked in several separate divisions of one enterprise - the 6-NDFL calculation must be completed and submitted by each structural division; in this case, this individual is taken into account in line 060 of each of these calculations.

IMPORTANT! If employees of a structural unit do not receive income directly from the unit itself (i.e., all payments are made exclusively through the head office), then it does not report on Form 6-NDFL, and all data is included in the calculation of the parent organization.

Remuneration under civil contracts from which personal income tax is not withheld does not need to be reflected in the calculation. So, in particular, there is no need to display in the calculation:

- payments under a civil contract, if it is concluded with an individual entrepreneur;

- amounts paid to individuals for property purchased from them. In such cases, individuals independently report to the tax authority on their income (subclause 1, clause 1, clause 5, article 227, subclause 2, clause 1, clause 3, article 228 of the Tax Code of the Russian Federation).

Section 2 of report 6 personal income tax

In this section it is necessary to reflect by date:

- When did the employee actually receive income;

- The date of personal income tax withholding from him;

- deadlines for transferring personal income tax;

- the amount of income actually received;

- amount of personal income tax withheld.

| Line | Decoding |

| 100 line | Date of actual receipt of income |

| 110 | When should tax be withheld? |

| 120 | Date of personal income tax transfer |

| 130 | Amount of income |

| 140 | Withholding tax |

Important! If two individuals have the same dates for the actual transfer, withholding and calculation of tax, then they are formed into one amount in the report in blocks 100-140.

On line 100, you must indicate the specific date of receipt of income; for wages, it is considered the last day of the month for which this income was received.

Sick leave is reflected on the date when the money is paid.

Please note that in the calculation for the 1st quarter you may encounter December wages, which were paid in January 2021, as well as March wages, which will be paid in April 2021. In this case, the December salary is reflected only in section 2 of the Calculation, and the March salary - only in section 1. In section 2, the salary for March, paid in April, will be shown only in the report for the half-year of 2021.

General approach to the formation of section 1 6-NDFL

The 6-NDFL reporting form and the procedure regulating the process of its preparation were approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] In accordance with this procedure and further clarifications of the Federal Tax Service:

- Section 1 of the report is formed based on summary information, based on data for the 1st quarter, 1st half of the year, 9 months and a year on a cumulative basis.

- Information for inclusion in the report must be taken from tax registers for personal income tax (clause 1 of article 230 of the Tax Code of the Russian Federation).

For more information about registers, see the material “How is the personal income tax register maintained?”

The absence of personal income tax registers at an enterprise falls into the category of gross violations of tax accounting rules. ConsultantPlus experts spoke about the consequences of such violations. Get trial access to the K+ system and upgrade to the Ready Solution for free.

- For each division where there are workplaces separate from the parent enterprise, a report should be drawn up and submitted separately, even if the territorial divisions and/or enterprise belong to the same Federal Tax Service (letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS- 4-11/ [email protected] ).

- An exception to reporting is the situation when employees (counterparties) do not receive income directly from the division itself (for example, all payments to employees and contractors come from the head office). Then 6-NDFL for such a branch may not be formed. This is stated in the letter of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11/4901.

Responsibility for failure to submit 6NDFL to the tax office

There is no need to submit a blank personal income tax form if the legal entity did not accrue or pay income during this period.

If there was at least one payment, be it sick leave, vacation pay, which led to the fact of transferring personal income tax, the report must be submitted in any case.

The fines for failure to submit 6NDFL on time are not large, but still.

If the violation is for the first time and up to a month has passed, then the fine will be 1000 rubles, if longer, then another 1000. A fine of 300-500 rubles may be imposed on the director.

Important! If personal income tax is not paid on time, the tax office has the right to block the taxpayer’s current accounts and impose penalties. The bank will receive a notification that the required amount has been blocked; now, as a rule, not the entire account is blocked, but only within the limits of what needs to be paid.

For untimely transfer of tax to the budget, for failure to pay penalties, for failure to submit reports, the tax agent is held accountable and penalties may be imposed on him. Depending on the violation, the following types of punishment are provided:

| Violation | Amount of fine |

| For one tax period | 10,000 rubles |

| More than one period | 20 000 |

| Understatement of tax | 20% of the underpaid amount, but not less than 40,000 |

Important! For more serious violations regarding non-payment, the employer may be held administratively liable, as well as suspended from his position for a certain time.

Generating information about the number of individuals. persons in field 060

Information on the number of employees who have made a profit since the beginning of the year is reflected in 6 personal income taxes on line 060.

