| A busy schedule prevents you from attending professional development events? We found a way out! |

Consultation provided on May 21, 2015.

The organization is going to hand over a sum of money in cash to the bank from the cash desk for depositing into its current account.

What documents are used to document such an operation? How should I fill out an expense cash order (in whose name)?

Quick step by step guide

So, let's look at the actions that need to be taken.

Step -

0

cash

that an organization has as a result of its business activities, according to the so-called cash discipline, must be entered into the cash register and deposited in the

bank

into its current account by the end of the working day.

from depositing

cash into the bank. Next, move on to the next step of the recommendation.

Step -

1 To deposit cash at the bank, you will need a cash settlement order. Its form N KO-2 is approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88. The RKO is written out in one copy by an accounting employee, and then certified by the signature of the chief accountant and the head of the enterprise. Next, move on to the next step of the recommendation.

Step -

2 Cash is deposited by the cashier or an authorized representative. You can also use the services of collectors by concluding a collection service agreement with the bank. But this service is quite expensive, so large companies usually resort to it, while small ones, as a rule, donate money on their own. Next, move on to the next step of the recommendation.

Step -

3 In RKO, in the “issue” line, the last name, first name and patronymic of the person to whom the money is issued to be deposited in the bank are indicated. In the line “basis” - the content of the financial transaction. As a rule, this is the delivery of money to the bank from proceeds and sales of goods and services. The cash settlement order must be registered in the journal of incoming and outgoing cash documents in Form N KO-3. Next, move on to the next step of the recommendation.

Step -

4 When depositing cash at the cash desk of a banking institution, you need to fill out an announcement for a cash deposit (form No. 0402001), present a cash receipt order and receive a receipt, which the bank teller must give you after receiving the money. The receipt must bear the bank's stamp. Next, move on to the next step of the recommendation.

Step -

5 Afterwards, it, together with the RKO, is attached to that part of the cash book, which is filled out as a carbon copy and torn off. The bank will also issue you a bank statement. After the money is transferred to the current account, the accountant makes an entry debit 51 credit 50, reflecting the transfer of money from the cash desk to the bank.

Only a certain limit of money can remain in the company's cash register. The exception is money intended to pay salaries and benefits. But you can keep them in the cash register for no more than three days, and for enterprises in the Far North no more than 5 days.

Additional information and useful advice from a financial expert

Do not forget that if there is money in the cash register that exceeds the required limit, the enterprise and its manager face a substantial fine. We hope the answer to the question - How to arrange cash transfer to a bank - contained useful information for you. Good luck to you! To find the answer to your question, use the form -

At the end of the working day, funds that exceed the established limit are transferred from the organization’s cash desk to the financial institution in which the company has a current account. In addition, money can be donated to pay for goods, work or services to suppliers, as tax deductions and payments on loans and other current transfers. To donate funds, fill out an ad for cash donation.

Topic 1. Rules for organizing cash and non-cash circulation in the Russian Federation

⇐ PreviousPage 2 of 11Next ⇒

1. Acceptance of cash by banking institutions.

2.Procedure and terms for cash delivery.

3.The concept of a limit.

4.Issuance of cash for specific purposes.

5.Documentation for processing money circulation

1. Acceptance of cash by banking institutions

Acceptance of cash from enterprises and organizations is carried out mainly upon the personal appearance of the client in his presence. The operation of the cash desk is organized in such a way that bank clients have the opportunity to deposit proceeds during the operating day (day cash desk) and after the operating day (evening cash desk).

The document for accepting cash at the bank's cash desk is an announcement for cash deposits, which is a set of documents consisting of three parts; advertisements, orders and receipts. When depositing money according to an advertisement, the client transfers it to the operational employee who maintains the personal account of this client. The operational worker checks the correctness of filling out the document, reflects the amount of money in the cash register upon receipt, indicating the type of transaction, document number, cash turnover symbol, and transfers the signed announcement to the cash register.

Having received an announcement for a cash contribution, the cashier of the cash register checks the presence and identity of the transaction worker’s signature with the sample he has, the correspondence of the amount in numbers and words, calls the bearer of the money and accepts cash from him. After accepting the money, the cashier checks the amount indicated in the announcement for a cash deposit with the amount actually found during the calculation. If the amounts match, the cashier signs the announcement, receipt and order, puts a stamp on the receipt and hands it to the depositor. The cashier keeps the advertisement, and transfers the order for the advertisement to the appropriate operational employee to make an accounting entry on the client’s account. Subsequently, the order is issued to the client along with a statement of his personal account.

