Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

The simplified declaration is submitted only once at the end of the calendar year (Article 346.23 of the Tax Code of the Russian Federation) - this is the tax period. Organizations need to report by March 31 in the post-reporting year, individual entrepreneurs - by April 30.

- When a declaration under the simplified tax system is submitted at other times

- Penalties and fines

- Where is the simplified taxation system report submitted?

- Zero declaration according to the simplified tax system

Title page

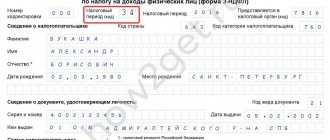

In particular, the title page must include the following information:

- Correction number. The number “0” indicates that the declaration is primary. A clarification can be identified if the field contains a number other than zero (for the fourth clarification the number is “4”, for the third – “3”, etc.).

- Tax period code (for companies that continue to operate, you need to select code “34”).

- Tax office code (take it from the registration notice. If the notice is not at hand, the tax authority code can be found on the Federal Tax Service website).

- Code for the place of submission of the declaration (120 - for individual entrepreneurs; 210 - for organizations).

- Full name of the enterprise or full name of the businessman (Limited Liability Company "Elka", Individual Entrepreneur Artemy Stepanovich Senkin).

- OKVED code. It can be easily found in an extract from the Unified State Register of Legal Entities (USRIP) or determined using the OKVED classifiers. An extract from the Unified State Register of Legal Entities can be obtained by sending a request to the Federal Tax Service via the Internet or by coming in person. Persons combining several modes must indicate the OKVED code corresponding to their type of activity on the simplified tax system.

- Numerical code of the reorganization or liquidation form (leave it blank if there were no specified circumstances).

- TIN/KPP of the reorganized organization (if there were appropriate circumstances).

- Phone number.

- How many pages does the declaration have?

- How many sheets are there in supporting documents?

All possible codes involved in the declaration are included in the appendices to the filling procedure.

For signatories of the declaration, codes are assigned: “1” - if the signature is placed by a manager or individual entrepreneur, “2” - if the signature in the declaration belongs to a representative of the taxpayer.

Where should I submit a report on the simplified tax system?

Taxpayers submit the report to the tax office where they are registered. For individual entrepreneurs, this is the tax office at the place of residence of the entrepreneur as an individual; for organizations, this is the tax office at the location of the legal entity. If an organization has several offices, then the declaration is submitted at the place of registration of the head office. There are three ways to submit a report:

- by mail (valid letter + described attachment);

- in person (bring the original + a copy for the Federal Tax Service and the individual entrepreneur);

- in electronic format (using an electronic document management system and digital signature or through the Federal Tax Service Inspectorate service or using a telecommunications operator).

Section 1.1

Although sections 1.1 and 1.2 of the declaration go directly after the title page, they must be completed after the data is reflected in subsequent sections. This is explained by the fact that these sections are, as it were, summary and collect the final data from the remaining sections.

Section 1.1 will only be needed by taxpayers working on the simplified tax system for “income”.

In line 010, as well as in lines 030, 060, 090, OKTMO is supposed to be indicated. The last three lines indicated are filled in only when the address changes.

OKTMO occupies eleven cells in the declaration. If there are fewer digits in the code, dashes are placed in unoccupied cells (to the right of the code).

In line 020, the accountant enters the amount of advance tax for the first three months of the year.

The payer enters the advance payment for the half-year in line 040. Do not forget that the advance payment for the first quarter must be subtracted from the amount of the advance payment for the half-year (otherwise there will be an overpayment). By the way, the advance must be paid no later than July 25th.

During a period of crisis or downtime, it is likely that the advance payment for the first quarter will be greater than that calculated for the first half of the year (due to a decrease in income). This means that the amount to be reduced will be written down in the line with code 050. For example, for the first quarter, Elka LLC sent an advance of 2,150 rubles, but at the end of the six months, the advance was only 1,900 rubles. This means that you don’t need to pay anything, and in line 050 the accountant of Elka LLC will write down 250 (2,150 - 1,900).

The algorithm for filling out line 070 is similar to the algorithm for line 040, only information is entered here for 9 months. Line 080 stores information about the tax to be reduced for 9 months.

Line 100 summarizes the year and records the amount of tax that needs to be written off from the current account in favor of the Federal Tax Service. Line 110 is useful if advances exceed the tax amount for the year.

Based on the results of 2021, Elka LLC must send a “simplified” tax in the amount of 145,000 rubles to the budget. However, during the quarters advances were made in the amounts of RUB 14,000, RUB 18,500 and RUB 42,300. This means that in total Elka LLC will have to pay an additional 70,200 rubles (145,000 - 14,000 - 18,500 - 42,300).

Design requirements: 5 basic rules

We list 5 mandatory rules for completing a declaration under the simplified tax system (clauses 2.1─2.6 of the Procedure for filling out a declaration under the simplified tax system, approved by order No. ММВ-7-3/ [email protected] ):

- Rule for reflecting cost indicators.

All cost indicators must be entered in the declaration in full rubles: values less than 50 kopecks are discarded, and 50 or more kopecks are rounded up to the full ruble.

