In accordance with the Labor Code of the Russian Federation, an employee can count on financial assistance from the state in case of illness. To take advantage of this type of support, the interested subject of labor relations must provide the appropriate sick leave certificate to the government agency.

The correctness of filling out the form and the authenticity of the certificate of incapacity for work is checked by the Social Insurance Fund of the Russian Federation (FSS RF). And as practice shows, cases often arise when errors are discovered when sending documentation.

Procedure for submitting the 4-FSS report

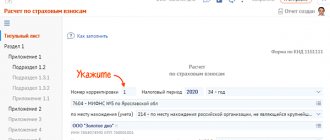

Form 4-FSS is submitted quarterly by all employers using hired labor.

From 2021, due to a change in the insurance premium administrator, this report now contains only information on accident insurance premiums. The report form submitted in 2020-2021 and the procedure for filling it out were approved by Order No. 381 of the Federal Insurance Service of the Russian Federation dated September 26, 2016. The main regulatory act regulating the procedure for calculating and paying contributions for injury insurance is the Law “On Insurance against Industrial Accidents” and occupational diseases" dated July 24, 1998 No. 125-FZ.

Legislators have provided 2 deadlines for submitting the calculation (clause 1, article 24 of law No. 125-FZ):

- before the 20th day of the month following the reporting quarter - to submit the report on paper;

- until the 25th of the same month - to submit an electronic version of the calculation.

However, the right to choose the sending option is granted only to small companies with an average number of employees up to 25 people inclusive. If an organization employs more than 25 employees, then files can only be submitted electronically. Failure to comply with the reporting method will result in a fine of 200 rubles. (Clause 2, Article 26.30 of Law No. 125-FZ).

Upon receipt of the calculation, the FSS authorities must send the policyholder a receipt confirming receipt of the report or a negative inspection report describing the errors.

Popular questions and answers to them

Question 1. The accounting employee sent the report electronically at the end of the last day of its submission. The document was returned with an error code. Can the report be considered submitted on time? Answer. When a document is returned to the policyholder with an indication that it contains errors, its provision is not counted by social insurance as a properly fulfilled obligation of the enterprise. Such a document did not pass the logical-format control procedure. The report will be considered completed only after everything is indicated correctly.

What to do if I receive a negative inspection report?

If, based on the results of the inspection, the FSS body sent a negative report, the payment is considered not submitted. It is necessary to correct all errors indicated in the document and send the report again. The date of submission of the calculation is the date when the file passed all stages of verification and was accepted by the fund.

If the file is accepted after the 25th, the FSS will charge a fine, which will be calculated as 5% of the amount of assessed contributions for injuries for the reporting period, but not less than 1,000 rubles. and no more than 30% of the specified amount (Clause 1, Article 26.30 of Law No. 125-FZ).

Important! Hint from ConsultantPlus In a situation where you submit an updated calculation after the deadline for paying contributions and the deadline for submitting the initial calculation have passed, you can avoid a fine if the following conditions are simultaneously met... Read more about the conditions in K+ . This can be done for free with trial access.

Let's look at the most common error codes in the protocol and how to correct them.

Technical support Kaluga-Astral

The correctness of the encryption of the transferred file is first checked by the operator, i.e. Kaluga-Astral company, after successful verification by the operator, the files are sent to the direct recipient of the receipt, for example, to the Pension Fund of Russia.

If you encounter problems with the transmission of reports, including decryption of the transferred file, you can call the Kaluga-Astral operator directly and ask for help:

- technical support phone number;

- website - https://astral.ru/support/.

The company's technical support works around the clock and successfully resolves problems associated with transferring files via the 1C-Reporting service by remotely connecting to the user's computer.

It’s not at all difficult to reach an operator, unlike the 1C hotline, and the operator’s work on solving problems is carried out without delay - at the time of the call.

Contacting Kaluga-Astral technical support is one of the easiest options to solve problems. The work is performed professionally and free of charge as part of the purchased 1C:Reporting service.

The operator's website contains all possible errors and ways to eliminate them. This is a real first aid library for the user. We highly recommend checking it out:

- Questions about the 1C Reporting service

Common protocol errors and how to resolve them

A complete list of error codes and their interpretation can be found on the FSS website and below in our article.

- The most common error code in the FSS Form 4 verification protocol is error 508, which means that the file format is incorrect and the calculation has not passed format-logical control.

Its main reasons:

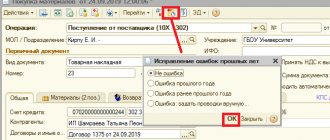

- When filling out a report in the 1C program, only part of the data is uploaded;

- The program for generating the report has not been updated.

