If workplaces are located at a remote distance from transport routes and public stops, certain difficulties may arise. For example, due to the nature of the work schedule, employees will not be able to get to their workplaces on time and go home without problems. Taking this into account, some companies decide to organize the delivery of employees, including it in the terms of the collective and/or employment agreement.

At first glance, this solution may seem easy to implement. But, it is necessary to take into account a very important point - expenses that should be displayed on the balance sheet. If this is done correctly, tax inspectors will not have any unnecessary questions.

Delivery on a rotational basis

With a shift method, employees cannot come to work and return home every day. Therefore, organizations working on a rotational basis are required to transport employees from their gathering place to the rotation camp and back. This is stated in paragraph 2.5 of the Regulations approved by Resolution of the USSR State Committee for Labor, the Secretariat of the All-Union Central Council of Trade Unions and the USSR Ministry of Health dated December 31, 1987 No. 794/33-82. A similar procedure applies to employees who work in field (expeditionary) conditions.

Accounting

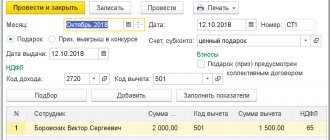

In accounting, reflect the costs of transporting employees to and from work on account 26 “General business expenses” (in trade organizations - on account 44 “Sales expenses”).

Depending on the method in which the organization transports employees to work and back, make the following entries in accounting:

Debit 26 (44) Credit 10 (02, 70, 68, 69…)

– the costs of delivering employees using their own vehicles are reflected;

Debit 26 (44) Credit 60 (76, 73)

– the costs of delivering employees using hired (rented) transport are reflected.

Accounting

In accounting, three accounts can be used to reflect such transactions:

- 71 – if an employee takes money on account and then confirms travel expenses with documents;

- 70 – if the LNA specifies payment for travel as part of wages (payment in kind);

- 73 – in other cases.

The accounts correspond with the cost accounts, the amounts are allocated to the corresponding department. It should be said right away that participation in account 70 postings can lead to disputes with tax authorities. As a rule, compensation is not subject to income tax or contributions, but the presence of such amounts in account 70 gives the Federal Tax Service a reason to do so. The situation may result in litigation.

Depending on the payment method, the wiring diagram may be different. Let's give a few examples.

Money is issued on account:

- Dt 20, 23, 44, etc. Kt 71.

- Dt 71 Kt 50, 51 - taken into account in expenses and compensation was issued to the employee.

- Dt 71 (50, 51) Kt 50, 51 (71) – mutual settlements between the organization and the employee for amounts issued.

The organization buys travel passes:

- Dt 76 (60) Kt 51 – transfer of payment.

- Dt 50/3 Kt 76 (60) – travel cards have been capitalized.

- Dt 71 Kt 50/3 – a travel pass was issued to the employee.

- Dt 50/3 Kt 71 – return of the travel card by the employee at the end of the month.

- Dt 20 (23, 44, etc.) Kt 50/3 – the cost of the travel card is written off as expenses.

Travel passes can also be purchased through an accountable person, then the entry for capitalization will have the form Dt 50/3 Kt 71.

On a note! The entry of travel tickets into account 50/3 “Cash Documents” is carried out at the collateral value.

The third option is for the organization to issue a fixed amount. Here the postings are similar to calculations for imputed amounts, but account 73 is used: Dt 20 (23, 44, etc.) Kt 73 - a fixed amount is taken into account in expenses. This method is convenient if the employee makes multiple trips by ground public transport. Based on the expected number of trips, an economic calculation is drawn up, and the document is approved by the manager. If an employee was absent from work for part of the month (sick, took unplanned leave), the amounts are recalculated proportionally. Unused funds are carried over to the next month.

Note that a situation is possible here when the tax authorities recognize the amount as an additional payment to wages, and not compensation, and will require personal income tax and contributions to be calculated, because the employee will not be able to document it.

In this case, to include it in labor costs, a clear justification is required using real travel prices in force in the region.

