VAT reporting deadlines for 2021

The VAT return for the year is submitted four times, since the tax period for the tax is quarterly.

At the same time, for most taxpayers, a unified approach to determining the deadlines for submitting VAT reporting is used - the VAT return must be prepared and submitted to the tax authorities within 25 days from the end of the quarter. If the 25th is a holiday, the reporting period is shifted to the next working day. For example, for the VAT return for the 4th quarter of 2021, the deadline for submission is no later than 01/25/2021.

ATTENTION! Starting from the report for the 4th quarter of 2021, it is necessary to use the updated VAT declaration form, as amended by the Federal Tax Service order No. ED-7-3 dated August 19, 2020/ [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Find out about the nuances of filling out a VAT return for the year from the materials in our section.

In addition to the 25th, there is another milestone for VAT reporting in January 2021. For those who care not to forget about this reporting date, we will tell you in the next section.

Document flow procedure

After the taxpayer has submitted the return, the IRS verifies that it matches the requested format. If there are violations, the organization will be sent a notice of refusal of admission, after which it will be required to resubmit the declaration and attachments.

When the format check is passed, the organization receives an acceptance receipt, indicating that the declaration has been accepted.

Come in and register with an electronic signature certificate (from any CA in the Russian Federation) in Kontur.Externe and use the service for 3 months for free!

Try it

Which VAT report must be submitted no later than 01/20/2021?

Speaking about VAT, it is necessary to note one more reporting date - the Tax Code of the Russian Federation allocates 20 days for the preparation and submission of an invoice journal to the tax authority (clause 5.2 of Article 174 of the Tax Code of the Russian Federation).

Find a sample magazine here.

At the end of the 4th quarter of 2021, the invoice log must be submitted no later than January 20, 2021.

The invoice journal is prepared by intermediaries (commission agents, agents, forwarders, developers) if they:

- are not recognized as VAT payers (exempt from the duties of a VAT payer), and are also not recognized as tax agents for VAT;

- issued or received invoices with allocated tax during the reporting period.

During the year, the submission of a VAT report in the form of an invoice journal by the specified categories of intermediaries also occurs at least four times - based on the results of each quarter. But if the intermediary did not receive or issue invoices in any quarter, the invoice journal does not need to be submitted to the controllers.

Tax authorities will accept the journal only in electronic form via TKS through an EDI operator - this method is provided for by the Tax Code of the Russian Federation for this type of VAT reporting.

Whether it is necessary to notify tax authorities about a change of e-document flow operator, find out here.

How to avoid difficulties when sending a declaration

Firstly, it is important to determine how data will be downloaded from the accounting system and converted into the required xml format. If there is a large volume of transactions, it will be quite difficult for an accountant to fill out the declaration personally. For these purposes, it is optimal to use a special software product that converts information (from Excel tables into xml format). For example, the VAT+ (Reconciliation) service converts xls, xlsx and csv files into the format established by the tax authority.

Secondly, in order not to encounter errors when uploading files or submitting a declaration, it is important that all data is entered correctly. To do this, it is necessary to enter information into the purchase and sales books, as well as fill out invoices in accordance with all established requirements (Resolution of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Thirdly, when sending an electronic declaration, it is important not to allow “overweight”. Declarations with attachments can weigh up to several gigabytes, which means that preparing and sending such a volume will take a lot of time. You should first check whether your computer and Internet connection can cope with such tasks.

Payment of VAT for 2021 in 2021: what dates should you remember?

The deadlines for paying VAT for the year are different, and to determine them, decide:

- you will transfer the amount of tax indicated in the declaration in a single payment (Clause 1, Article 45 of the Tax Code of the Russian Federation);

- or apply the tax payment scheme in installments (clause 1 of Article 174 of the Tax Code of the Russian Federation).

For the first payment option, the same 25 days from the end of each quarter are allotted for VAT transfer as for filing a VAT return.

