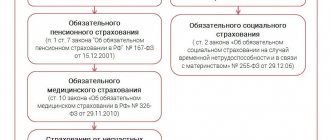

In this case, JSC or LLC are tax agents for personal income tax and must calculate, withhold from the individual and transfer the tax amount to the budget.

If dividends are paid by a joint-stock company, then it acts as a tax agent on the basis of Article 226.1 of the Tax Code of the Russian Federation. This article establishes the features of calculation and payment of personal income tax by tax agents when performing transactions with securities, with financial instruments of futures transactions, as well as when making payments on securities of Russian issuers. It contains a list of persons recognized as tax agents when performing these transactions. In particular, these include Russian organizations that pay the taxpayer income on securities issued by these organizations, the rights for which are recorded in the securities register of the relevant organization on the date determined in the decision on the payment (declaration) of income on these securities.

Section 1

In this section, tax agents indicate generalized data for all individuals . The amount of income accrued to him is reflected, as well as the calculated and withheld personal income tax. The data is indicated on an accrual basis for the entire tax period.

The following violations are often committed when filling out this section:

- The data is not reflected on an accrual basis .

- Line 20 also reflects income not subject to personal income tax, whereas on the basis of Article 217 of the Tax Code of the Russian Federation they are not subject to reflection within the specified period (Letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11 / [email protected] ).

- Line 70 indicates the amount of personal income tax that will be withheld in the next period. Most often this happens if wages are accrued in one period and paid in another. Personal income tax is transferred when paying wages, so it must relate to the period when it was paid and not accrued.

- Tax amounts are incorrectly indicated on line 80 . This line should indicate the amount of tax that the tax agent cannot withhold. The Federal Tax Service in letter No. BS-4-11/ [email protected] explained that this line reflects the amount of unwithheld tax on income received in kind and in the form of material benefits, if there are no payments in cash. Instead, tax agents often reflect in line 80 the amounts of personal income tax, the obligation to withhold which will occur in the next tax period. Also, line 80 erroneously reflects the difference between the personal income tax that is accrued and the amount of tax withheld.

Calculation of 6-NDFL. Filling example

What does counted mean?

The tax agent, who is the employer, before issuing wages to the employee, must calculate the amount of personal income tax, which will then be withheld from the total wages and sent to the state budget.

The calculated personal income tax is the same calculated amount. It must be reflected in the certificate of form 2-NDFL. This position is recorded in the column “Calculated tax amount”.

Also see “Calculating Income Tax”.

Section 2

Section 2 of form 6-NDFL is intended to indicate:

- dates when individuals received income;

- dates when the tax was withheld;

- deadlines for transferring personal income tax;

- generalized indicators of income and personal income tax.

At the same time, transactions are reflected only for the last three months of the reporting period - the Federal Tax Service has repeatedly informed tax agents about this (letters dated July 21, 2017 No. BS-4-11/ [email protected] , dated January 16, 2017 No. BS-4-11/499, dated May 22, 2017 No. BS-4-11/9569).

However, some individuals, when filling out 6-NDFL, reflect the data in section 2 on an accrual basis from the beginning of the year. And this is considered a gross violation of filling out the calculation.

The block of lines 100-140 of section 2 is filled out separately for each period for transferring personal income tax. This also applies to cases where different types of income have the same tax payment date.

Let's say that on the last day of the month an employee was paid wages for the second part of this month and vacation pay for the upcoming vacation next month. From the point of view of the law (Article 223 of the Tax Code of the Russian Federation), the date of actual receipt of income (wages and vacation pay) is the day of their receipt. But the deadlines for transferring personal income tax on these incomes are different. Tax on vacation pay is transferred on the same day, and tax on wages can be transferred on the next day. These incomes must be included in section 2 of form 6-NDFL in separate blocks.

In addition, quite often tax agents do not separate inter-account payments - wages, sick leave, vacation pay - into a separate group. This is also a gross violation (letter of the Federal Tax Service No. GD-4-11/ [email protected] ).

When filling out the block in question for different types of income, most often tax agents incorrectly indicate the dates of actual receipt of income in line 100 , the dates of personal income tax withholding in line 110 , as well as the deadline for tax remittance in line 120 . We will further look at how to fill out this block correctly using specific examples.