Personal income tax and insurance premiums: rotation method

The cost of delivering employees to their place of work, working on a rotational basis, from the location of the organization (collection point) to the rotation camp and back is not taxed:

- Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 2, 2010 No. 03-04-06/68);

- contributions for compulsory pension (social, medical) insurance (subclause “and” clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, letter of the Ministry of Labor of Russia dated September 12, 2014 No. 17-3 /B-434);

- contributions for insurance against accidents and occupational diseases (subparagraph 2, paragraph 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

Situation: is it necessary to include the cost of transporting employees from their place of residence to the collection point and back to their income and withhold personal income tax from them? The organization uses a rotational work method.

Answer: yes, it is necessary.

The organization is not obliged to compensate for travel expenses for employees from their place of residence to the collection point (and back) (decision of the Supreme Court of the Russian Federation of December 17, 1999 No. GKPI 99-924). Therefore, if she pays such expenses, then, regardless of the tax system applied, personal income tax must be withheld from the amount of compensation (clause 1 of Article 210, clause 2 of Article 211 of the Tax Code of the Russian Federation).

This position is confirmed by the Ministry of Finance of Russia in letters dated June 30, 2011 No. 03-03-06/1/384, dated February 2, 2010 No. 03-04-06/68, dated August 20, 2009 No. 03-04- 06-02/60, dated April 24, 2008 No. 03-04-06-02/41.

Advice: there are arguments that allow an organization not to withhold personal income tax on the cost of transporting employees from their place of residence to the collection point and back. They are as follows.

The rotation method involves working outside the place of permanent residence of employees (Part 1 of Article 297 of the Labor Code of the Russian Federation). In this case, the employer is obliged to deliver employees to the shift site by any economically feasible transport (clause 2.5 of the Regulations approved by Resolution of the USSR State Committee for Labor, the Secretariat of the All-Union Central Council of Trade Unions and the USSR Ministry of Health dated December 31, 1987 No. 794/33-82). This obligation does not limit the right of the organization to independently determine the methods and methods of delivery, including from the place of residence to the collection point. Therefore, the costs of transporting workers from their place of residence to the place of assembly are not their income. Such payments can be considered as legally established compensation related to the employee’s performance of his job duties. This means that there is no need to withhold personal income tax from compensation for the cost of travel from the employees’ place of residence to the place of assembly (and back) (clause 3 of Article 217 of the Tax Code of the Russian Federation).

To confirm the validity of compensation for travel expenses from the place of residence to the collection point (and back) and the lack of income for employees when receiving it:

- record the payment of such compensation in the internal documents of the organization (for example, in a collective agreement);

- organize travel for employees by economical transport (when using public transport, it is necessary that the travel document is one-time and individual - this will confirm its use only for business purposes and not for personal needs).

In arbitration practice, there are examples of court decisions in which the courts recognized as lawful the actions of organizations that did not withhold personal income tax from compensation for travel expenses of employees from their place of residence to the place of assembly and back (see, for example, the resolutions of the Federal Antimonopoly Service of the West Siberian District dated February 13, 2009. No. F04-482/2009(20348-A81-14), dated November 22, 2007 No. F04-7996/2007(40258-A75-7), dated February 28, 2007 No. F04-892/2007(31914-A81 -42), Northwestern District dated April 12, 2006 No. A05-17066/05-22).

Situation: is it necessary to withhold personal income tax from the cost of transporting employees from their place of residence to their place of duty and back? Employees have the opportunity to get to their shift location independently. The organization does not create a collection point.

Answer: yes, it is necessary.

If employees have the opportunity to independently get to the place of shift (the rotation camp is not a place of limited transport accessibility), then payment for travel by the employer is recognized as the employee’s income in kind (clause 1 of Article 210, clause 2 of Article 211 of the Tax Code of the Russian Federation).

It is explained this way.

Compensation payments provided for by law and related to the employee’s performance of work duties are not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). Article 302 of the Labor Code of the Russian Federation defines a list of guarantees and compensations for persons working on a rotational basis. This list is closed. Payment for travel of employees from their place of permanent residence to the place of rotation work and back is not provided for by this norm. Consequently, the organization is not obliged to compensate for the costs of travel of employees from their place of residence to the place of duty (and back). This conclusion is confirmed by the decision of the Supreme Court of the Russian Federation of December 17, 1999 No. GKPI 99-924. It turns out that payment for travel in this case is not considered a compensation payment established by law.

Based on this, if an organization pays such expenses, then, regardless of the taxation system applied, personal income tax must be withheld from compensation.