When forming 6 personal income taxes on an accrual basis, we are guided by the main rules:

- Line 60 indicates the number of individuals. persons to whom earnings were transferred during the reporting period from the beginning of the year. The list of income is given in the table;

- if an employee received income at the parent enterprise and at a branch, the income is included in the reporting at each enterprise;

- if the profit was received at one enterprise in different contracts, 1 person must be indicated on line 60;

- if the income is received in one organization at different personal income tax interest rates, consider 1 individual. face;

- if during the reporting period a person is fired and then rehired, the calculations are not summed up and 1 person must be reflected.

Procedure for calculating income:

Line by line filling out 6 personal income tax: title page and calculation

Example of accounting for employees of the parent organization and branch

Let's consider an example of filling out for a new structural organization and the parent company.

What information is indicated in line 060 of declaration 6 for the parent and structural organization?

- During January – March, 22 people received income and paid personal income tax;

- in the second quarter, the structural division “Firm 1” was organized, where 5 employees were transferred in April;

- In addition, 5 more individuals were admitted to the branch in June. persons;

- The branch calculates wages independently;

- in month 06, 3 employees left the branch;

- 2 people from those laid off went back to work at the parent company “Firm”;

- in June, 4 more people were hired into the staff of the parent organization “Firm”.

Both organizations “submit two personal income tax declarations according to OKTMO.

The calculation of 6 personal income taxes for the six months for the organization “Firm” will be as follows:

- line 060 = 22 + 4 = 26 people.

The calculation is not affected by 2 people who were transferred to the branch and then returned to the parent organization.

Calculation of employees for the structural unit “Firm 1”:

- line 060 = 5 + 5 = 10 people (5 employees were hired due to transfer from the parent organization, 5 were hired in June).

Fill out correctly: personal income tax 6 on an accrual basis

Example of filling out a report for the 1st quarter

In the company's staff, in January, employment contracts were concluded with 18 people. At the same time, 1 person did not start work, and no profit was accrued for January. Salaries were paid to 17 employees.

In February:

- 1 employee was dismissed without accrual of income on 01.02;

- 1 woman went on maternity leave on 02/01;

- 1 person was contracted for a “maternity” place on 02/02.

For February, the amount of earnings of 18 individuals must be transferred. persons.

In March, earnings were accrued to 18 employees.

Explanations for filling out the report in this situation.

Line 060 indicates the number of individuals to whom profit has been accrued since the beginning of the reporting year. In this case, the average payroll or payroll number is not calculated. Calculation of labor relations does not play a role in filling out the line - an employment contract, a civil contract or a combination agreement has been drawn up.

It is important to observe the control ratios when filling out line 060: the number on line 060 coincides with the number of submitted annual reports on Form 2.

Line 060 6 Personal income tax is filled in with an accrual total. Here indicate the number of physical. persons to whom the profit is accrued. Therefore, for January, profit is not taken into account in the calculation if 1 worker’s income was not accrued. Thus, the headcount for January in this example is 17 people.

Another employee was hired in February. This means that another employee is added to the report in line 060 for February. Headcount for month 02 – 18 people.

The situation did not change in March. When filling out line 060 of the first section, 1 person to whom income was not paid for January is not taken into account. You need to specify 18 employees.

Personal income tax 6 cumulatively from the beginning of the year: general information

In accordance with the current rules, a certificate in this form is provided every quarter. Form 6 personal income tax is submitted on an accrual basis, and each report contains data for only three months. You should pay attention to the correctness of information between these periods. So, for example, workers’ salaries for June will only be received in July. Accordingly, it will only be entered on the form that is submitted three quarters in advance.

Next, we will consider in detail how 6 personal income taxes are filled out on an accrual basis for the six months. The first page is intended for entering standard identification data, so we will note only some features of the example:

- In the column with the adjustment number, zeros are entered when submitting reports for the first time. If the inspector finds errors, he has the right to demand corrections within a period of no more than five days. Corresponding corrections are made in new documents, where serial numbers “001”, “002”, etc. are indicated.

- In this example, a reporting period of 6 months is considered, so the code “31” is entered in the “Representation period” column.

- An individual entrepreneur writes “120” in the group of cells “By location”. When using the patent system, indicate “320”.

- In a separate group (bottom right) the entry “PETRO PETROVICH PETROV” was made. If the document is submitted by an authorized representative of the tax agent, the relevant information is entered here and the identification parameters of the document confirming such authority must be indicated.

There should be no empty cells in all fields of the document. Instead of data, a dash is entered in them. Here, in particular, dozens of cells after the entry “IP “PETROV”” are filled with the corresponding signs. In order not to waste time, it is more convenient to fill out 6 personal income taxes on an accrual basis using “blanks” on a computer, rather than manually. If necessary, the first page can be saved as a sample, not forgetting to change the code of the reporting period and the date of its compilation.