In this case, the report can be filled out on the official FSS website portal.fss.ru (tab “Form 4-FSS”), and then download the correct file and send it through your telecom operator.

Sending is also available from the portal of the fund itself, but before this you need to register on the site and request a digital signature key. You need to take these steps in advance so as not to miss the deadline for submitting the calculation.

- Error code 503 in the FSS report means that the file name specified is incorrect and does not match the XSD schema.

According to Appendix 1 to the FSS order “On the implementation of secure exchange of documents in electronic form...” dated 02/12/2010 No. 19, the file name should look like this:

<policyholder number>_<accounting year>_<reporting quarter>. xml.

For example, 1234567891_2020_12.xml.

In this case, the policyholder number is a 10-digit digital designation of the payer’s registration number. It must correspond to the registration documents. The accounting year is written in YYYY format, for example 2021. The reporting quarter must contain 2 digits: for the 1st quarter it is designated 03, for 6 months. — 06, 9 months. - 09, years - 12.

To fix error 503, you need to rename the file or generate the file in the program and upload it again.

- Error 598 in the FSS report means that the provided file contains a TIN that does not match the registration number of the policyholder.

The reason may be the erroneous entry of information into the database by the special communications operator through whom the calculation is signed and sent, as well as an error by the accountant.

To resolve discrepancies, you must check the Taxpayer Identification Number and Registration Number on the cover page of the form. If no errors are identified, you should contact a representative of the operator’s company and check the data in their database.

Keep in mind that the courts do not consider an error in the policyholder's registration number to be a sufficient reason for not accepting a settlement. Read more about this in the material “An error in the registration number is not a reason for a fine for failure to submit 4-FSS.”

If you need to draw up an updated 4-FSS, use the recommendations of ConsultantPlus experts. Trial access to the legal system is free.

This device cannot start - CODE 10

From time to time, every user of the Windows operating system encounters errors. Some of them are more common than others, some are more difficult than others, but the built-in Windows tools do not help solve any of these problems. One of the most common errors that almost every user of Microsoft operating systems has encountered is error code 10. This error often occurs when installing or launching Dr. Web, as well as when setting up a network adapter. If this error occurs, it is impossible to start the treated device, and the problem occurs both with USB devices, for example, wi-fi adapters, flash drives, modems, and with video and sound cards.

Why does error code 10 occur?

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

It will never be possible to determine the exact cause of an error on a connected device the first time.

The reason is that, at its core, the code and name of the error only indicate the occurrence of a certain problem - the device cannot be started, although there are possible ones, but not the possible sources of this error. Therefore, the user has to find out for himself what exactly happened. Here is a list of possible reasons:

- There are no drivers for the device;

- Already installed ones transmit error data to the operating system, which cannot decrypt it on its side;

- Identification data and other information located on the device and necessary for its operation are not transferred to Windows;

It is important to note that error 10 occurs not only when connecting for the first time and identifying a new device in the system, but in the process of working with an already known device or when connecting it again. From here we conclude that the main cause of this error is drivers, or rather their absence or incorrect installation.

Fixing error code 10 - port not found

Thus, to fix the error code 10 port not found, you need to do:

- Open the “device manager” by right-clicking on “Start” and selecting the appropriate item in the window;

- Check all the required sections in the device manager and find the device with the error. It is marked with a yellow triangle with an exclamation mark;

- Right-click on the problematic device and select “Properties”;

- In the window that opens, go to the “Driver” tab and click “Update Driver”. You can search for the driver on the Internet using the “Automatic search for updated drivers” item, and it will download and install automatically. If the computer already has the required driver, then select “Search for drivers on this computer”;

What do other error codes mean?

| No. | Error code | Meaning | Possible reasons | Elimination procedure |

| 1 | 10 | Unable to decrypt file | Invalid or expired certificate | Check the validity period of the digital signature certificate and its validity |

| 2 | 11 | It is impossible to verify the digital signature | 1. Certificate error. 2. The file is signed twice. 3. The file encryption algorithm is broken | 1. Contact a special operator and fix the certificate error. 2. Re-sign the file and send. 3. Sign the file first and then encrypt it |

| 3 | 13 | Absence of the policyholder's registration number in the certificate | An error made by a special operator when issuing a certificate | Contact the special operator representative and reissue the certificate |

| 4 | 14 | Lack of FSS department code in the certificate | See paragraph 3 | See paragraph 3 |

| 5 | 15 | Encryption error | System crash while transferring file | Resend the file |

| 6 | 16 | Incorrect format of policyholder registration number in the certificate | The number of characters of the registration number is less than or more than 10 | Reissue certificate |

| 7 | 17 | Incorrect format of the FSS unit code in the certificate | Number of code characters more or less 4 | Reissue certificate |

| 8 | 18 | The file is encrypted with an incorrect digital signature key | 1. An incorrect FSS authorized person certificate was selected. 2. Expired certificate selected | 1. Sign and encrypt the file using a valid certificate from an authorized person of the FSS. 2. Download a new certificate from the FSS website and install it in the certificate store |

| 9 | 19 | The file is not signed or encrypted | Re-sign, encrypt and send the file | |

| 10 | 20 | Unknown file format | File name does not match XD schema | Regenerate the xml file (see procedure for error 503) |

| 11 | 41 | The certificate issuer is not trusted | 1. The special operator’s certificate does not comply with the Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ. 2. The special operator’s certificate has been revoked or expired | Contact the special operator company, having first checked the validity of the root certificate in the cross-certification table |

| 12 | 42 | Error verifying certificate | Resend calculation | |

| 13 | 43 | The policyholder's certificate has been revoked | The digital signature of the certificate is invalid | Reissue certificate |

| 14 | 44 | The certificate revocation list (hereinafter referred to as CRL) of the certificate issuer is expired or not found | Certification center SOS error | Contact a representative of the telecom operator company |

| 15 | 45 | The certificate is damaged | Resend payment | |

| 16 | 46 | The insurance certificate is expired | Reissue certificate | |

| 17 | 50 | The organization's TIN is not included in the certificate | Error creating certificate | Reissue certificate |

| 18 | 504 | The certificate contains the wrong FSS division | See paragraph 17 | See paragraph 17 |

| 19 | 505 | Incorrect file name | File format does not match XD schema | Regenerate the file in xml format |

| 20 | 506 | Identical tax codes in section 2 of the report | Error filling out the form | Correct an error in the report, upload and send |

| 21 | 507 | xml file missing | Calculation file not loaded into the system | Upload file, sign, encrypt and send |

| 22 | 509 | The file contains a period that differs from the period in its name | Error when filling out the calculation | Regenerate the file and send it to the FSS |

| 23 | 511 | Error reading file | The file is empty or not in xml format | Regenerate the file and send |

| 24 | 512 | The reporting year in the file differs from the year in its name | Error when filling out the calculation | Correct the error, generate and send the file |

| 25 | 513 | The file contains a registration number that is different from the number in the file name | See paragraph 24 | See paragraph 24 |

| 26 | 514 | The policyholder's registration number on file is different from the number on the certificate | 1. Error when filling out the calculation. 2. Error when issuing a certificate | 1. Correct the error, generate the file and resend it. 2. Contact the certification authority and reissue the certificate |

| 27 | 515 | The registration number in the file name is different from the number in the report | See paragraph 24 | See paragraph 24 |

| 28 | 516 | The separate department code in the file name differs from the code in the file | See paragraph 24 | See paragraph 24 |

| 29 | 517 | File size is too large | The file must be no larger than 655 kilobytes | Generate a new calculation file |

| 30 | 518 | The file is zero size | The file is zero size | Generate a new file |

| 31 | 519 | The TIN in the certificate differs from the TIN in the calculation file | See paragraph 26 | See paragraph 26 |

| 32 | 520 | OGRN in the file differs from OGRN in the certificate | See paragraph 26 | See paragraph 26 |

| 33 | 550 | The certificate is not qualified | The certificate is not qualified | Contact the special operator company and reissue the certificate |

| 34 | 599 | The policyholder's data has not yet been entered into the FSS database | The report will be processed upon entry into the FSS database | |

How to decipher the negative protocol for SZV-STAZH, see here.

What are the ways to find out the FSS registration number using the TIN?

The registration number of a company or individual entrepreneur in the FSS can be found out from the registration notice issued by the fund, and if such a document is missing:

- by contacting the department;

- through a specialized online service that allows you to find out the Social Insurance Fund number assigned to a business entity.

In the first method, you need to write a request to social security to issue a duplicate of the registration notice.

The second method is more efficient and in many ways more convenient. To do this you need:

- Go to the search page of the FSS website.

- In the search form, enter the TIN of the company or individual entrepreneur and click the “Search” button.

If the business entity is registered with the Social Insurance Fund, the corresponding number will appear on the page.

But there may be cases when the required details will not be in the FSS database. With what it can be connected?

