Has a new form been introduced? When and what changed in her for the last time? For which reporting period should the new calculation form be used? Where can I download a free RSV form in an easy-to-fill out format? How to fill out the DAM for the 4th quarter of 2021: a sample filling, including for affected industries, as well as download links - in this material.

In January 2021, it is necessary to submit to the Federal Tax Service “Calculation of insurance premiums” for 2021 using a new form. At the same time, from April 2021, new rules for calculating contributions have been introduced for a number of companies and individual entrepreneurs - small and medium-sized businesses can take advantage of the right to reduced tariffs, and for companies affected by coronavirus, a tariff with a zero rate is provided. Let's look at how to fill out the DAM for 2021 for affected industries, taking into account the new requirements.

Fines for DAM in 2021

If you do not provide a calculation of insurance premiums (DAM) or violate the deadline, administrative liability and penalties will follow.

If the deadline for submitting the RSV-1 form is violated (for the 4th quarter - before 02/01/2021), a fine of 1000 rubles or 5% of the calculated insurance premiums in the billing period will be charged for each full or partial month of delay.

If errors or discrepancies are found in the DAM when filling out, the report will not be provided. Corrections may be made within 5 working days from the date of receipt of the notification from the Federal Tax Service. After making changes, the date of submission of the DAM is recognized as the day when the single calculation form for insurance premiums for the 4th quarter of 2020 was sent for the first time (paragraphs 2 and 3 of paragraph 7 of Article 431 of the Tax Code of the Russian Federation).

IMPORTANT!

In 2021, submit a single report for the 4th quarter of 2021 no later than 02/01/2021! January 30th is Saturday; the deadline is moved to Monday February 1st.

When to take it in 2021

The deadline for providing DAM is the same for all employers - no later than the 30th day of the month following the reporting period. They report 4 times a year, generating information on an accrual basis: for 1 quarter, for half a year, for 9 months and for a year.

Deadlines for providing DAM in 2021:

- for the 4th quarter of 2021 (per year) - until 02/01/2021 (01/30 - Saturday);

- for the 1st quarter of 2021 - until 04/30/2021;

- for the six months - until July 30, 2021;

- 9 months - until 01.11.2021 (30.10 - Saturday);

- for 2021 - until 01/31/2022 (01/30 - Sunday).

What does “number of insured persons” mean?

In the Russian Federation, insurance activities are strictly regulated by existing legislative acts. For example, Chapter 48 of the Civil Code. According to No. 167-FZ, insured persons are any citizens who permanently reside in the territory of the state. They can carry out activities in accordance with an employment contract or a civil law agreement.

Attention! Only those who carry out official activities according to the relevant documents can apply for an insurance pension. Accordingly, the number of insured persons at an enterprise is the number of citizens whose information is officially recorded. And for whom contributions are paid.

Which RSV form to use

The unified form and procedure for filling out calculations for insurance premiums were approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. MMV-7-11/ [email protected] as amended by Federal Tax Service Order No. ED-7-11/ [email protected] dated October 15, 2020. The KND code is 1151111. The RSV consists of a title page and three sections that contain 10 applications, a total of 21 sheets. Previously there were 11 applications, their numbering in the form has changed.

IMPORTANT!

Submit reports for the 4th quarter of 2021 using the updated form with changes from Federal Tax Service Order No. ED-7-11/ [email protected] dated 10/15/2020.

Use the new DAM forms, otherwise fines cannot be avoided.

Answers to common questions

Question No. 1 : What adjustment number should be entered on page 010 of section 3 of the RSV? Submit all information on employees or only those for whom changes are made?

Answer : When submitting an adjustment, “1” is indicated in line 010 of section 3.

Question No. 2 : When submitting an adjustment DAM based on an employee’s data, do you need to submit all the information or only for the employees for whom changes are made?

Answer : When clarifying the DAM, section 3 includes only those employees for whom adjustments are made.

