Choosing the form of tax regime

Small businesses are given the opportunity to independently choose taxation, thanks to which newly created enterprises have comfortable and affordable conditions for their operation.

Small business, like any other legal business, is characterized by its versatility. In small enterprises, as well as in large ones, tax contributions to the state treasury have a significant share in the financial flows of the organization. Neglect of this aspect of doing business results in large financial losses for the company. Therefore, if you are just starting to work or want to optimize your expenses, contact a good accountant, or better yet, become one yourself.

Of course, we can admit that the tax system in the Russian Federation is imperfect, but a reasonable selection of the optimal tax payment method is quite possible.

Today, when creating a small enterprise, it is possible to choose one of several tax systems currently in force, most suitable for the company’s planned activities.

General mode

Taxation of enterprises of all forms of ownership and types is by default established in the form of a general regime - OSNO. Under this regime, the enterprise’s responsibility includes maintaining both accounting and tax records. If an organization works for OSNO, it pays the following taxes to the state:

- for added value,

- on organizations

- for profit (legal entities),

- on the income of individuals (individual entrepreneurs).

Advantages of OSNO

The advantages of this system include:

- the opportunity to engage in various types of activities, without having a limit on the amount of revenue;

- reimbursement of VAT from the budget for various reasons;

- greater attractiveness for counterparties due to the reimbursement of their VAT;

- possession of any number of employees and others.

Disadvantages of OSNO

The disadvantages of the general mode include:

- obligation to pay a large number of taxes,

- the obligation to provide a large number of reports to tax authorities and other government organizations,

- complex form of managing income and expenses,

- collection and mandatory storage of all documentation related to the activities of the enterprise and others.

Who submits reports as a small enterprise?

In accordance with the provisions of Federal Law No. 209 of 2007, the following business entities are considered small enterprises.

- Microenterprise. The staff includes up to 15 employees, annual revenue excluding VAT is up to 120 million rubles.

- Small. The number of employees is up to 100 people, the annual revenue is within 800 million rubles.

- Average. Team of 101–250 employees, revenue at the end of the year up to 2 billion rubles.

A common feature for all three groups is the ratio of shares in the authorized capital - up to 25% for government agencies, foundations, social and religious movements, up to 49% for foreign capital and large businesses.

Small business in agriculture

Entrepreneurs whose activities include only the production of agricultural products and who do not process them have the opportunity to work under the Unified Agricultural Tax system.

In this case, collecting taxes from small businesses is much simpler, since the organization has the right not to pay the following types of taxes to the treasury:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

If a company wants to work in this mode, it needs to show the share of all income from the sale of manufactured products in total sales revenue, and its share must exceed 70%.

Reporting is submitted every six months, the tax period is one year. Therefore, it should be remembered that having switched to the unified agricultural tax, it is impossible to change the taxation regime before the end of the tax year. However, under other systems, changing the regime is also difficult and is carried out only from the beginning of the year. Moreover, an application to change the form of tax collections must be submitted in advance within a strictly defined period.

Automation of tax accounting

If you use specialized accounting programs, then automating tax accounting does not present any difficulties. In this regard, almost everything will happen truly automatically. Typically, accounting programs simultaneously make postings to both charts of accounts. The user doesn't even see it. Special registers can also be generated and filled out in an automated way, which can be used by the functionality of the programs.

However, it is impossible to completely do without manual entries. This is precisely due to the separation and difference between the two accounts. Even more manual work in programs will be needed if the taxpayer applies special tax regimes. Some entries in registers must be made manually. This especially applies to individual entrepreneurs.

Patent tax system

Previously, small businesses had the right to apply a simplified tax system, payments of which were calculated on the basis of a patent. Today, the provisions of the legislation have changed significantly - since 2013, a new independent regime has been introduced - the patent taxation system. Therefore, now the features of taxation of small businesses in terms of payment for the cost of a patent are differentiated from the taxation of business entities operating under other regimes, since under the new system it is necessary to pay only the cost of the patent.

The total patent amount is calculated at a rate of 6% of the company's estimated annual revenue. However, you should know that it can no longer be reduced, as before, by the amount of insurance premiums paid for compulsory insurance.

This regime can only be applied to individual entrepreneurs. In addition, patent taxation applies only to certain types of activities - the law specifies 69 of them, and this list is final. It should be remembered that when purchasing a patent for a period of less than 6 months, its full cost must be paid before the 25th day of the month after the start of its validity. If the patent is valid for a longer period, you can first pay for a third of it, and the remaining two-thirds closer to the end of its validity period - but no later than 30 days before its termination.

Legal optimization of the fiscal burden

A modern entrepreneur can significantly reduce taxes, simplify accounting, and also take advantage of benefits for small businesses. The key condition is the correct choice of mode or proper combination of mechanisms.

Recommendations for simplified taxation system payers

The safest option is a simplified system with a rate of 6%. This solution is suitable for beginning entrepreneurs who have no idea about primary reporting and do not want to take risks. The object of taxation is especially relevant when providing services via the Internet. The system is recommended for self-employed citizens - freelancers.

If the company's costs are significant, it makes sense to pay attention to the 15% rate. The key to success will be documenting expenses. Checking counterparties for integrity will be of great importance. To avoid challenging costs by regulatory authorities, preference should be given to non-cash payments.

