All individual entrepreneurs are faced with the fact that they have to make contributions to various funds for themselves and their employees, pay taxes, pay fines, etc. By the way, fines are paid to the budget in any case, so in order to fill out a payment order you will need to use a certain KBK, depending on which structure the fine must be paid to. For different structures and for different types of activities, there are separate BCCs for each type of fine. One of these is KBK 39211620010066000140.

Payment order kbk 39211620210066000140 originator status

This is what we will do now, and in addition, we will look at the most common questions about filling out payment slips.

General information about details 101 Status of the compiler when transferring insurance premiums by entrepreneurs Status of the compiler when paying income tax for individual entrepreneurs Status of compiler for organizations Consolidated group of taxpayers Results General information about details 101 Tax Code of the Russian Federation in p. To generate a receipt, fill in the fields that you need and they will be automatically included in the form; fields that are left blank will not be entered. Do you want a blank receipt form for payment on your website? Just copy the code to embed on the website. Receipt form for the website with the above details. The Internet resource “Service-Online.su” is designed for free and free use.

Kbk 39211620010066000140 - decryption in 2021

The main reason is that regulatory authorities do not have the ability to conduct a prompt analysis of the financial transactions carried out, as well as reflect the actions on the correct account. During this time, this amount will remain unfixed, and the payer will remain in arrears.

Where to pay in 2021

Important Status of the compiler when transferring insurance premiums by individual entrepreneurs Since 2021, insurance premiums (except for payments for injuries) are paid to the tax authority. An individual entrepreneur can transfer insurance premiums both for himself and for his employees.

In most cases, the status of the IP compiler will have exactly this meaning. Previously, this value was used by individuals when transferring taxes and insurance premiums. Now this code is indicated only when paying fees, as well as contributions to the Social Insurance Fund and other payments to the budget; there are a number of exceptions. Another question regarding filling out the details arose when processing payment orders in connection with changes in the Tax Code of the Russian Federation regarding the possibility of paying taxes and contributions for an obligated entity by another person.

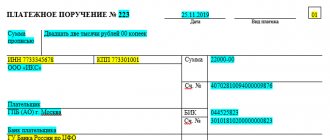

Sample payment order PFR fine kbk 39211620210066000140

Our task is to simplify your work and try to help you to the best of our ability. This site is a free service designed to make your work easier. The website offers a large number of forms that are convenient to fill out and print online, services for working with texts, and much more.

- Field 101 - code "01" - taxpayer status.

- 4 - date of formation of the PP in the format DD.MM.YY.

- Cell 6 - status “01”, in 7 and 8 - the amount in words and numbers, respectively.

- 16 - abbreviated name of the FC body, in brackets - the name of the Federal Tax Service.

- 61 - INN IFTS.

- 103 - checkpoint of the Federal Tax Service.

- In fields 13, 14, 15 and 17 - bank details of the Federal Tax Service.

- 104 - new KBK.

- 105 - seven-digit OKTMO.

- 106 - basis for payment.

Kbk 39211620210066000140 fine how to fill out a payment order 2021

The formation of refund applications by the Federal Tax Service of Russia on the basis of decisions received on paper is carried out in the presence of open KRSB only after receiving and reflecting the balance of settlements for insurance premiums, penalties and fines in accordance with the approved Procedures for interaction between the branches of the Pension Fund of the Russian Federation and the Federal Tax Service of Russia with the departments of the Federal Tax Service by constituent entity Russian Federation and formats in accordance with paragraph 3 of this letter.

- <TP9gt; if the company has already received an official request from the tax authorities to pay a fine;

- <ЗД9gt; , if the accountant independently transfers funds to pay the fine, without waiting for notification from the Federal Tax Service, because knows that the deadlines for paying a tax or fee have been violated and a fine will be imposed.

This is interesting: What is expected of low-income families in 2021 in Perm

KBK 39211620210066000140

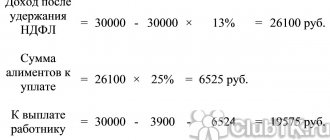

Those who carry out entrepreneurial activities are interested in how to fill out a payment order in 2021? KBK 39211620210066000140 is indicated in field 104 of the payment order. Also, in field 22, you must indicate the UIN code, if there is one in the payment request.

2021 brought some changes to legislation. For example, those for which insurance premiums fall under the jurisdiction of the Tax Code. Will this affect RSV-1 and payment of fines on this form? Most likely no. Since the new year, reporting to pension funds will continue. Accordingly, it will be controlled by these structures. And if you are interested in decoding KBK 39211620210066000140 in 2021, then most likely it will remain the same and will not change its direction. Perhaps the new year will begin with urgent amendments in this area of legislation.

