New invoice in 2021. Photo by blog.wonderlist.property Changes in legislation in 2021 are numerous and specific. Putin signed several bills, on the basis of which various taxes were increased.

The innovations also affected VAT, which was increased to 20%. All entrepreneurs working under OSNO must now correctly calculate this fee, and are also required to understand how to correctly fill out the new invoice form.

New VAT from 2021 – 20 percent

Since 2004, the main VAT rate in Russia has been 18% (clause 11 of Federal Law No. 117-FZ dated July 7, 2003). However, Federal Law No. 303-FZ dated August 3, 2018 established a return to the VAT rate of 20% that applied before January 1, 2014.

The new VAT rate of 20 percent is effective from January 1, 2019.

The transition to a VAT rate of 20 percent will also include a change in the calculated rate. Thus, when receiving advances for upcoming sales, instead of the rate of 18/118, the rate of 20/120 will be applied.

See “ VAT rates from 2021: table ”.

Filling rules

The detailed procedure for filling out is given in Resolution No. 1137 and Article 169 of the Tax Code. One of the mandatory details that the completed invoice contains is the serial number (clause 1, clause 5, article 169 of the Tax Code of the Russian Federation). There are no special numbering rules.

IMPORTANT!

The document is signed by the head of the organization and the chief accountant or other persons authorized to carry out such actions by order or power of attorney from the organization. On behalf of the individual entrepreneur, another person has the right to sign on the basis of the entrepreneur’s power of attorney indicating the details of the certificate of state registration of the individual entrepreneur.

Invoices do not constitute:

- persons who are not taxpayers, exempt from fulfilling the duties of a taxpayer (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation);

- for transactions that are not subject to taxation (exempt from taxation) on the basis of Article 149 of the Tax Code of the Russian Federation;

- organizations, individual entrepreneurs working in the field of retail trade, public catering, performing work (providing services) for the population in cash, subject to the issuance of a cash receipt or other documents of the established forms (clause 7 of article 168 of the Tax Code of the Russian Federation);

- organizations and individual entrepreneurs applying special tax regimes: Unified Agricultural Tax, simplified tax system, UTII, PSN, subject to some exceptions;

- in other cases.

New VAT documents

The increase in the VAT tax rate from 18 to 20 percent required changes in some documents that are drawn up when working with VAT. So, for example:

- changed the form of the sales book;

- adjusted the form of the journal of received and issued invoices;

- updated VAT return.

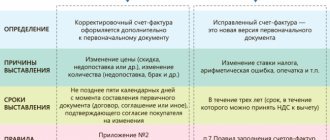

After the law on increasing VAT from 2021 was signed, many were interested: how will the invoice change from January 1, 2021?

Government contract ID.

Contracts concluded in accordance with 44-FZ are assigned an identifier, which encrypts basic information about the contract. The identification code helps to track the movement of funds from the beginning of procurement procedures until the moment of payment for the product or service.

The electronic appearance of the following documents will change:

- invoices, today the format from the order of the Federal Tax Service dated March 24, 2016 No. ММВ-7-15/ [email protected] ;

- adjustment invoice approved by order of the Federal Tax Service dated April 13, 2016 No. ММВ-7-15/ [email protected] ;

- document on the transfer of goods during trade operations in accordance with the order of the Federal Tax Service dated November 30, 2015 No. ММВ-7-10/ [email protected] ;

- document on the transfer of work results and provision of services in accordance with the order of the Federal Tax Service dated November 30, 2015 No. ММВ-7-10/ [email protected]

The invoice already contained these details previously. On October 1, 2017, a column with information about the code according to the Commodity Nomenclature of Foreign Economic Activity was entered into the document form. The line with information on the government contract identifier became a mandatory detail and was included in the invoice form from 07/01/2017.

The new columns have not yet been duplicated in electronic formats, so the accountant needs to manually enter the information.

New or old invoice form in 2019?

Changes in filling out the invoice are related only to the increase in the value added tax rate from January 1, 2021.

Let us remind you that the rate at which the tax is calculated is reflected in column 7 of the form. In 2021, a new percentage is in effect - 20, so this particular rate will have to be shown instead of the previous 18 percent. However, the form itself must be taken from the already valid Government Decree dated December 26, 2011 No. 1137. No changes have been made to this document, therefore, from January 1, 2019, fill out the invoice on the “old” form.