This conclusion is confirmed by letters of the Ministry of Finance of Russia dated February 26, 2013 No. 03-04-06/5379, dated June 22, 2009 No. 03-03-06/1/418, dated May 8, 2009 No. 03-04-06 -01/112.

Advice: there are arguments that allow an organization not to withhold personal income tax from the cost of transporting workers from their place of residence to their place of duty, regardless of whether they have the opportunity to get there on their own or not. They are as follows.

The rotation method involves working outside the place of permanent residence of employees (Part 1 of Article 297 of the Labor Code of the Russian Federation). In this case, the employer is obliged to deliver employees to the shift site by any economically feasible transport (clause 2.5 of the Regulations approved by Resolution of the USSR State Committee for Labor, the Secretariat of the All-Union Central Council of Trade Unions and the USSR Ministry of Health dated December 31, 1987 No. 794/33-82). This obligation does not limit the organization’s right to independently determine delivery methods and methods, including from residence to place of work. Therefore, the costs of transporting employees from their place of residence to their place of duty are not their income. Such payments can be considered as legally established compensation related to the employee’s performance of his job duties. This means that there is no need to withhold personal income tax from the amount of compensation for the cost of travel from the employees’ place of residence to the place of shift (Clause 3 of Article 217 of the Tax Code of the Russian Federation).

To confirm the validity of compensation for travel expenses from the place of residence to the place of duty and the employees’ lack of income when receiving it:

- record the payment of such compensation in the internal documents of the organization. For example, in a collective agreement the following can be stated: “The employer undertakes to compensate the cost of travel for an employee from his place of residence to his place of duty (back) in the amount of actual expenses incurred for travel by rail by the shortest route in a reserved seat carriage of the train. The cost of travel is compensated upon presentation of a railway ticket by the employee”;

- Organize travel for employees by economical transport (for example, a reserved seat train carriage).

In arbitration practice, there are examples of court decisions in which the courts recognized as lawful the actions of organizations that did not withhold personal income tax from compensation for travel expenses of employees from their place of residence to their place of duty (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated March 15, 2010 No. KA-A40 /1852-10).

Reimbursement for travel expenses on a business trip

Quite often, employees, especially in large companies, go on business trips.

When an employee goes on a business trip, the employer is obliged to reimburse him for expenses incurred, including travel expenses.

The amount of reimbursement for travel expenses is not limited by law. The employer compensates for the cost of travel tickets or flights to the business trip, and also reimburses all transportation expenses while on a business trip. .

Despite the fact that such expenses are not standardized or limited at the legislative level, many employers establish certain frameworks in internal regulations that must be adhered to. For example, an employee has the right to purchase only economy class tickets. Many people prohibit using taxi services if it is possible to travel by public transport.

Thus, company management makes efforts to save their budget. Previously, such restrictions were more characteristic of the public sector, but many commercial organizations began to establish similar restrictions.

Personal income tax and insurance premiums: non-shift method

Situation: is it necessary to withhold personal income tax from the cost of transporting employees to their place of work and back? The organization does not use a rotation method, but organizes the delivery of personnel at its own expense.

The answer to this question depends on whether employees can independently get to their place of work and back by public transport or not.

If this is not possible, do not withhold personal income tax from the fare amount. This is due to the fact that in the absence of public transport, the cost of travel for employees to their place of work and back is not an economic benefit (income) of the employee (Article 41 of the Tax Code of the Russian Federation). This opinion is also shared by the Russian Ministry of Finance (letters dated March 6, 2013 No. 03-04-06/6715, dated November 24, 2011 No. 03-03-06/1/778, dated October 20, 2011 No. 03-03 -06/1/680). The courts adhere to a similar point of view (see, for example, decisions of the Federal Antimonopoly Service of the East Siberian District dated July 15, 2008 No. A19-13528/07-30-F02-3200/2008, Northwestern District dated February 18, 2008 No. A21 -3559/2007, Ural District dated January 29, 2008 No. Ф09-9195/07-С2).

