New forms for registration of legal entities and individual entrepreneurs:

- P11001;

- P12001;

- P13001;

- P16001;

- P21001;

- other.

The procedure for filling out and processing applications and notifications has been updated. The changes will take effect from November 25, 2020.

The Federal Tax Service of Russia (FTS) has issued an order on new forms for state registration of legal entities, individual entrepreneurs and peasant farms. This is the first change in registration documents in 8 years. During this time, significant changes have occurred in Russian legislation related to business registration. Current documents do not allow these standards to be fully implemented. Order of the Federal Tax Service No. ED-7-14/ [email protected] dated 08/31/2020 allows the legislative changes to be applied in full and introduces new registration forms to the tax office for all situations and changes in the activities of legal entities and individual entrepreneurs. Order of the Federal Tax Service No. ММВ-7-6/ [email protected] dated January 25, 2012, which approved the current forms (notifications, messages) for registration of legal entities, peasant farms and individual entrepreneurs, will become invalid.

Additionally:

- Documents required for registration of a legal entity.

- New forms for state registration of organizations, individual entrepreneurs and peasant farms have been approved.

- Opening an individual entrepreneur in 2021: step-by-step instructions.

- How to write an application to add OKVED codes.

- OKVED codes for individual entrepreneurs in 2021.

- How to close an individual entrepreneur in 2021

For what purpose were new forms introduced?

Until November 25, the forms approved eight years ago by Order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. ММВ-7-6 / [email protected] During this period, many changes occurred, in particular, in 2014, corporate legislation changed.

In practice, the existing forms did not allow the application of all legislative innovations, and therefore difficulties arose.

Thus, from June 24, 2021, LLCs have the right to act on the basis of one of 36 standard charters developed by the Ministry of Economic Development (Order of the Ministry of Economic Development of the Russian Federation dated August 1, 2020 No. 411). But in practice it was not possible to apply this: in the application form for state registration there was no corresponding column indicating the organization’s use of a standard charter. Thanks to the new form P11001, this problem has been solved.

Also from August 13, 2021 in Art. 178 of the Labor Code of the Russian Federation states that in order to complete the liquidation of a legal entity, it is necessary to make a full settlement with the dismissed employees. The new form P15016 provides a line to confirm that all payments have been made.

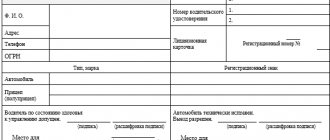

Application for registration of individual entrepreneurs in 2021

Home / Opening an individual entrepreneur

Download the individual entrepreneur registration form (Excel) or in PDF format.

View a sample of filling out form p21001

The application is submitted in 1 copy. There is no need to stitch or staple the sheets.

When submitting an application to the Federal Tax Service, you must attach the original receipt for payment of the state duty and a photocopy of your passport (with presentation of the original).

The preparation of the form should be approached responsibly, since all forms submitted to the Federal Tax Service are machine-readable, and any errors may result in inspectors refusing to register an individual entrepreneur.

In such a situation, the applicant will have to fill out the form again and also pay a state fee of 800 rubles again.

Instructions for filling out form p21001

Click (click) on the field to reveal detailed information.

General requirements

1) The form must be filled out manually or using software.

2) Data is entered in capital letters, when using software - in Courier New font 18 points high, starting from the first left cell.

3) When creating a form manually, only black ink is used; when printing on a printer, only black ink is used.

4) Only one character (letter, number, punctuation mark) is allowed to be entered into one familiar place.

5) When entering text information consisting of several words that are written separately, you must leave one empty space between the words.

6) If the data does not fit on one line, entering information is allowed in the following ways:

- up to and including the last cell of the line, as many characters as fit are written, the remaining characters are entered from the first left cell of the new line, without adding a hyphen;

- a word that does not fit (several words, a punctuation mark, a number) is written from the first cell of a new line, while empty spaces remaining in the previous line are considered a single space;

- if a word (number, punctuation mark) ends in the last character of a line, then the next word (sign, number), if written separately from the previous one, must be written from the second cell of the new line, the first empty cell will be a space.