In cases where the cashier establishes a discrepancy between the amount of money deposited and the amount indicated in the announcement for a cash contribution, as well as when non-payment or dubious banknotes are detected, the announcement for a cash contribution is re-issued for the actual amount of money accepted. The senior cashier crosses out the original document and on the back of the receipt for this document puts down the amount of money actually accepted, as well as the denominations, series, numbers and amount of dubious banknotes accepted for examination, puts his signature and returns it to the operational employee.

The operational employee checks the newly filled out announcement for a cash contribution, makes corrections in the cash register upon receipt, and for dubious banknotes that are subject to examination, draws up a special receipt, on the reverse side of which he indicates the denomination, series, numbers of dubious banknotes and the total amount. The operational employee passes announcements for cash contributions and a special receipt to the cash desk. A special receipt for questionable banknotes accepted for examination and a receipt in the advertisement for a cash deposit for the amount of money actually accepted, signed by the cashier and sealed by the cash register, are issued to the client. The originally issued advertisement and the order for the advertisement for a cash contribution are destroyed.

The cashier of the cash register keeps daily records of the amounts of money received from clients and handed over to the cash register manager in the book of accounting for accepted and issued money (valuables). At the end of the operating day, based on the receipt documents, the cashier draws up a certificate about the amount of money accepted and the number of monetary documents received at the cash desk and checks the amount on the certificate with the amount of money actually accepted by him. The certificate is signed by the cashier and the cash turnover indicated in it is verified with the cash registers of the cashiers. The reconciliation is formalized by the signatures of the cashier in the cash registers and the operator's signatures on the cashier's certificate. Cash received during the operating day, together with receipt documents and a certificate of the amount of money received, is handed over by the cashier to the cash register manager against a signature in the book of accounting for accepted and issued money (valuables).

All cash received during the operating day must be credited to the bank's operating cash desk and credited to the corresponding customer accounts on the same business day, which is reflected in the following transactions:

D-tsch.; 20202 “Cash desk of a credit organization”;

K-t - settlement (current) account of the client.

The bank accepts cash during the postoperative period at the evening cash desks. Money accepted by the evening cash desk must be credited to the appropriate accounts of bank clients no later than the next business day. When accepting cash directly from an organization, the donor hands over the money to the evening cash desk, also following an announcement for a cash contribution. Making an advertisement and accepting money from clients is carried out in the same way as the procedure for carrying out these operations during bank operating hours.

After the evening cash register has received money, the cashier and the operational employee check their actual availability with the data of incoming documents and the cash register upon receipt and sign the cash register. Cash, cash receipt documents, a cash journal and a seal at the end of the evening cash register operations are stored in a safe, which is handed over under security. On the morning of the next day, the evening cash desk workers accept the safe from security and hand over the money and receipt documents to the cash register manager against a signature in the cash register.

Another channel for cash entering the bank is through a cash collection machine.

The Bank can carry out collection and delivery of its funds and valuables, as well as funds and valuables of clients, using its own resources and resources or on contractual terms through specialized collection services licensed by the Bank of Russia to conduct collection operations.

2. Procedure and terms for depositing cash.

The procedure and terms for depositing cash are established by bank service institutions for each enterprise in agreement with their managers based on the need to accelerate the turnover of money and timely receipt of it at the cash desks during the working days of bank institutions.

In this case, the following deadlines for the delivery of cash by enterprises may be established:

- for enterprises located in a populated area where there are banking institutions or enterprises of the State Committee for Communications of Russia - daily on the day cash is received at the cash desks of enterprises;

- for enterprises that, due to the specifics of their activities and operating hours, as well as in the absence of evening collection or the evening cash desk of a bank institution, cannot deposit cash at the end of the working day every day at bank institutions or enterprises of the State Committee for Communications of Russia - the next day;

- for enterprises located in a populated area where there are no banks or enterprises of the State Committee for Communications of Russia, as well as those located at a remote distance from them - once every few days.

Cash accepted from individuals for the payment of taxes, insurance and other fees is handed over by the administrations and collectors of these payments directly to banking institutions or by transfer through enterprises of the State Committee for Communications of Russia.

Cash received from the current account to the cash desk is spent strictly for its intended purpose (the purposes for which the money was received are indicated on the back of the cash receipt). The unspent balance is handed over to the cashier. For example, wages not received on time must be returned to the current account within three days. Money received at the cash desk as a contribution to the authorized capital, proceeds from the sale of products in cash are deposited into the current account

The transfer of money to the current account is formalized by a cash receipt order.

At the bank, the cashier who deposits the money fills out an “Announcement for Cash Deposits.” The “Announcement” form can be obtained from the bank operator.

It consists of three parts. The upper part remains in the bank, the middle part (receipt) is given to the cashier. The lower part of the advertisement (order) is also returned to the cashier, but only after the bank has carried out the corresponding operation and together with the bank statement.