- Page numbering rule.

All pages of the declaration must have continuous numbering starting from the title page. Number format: “001”, “002” ... “010”. A special field of three characters is provided for entering the page number.

- Rules for preparing a paper declaration.

For declarations filled out manually, special requirements apply:

- It is permissible to fill out the declaration information only in blue, purple or black ink;

- it is unacceptable to correct errors using a correction tool;

- double-sided printing of the declaration and binding of its sheets, leading to damage to the paper medium, are prohibited.

- Rule for filling in the fields.

For different types of information it is necessary to use different formats:

- The rule for filling out the fields of the declaration in the absence of indicators.

If the taxpayer does not have any indicator to fill out, the field intended for him is crossed out (a straight line is drawn in the middle of the information along the entire length of the field).

Section 1.2

Fill out Section 1.2 if your object is “income minus expenses.”

The principle of filling it out completely repeats the principle of filling out section 1.1.

Lines 010, 020, 060, 090 contain OKTMO.

Tax advances are recorded in lines 020, 040, 070. The timing of their payment does not depend on the object of taxation - it is always the 25th.

Entries are made in lines 050 and 080 if prior payments to the budget exceeded the advance for the current period.

The only difference between the described section and section 1.1 is line 120. In it you need to indicate the amount of the minimum tax (1% of income). For example, with an annual income of 10,000 rubles and expenses of 9,500 rubles, the tax payable by Elka LLC will be only 75 rubles ((10,000 - 9,500) x 15%). If you calculate the minimum wage, you get 100 rubles (10,000 x 1%). Elka LLC must pay exactly the minimum tax, naturally reducing it by the amount of advances. If the company had advances in the amount of 30 rubles, then in line 120 the accountant will indicate 70 (100 - 30).

If advances based on the results of three quarters of the year exceed the minimum tax, line 120 is crossed out.

Content

- Individual entrepreneur reporting

- Individual entrepreneur reporting according to the taxation system used

- Individual entrepreneur reports on other (additional) taxes

- Reporting of individual entrepreneurs with employees

- Individual entrepreneur reporting on cash transactions

- Service for maintaining and submitting reports for individual entrepreneurs

Let me say in advance that the most convenient way to generate and submit reports is through a special service.

Today we will partially try to do this: we will try to briefly and clearly talk about what kind of reporting must be submitted to an individual entrepreneur.

Section 2.1.1

It is needed as part of the declaration only for those categories of payers who pay income tax. Please note that persons paying a trade tax in addition to tax will not need this section.

So, it is advisable to fill out a declaration under the simplified tax system starting from this section.

In line 102 you must indicate one of two characteristics of the taxpayer:

- code “1” - for companies and individual entrepreneurs with employees;

- code “2” - exclusively for individual entrepreneurs without employees.

Lines 110–113 collect information about income for the first quarter, six and nine months, and the year. The main principle: all income and expenses are recorded on an accrual basis. Using the example of Elka LLC, we will show what income is on an accrual basis. Initial income data: I quarter - 13,976 rubles, II quarter - 24,741, III quarter - 4,512 rubles, IV quarter - 23,154 rubles. To fill out lines 110–113, the accountant at Elka LLC will add the current value to the previous value. So, in line 110 the accountant will write 13,976, in line 111 - 38,717 (13,976 + 24,741), in line 112 - 43,229 (38,717 + 4,512) and in line 113 - 66,383 (43,229 + 23,154 ).

The tax rate is fixed in lines 120–123.

Line 130 records the tax advance for the first quarter. Lines 131–133 reflect advances and tax. How to calculate them is indicated directly on the declaration form to the left of the corresponding line.

In lines 140–143, entries are made about the amounts of insurance premiums, sick leave and payments for voluntary personal insurance. An accountant of any company must remember that the amount of tax and advances can be legally reduced by the amount of these expenses, but not more than 50%. Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and the sick leave of director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles (68,324 + 17,333). The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the amount of expenses, which turned out to be 42,829 rubles (85,657: 2). The amount received is more than half the tax (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37,070, not 42,829.

Let us add that individual entrepreneurs in lines 140–143 reflect contributions for themselves. Single entrepreneurs have a special advantage - they can reduce taxes by 100% of contributions transferred to the budget. Individual entrepreneur Semechkin V.O. (without employees) for the year, according to preliminary calculations, should send 36,451 rubles to the budget, the contributions paid amounted to 17,234 rubles (this is exactly the amount Semechkin paid). Individual entrepreneur Semechkin V.O. reduced the tax on contributions (by 17,234) and transferred 19,217 rubles (36,451 - 17,234) to the Federal Tax Service.

Declaration according to the simplified tax system for the quarter

In general, there is only one declaration to be submitted – an annual one. But it happens that the declaration needs to be submitted in just one quarter. This is done if a company or individual entrepreneur began operations in one quarter and completed them in the same quarter. Let's face it, this is rare. In this case, the declaration is submitted on the annual declaration form, but data on income and expenses will be entered only for the quarter in which the company operated.

