Correcting an error in the declaration

First of all, you need to make sure that the file name is identical to the identifier inside the file. The identifier should also not have the .xls extension at the end of the file. This is very important and can be the key reasons for the error.

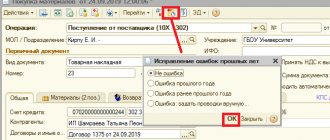

The error itself “The declaration (calculation) contains errors and has not been accepted for processing” with code 0000000002 when sending means that your calculations inside the document still contain inaccuracies. Therefore, open the document and double-check your data. When you do this and are one hundred percent sure that the calculations are correct and the document does not contain any errors, then you need to write a letter to technical support asking for help.

Similar error: 0400300003 The requirement for the presence of an element (attribute) depending on the value of another element (attribute) was violated.

When an updated declaration is required when errors with the specified codes are identified

After receiving from the inspectorate a request to provide explanations in connection with errors identified in the declaration, the question arises: can the taxpayer limit himself to submitting only explanations or is an updated declaration also required?

To answer it you need:

- take from the primary declaration submitted to the inspection the indicators of lines 040 and 050 of section 1 (information about the calculated amount of tax to be paid or reimbursed);

- analyze how the correction of errors affected the amount of tax indicated in these lines;

- If, after correcting errors, the tax payable to the budget turns out to be underestimated (the amount of compensation turned out to be overstated), it is mandatory to submit an updated declaration.

See also “Correcting errors - reducing VAT in the declaration.”

An updated declaration will not be required if there is no understatement of tax. But explanations must be provided:

- in the case when you did not find any errors in your declaration;

- when adjustments (caused by the identification of errors) did not affect the change in the tax base and the final amount of tax.

We talk about the rules for writing and submitting explanations when errors are identified in a VAT return, as well as the amount of fines for failure to submit them (or being late with explanations) here .

Technical support 1C reporting

If you have problems with the declaration, but you are confident in the correctness of your calculations and execution, then you need to write a report to 1C technical support. To do this, go to the website https://1c.ru/rus/support/support.htm, select the program version from those offered and go to the desired section to solve the problem.

Many people are interested in what consequences will apply to the payer if the declaration is not submitted on time. Thus, if the payer does not submit a declaration within the specified time frame, he will be charged a fine of five percent of the amount that had to be paid, but not less than 1 thousand rubles.

The tax return can be provided by the payer in the form of mail with the described attachment, and also sent electronically through special communication channels using the payer’s personal account.

The deadline for submitting the declaration depends on the system in which taxation is carried out. If a simplified taxation system was used, the payer undertakes to pay the tax no later than the 25th day of the month following the month. In it, upon notification, entrepreneurial activity was terminated, to which a simplified system was applied.

What to do after receiving a request containing error codes

The actions of the taxpayer in such a situation are presented in the figure:

It is important to remember that at each stage there are deadlines, failure to comply with which threatens the taxpayer (VAT tax agent) with fines and, in some cases, blocking of accounts.

The main deadlines are shown in the figure:

Inspectors have a very effective and unfavorable tool for the taxpayer to force him to send a receipt for receipt of the claim on time - blocking the account (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

Error "The template is not identified in relation to the document code"

Users often encounter another error in addition to “The declaration (calculation) contains errors and has not been accepted for processing” when they try to submit declarations. Here the situation is a little more complicated due to the fact that the declaration is submitted for 2021, but the form from 2021 is used.

This is due to the order of the Federal Tax Service, where declarations filled out in the 2021 form are valid until February 2021, but some Federal Tax Service institutions have arbitrarily stopped accepting such a report. What to do in this case? You need to wait a little, then create a new report in the updated version of the program. This can be done after February 18th.

On the website of the Federal Tax Service there is a program from the State Scientific Research Center “Declarations 2017”. It may be perfect for you to automatically fill out personal income tax documents. It can be found, along with instructions, on the website https://www.nalog.ru/rn91/program//5961249/.

So we have solved error 0000000002 for you. For more detailed information, visit the official website, where you can contact technical support, as well as find out about the latest news about the product.

When does the taxpayer become aware of errors?

When sending the initial VAT return to the tax office, the taxpayer may not even suspect that inspectors will find errors in it.

Moreover, these errors can arise not only through the fault of the taxpayer himself (due to inaccurate filling, technical errors, etc.), but also in connection with any actions/inactions of his counterparties. ATTENTION! The VAT declaration for reports for the 4th quarter of 2021 and tax periods of 2021 is drawn up as amended by the order of the Federal Tax Service of Russia dated August 19, 2020 No. ED-7-3/ [email protected]

What changes have been made to the declaration form and how to correctly prepare it for reporting for the 4th quarter of 2021, ConsultantPlus experts told. Explore the ready-made solution by getting trial access to the K+ system for free.

