If you sent a DAM report to the tax office and then discovered that the employee’s full name or SNILS was incorrect, generate a corrective report. Include the same sections and sheets as in the primary report. In section 3, provide information only about the employee who had the error.

ONLINE.SBIS.RU

VLSI 2.4

VLSI 2.5

- Create an adjusting report on the DAM.

- On the title page, indicate the adjustment number 1 greater than in the previous report.

- In section 3, add the employee twice:

- with an incorrect full name or SNILS - set the “Cancellation” flag and click “Reset amounts”;

with correct data - correct your full name or SNILS, indicate the payment amounts.

- with an incorrect full name or SNILS - set the “Cancellation” flag and click “Reset amounts”;

- Make sure that all employees whose information needs to be corrected have an icon. It means that the data has been edited and will be sent as part of the corrective report.

If you accidentally changed an employee's data (for example, you turned on auto-calculation or used the wizard) and do not want to send it, hover your mouse over the full name and click .

- Review and submit report.

To avoid adding a second employee manually, copy the entry. To do this, hover your mouse over the line with the employee’s full name and click.

When the inspection sends a positive protocol, the RSV is considered accepted.

Will a new green card be issued at this time?

From April 1, green cards were officially abolished at the Government level. Instead, another form with approval and registration should have appeared, but it was not possible to complete the process immediately. Starting from September 29, registration with the Pension Fund of Russia is confirmed using another document. Instead of green cards, they now issue a regular paper form.

In practice, the issuance of green cards continued after the official cancellation, until August. According to the law, no violations were identified; the department had several months to change the situation.

But then separate forms of notifications appeared, paper or electronic. Now these are ordinary white forms that do not have any additional symbols or design elements. The first difference between the new forms and the old cards is the absence of quantitative restrictions.

For example, one is presented to employers, the second to social security authorities, and the third to apply for loans.

Grounds for non-acceptance of settlement

Order of the Ministry of Finance dated July 2, 2012 No. 99n provides the following reasons why the report may not be accepted:

- the individual submitting it does not present an identity card and/or a document giving him the authority to represent the organization to the Federal Tax Service;

- the report is submitted in the wrong form or format;

- the submitted documents are not signed by the head of the organization (or with an electronic signature, if submitted via the Internet);

- the report is not submitted to the tax authority that is authorized to accept it;

- the electronic document submitted under the TKS does not contain certain details - the full name of the individual, the full name of the organization and its TIN, the name of the tax authority, as well as the type of document (initial filing or adjustment).

How to get a new document

The full form of the name of the new document is “Notice of registration in the individual accounting system.” Another form is designated as ADI-Reg.

The form confirms registration in the system and the availability of the corresponding individual number. The form contains the same information that was previously present on the green cards.

There are several ways to receive notifications:

- Personal visit to Pension Fund offices, with an application and a civil ID.

- At the MFC, if appropriate services are available.

- On the PFR website.

Requesting a notification through the official website is the simplest solution of all. There is no limit to the number of requests and forms; there is no need to waste time visiting institutions.

Actions are performed according to the following algorithm:

- Login to your Personal Account through the Pension Fund website. Authorization involves using an account from the State Services portal.

- Go to the “Individual personal account” section. Next, you need the part with “issuance of a duplicate insurance certificate.” There is a high probability that the service itself will soon change its name to a more modern version.

- If desired, you can specify the email to which the forms will be sent. In the settings of your personal account, information of this nature can be entered in advance.

- Next, they send a request for a notification form. At first, only the viewing mode will be available, then the printout will open.

The rules write about the mandatory presence of an electronic signature, but no one is involved in certification yet. Some of the ideas are still being adjusted and implemented.

What should the policyholder do?

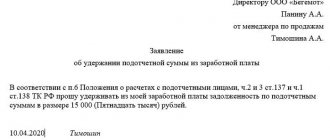

In this case, experts recommend starting with submitting an application addressed to the head of the Federal Tax Service , signed by the head of the organization. It must indicate that the policyholder cannot report through no fault of his own and explain the current situation. It is definitely worth mentioning that the organization was unable to receive notification of the correct submission of the report due to discrepancies in the personal data of employees.