ConsultantPlus experts spoke about the nuances of paying VAT. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

If for the 4th quarter you apply a “fractional” VAT payment scheme (in equal shares within 3 months after the end of the reporting period), on 01/25/2021 you will have to transfer only the first part of the tax. With this payment scheme, issue payments regularly every month. Let's show with an example how to do this.

Example

Individual entrepreneur R. N. Khusnutdinov applies a general taxation system and pays VAT. Based on the results of the 4th quarter of 2021, he completed a VAT return and sent it via TKS to the inspectorate on 01/22/2021 (without waiting for the deadline for VAT reporting of 01/25/2021).

In the declaration, VAT payable amounted to 198,495 rubles. IP Khusnutdinov R.N. decided not to delay the transfer of tax to the budget. To do this he:

- calculated the monthly VAT payment: 198,495 rubles. / 3 = 66,165 rub.;

- compiled a table of payments (the basic rule for timely settlement with the budget is to determine the date based on the fact that the planned payment date should be 2-3 days earlier than the norm):

| Amount of VAT to be transferred, rub. | Date of payment of VAT according to the Tax Code of the Russian Federation, taking into account transfers, no later than | Planned payment date |

| 66 165 | 25.01.2021 | 22.01.2021 |

| 66 165 | 25.02.2021 | 20.02.2021 |

| 66 165 | 25.03.2021 | 23.03.2021 |

Find out about other VAT payment deadlines in the next section.

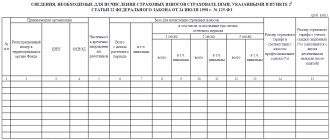

What is insurance premium calculation?

The calculation of insurance premiums - ERSV or RSV (the extra letter in the first abbreviation corresponds to the definition of “single”) - is completely different from the reports of the RSV-1 and RSV-2 forms that were submitted to the Pension Fund until 2021.

Why? Because in connection with the introduction of all rules for working with insurance premiums (except for payments for injuries), previously contained in various laws, into the Tax Code of the Russian Federation in 2017, control over their accrual and payment passed to the tax authorities. That is, all reporting on contributions, which was previously submitted to 2 funds (PFR and Social Insurance Fund), began to be submitted to the Federal Tax Service. Since insurance premiums in such a situation turned out to be just part of tax payments, rational actions in relation to the reporting generated on them were:

- creating a summary report form that combines the data that was previously entered into 4 forms:

- RSV-1 - in relation to contributions to the Pension Fund and the Compulsory Medical Insurance Fund accrued by the majority of employers;

- RSV-2 - regarding payments to the same funds, but accrued by the heads of farms;

- RSV-3 - in relation to contributions aimed at additional social security for employees of certain categories;

- 4-FSS - regarding social security contributions for disability and maternity insurance;

There is little new in the content of the consolidated DAM in comparison with the reports made for funds. It has been shortened by excluding:

- the results of settlements with each of the funds at the beginning of the year and at the end of the reporting period;

- data on documents for payment of contributions;

- personal information about the length of service of employees.

That is, the report on contributions submitted to the Federal Tax Service has acquired an appearance close to that of a traditional tax report, while retaining the features inherent in reporting on insurance contributions previously submitted to the funds.

Other deadlines for paying VAT and amounts of penalties for violating payment deadlines

The deadline for paying VAT for the year is not always limited to the 25th. Find out about other VAT control dates from the table:

| Operation | VAT payment deadline | Link to legal acts |

| Import of goods from EAEU member countries | Based on the results of the 4th quarter of 2021 - no later than 01/20/2021 | Clause 19 of Appendix No. 18 to the Treaty on the EAEU |

| Import of goods from other countries (not members of the EAEU) | Without waiting for the end of the quarter, at customs simultaneously with other customs payments | Customs Code of the EAEU |

| Purchase of works (services) from a foreign person not registered for tax purposes in the Russian Federation | On the day of transfer of money for work (services) by a separate payment (tax agent function) | Clause 4 art. 174 Tax Code of the Russian Federation |

