New reporting form for 2021

You will have to report your organization’s property tax for 2021 using a new form. Not only the declaration form was adjusted, but also the rules for filling out and submitting. The changes were approved by Order of the Federal Tax Service No. KCh-7-21/ [email protected] dated 12/09/2020. The document was published on January 14, 2021 and will come into force two months later - from March 15, 2021. This is the second change to the reporting form since it was last submitted in March 2021.

The amendments were first introduced by order of the Federal Tax Service of Russia No. ED-7-21 / [email protected] dated July 28, 2020; they came into force on November 3, 2020 and are absolutely applicable to reporting for 2021. Key autumn changes compared to the previous property tax declaration are collected in the table.

| Declaration section | What changed | How to fill out |

| Section 1 | Added the field “Taxpayer Attribute” | Enter:

|

| Sections 1, 2 and 3 | Added the field “SZPK Attribute” | To be completed by taxpayers who have entered into an investment protection and promotion agreement |

| Tax benefits field | Added new benefit codes. This is necessary for organizations that have had their property taxes written off for the 2nd quarter. |

Amendments to Article 386 of the Tax Code of the Russian Federation, which required the inclusion in the declaration of information on the average annual cost of movable property items recorded on the organization’s balance sheet as fixed assets, were introduced by Federal Law No. 374-FZ of November 23, 2020. In connection with them, a new section 4 was added to the form, in which legal entities will indicate the average annual value of movable property items recorded on the balance sheet.

Additionally, the procedure for using codes “2010501” and “2010505”, intended to identify SMEs from affected sectors of the economy, for which special deadlines and rules for making advance payments on corporate property tax for the reporting periods of 2021 have been established, has been clarified. All new changes are mandatory for reporting for 2021.

Title page

Let us briefly recall the basic rules for its design. If you have experience filling out tax calculations and declarations, you can prepare this sheet by analogy with them. With the exception of certain nuances, which we will now talk about.

Difficulties can be caused by various codes ─ the top part of the sheet is most saturated with them. The figure below deciphers individual codes that cause difficulty when filling out the field:

There are several more fields on the title page, which we will discuss separately ─ the requirements for filling them out differ for different tax returns and calculations. These fields include “Contact phone number” and “Date”:

These fields are not significant (they do not reflect such important calculation indicators as the advance amount, benefit code, etc.), however, the legally established rules for filling out this document should not be ignored.

Who fills it out

A completed or zero property tax return is submitted to the Federal Tax Service by those taxpayers who have property in their possession or disposal and keep its tax records, that is, make accruals and payments to the budget of property tax (clause 1, article 373, clause 1 Article 386 of the Tax Code of the Russian Federation). Institutions that are on preferential tax regimes and have real estate valued at cadastral value must report to the Federal Tax Service according to generally established rules.

Only those organizations that do not have property assets subject to taxation do not submit a declaration. In such cases, there is no need to submit zero reporting. The rules and regulations for filling out a property tax return clarify the situation with a zero report: if the residual value of all property assets of an enterprise is zero (for example, due to depreciation), then the taxpayer still reports to the tax office, albeit in zero form (Federal Tax Service Letters No. 3 -3-05/128 dated 02/08/2010, No. ED-21-3/375 dated 12/15/2011).

Foreign organizations that have a permanent representative office and property subject to taxation in Russia also submit a reporting form. Reporting is provided by foreign companies without a permanent establishment in the Russian Federation, which have taxable real estate assets owned by them or received on the basis of a concession agreement.

Due to recent changes, the article is no longer accurate!

We are already updating it and will republish it soon. If you need up-to-date instructions right now, use free access to ConsultantPlus materials.

Get free access to ConsultantPlus for 2 days

Zero property tax return for 2021

If the company is provided with benefits for all existing facilities on the basis of Art. 381 of the Tax Code of the Russian Federation, and it is exempt from paying it, then you will still have to file a declaration, since such companies remain payers, since they have objects of taxation, and the use of the benefit does not abolish the declaration.

The same situation occurs when the cost of fixed assets is fully depreciated, but objects with zero cost continue to participate in the production process, are listed on the balance sheet and are not liquidated. There is no need to accrue tax, but it is necessary to report (submit a declaration and calculations for quarterly advances), because the company remains a tax payer (letter of the Federal Tax Service of the Russian Federation dated 02/08/2010 No. 3-3-05/128).

Thus, the presence of fixed assets as an object of taxation is an indispensable condition for drawing up a declaration, even if it has no value or is subject to a benefit. A zero declaration is filled out following the general rules. We present a sample declaration of a company in which fixed assets are fully depreciated.

When is it due?

The tax property declaration is submitted once a year - before March 30 of the next tax period (clause 3 of Article 386 of the Tax Code of the Russian Federation). If the date falls on a weekend, the deadline is moved to the first working day.

IMPORTANT!

For 2021, the report must be submitted by March 30, 2019.