The simplified regime is relevant for developing businesses. A high annual turnover threshold allows companies to actively expand and enter new markets. Unlike PSN and UTII, there are no territorial boundaries for conducting commercial activities. You can work in any region of the country without additional registration.

Tax optimizer advice! If a company on the simplified tax system begins to regularly sell products, the sales area can be allocated to UTII. The scheme will be legal if there is a clear delineation of cash flows and documentation of the movement of material assets.

Recommendations for UTII payers

Since this tax system for small businesses is not related to real income and costs, emphasis should be placed on physical indicators. So, you can reduce the fiscal burden by remodeling the premises. Installation of partitions separating the sales area from warehouse and technical areas will legally reduce payments to the budget. It is better for UTII payers to rent fixed assets. In the event of a sharp decline in income or downtime, the agreement can be terminated. The absence of a physical indicator will exclude the calculation of tax. It will be much more difficult for owners of commercial assets to prove the “freezing” of their business.

Tax optimizer advice! Some types of activities subject to UTII duplicate positions in the PSN and STS lists. If the actual revenue in a direction is lower than the imputed income, it is wiser to change the system.

Optimization when applying the PSN regime consists of competently calculating the period of activity. The legislator allowed the acquisition of a patent with minimal terms. This option is optimal for seasonal businesses.

Unified tax on imputed income (UTII)

Taxes for small businesses changed significantly in 2013. Starting this year, as well as now, the transition to a single tax on imputed income has become voluntary. The calculation of UTII has also undergone changes - now it is calculated starting from the day of registration, based on the number of days that were actually worked in a given month.

It is calculated according to a formula that includes the amount of basic profitability established by the subject of the federation, coefficients that depend on the specifics of the enterprise and the tax rate. Online services will help you quickly calculate and pay taxes.

The maximum calculation of the number of hired personnel is calculated not as before, but from the average workforce. The number of employees, as before, should be no more than 100.

Advantages of UTII

Taxation of an enterprise's activities using UTII has the following advantages:

- exemption from paying the following taxes:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

As noted earlier, the above taxes require maintaining rather complex accounting and tax records. Accordingly, replacing the specified number of tax payments greatly simplifies accounting and reduces document flow.

- ease of tax calculation;

- fixed tax amount;

- a tax that does not depend on the actual revenue of the enterprise, allows you to legally conduct business with various turnovers without fear of the tax authorities;

- ease of maintenance, simplicity of accounting for income and expenses.

Disadvantages of EVND

Features of collecting taxes from small businesses include the possibility of combining different taxation regimes, and this seemingly favorable opportunity, with UTII, turns into a significant disadvantage.

In this case, multi-industry enterprises are required to keep separate records for all types of activities, which significantly increases labor costs, since more detailed accounting of analytics is required. Accordingly, the number of taxes paid to the budget increases.

The disadvantages of this mode include the following:

- mandatory payment of a fixed amount, in the absence of the necessary revenue, may cause a loss to the enterprise;

- taxation of small businesses in Russia is imperfect, so there is confusion in the calculation of UTII in the regions.

How to submit tax returns correctly?

No claims from the Federal Tax Service are guaranteed if the forms are filled out correctly and submitted on time. The instructions will help you comply with the first point - they are designed for each declaration and calculation. But, each time filling out reports according to instructions is long and tedious. It still needs to be sent on time using one of the methods below.

- By mail in paper form. The date of delivery is considered to be the number that appears on the postmark upon dispatch. The documentation is sent to the Federal Tax Service with a list of the contents and a notification of delivery. Only under these conditions can timely dispatch be proven.

- Electronically. You can send a virtual version of completed forms via Internet channels at any time before the deadline for receiving reports. There is no need to adapt to the work of the post office. Evidence of sending is a corresponding entry in the log of sent messages.

It’s not difficult to get confused about the contents and terms of delivery, but it takes time to figure it out. The experience of our specialists in this regard is invaluable - you won’t have to be distracted by entering information into forms.

We provide services for filling out tax reports, sending them and defending the interests of the client if questions arise regarding the submitted documentation from the Federal Tax Service. Our specialists independently monitor the composition and completeness of reporting, depending on the specifics of the client’s activities. We guarantee compliance with legal requirements and quiet work for clients.

Simplified system (STS)

The most common tax regime is the so-called “simplified tax regime”. Like other special tax regimes, the simplified tax system is used by small businesses on a voluntary basis. But again, tax legislation has a number of restrictions for application in the simplified tax system.

Who cannot use the simplified tax system? So, these include:

- companies that have income for 9 months of more than 15,000,000 rubles;

- enterprises that earned more than 20,000,000 rubles during the year;

- the number of hired personnel should not exceed 100 people;

- the value of the property must be more than 100,000,000 rubles.

Advantages of the simplified tax system

Accordingly, as with other special regimes under the simplified tax system, an enterprise has the right not to pay the following taxes:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

The specified tax payments are replaced by one, the calculation of which is chosen at the request of the enterprise.

Cons of the simplified tax system

No tax regime is ideal for doing business. Therefore, the currently popular simplified system also has disadvantages:

- loss of counterparties due to the impossibility of refunding VAT and the budget, which enterprises do not pay under the simplified tax system;

- restrictions on the range of subjects who have the right to choose the simplified tax system;

- a significantly limited list of expenses compared to OSNO when calculating the tax base;

- the obligation to pay the minimum tax even if the enterprise is unprofitable.