If employees can independently get to their place of work and back by public transport, personal income tax must be withheld from the cost of transporting employees. According to regulatory agencies, the cost of free delivery of employees at the initiative of the organization is their income received in kind (letters of the Ministry of Finance of Russia dated October 12, 2011 No. 03-04-05/6-728, dated July 17, 2007 No. 03- 04-06-01/247 and Federal Tax Service of Russia dated September 24, 2010 No. ШС-37-3/11928). It must be included in the tax base for personal income tax (clause 1 of article 210, clause 2 of article 211 of the Tax Code of the Russian Federation). Employees receive income regardless of whether their delivery is provided for by the labor (collective) agreement or not. The organization is obliged to withhold tax at the expense of any cash payments in favor of the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

However, the obligations of a tax agent for personal income tax arise for an organization only if it can determine the amount of income received by each employee (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 21, 1999 No. 42). Thus, in order to withhold personal income tax, the organization must take into account its costs for transporting personnel on a daily basis and distribute them among each employee brought to work on a given day. In letter dated July 17, 2007 No. 03-04-06-01/247, the Russian Ministry of Finance recommends determining the amount of such income based on the total cost of travel and data from the work time sheet (other similar documents).

An exception to this general case is the following situation. If an organization provides free transportation to work and back for disabled people who are unable to get to work and back on their own, such services can be classified as measures for the rehabilitation of disabled people (Article 9 of Law No. 181-FZ of November 24, 1995). At the same time, the cost of services for the rehabilitation of disabled people paid for by organizations is not subject to personal income tax (clause 22 of article 217 of the Tax Code of the Russian Federation). Thus, the organization does not have the obligation to withhold personal income tax when paying for transportation of disabled people to their place of work and back. A similar conclusion is contained in the letter of the Federal Tax Service of Russia for Moscow dated November 16, 2007 No. 28-11/109498.

Situation: is it necessary to charge insurance premiums for the cost of transporting employees to their place of work and back at the expense of the organization? The organization does not use a rotation method.

The answer to this question depends on whether or not the transportation of employees to and from work is determined by the technological features of production.

If the need for delivery is due to the technological features of production (i.e., employees have no other way to get to their place of work and back), it cannot be considered as a free service provided in the interests of employees. It does not matter whether the organization’s obligation to transport employees to the place of work and back is stipulated in the labor (collective) agreement or not. In this case, the cost of transportation does not fall under the criteria of the amounts taken into account in the calculation base for insurance premiums (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Clause 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ). Consequently, the object of taxation by insurance premiums does not arise in this situation.

If an organization delivers employees to their place of work on its own initiative in the absence of technological production features, then include the cost of delivery in the calculation base for insurance premiums. Calculate contributions even if the organization’s obligation to transport employees to their place of work is not specified in the labor (collective) agreement. After all, the cost of transportation services provided solely in the interests of employees is not included in the list of amounts not subject to insurance premiums. In addition, transportation of employees to their place of work occurs within the framework of the employment relationship. This conclusion follows from Part 1 of Article 7 and Article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 1 of Article 20.1 and Article 20.2 of the Law of July 24, 1998 No. 125-FZ. The correctness of this approach is confirmed in the letter of the Ministry of Labor of Russia dated May 13, 2014 No. 17-4/OOG-367 and the letter of the Federal Social Insurance Fund of Russia dated April 14, 2015 No. 02-09-11/06-5250. The judges agree with the officials (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 10, 2011 No. 17950/10). For more information about calculating contributions to compulsory pension (social, medical) insurance from the cost of services provided to an employee, but not specified in employment contracts, see What payments should be paid for compulsory pension (social, medical) insurance.

Payment for travel as financial assistance

If an employee is in a difficult situation and needs help, then one of the forms of support for such an employee is travel compensation . In this case:

- the employee is required to write an application requesting compensation for travel

- explain the reasons why such support should be provided. Supporting documents are attached to the application

- if the employer agrees to provide assistance, then an order is issued and the issue of the amount of compensation is decided

BASIC: shift method

When working on a rotational basis, the costs of transporting employees from their place of residence or collection point to their place of work and back can be included in other costs associated with production and sales (subclause 12.1, clause 1, article 264 of the Tax Code of the Russian Federation). The only condition is that this obligation of the organization must be provided for in the collective (labor) agreement (letters of the Ministry of Finance of Russia dated May 16, 2013 No. 03-03-06/1/17142, dated September 2, 2011 No. 03-04-06/0 -197, dated June 30, 2011 No. 03-03-06/1/384, dated May 8, 2009 No. 03-04-06-01/112).