In this case, it is allowed to fill in text data while simultaneously using all of the above methods.

7) Blank sheets of the form are not included in the document submitted to the registration authorities.

It is not permitted to make corrections (including using a proofreader) or additions to the completed document.

It is not permitted to make corrections (including using a proofreader) or additions to the completed document.

9) When printing on a printer, the absence of cell frames is allowed. Changing the location and size of fields is not allowed.

10) Double-sided printing of form sheets is prohibited.

Page 1

1. The page number is indicated: “001” (the following pages are numbered in order in the same format: “002”, “003”, etc.).

2. Full name to be filled in. in Russian. This point is mandatory for both Russian citizens and foreigners (Russians fill out the data in accordance with their passport, foreigners - according to their residence permit).

3. Item Full name Only foreigners should fill in Latin letters, and only if the information in Latin letters is indicated in the identity document. Citizens of the Russian Federation leave these fields empty.

4. The citizen's TIN is entered. If the code is missing, the field remains empty, the tax authorities will assign a TIN automatically.

Note: you can find out whether a citizen has been assigned an INN code on the Federal Tax Service website using the “Find out INN” service (https://service.nalog.ru/inn.do).

5. Next, fill in the following lines: gender, date of birth, place of birth.

Important! The place of birth should be recorded exactly as indicated in the passport (identity document), including abbreviations and punctuation marks.

6. Information about citizenship is entered below (nationals of foreign countries indicate the code of the country of citizenship, Russians do not fill in the country code).

Page 2

1. The address of the citizen's place of registration is indicated.

To fill it out correctly, you should use the codes and abbreviations from the Document Preparation Requirements (Appendix No. 20 to the Federal Tax Service order dated January 25, 2012 No. ММВ-7-6/ [email protected] ):

- Appendix No. 1. Codes of the constituent entities of the Russian Federation (but it’s easier to look up the code of your region on the Internet);

- Appendix No. 2. Names of address objects ().

For subjects of the Russian Federation: Moscow and St. Petersburg (77 and 78) – the “City” line is not filled in.

2. The details of the identity document are recorded.

Wherein:

- for a passport of a citizen of the Russian Federation, the document type code is 21. The remaining codes can be found in Appendix No. 3 to the above Requirements;

- Between the series and the number of the identity document, you must leave a blank space. If there is a space in the document series or number, it should be displayed as an empty cell.

Page 3

To be completed only by foreign citizens and persons without citizenship. Citizens of the Russian Federation do not fill out this page and do not submit it as part of the form.

Sheet A

It is necessary to indicate the OKVED codes of the types of activities that the future entrepreneur plans to engage in.

You can write down any number of codes, but only one of them will be the main one. It is filled out first on the sheet, and it is this code that the entrepreneur will subsequently indicate in tax returns.

Important! The OKVED code cannot contain less than 4 digital characters.

Sheet B

Lines Full name and the applicant’s signature must be filled in exclusively by hand in black ink in the presence of a tax inspector when submitting the application!

There is no need to notarize the signature when submitting the form in person.

Next, you need to indicate the procedure for issuing documents and contact information.

The telephone number must be filled in without spaces or dashes. The landline telephone number is recorded with the area code.

Examples of filling out a telephone number: +7(999)1234567 – for a mobile phone, 8(452)1234678 – for a landline phone.

If the document is sent to the Federal Tax Service electronically, you need to fill in the email address.

