Procedure for conducting operations

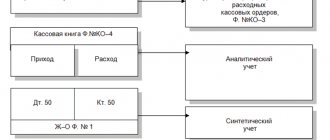

The receipt of cash into the organization is formalized by an incoming cash order (form KO-1), and the issuance of money - by an outgoing order (form KO-2). Each incoming and outgoing order is recorded in the order register (form KO-3) and in the cash book (form KO-4). Individual entrepreneurs have the right not to keep a book.

The maximum possible amount of cash in the cash register is called the cash limit. It is calculated by the organization independently, based on the daily volumes of cash receipts and cash disbursements.

Individual entrepreneurs and legal entities belonging to small businesses may not set a cash limit by writing this down in their accounting policies.

How to calculate the cash limit

The appendix to document No. 3210-U dated 11/03/14 of the Bank of the Russian Federation offers two options for calculating the cash limit:

- by the volume of cash received at the cash desk;

- by the volume of cash dispensed from the cash register.

The calculation formulas are as follows:

- L1 = V / P * Nc – “according to the volume of receipt”;

- L2 = R / P * Nn – “according to the volume of issue.”

Here L1 and L2 are the calculated limits, V and R are the amount of cash receipts and withdrawals, Nc and Nn are the time period in the river. days between the moments of depositing proceeds and receiving money from the bank by check, respectively. It cannot exceed 14 rubles. days; P – settlement period for which the amount of cash receipts or withdrawals is taken into account. It cannot be higher than 92 rubles. days. The calculation “by volume of issue” excludes days and amounts of salary payments and other payments to employees of a “salary” nature.

Example. The organization sets a cash limit. The calculation period was December of last year. It has 21 working days. The limit is calculated according to the first option, the amount of cash proceeds received is 550,000 rubles. Proceeds, by agreement with the bank, are surrendered every 3 days.

550000 / 21 * 3= 78571 rubles – cash register limit.

The limit on the issuance volume is calculated in the same way.

Over-limit amounts at the end of the day are calculated by subtracting the established limit and unpaid wages from the actual cash balance.

The excess balance may be exceeded on the following days:

- issuing wages (no more than 5 days);

- weekends and holidays (cash is deposited on the first day).

If a legal entity has separate divisions, the total limit is calculated taking into account the limits in separate divisions.

The cash limit may not be calculated by individual entrepreneurs and representatives of small businesses.

How can a small company organize cash accounting ?

Accounting of transactions

If the organization has a cash register, accounting is carried out on the basis of PKO and RKO. If there are separate divisions, a cash book is opened in each. A copy of it is sent daily to the head office.

The most typical entries for cash transactions:

- D 50.01 K 51 - cash was withdrawn from the current account;

- D 50.01 K 90 - retail revenue received;

- D 50.01 K 62 - advance received from the buyer;

- D 50 K 71 - return of funds by the accountable person;

- D 50.01 K 73 - repayment of employee loans;

- D 50.01 K 75 — founder’s contribution;

- D 50.04 K 76.09 - acceptance of payments from the population to the cash desk of the paying agent;

- D 51 K 50 - cash was deposited into the current account;

- D 57 K 50 - collection of cash proceeds through a bank terminal;

- D 70 K 50 - wages were paid to employees;

- D 73 K 50 - financial assistance was paid to the employee;

- D 71 K 50 - money was issued to the accountable person;

- D 94 K 50 - the lack of funds in the cash register is reflected.

The concept of cash, the main tasks of accounting

Modern economics defines money as one of the main attributes of economic activity. Settlements with suppliers for purchased raw materials, purchase of fixed assets, settlements with the budget for taxes and fees, all this and much more involve the use of cash. In addition, money is the most important element in the circulation of funds of an enterprise.

The origin of the concept of "money" refers to the ancient Greek word "donaka", which translates as "copper coin". This concept came into the Russian language from Turkic languages.

Since ancient times, the circulation of goods implied barter relations, that is, the exchange of a certain amount of one product for another. Later, among different nationalities, precious stones, gold, skins, furs, metal, etc. began to act as a general equivalent for the exchange of goods. The first coins appeared in the 7th century BC, and the first paper money in China in 910 AD. e.

The essence of the concept of “money” is revealed in more detail in economic theory and is defined as a measure of value, as a commodity with absolute liquidity.

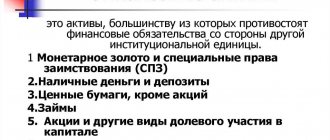

Within the framework of accounting, this concept is interpreted as follows. Conceptual help!

