Hello! In this article we will tell you why a 2-NDFL certificate is required at a new place of work.

Today you will learn:

- What data in the certificate is important for an accountant;

- In what cases is it not necessary to bring 2-NDFL to a new job;

- Differences between salary certificate and 2-NDFL.

Why do you need a 2-NDFL certificate for a new job?

When you leave your job and move to a new organization, you provide some documents for employment. The list of papers may also include a 2-NDFL certificate. It may be required by the accounting department. It is not always clear to employees why a new employer needs it.

The fact is that taxes are deducted for each employee. Personal income tax of 13% is deducted from your monthly earnings. The accounting department does this for you, and you receive in your hands the amount from which the obligatory payment to the tax office has already been deducted.

When paying personal income tax, there are certain deductions that reduce the tax base. That is, you have the right to pay tax not on the entire amount of earnings, but on the remainder after deduction. This discount is provided to some employees, and the amount depends on the preferential categories of citizens specified in the laws.

Deductions are calculated monthly until the amount of your earnings for the reporting year exceeds 350,000 rubles. As soon as this limit adds at least a ruble, deductions are no longer allowed. Then you will pay tax on all income.

In order for the accountant to figure out what deductions you used at your previous place of work and to view the total amount of your earnings for the reporting period, you must provide a 2-NDFL certificate. This way, the accounting department will be aware of your accruals and will be able to apply a deduction to you if it is due.

Where they may require

The 2-NDFL certificate is generated in 2 cases: at the request of the employee or for submission to the tax authorities. In the first case, the document is issued at any time, as a rule, upon a written application from the employee for the specified periods, taking into account the actual time worked. That is, if an employee needed a certificate in July for personal needs, the accounting department will generate data on earnings and withheld tax from January (or from the month of starting work) to June.

In addition, certificates for all employees are submitted to the Federal Tax Service annually at the end of the working year. Based on them, the tax office checks the completeness of accrued and paid income tax for the enterprise as a whole. Both documents are identical to each other. Why does the employee need a certificate? The need arises when it is necessary to show the level of income, including to confirm the status of the poor. Also, 2-NDFL can serve as proof of a sufficient level of solvency of a citizen. In some cases, the purpose of the receipt is to show the amount of income tax transferred from earnings.

Who can request a 2-NDFL certificate? The document is generated to provide:

- To banks and other credit institutions to obtain borrowed funds.

- To government bodies (social protection and others) to register a number of benefits and payments in favor of the poor.

- In stores and shopping centers when making an expensive purchase on credit.

- To receive tax deductions (refund of previously paid tax).

- To confirm previously received income at a new place of work.

What deductions can you expect?

For officially employed employees, the state has developed a system of deductions that reduce the tax base and reduce the tax amount.

These include:

- 400 rubles – provided to everyone who has not worked since the beginning of the year (those who do not receive other deductions);

- 500 rubles – for persons involved in liquidation of the consequences of the Chernobyl accident, participants of the Second World War, disabled people of groups 1 and 2;

- 1400 rubles – for the first child and the second;

- 3000 rubles – for citizens who have received radiation exposure, as well as families with more than two children;

- 6000 rubles – for a disabled child.

Example: if your earnings are 20,000 rubles, then tax deductions will be: 20,000 * 13% = 2,600 rubles. You will receive 17,400 rubles in your hands. If a standard deduction of 400 rubles is applied to you, then the income will be: 20,000-(20,000-400)*13% = 17,452 rubles. Of course, the amount changed to only 52 rubles, but the higher the deduction, the more you get in your hands.

When a certificate is not needed

Not in all cases, a 2-NDFL is required for a new job.

It will not be needed if:

- You did not receive any income during the reporting period;

- You have not worked anywhere before;

- You do not claim any deductions;

- You started a new job on the first day of the year.

If you were not accrued any income at your previous place of employment, the new employer can still ask for a certificate. He needs to check the accuracy of your words. Even if 2-NDFL turns out to have empty lines, it is still taken into account. This means that you can count on all the deductions that are due to you.

If you do not have the right to reduce the tax base, then you are not required to bring a certificate. In this case, the accountant will not ask her.

When you are hired for a new position on the first working day of January, the reporting year begins for you in the new company. This means that it is the new employer who will provide you with deductions in the new year, and you do not need to bring a certificate.

For what period?

The use of the method of calculating personal income tax cumulatively for the entire calendar year allows the employee to adjust the accrual of income tax during the year if additional grounds for changing it arise. For example, the birth of a child in the family or the cost of treatment.

The company's accountant will be able to take this into account in the current year, that is, within one tax period from January to December inclusive.

A reduction in income tax can be achieved through legalized tax benefits - deductions.

The application of the standard deduction is described in detail in Article 218 of the Tax Code of the Russian Federation.

Important! The next amendments to the “Tax Code of the Russian Federation (Part Two)” dated 08/05/2000 N 117-FZ as amended on 12/28/2017 were legalized from 01/01/2018.

The legislator has identified several categories of employees who have received the right to standard deductions:

- 3,000 rubles per month for Chernobyl victims (1988-1989), including civilian employees and military personnel.

- 3,000 rubles monthly - participants in Operation Shelter (1988-1990), liquidators of the consequences of events at the Mayak Production Association and territories along the Techa River bed (1957-1961); participants in nuclear tests and combating their consequences; military personnel who became disabled in groups I, II and III due to wounds and injuries received during the performance of military duty to defend the USSR and the Russian Federation.

