A quarterly amount of a fixed trade fee is payable by business entities operating in Moscow. The authorities in St. Petersburg and Sevastopol have the right to introduce a fee, but so far they have not paid it in these cities (read more about fee payers in our article). In fact, a trade tax has been introduced (rates on it can be adjusted by local authorities) only in Moscow.

The procedure and rules for calculating the amount to be paid are regulated by the Tax Code of the Russian Federation in Art. 410-418. The amount of rates expressed in rubles is fixed by the Law of Moscow dated December 17, 2014 under No. The latest update of the regulation was made in November 2021 (after adjustments for some objects, rates became lower).

Read also: Trade fee. Payment deadlines 2018

Who should pay the trade tax

The trade tax was introduced in 2015; all organizations and individual entrepreneurs who are engaged in:

- trade through fixed network facilities with and without trading floors (shops and kiosks, with the exception of gas stations);

- trade through non-stationary network objects (tents, tables, counters, carts, delivery trade);

- organization of retail markets;

- trade in goods from a warehouse.

Do I need to pay a sales tax when selling online? Read here >>

Payment is mandatory for companies and individual entrepreneurs using the general taxation system and the simplified tax system. UTII for those activities for which payment of a trade tax is established cannot be applied in Moscow. Then you will have to switch to a different taxation system.

If you are on the list of those who pay the trade tax in 2021, you must submit a tax notice in the TS-1 form. From us you can download a notice of trade fee and a sample form for free.

Legal regulation

The regulatory normative act, in addition to the Tax Code itself, is the Moscow City Law of December 17, 2014 No. 62 “On Trade Fees.” It contains all the details: rates, payment procedure and deadline, as well as benefits for this payment. A trade tax has been in force in Moscow since 2015.

There is also a decree of the Moscow Government dated June 30, 2015 No. 401-PP. It defines the procedure for collecting, processing and transmitting information about retail facilities to the Federal Tax Service. This resolution helps to correctly determine the area of the sales area in order to correctly calculate the amount of tax.

How to register as a trade tax payer

You need to register with the tax office at the place of registration of the property or at the place of registration of the organization or individual entrepreneur, if the premises are not used for trading.

If the retail outlet is registered in Moscow, and the legal entity is in another region, then you need to contact the Moscow Federal Tax Service at the place where the real estate is registered. This rule also applies to movable property.

Documents must be submitted no later than five days from the start of trading.

The tax office, within five working days after submitting the notification, will send a certificate of registration as a trade tax payer.

Objects of taxation

The object of taxation with a trade tax (according to Article 412 of the Tax Code of the Russian Federation) is the use of an object of movable or immovable property for types of trade in respect of which this tax is established.

The facility can be used at least once a quarter - in which case the obligation to pay a fee arises. The date of occurrence of the object of taxation will be the date of the beginning of the use of this property, and the date of termination of collection of the fee will be the date of termination of the use of such property.

The objects of taxation of the trade tax can be: buildings, structures, premises, stationary and non-stationary retail facilities and retail outlets, real estate objects used by market management companies in organizing retail markets.

What has changed in 2021

From January 1, 2021, a new trade tax rate has been established in Moscow for non-stationary retail facilities in the Central Administrative District of the city. Now it is 40,500, not 81,000 rubles, as before. For stationary ones, it remains the same.

From July 1, 2021, the sales tax rate for objects with sales floors up to 50 sq.m. reduced by 10%, for sales areas up to 300 sq. m - by 2-10% (depending on the area of the object). And for objects with an area of more than 300 sq. m. the rate was raised to 75 rubles per sq. m. m.

The amount of tax in Moscow depends on the type of trade, the location of the facility and the area of the hall. Use our online trade fee calculator to calculate >>

Where to get the data to calculate the trading fee (rates and physical characteristics)

Let us recall that Moscow is the only city in Russia in which, as of the beginning of 2021, a trade tax has been introduced. Therefore, in practice, its calculations are so far carried out only by entrepreneurs in the capital. The main regulatory source for them is the Moscow City Law “On Trade Fees” dated July 17, 2014 No. 62.

Physical characteristics and vehicle rates for Moscow are defined in the provisions of Art. 2 of Law No. 62. These and other indicators are determined, first of all, based on the geography of the location of retail facilities. The city authorities have identified 3 main tariff zones for trading:

- zone 1 - central areas (located in the Central Administrative District of Moscow);

- zone 2 - areas located primarily outside the Moscow Ring Road (including New Moscow);

- zone 3 - areas located primarily within the Moscow Ring Road, but not included in the Central Administrative District.