Each of the three parts is marked with: the date from whom the money was received, the recipient's bank and the recipient, the purpose of the contribution. In the upper right corner of the first and second parts we put our current account number and the amount in numbers. The same amount is written in words in the following order. The entry must begin close to the beginning of the field allocated for it with a capital letter. The remaining spaces on the field should be crossed out with a horizontal line.

The third part is filled out a little differently. In the order you need to indicate the code of the recipient bank and the amount of the loan (in our current account this amount will be debited, and in the bank - as a loan).

3. The concept of limit

Cash desks of enterprises can store cash within the limits established by the banking institutions that serve them in agreement with the heads of these enterprises.

The limit on the balance of cash in the cash register is established by banking institutions annually for all enterprises, regardless of their legal form and field of activity, that have a cash register and carry out cash payments.

To establish a limit on the cash balance in the cash register, an enterprise submits to the bank institution that provides its cash settlement services a calculation in form N 0408020 “Calculation for establishing a cash balance limit for an enterprise and issuing permission to spend cash from the proceeds received at its cash desk” ( Annex 1).

For an enterprise that includes divisions that do not have an independent balance sheet and accounts with bank institutions, a single cash balance limit is established taking into account these structural divisions. The cash balance limit for structural divisions is communicated by order of the head of the enterprise.

For representative offices, branches and other separate divisions of an enterprise located outside its location, forming a separate balance sheet and having accounts in bank institutions, the limit on the cash balance in the cash register is established by the servicing institutions of banks at the place of opening the corresponding accounts of the structural divisions.

Limits on the cash balance of administrators and recipients of federal budget funds who have opened personal accounts with federal treasury authorities are established by institutions of the Bank of Russia or authorized credit organizations of the federal treasury authorities of the Russian Federation, taking into account the specified administrators and recipients of federal budget funds. The calculation for establishing a cash balance limit in this case is presented by the federal treasury authorities, taking into account the managers and recipients of federal budget funds who have opened personal accounts with the federal treasury authorities in the prescribed manner.

If an enterprise has several accounts in various banking institutions, the enterprise, at its own discretion, applies to one of the banking service institutions with the expectation of establishing a limit on the cash balance in the cash register. After establishing a cash balance limit in one of the bank institutions, the enterprise sends notifications about the cash balance limit determined for it to other bank institutions in which the corresponding accounts are opened for it. When checking a given enterprise, banking institutions are guided by this limit on the cash balance in the cash register.

For an enterprise that has not submitted a calculation for establishing a limit on the cash balance in the cash register to any of the bank's servicing institutions, the cash balance limit is considered zero, and cash not handed over to banking institutions by the enterprise is considered above the limit.

The cash balance limit is determined based on the volume of cash turnover of an enterprise, taking into account the peculiarities of its mode of operation, the procedure and timing of depositing cash at bank institutions, ensuring safety and reducing counter transportation of valuables.

In this case, the cash balance limit is set:

- for enterprises that have cash revenue and hand over cash to bank institutions or enterprises of the State Committee for Communications of Russia every day at the end of the working day - in the amounts necessary to ensure the normal operation of enterprises from the morning of the next day;

- for enterprises that have cash revenue and hand over cash to bank institutions or enterprises of the State Committee for Communications of Russia the next day - within the limits of average daily cash revenue;

- for enterprises that have cash revenue and donate cash to banking institutions or enterprises of the State Committee for Communications of Russia not daily, - depending on the established deadlines for delivery and the amount of cash revenue;

- for enterprises that do not have cash revenue - within the limits of the average daily cash expenditure (except for wages, social benefits and scholarships).

The cash balance limit must be calculated using one of two formulas.

If the organization receives cash proceeds

L = V: P x N,

where L is the cash balance limit (RUB); V – volume of cash receipts; P – billing period for which the volume of receipts is taken into account (no more than 92 working days); N – period of time between the days of delivery to the bank (no more than 7 working days).

The period of time between the days of depositing cash received to the bank for goods sold, work performed, services rendered is also counted in working days and cannot exceed seven working days. If the organization operates in a locality where there is no bank, 14 working days. The only exceptions are acts of force majeure.

Example:

Anna LLC (retail trade, opening hours from 9.00 to 21.00, closed on Sundays).

Cash revenue for October is 1,200,000 rubles, for November 1,250,000 rubles, for December 1,350,000 rubles.

Total for 3 months (92 days) – 3,800,000 rubles.

The proceeds are deposited in the bank the next day at 12 noon.

The cash register limit will be 82,000 rubles. (3,800,000: 92 days x 2 days).

In the absence of cash receipts

L = R x N,

x N,

where L is the cash balance limit (RUB); R – volume of cash disbursement, excluding amounts intended for salary payments; P – billing period for which the volume of issues is taken into account (no more than 92 working days); N – the period of time between the days of receiving cash from a bank check (no more than 7 working days).