For example, the partner will not reflect the invoice issued to you in the sales book. As a result, he will not only underestimate the amount of sales and VAT in his declaration, but will also cause a lot of trouble for you, the recipient of the invoice:

- You will be forced to give explanations to the controllers.

- There is an increased risk of denial of VAT deductions on an invoice reflected in your purchase book and not recorded in the sales book of your counterparty.

How will you know that your counterparty did not reflect the invoice in the sales book or the data was distorted? It's simple: you will receive a request from the tax authorities to provide explanations in connection with the discrepancies identified during the audit of the declaration. The annex to the request will list the errors and their codes. We'll talk about this in more detail below.

Code 000000001: there are deductions, but no accrual

The first error indicates that the tax office discovered discrepancies with the buyer’s purchase book and the supplier’s sales book.

The reason for this may be:

- Dishonesty of the buyer, who either did not provide his VAT return or indicated an invoice with a different number that does not match yours.

- The seller’s dishonesty: instead of actual sales, he reflected zero values in the declaration.

- Buyer's carelessness: mistakes were made when filling out the purchase book.

- If the buyer has registered an invoice with an error in the purchase book, provide an explanation with updated data

- The supplier, in turn, made a mistake in the sales book - if the request came to the buyer, inform the tax authorities that everything is correct with you

- The supplier for some reason did not charge VAT - everything is fine, then provide supporting documents that there was a transaction and you have signed documents

- The supplier forgot to indicate the invoice - here you will have to submit an updated declaration to the supplier, and show the buyer that he has everything reflected

Important! As a rule, this error occurs if you are caught in the network of one-day companies that do not provide reports or submit zero reports, and then disappear.

How to decrypt

All erroneous VAT report items are recorded in a separate list. All error codes in the VAT return, as well as explanations and the nature of each defect, are described in the Appendix to the Letter of the Federal Tax Service of Russia dated December 3, 2018 No. ED-4-15/ [email protected] There are nine codes in total:

| Codes of types of errors in the VAT return | |

| 0000000001 | Discrepancy with counterparty data |

| 0000000002 | Inconsistency between the data of section 8 (according to the purchase book) and section 9 (according to the sales book) |

| 0000000003 | Discrepancies between invoices issued and received in sections 10 and 11 |

| 0000000004 | Error in a specific column of the report (the declaration line number is indicated in brackets) |

| 0000000005 | The invoice date in sections 8-12 is incorrect |

| 0000000006 | The date of the application for deduction exceeds the allowable period of three years |

| 0000000007 | The date of the invoice claimed for VAT deduction does not correspond to the period of activity |

| 0000000008 | The transaction code is incorrectly indicated in sections 8-12 of the declaration (the codifier is given in the Order of the Federal Tax Service dated March 14, 2016 No. ММВ-7-3 / [email protected] ) |

| 0000000009 | Canceling entries are incorrectly reflected in section 9 of the declaration |

Code 1

The requirement from the Federal Tax Service already contains codes for shortcomings that need to be clarified or eliminated.

How are inaccuracies determined in VAT returns?

If the request from the Federal Tax Service indicates the code 0000000001, this means that the tax authorities have identified discrepancies in the reporting of counterparties. Error code 1 in the VAT return indicates several categories of defects. All of them are related to the actions or inactions of the counterparty. For example, these are the following options:

- the counterparty did not report value added tax at all;

- the supplier passed zero;

- the counterparty's declaration does not contain transactions declared by the taxpayer for deduction.

In a separate situation, code 1 means that the Federal Tax Service is unable to identify the invoice entry in the reporting and compare it with the information of counterparties.

Code 2

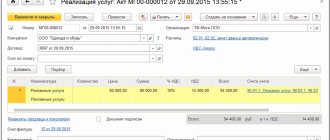

Codifier number 2 means that when checking the reporting, a discrepancy was revealed between the data of sections 8 and 9. That is, the taxpayer made a mistake when filling out information about the data from the purchase book and the sales book. Often the error lies in operations to accept a VAT deduction on advance invoices for which the deduction has already been claimed.

Code 3

The format of the deficiency under code 3 indicates a discrepancy in the information in the accounting journals for issued and received invoices. The current directory of error codes in the VAT return identifies the discrepancy between sections 10 and 11 of the declaration report. For example, when taxpayers incorrectly report information about intermediary transactions.

