Any company, in accordance with current legislation, must submit financial statements drawn up on form 0710099 after a certain period of time.

This reporting form was adopted back in 2012 and is still in effect today. It contains balance and reporting on all income and expenses, while you can, as before, submit reports on existing forms that are provided for certain types of reporting, but most tax officials prefer to use this form.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

It is for this reason that it is better for authorized persons to understand how to correctly draw up the KND 0710099 form in 2021 and what features need to be taken into account in the reporting process.

Which regulatory act approved the financial statements of KND 0710099

The list of reports included in the accounting records is determined by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. This document divides the sets of prepared reporting forms into 2 types:

- Full;

- Simplified.

The simplified version is available to persons who are permitted by law to conduct accounting using the simplified version (small enterprises, non-profit organizations, participants in the Skolkovo project). At the same time, they must fully meet the conditions provided for in paragraph 5 of Art. 6 of Law No. 402-FZ of December 6, 2011 “On Accounting”.

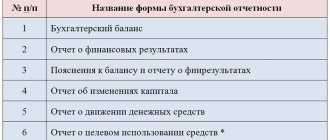

Both sets include:

- Balance.

- Income statement.

- Report on the intended use of funds.

- Explanations for accounting.

The first three documents for full and simplified reporting are different, since simplification entails combining report indicators, and therefore changing the number of lines in it. The last two documents are drawn up only if necessary.

The full set of reporting forms additionally includes reports:

- about changes in capital;

- about cash flow.

Each of the above forms has its own code according to OKUD (All-Russian Classifier of Management Documentation), indicated in its upper right corner. The codes are assigned numbers 0710001-0710004, 0710006, of which 0710001 and 0710002 correspond to the balance sheet and income statement. Moreover, for the simplified and full forms they do not differ. Numbers 0710003, 0710004 and 071006 are assigned respectively to statements of changes in capital, cash flows and intended use of funds.

As you can see, accounting (financial) statements 0710099 are not among them. However, accounting statements 0710099 have every right to exist. The fact is that this code is assigned by another classifier (departmental, used by the Federal Tax Service).

The departmental tax classifier not only takes into account the codes entered by OKUD, but also supplements them with its own. It is in the KND (classifier of tax documentation) that the accounting reporting form 0710099 is present. At the same time, it is more correct to call it with reference to the classifier - accounting (financial) reporting form according to KND 0710099.

Sample zero balance sheet of an LLC for 2021

This opinion is fundamentally wrong. If a company is registered with the tax office, then it must regularly submit reporting documentation even if the activity has been completed. In this situation, it is necessary to use zero reporting for the LLC. Contents of the article

This document is submitted to the tax office and non-budgetary funds. The structure of the reporting is in the form of a declaration.

It is submitted in situations where the company’s activities are not carried out, but have not been suspended. In order to submit a zero declaration in 2021, the following must be completed: There are no movements of money in the bank account. Since the registration of the LLC, there have been no transactions of a financial nature . The exception is the amount paid for registration

What is accounting reporting form according to KND 0710099

Code 0710099 is assigned in the KND to a form containing all the reports included in the full version of the accounting report. But this form is standardized to accept a report in machine-readable form and forms the basis for electronically submitted reporting. Its latest formats are reflected by the order of the Federal Tax Service of Russia dated March 20, 2017 No. ММВ-7-6/ And using the barcode available in the upper left corner of each page of the form, such a report can be easily submitted on paper.

The accounting (financial) reporting form KND 0710099 is not the only one that combines several forms with the code OKUD. A similar form with code KND 0710096 was created for a simplified version of accounting. Its electronic version is also presented in the order of the Federal Tax Service of Russia No. ММВ-7-6/

Sample zero balance sheet

The fact is that a business company must have, at least in a minimal amount (in the case of an LLC - 10 thousand rubles).

From an accounting point of view, the authorized capital consists of:

- The asset is in the form of a debt obligation of the owners to form the authorized capital, if the capital has not yet been formed at the time of drawing up the balance sheet.

- An asset is in the form of funds that the company has the right to dispose of as a result of converting the authorized capital into these funds, if the authorized capital is formed by the time the balance sheet is drawn up.

