Net operating profit after taxes will help determine the level of efficiency of a business project. For investors and founders, this is the main indicator of a company’s profitability and investment attractiveness. The management of an enterprise can influence the amount of generated profit through:

- increasing profitable operations by increasing trade turnover;

- rationalization of variable costs through the introduction of innovative technologies, optimization of logistics routes;

- minimizing overhead costs.

Composition, display, increase in operating profit

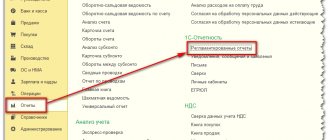

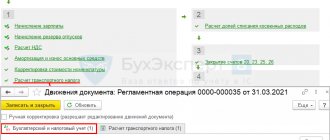

OP includes 3 components: cost and volume of products sold, as well as its range. An OP is formed on the account. 90, and at the end of the month is written off to the financial result (DT 90.9 KT99). It is displayed in the financial results report (OKUD 0710002, Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010) on line 2200. This line is called, literally: “Profit (loss) from sales.” For comparison, EBIT, as is customary, is shown on page 2300.

In addition to EBIT, it is worth noting a number of analytical indicators that are in one way or another related to operating profit. First of all, these are OIBDA, EBITDA, EBI.

| Characteristics of indicators | ||

| EBITDA | OIBDA | EBI |

| Definition: EBITDA is the amount of profit before withholding expenses for taxes with interest, as well as depreciation with already accrued depreciation. Application: in conjunction with EBIT, it serves to assess the profitability and efficiency of an enterprise without taking into account depreciation transfers and regardless of debts | Definition: OIBDA is operating income together with depreciation of fixed assets and assets, which is calculated with the participation of operating profit. Application: it is recognized as the largest indicator of profitability than EBITDA, because, according to economists, non-operating expenses with income distort EBITDA | Definition: EBI is the difference between EBIT and interest accrued on the use of debt capital. Application: this is one of the key indicators of operating profit (NOP - net operating profit) |

It should be noted that some enterprises do not calculate OP. Nevertheless, it is a very productive, useful indicator, since it clearly shows the profitability of the enterprise, taking into account specific expenses made.

A positive result is an increase in the OP indicator. This indicates that the company's income exceeds its expenses. Overall, profit growth confirms intensive development. A similar effect is achieved through complex measures and actions aimed at at least reducing variable expenses.

Renewal, modernization of equipment, intensive labor, reduction of management costs, consumable standards of materials are a few components of the process that allows you to reduce the cost of 1 unit. goods. Along the way, they usually increase sales volumes, lowering product prices and thereby attracting buyers.

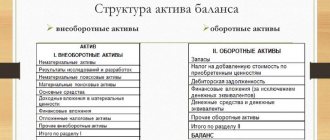

How are operating expenses reflected on the balance sheet?

It is impossible to see the amount of OR or OD in the balance sheet. Since these values are not included directly in the form lines, but affect the overall financial result for the period. Results from other activities are indicated on page 1370 of the balance sheet, where data on retained earnings (or uncovered loss) is reflected.

You can clarify information on the required indicators using the financial results report. The document has special lines for entering information on other income and expenses. These are columns 2340 and 2350. They provide generalized information for a given period. Detailed data is explained in the appendix to the financial statements, which reflects what revenues and expenses make up the indicators.

Note! When filling out pages 2340, 2350, you do not need to enter information on interest (to be paid or received), as well as on the company’s participation in the management capital of other persons. For these indicators, the report provides special lines - 2310, 2320, 2330.

What formula is used to calculate operating profit?

As mentioned above, OP is the difference between VP and OD expenses (or operating expenses). Therefore, the general formula for calculating OP will be as follows:

If we detail this formula taking into account the lines of the financial report. results, you get a slightly different calculation option:

Gross profit is an indicator of the profitability of an enterprise; it means the difference between revenue and the cost of goods (services) sold. At the same time, the cost of goods sold is calculated differently for manufacturers and trade.

As for operating expenses, they include: wages, transportation costs, rent and other daily expenses of the enterprise necessary for carrying out activities and producing products.

Thus, to calculate OP, it is enough to know the value of VP and operating expenses (OT). Let's say VP = 300,000 RUR. rub., and OT = 120,000 RUR. rub. This implies OP = 180,000 (300,000 – 120,000). The result is positive. If the calculation shows a negative result, this will indicate an operating loss.

