The person acting as the authorized signatory of the financial statements is the head of the business entity, or the manager who is charged with such powers in accordance with the decision of the governing bodies of the entity. Unless the organization's charter provides otherwise, the head of the company has the right to delegate his powers regarding the signing of financial statements to another person. The transfer of this right is accompanied by the drawing up of an appropriate power of attorney and does not require notification of this to the company’s management bodies. In the article we will consider on the basis of what documents and who signs the financial statements.

Who signs the financial statements in accordance with the law?

Law 402-FZ “On Accounting” does not contain provisions that strictly regulate the restriction of the rights of the head of the company to delegate the authority to sign statements to other persons. According to Art. 13 of this law, financial statements are recognized as drawn up after they are signed on paper by the head of the company. A copy of the financial statements signed by the manager must be kept in the company. In this case, the manager’s signature must also contain the date of signing the copy of the reporting.

The head of a company is understood as a person who is the sole executive body or is responsible for conducting affairs in the company. A manager may also be considered a manager, to whom the functions of the sole executive body are transferred.

Only the head of the company has the right to sign financial statements. The authority to sign financial statements is prescribed in the company's constituent documents by decision of the governing body (meeting of founders). This decision is formalized in the appropriate protocol (

How to obtain the signature of the chief accountant if he is not on the company’s staff

Yulia Tarasova, lawyer of the corporate department of LEVINE Bridge law firm

The absence of a full-time accountant and the transfer of accounting responsibilities to a third party is a fairly common situation. In this regard, in practice, the question often arises of how to correctly draw up documents so that a third party, a representative of the outsourcing company, can sign the documents for the organization’s chief accountant.

There are a number of nuances here that are undoubtedly worth paying attention to. This will allow you to avoid being held accountable for violating the rules for accounting for the organization’s income and expenses (due to the signing of primary documents by unauthorized persons and the subsequent possible recognition by tax authorities of the organization’s expenses based on these primary documents as unfounded and unconfirmed). After all, according to the provisions of Art. 120 of the Tax Code of the Russian Federation, the fine imposed on an organization for this violation can range from 10,000 to 40,000 rubles and more, depending on the specific type of violation. In addition, in accordance with paragraph 4 of Art. 108 of the Tax Code of the Russian Federation, if an organization is brought to justice, its officials, if there are necessary grounds, are not exempt from administrative, criminal and other liability for violations committed. Therefore, an official of an organization (in particular, a director) may be charged under Art. 15.11 Code of Administrative Offenses of the Russian Federation (fine in the amount of 5,000 to 20,000 rubles or disqualification for a period of 1 to 2 years).

Since civil and labor legislation does not contain special rules on outsourcing, the rules on paid provision of services apply to such legal relations. According to the provisions of clauses 1, 4 of Art. 185 of the Civil Code of the Russian Federation, powers equivalent to a power of attorney will also apply to the case when the powers of the representative are contained in the agreement (including between the representative and the represented).

Thus, in order for a third-party signatory to become authorized in most cases, it is necessary to clearly state in the contract for the provision of accounting services:

- whose powers are transferred to a third party (in our case, the chief accountant);

- which individual - a representative of a third-party organization - has the right to sign documents for the chief accountant (full name, passport details, position in a third-party organization);

- the right to sign which specific documents has been transferred under the contract to an authorized person of a third-party organization (list all necessary documents).

What is meant by financial statements?

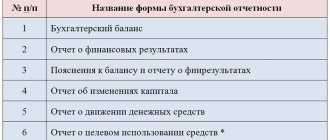

Accounting statements are understood as any reporting document that contains information about the financial and economic operations carried out by the company. As a rule, these are reports that are submitted at a certain frequency (for example, every quarter, every six months or annually) to regulatory authorities:

- Federal Tax Service;

- Goskomstat;

- FSS;

- Pension Fund.

Important! Who exactly signs the reports submitted to these authorities will depend on what standards of responsibility for the approval of reports are assigned to the company.

Procedure for approving annual reporting of LLC ↑

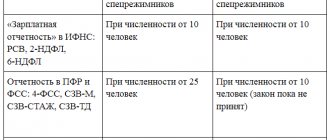

The company's annual report includes financial reporting, tax reporting and reporting for extra-budgetary funds and statistics.

The procedure for approving annual reports depends on the legal form of the company. The reporting is approved by the company's participants.

If a documentation audit is carried out, the report is certified by the auditor. The meeting is held at least once a year.

The deadlines are established by the company's charter. It is unacceptable to hold a meeting earlier than 2 months and later than 4 months after the end of the reporting year.

One month before the meeting, each participant is notified by registered mail. All the details of the procedure are indicated - place, time and date, what is on the agenda.

If the organization has more than 15 employees, the reports are checked by the audit commission. Reporting cannot be approved without an inspector's opinion.

The approval message is issued in accordance with the protocol. There is no set form for the form; it can be compiled in any form.