Salary examples

First, let us recall the basic rules related to the payment of wages and withholding personal income tax:

- the date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- if the employee was fired before the end of the month, then the date of actual receipt of income in the form of wages is recognized as his last working day;

- Personal income tax on wages is withheld by the tax agent upon actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation);

- transfer of personal income tax to the budget must be made no later than the next day (clause 6 of Article 226 of the Tax Code of the Russian Federation).

So, let’s look at the correct reflection of wages in 6-NDFL using specific figures.

Let the employee’s salary be 100,000 rubles. On November 30, he received wages for November in the amount of 87,000 rubles (minus personal income tax of 13,000 rubles).

Blocks of lines 100-140 of section 2 are filled in as follows:

- line 100 - November 30, 2017 (date of actual receipt of income);

- line 110 - November 30, 2017 (date of personal income tax withholding);

- line 120 - 12/01/2017 (deadline for transferring personal income tax to the budget);

- line 130 - 100,000 (salary amount);

- line 140 - 13,000 (amount of calculated and withheld tax).

We recommend paying attention to the following features :

- If the last day of the period for transferring personal income tax falls on a weekend, then the end of the period is postponed to the next working day.

- If the last day of the month, that is, the date of actual receipt of wages, falls on a weekend, then the transfer to the next day is not carried out. Thus, the date of actual receipt of salary is considered the last day of the month even if it falls on a weekend.

- Accrual of income and withholding of personal income tax are included in the calculation for the period in which the date of actual receipt of income falls.

- The amount of personal income tax is included in the calculation for the reporting period if the period of its withholding and transfers relate to this period.

- On line 120, you should indicate not the date of the actual transfer of the tax, but precisely the last day of this period.

Another example that will illustrate filling out calculations for wages paid at the junction of quarters.

Let's say the salary for September was paid on October 2. How to reflect this in section 2 of the 6-NDFL calculation?

The calculation for 9 months of the reporting year indicates:

- in line 100 - 09/30/2017;

- in line 130 - the salary amount.

- The calculation for the year indicates:

- in line 110 – 10/02/2017;

- in line 120 – 10/03/2017;

- in line 140 - the amount of tax.

Withholding and transfer of personal income tax by a tax agent

As a general rule, personal income tax withheld from employee income must be sent to the budget no later than the day when the money goes to the employees’ accounts. We transfer taxes to the state before employees receive wages (we pay taxes and contributions by the 15th, and transfer wages on the 25th). So it turns out that formally we paid personal income tax for the employee not from his funds, but from the funds of the company itself, that is, the tax agent. But the law prohibits doing this. Therefore, the money that we sent to the budget ahead of time is formally not a tax at all.

Can inspectors demand payment of the amount of tax withheld from employee income again, that is, after the money “falls” on the employees’ cards? And since we transferred personal income tax prematurely, are we violating clause 6 of Art. 226 of the Tax Code of the Russian Federation, do we face a fine for this?

According to Art. 226 Tax Code of the Russian Federation

tax agents from whom or as a result of relationships with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of personal income tax.

Tax agents are required to withhold

the accrued amount of tax directly from the taxpayer's income

upon actual payment

.

Tax agents are required to transfer amounts

calculated and

withheld tax no later than the day of actual receipt

of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks.

Payment of tax at the expense of tax agents is not allowed

.

When concluding agreements and other transactions, it is prohibited to include tax clauses in them, according to which tax agents paying income assume obligations to bear expenses associated with the payment of personal income tax.

Tax authorities do not recognize as tax even an amount exceeding the amount of personal income tax actually withheld from the income of individuals.

(letter of the Federal Tax Service of the Russian Federation dated July 4, 2011 No. ED-4-3/10764).

And if at the time of payment of wages personal income tax is already transferred to the budget, this means that tax is not withheld from the taxpayer’s funds

.

Consequently, the tax agent transferred personal income tax at his own expense.

That is, the prohibition established by paragraph 9 of Art. 226 Tax Code of the Russian Federation

.

The Tax Code of the Russian Federation provides for penalties for tax violations.

In accordance with Art.

123 of the Tax Code of the Russian Federation , unlawful failure to withhold

and (or)

non-transfer

(incomplete withholding and (or) transfer)

within the period established by the Tax Code of the Russian Federation of tax amounts

subject to withholding and transfer by a tax agent

entails a fine in the amount of 20% of the amount subject to withholding and (or) transfer. transfer

.

In your situation, transferring personal income tax earlier than established cannot be considered a violation

.