Example 1. OP for selling watches

The store purchases watches from the manufacturer and displays them in its windows for sale. Buyers come to the store and buy the products offered. Let's assume that during the reporting period the store sold watches worth RUR 300,000. rub. This is the money that buyers paid for the watch. The actual cost of the watch sold (i.e. the price for which the store bought this watch from the manufacturer) is 150,000 rubles. rub.

It follows that gross profit (GP) = 150,000 RUR. rub. (300,000 – 150,000). This is the profit that the store received directly after selling the watch. Nothing has been deducted from it yet.

Meanwhile, the store was making expenses: on renting premises (Russian rubles 25,000), staff salaries (Russian rubles 45,000). Accrued depreciation and depreciation (for display cases, cash register) in the amount of RUR 3,000. RUR. Other utility expenses amounted to RUR 2,000. rub.

If all the listed expenses are subtracted from the VP, you get the OP: 150,000 – 25,000 – 45,000 – 3,000 – 2,000 = 75,000 RUS. rub. This is the profit received by the store from trading operations.

Example 2. Calculation of EP for the year based on information from the financial statements of the Rosfrezer enterprise

The Rosfrezer manufacturing enterprise produces drills for machine tools. It is necessary to calculate the OP indicator for the year using the VP value and information on expenses made during the specified period. The data used in the calculation is conditional. The calculation is made using the general formula (VP–OT).

| Indicator name | Line in finance. report | Annual data |

| VP | 2100 | 90 000 |

| Commercial expenses (CT) | 2210 | 6 000 |

| Management expenses (UT) | 2220 | 20 000 |

In the proposed example, OP = 90,000 – 6,000 – 20,000 = 64,000.

What does the term "operational analysis" mean?

There is such a thing as “operational analysis”. What is noteworthy is that this type of analysis is considered a trade secret and is not disclosed to third parties. This method is based on calculation and the study of several basic indicators and is used in management accounting. In particular, the following are subject to study:

- profitability threshold or break-even point or critical volume of production, sales (revenue received by the enterprise, which covers all expenses with zero profit), i.e. the enterprise in this situation has neither profit nor damage;

- operating leverage or production, operating leverage (the ratio of variable and fixed expenses, which influences the OP in a certain way, reflects the excess of the growth rate of profit over revenue);

- margin of financial strength, an indicator of financial stability (the excess of revenue received from the sale of goods over the profitability threshold shows to what extent production can be reduced so as not to incur losses).

In addition, in the process of operational analysis, gross margin ratios (GMR) and changes in gross sales (CGSP) are calculated. The first indicator (KVM) shows how capable the enterprise is of covering its own fixed expenses and, accordingly, receiving OP, i.e., sales profitability. The second (CIVP) allows you to analyze the dynamics of change. It can be used to characterize changes in the volume of gross sales that occurred in the current and previous periods.

Operational analysis is used in planning and forecasting the operation of enterprises. With its help, you can find out the most acceptable prices for products, the most profitable, cost-effective and most unprofitable products, the most significant spending lines and ways to influence them, etc. This is a kind of search for the most optimal suitable combinations between variable expenses, cost and sales volumes.

The OP indicator is used as one of the important components of this analysis. With his participation, they also determine the profitability of products by type, the influence of cost on pricing, the margin of financial strength of the enterprise, the minimum permissible volume of production (sales) corresponding to the break-even point, the influence of production volumes on expenses, etc.

Operational analysis is often called break-even analysis. This name speaks for itself. With its help, you can calculate the required number of sales at which the company will have neither loss nor profit. To survive in the current financial situation, the company needs to overcome and exceed this break-even point.

Income Statement Analysis

AGREEMENT OFFER FOR THE PROVISION OF INFORMATION SERVICES 1. GENERAL PROVISIONS 1.1. The “Fin-plan.org” project, represented by the individual entrepreneur Vitaly Vladimirovich Koshin, OGRNIP 31658350005774, INN 583708408904 (hereinafter referred to as the Contractor), with this public offer invites any individual or legal entity, as well as an individual entrepreneur (hereinafter referred to as the Customer), to conclude an Offer Agreement (hereinafter referred to as the Offer ) for the provision of information services for online training.

1.2. in accordance with paragraph 2 of Article 437 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), in case of acceptance of the conditions set out below and payment for services, the person accepting this offer becomes the Customer (in accordance with paragraph 3 of Article 438 of the Civil Code of the Russian Federation, acceptance of the offer is tantamount to concluding an agreement on the terms stated in the offer).