Cash is the funds of an enterprise accumulated in monetary form, in circulation and used to achieve business goals.

Cash at an enterprise can be in the following forms (types of cash):

- cash:

- cash in the cash register;

- non-cash (cash in bank accounts):

- current accounts;

- foreign currency accounts;

- loan accounts;

- special accounts.

The objectives of cash accounting in an enterprise are as follows:

- Reflection in primary documents of transactions for the receipt and expenditure of funds;

- Generating data on cash flow transactions in synthetic and analytical accounting registers;

- Ensuring the safety of funds, conducting inventories;

- Monitoring the economic feasibility of spending, identifying ways for the most rational use.

Cash control discipline in 2020–2021

Cash control (or cash) discipline is compliance by legal entities and individual entrepreneurs with the rules for making cash payments legally established in the Russian Federation.

Cash payments include all types of income and expense transactions carried out by a company or individual entrepreneur with cash. The broadest concept for cash payments is the concept of a cash desk (operating cash desk), through which a company or individual entrepreneur makes cash payments. Most often, these are operations such as payment of salaries, receipt and delivery of money to the bank, settlements with accountable persons, issuance and repayment of loans. The cash register may also receive cash proceeds.

Receipt of cash proceeds obliges the use of cash register equipment (Clause 1, Article 1.2 of the Law “On Cash Register…” dated May 22, 2003 No. 54-FZ). Although in some cases its non-use is allowed:

- Legal entities and individual entrepreneurs when carrying out certain types of activities (clause 2 of article 2 of law No. 54-FZ).

- Legal entities and individual entrepreneurs when carrying out activities in conditions that impede the use of cash register systems (Clause 3, Article 2 of Law No. 54-FZ).

- Individual entrepreneurs engaged in providing services, performing work or selling goods of their own production, who do not have employees - until 07/01/2021 (Law dated 06/06/2019 No. 129-FZ).

For a complete list of cases when it is allowed to work without a cash register, with explanations of ambiguous points, see ConsultantPlus. Trial full access to the system is provided free of charge.

The number of cash registers or other points for receiving money in ways that allow the non-use of cash registers is not limited. But at the end of the working day, the received revenue must be credited to the cash desk of the company or individual entrepreneur.

Thus, compliance with cash discipline in 2020–2021 involves compliance with the rules for conducting income and expense transactions carried out at the cash register of a legal entity or individual entrepreneur, and the rules for working with cash registers or documents that are drawn up when cash registers are not used.

Cash discipline is mandatory for everyone.

What you need to know about working with CCP

The requirements for the CCP used in 2020–2021 are determined by the updated law No. 54-FZ.

From 02/01/2017, only new-style cash registers (online cash registers) began to be registered with the Federal Tax Service. From July 1, 2019, this type of cash register became mandatory for use by almost all business entities.

Online cash registers are fundamentally different from previously used cash registers with a fiscal drive. Accordingly, the requirements for them are completely different.

For general requirements that online cash registers must meet, read the article “Where and at what price can you buy an online cash register?” .

The problems that arise during their work also became different.

You will find answers to many questions related to the use of online cash registers in our section “Online cash registers KKT KKM”.

Cash payment limit

The previous rules for cash payments were approved by the instructions of the Central Bank of October 7, 2013 No. 3073-U.

They became invalid on April 27, 2021. From April 27, 2021, new rules for cash payments in the Russian Federation are in effect, which were approved by the instructions of the Central Bank of December 9, 2021 No. 5348-U.

When giving out money from the cash register, remember the maximum amount for cash payments. Cash payments are limited for:

- between organizations;

- between the organization and the individual entrepreneur;

- between IPs.

The limit for cash payments in the amount of 100,000 rubles (or an equivalent amount in foreign currency) under one agreement was this according to the old rules (in accordance with Directive No. 3073-U), and it remained so under the new Directive No. 5348-U.

The limit for cash payments under one contract (no more than 100,000 rubles) should also be observed if the contract has expired and the settlements under it have not yet been completed and the buyer still has an outstanding debt.

If you violate the established cash payment limit, you may be fined. The amount of the fine is from 40,000 to 50,000 rubles. For the same violation, an administrative fine in the amount of 4,000 to 5,000 rubles may be imposed on the head of the company (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

What should you do if the amount under an agreement that requires cash payment is more than 100,000 rubles?

Even if it is 100,001 rubles, you will be fined. You can pay not under one, but under two different agreements (for example, under one agreement 50,000 rubles, and under the second - 51,000 rubles). In this case there will be no violation.