A similar procedure applies in cases where employees work in field (expeditionary) conditions.

An example of how expenses for transporting employees to and from work are reflected in accounting and tax purposes. The work is carried out on a rotational basis. The organization applies a general taxation system

The work of Proizvodstvennaya LLC is organized on a rotational basis. The organization pays income tax quarterly. The collective agreement states that the organization provides transportation for employees from the gathering place to the rotational camp and back. To transport employees, “Master” rents a bus. In June, the cost of renting a bus was 118,000 rubles. (including VAT – 18,000 rubles).

The accountant made the following entries in the organization’s accounting:

Debit 26 Credit 76 – 100,000 rub. (RUB 118,000 – RUB 18,000) – a fee has been charged for renting a bus for delivering employees working on a rotational basis;

Debit 19 Credit 76 – 18,000 rub. – input VAT on rent is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – VAT is accepted for deduction on expenses associated with the production and sale of products.

When calculating income tax for the first half of the year, Master’s accountant included the bus rental fee among other expenses. The accountant did not withhold personal income tax from the cost of delivery to employees. Contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases were not charged.

Situation: is it possible to take into account the costs associated with renting housing when calculating income tax? The organization uses a rotation method. During delivery to the place of work, employees spend the night in rented premises.

Answer: yes, you can.

If such expenses are provided for in a collective (labor) agreement, then they should be considered as an integral part of the costs of transporting employees to their place of work. The basis for reducing taxable profit is subclause 12.1 of clause 1 of Article 264 of the Tax Code of the Russian Federation. The same point of view is reflected in the letter of the Ministry of Finance of Russia dated November 22, 2004 No. 03-03-01-04/1/126.

BASIC: non-shift method

As a general rule, expenses for travel of employees who do not work on a rotational basis to their place of work and back are not taken into account when calculating income tax (Clause 26, Article 270 of the Tax Code of the Russian Federation).

There is an exception to this rule. Thus, the costs of transporting workers can be included as expenses when taxing profits if they:

- due to technological features of production;

- provided for by labor (collective) agreements.

This procedure is established by paragraph 26 of Article 270 of the Tax Code of the Russian Federation.

Thus, if the delivery of employees to work and back is determined by the technological features of production, then the costs of such delivery can be taken into account as part of labor costs, provided that this is provided for in the labor (collective) agreement.

A similar conclusion follows from paragraph 25 of Article 255, paragraph 26 of Article 270 of the Tax Code of the Russian Federation and is confirmed by letters of the Ministry of Finance of Russia dated March 18, 2015 No. 03-03-06/14664, dated August 31, 2012 No. 03-03-06/1 /449, dated November 24, 2011 No. 03-03-06/1/778.

Situation: how to justify for profit tax purposes that the costs of transporting employees to their place of work and back are determined by the technological features of production?

Such justification could be, for example:

- the organization's remoteness from populated areas;

- use by the organization of a multi-shift (continuous, night) operating mode.

The organization (in particular, due to the hazardous nature of production) may be located far beyond populated areas. The consequence of this may be the lack of public transport routes between the places of permanent residence of employees and the location of the organization. Accordingly, in such a situation, employees simply will not be able to come to work by public transport.

In a multi-shift mode, the operating hours of public transport may not coincide with the time by which a number of employees should report to work. And, if a person works at night or early in the morning, he will also not be able to get there by public transport.

Therefore, if an organization, due to technological features, operates in a continuous (night) mode or is located outside populated areas, the costs of transporting employees to and from work can be taken into account when taxing profits.

It should also be noted that the condition for paying employees for travel must be provided for in an employment (collective) agreement.

Such conclusions can be drawn based on the provisions of Article 252, paragraph 25 of Article 255, paragraph 26 of Article 270 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated August 31, 2012 No. 03-03-06/1/449, dated November 24, 2011 No. 03-03-06/1/778, dated May 11, 2006 No. 03-03-04/1/435.

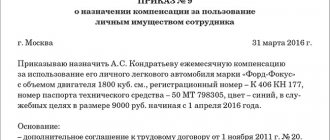

Securing compensation for travel in an employment contract

As mentioned above, travel compensation can be specified in an employment contract. In this case, the amount of travel costs is part of the employee’s salary.