1.3. Full and unconditional acceptance of this offer is the Customer’s payment for the Services offered by the Contractor. In relation to the Services offered by the Contractor under promotions (special offers, if any) with terms of payment in installments, full and unconditional acceptance of this offer is the Customer’s payment of the first part of the amount agreed upon by the parties.

1.4. The Contractor and the Customer provide mutual guarantees of their legal capacity and capacity necessary for the conclusion and execution of this Agreement for the provision of information services.

2. DEFINITIONS AND TERMS

2.1. For the purposes of this Offer, the following terms are used in the following meaning:

Offer is a real public contract for the provision of information services to the Customer.

Website – Internet sites: and https://invest-razum.ru, as well as all related “subdomains” used by the Contractor as property.

Information services – the Contractor’s services for conducting Online training for the Customer in accordance with the selected Event Program and the paid Information Package.

Online training is an information service of the Contractor, which, depending on the selected Event Program and the paid Information Package, includes: A. Providing limited access to the Customer’s training materials on the Site (videos, articles, files, links) in accordance with the terms of the Offer. The scope of training materials is determined by the Contractor independently and is described in the Training Program. The volume of training materials and the materials themselves can be changed in order to update the information at any time at the discretion of the Contractor. B. Participation of the Customer in thematic discussions in the format of online Skype sessions. B. Providing the Customer with homework to practice skills and consolidate knowledge. D. Checking homework; related analytical services of the Contractor. D. Related information services of the Contractor in the form of consultations (by mail, by phone, by Skype, personal consultations). The form and necessity of providing related information services are determined by the Contractor independently.

The event program is a list of issues that will be disclosed during the provision of information services (hereinafter referred to as the Program).

Programs are published on the Site. Information package – a set of services that will be included in addition to a particular training program (hereinafter referred to as the Package). The description of the Packages is published on the Site on the page of the corresponding Program.

3. SUBJECT OF THE OFFER

3.1. The subject of this Offer is the paid provision of Information services to the Customer by the Contractor in accordance with the terms of this Offer by organizing and conducting online trainings.

3.2. The cost of the Information Service varies for different Programs and for different Packages. The cost of various Information Service Packages is determined on the corresponding Internet pages of the Site.

4. TERMS OF PROVISION OF INFORMATION SERVICE

4.1. The Contractor provides limited access to the Customer to the Information Service posted on the Site (provides access to a closed area of the site by transferring access passwords), subject to 100% prepayment of this service. In case of payment in installments or in installments (if there is a corresponding promotion), access to the Online Training materials is provided gradually as the corresponding parts of the package are paid for (in accordance with the parameters of the promotion).

4.2. Payment for the Information Service occurs by transferring funds by the Customer to the Contractor's bank account in one of the following ways: - Payment by bank card or electronic money (Yandex Money) via the Internet through Internet acquiring and/or third-party payment services (Yandex Cash Desk). — Payment according to the details from clause 11 of this Offer to the Contractor’s bank account. — Payment in cash to the Contractor's cash desk. — Payment by other means by prior agreement with the Contractor.

4.3. Participation in the Online Training is confirmed by filling out the appropriate application for participation and making payment. The links and passwords necessary to access the materials are provided to the Customer by sending them to the Customer’s email address specified by him when filling out the application for participation in the training.

4.4. If within 2 business days the Customer, for one reason or another, has not received access to the Information Service, he must contact the Contractor’s support service in writing at the address or call the phone number listed on the Site in the “Contacts” section.

4.5. The Contractor undertakes to provide the Customer with an Information service by organizing and conducting online training within the period specified on the Site, or by providing the Customer with access to a closed area of the site within 2 days from the date of receipt of funds to the Contractor’s account.

4.6. This agreement has the force of an act of provision of services. Acceptance of services provided is carried out by the Customer without signing the corresponding act.

4.7. The Contractor reserves the right to cancel the Customer’s participation in the training without refunding the paid fee if he violates the rules of conduct during the training. These violations are: inciting ethnic conflicts, insulting other training participants, insulting the leader and/or employees of the training project, repeated (more than two times) deviation from the topic of the training, advertising of any kind, obscene statements, dissemination of information that is deliberately false, as well as other actions that may be regarded by the presenter as actions that insult him and other training participants.