Did you like the article? Share on social media networks:

- Related Posts

- Open an individual entrepreneur in Chelyabinsk and the Chelyabinsk region in 2021

- Open an individual entrepreneur in Nizhny Novgorod and the Nizhny Novgorod region in 2021

- Registration of individual entrepreneurs in 2021: step-by-step instructions

- Open an individual entrepreneur in Krasnodar and the Krasnodar region in 2021

- Open an individual entrepreneur in Orenburg and the Orenburg region in 2021

- Open an individual entrepreneur in Rostov-on-Don and the Rostov region in 2021

- Open an individual entrepreneur in St. Petersburg and the Leningrad region in 2021

- Open an individual entrepreneur in Tolyatti and Stavropol Territory in 2021

Discussion: there is 1 comment

- Zhanna:

04/29/2019 at 02:44Hello! Please tell me where I can get a certificate for opening an individual entrepreneur P21001?

Answer

Leave a comment Cancel reply

What forms will be introduced from November 25

All forms are divided into groups: for legal entities, individual entrepreneurs and peasant farms.

The order approved the following forms for legal entities:

- P11001 - application for state registration of a legal entity upon creation;

- P12003 - notification of the start of the reorganization procedure;

- R12016 - application for state registration in connection with the completion of the reorganization of a legal entity;

- R13014 - application for state registration of changes made to the constituent document of a legal entity, and (or) for changes to information about a legal entity contained in the Unified State Register of Legal Entities;

- R15016 - application (notification) about the liquidation of a legal entity;

- R16002 - application for making an entry in the Unified State Register of Legal Entities on the termination of a unitary enterprise, state or municipal institution.

Individual entrepreneurs can now use three forms:

- P21001 - application for state registration of an individual as an entrepreneur;

- P24001 - application for amendments to information about individual entrepreneurs contained in the Unified State Register of Individual Entrepreneurs;

- P26001 - application for state registration of termination by an individual of activities as an individual entrepreneur.

Two forms have been created for peasant (farm) households:

- P24002 - application for amendments to information about a peasant (farm) holding contained in the Unified State Register of Individual Entrepreneurs;

- P26002 - application for state registration of termination of a peasant (farm) enterprise.

A separate registration form for international companies and funds on the territory of the Russian Federation has been approved:

P18002 - application (notification) about state registration of an international company, international fund.

From November 25, the old forms will be canceled. Some of the new forms did not change their purpose and numbering; only their content was updated. The table shows the ratio of old forms to new ones.

| Old form | New form |

| P11001 | P11001 |

| P12003 | P12003 |

| P12001 and P16003 | P12016 |

| P13001 and P14001 | P13014 |

| P15001 and P16001 | P15016 |

| P16002 | P16002 |

| There were no analogues | P18002 |

| P21001 | P21001 |

| P24001 | P24001 |

| P24002 | P24002 |

| P26001 | P26001 |

| P26002 | P26002 |

Filling using online services and software

Among other things, the Federal Tax Service is currently finalizing the software on its website and making it more user-friendly.

A mobile application for generating a package of documents for state registration was also recently announced.

While filling out the new forms raises many questions, in general it is not much different from the 2013 forms. It is especially convenient to do this in the PPDGR program or using the online services presented in the table above.

5 / 5 ( 2 voices)

Changes to how you fill out forms

The order of the Federal Tax Service not only approved new forms and updated old ones, but also changed the rules for filling them out. Apply the following rules:

- For paper documents, use only black, blue and purple ink, and letters must be in capitals.

- On your computer, install the font Courier New, size 18, color black, capital letters.

- Corrections and additions are prohibited.

- Enter your email address; when the application is reviewed, all documents will be sent to this address. To receive a paper version, you need to make a note about this on the last page of the form.

- Write each character in one familiar place (cell).

Requirements for filling

General rules for completing new registration forms are listed in the Order Requirements. There are few innovations here.

- Handfill ink can be black, purple or blue (previously only black was allowed).

- The contact phone number is now entered without brackets, spaces, or dashes. Russian numbers must start with +7, even landlines.

- Now there is no ban on double-sided printing, but we still advise, as before, to print each sheet separately.

