Legal advice > Administrative law > State duty in the tax code: main articles and rules

The Tax Code is the main document regulating the system of taxes and fees, which includes state duty. This is a fee that, by law, is charged to a citizen for services provided by the state related to paperwork and more.

The state duty in the Tax Code is prescribed in the eighth section “Federal taxes”; its detailed description is presented in several paragraphs of Article 333. It is important to know when you are obliged to pay the state duty and what its size should be: the law protects certain groups of citizens and relieves them of paying for public services .

How are they similar?

A tax or fee is an amount levied on individuals, organizations and individual entrepreneurs and sent to the budget.

Without going into details, then, undoubtedly, state duty refers to taxes and fees that have common features:

- enshrined in the Tax Code of the Russian Federation;

- amenable to clarification and change of amount at the local level;

- the amounts paid go to the treasury.

Tax accounting of expenses

According to paragraph 10, paragraph 1 of Art. 265 legal expenses are included in non-operating expenses. The legislation does not specify the procedure for accepting expenses and the date of write-off. To confirm expenses you will need to have:

- documentary confirmation;

- economic feasibility of costs;

- connection with the legal process (being one of the parties);

- presence of a decision of a judicial authority that has entered into force;

- confirmation of payments using the cash method of accounting for expenses and income.

Enterprises that use the general tax system for accounting include legal expenses in calculating the tax base of profits. The costs may include any costs confirmed by the court. When reimbursement of expenses, the amount is included in non-operating income.

Legal definition

Tax refers to funds transferred free of charge by a subject for the purposes of the state or municipalities. This payment is mandatory and is paid in accordance with the Tax Code of the Russian Federation.

A fee is the amount that is paid to the budget for performing legally significant actions against persons. In some cases, funds are paid for conducting business activities, which may be determined by local legislation.

Differences

To determine whether a state duty is a tax or a fee, you need to consider their main characteristics. The first concept is more capacious, because a tax is the obligation of all payers to transfer part of their income or profit to the treasury. The collection is not mandatory. Such a contribution is necessary for the state to carry out any actions against the payer.

The main characteristics of the tax are:

- obligation;

- gratuitousness;

- coercion;

- the need for calculation;

- belonging to budgets of various levels.

To correctly calculate the payment amount, you need to decide on the object, know its base cost, tax rate and period. It is also necessary to understand what the tax collection procedure is, so as not to miss the established deadlines.

Different rules apply regarding collection. It is paid one-time and for a specific service by authorized bodies. This means that it is optional and cannot be forced. However, the main difference between a fee and a tax is that after payment, the implementation of legal actions to obtain certain rights is guaranteed.

When it becomes necessary to pay a state duty, whether it is a tax or a fee, the individual does not care. Having a receipt in hand, he deposits the amount established by law. It doesn’t matter to him at all what such an action is called.

For a legal entity, everything is more complicated. The form of payment order, with which it is possible to transfer funds, requires a precise definition of the purpose of the contribution and entering this information in the appropriate field. However, it is enough for the bank to know that a state fee has been paid. Whether it is a fee or a tax, you do not need to specify in the payment purpose field.

What is a fee?

In fee is understood as a fixed payment collected from companies or citizens to pay for certain services. For example, those that turn out to be some kind of entity - a private or government organization. Let's say it could be a fee for selling an airline ticket.

As a rule, the amount of the fee is determined directly by the entity that collects it. That is, the amounts of the corresponding payments, unless we are talking about services provided by a government agency, are usually not regulated by law. Also, at its discretion, the entity providing services may establish benefits for paying fees for certain categories of citizens or firms.

Comparison

To understand whether a state duty is a tax or a fee, it is necessary to analyze these two concepts according to the following criteria:

- Target. Any fee is intended to ensure the activities of those bodies that provide a service or register the right to something. The tax is not directed towards anything specific.

- Regularity. The fee is paid one-time, and the tax is paid at regular intervals.

- Legislative support. The need for collection is determined individually. It depends not on the subject, but on the nature of the service provided. Taxpayers are determined at the legislative level.

- Sum. For collection, the fee is fixed; for tax, it depends on the base, rate and possible benefits.

- Date of. Fees are not tied to time, but are determined by the need of the payer. Taxes are paid at the end of the reporting period within a limited period.

- Termination of obligations. Taxes are collected from legal entities until the company ceases to exist. Individuals pay for them for life. An exception is a number of taxes that are not levied on certain categories of citizens, for example, property tax on pensioners. Fees are one-time amounts for services.

- Individual characteristics of the payer. Counted for taxes and not relevant for fees.

- Result. Paying a tax only saves you from unpleasant consequences, but collecting a fee gives you the right to something.

- Failure to pay: the tax threatens to be subject to forced collection along with penalties and fees - will lead to non-receipt of the service.

Determination of legal costs by the judicial authority

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.

Classification

Taxes and fees are divided into the following areas:

- By method of collection: direct and indirect. The first ones depend only on the amount of actual or expected income. The latter are related either to costs or to sales. An example of indirect contributions is a fee for the use of subsoil or income tax.

