Information on the average number of employees (AHR) is one of the first reports of a newly created LLC. The reporting form looks simple, however, submitting the SSR raises a lot of questions, which we will answer in this article.

Who should I give it to and what is it?

A report on the average number of employees (ASH) must be submitted by all organizations and individual entrepreneurs (regardless of the chosen taxation system) that had employees in the calendar year.

Newly created organizations (not individual entrepreneurs) need to submit the CHR report twice: once after creation, and the second time at the end of the year.

Individual entrepreneurs without employees, starting from January 1, 2014, do not need

.

Note!

2020 was the last year in which a CHR report had to be filed. From 2021, it is abolished by law dated January 28, 2021 No. 5-FZ. Information on the number of employees will be transmitted to the Federal Tax Service as part of the calculation of insurance premiums.

Will they be punished for failure to submit ERSV with information on the number of employees?

Of course they will be punished. For each case of failure to submit or delay in submitting a report in the ERSV form with information on the average number of employees, the taxpayer will be fined at least 1,000 rubles. If the contributions specified in the declaration are also not paid, the taxpayer will face a fine of 5% of the amount of arrears for each month of delay, but not less than 1,000 rubles. and no more than 30%.

Read more about possible sanctions in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Keep in mind that if you fail to submit the ERSV for more than 10 days, inspectors will block your account.

Read more about blocking and unblocking accounts here.

The deadline for the completion of the SSR is in 2021

Information on the average payroll number is submitted by:

Existing individual entrepreneurs and organizations

Based on the results of the calendar year, no later than January 20.

For 2021, the SChR information must be submitted by January 20, 2020

.

Newly created organizations

No later than the 20th

the month following the month in which the organization was created.

Upon liquidation of an organization or closure of an individual entrepreneur

No later than the official date

liquidation of an organization or closure of an individual entrepreneur.

INN, KPP and tax authority codes

Each company has its own accounting features. When filling out the tax payer identification number field (abbreviated as TIN), which is assigned to legal entities and individuals, start entering the code numbers from the leftmost square cell. The “Checkpoint” column is intended only for organizations. Individual entrepreneurs do not need to fill out this field.

Please note! If your code has fewer numbers than cells, you must first enter zeros and then the digital values of the TIN. The tax office code for your area always consists of four digits.

[adv2]

Where to take the SChR in 2021

A report on the average number of employees is submitted to the tax authority:

- Individual entrepreneur - at the place of residence;

- LLC - at its location (legal address).

The address and contact details of your tax office can be found using this service.

Note

: the average number of employees by location of separate units does not need to be submitted. Data on department employees is indicated in a general report for the entire organization, which is submitted to the Federal Tax Service of the head office.

Who must submit information about the number of employees

Judging by the name, only employers must submit information about the average number of employees. But the Ministry of Finance believes that all companies must report, including newly organized ones that do not yet have employees .

From the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for exemption of organizations that do not have employees from submitting information on the average number of employees to the tax authorities within the prescribed period.”

Let's list who is required to submit a report on the average headcount:

- newly registered legal entities, regardless of the availability of personnel;

- individual entrepreneurs-employers;

- organizations that have entered into employment contracts;

- organizations that do not have employees on staff.

Thus, only individual entrepreneurs without employees have the right not to submit this information; all other businessmen are required to report.

Free accounting services from 1C

Methods for filing SCR in 2021

The average number of employees can be submitted:

- In paper form (in 2 copies). One copy will remain with the tax office, and the second (with the necessary marking) will be returned. It will serve as confirmation that you have submitted the declaration.

- By mail as a registered item with a description of the contents. In this case, there should be an inventory of the investment and a receipt, the number in which will be considered the date of delivery of the number.

- In electronic form via the Internet (under an agreement through an EDF operator or a service on the Federal Tax Service website).

note

, when submitting SCR information in paper form, some Federal Tax Service Inspectors may additionally require you to attach a file with an electronic version of the report on a floppy disk or flash drive.

Tips for filling out the form

The tax office accepts reports with legible data entered in black ink. Forms filled out with other color variations will not be considered. Write information in cells and rows as legibly as possible. Tax professionals should not feel like graphologists.

If you are an advanced computer user, feel free to fill out the form using editing software. Tax officials accept printed forms filled out in 18 Courier New font.