- Liability - in the form of an obligation to the owners to use the received authorized capital.

Moreover, since assets are formed at the expense of liabilities, the value of the former must be equal to the value of the latter. Let's consider how this is recorded in a zero balance sheet.

Let us agree to understand by

We recommend reading: What types of activities fall under the usn for individual entrepreneurs

Zero declaration (reporting): simplified tax system, UTII, OSNO

In the finished declaration, you will only need to enter your data instead of the fields marked in red. By the way, you can generate and send to the Federal Tax Service a zero declaration of the simplified tax system through this website absolutely free of charge. Even with a zero simplified tax system, an individual entrepreneur (or organization) must have a zero book of income and expenses: .

It is optional to have it certified by the tax authorities, but many Federal Tax Service Inspectors require it.

Page 1 of the declaration is filled out as standard: with your data.

Page 2 declarations: put dashes in all lines except 001, 010 and 020. Page. 3 declarations: put dashes in all lines except 201. Once a year. For individual entrepreneurs - until April 30.

For organizations - until March 31. For closed companies and individual entrepreneurs, it is necessary to provide a declaration even for less than a full year. There is no need to make advance payments if you have zero income. There are no penalties for providing a zero declaration or a zero simplified report. For delivery not on time - 1000 rubles.

example and form of a zero tax return You will not find a sample of filling out a zero UTII return.

Where is the accounting reporting form KND 0710099?

All versions of this form, starting from 2011, are available on the sites:

- JSC "GNIVC" in templates for accounting forms (https://www.gnivc.ru/inf_provision/form_templates/forms_buch/);

- Federal Tax Service of Russia in templates for accounting (financial) reporting forms (https://www.nalog.ru/rn78/taxation/submission_statements/).

Here you can find accounting statements KND 0710099, as well as a simplified accounting form with code KND 0710096.

Why do you need a summary report form? Then, you first need to create a report by entering all the necessary data into it. And only after verification can you generate a report that will be sent to the tax office electronically.

Well, to prepare a paper version of accounting reporting 0710099 you will have to do even more so. You can download it here:

Read also

11.12.2017

Liquidation balance sheet: step-by-step closure of a business

The procedure for liquidating a company is strictly regulated by law.

In particular, according to the norms, the liquidation of a legal entity entails its termination without the transfer of rights and obligations by way of succession to other persons. This means that the concept of “liquidation” is final and irrevocable, so the last report should ideally be zero. After all, it is necessary to sell all assets or transfer them to interested parties during the organization’s activities.

Therefore, with figures there is usually an interim liquidation balance sheet, a sample of which can be filled out at the end of this article.

It is noteworthy that the form of this report is not directly regulated by any regulatory documents, so it can be filled out either in any form or using the forms of a regular balance sheet given in the appendix to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. This is exactly what the Federal Tax Service of Russia recommends in its “On the provision of documents during the liquidation of a legal entity.”

Who should take it?

Simplified forms of accounting are provided for all small businesses. Non-profit organizations and Skolkovo residents, that is, those companies that have received special status as participants in the Skolkovo project, can also submit lightweight forms.

Who cannot keep simplified accounting:

- Construction and housing cooperatives or simply housing cooperatives.

- Companies and organizations whose reporting is subject to mandatory audit.

- Credit consumer cooperatives, including agricultural ones.

- Microfinance organizations, for example, companies providing microloans to individuals.

- Budgetary, government, autonomous institutions and other public sector organizations.

- Political parties, both parent organizations and regional offices.

- Law offices, colleges and chambers, notary offices, legal consultations.

- Non-profit organizations entrusted with the functions of a foreign agent.

Consequently, if a company cannot be classified as one of the eight points on the list, then it has the right to create simplified forms of accounting.

Preparation of tax returns in the form of machine-readable forms in programs

Preparation of tax returns in the form of machine-readable forms is only possible when using specially developed software, in particular economic programs.