Changes in document forms

Most of the forms have been modified to meet modern requirements. In this regard, new lines have been added in which certain information must be indicated.

In the forms, blocks with addresses of organizations and individual entrepreneurs have been made more complex. Now it is necessary to indicate the address in full accordance with the State Address Register, indicating, if available, the following data:

- The subject of the Russian Federation;

- type of municipality;

- locality;

- planning structure element;

- element of the road network;

- building/structure;

- premises - within a building, structure or apartment.

Also, in some forms (for example, P21001) a special line was added where it is necessary to note which body the applicant applied to - the MFC or the Federal Tax Service.

Names of address objects

Allowed abbreviations in accordance with the appendix to the document requirements

Name of the address object used when filling out information about the district (ulus, etc.)

| Full name | abbreviated name |

| Area | R-N |

| Territory | TEP |

| Ulus | U |

Name of the address object used when filling out information about the city (parish, etc.)

| Full name | abbreviated name |

| Parish | PIVOTALITY |

| City | G |

| Suburban village | DP |

| Array | ARRAY |

| Post office | BY |

| Settlement | PGT |

| Workers' village | RP |

| Village administration | S/A |

| Rural district | S/O |

| Rural settlement | S/P |

| Village Council | S/S |

| Territory | TEP |

Name of the address object used when filling out information about the locality (village, etc.)

| Full name | abbreviated name | Full name | abbreviated name |

| Aal | AAL | Lespromkhoz | Private household plots |

| Road | HIGHWAY | Place | M |

| Arban | ARBAN | Microdistrict | MKR |

| Aul | AUL | Locality | NP |

| Parish | PIVOTALITY | Island | ISLAND |

| Vyselki(ok) | EVICTION | Village | P |

| City | G | Post office | BY |

| Town | TOWN | Planning area | ETC |

| Village | D | Village and station(s) | P/ST |

| Suburban village | DP | Settlement | PGT |

| Railway booth | RAILWAY_BOOK | Pogost | POGOST |

| Railway barracks | RAILWAY_BARRACK | Pochinok | POCHINOK |

| Railway stop, (overtaking) point | Railway_OP | Industrial Zone | INDUSTRIAL ZONE |

| Railway platform | RAILWAY_PLATF | Departure | RSD |

| Railway post | RAILWAY_POST | Workers' village | RP |

| Railway siding | Railway_RZD | Village | WITH |

| Railroad station | Zh/D_ST | Sloboda | SL |

| Residential area | RESIDENTIAL AREA | Garden non-profit partnership | SNT |

| Zaimka | ZAMKA | Station | ST |

| Barracks | BARRACKS | Stanitsa | ST-CA |

| Quarter | KV-L | Territory | TEP |

| Cordon | CORDON | Ulus | U |

| Resort village | KP | Khutor | X |

The name of the address object used when filling out information about the street (avenue, etc.)