For zone 1 the rates are determined in the amount of:

- 81,000 rub. according to physical characteristics in the form of an object - for companies conducting stationary trade without halls (except for sales at gas stations), as well as non-stationary trade (except for sales in peddling and delivery formats);

- 60,000 rub. according to physical characteristics in the form of an object - for companies conducting stationary trade with halls of no more than 50 square meters. m;

- 40,500 rub. by physical characteristics in the form of an object - for companies engaged in trade in delivery and delivery formats;

- 1,200 rub. according to physical characteristics in the form of area - for companies that conduct stationary trade with halls exceeding 50 square meters. m (in this case, the 51st square meter and subsequent ones are charged at a rate of 50 rubles);

- 50 rub. by physical characteristics in the form of area - for territories of retail markets.

For zone 2, rates are set (in accordance with the above characteristics for zone 1) in the amount of: 28,350 rubles, 21,000 rubles, 40,500 rubles, 420 rubles, 50 rubles. For zone 3 - 40,500 rubles, 30,000 rubles, 40,500 rubles, 600 rubles. and 50 rub.

Who doesn't pay the trading fee?

Entrepreneurs using the patent system and payers of the unified agricultural tax are exempt from payment. In addition, the trade fee is not paid by legal entities that, when registering, indicated the following main types of activity:

- hairdressing and beauty salons, laundry services, dry cleaning and dyeing of textiles and fur products;

- repair of clothing and textiles for household purposes, repair of shoes, leather goods and watches, as well as jewelry;

- production and repair of metal haberdashery and keys.

The benefit only applies to properties with an area of less than 100 square meters. m, in which the area occupied by equipment for displaying and displaying goods is no more than 10% of the total.

Catering services, including the sale of purchased products, if it is an integral part of these services, are not recognized as trading activities (Letter of the Ministry of Finance No. 03-11-11/40960 dated June 5, 2019). Therefore, catering organizations do not have to pay a sales tax.

Who is exempt from paying

As you can see, the sales tax rates are very high, and its payment is not related to whether the store makes a profit . Therefore, for Moscow companies and individual entrepreneurs, this payment has become a very serious burden. True, in some cases you can count on benefits . Thus, companies and individual entrepreneurs from Moscow do not pay a trade tax if they:

- conduct trade through vending machines;

- trade at fairs and retail markets;

- engage in differential trading on the premises of budgetary and some other government institutions;

- sell goods in the territories of theaters, cinemas, circuses, planetariums, museums, provided that revenue from ticket sales is at least 50% of total revenue for the quarter;

- sell goods through non-stationary objects with the specialization “Printing”.

Also do not pay a trading fee :

- autonomous, budgetary and government institutions;

- organization of postal services;

- religious organizations when trading on their territory.

, hairdressers and beauty salons, laundries and dry cleaners, clothing and shoe repair shops, jewelry and watch shops, booksellers, newspapers and magazines do not have to pay the trade tax The law establishes special conditions for specific types of activities. For example, in order for a bookstore not to pay a sales tax, the following conditions must be met:

- income from the sale of books, newspapers and magazines must be at least 60% of total income;

- stands with books, newspapers and magazines must occupy at least 60% of the store area;

- Payments to customers must be made using online cash registers.

What happens if you don't pay the trading fee?

If you have not notified the tax office, this is equivalent to conducting business without registering. You face a fine of 10% of the income received during the period during which you traded without notifying the Federal Tax Service, but not less than 40,000 rubles. In addition, the amount of the trade fee cannot be deducted under the single tax under the simplified tax system.

Although the trade tax was introduced back in 2015, many entrepreneurs still do not understand everything. We have prepared answers to the main questions.

Frequently asked questions and answers about trade fee

Basis and legal basis

Trade tax is the newest tax in the Russian tax system.

It was introduced by Federal Law No. 382-FZ of November 29, 2014 - this law included Chapter 33 “Trade Duty” in Part Two of the Tax Code. Trade tax refers to local taxes, that is, it is regulated both by the Tax Code of the Russian Federation and by the regulatory legal acts of municipalities, the laws of Moscow, St. Petersburg, and Sevastopol.