Property tax is a fee for which regional authorities are responsible. They also establish the obligation to pay advances and submit tax calculations during the year. If the advance rule applies in a particular constituent entity of the Russian Federation, then the property settlement must be submitted quarterly. The deadline is the 30th day of the month following the reporting quarter.

IMPORTANT!

Don't be confused! The declaration is submitted once a year, using the form KND 1152026. Therefore, you do not have to figure out how to fill out a property declaration for the 3rd quarter of 2021; such a report does not need to be submitted. An advance report is submitted quarterly in the form KND 1152028. How to fill it out: “Instructions: fill out an advance report for property tax.”

Property tax return for 2021: form and deadlines for submission

The declaration form (according to KND 1152026), used today, and the procedure for its preparation were approved by Order of the Federal Tax Service No. ММВ-7-21/271 dated 03/31/2017. It can be presented in paper or electronic form; the latter is the only option for those companies whose average number of employees in the previous year exceeded 100 people and for newly created legal entities with an average number of employees of more than 100 people.

The deadlines for submitting advance calculations of the “property” tax have not changed - they must still be submitted within 30 days after the end of the 1st quarter, half-year, 9 months. Declaration for 2018, incl. zero, must be submitted no later than April 1, 2021 (since the deadline, March 30, falls on a Saturday). Violation of the deadline for completing the zero grade will result in a minimum fine of 1,000 rubles. (Article 119 of the Tax Code of the Russian Federation).

What property is taxed?

Objects of taxation for Russian enterprises include real estate in ownership, possession, use, disposal and received under concession, which are recorded on the balance sheet of the taxpayer (Articles 378, 378.1, 378.2 of the Tax Code of the Russian Federation).

For foreign companies, taxable objects will be:

- For foreign organizations with a permanent establishment in the Russian Federation - real estate as fixed assets and real estate received under a concession agreement.

- For foreign companies that do not have a permanent representative office in Russia - real estate that is owned by such companies and real estate assets received under a concession agreement.

IMPORTANT!

Since 2021, the procedure for tax accounting and reporting for property funds has changed significantly. Now movable property fixed assets, land, natural resources and other assets are not taxable.

How to calculate tax

The amount of contributions to be paid to the budget is calculated on the basis of the book value for property assets and fixed assets and the cadastral value for real estate.

To calculate payments for the property tax return on fixed assets, the average annual value of the asset is calculated by adding the residual value for each month for the reporting calendar year and dividing the resulting total by 13. Now the tax payment itself is calculated. To do this, the result of the product of the average annual cost of funds and the rate in force in a specific constituent entity of the Russian Federation, but not exceeding 2.2%, is determined. The report then indicates the amounts of advances transferred during the reporting period (if any). The final result payable is the difference between the calculated contribution amount and the advance payments.

Calculation of the cadastral value for real estate is carried out only for those objects that belong to the institution on the basis of ownership or management and are listed as fixed assets.

The cost according to the cadastre is taken as of January 1 of the reporting period. If real estate is sold during the reporting year, the contribution is calculated not for the entire period, but only for those months during which the organization owned the property. The tax base is indexed by an indicator resulting from dividing the total number of months of the holding period by 12 - the total number of months per year.

How to fill out the form

The form, which has been used since the beginning of 2021, was approved by order of the Federal Tax Service of the Russian Federation dated March 31, 2017 No. ММВ-7-21/ [email protected] . He also approved the procedure for completing the calculation (hereinafter referred to as the Procedure). The full version of the form, which all Russian and foreign organizations working through permanent missions are required to submit, consists of the following sections:

- Title page - contains all the information about the taxpayer and the reporting period.

- Sec. 1 - reflects the entire amount of tax to be paid into the budget.

- Sec. 2 - shows the amount of tax, which is calculated based on the average value of the property.

- Sec. 2.1. — contains information about objects, the tax on which is calculated at the average annual cost.

- Sec. 3 - shows the amount of tax calculated based on the cadastral value of objects.

If there are no objects that have any characteristic, dashes are placed on the form, but all pages are submitted. The shortened form of the report can only be submitted by foreign companies that do not operate through post-representative offices.

Completion requirements

The rules for the formation are enshrined in Appendix 3 of Order No. ММВ-7-21/ [email protected] The regulations prescribe the procedure for filling out a property tax return in 2021 and provide additional appendices, including various types of codes required when preparing reports.

To begin with, let's outline the general standards. All cost values are entered in full rubles (amounts up to 50 kopecks are removed, above - rounded to the nearest whole). All form pages are numbered in order. The fields are filled in from left to right, starting from the first cell, and with a capital letter. Free cells throughout the form are filled with dashes. It is prohibited to correct errors and omissions with the help of a proofreader and to use double-sided printing on the sheets of the property tax declaration form.

How to fill out a report

Here are step-by-step instructions for completing your 2021 property tax return:

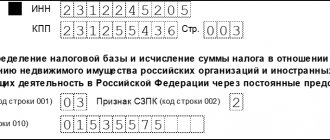

Step 1. Fill out the Title Page.