Thus, a simplified taxation system for small businesses may not always be beneficial for business development.

Moscow State University of Printing Arts

6.

Tax accounting and reporting for small businesses

6.1.

Types of taxation for small businesses

For small businesses, tax accounting and reporting are the most important elements of accounting policy. The main purpose of tax accounting and reporting in a small enterprise is to summarize the information necessary for the correct calculation of the tax base by type of tax payments.

The existing taxation system in the Russian Federation includes general and special taxation regimes, which allows all small businesses to be divided into three main groups.

The first group includes small enterprises that have chosen the general taxation regime along with large and medium-sized enterprises.

The second group includes small enterprises that apply this type of special taxation regime, such as a simplified taxation system, the application of which is regulated by Chapter 26.2 “Simplified taxation system” of the Tax Code of the Russian Federation.

The third group consists of small enterprises that apply another type of special taxation regime in the form of payment of a single tax on imputed income, the application of which is regulated by Chapter 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities” of the Tax Code of the Russian Federation.

Thus, any small enterprise can choose either general or one of the special types of taxation regime.

A small enterprise that uses the generally accepted taxation system must pay a fairly large number of taxes (we list the main ones), including:

Federal significance:

Organizational profit tax at rates 0, 6,; 10, 15, 20, 24% (Article 284 of the Tax Code of the Russian Federation). The basis for levying this tax is Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation. The object for taxation is income received, reduced by the amount of expenses incurred (Article 247 of the Tax Code of the Russian Federation). The tax reporting period for this tax is the calendar year (Article 285 of the Tax Code of the Russian Federation). Tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated December 7, 2001 No. BG-3-02/542 (as amended on July 12, 2002);

Value added tax (VAT) at the rate: 0%, 10%; 18% . The basis for collection is Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation. The object of taxation is regulated by Art. 146 “Object of taxation”, the tax reporting period is a calendar month.

It should be especially noted here that for small businesses the reporting period is extended to a quarter, provided that the monthly revenues from the sale of goods (works, services) during the quarter do not reach a million rubles excluding tax (Article 163 of the Tax Code of the Russian Federation).

Tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated July 3, 2002 No. BG-3-03/338;

Excise taxes, the payment of which is regulated by Chapter 22 “Excise Taxes” of the Tax Code of the Russian Federation. The object of taxation is the sale of produced excisable goods at rates established in rubles and kopecks per unit of measurement of excisable goods, depending on their type (Article 193 of the Tax Code of the Russian Federation). The tax period is a calendar month (Article 192 of the Tax Code of the Russian Federation) and tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated December 17, 2002 N BG-3-03/716;

Tax on personal income, the basis for collection of which is Chapter 23 “Tax on personal income” of the Tax Code of the Russian Federation. The object of taxation is income paid by a small enterprise to employees (individuals) in the form of remuneration for work performed, services rendered, etc. (Article 208 of the Tax Code of the Russian Federation), at established rates of 6, 13, 30, 35% (Article 224 Tax Code of the Russian Federation). The tax period is established by the calendar year (Article 216 of the Tax Code of the Russian Federation) and tax reporting is a certificate of income of an individual for the year in Form No. 2-NDFL, approved by Order of the Ministry of Taxes of the Russian Federation dated December 2, 2002 No. BG-3-04/686;

The Unified Social Tax (UNS), the payment of which is regulated by Chapter 24 “Unified Social Tax” of the Tax Code of the Russian Federation. The object of taxation is payments and other remuneration in favor of individuals under labor and civil law contracts that are concluded for the performance of work, provision of services, as well as for work performed under copyright agreements (Article 236 of the Tax Code of the Russian Federation). The rates are set as a percentage and depend on the amount of income paid (Article 241 of the Tax Code of the Russian Federation). The tax period is set to a calendar year (Article 240 of the Tax Code of the Russian Federation), and tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated October 9, 2002 No. BG-3-05/550, as well as calculation of advance payments approved By order of the Ministry of Taxes and Taxes of the Russian Federation dated 01.02.2002 No. BG-3-05/49.

Regional level:

Organizational property tax, the payment of which is regulated by Ch. 30 “Property tax of organizations” of the Tax Code of the Russian Federation (introduced by Federal Law No. 139-FZ of November 11, 2003), the rate of which is established by the laws of the constituent entities of the Russian Federation and cannot exceed 2.2% (Article 380 of the Tax Code of the Russian Federation). The object of taxation is the average annual value of property as of the reporting date (Articles 375, 377 of the Tax Code of the Russian Federation). The tax period is established by the calendar year (Article 379 of the Tax Code of the Russian Federation). Tax reporting is tax calculations for advance payments submitted within the deadlines established for quarterly and annual financial statements (Article 386 of the Tax Code of the Russian Federation). Calculation of the property tax of enterprises is carried out according to the form approved by the instruction of the State Tax Service of the Russian Federation dated 06/08/1995 No. 33 (as amended by Order of the Ministry of Taxes of the Russian Federation dated 01/18/2002 N BG-3-21/22);

Transport tax (the rate is set in rubles, depending on the type of vehicle (Article 361 of the Tax Code of the Russian Federation). The basis for collection is Chapter 28 “Transport Tax" of the Tax Code of the Russian Federation. The tax reporting period is set to a calendar year (Article 360 of the Tax Code of the Russian Federation), The tax return form is established by the laws of the constituent entities of the Russian Federation.