Conditions for filling out the RSV

Let's consider an example of filling out a calculation of insurance premiums for the 4th quarter of 2021 for a budget organization. GBOU DOD SDYUSSHOR "ALLUR" uses OSNO. For the calculation, general tax rates and general insurance rates are established. The average number of employees is 2 employees: a director and a subordinate, the figure has not changed.

Please pay attention to the Federal Tax Service's recommendations for filling out insurance premium calculations in 2021. Use the ConsultantPlus review and instructions for free.

to read.

In October, Fedin’s subordinate Viktor was ill for five calendar days. During this period, he received sickness benefits in the amount of 8,207.95 rubles. Of this money, 3283.18 rubles. paid for using Social Security funds. There were no other benefits, sick leave or other payments from Social Insurance in the 4th quarter.

The salaries of the employees of the ALLURE sports school were:

- in October - 100,000.00 rubles;

- in November - 100,000.00 rubles;

- in December - 88,095.24 rubles.

Total for three months - 288,095.24 rubles.

The budgetary institution did not make any other transfers in favor of employees. None of the employees of the State Budgetary Institution of Children's and Youth Sports School "ALLUR" exceeded the maximum amount for contributions to pension and social insurance (OPS and VNiM).

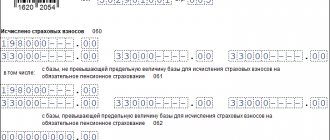

Calculation of insurance premiums in the 4th quarter of 2021:

| Period | OPS (22%) | VNiM (2.9%) | Compulsory medical insurance (5.1%) |

| For October: | RUB 22,000.00 | RUB 2900.00 | 5100.00 rub. |

| For November: | RUB 22,000.00 | RUB 2900.00 | 5100.00 rub. |

| For December: | RUB 19,380.95 | RUB 2,554.76 | RUB 4,492.86 |

| Total | RUB 63,380.95 | 8354.76 rub. | RUB 14,692.86 |

Calculation of contributions at zero tariffs.

How many applications should be included in the calculation for the Ⅳ quarter of 2020?

If for April-June zero insurance premium rates are set for the policyholder, when filling out the calculation for the year, you must fill out several appendices 1 and 2 to section 1 - exactly as many rates as were applied.

Provided that an organization or individual entrepreneur meets the criteria for using both zero and reduced rates for SME applications there will be three:

- for January-March - general;

- for April-June - zero (for a number of policyholders from the affected industries);

- for July-September (and further until the end of the year) - a reduced 15% (for SMEs, regardless of industry).

Thus, the DAM for the 4th quarter for the affected industries will contain three appendices 1 and 2:

- With tariff code 01 - in relation to contributions at general tariffs. These are contributions for the 1st quarter, as well as contributions from payments for July-December within the minimum wage.

- With code 21 - in relation to zero contributions for April-June.

- With code 20 - 15% for contributions for July-December.

If an organization or individual entrepreneur does not meet the criteria for using zero tariffs, then there will be two applications.

Section 3 of the calculation of contributions for the Ⅳ quarter of 2021 for affected industries

Section 3 is filled out for payments for the last three months of the billing period, so there will be no zero rates in it.

As mentioned above, when applying the 15% tariff for the 4th quarter of 2021, section 3 must be filled out twice for each employee - with different codes of insured persons in subsection 3.2.1:

- with code HP and the amount of 12,130 rubles. (this is a salary within the minimum wage, to which general rates apply);

- with MS code and wages above the minimum wage, taxed at a rate of 15%.

The title page and section 1 will be common. In section 1, you need to summarize the results by type of contribution for all tariffs on a cumulative basis from the beginning of the year.

Example:

Omega LLC, which is a micro-enterprise, has one employee. He is also the director Ivanov I.I. Since April, Omega has been using reduced insurance premium rates as a SME, but does not fall under the criteria for applying zero tariffs.