For example, an organization works from Monday to Friday and spends 2,000,000 rubles per week. Money is deposited into the bank once every two days, not counting Saturdays and Sundays. Then the limit will be 800,000 rubles (2,000,000 rubles: 5 working days x 2 working days).

The cash balance limits established by the bank institution are communicated in writing to each enterprise, for which second copies of the submitted calculations in form 0408020 can be used.

The cash balance limit can be revised during the year in the prescribed manner at the justified request of the enterprise (in case of changes in the volume of cash turnover, conditions for the delivery of proceeds, etc.), as well as in accordance with the bank account agreement.

Enterprises are required to hand over to banking institutions all cash in excess of established limits on the cash balance in the cash register.

Enterprises can keep cash in their cash registers in excess of the established limits only for issuance for wages, social payments and scholarships for no more than 3 working days (for enterprises located in the Far North and equivalent areas - up to 5 days), including the day the money is received at the bank institution. After this period, amounts of cash not used for their intended purpose are handed over to banking institutions, and subsequently these funds are issued in the order established by federal laws, other legal acts of the Russian Federation and banking rules developed in accordance with them.

4. Issuance of cash for specific purposes.

The proceeds received by the enterprise's cash desk can be spent on the following purposes:

- for wages;

— other payments to employees (including social ones);

- scholarships;

— travel expenses;

— for payment for goods (except for securities), works, services;

— payment for previously paid in cash and returned goods, uncompleted work, unrendered services;

— payment of insurance compensations (insurance amounts) under insurance contracts for individuals.

Spending proceeds for other purposes is not permitted.

Entrepreneurs should take into account that payments under one agreement concluded between these persons can be made in an amount not exceeding 100 thousand rubles.

If the organization does not set a cash limit before January 1, then all cash in the cash register will be in excess of the norm.

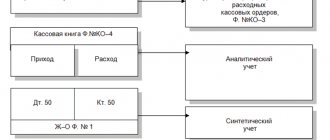

5. Documentation for processing money circulation

A bank account agreement usually provides that an organization can convert its non-cash money into cash, and vice versa. To receive cash from a bank, an organization must have a checkbook, which it receives from the bank upon application.

A checkbook refers to strict reporting forms, and a strict reporting form is each sheet of a checkbook, and a checkbook is a set of strict reporting forms.

Strict reporting forms are forms that are printed at state printing factories on special paper. Each strict reporting form indicates its series and number. Strict reporting forms have several degrees of protection, making them difficult to falsify.

Each fact of transfer of strict reporting forms from one organization to another or from an organization to an individual is registered.

After completely using the checkbook, the organization is obliged to hand over its cover and what remains of it to a commercial bank.

The check is filled out by hand using ink or a ballpoint pen in accordance with the rules outlined on the cover of the checkbook. No amendments to the check are allowed - in case of an error, the check must be completely rewritten. Damaged checks cannot be thrown away; they should be left in the checkbook and returned to the commercial bank along with the cover.

The check is issued on behalf of the organization to a specific recipient of money and for a specific amount. There are two signatures on the check - the first and the second, as well as a seal impression. This information is duplicated on the counterfoil of the check.

On the back of the check information about the purpose of payment is indicated. In this case, it is payment of wages.

The check is accepted by the bank within 10 days from the date of its issue. To transfer it to the bank, the check is torn off from the checkbook along the tear line. The counterfoil of the check remains in the checkbook.

The organization must notify the bank in advance about receiving cash and agree with the bank on a specific time when a representative of the organization can receive it. This is logical from the point of view of bank security: it is better for it not to keep excess cash reserves in its vault.

The amount of money indicated on the check must correspond to the maximum balance of funds in the current account. The bank has the right to refuse an organization to receive cash if, in its opinion, the organization’s request is not sufficiently justified. For example, an organization can receive cash for salary payments from the bank only in accordance with the salary payment schedule, and for settlements with another organization, it can receive no more than the established limit for cash payments between legal entities.

Here are two more rules for filling out a check that prevent counterfeiting:

· in the check details “amount in numbers”, the empty spaces in front and after the amount of rubles must be crossed out with two lines;

· the amount in words must begin at the very beginning of the line and with a capital letter. The word “rubles” is indicated after the amount in words without empty space.

Questions for self-control:

1. Tell us about how cash is accepted by banking institutions.

2. What procedure and terms for depositing cash do you know?

3. Define cash limit.

4. Who sets the organization’s cash limit and how?

5. For what purposes can cash be issued from the cash register?

⇐ Previous2Next ⇒

Recommended pages:

Information about the form

The new standard document format was approved in 2014 by Directive of the Central Bank of the Russian Federation No. 3352-U. The format is also relevant for 2021. This is a primary cash document and corrections are not permitted. If the person filling out the paper made a mistake, a new form should be filled out.