Local taxes:

Land tax, the rate of which is set by the constituent entities of the Russian Federation. The basis for collecting land tax is the Law of the Russian Federation of October 11, 1991 No. 1738-1 “On Payment for Land” (as amended by the Federal Law of December 24, 2002 No. 176-FZ. The tax period is set to a calendar year (Article 3 Law of the Russian Federation No. 1738-1), tax reporting is carried out according to the Tax Declaration for Land Tax in the form approved by Order of the Ministry of Taxes of the Russian Federation dated April 12, 2002 No. BG-3-21/197;

Advertising tax, the basis for collection of which is the Law of the Russian Federation of December 27, 1991 No. 2118-1 “On the fundamentals of the tax system in the Russian Federation” (as amended by the Federal Law of November 11, 2003). The tax rate is set by local governments, but should not exceed 5% (Article 21p.4 of RF Law No. 2118-1). The object for taxation is the cost of advertising services without value added tax. Local government bodies establish the tax period (for the city of Moscow - quarter) and the reporting form for advertising tax.

Even just the list of main taxes and fees indicates that for small businesses the general taxation regime is a heavy burden. Therefore, a number of small enterprises are switching to a special taxation regime, which includes a simplified taxation system, which is applied along with the general taxation system.

6.2.

Simplified taxation system

The use of a simplified taxation system provides for the replacement of payment of: 1) corporate income tax; 2) tax on property of organizations; 3) the unified social tax and 4) the value added tax (with the exception of the value added tax payable when importing goods into the customs territory of the Russian Federation) by paying a single tax, which is calculated based on the results of the organization’s economic activities for the tax period (Article 346.11 p. .2 Tax Code of the Russian Federation).

All other taxes are paid by small businesses that have switched to a simplified system in accordance with the general taxation regime.

The transition of a small enterprise to a simplified taxation system has a certain procedure, which is established by Chapter 26.2 (Article 346.12 “Taxpayers”).

- • A small enterprise has the right to switch to a simplified taxation system if, based on the results of nine months of the year in which the organization submits an application to switch to a simplified taxation system, sales income (revenue from the sale of goods (work, services, property rights) as its own production , and previously acquired) did not exceed 11 million rubles. (Article 346.12, paragraph 2);

• Does not have the right to apply the simplified taxation system:

• organizations whose average number of employees for the tax (reporting period) exceeds 100 people;

• organizations whose residual value of fixed assets and intangible assets, determined in accordance with the legislation of the Russian Federation on accounting, exceeds 100 million rubles;

• organizations that have branches and (or) representative offices;

• Organizations that cannot apply the simplified taxation system include: banks, insurers, non-state pension funds, investment funds, professional participants in the securities market, pawnshops;

• Organizations and individual entrepreneurs engaged in the following types of activities cannot switch to a simplified taxation system:

• production of excisable goods;

• extraction and sale of minerals, with the exception of common minerals;

• gambling business;

• notaries engaged in private practice.

• Organizations and individual entrepreneurs cannot be such if they:

• are parties to production sharing agreements;

• transferred to a taxation system for agricultural producers (single agricultural tax);

• are organizations in which the share of direct participation of other organizations is more than 25 percent (in this case, this restriction does not apply to organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent) (Article 346.12, clause 3).

• A separate paragraph 4 of Article 346.12 (introduced by Federal Law No. 117-FZ of July 7, 2003) established a procedure for organizations and individual entrepreneurs transferred to the payment of a single tax on imputed income for certain types of activities for one or more types, which they are now entitled to apply a simplified taxation system in relation to other types of business activities carried out by them. But at the same time, for these organizations and individual entrepreneurs, restrictions on the amount of income from sales, the number of employees and the value of fixed assets and intangible assets established by Article 346.12 are determined based on all types of activities they carry out.

The procedure for transition to a simplified taxation system is determined by Art. 346.13 of the Tax Code of the Russian Federation, which establishes that:

Organizations that have voluntarily expressed a desire to switch to a simplified taxation system submit an application to the tax authority at the location of the organization (or place of residence) in the period from October 1 to November 30 of the year preceding the year from which taxpayers switch to a simplified taxation system (Article .346.13 p.1);

Newly created organizations have the right to submit an application for the transition to a simplified taxation system simultaneously with the submission of an application for tax registration, which gives them the opportunity to apply the simplified taxation system in the current calendar year from the moment of establishment of the organization (Article 346.13, paragraph 2);

Taxpayers using the simplified taxation system do not have the right to switch to the general taxation regime before the end of the tax period (Article 346.13, paragraph 3).

The procedure for calculating the single tax

The objects of taxation for calculating the single tax are:

- • income;

• income reduced by the amount of expenses (Article 346.14 clause 1).

Thus, with a simplified taxation system, a small enterprise independently chooses the tax base, taking into account the specific type of its activity, the composition of expenses or income, etc.

When making a choice in favor of income or income reduced by the amount of expenses, it is necessary to follow the procedure for determining the income of a small enterprise (Article 346.15), as well as expenses (Article 346.16).