All accruals made in the Ⅳ quarter are summarized in the table:

| Period | Employees | Rate | Taxable base | Pension Fund contributions | FFOMS contributions | Social Insurance Contributions |

| Accruals for October | Ivanov | base* | 12130,00 | 2668,60 | 618,63 | 351,77 |

| reduced** | 47870,00 | 4787,00 | 2393,50 | 0,00 | ||

| TOTAL | 60000,00 | 7455,60 | 3012,13 | 351,77 | ||

| Charges for November | Ivanov | base* | 12130,00 | 2668,60 | 618,63 | 351,77 |

| reduced** | 47870,00 | 4787,00 | 2393,50 | 0,00 | ||

| TOTAL | 60000,00 | 7455,60 | 3012,13 | 351,77 | ||

| Charges for December | Ivanov | base* | 12130,00 | 2668,60 | 618,63 | 351,77 |

| reduced** | 47870,00 | 4787,00 | 2393,50 | 0,00 | ||

| TOTAL | 60000,00 | 7455,60 | 3012,13 | 351,77 | ||

| For the Ⅳ quarter of 2021 total | base | 36390,00 | 8005,80 | 1855,89 | 1055,31 | |

| reduced | 143610,00 | 14361,00 | 7180,50 | 0,00 | ||

| TOTAL | 180000,00 | 22366,80 | 9036,39 | 1055,31 | ||

* For amounts within the minimum wage (up to 12,130 rubles) – the basic tariff is 30%; ** — For amounts above the minimum wage – a reduced tariff of 15%.

In general, for 12 months the accruals amounted to:

| Period | Rate | Taxable base | Pension Fund contributions | FFOMS contributions | Social Insurance Contributions |

| 1st quarter | base | 180000,00 | 39600,00 | 9180,00 | 5220,00 |

| 2nd and 3rd quarter | base | 36390,00 | 8005,80 | 1855,89 | 1055,31 |

| reduced | 143610,00 | 14361,00 | 7180,50 | 0,00 | |

| Total | 180000,00 | 22366,80 | 9036,39 | 1055,31 | |

| 4th quarter | base | 36390,00 | 8005,80 | 1855,89 | 1055,31 |

| reduced | 143610,00 | 14361,00 | 7180,50 | 0,00 | |

| Total | 180000,00 | 22366,80 | 9036,39 | 1055,31 | |

| 2020 | base | 252780,00 | 55611,60 | 12891,78 | 7330,62 |

| reduced | 287220,00 | 28722,00 | 14361,00 | 0,00 | |

| Total | 540000,00 | 84333,60 | 27252,78 | 7330,62 |

When calculating insurance premiums for the 1st quarter, only the basic rate is applied - 30% (including 22% of the Pension Fund, 5.1% of the Federal Compulsory Medical Insurance Fund and 2.9% of the Social Insurance Fund), and from April a reduced rate is added.

Sections of the Calculation (Appendices 1 and 2 to Section 1) and personalized information on employees (Subsection 3.2.1 of Section 3) are filled out separately for the base within the minimum wage (codes 01 and NR) and above the minimum wage (codes 20 and MS).

When filling out the calculation in the example given, we will use the most convenient sequence of filling out forms:

- First of all, you must fill out the information in the third section, which is filled out for all insured persons and includes information for the last three months. In addition, in the example, information is filled in for only one employee, but if the number of insured persons differs from one, then the number of sheets containing information in the Calculation must correspond to the number of insured employees.

- Secondly, we will fill out subsection 1.1 of Appendix 1 of Section 1 on pension contributions: we will calculate and include personalized accounting data from Section 3.

- In the third place, subsection 1.2 of Appendix 1 of Section 1 on contributions for Compulsory Health Insurance must be completed.

- Fourthly, we fill out social insurance. The indicators are calculated in Appendix 2 of Section 1. If in the billing period there were expenses for sick leave or payment of benefits, then they must be reflected in Appendix 3 to Section 1. That is. line 070 of appendix 2 of section 1 must be filled in. Since Ivanov I.I. I was not sick during the reporting period, so there is no need to fill out Appendix 3.