The application is drawn up in free form, but it is mandatory to indicate the employee’s full name , his passport details and the controversial SNILS . It is advisable to attach a copy of the specified employee’s passport to the application.

Also in the application it is worth stating a request not to apply sanctions to the company for not submitting the calculation on time, since this happened not through its fault.

Based on such a statement, the Federal Tax Service must make a request to the territorial body of the Pension Fund. In addition, the policyholder can apply to it independently with a similar application.

What questions may arise

If green plastic is already available, then you don’t have to take any action. The cards have not yet lost their power; they operate as before. You can’t get plastic, but you don’t have to throw them away right away.

If lost, new green cards will no longer be issued. Previously, you would have had to go to the Pension Fund and write a notice of loss and replacement. Now there is no need for such actions. There is a number that is assigned to everyone once in their life, forever. If papers are lost, nothing changes in this data. It is enough to request notification using a new form if the need still arises.

When the last name has changed, the pension fund is told about the new situation. The issue is resolved personally or by contacting the employer. New plastic is not issued; information is corrected in the Personal Account. When you request a registration notification, it comes with a new last name.

The production time for new certificates may vary depending on the region in which the citizen is located. If there are errors with personal data, the standard period of time should not exceed 5 days. But usually everything is handed out right away, after minor adjustments are made depending on the request.

The initial appeal or application requires the presence of the originals of all documents. This usually applies to the application and civil ID. Foreign citizens will need a temporary residence permit.

You can contact any institution at your actual place of residence. That is, permanent and official registration at the address is not required for this. All that remains is to submit the documents and wait until the review is completed. If necessary, any employee will provide advice orally and in writing.

Adjustment of calculation of insurance premiums in 1C: Salaries and personnel management ed. 3.1

Published 01/27/2021 08:10 Author: Administrator Calculation of insurance premiums in itself is considered one of the complex reports in payroll accounting. And its correction – even more so. Even with all the care in the process of filling out a report, it is very easy to make a mistake. In this article we will not only talk about the most popular errors in the DAM, which entail the need to submit adjustments, but also show how to do this using the example of the 1C program: ZUP ed. 3.1

So, the procedure for filling out the report form “Calculation of insurance premiums” is regulated by Order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11 / [email protected] “On approval of the form for calculation of insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form and on the invalidation of the order of the Federal Tax Service dated 10.10.2016 N ММВ-7-11/ [email protected] "; (Registered with the Ministry of Justice of Russia on October 8, 2019 N 56174)

In the practice of an accountant, situations often arise when it is necessary to make clarification on the calculation of insurance premiums (DAM).

Conventionally, types of corrections can be divided into three types:

1. If the base and calculated insurance premiums have decreased;

2. Errors in the employee’s personal data;

3. Other data errors.

Situations may be different:

• correction of inaccuracy or error in calculation;

• change in data as a result of reversal of calculations for the period for which information was transferred.

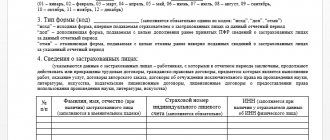

You can also highlight situations when errors are detected in the personal data of employees (section 3):

• mistaken full name, erroneous or incorrect SNILS, etc.;

• change of employee's passport data and other similar situations.

Each clarification option has its own characteristics.

When making changes and clarifying information on insurance premiums, you should be guided by the Letter of the Federal Tax Service dated April 2, 2021 No. BS-4-11 / [email protected] On the submission of updated calculations on insurance premiums.

Let's look at the situations using examples.

Let's consider the initial calculation of insurance premiums for 9 months.

Section 3.2.1 reflects the amount of income of an individual. Sheets were generated separately for each employee.

Errors in accruals and personal data will be caused by V.M. Kiselev’s employees. and Sviridova M.V.

Section 1 of the report shows the amounts broken down by insurance premiums and detailed by month of accrual.

Situation No. 1: adjustment of the DAM as a result of a reversal of accrual

Let's consider an example when the calculation base changes and, accordingly, the amount of insurance premiums for the period for which they have already reported.

One example would be a situation where a recalculation (reversal) occurs, for example, in the 4th quarter, and the amounts of the 3rd quarter are affected.