To fill out, use form 0402001. Both manual and electronic entry of information is allowed. This is done by the company's accountant or other authorized employee. The contributor can also be any employee who has a power of attorney issued by management. Usually this is a cashier or an accounting employee.

It is allowed to enter some information using stamps. These include:

- account owner;

- Account number;

- Name of the bank.

To correctly formulate the paper, you should study a sample of filling out the announcement form for a cash contribution.

How to fill

The document consists of three sections: announcement, receipt and expenditure order. The following information is entered into the fields of the form:

- number and date;

- name of the company depositing cash to the bank;

- name and details of the recipient's bank, that is, the addressee to whom the money will be sent;

- amount - in numbers and words;

- source of contribution;

- donor visa.

The source of payment field is sometimes confusing. The payment code corresponding to the nature of the transfer is entered here. A total of 15 codes are used, among them the most popular are:

- 02 – trading revenue;

- 12 – taxes, fees and other contributions;

- 14 – payment of loans and borrowings;

- 16 – deposits of individuals;

- 32 – other income;

- 19 – transfers to the account of an individual entrepreneur.

The signature is placed only by the one who hands over the money; approval from the manager or chief accountant is not required. The question arises, how to fill out the remaining three parts? The order and receipt contain all the same fields as the first block, so they are filled out in the same way.

The first part remains in the bank, the second is cut off and transferred to the representative of the legal entity with a bank note confirming the receipt of funds. The expense order also remains with the client, and he transfers it to the accounting department of his enterprise. This block is attached to the cash receipt order, on the basis of which money was issued from the cash register.

An example of filling out an announcement for a cash contribution can also be viewed at a bank branch. Some companies offer services to fill out this form.

- Which intermediary is a paying agent and which is not, No. 24

- How to properly receive money from citizens through an intermediary, No. 22

- How to install, re-register or deregister a cash register in one go, No. 22

- Who and when can work without a cash register, No. 21

- Cash receipts and expenses according to the new rules, No. 10

- How much cash to leave in the cash register, No. 8

- How tax authorities will now check cash registers and cash registers, No. 6

- I was fined for not having a cash register last year, should I pay a fine this year?, No. 4

- Free cash register: has it become easier to work with cash, No. 1

2011

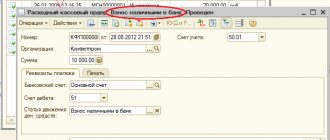

How to draw up an RCO for an employee’s cash delivery to a bank

In the line “Organization” the legal form (LLC, CJSC, etc.) and the name of the organization are indicated (for example, LLC “you must indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash. Next is indicated the name of the structural unit of the organization that draws up cash settlements (if the organization does not have structural units, put a dash).

In the “Document number” field, the serial number of the cash register is indicated (the numbering of incoming and outgoing cash documents during the year must be continuous, and start anew from the beginning of the next year). The “Date of compilation” field indicates the date of issue of money from the cash register in the format DD.MM.YYYY (for example, 03/05/2016). RKO must be issued on the day the money is issued from the cash register, so the date of issue of money and the day the order is generated coincide.

Expense cash order (form ko-2)

Announcement for cash contribution, form, download Word format for filling out an announcement for cash contribution 2021 Let's consider in table form how to fill out an announcement for cash contribution. Field name Explanations Date Indicate the date of transfer of cash to the bank. From whom We register the full name of the employee who actually deposits funds into the r/account.

We remember that a power of attorney must be issued for this employee at the bank. Recipient Full name of the organization to whose account we are depositing cash. TIN We indicate the identification number of the taxpayer - a budget organization Account No. The field values are identical, we enter the number of the current account into which we deposit money. Account credit No. To be credited to the account Name of the depositing bank, BIC We write the name and BIC of the bank branch (credit institution) through whose cash desk we deposit funds.

An example of filling out an expense cash order when depositing cash at a bank

Accountants usually explain this by saying that they indicate in the order the posting of Account Dt 51 - Account Kt 50, but in their opinion it does not imply the preparation of cash settlements for an individual. That is, they believe that the money under such a cash settlement is issued immediately to the bank, and the recipient’s signature is replaced by a bank receipt attached to the order. What is wrong. The following rules for drawing up cash settlements and the rules for issuing money from the cash register were violated.