Column 7 shows the VAT rate at which the tax is calculated. In the sample and new invoice form from January 1, 2021, in column 7, enter 20 percent instead of the usual 18.

Below is a sample of filling out an invoice in 2021, taking into account the new VAT rate:

Apply the new 20 percent VAT rate only to goods, works, services or property rights whose shipment date falls on or after January 1, 2021. The date of conclusion of the contract does not affect the rate. This procedure follows from paragraph 4 of Article 5 of the Law of August 3, 2018 No. 303-FZ.

Question: how can the buyer deduct VAT if he received an invoice for the 2021 shipment along with the goods later - in 2021

Answer: Deduct VAT at a rate of 18 percent.

At the time of shipment, this was the rate in effect. Therefore, you paid tax at this rate. We also received an invoice at a rate of 18 percent. It doesn’t matter that you received the goods at a time when another rate is already in effect. The new VAT rate of 20 percent applies only to goods, works, services or property rights, the date of shipment of which fell on the period from January 1, 2021.

Why were the changes needed?

Amendments to the standard form of invoices were required due to changes in tax legislation. Whether the company can count on receiving a VAT deduction depends on the correct completion of this documentation.

Often, due to numerous errors, company accountants have to use adjustment forms. Therefore, specialists must understand the rules for issuing an invoice in advance.

For this purpose, documents transmitted by counterparties are taken into account. Additionally, information about invoices must be entered into the company’s special accounting books.

The main reason for making changes to the form is the increase in VAT to 20% on some types of goods. This is due to the fact that column 7 of this document requires the applicable rate to be reflected.

Legislative regulation

The basic rules that an accountant filling out this documentation must follow are contained in PP No. 1137. The latest adjustments were introduced by PP No. 981.

What is an invoice? Watch the video:

No new uniform was introduced in 2021, so the old uniform is used. But some adjustments are made to it to correctly display the new tax rate.

Rules for filling out invoices in 2019

The rules by which invoices must be filled out in 2021 are given in Government Decree No. 1137 dated December 26, 2011. These rules also did not change in any way in 2021 (this is logical, because the invoice form itself has not undergone amendments).

At the same time, we recall that the Tax Code of the Russian Federation has established a number of mandatory requirements for the preparation of invoices. They are contained in paragraphs 5, 5.1, 6 of Art. 169 of the Tax Code of the Russian Federation.

As a general rule, if the supplier does not indicate any of the required information when filling out an invoice or makes a mistake, the buyer will not be able to deduct the amount of VAT that he paid on such an invoice (Clause 2 of Article 169 of the Tax Code of the Russian Federation) .

If you receive an incorrect invoice from the seller, you have the right to ask the seller to make appropriate corrections.

A complete list of details that must be filled out in 2019 in the invoice for goods shipped, services provided, work performed or property rights transferred:

- serial number and date of compilation;

- name, address and identification numbers of the seller or contractor (taxpayer or tax agent) and buyer or customer;

- name and address of the shipper and consignee - only for shipped goods;

- number of the payment order or other payment and settlement document - if payment took place before shipment;

- the name of the goods shipped or a description of the work performed, services provided and property rights transferred, their units of measurement, when they can be determined;

- the quantity of goods shipped or the volume of work performed and services provided in the specified units of measurement, when they can be determined;

- name of currency;

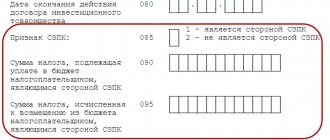

- identifier of a government contract, contract (agreement) (if any) – for deliveries under government orders;

- price per unit of measurement, if possible, under the contract excluding tax. In case of application of state regulated prices - taking into account the amount of tax;

- the cost of goods shipped, work performed, services provided, transferred property rights without tax;

- the amount of excise duty on excisable goods;

- tax rate;

- the amount of tax based on current tax rates;

- the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

- country of origin of the goods - only for imported goods;

- registration number of the customs declaration - only for imported goods;

- code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU - when exporting goods to the countries of the Eurasian Economic Union.

Read also

20.09.2018

Will it be easier to fill out?

Changes in the rules for filling out invoices are not very significant. Only one column changes, so there is no significant difference in filling out the two documents.