Issuance of cash to accountable persons

Accountable money is money that is given to accountable persons (employees) for business trips, entertainment expenses and business needs.

You can issue money on account based on an application from an employee or an order from the director

(other administrative document). An order or instruction is drawn up in any form, but it must contain the following data:

- Last name, first name and patronymic of the accountable person;

- Document Number;

- amount to be issued;

- term;

- purpose (optional);

- date, signature.

If an application is drawn up, the employee must indicate almost the same data: the amount of money, the purpose for receiving it and the period for which it is taken. The application is written in any form and must be signed by the manager (IP).

If an employee has spent his personal money, then he needs to compensate for it; in this case, a statement is also written, but with a different wording (samples of statements).

Within 3 working days

after the end of the period for which the funds were issued (or from the date of return to work), the employee must submit an

advance report

with documents confirming the expenses made (cash register receipts, sales receipts, etc.).

Otherwise, funds issued to the employee cannot be counted as expenses and the tax can be reduced accordingly. Moreover, if there are no supporting documents, then personal income tax will have to be withheld from the amount issued and insurance premiums must be paid.

Note

: Until August 19, 2021, it was prohibited to issue money on account to employees who had not reported on previous advances. But now this rule has been canceled.

How is cash discipline checked?

Checking cash discipline in 2020–2021 is carried out by decision of the head of the Federal Tax Service in the manner established by order of the Ministry of Finance of the Russian Federation dated October 17, 2011 No. 133n. During the verification process, the following are studied:

- All documents that are related to the execution of cash transactions.

- Fiscal memory reports.

- Documents for the purchase, registration and maintenance of cash registers.

- Documents related to the acquisition, accounting and destruction of BSO.

- Accounting registers of accounting or business transactions.

- Order for cash balance limit.

- Expense reports.

At the same time, inspectors are given unlimited access to the cash register, including its passwords and cash.

During the inspection, any other documents related to the subject of the inspection, as well as explanations, may be requested.

Find out how a bank checks cash discipline in the Ready-made solution from ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Results

Acceptance of cash proceeds, as a rule, obliges the recipient to have a cash register that issues a document confirming the acceptance of the corresponding amount. Currently, a new type of cash registers - online cash registers - have become mandatory for use. They generate not only cash receipts, but also BSO. Accordingly, the requirements for new cash registers and the documents issued by them have changed.

There are no changes in 2020–2021 regarding the documents generated by the operating cash desk. Just as there are no changes in the authority that checks the state of cash discipline (i.e. compliance with the rules for working with cash), it remains the Federal Tax Service Inspectorate. Despite the limited period for bringing to justice for violations when working with a cash register, the detection of such violations is fraught with consequences in the form of an on-site tax audit.

Administrative liability itself has been significantly increased since 2021: the amount of fines has increased, the types of liability for non-use of cash registers have been expanded, and in connection with the start of work with a new type of cash register equipment, new grounds for prosecution have been introduced.

Sources:

- Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making payments in the Russian Federation”

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Labor Code of the Russian Federation

- Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control”

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Online cash register transactions

On July 1, 2019, the last stage of introducing online cash registers into the cash payment system, which began on July 1, 2017, is completed (FZ-54 dated May 22, 2003). It should be said right away that there have been no changes in accounting for the operating cash desk in connection with the introduction of online cash services. The procedure for documenting and conducting cash transactions, as before, is regulated by document No. 3210-U.

At the same time, significant changes and additions to the previously existing order have been introduced. The use of online cash registers is regulated by Federal Law 54 itself and by-laws adopted on the basis of its provisions.

Rules for cash payments established by the Central Bank of the Russian Federation.

Today there is no need to maintain:

- acts KM1-KM3, KM9 (on transferring cash meter readings to zero, on taking meter readings when transferring the cash register for repairs, on returning money, on checking cash);

- logs KM4, KM5, KM8 (cashier-operator, recording meter readings, recording calls from technical specialists);

- reports and references KM6, KM7 (cashier-operator, about meter readings and revenue).

According to Federal Law-54, the following are formed (Article 4.1-4):

- shift opening/closing reports;

- report on closing the fiscal drive;

- cash correction check;

- operator confirmation, etc.

Transactions of cash receipts, issuance and receipt of money, and their returns are recorded. Cash revenue is credited to the operating cash register by issuing PKO on the basis of the shift closure report, an analogue of the previously used z-report.

Important! There are organizations and entrepreneurs that are completely exempt from the obligation to use an online cash register. Their list contains Article 2 of Federal Law-54.