4.8. The Contractor reserves the right to cancel the Customer’s participation in the training (without returning the funds paid by the Customer) if it is established that he transferred the training materials to third parties, the Customer distributes information and materials received in connection with participation in the training to third parties, including for a fee. The use of information and materials is permitted only for personal purposes and for the personal use of the Customer.

5. CUSTOMER REGISTRATION ON THE SITE

5.1. Providing the Information Service to the Customer is possible subject to the creation of an appropriate account on the Site. An account (registration account) is created at the time of purchase and must contain the Customer’s real last name, first name, patronymic, email address and telephone number.

5.2. Registering an account is done by filling out the registration form. The registration form must include your true first name, middle name, last name, email address, and available phone number.

5.3. The customer is responsible for the confidentiality of the password. If the Customer establishes facts of unauthorized access to his account, he undertakes to notify the Contractor’s support service about this circumstance as soon as possible at the address or telephone number indicated on the Site in the “Contacts” section.

6. RIGHTS AND OBLIGATIONS OF THE CONTRACTOR

6.1. The Contractor undertakes to provide the Customer with round-the-clock access to the Site using the Customer’s account (except for short-term and rare cases of preventive maintenance on the Site, Site hosting) for the entire duration of the Site’s existence.

6.2. The Contractor is responsible for storing and processing the Customer’s personal data, ensures the confidentiality of this data during their processing and uses it exclusively for the high-quality provision of Information services to the Customer.

6.3. The Contractor guarantees to provide the Customer with complete and reliable information about the service provided upon his request.

6.4. The maximum duration of online training is 365 days from the date of payment. After this period, participation in Skype sessions, as well as checking homework (if these services were purchased as part of the relevant Package, but were not provided within 365 days from the date of payment) can only be carried out for an additional fee and subject to availability from the Contractor resources and time. At the same time, access to online training materials remains open to the Customer throughout the existence of the Site.

6.5. If the Customer, for reasons independent of the Contractor, was unable to use the online training materials, the information service is considered provided.

6.6. The Contractor reserves the right at any time to change the duration of the training and the terms of this Offer unilaterally without prior notice to the Customer, publishing these changes on the Site no later than 5 days from the date of their introduction (acceptance). At the same time, the new conditions apply only to newly concluded contracts.

6.7. The Contractor has the right to block the Customer’s account if he violates the training rules (clauses 4.7, 4.8 of this Agreement) without returning the paid fee.

7. RIGHTS AND OBLIGATIONS OF THE CUSTOMER

7.1. The Customer is obliged to provide reliable information about himself during the process of creating an account (registration) on the Site.

7.2. The Customer undertakes not to reproduce, duplicate, copy, sell, or use for any purpose the information and materials made available to him in connection with the provision of the Information Service, with the exception of personal use.

7.3. The customer has the right to apply the acquired knowledge and skills in practice.

7.4. The Customer is obliged to maintain in good technical condition the equipment and communication channels that provide him with access to the Site, to have functioning Internet access, and to log into the Site under his account from only one device at a time (personal computer, tablet, phone). Violation of this clause may be regarded as the fact of transfer of access to third parties (clause 4.8.) and lead to cancellation of access to online training materials.

8. CONSIDERATION OF CLAIMS. A REFUND

8.1. The Contractor is not responsible for non-provision (poor quality provision) of the Information Service for reasons beyond the control of the Contractor.

8.2. Refunds are not provided if the Customer does not apply the acquired theoretical knowledge in practice. Also, refunds are not made after the Customer receives access to the closed training site (that is, receives passwords for access to the closed area of the site where the training records are located) and the information located on it. These conditions are unconditionally accepted by the Parties.

8.3. Refunds are made by the Contractor if the Customer made a 100% prepayment for receiving the Information service, but the Contractor refused to provide the information service to the Customer for any reason.

9. RESPONSIBILITY OF THE PARTIES

9.1. The Contractor and the Customer, taking into account the nature of the service provided, undertake in the event of disputes and disagreements related to the provision of the Information service, to apply the pre-trial procedure for resolving the dispute (negotiations, correspondence). If it is impossible to resolve the dispute out of court, the parties have the right to apply to the court of the city of Penza.

9.2. For failure to fulfill or improper fulfillment of obligations under this Offer, the parties are liable in accordance with the legislation of the Russian Federation.