According to Article 249 of the Tax Code of the Russian Federation, income is recognized as income from sales in the form of proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

If a taxpayer recognizes as an object of taxation income reduced by the amount of expenses, then in this case he must reduce the income received by the amount of expenses incurred.

Expenses are recognized as justified (economically justified) and documented (supported by documents and executed in accordance with the legislation of the Russian Federation) expenses, provided that they are incurred to carry out activities aimed at generating income (Article 252 of the Tax Code of the Russian Federation). Expenses not taken into account for tax purposes are determined by Art. 270 Tax Code of the Russian Federation.

To expenses according to the criteria of Art. 252 of the Tax Code of the Russian Federation can include primarily those defined by Article 346.16 (clause 1 subclause 1-4):

- • expenses for the acquisition of fixed assets, including expenses for repairs of fixed assets, including leased ones;

• expenses for the acquisition of intangible assets;

• rental payments (including leasing) for rented (including leased) property.

Particular attention should be paid to the costs of acquiring fixed assets, which are accepted in the manner determined by Art. 346.16 clause 3 of the Tax Code of the Russian Federation.

You should also keep in mind the procedure for recognizing income and expenses.

Article 346.17 determines that: 1) the date of receipt of income is the day the funds are received in accounts (in banks and (or) at the cash desk); 2) expenses are recognized as expenses after their actual payment (expenses for the acquisition of fixed assets are reflected on the last day of the reporting (tax) period).

When determining the tax base of the single tax, income and expenses are determined on an accrual basis from the beginning of the tax period (Article 346.18, paragraph 5).

The tax rate of the single tax is established depending on the selected object of taxation:

6 percent if the object of taxation is in the form of income;

15 percent when the object of taxation is in the form of income reduced by the amount of expenses (Article 346.20 of the Tax Code of the Russian Federation).

The types of payments for the single tax are:

Quarterly advance payments, which are counted towards the payment of the single tax at the end of the tax period. In this case, the amount of tax at the end of the tax period is determined by the taxpayer independently (Article 346.21, paragraph 2).

Example of calculating a single tax [6]:

In an organization using a simplified taxation system, at the end of 2003, the income amounted to 362,500 rubles, including:

- — for the first quarter — 125,000 rubles;

— for half a year — 225,000 rubles;

— for 9 months — 235,000 rub.

Let us assume that the organization has chosen as the object of taxation income reduced by the amount of expenses. At the same time, the total amount of expenses amounted to 302,500 rubles, including:

- — for the first quarter — 100,000 rubles;

— for half a year — 180,000 rubles;

— for 9 months — 250,000 rub.

Calculation of the amount of advance payments, as well as the amount of tax for the reporting year.

- I quarter 2003:

tax base for the single tax for the first quarter:

125,000 rub. — 100,000 rub. = 25,000 rub.;

advance payment amount based on the results of the first quarter:

25,000 rub. x 15% / 100% = 3750 rub.

Half year 2003:

tax base for the single tax for the half-year: 225,000 rubles. -180,000 rub. = 45,000 rub.

amount of advance payment at the end of the half year:

total: 45,000 rub. x 15% / 100% = 6750 rub.

paid at the end of the half year: 6,750 rubles. — 3750 rub. = 3000 rub.

9 months 2003:

tax base for the single tax for 9 months of 2003:

235,000 rub. — 250,000 rub. = - 15,000 rub.

If the tax base is negative, the advance payment of the single tax for 9 months of 2003 is not calculated and paid.

- 2003

tax base for the single tax for the tax period:

RUB 362,500 — 302,500 rub. = 60,000 rub.

tax amount at the end of the tax period:

60,000 rub. x 15% / 100% = 9000 rub.

subtract advance payments: 9,000 rubles. — 3750 rub. — 3000 rub. = 2250 rub. Consequently, this amount will be paid as a single tax for 2003.

Example 2. At the end of 2003, the organization’s income amounted to 362,000 rubles. The organization chose income as the object of taxation. At the same time, the total amount of contributions for compulsory pension insurance in the current year was 15,000 rubles, the amount of payments of temporary disability benefits was 2,000 rubles.

Let's calculate the amount of single tax for 2003:

- the amount of single tax calculated based on the results of 2003:

RUB 362,500 x 6% /100% = 21,750 rub.

Now you should calculate the amount by which the amount of tax can be reduced due to contributions to compulsory pension insurance, since the amount of contributions paid to compulsory pension insurance (15,000 rubles) is more than 50% (Article 346.21, paragraph 3):

RUB 21,750 x 50% / 100% = 10,875 rub. Consequently, only by this amount can the amount of the single tax reduced by “pension” contributions be reduced.