Results

All employers in 2021 - 2021 are required to provide quarterly calculations to 4-FSS in relation to contributions for injuries within the established time frame. If the form is filled out incorrectly, upon verification, a negative report will be sent to the policyholder. In this case, the report will be considered not accepted until the identified errors are eliminated. If the corrective report is accepted later than the established deadlines, the policyholder will be subject to penalties.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

News on changing the PFR certificate of Moscow and the Moscow region

On November 22, 2021, the 1C Reporting operator distributed the following information to 1C partners and users submitting reports to the Pension Fund of Moscow and the Moscow Region.

If you submit reports to the Pension Fund of Moscow and the Moscow region, then you are guaranteed to receive the indicated error.

Errors Occurring

Using crypto providers below versions of VipNet 4.2 or CryptoPro CSP 4.0 will result in errors when processing documents on the Pension Fund’s side.

Crypto providers update

To eliminate technical problems when working with the Pension Fund, it is necessary to update the crypto providers to versions: VipNet 4.2 or CryptoPro CSP 4.0 and higher.

Step-by-step instructions for updating your crypto provider

Step 1. Open the crypto provider by clicking on the VipNet CSP icon.

Step 2. Check the version of the VipNet crypto provider in the lower left corner of the form that opens.

Step 3. Update the version of the crypto provider according to the instructions of the Kaluga Astral operator if:

- submit reports to the Pension Fund of Moscow and the Moscow region;

- The version of your crypto provider VipNet is lower than 4.2.

After updating VipNet, if a registration request arises, you need to obtain a new serial number; you can request it from the website www.infotecs.ru, download the distribution again and use the instructions.

Required information

The owner of the number always has a memo on hand indicating how to find out the registration number in the Social Insurance Fund using the Individual Entrepreneur’s Taxpayer Identification Number (TIN) next to useful information on how he is obliged to determine the amount of insurance premiums payable during the reporting period for all people working in the organization. To restore information confirming registration with the tax service that was lost, you must refer to the registration data indicated in the certificate.

In practice, there may be cases when, after searching, the necessary data is not found, and a corresponding notification from the site will appear. What could be the reason? This happens only in a few cases:

- Incomplete taxpayer registration procedure.

- The process of updating an existing database.

- If a legal entity does not have hired employees.

To summarize, it should be noted once again that, if necessary, you can find a registration number in the FSS using the TIN of a legal entity in just a few minutes. To do this, you just need to enter the data in the “Reference” section on the official website of the tax office.

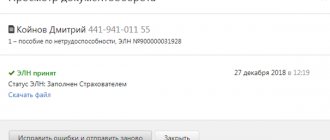

ORA-20015: Failed to determine the state of the electronic device:

To switch to the 'Extended' status, you must add a period of incapacity; To switch to the 'Closed' status, you must fill in the fields: 'Start working from: date' or 'Other: code'; To switch to the 'Referral to ITU' status, you must fill in the 'Date of referral to ITU bureau' field

Cause:

1. There is an electronic registration number in the system with the same number and the same data that you send (data duplication);

2. The data sent to the ENL does not correspond to the stage of registration (filling out) of the ENL:

- there is insufficient data to determine the condition of the ELN;

- The entered data relates to different stages of registration (filling out) of the electronic tax record.

What to do:

1. Request the current status of the e-mail from the system, thereby preventing repeated sending of the same data;

2. Perform the necessary further operation with ELN in accordance with procedure 624n:

- extension (add a new period of incapacity);

- closure (add closure information);

- referral to ITU (add information about referral to ITU).

ORA-20001: Access to ELN with No._________, SNILS_________, status _________ - limited

Cause:

You are trying to obtain data from an email account that is in a status that restricts your access. For example, the policyholder is trying to obtain data from an electronic health insurance policy that has not yet been closed by a medical organization. According to the process model, the policyholder can receive ELP data for editing only with status 030 - Closed. Another example is that the ITU bureau cannot receive data from an electronic information source that has not been sent to the ITU bureau (status 040 - Sent to the ITU)

What to do:

1. Make sure that the ELN number whose data you want to receive is entered correctly.

2. Wait for the ELN to transition to a status that will allow you to receive the ELN data.

Actions in case of loss of registration number

There are two main ways to quickly find out the Social Insurance Fund number yourself using the TIN of a legal entity:

- Go to the territorial division of the tax service.

- Open the official website to find out the FSS registration number using the organization’s TIN online yourself.

The second method is the most convenient due to the speed of data acquisition:

- you need to follow the available search engine link to the site, then in the main “Reference” section open the page called “Analytics”

- after clicking on the hyperlink called “registration number for the policyholder,” you should enter the available information and click on the “search” tab.

The number will appear directly in the browser in a couple of seconds if this business entity was registered with the Social Insurance Fund.