BCC for payment of fines has changed

Moscow (for GU - PFR Branches for Moscow and the Moscow Region) INN: 7703363868 KPP: 770301001 Account No.: 40101810045250010041 in the bank: GU of the Bank of Russia for the Central Federal District BIC: 044525000 KBK: 392116200100660 00140 OKTMO: 45381000 Payment of fine form SZV-M for April 2021 (LLC ‟Vector‟ 109147, MOSCOW, ABELMANOVSKAYA STREET, 5, INN 7709748350 KPP 770901001, registration number in the Pension Fund 087-102-069291) UFK for the city.

Your right

In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service. In 2021, there were a number of changes in the legislation on insurance premiums.

All individual entrepreneurs are faced with the fact that they have to make contributions to various funds for themselves, employees, pay taxes, pay fines, etc. By the way, fines are paid to the budget in any case, so in order to fill out a payment order you will need to use determined by the BCC, depending on which structure the fine must be paid to. For different structures and for different types of activities, there are separate BCCs for each type of fine. One of these is KBK

An example of a payment order for the payment of a transport tax fine. When issuing a payment order to transfer payments to the budget system of the Russian Federation, you must be guided by the Rules, approved. By order of the Ministry of Finance of Russia from the Bank of Russia In order for the obligation to transfer the fine to be considered fulfilled, it is necessary to correctly indicate in the payment order the Federal Treasury account and the name of the recipient's bank, paragraphs. But starting from the year the Federal Treasury account can be clarified p.

How to fill out a payment order for fines (nuances)?

Practice shows that filling out this information in practice raises many questions. In addition, changes have recently been made to the rules for filling out this code. Our review contains all the current code values for the field with the status of originator. The field with the status of the originator in the payment order of the year is located in the upper right corner. It is left empty only in one case - when payments occur between individuals and are not related to the budget system. That is, when paying taxes, fees, contributions, state duties, etc. Note that the affixing of the compiler’s status in the year’s payments was influenced by amendments to tax legislation, where

. Then here is a ready-made answer for you. The Pension Fund of the Russian Federation will learn all the necessary information about contributions, the calculation mode and other parameters of payment for pension insurance from the reporting form RSV-1. It is for its failure to submit or late submission that fines are mainly imposed by the Pension Fund. Moreover, such fines should not be more than 30% of the amount of contributions, and should also be at least 1 thousand.

How to correctly fill out the KBK field in a payment order

From 01/01/2021, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. So, to pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

Let us turn to clause 7 of Art. 45 of the Tax Code of the Russian Federation. If an error is discovered in the execution of a document for the transfer of a tax or other obligatory payment to the budget system, but no debt has been incurred for this tax, the taxpayer has the right to submit a free-form statement to the tax authority at the place of his registration that an error has been made. The application must be accompanied by documents confirming payment of the tax (i.e., transfer to the accounts of the Federal Treasury), with a request to clarify the details of the specified payment: its basis, type and affiliation, tax period or payer status. We wrote about this in detail in an article on how to offset or return overpayments on taxes.

Payment order to bailiffs

Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution. In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the bailiffs’ writ of execution for 2021. In 2021, the ciphers of the corresponding year were used. This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

Rules for filling out a payment order

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment. The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

The payment order has a separate field for KBK (this is the 104th field), and it must be filled out correctly (you can see the rules for filling out a payment order in the “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 No. 383-P If the BCC is indicated incorrectly on the payment slip, then the corresponding amount may be classified as unexplained payments. The Federal Treasury may classify it as “unclarified.” At the same time, an error in indicating the BCC on the payment slip can lead to arrears in taxes and insurance premiums.

Step 1. An application must be sent to the tax office or the territorial branch of an extra-budgetary fund to clarify the details of the payment order. The application is written in any form. Please attach a copy of the payment slip with the bank's stamp to your application.

Payment order for penalties in 2021 - 2021

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2021 - penalties for February 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

This is interesting: Amendments 228 in 2021

Main fields of a payment order in 2020-2020 (sample)

When paying a tax payment once a year, a zero (0) is placed in place of the 4th and 5th digits of the tax period indicator. If the annual payment provides for more than 1 payment period and specific dates are established, then these dates are indicated.