Before signing an employment contract, the employee and the employer discuss all the nuances and working conditions.

As for travel expenses, the employee must clearly understand how beneficial such a “bonus” is to him. Since travel costs in this case are part of earnings, it is necessary to transfer salary taxes.

VAT deduction when paying for travel tickets

Situation: is it possible to deduct input VAT when paying employees working on a rotational basis the cost of travel tickets? Employees travel to their place of work independently.

The answer to this question depends on how payment for travel tickets is organized:

- the organization independently purchases tickets (including through an accountable person);

- the organization compensates the employee for the cost of the tickets he purchased.

If an organization purchases tickets independently, the following rules apply. VAT deduction is possible if there is an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). If you pay for a ticket in cash, the employee will not be given an invoice. And the possibility of deducting VAT on the basis of a strict reporting form (ticket) with an allocated tax amount is provided for in the legislation only for business trips (clause 18 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). At the same time, in letter dated October 10, 2008 No. 03-07-11/333, the Russian Ministry of Finance recognized that when paying employees working on a rotational basis, the cost of travel tickets, the organization can deduct tax on the basis of a ticket with an allocated amount of VAT.

If an organization compensates an employee for the cost of tickets purchased by him, do not deduct VAT. In this case, one of the conditions for deducting input tax has not been met - registration of assets for which the deduction is applied (paragraph 2, paragraph 1, article 172 of the Tax Code of the Russian Federation). For more information about this, see Under what conditions can input VAT be deducted?

Payment procedure and amount of compensation

In order for expenses to be reimbursed, they must be confirmed. Such confirmation of expenses incurred by the employee is travel documents, to which is attached a corresponding application for travel compensation. Some companies do not consider it necessary to collect these documents and compensate employees with a traveling nature of work a certain fixed amount every month. But in this case, there is a high probability that the regulatory authorities will consider such payments not as reimbursement of expenses, but as an additional salary for special working conditions, and will impose appropriate taxes and contributions on them.

When the employer pays for the road to the place of rest, such payment is made at the lowest cost of the road by the shortest route. In accordance with Part 4 of Art. 325 of the Labor Code of the Russian Federation, a person can apply for compensation for travel before leaving on vacation, based on the approximate cost of the ticket. And the final payment is made upon return based on the provided travel documents.

Sample application for compensation of transportation costs to a vacation spot

simplified tax system

The tax base of simplified organizations that pay a single tax on income, expenses associated with transporting employees to and from work will not be reduced (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses can take such expenses into account. If they deliver employees with their own transport - according to subparagraph 12 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation, if by rented transport - according to subparagraph 4 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Situation: is it possible to simplify the payment for services under an agreement concluded with a transport company to deliver employees to their place of work and back?

Answer: yes, you can.

If such expenses are provided for in a collective (labor) agreement, then they can be included in labor costs (subclause 6, clause 1, article 346.16, clause 25, article 255 of the Tax Code of the Russian Federation). The main condition: the fact of delivery must be documented, and the corresponding costs must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Documentary evidence may include:

- an agreement concluded with a transport company;

- certificate of completion;

- employee travel cards;

- other documents.

The Russian Ministry of Finance adheres to a similar point of view in letter dated August 31, 2007 No. 03-11-04/2/217.

What is compensation, and what personnel expenses are classified as transportation?

Most companies have employees whose functions are related to travel.

These could be drivers, couriers, sales agents, managers, and office workers. For example, a cashier periodically needs to hand over funds to the bank, and an accountant needs to submit documents to the inspectorate. Such costs must be compensated by the employer. Compensation is a monetary payment that is associated with reimbursement to an employee of expenses incurred during the performance of his work duties (Article 164 of the Labor Code of the Russian Federation).

Transportation costs that are subject to reimbursement to employees include:

- Compensation for the use of personal vehicles.

- Payment for rental property (such as a car or an employee's computer) and the cost of maintaining it.

- Compensation for public and other transport tickets, as well as taxi services, etc.

The employer has the right to compensate employees for the cost of travel to their place of work. Find out about the nuances, timing and risks of such payments in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

If the employee’s work is of a traveling nature, then the employer must reimburse the costs of renting residential premises, travel costs, daily allowance and other costs provided for in Art. 168.1 Labor Code of the Russian Federation.