- By location: federal, regional and local.

- By subject of payment: for individuals, for legal entities and mixed.

- For replenishment: fixed, which go only to the federal budget, and regulating (with the distribution of funds at different levels).

The concept of state duty

Taxes, fees and their characteristics are explained in sufficient detail. Now you can easily understand the state duty and understand what type of payment it refers to.

In fact, this is a payment established by Russian legislation. It is charged throughout Russia in the same amount for performing actions of a legal nature or for issuing a certain document when applying to arbitration and magistrate courts, courts of general jurisdiction and other organizations in order to perform certain actions:

- notarial character;

- acquisition of citizenship;

- entry and exit from the Russian Federation.

Registration fee required:

- medicines and medical devices;

- acts of civil status;

- property rights;

- transport;

- legal entities;

- political parties;

- mass media.

The payment of this fee is also determined at the legislative level:

- for the use of certain words of national significance when assigning the name of an organization;

- upon receipt of permission to move hazardous waste across the border;

- for issuing permits for the import and export of cultural property, rare animals and plants.

All of the above clearly determines the state duty. Whether this is a tax or a fee becomes clear immediately after it becomes clear that it is charged for the provision of a service or the performance of an action by government bodies at various levels. The purpose of the payment indicates that the duty is a fee.

This is confirmed by the characteristics of this type of contribution, namely: non-binding, no need for calculation and no compulsion to pay. In addition, in return for the money spent, the subject receives a document or the registration he needs.

State duty rates for actions of authorized bodies related to licensing

Obtaining a license for authorized bodies requires the mandatory payment of a state fee.

Each type of activity has its own specific rate. Let's look at them:

| Name of the area taken into account when obtaining a license | State duty amount |

| Granting of license. | 7.5 thousand rubles. |

| Production, storage, supply of produced ethyl alcohol and alcoholic products. Please note that there are exceptions for alcoholic products. They are specified in Article 333.33 of the Tax Code of the Russian Federation. | 9.5 million rubles |

| Production, storage, supply of industrial wines, champagne created by peasants/farmers and individual entrepreneurs, as well as other alcoholic products made without the addition of ethyl alcohol. | 800 thousand rubles. |

| Production, storage, supply and retail sale of wine and champagne created by farms and individual entrepreneurs recognized as agricultural producers. | 65 thousand rubles |

| Production, storage and supply of manufactured wines and champagnes with a protected designation of origin, wines and champagne with a protected geographical indication. | 65 thousand rubles |

| Re-issuance of a license and other related documents, addition of services and types of work provided. | 3.5 thousand rubles. |

| Re-registration in other cases, for example, if a document or application is lost. | 750 rub. |

| Registration of a temporary license for educational activities. | 750 rub. |

| Issuance of a repeated certificate, license. | 750 rub. |

| Extension of license validity period. | 750 rub. |

The amounts of state fees for obtaining a license for other types of activities are indicated in Art. 333.33 Tax Code of the Russian Federation.

Payers

They are legal entities and individuals who need:

- in performing actions provided for by the Tax Code of the Russian Federation;

- act as participants in courts.

If the plaintiff, in accordance with the law, is exempt from paying the fee or the decision is made in his favor, then the state fee is collected from the defendant.

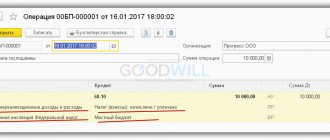

How to take into account the cost of state duty for income tax purposes and under the simplified tax system

Tax accounting of state duty depends on its type.

The state duty for registering rights to real estate and for registering cars both under the OSN and under the simplified tax system is taken into account depending on when it is paid:

- if before the facility is put into operation, it is included in the initial cost of the operating system;

- if after putting the facility into operation, it is taken into account in expenses at a time.

The state fee paid by an organization when filing an application, statement of claim, complaint (appeal, cassation or supervisory) in court (arbitration or general jurisdiction), both under the OSN and under the simplified tax system, is taken into account in expenses.

The state fee, which the court decides to reimburse the defendant, is taken into account:

1) the defendant has expenses:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of payment;

2) the plaintiff’s income:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of receipt of money.

In other cases, both under the OSN and under the simplified tax system, the state duty is taken into account in expenses on the payment date, which always coincides with the accrual date.

This also applies to state fees for state registration:

- changes made to the organization's charter (Unified State Register of Legal Entities);

- real estate lease agreement concluded for a period of at least one year;

- rights to land plots.

Is it possible to return the state fee?

The law allows for the return of only overpaid amounts. It is not possible to receive a full refund. However, there are cases when the state fee is counted for similar actions if it was not used for its intended purpose. To do this, you should write an application to the authority where you expected to receive the paid service. The time limit for filing a request for set-off is limited to three years.

As a result of a painstaking analysis of the concepts of tax and fee, we can make an unambiguous conclusion that state duty belongs to optional payments. Of the two categories under consideration, this condition is satisfied only for the latter.

Thus, the state fee is a fee.