| Full name | abbreviated name | Full name | abbreviated name |

| Aal | AAL | Village | P |

| Alley | ALLEY | Post office | BY |

| Aul | AUL | Planning area | ETC |

| Boulevard | B-R | Village and station(s) | P/ST |

| Shaft | SHAFT | A park | A PARK |

| Entry | ENTRY | Lane | PER |

| Vyselki(ok) | EVICTION | Moving | MOVING |

| Town | TOWN | Square | PL |

| Garage and construction cooperative | GSK | Platform | PLATF |

| Village | D | Area | PL-KA |

| Road | DOR | Stop station | STATION |

| Railway booth | RAILWAY_BOOK | Avenue | PR-CT |

| Railway barracks | RAILWAY_BARRACK | Directions | DIRECTIONS |

| Railway stop, (overtaking) point | Railway_OP | Prosek | PROSEK |

| Railway platform | RAILWAY_PLATF | Country road | COUNTRYWAY |

| Railway post | RAILWAY_POST | Duct | DUCT |

| Railway siding | Railway_RZD | Alley | ALNEY |

| Railroad station | Zh/D_ST | Departure | RSD |

| Livestock point | ZhT | Rows | RANKS |

| Check-in | CHECK IN | Village | WITH |

| Barracks | BARRACKS | Garden | GARDEN |

| Channel | CHANNEL | Square | SQUARE |

| Quarter | KV-L | Sloboda | SL |

| Kilometer | KM | Garden non-profit partnership | SNT |

| Scythe | SPIT | Station | ST |

| Line | LINE | Structure | STR |

| Lespromkhoz | Private household plots | Territory | TEP |

| Place | M | Tract | TRACT |

| Microdistrict | MKR | Dead end | TUP |

| Bridge | BRIDGE | Street | UL |

| Embankment | NAB | Plot | UC-K |

| Locality | NP | Farm | FARM |

| Island | ISLAND | Khutor | X |

| Highway | Sh |

Form P11001 - on registration of a legal entity

Several new lines have been added to the form for the following information:

1. The organization operates on the basis of a standard charter.

All standard charters are presented in Order of the Ministry of Economic Development of the Russian Federation dated August 1, 2020 No. 411.

2. Several persons are authorized to act on behalf of a legal entity.

3. The participants entered into a corporate agreement.

Additionally, the applicant has the opportunity to restrict access to information about the company in the Unified State Register of Legal Entities. To do this, you need to fill out sheet 3 of the form, indicating the grounds provided for by Federal Law No. 290-FZ dated 03.08.2018 or Decree of the Government of the Russian Federation dated 06.06.2019 No. 729.

You can limit access to information, for example, to the following companies:

- organizations subject to foreign sanctions;

- credit institutions providing banking support for state defense orders;

- legal entities located in the Republic of Crimea or Sevastopol.

Amount and payment of state duty

The state fee for registering an individual entrepreneur is 800 rubles (subclause 6, clause 1, article 333.33 of the Tax Code of the Russian Federation). Here you can save money - you won’t have to pay if you submit registration documents not in paper form, but via the Internet, using a special electronic service. The fee will not be charged even if you submit papers through the MFC (subclause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation).

If you still decide to submit documents to the tax office in person, you can pay the fee at any bank. To do this, you will need a receipt - it can be generated on the tax service website using the “Payment of state duty” service.

Form P120016 - on state registration in connection with the completion of the reorganization of a legal entity

The list of reorganization methods has been supplemented with number 6, “Simultaneous combination of various forms of reorganization.” Lines have also been added to indicate the following information:

- the organization uses a standard charter;

- Several persons are authorized to act on behalf of a legal entity;

- A corporate agreement has been concluded between the participants.

You can restrict access to information about the succession and founders of the organization. The reasons for this should be specified in section 3.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Decision to create an individual private enterprise”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Form R13014 - on state registration of changes in constituent documents or changes in information in the Unified State Register of Legal Entities

The form combined the old forms P13001 and P14001.

A new basis for filing form P13014 has been added. The form must be submitted to the Federal Tax Service if the organization has started or stopped using the standard charter. There are now columns for the following information:

- the company operates on the basis of a standard charter;

- several persons act on behalf of the LLC;

- A corporate agreement has been concluded between the participants.

Access to information can also be restricted. To do this, fill out sheet M. In addition, on page 5 of sheet E, a section has appeared on information about collateral management.

When to fill out an application

The document is sent to the Federal Tax Service in the following situations:

- the name of the LLC has changed;

- replaced by YUL;

- OKVED changed, as a result of which adjustments were made to the charter;

- the amount of the authorized capital has changed.

Not all situations are listed here. The statement is written, as already mentioned, if the changes included in the text of the charter have legal significance for third parties.

Reference! The application form was formalized by Federal Tax Service order No. ММВ-7-6/ [email protected] dated January 25, 2012. The form can be found in Appendix No. 4 to this order, and the filling rules can be found in Appendix No. 20.

