Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

For each organization, it is important to maintain two legally established types of accounting. Each of them has its own goals and objectives. What is the difference between accounting and tax accounting?

First, the purposes of record keeping differ. Accounting provides information about the results of activities to the management of the organization and stakeholders. Tax accounting allows fiscal authorities to control the completeness of tax payment, the reliability of reporting and the implementation of legislation on taxes and fees.

Secondly, appropriate legislation has been developed for taxation purposes, in particular the Tax Code. Accounting statements are maintained in accordance with federal law, PBU and other documents. It is legislative regulation that is the main reason for the differences.

Accounting concept

To understand the difference between accounting and tax accounting, let’s study each concept separately. Let's start with the first one.

Accounting (AC) is the regular documentation of all operations of a subject’s economic activity and the preparation of a financial report based on this information. In other words, this is a reflection of the enterprise’s activities, a complete picture of its financial situation.

This takes into account not only net profit, but also property owned by the company, accounts payable and receivable, and dividends. The main goal of accounting is to compile a report, based on the indicators of which one can judge the profitability of the activities of a particular enterprise. This information is important both for the manager himself and for third parties - creditors, investors.

In addition to drawing up a complete picture of the organization’s budget, accounting tasks include searching for reserves, monitoring implementation and compliance with legal norms, and minimizing exit risks.

Individual entrepreneurs and small enterprises are exempt from the responsibility for accounting. Large companies must conduct accounting without fail. By law, the following may be involved in preparing a statement of financial position:

- chief accountant officially employed by this company;

- director of the enterprise;

- third-party organizations specializing in accounting (an appropriate agreement is required).

Their activities should include documenting all transactions, evaluating any company property in monetary terms, drawing up double tables when indicating financial turnover (debit and credit columns, what are they - we wrote in this article), calculating the balance sheet - both the tax and tax authorities will be interested in this information counterparties.

There are two types of accounting management:

- standard - carried out entirely in accordance with the law, operated by LLCs and JSCs;

- simplified - allows you to take into account financial activities in a simplified mode, used in small or non-profit enterprises.

Regardless of the type, accounting is based on two principles - frequency, that is, the report is compiled monthly, quarterly and annually; monetary measurement of any company activity.

The circle of people for whom understanding of terminology is important

Accounting is carried out only by legal entities . Individual entrepreneurs and individuals have no obligation to maintain financial statements. Meanwhile, tax accounting is carried out not only by the owners of the enterprise, but also by individuals (for example, individual entrepreneurs) . In this case, it is important for them to report taxes on time, avoid delays, and accurately calculate interest on income (expenses) on which tax is calculated. This obligation (right) is assigned to the following categories of taxpayers:

- individuals engaged in business;

- individuals who wish to receive a refund of overpaid tax to the budget (for a purchased apartment, partially compensate for the costs of an apartment, treatment, education of children);

- employers acting as tax agents, etc.

When accounting and tax accounting are compared, the difference becomes obvious even to a layman. Both forms of financial reporting are considered a collection of summary information based on the results of work for the reporting period. But they are conducted according to different rules depending on the taxation system, regulations and changes in them. Is it fair for the data to be so different? Legislators made attempts to “smooth out” the conflicting information, but this project did not lead to a positive result. The result would be a violation of taxpayers' rights to benefits and preferences.

Tax breaks are created to support entrepreneurs and small businesses. As for the “true state of affairs,” the real picture of creditworthiness, profitability and solvency can be seen from the financial statements. It’s not called management documentation for nothing.

Tax accounting concept

Now let’s look at what tax accounting (TA) is and how it differs from accounting.

Tax accounting is also a systematic reporting of the financial activities of an enterprise, only here the data is needed to transfer it to the tax office and, accordingly, pay taxes on the basis of these reports.

Conclusion: the main purpose of accounting is to compile a complete summary of the company’s budget, while the purpose of tax accounting is to determine the income tax.

All companies - individual entrepreneurs, individuals, and LLCs - are required to maintain NU. There are no exceptions here. Even individuals who work for hire are required to maintain NU, only the counterparty employer does this for them. Both an accountant and the director of the enterprise can prepare data for the tax office.

All information about the company’s income and expenses for the current period is entered into the tax return - this is the main document for tax accounting. In addition to information about expenses and income, the declaration includes:

- accounting for tax benefits, if any, for a particular company;

- materials related to tax calculation;

- the amount of the final contribution to the Federal Tax Service for a specific period.

All financial transactions made by the company must be documented.

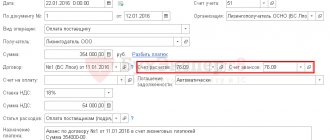

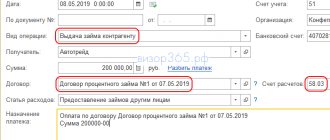

It is important that all papers are filled out correctly. They must contain the details of the parties involved in the monetary turnover, the full name of the company, the date of the agreement, the type of transaction, the income/expense that resulted from the transaction and the signatures of the responsible persons.

Differences in expense recognition

To recognize expenses, a certain list of conditions must be met. It will be different for accounting and NU. Let's consider the conditions for NU:

- Justification for spending.

- Availability of documentary evidence.

- Expenses are made for work that is needed to generate income.

List of conditions for accounting:

- Expenses were made on the basis of an agreement.

- The amount spent is certain.

- There are signs that the benefits will be reduced as a result of the operation.

If any condition is not met, then expenses cannot be recognized.