If the report for the 3rd quarter is submitted, then clarification of the information is submitted, i.e. adjustment report.

But not in all cases a reversal results in filing an adjustment.

If the amount of income being reversed is less than the accrued amount in the current period, then no adjustment is required. If the reversed amount of the previous period exceeds the current accrual for the employee, then clarification is necessary.

Let's look at specific examples.

Let's analyze two situations in parallel.

In October, employees of Sviridov M.V. and Kiselev V.M. provided sick leave certificates. The salary for the month of September has already been accrued and the DAM for 9 months has already been paid. In both situations, the date of onset of the disease affects September: from September 24, 2020 to October 29, 2020.

Both employees had their wages recalculated for the previous period – for September. And this “minus” was reflected in October.

But employee Sviridov M.V. for October the accrued payment was more (RUB 4,806.82) than the amount being reversed (RUB 1,534.09). And Kiselev V.M. less was accrued in October (RUB 2,045.45) than the reversal for September (RUB 10,227.27).

As a result, employee V.M. Kiselev the program recalculated insurance premiums for September, because The salary reversal for September is greater than the current accrual and in this case the base for calculating insurance premiums for September has changed. If the reversed amount does not exceed the current accrual (as with employee M.V. Sviridov), no recalculation occurs and there is no need to clarify the DAM.

In Kiselev V.M. The repayment for September is greater than the accrued salary in October, so there has been a change in the base for calculating insurance premiums, requiring an adjustment to the DAM.

Let’s create an adjustment report “Calculation of insurance premiums”.

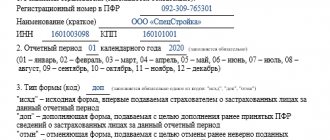

Step 1. Go to the “Reporting, certificates” section - “1C – Reporting”.

Step 2. Create a new DAM report and indicate the adjustment number “1” on the title page.

Step 3. After taking sick leave and calculating wages for October, generate an adjustment report using the “Fill” button.

Section 1 reflects the amount of contributions, taking into account the change - the total amount and the month that affected the recalculation. In our example, this is the 3rd month of the period – September.

Section 3 shows only those employees for whom the amount of income and contributions has changed. The rest of the employees are not repeated.

Table 3.1 shows personal data that remained unchanged - provided that there was no error or correction in it.

In our example, a sheet appeared for employee V.M. Kiselev, on which the amount of clarification for September is reflected in section 3.2.1. Those. instead of 45,000 rub. we see the base taking into account the amount being reversed - 34,722.73 rubles.

According to employee Sviridov M.V. the amounts remained unchanged, because The September reversal did not exceed the accrued salary in October and no clarification is required.

Let's conclude:

• Adjustment is NOT REQUIRED if the reversal income for the 3rd quarter overlaps with the income for the 4th quarter, i.e. the amount of reversal income is less than the income of the current month.

• An adjustment is REQUIRED if the recalculation was performed after the report was submitted and the reversed income of the 3rd quarter is greater than the amount of income of the current month.

All created types of reports with notes are saved in the journal, for example K/1 - adjustment 1.

Situation No. 2: Adjustment of the DAM due to changes in personal data

Situations often arise when an error is made in personal data - an error in the full name or SNILS.

We decided to consider this example. The program initially entered the employee's last name with an error and, accordingly, the initial DAM report was generated and submitted with incorrect personal data.

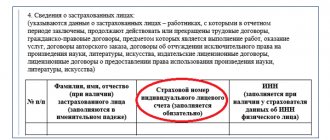

According to the explanations of the Federal Tax Service, clarification is made as follows:

When receiving an updated calculation of insurance premiums for the corresponding billing (reporting) period, the personalized information reflected by the payer in the initial calculation is compared using the set of details “SNILS”, “Last Name, First Name, Patronymic”.

