In order to improve the legal regulation of accounting and reporting, the Ministry of Finance of Russia approved the Accounting Regulations “Correcting Errors in Accounting and Reporting” - PBU 22/2010 (order No. 63n dated June 28, 2010, registered with the Russian Ministry of Justice No. 18008 on July 30, 2010 ) and forms of financial statements of organizations (order dated July 2, 2010 No. 66n, registered with the Ministry of Justice of Russia on August 2, 2010 No. 18023)*.

Note: * Accounting statements will change starting in 2011.

PBU 22/2010 should be applied by organizations that are legal entities under the laws of the Russian Federation (with the exception of credit organizations and budgetary institutions) from the annual financial statements for 2010.

Types of errors

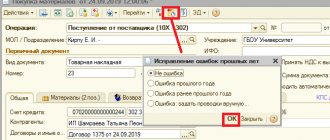

The procedure for correcting errors in accounting and reporting depends on the nature of the error made and on the period in which it was made and discovered.

You may discover an error at one of the following moments.

| The moment when an error can be detected | |||||

| Until the end of the calendar year | Last year’s reporting was prepared | Last year’s reports were signed | Last year's reporting is presented to external users | Last year's reporting approved | Subsequent years |

| Year the error occurred | The year following the one in which the error occurred | ||||

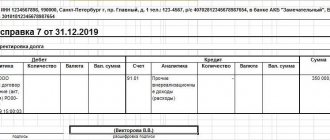

Errors are divided into significant and insignificant. You will have to determine the materiality threshold yourself. After all, there are no limit values provided for in the legislation.

In this case, one must proceed from both the magnitude and the nature of a particular item or group of items in the financial statements. Specify the thresholds for the materiality of an error in the accounting policy (clause 7 of PBU 1/2008, clause 3 of PBU 22/2010).

For example, you can write down the materiality threshold as follows: “An error is considered significant if the ratio of its amount to the balance sheet currency for the reporting year is at least 5 percent.”

Error occurrences and how to detect them

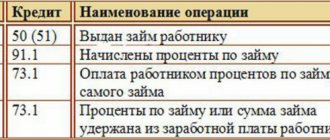

The most common errors in accounting and reporting are divided into three types:

1. Counting errors

These errors are associated with incorrect calculations or incorrect transfer/entry of information in accounting registers.

2. Errors associated with late recording of primary documents

Such errors often arise due to uncoordinated work of departments. The documents are signed, but simply do not reach the accounting department on time.

However, if the primary documents were detained by counterparties, their failure to be reflected in the organization’s accounting will not be erroneous.

3. Errors arising from incorrect application of legislation

These errors arise when the requirements of current legislation regarding the procedure for maintaining accounting records and the disclosure of information in financial statements are not met.