- 500 rubles monthly - heroes of the USSR and Russia; disabled people since childhood, as well as disabled people of groups I and II; bone marrow donors; residents displaced due to the consequences of radiation disasters.

The most common is the standard child deduction provided to parents or guardians:

| No. | Child's birth order | Standard deduction for a child, rubles |

| 1 | Firstborn or only child | 1400 |

| 2 | Second child | 1400 |

| 3 | Third and subsequent children | 3000 |

An additional 12,000 rubles are excluded from taxation for parents of minor disabled children or full-time students with group I or II disabilities under 24 years of age. For guardians, the standard deduction in this case is 6,000 rubles.

Important! The chance to take advantage of the standard deduction remains until the child reaches 18 years of age; for full-time students studying at universities and graduate schools, the period has been extended to 24 years.

Find out whether it is possible to submit 2-NDFL without a TIN. In what cases is a 2-NDFL certificate needed? Detailed information on the issue is presented in this material.

Where is 2-NDFL issued?

If an accountant from a new place of duty requires you to bring a 2-NDFL certificate, you need to contact your former employer.

For these purposes you can:

- Leave a request by phone;

- Visit the accounting department in person.

The simplest option is when the employer and the head office for issuing certificates are located in the same city, or better yet, in the same building. In this case, you will not have any problems obtaining 2-NDFL.

It is prepared within three days and delivered to you. The validity period of the document is one month. If for some reason you did not have time to pick it up and provide it to a new accountant, it is considered overdue and is not subject to accounting. Then it will need to be issued again.

In large companies, certificates are often issued only at the head offices, which may be located in another region of the country. Here everything is much more complicated. To get a certificate, you need to go to the branch of your city and express your request to the manager. He will leave a request.

The certificate also takes three days to prepare, but it may arrive in a few weeks. It all depends on the speed of postal services. The main thing is to get it on time.

What is 2-NDFL?

The certificate is printed on A4 sheet and contains your data, including:

- FULL NAME.;

- Your tax number (TIN);

- Registration address;

- Lines with the amounts of income for each month starting from January (if you did not receive income, the lines will be empty. Your monthly earnings are taken into account here + all other transfers for sick leave, vacation, etc.);

- Applicable deductions and their size;

- The total amount of your income;

- Amount of tax paid.

This document may be needed not only in accounting, but also in:

- Tax office to obtain property deductions;

- To a credit institution to apply for a loan.

2-NDFL has a uniform design standard; no errors, amendments or inaccuracies are allowed.

In addition to information about the employee, it contains information about your former employer:

- Name;

- INN, OGRN.

Typically, such certificates do not contain any errors, since they are compiled on a computer with a specially installed program. But if you notice any incorrect data, then immediately bring this to the attention of the accountant from your previous place of duty. Otherwise, discrepancies in information will lead to invalidity of the document.

Normative base

As an independent type of reporting on the income of an individual, form 2-NDFL, as well as instructions for filling it out, were first introduced by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected]

2-NDFL is an A4 format report compiled on the basis of accounting data on an employee’s income, subject to income tax at a rate of 13%, indicating the source of payment.

It contains the following information:

- Employer details (name of enterprise or individual entrepreneur, INN/KPP, phone number, OKTMO code).

- Employee details (full name, tax identification number, address, citizenship, date of birth, identification document code).

- Settlement part: information about earnings, deductions, personal income tax.

2-NDFL not for all occasions

Often, an organization may ask you to provide a certificate of income. It differs in content from 2-NDFL. The latter is intended specifically for studying your tax deductions. It can be used to determine how much taxable income you received during the reporting period.

But the certificates do not always contain information about such earnings from which the amount of payment to the tax office is debited. There is a document confirming only your income.

Example: women on maternity leave receive monthly benefits to care for their children. This income is not taxed. Therefore, no deductions are applied. Therefore, a 2-NDFL certificate is not needed here, since it reflects other information.

The salary certificate, unlike personal income tax, includes only monthly income amounts. It can be formed not only for the reporting year, but also for any period.

For example, you can request such a document for the last three months. This certificate is most often provided to social security authorities. It confirms that your income does not exceed the established limit and you are entitled to receive certain benefits from the government.

How to fill it out correctly

A certificate in form 2-NDFL is filled out either at the request of the employee for his personal needs, or to the Federal Tax Service as an annual report. When forming, annual data on earnings received, subject to personal income tax, are taken into account. If the document is drawn up at the request of an employee, then the filling period is from the beginning of the current year (or the month of hiring) until the current moment.

The new requirements for filling out the certificate do not provide for indicating the address of the employee whose details are indicated in the document. Previously, this was considered a mandatory requirement. There is also no need to indicate the employee’s TIN if there are doubts about its authenticity or it is unknown. When preparing a 2-NDFL certificate, it is worth paying attention that some income and deduction codes have changed. Information with incorrect data makes the document invalid.

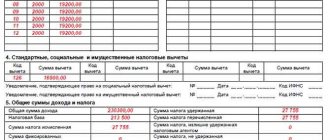

An employee's income is indicated monthly, separately for each type of income. So, if wages and vacation pay were accrued in the same month, then 2 lines appear with the coding 2000 and 2012, respectively, where the amounts received are reflected. Deductions are also taken into account separately for each type.

The summary data in the document (section 5) should be as follows:

- Total income, including all taxable payments (salaries, sick leave, compensation and others)

- Tax base, defined as the difference between total income and deductions

- Tax calculated, withheld from the employee’s salary and transferred to the budget. All 3 indicators must take the same value.

The certificate is signed by the tax agent - the employer responsible for the correctness of the accrual. There is no need to use a seal.