According to the simplified tax system, what you have to do quarterly is pay a single tax. Every quarter, organizations and entrepreneurs are required to transfer advance tax payments to the Federal Tax Service by the 25th of the next month. Deadlines may vary if the last day of delivery falls on a weekend or holiday. In 2021 the deadlines are as follows:

- tax for 2021 - until March 31, 2021 for organizations and until April 30 for individual entrepreneurs;

- for the 1st quarter of 2021 - April 26;

- for the 2nd quarter of 2021 - July 26;

- for the 3rd quarter of 2021 - October 25;

- the balance of tax for 2021 is until March 31 for organizations and until May 4 for individual entrepreneurs.

Section 2.1.2

If you pay a trading fee, then this section is for you.

All income is noted in lines 110–113. Definitely on a cumulative basis. For which period to record income, the explanation for the line indicated in the declaration form will tell you.

Also, as in section 2.1.1, taxpayers who have ceased operations or lost the right to work on a simplified basis duplicate income for the last reporting period in line 113, and the tax is repeated in line 133.

Similar to section 2.1.1, in line 130 you need to indicate the tax advance for the first three months of the year, and in lines 131–133 - payments for the following periods. The accountant will see the calculation formula directly under the specified lines in the declaration form.

In lines 140–143 you need to indicate the amounts of payments, the list of which is presented in clause 3.1 of Art. 346.21 Tax Code of the Russian Federation. It is on these payments that the tax can be significantly reduced. But there is a limitation here: it is legal to reduce the tax by no more than 50% of the specified payments. Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and sick leave for director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles. The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the amount of contributions and sick leave, which turned out to be 42,829 rubles (85,657: 2). The amount received exceeds half the tax (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37,070, not 42,829.

Enter the trading fee directly in lines 150–153. Enter the fee here if it has already been paid. Lines 160–163 will tell you about the amount of the trade fee, which reduces the tax and advances on it. Depending on the indicators, these lines can take different values. Which ones exactly, the formula under the lines in the declaration will tell you.

Penalties and fines

After receiving the declaration, the tax office checks the data from the declaration and the amount of advance payments received. If an error is made in calculating advances, the taxpayer only faces penalties. If you made a mistake in the declaration or sent the advance payment at the wrong time, this is punishable by fines.

According to Article 119 of the Tax Code of the Russian Federation, the amount of the fine for failure to meet deadlines will be from 5 to 30% of the amount of tax paid (but not less than 1000 rubles), while the violator will be fined for each full and partial month of delay. In any case, tax authorities will take into account all mitigating circumstances that prevented an individual entrepreneur or company from filing a return on time.

Responsibility for missing deadlines may lie not only with the company or individual entrepreneur, but also with a specific employee (official). The fine will be 300 – 500 rubles.

Important! If, after 10 days from the deadline for submission, the report has not yet been sent to the Federal Tax Service, then the company’s current account may be blocked (clause 2 of Article 76 of the Tax Code of the Russian Federation).

Section 2.2

If you pay tax on the difference between income and expenses, then this section is for you. Let us briefly describe the lines to be filled in. Remember that we count and record data on an accrual basis.

Lines with codes 210–213 are income for the reporting periods.

Lines with codes 220–223 are expenses, the list of which is given in Art. 346.16 Tax Code of the Russian Federation.

Line with code 230 - loss (part of it) for past tax periods. By declaring a loss, you can legally reduce your tax base.

Lines with codes 240–243 are the tax base. Let’s say the income of OOO “Sova” amounted to 541,200 rubles, expenses - 422,000 rubles, and the loss of the previous period - 13,400 rubles. The accountant of Sova LLC calculated the tax base: 541,200 - 422,000 - 13,400 = 105,800 rubles.

If at the end of the year the amount turned out to be a minus sign, the amount of the loss should be indicated in lines 250–253. Let’s say the income of OOO “Sova” amounted to 422,000 rubles, expenses - 541,200 rubles. The accountant of SOVA LLC calculated the tax base: 422,000 - 541,200 = - 119,200 rubles. The result was a loss.

Lines with codes 260–263 are the tax rate (usually 15%).

Lines with codes 270–273 are tax advances.

Line with code 280 is the amount of the minimum tax. It is not paid if it turns out to be lower than the tax itself according to the simplified tax system. LLC "Sova" in 2021 received income of 470,000 rubles, confirmed expenses amounted to 427,300 rubles. Accountant Filina A. Yu. calculated the tax: (470,000 - 427,300) x 15% = 6,405 rubles. Next, Filina A. Yu. calculated the minimum tax: 470,000 x 1% = 4,700 rubles. As we can see from the calculations, the minimum tax is less than the accrued tax. Therefore, the accountant of Sova LLC will transfer 6,405 rubles to the Federal Tax Service account (provided that there were no advances previously).

Individual entrepreneur reporting

Let me start, perhaps, with the fact that all the reporting that an individual entrepreneur must submit/keep can be divided into several groups for convenience. Basically, there are four of them:

- Reporting on the taxation system used;

- Reporting on other taxes (if necessary);

- Reporting for employees (if there are any, of course);

- Reporting on cash transactions (if there are cash transactions).

Now let's look at each of these four groups in more detail.