Support for machine-readable forms technology is included in the following software products:

- into sets of regulated reporting forms for 1C:Enterprise 7.7 - starting with update 07q3001 for the 3rd quarter of 2007;

- into the “Enterprise Accounting” configuration, edition 1.5, starting from release 1.5.19;

- into the "Enterprise Accounting" configuration, edition 1.6

- into the “Manufacturing Enterprise Management” configuration, edition 1.2 - starting from release 1.2.10.

The procedure for preparing tax returns in the form of machine-readable forms in 1C:Enterprise 8 is described here.

The procedure for preparing tax returns in the form of machine-readable forms in 1C:Enterprise 7.7 is described here.

The procedure for generating machine-readable tax return forms is also given in the articles on the “Information and technological support” disk:

- for "1C:Enterprise 7.7" in the section "Reporting forms, releases of programs and configurations (1C:Enterprise 7.7 and earlier versions) - 1C:Enterprise 7.7 - Machine-readable forms."

- for "1C:Enterprise 8" in the section "Reporting forms, releases of programs and configurations (1C:Enterprise

- 1C:Enterprise 8 - Machine-readable forms."

- 1C:Enterprise 8 - Machine-readable forms."

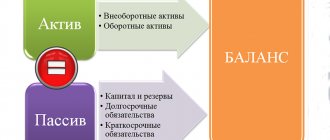

Filling Features

The principles for filling out accounting records for SMP are similar to the standard principles. Thus, the balance sheet also consists of two sections: assets and liabilities. Each section provides detail for the largest groups, which, in turn, are revealed over the dynamics of several reporting periods.

If, after submitting the balance sheet, errors are identified, even significant ones, then the submitted reports cannot be corrected. Error correction is not provided for SMP. In this case, new reports are completed using a retrospective method. That is, the error is corrected in accounting, the balance sheet indicators are recalculated.

KND 0710098: with barcode

Simplified accounting financial statements for 2021

Let's take a closer look at simplified financial statements, who submits the annual report in this form and what exceptions exist. First, let's find out who has the right to such a privilege provided for, namely, we will understand who can be considered representatives of small businesses.

The criteria for classifying organizations and individual entrepreneurs into this category are specified in the current edition. Thus, in 2021, a small enterprise is considered to be an organization that has: the average number of employees for 2021 does not exceed 100 people (how to correctly count employees is described in Rosstat order No. 739 dated December 30, 2014). A micro-enterprise cannot employ more than 15 people; the amount of income from business activities does not exceed 800 million rubles per year for small enterprises and 120 million rubles per year for microenterprises.

These values are set by the government.

Elimination stages

The liquidation procedure for legal entities has several stages, which proceed in a certain order:

- A decision on liquidation is made and a liquidator is appointed. The liquidator can be any person, including those who are not a member of the company or its employee. It is the liquidator, after appointment, who signs all documents for the tax authorities and funds.

- Within three days from the date of the decision on liquidation, an application in form P15001 is submitted to the registering authority, informing about the start of the liquidation procedure. At this stage, the tax office may schedule an on-site audit. Then the liquidation procedure can be continued only after the verification is completed.

- All creditors are notified by mandatory publication of an announcement of liquidation in the Bulletin of Russia (announcement is paid). At least two months are allowed for claims from creditors from the date of publication of the announcement. Before the expiration of this period, the liquidation cannot be completed. At the same time, notifications are sent to all existing creditors, as well as employees are notified about the upcoming reduction and information is submitted to the employment center about reductions in connection with the liquidation.

- Upon expiration of the period allotted for receiving claims from creditors, as well as upon completion of the tax audit, if any, an interim balance sheet is drawn up. The tax office must be notified of the preparation of this form (the report itself does not have to be submitted).

- Liquidation reports on taxes, insurance contributions and the Pension Fund are submitted.

- Settlements are made with all creditors. The remaining profit, if any, and the authorized capital are distributed. The current account is closed.

- A liquidation balance sheet is formed and submitted to the tax office, accompanied by an application in form P16001.

If the liquidation balance raises questions among tax authorities, the registering authority may suspend or even refuse liquidation.

- 1C:Enterprise 8 - Machine-readable forms."

- 1C:Enterprise 8 - Machine-readable forms."