The TIN and KPP are filled out in accordance with the registration documents. The tax period code for the 2021 report is “34”. If a liquidated or reorganized enterprise reports to the Federal Tax Service, the value “50” is entered. The location code is “214”. Then fill in the name of the taxpayer in accordance with the charter, contact phone number and full name. the responsible person - the manager and the date of submission of the form to the inspection. The title page is certified by the signature of the head and the seal of the institution.

Step 2. Fill out Section 1.

Here the taxpayer's OKTMO, the calculated contribution amount and the budget classification code to which the payment is sent are indicated.

Step 3. Fill out Section 2.

This block is used to reflect calculated information - the average annual value of all property assets for the reporting period. Data is listed for each month of the calendar year.

Line 150 shows the total result for the average annual cost.

Line 160 indicates the tax benefit code, if any.

Line 190 is intended to reflect the general tax base, and line 210 illustrates the current rate for property contributions in the region.

In field 220 the total calculated amount is entered, and in 230 - previously paid advance payments.

An updated example of filling out a property tax return for organizations involves entering in cell 270 the value of the residual value of fixed assets as of December 31, 2019 (as of the last date of a specific reporting period).

Step 4. Fill out Section 2.1.

This is a new section that is filled out carefully and in strict accordance with the explanations of the Federal Tax Service (Letter No. BS-4-21 / [email protected] dated March 14, 2018). Here you enter information about each property subject to taxation at the average annual value.

The cadastral number is entered in field 010, and the conditional number in 020, if the fund has one.

Line 030 reflects the inventory number of the asset if there is no cadastral or conditional nomenclature.

In line 040, write down the 9- or 12-digit OKOF code for a specific property.

Field 050 reflects the residual value of the asset as of December 31 of the reporting year. Information is entered for each fund separately, therefore, if an organization has several assets with cadastral or conditional numbers, then lines 010 to 050 of section 2.1 are filled in for each such property. The residual value at the end of the period is determined for each position separately by calculating the share in the total value of each asset in the inventory card. The calculated share of the fund is multiplied by the total residual value of all funds taken into account.

Step 5. Fill out Section 3.

The block is intended for calculating property contributions based on cadastral value.

In line 001 the code of the type of property is entered (Appendix 5 of the Procedure). Then OKTMO and the cadastral number of the property are registered.

Line 020 reflects the cadastral value of the real estate, which is also the tax base from line 060.

In field 080 the tax rate is entered, and in field 100 the calculated value of the contribution to be paid to the budget.

To submit the report you will need:

- print and sign with the manager if the form is submitted to the Federal Tax Service on paper;

- sign with an electronic digital signature and transfer to the Federal Tax Service via telecommunication channels for electronic reporting;

- receive confirmation (notice) that the register has been accepted by the inspector.

Line 050 of section 2.1 in case of accounting for several objects as one inventory object

The tax service also told us what to do if each of several fixed assets items recorded in one inventory card with a common initial cost has its own cadastral number. In this case, the organization should fill out several blocks of lines 010 - 050, indicating the cadastral number of the object in each. In this case, in line 050 of each block it is necessary to enter the residual value of the corresponding property. It can be calculated by calculation, based on the share of the object’s area in the total area of all objects recorded in the inventory card, multiplied by the total residual value of all objects recorded in the inventory card according to accounting data.

Where to take it

The property tax declaration is submitted every year to the territorial Federal Tax Service Inspectorate at the place of registration of the taxpayer. If an organization has an OP in another subject of the Russian Federation - separate divisions with a separate balance sheet and independent tax accounting, then the declaration is submitted to the inspectorate at the location of this separate division. Also at the location, reports are submitted for each immovable taxable object located separately from the OP and the parent organization.

If the enterprise is not one of the largest, transfers contributions strictly within one region and calculates tax only on the book value, then, with the consent of the territorial inspectorate, reporting on separate OP and remote assets is included in the general declaration and submitted to the Federal Tax Service, in which the head office is registered. organization.

Property tax returns are accepted in both paper and electronic form. The register is submitted by responsible persons or their authorized representatives. It is possible to send the declaration by registered mail with a mandatory list of all attachments. But some categories of payers are required to submit property tax reports strictly electronically through specialized communication channels (Article 80 of the Tax Code of the Russian Federation):

- organizations classified as the largest;

- institutions created during the reporting period, the list of employees of which exceeds 100 people;

- taxpayers whose average number of employees for the previous reporting period included 100 employees or more.

Section 1

Contains summary information on the amount payable to the budget. Filled in after calculating the tax base and the amount payable in the remaining sections. Contains several blocks in which information is entered based on OKTMO codes assigned to the property:

- OKTMO code. They put a code at the location of objects subject to taxation. If the code is less than 11 characters, empty cells are crossed out.

- KBK to which the payment is transferred.

- Calculated tax, which is determined as follows: