Trading fee is a quarterly payment for trading activities, established at the local level. Tax legislation allows you to reduce income tax by the amount of the trading fee.

From the article you will learn:

- how to register a retail outlet that pays a trade fee;

- how the trading fee is calculated and accrued in 1C;

- under what conditions and by what amount the fee reduces income tax;

- on which lines in the income tax return the trading fee is reflected.

General concepts of trade tax

A trade fee is a mandatory payment that the payer makes in exchange for obtaining the right to engage in trading activities. This definition can be given in accordance with the Tax Code of the Russian Federation.

The law providing for payment of the right to trade in the form of a fee was issued in 2015 and supplemented the Tax Code with Articles 411 and 412 of the Tax Code of the Russian Federation. As of today, according to the law, it applies only to cities of federal significance, such as Moscow, St. Petersburg and Sevastopol.

The conditions for paying the fee vary depending on the system on which the payer is located. As is known, they are distinguished as:

Trade fee

- general

- simplified

- single concubines

- and others

Some systems are generally exempt from this payment. It is worth noting that it is called a fee, and not a tax, since a number of taxpayers, again depending on the taxation system, may attribute it to expenses, thereby reducing the tax base.

The project provides that other municipalities will be able to introduce a tax on trade in other regions, but before the relevant law is issued by the federal authorities.

Postings when profit is negative

If an organization cannot accept a trade fee to reduce profit tax either in the current period or in subsequent periods due to negative profits, then the paid amount of the fee is recognized as an expense of the organization and is accounted for in the same manner as all other company taxes.

The corresponding wiring looks like:

- D44 K68.Torg.sb. – the fee paid is recognized as an expense for ordinary activities.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Registration with the tax authority

The Federal Tax Service compiles a separate register to record taxpayers of this fee. A person is included in the register on the basis of a notification provided for in Art. 416 of the Tax Code of the Russian Federation.

It can be sent by mail, delivered in person or electronically using the official website.

Taxes

From the moment of receiving this document, the tax office is obliged to process the information and register the person no longer than five days, after which, over the next 5 days, the payer is sent a certificate of registration. These actions are provided for in paragraph 3 of Art. 416 of the Tax Code of the Russian Federation.

In general, 10 days pass from the moment the taxpayer contacts the Federal Tax Service until final registration. If for any reason an entrepreneur decides to terminate his activities, he must be deregistered as a trade tax payer. To do this, he must fill out the appropriate notification and submit it to the tax authority at the place of registration.

Who pays

The fee is paid by companies and individual entrepreneurs engaged in trade, using both movable property and real estate for sales.

An organization or entrepreneur is recognized as a payer if at least once a quarter they were engaged in a type of activity that is subject to taxation by this fee (clause 1 of Article 411, Article 412 of the Tax Code of the Russian Federation). In Moscow, this is trade at stationary facilities without sales floors, with the exception of gas stations; non-stationary trading; delivery and peddling sale of goods; stationary trade in facilities with trading floors; organization of markets for retail trade. If the taxpayer has not submitted an application to the Federal Tax Service to open trade for which a fee must be paid, this is considered a serious violation and is considered as a failure to register with the Federal Tax Service.

Who is exempt from paying the fee (clause 2 of Article 411 of the Tax Code):

- paying a single agricultural tax;

- Individual entrepreneurs who have issued a patent.

In addition, according to Moscow Law No. 62 “On Trade Fees” dated December 17, 2014 (clause 2, article 3), the following are exempt from payment:

- mail;

- autonomous institutions;

- government organizations;

- budgetary institutions, etc.

Based on clause 1 of Article 3 of Law No. 62, benefits (exemption) from payment in Moscow were provided, incl. for the following activities:

- retail by vending (trading) machines;

- various fairs (weekend, specialized, regional);

- sales in retail markets;

- peddling trade in autonomous, budgetary and government institutions.

Objects and tax rates

This fee is charged based on the area or number of retail outlets.