How to calculate the average number of employees (formula)

To calculate the average number of personnel for a calendar year, you must first make a calculation separately for each month:

Step 1. Calculate the number of full-time employees

To do this, we use the following formula:

Ch1 = Chm / Dm

World Cup

– the sum of the average number of employees for each day of the month (that is, it is necessary to calculate the average number of employees for each day of the month and add it up);

Dm

– the number of calendar days in a month.

The result does not need to be rounded

.

The number of employees for a weekend or holiday is taken to be equal to the number for the previous working day.

When calculating the average payroll number, they are not taken into account

:

- External part-time workers (employees whose main place of work is another organization).

- Individuals working under GPC agreements (of a civil nature).

- Women on maternity or child care leave.

- Employees on study leave without pay.

If an employment and civil law contract is concluded with an employee at the same time, then he must be taken into account as one person in the calculation.

Employees working part-time at the initiative of the employer

(probationary period and homeworkers), as well as workers for whom the law establishes

a shortened working day

(including disabled people), are taken into account as

whole units

.

Step 2. We count the number of employees who worked part-time

Employees working under an employment contract part-time (including those who did not come to work due to illness or business travel) are taken into account in proportion to the time worked

.

This is done according to the following formula:

Ch2 = Total / Trd / Drab

Total

– the total number of man-hours worked by these employees in the reporting month.

Trd

– length of the working day, based on the length of the working week established in the organization. For example, with a 40-hour five-day work week, this figure will be 8 hours, with a 36-hour week - 7.2 hours, and with a 24-hour week - 4.8 hours.

Drab

– the number of working days according to the calendar in the reporting month.

The result does not need to be rounded

.

Example

. The employee worked part-time (4 hours) for 22 working days per month, while the working day in the organization is 8 hours. The average number in this case will be equal to:

0,5

(88 / 8 / 22).

Step 3. Calculate the average number of employees for the calendar year

To calculate the average number of employees, it is necessary to add up the headcount indicators ( Ch1

and

Ch2

) for all months of the year and divide the result by

12

months.

If the result is a non-integer number, it must be rounded

(discard less than 0.5, and round 0.5 or more to the whole unit).

Calculation example

Initial data

LLC "Company" has a 40-hour, five-day work week.

In 2021, from January to November, 15 people

(in December there were 11 of them left, since 4 people were laid off due to staff reduction).

For September and October, fixed-term part-time employment contracts were concluded with 5 new employees, according to which they worked 4 hours daily.

Throughout the year, the organization employed 3 external part-time workers who are on the payroll of another company.

Calculation of average headcount

In each month (from January to November) the average number of full-time

, was equal to

15 people

(external part-time workers are not taken into account in the calculation).

In December, the number of such workers was 11 people

.

part-time during the year

:

There were 22 working days in September and October, so the number in each of these months is:

(4 hours x 5 workers x 22 working days) / 8 hours / 22 working days = 2,5

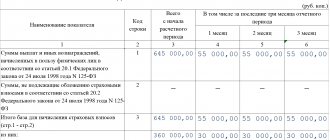

Below is a table of the average number of employees for each month, taking into account the results obtained:

| Month | Average headcount | Month | Average headcount |

| January | 15 | August | 15 |

| February | 15 | September | 17,5 (15 + 2,5) |

| March | 15 | October | 17,5 (15 + 2,5) |

| April | 15 | November | 15 |

| May | 15 | December | 15 |

| June | 15 | Total | 181 people |

| July | 15 |

Thus, for 2021 the average number of employees is: 15 people

(181 people / 12 months).

On what date are payroll calculations made?

There are deadlines for submitting the average number of employees for new organizations. They imply that the company must submit information about the number of employees at the beginning of the month following registration.

Example . The entry in the Unified State Register of Legal Entities was made on October 23, 2021. The director and chief accountant were hired on October 25 and 27, 2021, respectively. Managers of 5 people were added to the staff on November 5, 2021. Which of these employees will need to be included in the report?

Delivery will be made until November 20, 2021. The information in the report must contain information as of November 1, 2017. You need to count those employees who have worked for the company for at least 1 day as of the reporting date. This means that “2” should be entered in the SCH column. The remaining 5 people will not be taken into account.

Why is the average number of tax officials needed?

The average headcount indicator is involved in the calculation of some taxes, and the method of reporting to the tax authorities also depends on it.

So, for example, individual entrepreneurs and organizations with more than 100 people in a calendar year cannot use the simplified tax system and UTII.