Failure to comply with VAT payment deadlines may result in sanctions - not only penalties for late payment, but also fines:

| Type of violation | Consequences | Link to article of the Tax Code of the Russian Federation |

| During an on-site inspection, tax officials discovered that you incorrectly calculated VAT and therefore did not pay additional tax to the budget | In case of an unintentional error - a fine of 20% of the unpaid VAT. | Clause 1 Art. 122 Tax Code of the Russian Federation |

| If intent is proven - 40% of underpaid tax | Clause 2 Art. 122 Tax Code of the Russian Federation | |

| You are late with the payment of VAT, but in the declaration you calculated its amount correctly | Penalties will be charged for the entire period of delay. There shouldn't be a fine. | Art. 75 Tax Code of the Russian Federation, letter of the Ministry of Finance dated June 28, 2016 No. 03-02-08/37483, clause 19 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692 |

The article will tell you what circumstances are considered mitigating when imposing punishment for non-payment of VAT (incomplete or late payment).

Who reports monthly

If you pay tax on actual profit, then the reporting periods for you are a month, 2 months, 3 months, and so on until the end of the year (paragraph 2, paragraph 2, article 285 of the Tax Code of the Russian Federation). Therefore, you file monthly and annual returns.

The deadlines for submitting declarations based on the results of reporting periods are as follows (clauses 3 and 4 of Article 289 of the Tax Code of the Russian Federation):

- for January - no later than February 28;

- for 2 months (January–February) - no later than March 28 (in 2021 until March 29);

- for 3 months (January–March) - no later than April 28;

- and so on, ending on December 28 with a declaration for 11 months.

The year-end declaration is submitted within the general deadline - no later than March 28 of the following year. Moreover, even before submitting it, you begin a new reporting cycle. Accordingly, declarations for current reporting periods may be submitted earlier than last year’s annual declaration.

The declaration was submitted on time: why might sanctions follow?

Any VAT return for the year sent to the tax authorities (for example, based on the results of the 4th quarter) will not be considered submitted if the method of filing it is not followed - this is expressly stated in paragraph. 4 p. 5 art. 174 Tax Code of the Russian Federation. That is, you will be punished for failure to submit VAT reporting if you filled out a paper declaration, but were required to report according to the TKS electronically.

Paper returns are only permitted for withholding agents if certain conditions are met.

The amount of punishment for any unsubmitted VAT return for the year (based on the results of any quarter), for its late submission or submission in paper form (if only an electronic report format is provided) is 5% of the payable VAT for each month of delay (but not more than 30 % of the amount specified in the declaration and not less than 1000 rubles).

Whether they can be fined for failure to submit a zero VAT report, find out here .

VAT paid on time may also result in tax sanctions in the form of penalties, which results in additional material losses for any company and individual entrepreneur. In the next section we will look at an example of when this can happen.

What does the declaration include?

The declaration includes a title page and 12 sections.

The title page and section 1 of the declaration are submitted by all taxpayers (tax agents).

Sections 2 - 12, as well as appendices to sections 3, 8 and 9 of the declaration are included in the declaration when taxpayers carry out relevant transactions.

To send a declaration to the Federal Tax Service via telecommunication channels, you need to upload data in xml format, which is established by the tax service. After that, they are combined into an archive and sent in one package to the Federal Tax Service.

Split the payment - you will pay penalties

Splitting the VAT into 3 parts for subsequent monthly transfer to the budget is the norm provided for in paragraph 1 of Art. 174 Tax Code of the Russian Federation. This is what guided the company in our example.

Example

Vyatskie Products LLC applies the simplified tax system and does not work with VAT. In December 2021, due to certain circumstances, the company was forced to issue an invoice in the amount of RUB 377,600. (including VAT = RUB 57,600).

At the end of the 4th quarter of 2021, specialists of Vyatskie Products LLC prepared a VAT return with the amount of VAT payable - 57,600 rubles.