This is interesting: Filling out personal income tax when selling a car, sample 2020

Form and composition of payment order details

The tax period is indicated for payments of the current year, as well as in the event of an independent discovery of an error in a previously submitted declaration and voluntary payment of additional tax (levy) for the expired tax period in the absence of a requirement from the tax authority to pay taxes (levies). The grounds for payment in field 106 are TP and ZD, respectively.

They, like all government prosecutions, must be paid. It must be said that the longer the RSV-1 is not filed at the destination, the greater the fine the entrepreneur expects from the Pension Fund.

How to fill out a payment order for fines to the tax office

If an LLC or individual entrepreneur made mistakes as a result of which a tax, fee or contribution was not paid, or the accountant missed the deadline for sending funds to pay taxes, the company will soon receive a request from the Federal Tax Service to transfer the underpaid amounts. In addition, a fine and penalties will be assessed.

Every month, before the 15th, payments for insurance premiums for the previous month must be transferred to the budget. If this date falls on a weekend or holiday, according to the law, the calculation is made on the next working day. If these requirements are ignored, fines and penalties cannot be avoided. They will be charged not only for late payment, but also for incorrect calculation of payment amounts and, as a result, transfer of funds in incomplete amounts.

Kbk 39211620010066000140 - decryption in 2021

Budget classification codes are used to structure revenues, expenses and sources of replenishment of the state budget deficit. Each code consists of 20 digits, which encrypt data about the ownership of income or expense. The BCCs were put into effect by the order approving instructions on the procedure for applying the budget classification of the Russian Federation dated July 1, 2013 No. 65n. Using the example of VAT on goods sold in the Russian Federation, we will show how to find the required BCC using this order. Appendix 1 contains a list of types of income and analytical group codes. We find in it the code corresponding to the selected tax: 000 1 0300 110. Using Appendix 7, we determine the income administrator - this is the federal tax service, code 182. From Appendix 11 we find out that the VAT payment amount has code 1000 in place of 14–17 digits, and the amount, for example, a penalty - code 2100. The Federal Tax Service code, according to the subsection “General Provisions” of Section II “Classification of Income”, should come first. Thus, we obtain the required BCC - 182 1 03 01000 01 1000 110. Legal entities indicate the BCC when preparing payment orders for transfers to the budget in field 104 of this document. A sample payment order for VAT payment can be found here. BCC for VAT in 2021 remained the same as last year:

This is interesting: What is required for 3 children in the Krasnodar region in 2020

Fine pf kbk - your right

- Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the supervisory authority or “AP” - when accruing penalties according to the inspection report.

- Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement.

- Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

In this article we will look at a payment order to the Pension Fund. Let's learn about the rules for filling out an order. Let's look at common mistakes. Organizations and individual entrepreneurs, as job creators, are required to pay insurance premiums every month for the employees of their enterprises, and in the case of individual entrepreneurs without employees, also for themselves. Obviously, you need to fill out the payment order correctly, otherwise the funds will not find their recipient, the contributions will be considered unpaid, a fine and penalties will be imposed, and in extreme cases the current account may be blocked. It is believed that the preparation of such documents is an activity that does not require special skills, but it would be safer to entrust this to a qualified employee. Every month, the 1st date is the deadline for making payment of contributions; on this date, payment documents must be completed and sent, and money must be transferred. For insurance contributions to the Pension Fund from the cash receipts of enterprise employees within the framework established for the year, big changes came into force in relation to payment orders; from now on, control over payment and submission of reports on contributions to the Pension Fund belongs to the tax service, which means sending documents and money now it is also carried out by the Federal Tax Service at the place of registration of the entrepreneur or at the location of the LLC and separate departments. Already from 1. Calculations incl.Encyclopedia of KKT. KBK transcript in the year. Get demo access or subscribe immediately. Recommendations on the topic. Articles on the topic. KBK decoding in the year, what tax. News on the topic. From April 14, new BCCs for insurance premiums. The Ministry of Finance approved eight new BCCs for salary contributions. The Ministry of Finance returned the old BCCs for insurance premiums.

Payment order to the Pension Fund (form and sample)

Try online. All rights reserved. Register and you will have access to:. If you work in a small business, then sample forms, document templates for accountants, and articles from experts are available to you free of charge. We will be happy to help you with your work. And as a gift for getting to know us, we will send you a table of important changes according to the simplified tax system to the email address you provide during registration. The inspectors missed plans for personal income tax and contributions: it is not too late to correct this in quarterly reports.

Filling out a payment order to pay a fine to the Pension Fund

Moscow and the Moscow region Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) The city of Moscow, the capital of the Russian Federation, the federal city of South Nagorny, using the proposed above the form.