10. QUALITY GUARANTEES OF INFORMATION SERVICE

10.1. The Customer, by accepting the terms of this Offer, also assumes the risk of non-receipt/shortage of profit and the risk of possible losses associated with the use of knowledge, skills and abilities acquired by the Customer during the provision of the Information Service.

10.2. Guaranteeing the successful application of the acquired knowledge, skills and abilities, as well as the receipt by the Customer of the Information Service of a certain profit (income) with their use (sale) in a certain or indefinite future, the Contractor is not responsible for non-receipt of profit (income), receipt of profit (income) below expectations of the Customer, as well as for direct and indirect losses of the Customer, since the success of the Customer’s use of the acquired knowledge, skills and abilities depends on many factors known and unknown to the Contractor, such as: dedication, hard work, perseverance, level of intellectual development, creative abilities of the Customer, and his other individual qualities and personal characteristics, which is unconditionally accepted by both parties.

11. VALIDITY OF THE OFFER. FINAL PROVISIONS

This Offer comes into force from the moment of publication on the Site on the Internet and is valid until the Offer is withdrawn/changed by the Contractor.

Name of organization Individual entrepreneur VITALY VLADIMIROVICH KOSHIN

TIN 583708408904

OGRN 316583500057741

Current account 40802810400000005323

Bank JSC Tinkoff Bank

Legal address of the Bank Moscow, 123060, 1st Volokolamsky proezd, 10, building 1

Corr. Bank account 30101810145250000974

Bank INN 7710140679

BIC Bank 044525974

What mistakes should be avoided when determining the OP indicator

The OP indicator is not very often found in practice. Some generally believe that it is not typical for Russian booze. accounting, because it is not displayed in accounting. balance. It is often mixed up and confused with other economic indicators. But, since this is still profit, more precisely, one of the types of profit that shows and characterizes the financial result of the enterprise, it is not appropriate to ignore it. And in order to avoid mistakes, you should take note of the following facts.

Fact one. Revenue is often identified or confused with profit. These are two completely different concepts. Revenue is all the cash receipts that an enterprise receives from various available sources (sale of goods, services). Profit is the economic benefit of an enterprise, which involves a reduction in revenue received for certain expenses.

For example, if you subtract the cost of a product from revenue (that is, all the expenses that went into its production), you will get gross profit. Further, if the cost of production, as well as commercial and administrative expenses are subtracted from the revenue, the result will be operating profit.

Fact two. All economists are familiar with net profit, but even it is sometimes identified with operating profit. An emergency is always the final financial result of an enterprise. This is the part of the profit remaining after payment of all mandatory budget payments and which can be distributed (to dividends, funds). It is significantly influenced by the volume of VP and tax amounts. OP is profit only from operating, core activities. The OP does not take into account expenses and income that are not related to the named activity, as well as taxes with financing (see the definition and characteristics of this indicator above).

FINANCIAL COSTS

See what “FINANCIAL COSTS” is in other dictionaries:

- FINANCIAL COSTS - costs incurred as a result of attracting or using funds, costs of funds. Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.. Modern economic dictionary. 2nd ed., rev. M.: INFRA M. 479 p.. 1999 ... Economic Dictionary

- financial costs - Costs incurred in the process of attracting or using funds. Topics: accounting... Technical Translator's Guide

- FINANCIAL COSTS - (see FINANCIAL COSTS) ... Encyclopedic Dictionary of Economics and Law

- COSTS OF CIRCULATION - total social costs associated with the circulation of goods. As a rule, COSTS OF CIRCULATION are understood as the current costs of wholesale, supply, household, intermediary, commission, trading and other commercial organizations... ... Financial Dictionary

- Financial Costs - See Borrowing Costs Dictionary of Business Terms. Akademik.ru. 2001 ... Dictionary of business terms

- distribution costs - NDP. trade costs A monetary estimate of the costs incurred by the seller in the process of moving goods to the buyer over a certain period of time. Note There are material, financial, labor and other costs. ... ... Technical Translator's Guide

- financial costs - costs incurred as a result of attracting or using funds, costs of funds ... Dictionary of economic terms

- COSTS, FINANCIAL - costs incurred in the process of attracting or using funds ... Large accounting dictionary

- COSTS, FINANCIAL - costs incurred in the process of attracting or using funds ... Big Economic Dictionary

- Distribution costs are a monetary assessment of the costs incurred by the seller in the process of promoting goods to the buyer over a certain period of time. There are material, financial, labor and other costs... Encyclopedic dictionary-reference book for enterprise managers