Firstly, the RKO must indicate f. And. O. and passport details of the person to whom the money was issued, and his signature must be on it. This is a requirement not only of the Regulations on the procedure for conducting cash transactions. 4.2 Regulations, approved. Central Bank of October 12, 2011 No. 373-P (hereinafter referred to as the Regulations), but also the Law on Accounting. 2 tbsp. 9 of the Law of December 6, 2011 No. 402-FZ. After all, the RKO is the primary document. Secondly, the cashier does not have the right to give out money until the recipient signs and writes the amount in words. 4.3 Provisions. The attached primary and other documents on the basis of which money is issued (orders, statements, receipts) are indicated. The following lines are signed by the head of the organization and the chief accountant (or other authorized person). The signature of the manager in the RKO is not required, provided that he has given permission to carry out the operation in the documents attached to the consumables.

The line "Received". Filled out by the person to whom funds are issued from the cash register. In this case, rubles are indicated in words with a capital letter, and kopecks - in numbers. If there is a blank line left after writing the amount in rubles, a dash is placed in it.

Below is the signature of the recipient and the date of receipt of the money. When issuing money according to a debit order, the cashier requires the presentation of a document (passport, military ID, driver's license, etc.) identifying the recipient.

* * *

Organizations have sorted out the preparation of RKO. How to draw up a consumable document for depositing money into a bank from an individual entrepreneur?

If he himself conducts cash transactions and hands over cash from the cash register to the bank, then an “impersonal” cash settlement service is also suitable, that is, method 1. And if one of these is done by his employee, you need to record the transfer of money between him and the individual entrepreneur, then There is use method 3.

<1> Clause 4.2 of the Regulations, approved. Bank of Russia dated October 12, 2011 N 373-P (hereinafter referred to as the Regulations). <2> Clause 2 of Art. 9 of the Law of December 6, 2011 N 402-FZ. <3> Clause 4.3 of the Regulations. <4> Clause 4.2 of the Regulations; clause 3 art. 9 of the Law of December 6, 2011 N 402-FZ. <5> Regulation of the Bank of Russia dated April 24, 2008 N 318-P. <6> Clause 9.7 of the Regulations of the Bank of Russia dated April 24, 2008 N 318-P. <7> Clause 4.1 of the Regulations. <8> Clause 1.5 of the Regulations.

N.A. Martynyuk

Tax expert

An example of filling out an advertisement for a cash contribution

Info

Column “Purpose code”. The code for the purpose of using the disposed funds is indicated. This column is completed only if the organization uses the appropriate coding system. The "Issue" line. The full name of the individual or the name of the organization to whom the money is given is indicated in the dative case (to whom?).

Line "Base". The basis for the issuance of funds (the content of the financial transaction) is specified. For example, “Depositing cash to the bank”; “Issuing cash for business expenses.” Line "Amount". We indicate the amount of money that is issued from the cash register.

In this case, rubles are indicated in words with a capital letter, and kopecks - in numbers. If there is a blank line left after writing the amount in rubles, a dash is placed in it. Line "Application".

Expense cash order (form KO-2) in 2021

- Rules for handling counterfeit money, No. 24

- What will happen if there are no “accountable” statements, No. 24

- Backup CCP: problems of application, No. 24

- Cashier - a lot of questions! Part II, No. 23

- Should all EPs keep a cash book, No. 23

- How to capitalize yesterday's earnings, No. 23

- Cashier - a lot of questions! Part I, No. 22

- How to maintain cash books with OP, No. 22

- How to draw up cash settlements for cash deposits to the bank by an employee, No. 14

- I want to know everything: cash register test, No. 13

- How to issue and register a change fund for a cashier, No. 11

- Cash “dos” and “don’ts”, No. 2

2012

No organization has the right to keep cash in the cash register in excess of the limit, which is established by settlement method. The procedure is determined in the Directive of the Bank of Russia dated March 11, 2014 N 3210-U. The exception is days of payment of wages, benefits or scholarships.

Attention

If the company's cash desk at the end of the working day exceeds the limit, then the difference (money in fact minus the limit) must be handed over to the bank or credit institution in which the current account is opened. If you violate the established procedure for conducting cash transactions, the organization may be fined in the amount of 40,000 to 50,000 rubles, and the responsible employee - from 4,000 to 5,000 rubles (15.1 of the Administrative Code). The cash deposit transaction must be formalized with a special document, and the cash must be taken to the bank along with it.

The procedure for submitting revenue from separate divisions and documentation

One of the signs of a separate division is the territorial distance of the division from the enterprise. For a detailed consideration of this issue, let us turn to the main standard - the Regulation on the conduct of cash transactions in national currency in Ukraine, approved by Resolution of the NBU Board of December 15, 2004 No. 637 (hereinafter referred to as Regulation No. 637).

Clause 1.2 of these Regulations provides a definition of a separate division - branches, representative offices, departments and other structural divisions that are allocated part of the property of business organizations. exercising in relation to this property the right of operational use or other property right provided for by the legislation of Ukraine. Thus, the main criterion becomes not territorial, but property isolation of the division, which can be located at the same location as the parent enterprise.