After all, according to the Federal Tax Service of the Russian Federation, such an overpayment is not a tax.

Therefore, tax authorities do not allow it to be offset against upcoming payments.

, but believe that the tax agent needs

to contact the tax authority with an application for the return to

the organization’s current account of

an amount that is not personal income tax

and erroneously transferred to the budget system of the Russian Federation (letter dated July 4, 2011 No. ED-4-3/10764).

Penalties cannot be charged in this situation either

.

Art. 75 Tax Code of the Russian Federation

It is established that

a penalty is recognized as

of money

that a taxpayer must pay in the event of payment

of due amounts of taxes or fees

later

than the

deadlines

.

And in this case, the tax was transferred ahead of schedule

.

Considering that this issue is controversial (officials and tax agents have different points of view), it is necessary to know whether tax agents have a chance to avoid penalties.

The established arbitration practice is on the side of tax agents.

Firstly

, the courts note that tax

legislation does not establish a ban

on the transfer of calculated tax

before the day of actual payment of income

(Resolution of

the Federal Antimonopoly Service of the West Siberian District

dated December 8, 2005 No. F04-8839/2005(17637-A46-29)).

Secondly

, the courts refer to

Art.

108 of the Tax Code of the Russian Federation , according to which no one can be held accountable for committing a tax offense except on the grounds and in the manner provided for by the Tax Code of the Russian Federation.

Art. 106 Tax Code of the Russian Federation

It has been determined that

a tax offense

is recognized as a guilty wrongful act (in violation of the legislation on taxes and fees) (action or inaction) of a taxpayer, tax agent and other persons, for which the Tax Code of the Russian Federation has established liability.

The objective side of the offense, liability for which is provided for in Art. 123 Tax Code of the Russian Federation

, is an unlawful failure to transfer tax amounts by a tax agent.

At the same time, the fact of late payment of tax in itself does not constitute an offense.

(Resolution of

the Federal Antimonopoly Service of the Ural District

dated May 19, 2009 No. F09-3131/09-S3).

Third

,

Art.

45 of the Tax Code of the Russian Federation establishes that the taxpayer is obliged to independently fulfill the obligation to pay tax, unless otherwise provided by the legislation on taxes and fees.

The obligation to pay tax must be fulfilled within the period established by the legislation on taxes and fees.

The taxpayer has the right to fulfill the obligation to pay tax early

.

At the same time, the rules

, provided for

in Art.

45 of the Tax Code of the Russian Federation also

applies to tax agents

.

FAS Moscow District

, recognizing that the company

calculated, paid to the budget, but did not unlawfully withhold personal income tax

from taxpayers’ income, nevertheless believes that since the company

paid the tax amounts to the budget on time

, therefore their

repeated collection is contrary to the provisions of Art.

46 of the Tax Code of the Russian Federation , the accrual of penalties is contrary

to Art.

75 of the Tax Code of the Russian Federation (resolution dated March 4, 2011 No. KA-A40/17007-10;2).

In the resolution of the Federal Antimonopoly Service of the West Siberian District

dated November 13, 2007 No. Ф04-7817/2007(40014-А45-19) it is stated that in the actions of the tax agent, who timely and in full transferred to the budget from his own funds personal income tax amounts not withheld from taxpayers,

there are no signs of a tax offense

, provided for

in Art.

123 of the Tax Code of the Russian Federation , and

there are no grounds for accruing penalties

, which, in accordance with

Art. 75 of the Tax Code of the Russian Federation

are charged for violating the deadline for fulfilling the obligation to pay tax.

The courts also note that despite the fact that personal income tax is transferred to the budget by the tax agent at his own expense, this does not lead to the budget not receiving tax amounts

.

Therefore, there are reasons

to bring the tax agent to justice under

Art.

123 of the Tax Code of the Russian Federation is not available (resolution

of the Federal Antimonopoly Service of the Ural District

dated March 3, 2008 No. F09-942/08-S2).

However, it should be taken into account that recently court decisions have appeared that are not in favor of taxpayers

.

Thus, in a situation where personal income tax is transferred before the appearance of grounds for withholding from taxpayers’ income and in violation of clause 9 of Art. 226 Tax Code of the Russian Federation

, which does not allow the payment of tax at the expense of the tax agent,

the FAS Moscow District

indicated that since

Art.

45 of the Tax Code of the Russian Federation is used to determine the fulfillment of tax obligations;

another payment, in accordance with the general rules, is considered to have taken place only if funds are received into the budget

.