Form P15016 - on liquidation of a legal entity

The form combined two old forms - P15001 and P16001. There are two new grounds for filing an application:

- the liquidation period of the LLC has been extended;

- The organization has completed the liquidation process.

If there are grounds, access to information about the company can be limited by filling out sheet B. On page 2 of sheet B, you now need to confirm that the organization has made all payments due to its employees.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Decision to create an individual private enterprise” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Form P21001 - on state registration of an individual as an individual entrepreneur

There are no major changes. On the title page, Russians indicate their full name only in Russian. Foreigners and stateless persons write their full name in Russian, then repeat it in Latin.

The data on the passport and place of residence were swapped. Now the first thing to fill in is your passport details. Foreigners and stateless persons indicate a document permitting stay on the territory of the Russian Federation. A separate line has been added in which it can be noted that the document is valid indefinitely.

The decision to create an LLC

The decision to create an LLC is a document that confirms the intention of the business owner to register a commercial organization. Together with an application in form P11001 and the charter, the founder’s decision is submitted to the tax office when registering the company. If you are looking for a 2021 sample, you will find it in this article.

Decision or protocol on establishment

A protocol on the creation of an LLC is drawn up if there are several founders - from two to fifty persons. At the general meeting, the founders elect a chairman and secretary, and all issues on the agenda are put forward for discussion. At the first general meeting, voting on all points must only be unanimous.

If a limited liability company is created by one person, then a decision of the sole founder is made, which has the same legal force as the protocol. In this case, all powers that the Law “On Limited Liability Companies” No. 14-FZ refers to the competence of the general meeting of founders are transferred to one person.

At the same time, Article 39 of Law No. 14-FZ establishes that the decision of the sole founder, both when creating a company and later, in the course of its activities, is made without observing the formalities necessary for convening a general meeting.

In general, almost any person, both individuals and legal entities, can create an LLC:

- Russians, foreigners, stateless persons;

- subjects of the Russian Federation and municipalities;

- Russian and foreign organizations.

However, if we are talking about registering an LLC with one founder, then you need to be aware of the limitation established by Article 7 of the Law “On Limited Liability Companies”. According to this norm, a commercial organization cannot be created by a single founder, who is himself a company consisting of one person.

You can prepare all the necessary documents for opening an LLC, including the decision of the sole founder, easily and quickly in the free 1C-Start service.

Create documents for LLC registration

solutions

What questions should be included in the decision to create an LLC? In essence, they are similar to those considered at the general meeting of owners, only there will be no agenda in the decision of the sole founder. Questions are not submitted for discussion, but are immediately approved.

The decision does not have an officially established form; it is enough to simply follow the usual standard of business documentation. As a rule, all the necessary information can be placed on one sheet. If there are several sheets, then they must be stitched and sealed on the back of the firmware with your signature.

As for notarization of documents submitted for registration of a limited liability company, this requirement applies only to the application in form P11001. Moreover, notary costs can be avoided if applicants themselves submit an application to the tax office. But the decision on establishment and the charter do not need to be certified for any method of filing.

So, what items should a 2021 sample include?

- The date and place of the decision according to which it is planned to open an LLC.

- Identification information about the founder who creates the limited liability company. If this is an individual, then his full name, passport details, and place of residence are indicated. If the founder is a legal entity, then you must enter its full name, OGRN, INN, KPP codes, legal address, as well as details of its director.

- Expressed intention to create a limited liability company.

- The corporate name of the legal entity being created in full and abbreviated form. For example, the full name is “Limited Liability Company “Stroy Montazh”, and the abbreviated name is “LLC “Stroy Montazh”.

- Legal address of the future company. The address in the decision must be indicated in full, with the street, house, office or apartment number. You can limit yourself to indicating the locality only in the charter of the company.

- The size of the authorized capital in nominal value and shares in it. Naturally, the share of the sole founder will be 100%. Authorized capital exceeding the minimum amount of 10,000 rubles, which is contributed only in cash, can be contributed both in money and property.