A trade tax must be introduced by a regulatory document at the local level - and if such a document is adopted, then the fee becomes mandatory for payment in the territory of the relevant municipality or federal city. Municipal laws may also establish benefits, grounds and procedures for their application.

Please note that the trade tax could not be introduced earlier than July 1, 2015.

So far, the fee is established only by Moscow Law No. 62 dated December 17, 2014. In St. Petersburg and Sevastopol, a trade fee has not been introduced in 2021.

I trade through the premises I rent. Who pays the sales tax, the tenant or the landlord?

— The one who carries out trading activities pays. If you rent a commercial property, then you are the payer, not the landlord.

How to pay tax if I combine the simplified tax system and a patent?

— Entrepreneurs who combine the simplified tax system and a patent need to understand the scope of the activity within which trade is carried out. Trade tax for individual entrepreneurs on the simplified tax system in Moscow is mandatory. If trade occurs within the framework of patent activity, there is no need to pay tax. If you trade through the same store simultaneously under a patent and the simplified tax system, you must register as a payer of the trade fee and pay only for those square meters that are involved in trading activities under the simplified tax system. If it is physically impossible to divide the area by type of activity, you will have to pay for all square meters of the store.

Income tax calculation

Regulatory regulation

The income tax payable to the regional budget can be reduced by the amount of the trade tax paid before the date of payment of the income tax or advance payment (clause 10 of Article 286 of the Tax Code of the Russian Federation).

In this case, the conditions must be met (Letter of the Federal Tax Service of the Russian Federation dated August 12, 2015 N GD-4-3/ [email protected] ):

- The organization must be registered with the Federal Tax Service as a trade tax payer by submitting a Notification. PDF

- You can only reduce the trade tax on the regional part of the advance payment (or income tax) that goes to the budget of the entity in which the trade tax is valid (at the moment - to the budget of the city of Moscow).

- The collection tax can be reduced only if both of these payments go to the budget of the same entity (currently the city of Moscow).

- If the amount of trade tax paid for a quarter exceeds the amount of income tax calculated for the same period, then the tax on the fee can be reduced only within the limits of the calculated tax amount. The balance of the trading fee can be taken into account based on the results of the current tax period, but the total amount to be reduced cannot exceed the annual income tax. At the same time, the tax paid for the 4th quarter can be used to reduce the tax for the year (if the fee is paid before the date of the annual payment - before March 28 inclusive) or advance payments for the 1st quarter of the next year (if the fee is paid after March 28).

If the trading fee for the 4th quarter of the current tax period is paid in the 1st quarter of the next year, then in 1C it will be included in the profit tax reduction for the 1st quarter. There is no technical possibility to take such an amount into account in the expenses of the 4th quarter.

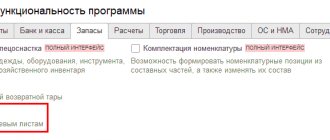

Accounting in 1C

The calculation of income tax is carried out through the procedure Closing the month - the document Calculation of income tax in the section Operations - Closing the period - Closing the month.

Postings according to the document

The document generates transactions:

- Dt 44.01 Kt 68.13 storno - exclusion of the amounts of accrued and paid trade tax from expenses;

- Dt 90.07.1 Kt 44.01 storno - reversal of expenses based on the results of the last tax (reporting period);

- Dt 99.01.1 Kt 90.09 storno - recalculation of the financial result of the previous tax (reporting period);

- Dt 68.04.1 Kt 68.13 - reduction of income tax calculated to the regional budget by the amount of the trade tax.

Reporting

In the income tax return, the calculated and paid trade tax is reflected in:

In Sheet 02: PDF

- p. 265 “The amount of trade tax actually paid to the budget of a constituent entity of the Russian Federation since the beginning of the tax period”;

- page 266 “The amount of trade tax actually paid to the budget of a constituent entity of the Russian Federation for the previous reporting period”;

- p. 267 “The amount of trade tax by which calculated advance payments (tax) to the budget of a constituent entity of the Russian Federation for the reporting (tax) period are reduced.”

Calculation of income tax to the budget of a constituent entity of the Russian Federation for 2021, taking into account the reduction in the amount of trade tax:

Learn in more detail the reflection of the sales tax in terms of advance payments

See also:

- Registration of an object subject to trade tax

- Payment of trade tax

- Trade fee under the simplified tax system

- Deduction for trade fee in the simplified tax system assistant

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of the trade fee Filling out a payment order for the payment of the trade fee is associated with a number of…

- Setting up postponing deadlines for reporting and paying taxes in 1C Coronavirus is changing our personal and work plans - due to forced...