Briefly

- Accounting for cash transactions is carried out on account 50, in correspondence with the cash receipts and expenses accounts.

- The main documents of the cash register are incoming and outgoing cash orders and a cash book.

- With the introduction of new technical means into economic circulation - online cash registers, cash accounting has not undergone significant changes, but the possibilities for cash accounting have expanded.

- For small businesses and individual entrepreneurs, the legislator provides the opportunity not to set a cash limit, and entrepreneurs may not maintain cash documents. This is possible if, for the purposes of financial accounting, they keep records of the indicators required in accounting for financial accounting - physical or monetary.

Money from the cash register for personal needs

Everything that an organization earns is its property. Therefore, even if there is only one founder in an LLC, he still does not have the right to dispose of the organization’s money at his own discretion. Accordingly, the founders cannot take cash from the cash register for their personal needs.

Individual entrepreneurs, unlike LLCs, have the right to take cash from the cash register or withdraw it from a current account at any time. The amounts that an individual entrepreneur can spend on his personal needs are not limited (the most important thing is to avoid arrears in paying taxes and insurance premiums).

Note

: if the individual entrepreneur has not issued an order canceling the maintenance of cash documents, then when receiving cash from the cash register, he needs to draw up a cash settlement with the wording:

“Issue of funds to the entrepreneur for his own needs”

or

“Transfer to the entrepreneur of income from current activities

.

Responsibility for conducting cash transactions with violations

Responsibility for violation of cash discipline is administrative. Terms of involvement in it (Article 4.5 of the Code of Administrative Offenses of the Russian Federation):

- 2 months - for offenses not related to CCP;

- 1 year - for violations of work with cash register systems (from July 15, 2016).

Important! ConsultantPlus warns This period begins to be calculated from the day the offense was committed, and in the case of a continuing offense - from the day it was discovered by the inspector (Parts 1, 2 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). A continuing offense should be understood... Read more about the nuances of the limitation period for fines for cash register transactions in K+. This can be done for free.

A timely detected violation will lead to fairly high fines, since by Law No. 290-FZ, starting from 2021, fines for violation of cash discipline, or more precisely, liability for non-use of cash registers, have been seriously increased. Administrative liability for non-use of cash registers entails:

- a fine for officials in the amount of 25 to 50% of the settlement amount made without the use of cash register systems, but not less than 10,000 rubles;

- a fine for legal entities in the amount of 75 to 100% of the settlement amount made without the use of cash register, but not less than 30,000 rubles. (clause 2 of article 14.5 of the Administrative Code).

If an organization or individual entrepreneur is caught a second time for not using the cash register, then in the case where the amount of settlements without using the cash register is (including in the aggregate) 1 million rubles. and more, this will entail:

- disqualification of officials for a period of 1 to 2 years;

- suspension of activities for up to 90 days for individual entrepreneurs and organizations (clause 3 of article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for violations of cash discipline in 2020-2021 in the form of the use of cash registers that do not meet established requirements, the use of cash register equipment used in violation of the procedure established by the legislation of the Russian Federation and the conditions for its registration and re-registration provides for liability in the form of:

- warning or fine in the amount of 1,500 to 3,000 rubles. for officials;

- warning or fine in the amount of 5,000 to 10,000 rubles. for legal entities (Article 14.5 of the Code of Administrative Offenses of the Russian Federation, paragraph 15 of Article 7 of Law No. 290-FZ).

Law No. 290-FZ introduced other grounds for holding people accountable for violations in the use of cash register systems. For example:

- for failure to send the buyer a cash receipt or strict reporting form in electronic form or for failure to transfer these documents on paper at the buyer’s request;

- responsibility has been introduced for fiscal operators, cash register manufacturers, and expert organizations.

But even if, at the time of the cash discipline check, the INFS is unable to hold the violator accountable in the form of an administrative fine (due to the expiration of the statute of limitations), there is no need to rejoice. Detection of violations in the use of cash register systems will serve as a reason for closer attention to the taxpayer and, if any other problems are identified in his work, may lead to an early on-site inspection. The clear interest of tax authorities will be caused by the incompleteness and untimely recording of revenue, as well as the identification of inconsistencies between documentary and actual cash balances in the cash register.

You can learn how you can avoid liability for an offense or reduce the fine from the Ready-made solution from ConsultantPlus. Follow the link and get trial access to K+ for free.

The fact of issuing large sums of money on account for unreasonably long periods may lead to additional personal income tax assessment on these amounts (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 14376/12).