If it is necessary to adjust the indicators specified in subsection 3.2 for individual insured persons. “Information on the amount of payments and other remuneration accrued in favor of an individual, as well as information on calculated insurance contributions for compulsory pension insurance” calculation (hereinafter referred to as subsection 3.2), whose personal data (“SNILS” has changed on the date of submission of the updated calculation) “Last Name, First Name, Patronymic”) the calculation is filled out in the manner corresponding to the explanations set out in the letter of the Federal Tax Service of Russia dated June 28, 2017 N BS-4-11/ [email protected]

In particular, for each insured individual for whom, at the time of submission of the updated calculation, the personal data (“SNILS”, “Last name, First name, Patronymic”) has changed in the corresponding lines of subsection 3.1 “Data about the individual in whose favor payments and other payments have been accrued” remuneration" calculation (hereinafter referred to as subsection 3.1), the personal data reflected in the initial calculation is indicated; in the lines of subsection 3.2 of the calculation, the total indicators are filled in with the value “0”.

At the same time, for the specified insured individual, subsection 3.1 of the calculation is filled out, indicating the personal data current on the date of submission of the updated calculation and the line of subsection 3.2 of the calculation in accordance with the established procedure.

Let's move on to a specific example.

So, employee Kiselev V.M. the surname is misspelled - KisIlev V.M. and this was discovered after the report was generated and submitted. Personalized information about the insured persons is reflected in section 3 of the report.

Let's consider the formation of the corrective DAM step by step.

Step. 1. Create a report in the “Reporting, references” - “1C – reporting” section.

Step 2. In the “Tax reporting” section, select the “Calculations for insurance premiums” report.

Step 3. Set the adjustment number on the title page of the report. If adjustments have already been made, then the next number is set (2, 3, etc.). Let in our case be adjustment No. 2.

Step 4. After correcting the error in the last name (or SNILS), generate a report - the “Fill” button.

When changing personal data in section 3, two sheets are generated for each employee:

• the first sheet - with the established sign of cancellation of information - the number “1”, which reflects the “old” information”, canceling erroneous data. Section 3.2 – not completed;

• second sheet – updated, new data.

And the next sheet reflects the corrected data indicating the income data for the “faithful” employee, we corrected the name V.M. Kiselev.

When saving a corrective report, the program will ask you to create a new report or save the current one. We answer “Yes, create a new one” and then all adjustments will be saved separately in the journal.

In this simple way, an adjustment is created to change erroneous data about individuals.

Situation No. 3: Adjustment of the DAM in case of other personal data errors

Let's look at another common mistake when filling out the RSV form - incorrectly filled out or blank passport data.

In this case, the correction occurs in a slightly different form - the correction number is indicated on the title page, and in Section 3 the general data is repeated for the entire list of employees and a correction is made for the employee with the error. Let's look at an example.

In section 3 of the DAM report on employee M.V. Kiselev. When submitting the report, they did not indicate passport information.

Go to the “Personnel” section of the “Employees” directory and on the “Personal Data” tab, add information about V.M. Kisilev.

Save the employee’s data and generate another report “Calculations for insurance premiums”. On the title page, set the correction number (next sequential) and click “Fill”.

In section 3, all employees will be displayed again, and for the employee being corrected, two sheets will be displayed - the first sheet with the cancellation sign set to “1”. Section 3.2. it is not filled in.

And the second sheet - with the corrected data of the employee and with transferred information about his income in section 3.2.

Thus, correct elimination of errors in primary documents leads to the normal completion of the adjustment calculation for insurance premiums.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Deadlines for submitting clarifications

The deadlines for submitting corrective documents under the DAM are also established by law.

Thus, it has been determined that without consequences in the form of fines and penalties, the adjustment must be submitted before the deadline for submitting the calculation itself. Let us remind you that the DAM must be submitted by the 30th day of the month following the reporting quarter.

Accordingly, if an error is discovered before this deadline, the organization must pay the missing amount of insurance premiums, and then submit a corrective document to the tax office.

Attention! If the document is submitted after the 30th day, then, among other things, the organization has an obligation to pay penalties, which are accrued on the unpaid amounts of insurance premiums.

Certificate verification is not a formality

The insurance certificate received from the Pension Fund must be checked. This matter cannot be approached formally. This conclusion is confirmed by practice.

If everything is in order, then the employee who received the new certificate must sign the statement in the ADI-5 form. Then, this statement should be submitted to the territorial office of the Pension Fund.

However, in the described situation, when delivering the document, an error was detected in SNILS. How to fix it? This is the first question that arises for a personnel specialist under such circumstances.