- Postponement of deadlines for payment of local taxes and trade fees From April 2021, constituent entities of the Russian Federation received the right to extend the deadlines for payment...

- Application for a deferment (installment plan) for tax payments in 2021 In 2021, the Government introduced a simplified procedure for providing deferments and…

How to determine the area of the sales floor for the purpose of calculating the sales fee?

— The total area is calculated on the basis of inventory and title documents. They must contain information about the purpose, design features and layout of the premises, as well as information confirming the right to use the point. Calculate the fee rate using an online calculator >>

If I trade on the retail market, do I have to pay a trading fee?

- No. Trading fees in relation to activities related to the organization of retail markets are paid only by management companies.

If I qualify for benefits and are exempt from trade tax, do I need to submit a notification to the tax office?

- Yes need. In this case, along with the notification, it is necessary to submit documents confirming the right to receive benefits. And in the notification indicate the benefit code. Download the notice of registration as a trade tax payer >>

Some questions from taxpayers

Do I have to pay a fee if trading is suspended?

Sometimes, for one reason or another, trading in a store is temporarily closed. For example, it worked in the first and second quarters, there will be no trading in the third quarter, and then it will continue again. Should I pay the trading fee for the third quarter?

It must be understood that if the taxpayer has registered the specified store and pays a trade tax on it, then it is impossible to skip payment due to lack of activity. If trading is not carried out in this object, you need to deregister it . To do this, a notification is submitted to the tax authority. Within 5 days, the Federal Tax Service will issue a deregistration document in form 1–5-Accounting. Moreover, the day of withdrawal in this case will be considered the day specified in the notice submitted by the taxpayer. If such a notification is not submitted and the trade fee is not paid, then the Federal Tax Service will recognize this as a violation.

Do I need to pay a fee if the trading company does not actually trade?

When registering, the company indicated trade as its main OKVED. However, in fact, she is not engaged in this activity. Do I need to pay a trade fee?

Article 412 of the Tax Code of the Russian Federation states the following: if at least once a quarter movable or immovable property is used to carry out an activity in respect of which a trade fee has been established, then it must be paid.

Accordingly, if trade was not carried out at the specified facility in principle, then there is no need to pay a fee . It does not matter that during registration the organization indicated OKVED for trade. What matters is what activities the company actually carries out.

If objects are in different areas

The company has two stores that are registered for trade tax with different Federal Tax Service. In relation to the first object, there was an overpayment of the fee, and in relation to the second - an underpayment. Is it possible to offset these amounts?

It should be noted that posing such a question is erroneous in itself. The fact is that, in accordance with paragraph 7 of Article 416 of the Tax Code of the Russian Federation, if 2 objects are located in the territories of different Federal Tax Service Inspectors, then the registration of the second object is carried out by the same tax authority where the first object is registered .

Thus, the situation in which the payer of the trade tax must pay it to different Federal Tax Service Inspectors is erroneous. To correct it, you need to deregister the second object and register it with the Federal Tax Service, where the first object is located.

As for offsetting the amount of overpayment against underpayment to another Federal Tax Service, current legislation does not provide for this. Therefore, the taxpayer needs to do the following:

- pay off arrears;

- contact the Federal Tax Service where the overpayment was made with a request for a refund of this amount.

Showroom + acquiring = sales fee?

Do I need to pay a trade fee if I install trade acquiring in the showroom?

First, you should decide whether the showroom is an object that is subject to a sales tax. Let us note right away that the official authorities believe that exhibition halls generally belong to the objects of a stationary retail chain. This opinion is shared by the Ministry of Finance (letter dated 02/11/2013 No. 03–11–06/3/3381) and the courts (Resolutions of the Federal Antimonopoly Service of the North Caucasus dated 10/24/2013 No. A25–347/2013 and Volgo-Vyatka dated 07/15/2013 No. A79– 8172/2012 districts). Thus, if trade is carried out in the specified facility, then a trade fee must be paid.

What is merchant acquiring? This is the purchase of goods and payment for it using a bank card through a special terminal. In other words, this also fully falls under the concept of trade. This means that such activities are subject to trade tax.