In accordance with clause 4.2 of Regulation No. 637, separate divisions that carry out operations to accept cash for products sold (goods, work, services) with the registration of its PKO, as well as to issue cash for payments related to wages, for business needs, other transactions with registration of their cash settlement and statements, maintain a cash book. Separate divisions of enterprises that carry out cash payments using cash registers or cash registers and maintaining cash registers, but do not carry out operations to receive (issue) cash using cash orders, do not maintain a cash book.

Sample cash receipt order for cash deposit to the bank

- Cash limit calculation: penny to penny, No. 15

- BSO: when, why and why, No. 14

- Soon the cash receipt will be sent to your mobile phone, No. 12

2015

- Putting order in the cash register and cash payments, No. 17

- "Strangers" on the payroll, No. 16

- How to register cash settlement when issuing salaries in cash, No. 12

- Cashier: we continue to learn new rules, No. 18

- The supplier came for cash: we issue money correctly, No. 18

- We operate the cash register according to the new rules, No. 17

- What, to whom and how can now be given in cash, No. 14

- Cash desk: forms - old, rules of operation - new, No. 12

- By revenue or by expenses: choose the cash limit formula, No. 8

- The imputation officer provides services to the population: do we issue a BSO or a cash register check?, No. 5

- New cash register procedure: simpler, but not for everyone, No. 2

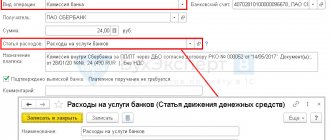

2013 Block “Debit”: In the column “Structural unit code” the code of the division of the organization issuing the cash register is indicated (if the organization does not have structural units, put a dash). In the column “Corresponding account, sub-account” the account number is indicated, the debit of which reflects the issuance of money from the cash desk in accordance with the chart of accounts:

- 51 – delivery of money to the bank for crediting to the current account;

- 60 – settlements with suppliers and contractors;

- 70 – settlements with employees regarding wages;

- 71 – settlements with accountable persons;

- 73 – settlements with employees for other transactions;

- 75-2 – settlements with founders for payment of income.

The column “Analytical accounting code” is filled in only if the corresponding codes are available.

And if something happens to the cash on the way to the bank, they will deal with the right people. METHOD 3. Preferred. The cash register service contains the employee’s data and signature without formalizing the issuance of money on account. The organization must have a person specially authorized to hand over money to the bank. It is appointed by order of the manager. 1.5 Regulations.

WE WARN THE CASHIER Any transfer of cash from hand to hand within the organization must be documented, indicating f. And. O. recipient of the money and his signature. Anonymized cash flow documents can lead to abuse. Now about the wiring that needs to be installed in the RKO. Depending on the circumstances, there are two options.

OPTION 1. Dt of account 51 – Kt of account 50. It is acceptable in a settlement account drawn up for an employee if there is confidence that the bank will accept the money on the same day. Reception date - the date on the receipt for the announcement for cash contributions.

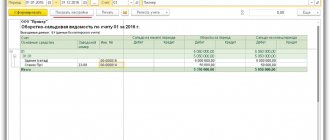

Receipt of proceeds to the current account - posting

Accounting Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media. networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > Tax-tax December 20, 2021 Revenue has been received into the current account - postings for such an operation are not always limited to one pair of accounts .

What determines the number of accounting entries for this operation?

What it is

Expenditure cash order (RKO)

- This is one of the cash discipline documents that is drawn up each time

cash is issued from the cash register The RKO is formed in one copy by an accounting employee and signed by the head of the organization, the chief accountant, the cashier and the person receiving the funds.

note

, starting from June 1, 2014, a simplified procedure for maintaining cash discipline has been in effect, according to which individual entrepreneurs are no longer

required

to draw up cash documents (PKO, RKO and cash book).

How to fill out RKO

Instructions for filling out the cash receipt form

In the line "Organization"

the legal form is indicated (LLC, CJSC, etc.) and the name of the organization (for example, LLC “Company”).

In the line “Code according to OKPO”

it is necessary to indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash.

In the "Document number"

the serial number of the cash register is indicated (the numbering of incoming and outgoing cash documents during the year must be continuous, and start anew from the beginning of the next year).

In the “Date of Compilation”

the date of issue of money from the cash register is indicated in the format DD.MM.YYYY (for example, 03/05/2019). RKO must be issued on the day the money is issued from the cash register, so the date of issue of money and the day the order is generated coincide.

Block "Debit"

:

In the column “Code of structural unit”

indicate the code of the division of the organization issuing cash settlements (if the organization does not have structural divisions, put a dash).