How to enter amended VAT on an invoice? Answer in video:

Accountants should only remember that instead of 18%, the rate is now 20%. This will lead to a significant increase in the tax paid by direct buyers, as companies receive a deduction from the government.

Partial refund of the advance and additional payment up to 20%

A situation is possible when the contract is not terminated completely, but only its amount is reduced. For example, the parties agreed that the volume of shipment should be reduced by half.

In a normal situation, the supplier was supposed to return 50% of the advance, but the increase in the VAT rate makes its own adjustments. If we use the conditions of the example from the previous section, then the price of half the batch without VAT is 100 thousand rubles.

Further development of the situation depends on the terms of the contract and the results of negotiations between the parties.

If the price in the contract is indicated without VAT or its terms provide for an automatic increase in the rate, then the cost of the shipped batch, including tax, will be 120 thousand rubles. The same situation will arise if the parties agree and make changes to the terms of the contract. In all these cases, the increase in the VAT rate is paid by the buyer. In this case, the supplier will return not half of the advance, but 2 thousand rubles. less, i.e. 116 thousand rubles.

How to correctly indicate VAT in a contract

If the price was indicated including tax, and the parties were unable to reach an agreement, then the shipment will be made at a price of 118 thousand rubles. In this case, VAT will be allocated from this amount by calculation and the increase in its rate will be borne by the supplier.

The second option is clearly more profitable for the buyer. He pays 2 thousand rubles less, and in the end he can claim almost the same amount of VAT as in the first option.

General rules for calculating VAT when paying advances

Upon receipt of an advance payment, the supplier is obliged to charge VAT based on the rate that was in effect on the date of transfer of money (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation).

Example

On December 10, 2021, Alpha LLC received an advance payment in the amount of 236 thousand rubles from Gamma LLC. Because in 2021 the rate was 18%, then Alpha LLC must charge VAT = 236 / 118 * 18 = 36 thousand rubles.

The buyer has the right to deduct the amount of “advance” VAT without waiting for the goods (services) themselves to be received from the supplier (Clause 12 of Article 171 of the Tax Code of the Russian Federation).

The right to deduction arises in the presence of an invoice, a payment document and an agreement containing the terms of the advance (clause 9 of Article 172 of the Tax Code of the Russian Federation).

If the contract was terminated (or adjusted), and the advance was returned in connection with this, then the parties to the transaction carry out transactions that are “mirror” in relation to those described above.

The supplier deducts the previously accrued VAT (clause 5 of Article 171 of the Tax Code of the Russian Federation), and the buyer restores this amount for payment to the budget (clause 3 of clause 3 of Article 170 of the Tax Code of the Russian Federation).

| Operation | Amount, thousand rubles | Provider | Buyer | ||

| DT | CT | DT | CT | ||

| Transfer of advance payment | |||||

| VAT on the transferred advance | 76.AB | 76.VA | |||

| Refund of advance | |||||

| VAT on the returned advance | 76.AB | 76.VA | |||

Deduction of VAT on advances received and issued

As a result, if the transactions took place within one quarter, then the tax accrual for both parties will look as if there was no advance at all.

We considered a situation where both the receipt and return of the prepayment occurred during a period with the same VAT rate. We will tell you further what to do if the advance payment transferred in 2021 was returned after the rate had increased.

How to avoid tax risks

Calculation of VAT, like other taxes, requires constant interaction with the Federal Tax Service: submission of reports, explanations, checks. Any “communication” with fiscal authorities is always a risk for business. To reduce this risk, entrust communication with tax authorities to people who speak the same language. Finding such specialists on staff is a great success (and, by the way, considerable expenses for paying for their labor).

The second option is to outsource accounting. For example, most of our experts have experience working as tax inspectors, chief accountants in the largest Russian and international companies, and auditors.

Any of our actions is aimed at eliminating financial losses for clients. And to do this, it is necessary to link the calculation of taxes with accounting data as a whole. In addition, we check all prepared reports using a number of control ratios.

This approach makes it possible not only to painlessly undergo desk audits regarding VAT, but also to get out of any dispute with fiscal officials with dignity:

- We fully support the client at all stages of interaction with the Federal Tax Service;

- when requests and demands are received, we prepare reasoned responses, and in case of verification, we try to achieve the most favorable outcome for the businessman;

- Our service standards include tax risk management.