Documentation

October 12, 2021 In continuation of answers to questions about submitting reports for 9 months

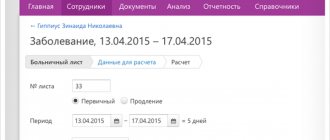

Working in any position and becoming ill, the employee has every right in accordance with the current

The article touches on the topic of calculating and paying sick leave, except in the case of “pregnancy and childbirth”.

New reporting form for 2021 Report on the organization’s property tax for

Free legal consultation by phone: 8 This is a service provided by many companies. However, today there is

For companies on the general taxation system, the main budget payment is income tax. Report

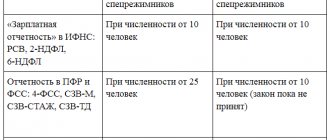

What is EO Electronic reporting (EO) - provision of established forms of reports to the Social Insurance Fund, Pension Fund of Russia,

Taxes and contributions Denis Pokshan Expert in taxes, accounting and personnel records Current on

Choosing the form of tax regime Small businesses are given the opportunity to independently choose taxation, thanks to which again

For LLCs with and without employees Date Reporting form and payments Tax regimes Where