In this case, payments were not received to the budget

(resolution dated March 14, 2012 No. A41-24636/11).

Therefore, in any case, you need to transfer personal income tax to the budget strictly according to the rules of Art. 226 Tax Code of the Russian Federation

.

Vacation pay in 6-NDFL

General rules for personal income tax on vacation pay:

- the date of actual receipt of income in the form of vacation pay is the day of their payment (subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation);

- Tax agents must transfer to the budget the amounts of calculated and withheld personal income tax from vacation pay no later than the last day of the month in which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The employee goes on vacation on June 1, 2021. The amount of vacation pay was 10,000 rubles, which he received on May 28. The amount of personal income tax is 1300 rubles.

We fill out section 2 of form 6-NDFL for the six months:

- line 100 - 05/28/2017;

- line 110 - 05/28/2017;

- line 120 - 05/31/2017;

- line 130 - 10,000;

- line 140 - 1,300.

The employee decided to quit immediately after his vacation. On March 15 of this year, he received vacation pay and went on vacation, followed by dismissal.

Fill out section 2 for the first quarter:

- line 100 - 03/15/2017;

- line 110 - 03/15/2017;

- line 120 - 03/31/2017;

- line 130 - amount of vacation pay;

- line 140 - personal income tax amount.

What does withheld mean?

The calculated income tax is withdrawn from the amount of money that a company employee or a person working for an individual entrepreneur receives. Thus, the withheld personal income tax remains with the employer before the latter transfers it to the state budget.

The mentioned amount is also reflected in the 2-NDFL certificate. The column “Amount of tax withheld” is assigned to it.

Also see “How to return excessively withheld personal income tax.”

Here is a fragment of interest to us from the 2-NDFL certificate:

Payment under the GPC agreement

General information on payment for civil contracts:

- the date of actual receipt of income for the provision of services is the day of payment of this income (subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation);

- Tax agents are required to withhold personal income tax upon actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation);

- Personal income tax must be transferred no later than the next day after the day the income was paid to the taxpayer.

It happens that the certificate of completion of work under a civil contract is signed in one month, and payment is made in another. In this case, 6-NDFL is filled out upon the payment of remuneration, and not on the drawing up of the act.

The agreement was concluded with an individual on August 5, 2021. The act was signed in August, and remuneration in the amount of 30,000 rubles was paid on September 7. The personal income tax amount was 3,900 rubles.

We fill out 6-NDFL. The operation will be reflected in both sections 1 and section 2 of the calculation for 9 months of 2021. In section 2 we indicate:

- line 100 – 09/07/2017;

- line 110 – 09/07/2017;

- line 120 – 09/08/2017;

- line 130 – 30,000;

- line 140 – 3,900.

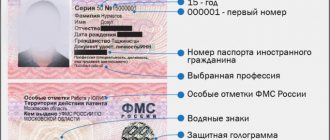

Residents and non-residents

The tax agent must withhold tax from both residents of the Russian Federation and non-residents. In the first case, income received from sources in the Russian Federation and abroad is subject to taxation. In the second case, tax is withheld only from income received in the Russian Federation (Articles 208, 209 of the Tax Code of the Russian Federation).

Let us add that if a company has an employee - a foreign citizen who has a patent for working in the Russian Federation, then when paying him income, personal income tax should be withheld, taking into account the tax paid when purchasing the patent (Clause 2 of Article 226, Article 227.1 of the Tax Code of the Russian Federation ).

Get a comprehensive accounting reporting solution: automatically generate and send reports via the Internet

Try for free

Sick leave

Payment and deduction of personal income tax from sick leave is carried out according to the following rules:

- the date of actual receipt of income is the day of its payment;

- personal income tax is withheld upon actual payment;

- Tax transfer occurs no later than the last day of the month in which the payment was made.

The employee's sick leave lasted from September 4 to September 8, 2021. The benefit was paid on September 15.

In section 2 of form 6-NDFL we reflect the following entries:

- line 100 – 09/15/2017;

- line 110 – 09/15/2017;

- line 120 – 09/30/2017;

- line 130 - benefit amount;

- line 140 – personal income tax amount.

The payment of disability benefits should be indicated in 6-NDFL upon the fact. That is, if sick leave income was accrued in one period and paid in another, then in 6-NDFL it should be reflected in sections 1 and 2 of the period in which the income was paid.