In the law it is referred to as a “trade facility”. This concept refers to stationary points, such as shops, tents, kiosks, etc., and also includes trade from mobile objects in the form of mobile shops.

It is worth noting that according to the law, a retail outlet, and therefore a warehouse, can be the object of taxation for this fee. This is only possible if goods are released from it. But since today the rate for them has not been determined, this type of trade is not subject to a trade tax.

Calculation example

In connection with all of the above, the issue remains uncertain regarding the activities of online stores. Despite the fact that the trade tax has been in effect for 2 years, today a decision has not yet been made on what to charge as an object of taxation when working with such entrepreneurs.

The size of the trade tax depends on the rate and the number of taxable objects. And it is determined by multiplying one indicator by another. In fact, this fee is currently valid only in Moscow. Therefore, tax rates should be taken into account within a given municipality. The rate depends on the taxable object.

The placement of the object also affects the size of the bet. In Moscow, 3 groups of districts have been identified that have different sales tax rates. The rate changes are observed from the center to the outskirts, downward. The rate is subject to annual indexation. Its size for the planning year can be found out from the Federal Tax Service.

Accountant's Directory

08/03/2018 Contents 1C: Accounting 8th ed. 3.0 If the simplified tax system is used with the object “Income”, the amount of the advance payment and tax under the simplified tax system can be reduced (by no more than 50%) for the expenses listed in paragraph.

3.1. Art. 436.21 Tax Code of the Russian Federation:

- sick leave paid by the employer;

- payments under voluntary personal insurance contracts.

- insurance premiums;

The taxpayer, in addition to these amounts, has the right to reduce the tax according to the simplified tax system by the amount of the trade fee paid during the reporting period (8 Article 346.21 of the Tax Code of the Russian Federation). At the same time, the requirement for a 50% limit on trade fees does not apply (letter from the Ministry of Finance dated October 7, 2015.

No. 03-11-03/2/57373). However, by the amount of the trade fee, you can reduce the tax calculated under the simplified tax system only in relation to the type of business activity for which the trade fee is established. Therefore, if an organization combines types of activities for which a trade fee is established, and for which there is no trade fee, then it is necessary to organize separate accounting of income for these types of activities (letter of the Ministry of Finance of the Russian Federation dated July 23, 2015.

Accounting for trade fees in accounting

Enterprises that pay the trade tax differ in their form of ownership and size. Most of them, according to the law, are required to maintain accounting and tax records. As part of this, it is important to display the trade fee as transactions in accounting.

You can do this in one of three ways:

Accounting

- attributed to expenses related to core activities

- include in other expenses

- create a separate sub-account

Which of the above options is more appropriate depends on the volume of activity of the enterprise. The first option is possible for individuals who plan to reduce the amount of tax payment based on financial results paid to the budget of the city of Moscow. But only if the trade fee does not exceed this payment.

Calculating the possibility of tax reduction is very simple, since it is paid quarterly in the form of advance payments. For paying tax on a positive financial result, the deadline is the 28th day of the month following the quarter for which calculations are made. Consequently, even if the payer paid the fee on time, he has the opportunity to reduce the amount of tax, document this and make the payment.

Rebus Company

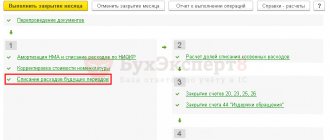

Contents In “1C: Accounting 8” (rev. 3.0), starting with version 3.0.42.72, it became possible to automatically calculate tax on the simplified tax system with the object “income” for payers of trade tax.

Now the program supports the method of separate accounting of income and expenses for activities subject to trade tax as part of activities on the simplified tax system for the application of paragraphs 3. and 8 of Article 346.21 of the Tax Code of the Russian Federation in accordance with the recommendations of the Ministry of Finance of the Russian Federation. From July 1, 2015, by law

Moscow dated December 17, 2014 No. 62, a trade tax was introduced in the capital. For taxpayers who use the simplified tax system with the object “income minus expenses” and pay a trade tax, keeping records under the new conditions should not cause difficulties.