Table 45. Tax reporting of a small enterprise under the simplified taxation system

| No. | Tax name | Basis for charge | Tax rate (fee, contribution) | Tax reporting | Tax (reporting) period |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | Single tax (federal) | Chapter 26.2. “Simplified taxation system” of the Tax Code of the Russian Federation | 6% (income) 15% (income minus expenses) | Tax return in form (Order of the Ministry of Taxes of the Russian Federation dated November 12, 2002) | calendar year (Article 346.19 of the Tax Code of the Russian Federation) |

| 2 | VAT regarding payment when importing goods to customs. territory. Russian Federation (federal) | Chapter 21. “Value added tax” Tax Code of the Russian Federation | 10% 18% | Not generated and not submitted to the tax authorities | absent |

| 3 | Excise taxes (federal) | Chapter 22. “Excise taxes” of the Tax Code of the Russian Federation | Rates depending on the type of goods (Article 193 of the Tax Code of the Russian Federation) | Tax return in form (Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 17, 2002) | calendar month |

| 4 | Personal income tax (federal) | Chapter 23. “Tax on personal income” Tax Code of the Russian Federation | 6% 13% 30% 35% | Certificate of income of individuals (Order of the Ministry of Taxes of the Russian Federation dated December 2, 2002 | calendar year (Article 216 of the Tax Code of the Russian Federation) |

| 5 | Transport tax (regional) | Chapter 28. “Transport tax” Tax Code of the Russian Federation | Rates depending on the type of vehicle (Article 361 of the Tax Code of the Russian Federation) | Tax return (laws of the constituent entities of the Russian Federation) | calendar year (Article 360 of the Tax Code of the Russian Federation) |

| 6 | Land tax (local) | Law of the Russian Federation of October 11, 1991 “On payment for land” No. 1738-1 | Rates are set by the laws of the constituent entities of the Russian Federation | Tax return in form (Order of the Ministry of Taxes of the Russian Federation 12.04.200) | calendar year (Article 3 of the Law of the Russian Federation “On Payment for Land”) |

| 7 | Advertising tax (local) | Law of the Russian Federation “On the Fundamentals of Tax. systems in the Russian Federation" dated December 27, 1991 No. 2118-1 | Not higher than 5% (Article 21, paragraph 4 of the Law of the Russian Federation of December 27, 1991 No. 2118-1) | The form is established locally (Article 21, paragraph of Law No. 21118-1) | installed locally (Article 21, Clause 4, Law of the Russian Federation No. 2118-1) |

| 8 | Fear. contributions to liabilities pension insurance | Federal Law of December 15, 2001 “On Obligations.” penny. insurance" | Rate based on age and gender (Article 22, 23 Federal Law) | Insurance tax return. contributions | calendar year (Article 23 clause 1 of the Federal Law) |

| 9 | Starkh. contributions to liabilities social fear. from accident sl. in production and prof. zab. | Federal Law of July 24, 1998 "125-FZ "On Obligations. social fear. from accident sl. on etc. zab | Prof. class rate risk (Article 21,22 Federal Law No. 125-FZ) | Sec. II Calc. led on Wednesday FSS of the Russian Federation according to the Post form. FSS dated October 29, 2002 No. 13 | quarter, half year, 9 months, year |

| 10 | Voluntary fear. vzn. on the next vr. not difficult. | Federal Law dated December 31, 2002 No. 190-FZ | 3% | Fear reporting. from 04/25/2003 | quarter, half year, 9 months, year |

Finally, let’s reduce the amount of the single tax by the amount of temporary disability benefits paid to employees:

RUB 10,875 — 2000 rub. = 8875 rub.

It is this amount that must be paid by the organization in the form of a single tax to the budget based on the results of 2000.

As a result, we will compile a table of tax reporting for small businesses using a simplified taxation system (Table 45).

Thus, we can conclude that the use of a simplified taxation system, which small enterprises can use under certain conditions in accordance with Russian legislation, to a certain extent relieves tax tension and promotes the development of entrepreneurial activity.

6.3.

Taxation in the form of a single tax on imputed income for certain types of activities

A special type of special taxation regime is a single tax on imputed income for certain types of activities. The fundamental difference between this tax and the single tax under the simplified taxation system is that it is levied not on actual, but on imputed income.

Currently (since January 1, 2003), the procedure for establishing and enforcing a single tax on imputed income is regulated by Chapter. 26.3 of the Tax Code of the Russian Federation “Taxation system in the form of a single tax on imputed income for certain types of activities.”

The following taxes are not collected from single tax payers on imputed income (Article 346.26, clause 4):

- • corporate income tax;

• personal income tax;

• value added tax (except for the part on payment of tax when importing goods through the customs territory of the Russian Federation);

• property tax for enterprises and individuals;

• unified social tax.

The object of taxation when applying a single tax is imputed income.

In Art. 346.27 provides the concepts of imputed income, basic profitability, basic profitability coefficients:

- — imputed income is the potential income of a single tax payer, calculated taking into account a set of factors that directly influence the receipt of said income, and used to calculate the amount of a single tax at the established rate;

— basic profitability is a conditional monthly profitability in value terms for one or another unit of a physical indicator characterizing a certain type of business activity in various comparable conditions, which is used to calculate the amount of imputed income;

— adjusting coefficients of basic profitability are coefficients showing the degree of influence of a particular factor on the result of entrepreneurial activity carried out on the basis of a certificate of payment of a single tax.

The tax base is calculated as the product of the basic profitability for a certain type of activity and the value of the physical indicator characterizing this type of activity.

The basic yield is adjusted (multiplied) by coefficients K1 (adjustment coefficient), K2 (adjustment coefficient), K3 (deflator coefficient).

Coefficient K1 is determined depending on the cadastral value of land (based on data from the State Land Cadastre) at the place of business activity by the taxpayer and is calculated using the following formula:

K1 = (1000+Kof) / (1000+Kom),

where Kof is the cadastral value of land (based on data from the State Land Cadastre) at the place of business activity by the taxpayer; Com - the maximum cadastral value of land (based on data from the State Land Cadastre) for this type of business activity; 1000 - cost estimate of other factors influencing the amount of basic profitability, reduced to a unit of area.