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2021 - penalties for February 2021. When paying at the request of tax authorities (basis of TR) - the period specified in the request. When repaying penalties according to the verification report (the basis of the AP), they also put 0.

What can they be fined for?

Everyone is accustomed to the fact that a fine becomes one of the accompanying aspects of late payment of taxes, contributions and other financial troubles. But failure to provide reporting may also result in a fine being imposed on the individual entrepreneur. In this case, the person who was obliged to provide any documentation on time, but for some reason did not do so, is fined. And the one who insures is the one who has the right to do so, or rather the state bodies for control and implementation of certain types of activities, which include the Pension Fund of Russia.

It is the Pension Fund of Russia that imposes a fine for documentation not provided within the reporting period or for violating the rule on the reliability of the information presented in it. If the question arises: “What is KBK 39211620010066000140 used for, what is the fine they pay for?” Then here is your ready answer.

Budget Classification Codes (BCC) for 2021

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

This is interesting: What benefits does a Labor Veteran have in the Kirov Region?

Kbk 39211620210066000140 fine as a payment order 2021 Sberbank business UIN

Accordingly, it will be controlled by these structures. And if you are interested in decoding KBK 39211620210066000140 in 2021, then most likely it will remain the same and will not change its direction. Perhaps the new year will begin with urgent amendments in this area of legislation.

- When an organization or individual entrepreneur generates payments for current tax payments, the UIN is not defined for them. These entities transfer taxes according to the deadline to certain details, indicating their TIN.

- The current rules provide that in field 22 in this case it is necessary to display “0” instead of the 20-digit code. In this case, quotation marks do not need to be indicated in the order itself.

- When making a payment for medical services, the UIN code, unless provided for by the contract, does not need to be indicated. In this case, "0" is also supplied.

Penalties for insurance premiums: sample payment order for 2021

The next field is the tax period for which the payment is made. If you transfer penalties on demand or an inspection report, then these documents indicate the period for which the penalties must be paid. If the payment is made voluntarily, that is, the code “ZD” is indicated in the previous field, then in the “tax period” field we put zero.

- First we write “UFK for...”, enter the name of the region, for example, “UFK for Moscow”,

- Then in parentheses we write the name of our tax inspectorate or FSS branch, for example, “UFK for Moscow (IFTS of Russia No. 43 for Moscow)”, or “UFK for Moscow (GU - Moscow regional branch of the FSS of the Russian Federation l / s 40100770142)".

Kbk 39211620210066000140 fine as a payment order 2021 Sberbank business UIN

9 individual entrepreneurs: · payer of taxes; · fees; · insurance premiums; · other payments supervised by tax authorities. 10 Private notary: · payer of taxes; · fees; · insurance premiums; · other payments supervised by tax authorities. 11 Lawyer (adv. office): · payer of taxes; · fees; · insurance premiums; · other payments that are supervised by tax authorities.

Credit institution (its branch)Paying agent Task: drawing up an order for the transfer of money for each payment individual 21 Responsible participant of the Group of Companies 22 Member of the Group of Companies 23 FSS 24 Individual Task: · transfer of money to pay fees, insurance premiums supervised by the Social Insurance Fund; · other payments to the budget system (with the exception of fees for tax officers performing legally significant actions and other payments supervised by tax and customs authorities).

How to correctly indicate BCC in settlement documents

The instructions contain a budget classification of income, expenses and sources of financing of various budgets of the Russian Federation, which is used for maintaining budget accounting, generating budget and other reporting and includes the classification:

The significance and role of the BCC in the system of budget regulation

The use of KBK budget classification codes is carried out on the basis of instructions approved by Order of the Ministry of Finance dated 06/08/2020 No. 132n. The instructions establish the structure, principles of purpose, general requirements for the procedure for the formation and application of the CBC and are mandatory for everyone.

Founders (participants) of the debtor Owners of the property of the debtor - a unitary enterprise Third parties Task: drawing up an order for the repayment of claims against the debtor for mandatory payments included in the register during bankruptcy 27 Credit institutions (their branches) Task: drawing up an order for the transfer of money transferred from the budget system of the Russian Federation , not credited to the recipient and subject to return to the budget. 28 Recipient of international mail – participant in foreign trade activities Also see “Field 101 “Status of the originator” of the payment order.” If you find an error, please select a piece of text and press Ctrl+Enter.

- pension insurance (“pension contributions” or “OPS”);

- insurance for temporary disability and in connection with maternity (“social contributions” or “VNiM”);

- health insurance (“medical contributions” or “CHI”);

- insurance against industrial accidents and occupational diseases (injury contributions).