Decision-making

The decision is made by the general meeting of participants of the limited liability company. Based on the decision, the chief accountant makes a note on the first sheet of reporting about the date of its approval.

A lawyer working in an organization must know how to conduct a meeting and formalize the results so that the decision is not invalidated.

Actions when convening a meeting:

- Notification of society participants (monthly in advance).

- Providing each of them with a report for the year, the results of the verification commission, and other information.

- Holding a meeting and making a decision.

At the meeting, the opinion of each LLC participant is taken into account. The decision is made by voting (based on the results of a majority vote).

Participants must be registered before the meeting begins. If someone does not register, they are not eligible to vote.

Drawing up a protocol or order (sample)

The protocol must indicate:

- place, date and time of the meeting;

- details of the chairman and secretary;

- the names of all participants who took part in the meeting, as well as their share in the capital of the organization;

- theme of the meeting;

- results.

The protocol can contain detailed information (statements of each participant, course of action), or it can briefly describe the decisions made. The document must be kept in the community.

Deadlines for approval of the annual accounting

Any organization other than a budgetary one must submit reports to statistical authorities and the tax inspectorate at the place of registration.

The specific deadline for approval of reporting must be indicated in the constituent documentation of the enterprise.

Who signs

In an organization, financial statements are signed by the manager and chief accountant.

If the enterprise has a centralized accounting department (accounting on a contractual basis), then the signature is placed by the governing body of the institution, the head of the centralized accounting department or the specialist responsible for accounting.

Approved 2 months before the start of the reporting year or 4 months after its end.

The manager can give his signature right to any employee, but in this case it is necessary to issue a power of attorney.

The date of signing is the one indicated in the financial statements when submitting them to the state regulatory authorities.

Power of attorney for the right to sign financial statements

The head of the company has the right to draw up a power of attorney for the right to sign the financial statements to another person, who, as a rule, is:

- Chief Accountant;

- head of one of the company's divisions;

- company lawyer;

- another employee.

Such a document can be drawn up by a secretary or lawyer, after which the document is signed by the manager. A power of attorney to sign statements represents the right to sign strictly defined documents, so they should be clearly indicated (Read also the article ⇒ Zero LLC reporting - list of mandatory reports).

There are no special requirements for drawing up a power of attorney, but when drawing up a document, you should adhere to the rules of office work for such documents. The main requirement for such a power of attorney is to indicate information about the principal, as well as the personal data of the authorized person. In addition, the power of attorney indicates the validity period of the document, as well as the signatures of the principal and the authorized representative.

Important! The wider the range of powers assigned to the trustee, the more detailed information about the parties should be indicated.

Federal Law requirements for accounting records

The scope of any other requirements for signatures on the accounting report of a business entity is not specified in the Federal Law “On Accounting”. But there are certain features, for example, the appendices to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66 - n “On the forms of financial statements of organizations” prescribe the following procedure. In forms:

- Balance sheet and its applications;

- In the income statement;

- In the statement of changes in equity;

- Cash flow report;

- The report on the direction of the intended use of funds excludes the signatures of the chief accountant, only one signature is regulated.

The financial statements are signed exclusively by the manager. The assignment of powers to sign economic documentation is also stated in the constituent documents of the business entity or by decision of the governing body - the meeting of founders, which is documented in the corresponding protocol. In this case, approval of the financial statements is assigned to the manager and chief accountant or other official entrusted with these functions.

The procedure for drawing up a power of attorney for the right to sign statements

- In the header of the document, you should indicate the name of the document (“Power of Attorney”), and, if necessary, assign a document number. Next, the place where the document was drawn up and the date are indicated (as a rule, the date is indicated in words).

- Next are the details of the trustor company. The full name of the company, INN, KPP, OGRN, as well as the legal address of the organization should be indicated.

- After this, information about the principal is indicated, then if the person on whose behalf the power of attorney is drawn up (usually the director). You need to indicate his full name and the document on the basis of which he acts (for example, “based on the Charter”).

- The following is information about the principal. The power of attorney includes the employee’s full name, identification document details, and registration address.

- The main part of the power of attorney indicates the powers that the authorized person is vested with this power of attorney (the list of documents that the authorized person can sign).

- The conclusion indicates the period for which the power of attorney is issued, as well as the right to transfer the right of signature to an authorized person.

- Finally, both the authorized person and the head of the organization sign the document. The power of attorney is also stamped unless the company refuses to use it.

Sample power of attorney

Answers to common questions

Question: If the power of attorney to sign financial statements is assigned to the chief accountant, can he delegate this right to another person?

Answer: As a rule, powers of attorney of this kind are drawn up without the right of substitution, otherwise the new document will require certification by a notary.

Question: For how long can a power of attorney for the right to sign statements be issued?

Answer: The validity period of the power of attorney for the right to sign accounting and tax reporting can be any, for example, one year, three years or five years. If the power of attorney does not indicate a validity period, it is considered to be equal to one year from the date of signing the document.