Deadlines for notification of deregistration

Failure by the taxpayer to submit documents or other information within the prescribed period entails a fine of 200 rubles. for each document not submitted. The fee is established in relation to activities at retail sites.

Registration or deregistration of an organization or individual entrepreneur as a fee payer with a tax authority is carried out on the basis of a corresponding notification of the fee payer submitted by him to the tax authority or on the basis of information provided by the authorized body to the tax authority. In case of termination of business activity using a trade object, the payer of the fee submits a corresponding notification to the tax authority.

The date of deregistration of an organization or individual entrepreneur as a fee payer is the date of termination of the type of activity specified in the notification.

Therefore, the payer of the trade tax is obliged to submit an appropriate notification to the tax authority in the event of termination of business activities using the object of trade. However, no deadline has been established for the fulfillment of this obligation by the Tax Code of the Russian Federation.

Since a specific period for fulfilling the obligation to submit a corresponding notification to the tax authority in the event of termination of business activities using an object of trade has not been established, it is impossible to determine in which case the payer of the fee is subject to liability for failure to submit a notification, since it is not clear what date should such a payer be considered to have violated the Tax Code of the Russian Federation?

In paragraph 7 of Art. 3 of the Tax Code of the Russian Federation it is established that all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer (payer of fees).

Therefore, we can conclude that the organization cannot be brought to tax liability under clause 1 of Art. 126 of the Tax Code of the Russian Federation, if it does not submit a notification to the tax authority after the termination of business activities using the object of trade.

Documentary evidence of no trade

The organization has a store, but there will be no trade in July, August and September. It is planned to resume it in the fourth quarter. Do I have to pay a trading fee in the third quarter? What documents can confirm the absence of trading activity at a trading facility during the third quarter?

The amount of the fee is determined by the payer independently for each object of taxation, starting from the taxation period in which the object of taxation arose, as the product of the fee rate in relation to the corresponding type of business activity and the actual value of the physical characteristics of the corresponding object of trade. Payment of the trade tax is made no later than the 25th day of the month following the taxation period.

In case of termination of business activity using a trade object, the payer of the fee submits a notification to the tax authority. The date of deregistration of an organization as a fee payer is the date of termination of activities specified in the notification.

When an organization is deregistered as a trade tax payer, such tax payer, within five days from the date of deregistration, is issued a notice of deregistration of the Russian organization with the tax authority in Form No. 1–5-Accounting. If such notification is not submitted, the organization continues to be considered a payer of the trade tax. Failure to pay the trade tax by such organizations will be considered a violation of tax laws.

Based on the above, in the situation under consideration, there is no need to pay a trade tax if the organization has submitted to the tax authority a notice of deregistration as a trade tax payer indicating the date of termination of trading activities.

How to calculate the fee amount

The entrepreneur is required to calculate the trade fee indicator himself for each retail facility that was used for trade at least once during the quarter. The Tax Code determines the maximum allowable tax rates. The specific conditions for payment are accepted by the city authorities of Moscow, St. Petersburg and Sevastopol, but they are not authorized to go beyond the limit established by the Tax Code of the Russian Federation. The maximum bet size, which determines its limit, is determined by such values as:

- three-month cost of a patent for retail trade in the relevant product;

- type of trading activity (there are restrictions on certain ways of organizing it);

- area of the retail outlet (if the retail premises occupies an area of more than 50 sq. m, then the sales tax rate is calculated based on the square footage at each individual retail location).

The amount intended for payment is calculated in the usual way for tax payments: the legislative rate is multiplied by the base value.

∑trade fee = Trade fee x Xphysical.

Where:

- Trade fee - the rate accepted for the trade fee by this municipal legislation (or the maximum in accordance with the Tax Code of the Russian Federation);

- Hphysical. – tax collection base – physical characteristics of a retail facility.

The basis for this tax, as mentioned above, is the physical characteristics of movable or immovable property assets with the help of which a businessman carries out trade. The profile physical characteristic is the area of a retail outlet, hall, store, retail market, etc., submitted in registration documents (subclause 5 of clause 3 of Article 346.43 of the Tax Code of the Russian Federation).

REFERENCE! The maximum tax rate that can become the basis for calculating the trade fee is an amount of 550 rubles. /sq. m., which is multiplied by the annual deflator coefficient.

What is subject to collection and when?