Knowing the norm of paragraph 1 of Art. 174 of the Tax Code of the Russian Federation on the possibility of paying VAT to the budget in installments, the accountant of Vyatskie Products LLC calculated the amount of the first VAT payment:

VAT1 = 57,600 rub. / 3 = 19,200 rub. - he indicated this amount in payments dated 01/25/2021, 02/25/2021 and 03/25/2021.

At this point, Vyatskie Products LLC considered its obligations for payment and VAT reporting to be fulfilled in full.

In April 2021, after completing a desk tax audit of the VAT return received by controllers from Vyatskie Products LLC, the company received a request to pay penalties. But why?

The mistake of the accountant of Vyatskie Products LLC was that, when dividing the VAT into parts, he did not take into account the requirements of clause 4 of Art. 174 Tax Code of the Russian Federation. It says that the persons specified in paragraph 5 of Art. 173 of the Tax Code of the Russian Federation (which includes special regime officers who issued invoices) are required to pay VAT no later than the 25th day of the month following the reporting quarter. There is no possibility for them to pay the tax in installments.

For those who are not yet allowed to split VAT, find out from the material.

How the Federal Tax Service verifies data on invoices

It is important for tax authorities to find a copy of the second counterparty for each invoice and compare them with each other. If during the inspection it is discovered that the invoices differ in some way, the Federal Tax Service requests the relevant explanations from the legal entity or individual entrepreneur.

After this, the company has five days to respond with a clarification declaration or documents containing confirmation of the information specified in the invoices. Otherwise, the organization will be punished with an appropriate fine (clause 1 of Article 126 of the Tax Code of the Russian Federation).

How to calculate VAT payable if the declared amount is not divisible by 3?

The statutory scheme for paying VAT in installments is an excellent opportunity for companies and individual entrepreneurs to distribute the tax burden over time.

At the same time, we should not forget that controllers strive to identify as many mistakes of taxpayers as possible and replenish the budget by imposing various tax sanctions.

In a situation of VAT splitting, it is necessary to correctly divide the tax amount so that at least this little detail is not presented to the taxpayer as a violation of tax legislation.

How to calculate VAT for the purpose of subsequent transfer to the budget if the total VAT amount indicated in the declaration is not divisible by 3? The Tax Code of the Russian Federation does not contain a clear and unambiguous answer to this question. Let's look at an example.

Example

The amount of VAT payable to the budget reflected in the declaration of Premiere LLC for the 4th quarter of 2021 amounted to RUB 698,431. To determine the amount of the first and subsequent VAT payments, the company’s specialists performed a simple arithmetic operation:

RUB 698,431 / 3 = 232,810.3333 rub.

As a result of calculating VAT for payment purposes, the amount with a balance was obtained. The specialists of Premiere LLC have several ways out of this situation:

| Month of payment | VAT distribution options, rub. | ||

| № 1 | № 2 | № 3 | |

| January 2021 | 232 810 | 232 811 | 232 810 |

| February 2021 | 232 810 | 232 910 | 232 811 |

| March 2021 | 232 811 | 232 810 | 232 810 |

| Total | 698 431 | 698 431 | 698 431 |

Conclusion: 1 ruble, which gives the result of dividing VAT with the balance, can be added to any part of the payment in one of the 3 specified months.

Tax officials are not against this VAT ruble entering the budget in the last of 3 payment months (in this case, option No. 1). They voiced this point of view in an information message dated October 17, 2008 and a letter from the Federal Tax Service of Russia in Moscow dated December 26, 2008 No. 19-12/121393.

Results

When submitting a VAT return for the year (based on the results of any of the four quarters), comply with the requirements for the form of its presentation - for most reporting companies and individual entrepreneurs, the electronic format of the report is mandatory. It is presented to controllers via TCS through an EDF operator. Deadline: no later than the 25th day after the end of the quarter.

Payment deadlines for VAT are varied: most payers transfer 1/3 of the amount specified in the declaration to the VAT budget monthly, no later than the 25th (including transfers). Certain categories of taxpayers are not allowed to pay VAT in installments, so for them there is only one payment deadline - the 25th.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.