In 2003, K1 was not used.

The values of the adjustment coefficient K2 are determined for all categories of taxpayers by the constituent entities of the Russian Federation for the calendar year and can be set in the range from 0.01 to 1 inclusive (Article 346.29, clause 7).

K3 depends on the index of changes in consumer prices for goods (works, services) in the Russian Federation (K3 in 2003 was equal to 1).

Using coefficients K1, K2 and K3, the basic profitability is adjusted.

It is very important to emphasize that a small enterprise under Art. 26.3 of the Tax Code of the Russian Federation cannot switch on a voluntary basis to paying a single tax on imputed income; moreover, this transition can even be carried out on a “forced” basis (by decision of a constituent entity of the Russian Federation).

This is due to the fact that, according to existing legislation, only organizations engaged in certain types of business activities can apply a single tax on imputed income, which (according to Article 346.26, paragraph 2 of the Tax Code of the Russian Federation) includes 6 types of activities:

- — provision of household services;

— provision of veterinary services;

— provision of repair, maintenance and washing services for vehicles;

- retail trade carried out through shops and pavilions with a sales floor area for each trade facility of no more than 150 square meters, tents, trays and other trade facilities, including those without a stationary retail space;

— provision of catering services carried out using a hall with an area of no more than 150 square meters;

— provision of motor transport services for the transportation of passengers and goods carried out by organizations and individual entrepreneurs operating no more than 20 vehicles.

At the same time, in Art. 346.27 introduces the following explanations, among which we note the most important: a) retail trade is the trade in goods and the provision of services to customers in cash, as well as using payment cards; b) a stationary retail chain is a retail chain located in specially equipped buildings intended for trading (shops, pavilions, kiosks); c) a non-stationary trading network is a trading network operating on the principles of distribution and distribution trade; d) trading place is a place used for making purchase and sale transactions; e) household services - paid services provided to individuals (with the exception of pawnshop services), which are classified in accordance with the All-Russian Classifier of Services to the Population: OKUN - OK 002-93, approved by Resolution of the State Standard of Russia dated June 28, 1993 No. 163 (ed. 07/01/2003) according to gr. 01 “Household services” (except for repair, maintenance and washing services of vehicles); f) number of employees - the average number of employees for the tax period, taking into account all employees, including part-time workers.

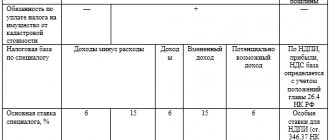

To calculate the amount of a single tax on imputed income depending on the type of business activity, a small enterprise uses physical indicators and indicators of basic profitability per month, which are presented in table. 46 (Article 346.29, paragraph 3).

Table 46. Tax base for calculating the single tax on imputed income

| Types of business activities | Physical indicators | Basic income per month (rubles) |

| Provision of household services | Number of employees, including individual entrepreneurs | 5000 |

| Provision of veterinary services | Number of employees, including individual entrepreneurs | 5000 |

| Providing repair, maintenance and washing services for vehicles | Number of employees, including individual entrepreneurs | 8000 |

| Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1200 |

| Retail trade carried out through objects of a stationary trading network that does not have trading floors, and retail trade carried out through objects of a non-stationary trading network | Trading place | 6000 |

| Catering | Area of the visitor service hall (in square meters) | 700 |

| Provision of transport services | Number of vehicles used to transport passengers and cargo | 4000 |

| Retail trade carried out by individual entrepreneurs (with the exception of trade in excisable goods, medicines, products made of precious stones, weapons and ammunition, fur and technically complex household goods) | Number of employees, including individual entrepreneurs | 3000 |

So, the amount of imputed income (tax base) for calculating the amount of a single tax is calculated as the product of the values of the basic profitability per month for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity, as well as the values of the adjustment coefficients of the basic profitability K1, K2 and K3.

The tax period for a single tax is a quarter (Article 346.30).

“Methodological recommendations for the use of Ch. 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities of the Tax Code of the Russian Federation”, approved by Order of the Ministry of Taxes of the Russian Federation dated December 10, 2002 No. BG-3-22/707 (as amended on April 3, 2003, dated October 28, 2003), it was proposed to use the following calculation formula when calculating the tax base:

VD = (BD x (N1+N2+N3) x K1 x K2 x K3,

where VD is the amount of imputed income; BD - the value of the basic profitability per month for a certain type of business activity; N1, N2, N3 - physical indicators characterizing this type of activity in each month of the tax period; K1, K2, K3 - adjustment coefficients of basic income.

If the value of a physical indicator changes during the tax period, the taxpayer, when calculating the tax base, takes into account such change from the beginning of the month in which this change takes place.

Example 1. A small enterprise that provides household services to the population from January 1, 2003 was transferred to paying a single tax on imputed income.

The basic profitability was 5,000 rubles. per month.

In January 2003, the average number of employees was 5 people, in February - 6 people, in March - 8 people.

The value of the basic profitability adjustment factors:

- K1 - 1

K2 - 0.5

K3 - 1

The tax base at the end of the tax period was

VD = 5000 x (5 + 6 + x 1 x 0.5 x 1 = 47,500 rub.

x 1 x 0.5 x 1 = 47,500 rub.