- Fifthly, section 1 must be completed. It indicates the amount of insurance premiums to be paid to the budget. For each type of insurance premium, in the first section of the calculation you must indicate your budget classification codes. The KBK classification allows tax authorities to correctly reflect financial receipts in the personal account of a company or individual entrepreneur. You can find out more about the new CBC for insurance premiums for 2021 here.

- Lastly, we will number all completed sheets of the document and indicate their number on the title page. After which, we will sign each section from I.I. Ivanov. and set the date.

If the calculation is filled out on a computer, then when printed on a printer, it is allowed that there is no framing of the acquaintances and dashes for unfilled (blank) acquaintances.

The code indicating for what period the calculation of insurance premiums is being submitted is reflected on the title page in accordance with Appendix No. 3 to the Procedure, approved. By order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] :

| Period | Code |

| I quarter | 21 |

| Half year | 31 |

| 9 months | 33 |

| Year | 34 |

| 1st quarter during reorganization or liquidation | 51 |

| Half a year during reorganization or liquidation | 52 |

| 9 months in case of reorganization or liquidation | 53 |

| Year upon reorganization or liquidation | 90 |

When filling out the “Adjustment number” field, “0—” is entered in the primary calculation for the billing (reporting) period; in the updated calculation for the corresponding billing (reporting) period, the adjustment number is indicated (for example, “1—”, “2—” and so on Further).

The code of the payer of contributions by location is given in the table:

| Payer | Code |

| Organization | 214 |

| Individual entrepreneur (at place of residence) | 120 |

| Individual, not individual entrepreneur (at place of residence) | 112 |

| Farmers | 124 |

| Separate division | 222 |

| A separate division of a foreign company | 335 |

| Advocate | 121 |

| Notary | 122 |

A complete list of codes for the place of submission to the tax authority is specified in Appendix No. 4 to the Procedure for filling out the calculation

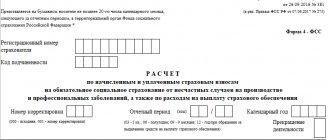

The DAM sample for the 4th quarter of 2021, filled out based on the data provided, will look like this:

Cover page for calculation of insurance premiums

The economic activity type code is filled in from OKVED2. If an organization (or individual entrepreneur) has several types of activities, then the code of the main type of activity according to OKVED2 is indicated.

When filling out the line “Contact telephone number”, you must leave spaces between the number “8” and the city code, as well as between the city code and the telephone number (clause 3.14 of the Instructions for filling out the calculation).

When filling out the calculation manually, you must follow the instructions in clause 2.18 of the Instructions for filling out: “In the absence of any indicator, quantitative and total indicators are filled in with the value “0” (“zero”), in other cases, a dash is placed in all familiar places in the corresponding field .

All calculation pages are numbered consecutively, starting from the title page. In the “Calculation compiled on ___ pages” field, the total number of pages of the calculation is indicated. When filling out the field “with the attachment of supporting documents or their copies on ____ sheets,” the number of sheets of supporting documents and (or) their copies is reflected, including the number of sheets of a document confirming the authority of the payer’s representative (if the specified calculation is submitted by the payer’s representative).

Section 1. Free data on the obligations of the payer of insurance premiums.

Line 010 indicates the OKTMO code of the municipality where insurance premiums are paid.

Line 030 reflects the amount of calculated contributions from the beginning of the year. It is equal to the sum of lines 031, 032, 033 plus the amount of calculated contributions for the previous reporting period.

Line 050 reflects the amount of calculated contributions for 3 months for compulsory health insurance. It is equal to the sum of lines 051, 052, 053 plus the amount of calculated contributions for the previous reporting period.

Since pension contributions at the additional rate and contributions for additional social security are not provided for in the example under consideration, we leave the corresponding lines blank.

When filling out “Appendix 1. Calculation of the amounts of insurance contributions for compulsory pension and health insurance to Section 1,” we take the payer’s tariff code from the table (Appendix No. 5 to the order of the Federal Tax Service of Russia dated September 18, 2019 MMV-7-11 / [email protected] ):