In the column “Corresponding account, sub-account”

the account number is indicated, the debit of which reflects the issuance of money from the cash register in accordance with the chart of accounts:

- 51 – delivery of money to the bank for crediting to the current account;

- 60 – settlements with suppliers and contractors;

- 70 – settlements with employees regarding wages;

- 71 – settlements with accountable persons;

- 73 – settlements with employees for other transactions;

- 75-2 – settlements with founders for payment of income.

Column "Analytical Accounting Code"

filled in only if the corresponding codes are available.

In the "Credit"

the number of the accounting account is indicated, the credit of which reflects the issuance of money from the cash register (as a rule, this is account

50.1 - “cash desk”

).

In the "Amount"

The amount of money dispensed from the cash register is indicated in numbers.

Column “Purpose code”

filled out if the organization uses the appropriate coding system in its activities. In this case, the code for the purpose of using the retired funds is indicated.

In the "Issue"

The full name of the individual is indicated (in the dative case, for example, Ivanov Ivan Ivanovich) or the name of the organization to which funds must be issued.

In the line "Base"

it is necessary to indicate the basis for issuing money from the cash register, for example:

“Issuing financial assistance”

or

“Depositing money to the bank”

, etc.

In the line "Amount"

The amount of money dispensed from the cash register is indicated in words. In this case, rubles are written with a capital letter, and kopecks with numbers. In empty fields you must put a dash.

In the "Application"

the attached primary documents are reflected, indicating their numbers and dates, on the basis of which money is issued from the cash desk (powers of attorney, receipts, orders, statements, etc.).

Note

: the manager does not have to sign for the cash register if he makes an authorization inscription on the attached documents to the cash receipt order.

The line "Received"

filled out by the person to whom money is given from the cash register. In it, he indicates the amount of money received (in this case, he needs to write rubles in words with a capital letter, and kopecks in numbers). Next is his signature and the date of receipt of the money.

When issuing money via cash register, the cashier must check the identity document

recipient (passport or other document). The cashier indicates the name, number, date and place of issue of this document in the corresponding line of the cash register.

Line “Issued by the cashier”

filled in by the cashier only after the cash is issued via cash register. In it he puts his signature with a transcript (last name and initials).

fully filled order remains at the cash desk

enterprise (and not handed over to the recipient of the money) and serves as confirmation that the funds were issued legally.

note

, it is prohibited to make corrections in the cash receipt order.

Postings for shortages at the cash register

Let's assume that when transferring funds in the amount of 856,000 rubles. a shortage was identified (RUB 8,400)

In this case, the accountant of Magnit Plus LLC will reflect the following transactions in accounting:

| Dt | CT | Description | Sum | Document |

| 57 | 50.01 | Cash proceeds are transferred to the collector for delivery to the bank | 856,000 rub. | Expenditure cash order, receipt for collection bag |

| 51 | 57 | The funds (minus the shortfall) were received by the bank and credited to the current account of Magnit Plus LLC (856,000 rubles - 8,400 rubles) | RUB 847,600 | Bank statement, recount statement |

| 94 | 57 | The amount of the shortage is reflected | 8,400 rub. | Recount act |

| 91/2 | 51 | The amount of collection services for accepting and counting cash was written off (RUB 847,600 * 0.15%) | RUB 1,271 | Bank statement |

Payment of funds to founders in the form of dividends

Let's say:

Olymp LLC decided to distribute the profit received at the end of 2015 between the company's participants - founder Petrenko and director Sidorenko. The share of the founder Petrenko, who is not an employee of Olimp LLC, is 465,000 rubles, the share of director Sidorenko is 118,000 rubles.

The following entries were made in the accounting of Olimp LLC:

| Dt | CT | Description | Sum | Document |

| 84 | 75/2 | Calculation of the amount of distributed profit (founder Petrenko) | RUB 456,000 | Minutes of the board's decision |

| 75/2 | 68 personal income tax | Withholding personal income tax from the amount of profit distributed in favor of the founder Petrenko (RUB 456,000 * 13%) | RUB 59,260 | Minutes of the board's decision |

| 84 | 70 | Calculation of the amount of distributed profit (Director Sidorenko) | 118,000 rub. | Minutes of the board's decision |

| 70 | 68 personal income tax | Withholding personal income tax from the amount of profit distributed in favor of director Sidorenko (RUB 118,000 * 13%) | RUB 15,340 | Minutes of the board's decision |

| 75/2 | 50/1 | Payment of income to founder Petrenko | RUB 396,740 | Account cash warrant |

| 70 | 50/1 | Payment of income to director Sidorenko | RUB 102,660 | Account cash warrant |

In addition to non-cash payments, an enterprise can carry out operations for the receipt and expenditure of cash, called cash transactions. Let's look at examples of how cash transactions are recorded, as well as accounting entries for the cash register.