For individual entrepreneurs with a patent, the average number of employees for all types of activities should not exceed 15 people.

There are other situations in which the exact number of employees may be of interest to tax authorities.

How to properly submit a completed reporting form?

When all fields of the form are completed, it must be signed manually. Only under this condition will the inspector accept your annual report for consideration. You do not have to appear in person at the tax office to submit a document. Send it by mail as a valuable letter of notification, of course taking into account the postmark date.

Useful advice! Experienced businessmen who do not like to stand idle in the crowded corridors of the tax office are advised to put an inventory of the enclosed documents in an envelope, certified with a post office stamp. The tax inspector will once again make sure that all documents are in place.

Calculation example

Let's give an example of calculating average values for a month and a year, and on its basis we will give a sample of filling out information on the average number of employees.

As of May 1, 2018, Vesna LLC employs 15 people full-time, two employees are registered at 1/2 rate. As of May 14, 2018, one of the employees (full-time) went on maternity leave.

To calculate averages for May 2021, the following will be taken into account:

- for the period from May 1 to May 13 (13 days) - 16 people (part-time employees are counted as 0.5 units, but since there are two of them, then 0.5 + 0.5 = 1);

- for the period from May 14 to May 31 (18 days) - 15 people (since an employee on maternity leave is not included in the calculation).

Total (16 people × 13 days) + (15 people × 18 days) / 31 days = 15.41.

The resulting fractional number is rounded towards a whole number according to the rules of mathematics. Thus, the average number of employees of Vesna LLC in May is 15 people.

Now let’s calculate the average number of employees of Vesna LLC for 2020, assuming that we know the average number of employees in each month, calculated by analogy with May.

| Month | Average (number of people) | Month | Average (number of people) | Month | Average (number of people) |

| January | 14 | May | 15 | September | 14 |

| February | 16 | June | 15 | October | 15 |

| March | 16 | July | 15 | November | 17 |

| April | 16 | August | 14 | December | 17 |

Add all the values and divide by 12:

(14 + 16 + 16 +16 + 15 + 15 + 15 + 14 + 14 + 15 + 17 + 17) / 12 = 15,33

We round up to whole numbers and get the average headcount of Vesna LLC for 2021 equal to 15.

Rules for filling out KND 1110018

Filling out the form should not cause difficulties, however, we will provide general recommendations that are indicated in the Letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/

Report form

The following example of filling out the average number of employees 2021 corresponds to the recommendations of officials:

- At the top of the page, fill out the TIN and KPP (individual entrepreneurs are not assigned a KPP, for them this field remains empty).

- In the line “Submitted to” the name of the territorial tax authority where the document is submitted and the inspection code are written.

- Next, indicate the full name of the organization or full name. IP.

- The date field indicates January 1 of the current year (01/01/2019).

- In the field reserved for the average number of people, the corresponding figure is indicated, the remaining empty cells are filled in with dashes.

- At the bottom of the page, the head of the organization enters his full name, signature, date and stamp. The individual entrepreneur only puts down a signature and date.

Features of delivery by different business entities

Inter-industry standard standards for the number of employees apply for state and budgetary enterprises. Commercial organizations and individual entrepreneurs have the right to determine the number of employees at their enterprises independently; there are no restrictions, but there may be consequences for reporting determined by law. This must be taken into account when filling out the average number of individual entrepreneurs with employees in 2019 and beyond.

The report for business entities is mandatory, unless it is an individual entrepreneur without employees, he has the right not to submit this form.

Should the founder and entrepreneur be taken into account?

As a general rule, the owner is included in the average payroll only if he works in his company under an employment contract and receives a salary. The founder, who is paid dividends but not a salary, must be excluded from the calculations.

In practice, the following situation is common: the director is the owner appointed by the general meeting of founders (without an employment contract). There are no clear instructions as to whether such a director should be included in the average headcount. Typically, in such circumstances, directors are counted as a unit, despite the absence of an agreement.

But if the only founder acts as a director, then, in our opinion, he cannot be taken into account in the average headcount. The fact is that the only founder is not able to hire himself and pay himself a salary. This was also recognized by the Russian Ministry of Finance (see “Ministry of Finance: the director - the only founder should not pay his own salary”). This means that such a manager a priori cannot relate to the company’s personnel.

An individual entrepreneur is also not taken into account in the average headcount, because, like the sole founder, he is not able to conclude an employment contract with himself.