- Deadline for payment of authorized capital. According to the law, it should not exceed four months after registration of the company.

- An indication that the founder approves the charter of the commercial organization.

- Information about the future head of the LLC. Most often, the management of the company is transferred to an individual, but it can also be a management organization or manager. For an individual who will become the general director of a company, his full data is indicated: name, passport details, registration. In addition, the founder must express his intention to conclude an employment contract with the manager. An agreement may not be concluded if the organization is led by its only participant; accordingly, this information can be excluded from the decision.

- The decision to open an LLC is sealed with the personal signature of the founder.

Download the founder’s decision to create an LLC, sample 2021

Loading…

Source: //r11001.ru/reshenie-o-sozdanii-ooo/

Form R24002 - on state registration of information about peasant farms in the Unified State Register of Individual Entrepreneurs

The number of sheets in the form has changed. Previously, there was a title page and seven sheets from A to G, now only the title page and sheets from A to C remain. Sheet A of the new form combines information from sheets A, B, C, D and D. Now it indicates:

- the reason for entering the information;

- information about the head of the peasant farm;

- information about citizenship;

- information about the identity document;

- address of residence in the Russian Federation;

- information about a document confirming the right of a foreigner to reside in the territory of the Russian Federation.

Sheet E with OKVED codes in the new version became sheet B, and sheet J became sheet C.

Types of documents proving the identity of an individual

| Code | Title of the document |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 21 | Passport of a citizen of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a military personnel of the Russian Federation |

Form P18002 - on state registration of an international company, international fund

This is a new form. It is served in the following cases:

- state registration of a legal entity in connection with a change in personal law through the procedure of redomiciliation (change of country of registration);

- termination of the status of an international company;

- the intention of an international company to change personal law in connection with registration in a foreign country through the procedure of redomiciliation;

- exclusion of an international company from the Unified State Register of Legal Entities due to registration in a foreign state through the procedure of redomiciliation;

- state registration of a legal entity in the order of incorporation.

The form indicates the reason for the submission, data of the legal entity, information about participants/founders, types of economic activity, branches and representative offices. Additionally, you can restrict access to information by indicating the reasons for this on sheet E.

Foreigner: Arrival

The notification must contain only reliable information; corrections and reductions are not allowed. The document consists of three sections.

In the first section you need to provide the following information about the foreigner:

- FULL NAME.;

- date, place of birth;

- profession;

- length of stay;

- migration card details;

- purpose and date of entry;

- phone number, etc.

In the detachable part of the notification form, information about the foreign citizen is duplicated.

In the second section, information about the foreigner’s place of residence (locality, address) is indicated.

The third section displays information about the receiving party. First you need to indicate who exactly it is: an organization or an individual. If a foreigner is accepted by an organization, the third section contains its name and address, as well as the details of the employee responsible for filling out the application form.

The receiving party confirms the accuracy of the information by signing on the back of the form. The legal entity affixes the signature with a seal (if any).

The department employee must carefully check the information specified in the notification and put an acceptance mark on it. The applicant will be given a detachable part of the notification; in the future, he will be able to use it to confirm the fact of migration registration. When leaving Russia, a foreigner will have to send the detachable part to the migration registration authority.

Actions after registration

If everything went well and the information that you are now an individual entrepreneur is included in the Unified State Register of Entrepreneurs, know that it is too early to relax. Now you need:

- Order a print. The stage is optional, but desirable - with a seal it will be easier to work with legal entities, certify strict reporting forms and participate in tenders.

- Open a bank account.

- Purchase an online cash register, except in cases where the activities of an individual entrepreneur fall into one of the categories established by Part 2 of Art. 2 of the Federal Law “On the Application...” of May 22, 2003 No. 54-FZ.

- If you have employees, register with the Social Insurance Fund as an employer.

- Obtain a business license if required by law.