Code 4

Error code 4 means that the taxpayer made an arithmetic error in filling out the declaration column. The Federal Tax Service's request specifies not just the codifier 0000000004. Next to the link to the error, the tax authorities indicate the number of the field or line in which the defect was identified.

Correcting an incorrect entry is simple. Pull up the declaration and look for the specified field or line. Double-check your entries for accuracy. There was probably a typo in the field. Prepare an adjustment.

Code 5

If the company made a mistake in the invoice date of sections 8-12, then the Federal Tax Service’s request will indicate error code 5 in the VAT return. This means that in the specified columns of the report the taxpayer:

- or did not indicate the invoice date at all;

- or made an entry in the wrong format;

- or you made a mistake with the invoice date and it does not fall within the reporting period (it is outside of it).

It is necessary to double-check the records with invoice data.

Code 6

VAT deductions are commonplace. You can apply for a reduction in value added tax within three years. If the deadline has expired, you cannot receive a deduction. This is indicated by error code 6 in the VAT return. If the request specifies the 6th code, check whether the claimed VAT deduction has not expired within three years.

Code 7

Among all the shortcomings of the declaration, cipher 7 is the least common. The approved codes for possible errors in the VAT return also provide for a situation where a company claims for deduction an invoice issued before the date of its registration.

For example, the company was created in 2021. And the declaration states a deduction for an invoice issued in December 2021. The company did not exist at that time and could not carry out the operation. Code 7 indicates an error in the date of the invoice claimed for deduction, or the payer’s desire to obtain a deduction illegally.

Code 8

All transactions reflected in the declaration statements are coded. The codes are fixed by the Order of the Federal Tax Service dated March 14, 2016 No. ММВ-7-3/ [email protected] If the organization indicated an incorrect transaction code, for example, made a typo, then the FTS request will indicate the defect code 8.

Code 9

Information in invoice journals is canceled for various reasons. It is important to complete the cancellation record correctly. If there is a blot in the adjustment, then the Federal Tax Service’s request will indicate error code 9 in the VAT return. The code indicates, for example, that the VAT amount indicated with a negative value turned out to be greater than the VAT amount indicated in the entry on the invoice subject to cancellation. Or another situation: in the reporting there is no entry at all on the invoice that is subject to cancellation.

Results

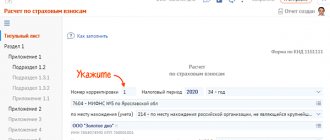

Very often, due to inattention or for some other reason, accountants distort information in the calculation of insurance premiums in such a way that the tax program is not able to accept the report. In this case, policyholders receive a refusal to accept reports indicating an error code. Error 0400400011 notifies the policyholder that the submitted calculation did not pass the logical control. There may be several reasons. It is necessary to identify them and eliminate mistakes made during the design of the form. There is not much time given to correct errors, after which the report must be re-sent to the tax office. In case of violation of delivery deadlines, the policyholder faces fines, and the blocking of the current account is quite likely.

Sources:

- tax code

- Order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

CLASSIFIER STRUCTURE

The error classifier is a list of names of classification objects and their corresponding code designations.

The classifier information is presented in one table.

Each row of the table consists of an error code and an error name.

The classifier table uses a hierarchical classification method and a sequential coding method.

COFO code structure:

KKKKRRRAAAA, where

KKK – class of errors (attribute reflecting the generality of the content of a subset of errors),

PRR - subclass of errors (

a sign reflecting the commonality of a subset of errors in a class of errors),

AAAA is the registration number of the error within the subclass.

Error classes:

010 – violation of the established procedure for submitting tax and accounting reports;

020 – the file name does not meet the established requirements;

030 – errors detected during format control;

040 – errors detected during logical control;

050 - errors detected when checking using reference books.

060 - errors detected when providing information services to taxpayers in the “ION” offline mode

The file name for loading the table into ASVK is KOFO. TXT.

Table rows are identified by the KOD (Classification Code) field.

The composition and formats of the fields of the KOFO table of the Directory are given in Table 2.1:

Table 2.1.

Composition and field formats of the

KOFO Directory

| N p/p | Submission to ASVK | Field name | Mandatory value sign | Field Contents | |

| Field name | Length | ||||

| 1 | KOD | 10 | Error code | ABOUT | Error code detected during format-logical control of files |

| 2 | NAIM | 500 | Error name | ABOUT | Error message |

*) O - required