Such taxpayers fully take into account the amount of paid trade tax in expenses on the basis of paragraphs.

22 paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (letters of the Federal Tax Service of Russia dated 08/12/2015 No. GD-4-3/14233, Ministry of Finance of Russia dated 03/27/2015 No. 03-11-11/16902, dated 07/23/2015 No. 03-11-09/ 42494).

But for simplifiers with the object “income”, who pay a trade fee and carry out several types of activities, accounting becomes significantly more complicated.

We remind you that with a simplified taxation system with the object “income” (hereinafter referred to as the simplified tax system “income”), the calculated amount of tax (advance payment) can be reduced by the expenses listed in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

These expenses include insurance premiums paid in the current tax (reporting) period, temporary disability benefits, payments (contributions) under voluntary personal insurance contracts.

Example of reflection in accounting

In order to understand in detail how to display trade fees by postings in accounting, let's look at examples of postings. To do this, let’s simulate the situation with, the retail area of which was a total of 90 m2. The tax rate taking into account the location of its facility is 1,200 rubles. for 1 m2 up to 50 and 50 rubles. for every remaining meter. In this case, the amount of the fee was (50 x 1,200) + (40 x 50) = 62,000 rubles.

The easiest way to reflect a trade tax is if the payer has received a negative financial result. In this case, the amount is reflected as an expense in ordinary activities. It looks like this.

Dt 44 Kt 68 amount 62,000 rub. – trade tax is classified as a basic expense.

If the income tax exceeds the amount of the fee, the following entries are used:

- Dt 76 Kt 68 amount 62,000 rub. A trade fee has been charged.

- Dt 99 Kt 68 amount 262,000 rub. Profit tax has been charged.

- Dt 68 Kt 51 amount 62,000 rub. Trade tax paid.

- Dt 68 Kt 76 amount 62,000 rub. The cost associated with paying the fee is shown.

- Dt 68 Kt 51 amount 200,000 rub. Transfer of funds to the tax office, advance payment.

Please note that the example shows tax calculation and payment data for one quarter. But the calculation of the possibility of reducing income tax is determined by the annual value.

The trade tax was introduced with the aim of replenishing municipal budgets from funds collected from persons engaged in trading activities. In addition, the law allows authorities, through the Federal Tax Service, to maintain records and control of retail outlets in the city.

In order to reduce the tax burden of entrepreneurs engaged in trade, the payment was classified as a fee. Thus, it not only reduces the number of taxes paid, but also allows you to reduce their amount. In particular, income tax. This gives grounds to classify it as an expense.

Top

Write your question in the form below

Application of correspondence under vehicles in the event of a loss: nuances

If at the end of the reporting period it turns out that the tax base under the OSN or simplified tax system “income” is equal to zero (in the second case, this is possible if social deductions exceed the simplified tax system), then the following correspondence will be applied in accounting (let’s agree that the tax is more than the TS).

| Dt | CT | Operation description |

| 76 (“TS”) | 68 (“TS”) | The vehicle has been calculated |

| 99 | 68 (“Income tax”) | Tax calculated |

| 68 (“TS”) | 51 | The collection is transferred to the budget |

| 68 (“Income tax”) | 76 (“TS”) | Tax reduced by collection |

| 68 (“Income tax”) | 76 (“TS”) | Reversal, restoration of the deduction in connection with the establishment of a loss at the end of the reporting period |

| 44 | 76 (“TS”) | Including sales tax as an expense |

| 99 (“PNO”) | 68 (“Income tax”) | A PNO has been generated for the vehicle included in expenses |

Under the simplified tax system, transactions for calculating the trade tax (including it in deductions) will contain subaccounts for the corresponding tax. The rest of the correspondence is almost the same as above.

Sources