Main differences

Based on the above, it is already clear what the difference is between accounting and tax accounting. Firstly, these are the goals : for accounting - drawing up a complete picture of the company’s financial position; for NU - accounting only for those cash flows that appear when preparing a tax return.

Secondly, the obligation to maintain : individual entrepreneurs and individuals are exempt from accounting; everyone, without exception, maintains tax records.

Thirdly, for whom the reporting is prepared : accounting - for company participants and third parties interested, tax reporting - in fact, for the tax service.

In addition, two types of accounting differ:

- legislative framework;

- features of the recognition of income and expenses, due to which permanent and temporary differences occur in the two reports;

- creation of reserves.

Let's look at each criterion in more detail.

The legislative framework

All information about accounting is enshrined in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” . The rules for maintaining reporting at each stage are outlined in the PBU - an accounting regulation to which the law also refers.

As for NU, everything here is regulated by the Tax Code of the Russian Federation, in particular Article 313, which stipulates general provisions.

Accounting for income and expenses

Here the differences lie in two criteria at once. Firstly, not all income/expenses are recorded equally in tax and accounting, and secondly, the procedure for accounting for cash flow may differ.

Now, in order. When compiling the accounting system, absolutely all incoming and outgoing funds are taken into account. NU has a list of income/expenses that are not taken into account when compiling it.

For example, a transfer from contractors came in for 50 thousand rubles - this is the income of the enterprise. Of this amount, 10 thousand were allocated to pay workers; 6.5 thousand - personal income tax; 5 thousand - contributions to funds and 6 thousand rubles - payment for consulting services - these are all expenses.

operates under a simplified taxation system, which involves paying tax only on net profit, that is, “income minus expenses.” In accounting, to calculate net profit, we subtract all expenses from income and get:

50 000 – 10 000 – 6500 – 5000 – 4000 = 24 500

When drawing up the NU, consulting services will not be included in the list of expenses taken into account. Thus, the final net profit will be higher by 6 thousand rubles, which means the tax will be higher.

Important: income that is taxed is listed in Articles 246, 250, 346.15 of the Tax Code of the Russian Federation. Expenses that reduce tax deductions are in articles 254, 246.16. Non-taxable income is stated in Article 251, and expenses not taken into account when compiling the NU are in Article 270.

Two statements for the same period may not have the same amount of income. The differences can be permanent or temporary. The first are due to the fact that not all operations are taken into account when compiling the NU. The second ones have different accounting times for these operations.

Temporary differences are divided into two types:

- Deductible - the amount in NU is greater than in BU. In this case, a deferred tax asset (DTA) is formed. Its size is equal to the amount of the difference multiplied by the tax percentage.

- Taxable - the amount in NU is less than in BU. A deferred tax liability (DTL) is formed. It is calculated exactly the same.

Let's look at the example of accounting for depreciation, which will result in a taxable difference. For the needs of the company, a machine worth 1 million rubles is purchased. The useful life is set at 3 years. For calculations in BU, the cost of the car will be divided by the number of months for which it will be used (1,000,000 / 36 = 27,777 - the amount of monthly depreciation).

But when doing tax calculations, the picture turns out to be different. When compiling the NU, you can immediately write off 10% of expenses in the first month as a depreciation bonus. That is, 100 thousand are written off immediately as expenses (1,000,000 / 10). Accordingly, further monthly depreciation deductions will be calculated not from 1 million, but from 900 thousand (1,000,000 - 100,000), and will be equal to 25 thousand (900,000 / 36).

Then in the first month of using the car, the amount of depreciation in the BU will be 27,777 rubles, and in the NU - 125,000 (100,000 is the depreciation bonus, 25 thousand monthly depreciation). The taxable difference will be 97,223 rubles. The amount of deferred tax liability is 19,444 rubles (97,223 * 20%).

Starting from the next month, the expense in accounting will be higher than in tax accounting by 2,777 rubles (27,777 - 25,000), respectively, the difference will be reduced by this amount every month. And the tax liability will be repaid monthly by 554 rubles (2,777 * 20%).

Who cares about accounting data?

Financial data from accounting is very indicative for the owner of the enterprise and other interested parties. They fully characterize the profitability of the enterprise, the current state of the property base, and the movement of liabilities in tabular form. The report compiled for the quarter and year is important for making management decisions. It is interesting in this case:

- owners of the enterprise or the manager alone;

- investors who want to invest in a company;

- bank managers considering a loan application.

Creation of reserves

Another difference in reporting is the specifics of creating reserves. Reserves are created when accruing vacations and in the case of doubtful debts, for example, accounts receivable.

In accounting, reserves for vacations can be created in advance, with a “reserve”, but in NU - only for the reporting year.

As for reserves for doubtful debts, in tax accounting this type of reserve is used “optional”, but in accounting it is an obligation. Based on this, discrepancies may also arise between the two reports.

So, tax and accounting have different purposes. From here there arise not only differences in the compilation, but also in the displayed finances. It is impossible to judge a company’s budget only on the basis of NU, just as it is impossible to pay taxes only on accounting data.

Who is it intended for?

The answer to this question will provide important insight into how accounting differs from tax accounting. After all, it is not only the tasks that the activity is intended to solve that matter. It is equally important who becomes the final addressee of the information obtained during reporting.

So, you need to understand that the peculiarities of the organization of accounting are aimed at the fact that it is intended for the managers of the enterprise and those who are directly related to it. In addition, this information can be provided to potential investors or creditors if the owners are interested in raising additional funds and in this way seek to confirm solvency.