The levy is imposed on an object - property (movable and immovable) with the help of which trade was carried out at least once a quarter. However, it does not have to be owned by the payer.

The following objects are exempt from the vehicle:

- Pawnshops, sale of pledged items;

- Gas stations;

- Online stores with delivery of goods by courier or mail;

- Sales of related products in the provision of household services;

- Offices where there is no display of goods, but only where purchase and sale agreements are concluded;

- Trade in food products through public catering.

In Moscow, benefits have been established (exemption from payment of sales tax) for the following retail facilities:

- Vending machines;

- Objects located at fairs (for example, a pavilion at a seedling fair);

- Objects located in the retail market (for example, a stall in a clothing market);

- Retail trade in budgetary institutions;

- Postal service trade.

TC is paid quarterly. If the company has been trading for a month or two, then the fee will have to be paid for the entire quarter. The payment date is before the 25th day of the month following the reporting quarter. If the 25th falls on a weekend, then the last day of payment is considered the nearest working day.

If the vehicle is not paid on time or in full, a fine is imposed:

- In case of non-intentional non-payment - 20% of the fee + the fee itself;

- In case of intentional non-payment - 40% of the fee + the fee itself.

Registration

Individuals - individual entrepreneurs, as well as legal entities subject to the requirements of the trade tax, must register with the tax authority as payers of this type of tax. To do this, you will have to notify the INFS about your status and the specifics of calculating the trade tax for your business. The procedure for registration and deregistration of trade taxes is regulated by Art. 416 of the Tax Code of the Russian Federation.

The deadline for registering as a trade tax payer is 5 days from the date of receipt of the trade object for use.

Lateness is punishable by administrative liability. Within the same period, you must notify in writing about changes in activities that may affect the fact of payment or the amount of the fee, if such changes have occurred.

If you do not inform the tax authority, then the trade fee cannot be deducted from the income tax, personal income tax or the amount of the single tax under the “simplified” procedure. In case of incriminating results of the inspection, you will have to pay not only the trade fee itself and a fine for late payment or work without making a mandatory payment, but also all stipulated income taxes without any deductions. A fine is also imposed on revealed false information about the tax base, that is, the object of sale, which resulted in arrears for this fee.

Experts express the opinion that this approach motivates businessmen to work with greater profit, so as not to transfer tax funds to themselves at a loss, because the trade fee is paid regardless of the monetary outcome of the trade.

Where to submit notification

The notification must go to the tax office at the location of the retail facility subject to the payment in question. Possible difficulties that may be caused by this requirement and ways to resolve them are given below:

- There are several existing objects for trading activities: you need to provide information about each of them separately.

- Several retail outlets located far from each other are in the jurisdiction of different tax authorities: it is enough to submit a notification to the department to which the first of the listed objects is assigned, not forgetting to indicate information about the others (see paragraph 1).

- The property is located in the region under the jurisdiction of the trade tax, and the registration of the entrepreneur relates to another city: the notification must be delivered to the inspectorate responsible for the area where the trade property is located.

- Only transportable means of trade are used: registration is carried out at the address of the individual entrepreneur or the legal address of the organization.

- Registration of an entrepreneur refers to one of three places that support the payment of a trade tax, and he conducts activities in other localities: there is no need to pay a trade tax, nor do you need to register for this with the tax office.

Notification form

The INFS must be informed not in the form of a simple statement, but on a specially designed form approved by letter of the Ministry of Finance of the Russian Federation dated June 10, 2015 No. GD-4-3/10036. It contains the required information:

- information about the newly created payer (business form, company name or full name of an individual entrepreneur, contacts, details);

- type of activity of the businessman, his OKVED code;

- name of the facility from which trade occurs;

- its location (exact address);

- data on the right to trade (permit number, ownership of a stationary point, etc.);

- procedure for calculating the payment amount;

- benefit (if applicable).

REFERENCE! The notification form for tax registration, changes to certain indicators, or deregistration is the same: you just need to check the box provided for this at the top of the recommended form.

The fiscal authorities, having accepted the notification from the entrepreneur, confirm this by issuing him a special certificate (clause 3 of Article 416 of the Tax Code of the Russian Federation), which the entrepreneur will receive within 5 working days.

Businessmen have the opportunity to draw up any type of notification in electronic form, using the service of the website of the Federal Tax Service of the Russian Federation, and deliver it to the tax authority via the Internet or directly in paper form.