The single tax on imputed income is calculated by the taxpayer based on the results of each tax period (quarter) at a rate of 15% of imputed income (Article 346.31 of the Tax Code of the Russian Federation) according to the formula

EH = VD x 15/100, where EH is a single tax; VD - imputed income; 15/100 is the tax rate.

The amount of single tax calculated for the tax period is reduced by the amount:

- · insurance contributions for compulsory pension insurance paid during this period of time to employees employed in those areas of activity for which a single tax is paid;

· Paid benefits for temporary disability.

In this case, the amount of the single tax cannot be reduced by more than 50% on insurance contributions for compulsory pension insurance.

Example 2. A taxpayer, an individual entrepreneur operating in the retail trade sector, calculated a single tax on imputed income in the amount of 6,000 rubles at the end of the tax period, and also paid insurance premiums for compulsory pension insurance for employees engaged in this activity in the amount of 3,800 rubles. and insurance premiums in the form of a fixed payment in the amount of 450 rubles.

In addition, the taxpayer paid temporary disability benefits in the amount of 1,500 rubles during the tax period.

In this case, the taxpayer reduces the amount of the calculated single tax by only 3,000 rubles. insurance contributions paid by him for compulsory pension insurance:

(6000 x 50/100) < 4250, and

for the entire amount of temporary disability benefits paid.

The total amount of payments for the tax period will be 5,750 rubles, including:

- • single tax on imputed income - 1,500 rubles. (6000 -3000 - 1500);

• amount of paid contributions for compulsory pension insurance - 4250 rubles.

Example 3. Based on the results of the tax period, the taxpayer calculated a single tax on imputed income in the amount of 4,100 rubles.

Paid insurance premiums for compulsory pension insurance in the amount of 1,500 rubles. and insurance premiums in the form of a fixed payment in the amount of 450 rubles.

During the tax period, benefits for temporary disability in the amount of 1,100 rubles were also paid.

In this case, the taxpayer has the right to reduce the amount of the single tax calculated by him on imputed income by the entire amount of paid insurance contributions for compulsory pension insurance:

(4100 x 50/100) > 1950 rubles, as well as the entire amount of temporary disability benefits paid.

The total amount of payments for the tax period will be 3,000 rubles, including:

- • single tax on imputed income - 1,500 rubles. (4100 - 1950 - 1100)

• the amount of insurance contributions paid for compulsory pension insurance - 1950 rubles.

Based on the results of the tax period, a tax return for the single tax on imputed income is filled out in the form approved by order of the Ministry of Taxes of the Russian Federation dated November 12, 2002 No. BG-3-22/648, which is submitted no later than the 20th day of the first month of the next tax period.

Payment of the single tax is made by the taxpayer based on the results of the tax period no later than the 25th day of the first month of the next tax period.

6.4.

Questions for self-control

1. What types of taxes are not calculated under the simplified taxation system?

2. What types of taxation object does it have under the simplified system?

3. What are the tax rates under the simplified taxation system?

4. List the types of business activities to which the taxation system is applied in the form of a single tax on imputed income.

5. Give the concept of basic profitability.

6. What is imputed income? What is the formula for calculating it?

7. Describe the adjustment factors of basic profitability.

8. What formula is used to calculate single income?

Features of the simplified mode

Taxation of small businesses under a simplified system is carried out on two objects.

The first is the total income of the enterprise. The tax payment in this case is 6% of the income.

The second is the difference between income and expenses. In this case, the tax burden will be 15% of the difference received.

Entrepreneurs have the right to choose any of these objects for taxation, but first it is necessary to calculate the costs of the enterprise. To find out which object is more profitable for the organization.

Replacing basic taxes with a single one does not relieve small business representatives from other responsibilities to the state, such as:

- regular provision of tax and statistical reporting;

- payment of other taxes depending on the conduct of business: for the use of water resources, for the extraction of minerals, etc.;

- payment of excise taxes if the entrepreneur sells excisable goods;

- payment of other fees, such as deductions and contributions to extra-budgetary funds - Pension Fund, Social Insurance Fund. So, if a private entrepreneur pays a fixed amount for himself to the pension fund once a year, then he must make contributions monthly for his employees.

Financial statements

This reporting list consists of:

- from the balance sheet;

- financial results report;

- explanations to the balance sheet and income statement;

- statement of changes in capital;

- cash flow statement;

- report on the intended use of funds (mandatory for non-profit organizations).

Accounting statements are submitted once a year to the Federal Tax Service, and the balance sheet is additionally submitted to the statistical authorities.

Small businesses applying on the basis of clause 4 of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ simplified methods of accounting, it is allowed to use simplified forms of the balance sheet and financial statements without filling out other forms (clause 6 of the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

We draw your attention to the fact that simplified forms are approved by the above-mentioned order (clause 6.1), therefore, if it is necessary to clarify information about your activities, we recommend that you do not change the form of documents, but prepare and submit reports in full (paragraph 2 subparagraph “b” p 6 of order No. 66n).

IMPORTANT! If an audit is required for your business, you cannot use simplified reporting forms (Clause 5, Article 6 of Law No. 402-FZ).

For more information about financial statements for SMEs and the procedure for filling them out, see the material “Simplified accounting financial statements - KND 0710096”.