When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which it is mandatory to provide an explanatory note to the tax office upon request (we offer a sample for NPOs) are specified in clause 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector may suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so you can prepare an explanatory note on losses in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (Letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

When can the inspectorate request documents?

As a rule, the inspectorate requests documents when conducting a desk, counter or on-site tax audit.

So, for example, when conducting a desk tax audit, the inspectorate may request documents to confirm the accuracy of the information reflected in the declaration, if during such a desk audit the inspectorate identified inconsistencies between the reflected data and the information available to the tax inspectorate (clause 4 of article 88 of the Tax Code of the Russian Federation , Resolution of the Presidium of the Supreme Arbitration Court of March 15, 2012 No. 14951/11 in case No. A40-54354/10-4-301).

Also, the inspection has the right to request invoices, primary and other documents if the taxpayer in his VAT return declared tax to be reimbursed from the budget (clause 8 of Article 88 of the Tax Code of the Russian Federation).

When conducting a counter tax audit, the inspectorate may request from you documents that relate to the activities of the taxpayer being inspected, who is, in turn, your counterparty (clause 1 of Article 93.1 of the Tax Code of the Russian Federation).

Naturally, the tax inspectorate may request documents during an on-site tax audit, if such documents relate to the periods being audited (Letters of the Ministry of Finance dated May 12, 2017 No. 03-03-06/1/28744, Federal Tax Service dated July 25, 2013 3 AS-4-2 /13622).

And even outside the framework of tax audits, the inspectorate can request documents on a specific transaction if it has aroused suspicion among tax authorities (clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

How to compose

When drawing up an explanatory note, we are guided by the following rules:

- We compose a response on the organization’s letterhead. If there is no such form, in the header of the document we indicate the full name of the institution, INN, KPP, OGRN and address.

- We indicate the number and date of the requirement for which the explanatory note is being drawn up. It is permissible to write a response to several tax requests at once.

- If there are errors or inconsistencies in the report, double-check the report to eliminate typos or typos.

- In the descriptive part of the explanatory note, we reveal in detail and consistently the circumstances of the situation that needs to be explained.

- When answering a request, rely on the facts and document the circumstances. Attach copies of documents to the answer, if any. For example, attach to the explanatory note a copy of the additional agreement to the contract with the provision for increasing prices.

If the inspector requires an explanatory note regarding inconsistencies in the value added tax return, the response will have to be sent electronically. An exception to the rules is reserved for organizations that report VAT on paper. If the institution reported electronically, but provided a response to the request on paper, then the tax office will consider such explanations not provided. Such norms are prescribed in the Letter of the Federal Tax Service dated January 27, 2017 No. ED-4-15/1443.

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens with punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory note:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Personal income tax accrued incorrectly

The error occurs infrequently, but still occurs. If the tax authorities have discovered an incorrectly calculated tax, the organization will have to not only prepare an explanatory note, but also generate corrective statements (certificate 2-NDFL).

For such a situation, an explanatory note in any form is suitable. If you don’t know how to write an explanatory note correctly, a sample will help you cope with the task.

Who should report income?

This applies to all persons who in one way or another receive any income outside of work. This category includes :

- those who received income from the sale of property - applies to both movable and immovable;

- persons who had private practice as a part-time job in addition to their main income;

- all persons who have foreign sources of income;

- private entrepreneurs with a staff of at least 100 people during the year;

- everyone who had additional income regardless of the main one (for example, rented an apartment);

- heirs of copyright;

- recipients of winnings.

The penalty for delay, according to the new edition of the mentioned 119th article, is calculated from the amount of tax that was not paid on time.

Reporting papers should not only not be delayed, they should also be filled out in accordance with the rules and the actual state of affairs. You can find out how to fill out the declaration yourself correctly here.

If an individual entrepreneur relies only on himself in business, it is still better to entrust the paperwork to a professional.

Because if errors are discovered, it will be a great success if the tax authorities consider them a banal mistake of a person who does not know how to count. But it can also be regarded as a deliberate misrepresentation.

So when does liability arise for a tax return, or more precisely, for its failure to submit or its delay ?

Late tax return is failure to submit it within the deadlines established by law. The following point causes considerable disagreement - what will happen if a businessman “delayed” the filing, but still filed reports and paid the tax, even if it went beyond the time frame?

There is no consensus among lawyers on this matter. Some believe that yes, this is an offense for which liability inevitably follows. Others believe that there is no violation - after all, the documents were presented.

Therefore, the following approach is most often used - whether liability measures were applied to the taxpayer or not. If he made it earlier, they usually turn a blind eye to his lateness.

Errors and discrepancies regarding VAT

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable.

The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy can only be the inattention of the person responsible for issuing invoices. Or a technical error when uploading data.

In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the presented forms of fiscal reporting. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require you to provide an explanatory note on this issue, provide explanations in free form. In the text, indicate specific reasons why the discrepancies arose.

Also, the reason for such inconsistency may be different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in an explanatory note.

It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

What criteria are used to consider companies that have shown a loss?

Typically, there are three types of losses:

- a fairly large loss;

- the loss is repeated over two tax periods;

- the loss was shown last year and in the interim quarters of the current year.

What should newly registered enterprises do? Loss is a common occurrence for new businesses. In addition, tax legislation requires accounting for expenses in the period in which they are incurred, despite the fact that income has not yet been received. If a company was created and suffered a loss during the same year, then the tax authorities most likely will not consider it as problematic.

However, if you show a loss for more than one year, the inspectorate will require you to explain the reasons for this situation, since it may consider that you are deliberately reducing profits. Therefore, we recommend that if you have a loss, submit a balance sheet and profit and loss statement with an explanatory note, this will allow you to avoid unnecessary questions.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with the provision of an explanatory note, an invitation to the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In the explanatory note, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service initiates an on-site inspection, which may take several months.

What to write in an explanatory note:

- Reduction of salary taxes. The reasons may be staff reduction, enterprise restructuring, or reduction in wages.

- A decrease in profits may occur due to termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the explanatory note.

- Increased costs as a result of decreased profits. The justification may be expansion of activities (increasing production volumes, opening a new branch, division, retail outlet), changing suppliers or increasing prices for inventories and raw materials (attach copies of contracts).

There can be quite a few reasons for reducing the tax burden. We will have to look into each specific case.

Source of the article: https://gosuchetnik.ru/bukhgalteriya/poyasnitelnaya-zapiska-v-nalogovuyu-po-trebovaniyu-obrazets

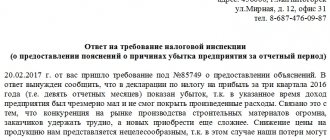

Sample explanatory note

For a clear understanding of how to write explanations to the tax office regarding losses, the sample presented below will help us.

To the boss

Inspectorate of the Federal Tax Service of Russia No. 6

in Kazan

Skvortsov A.S.

EXPLANATIONS

Having studied your request regarding the provision of explanations explaining the formation of the loss, Romashka LLC reports the following.

During nine months of 2014, the revenue of Romashka LLC from the sale of products amounted to 465 thousand rubles.

Costs taken into account in tax accounting amounted to 665 thousand rubles, including:

- material costs – 265 thousand rubles.

- labor costs – 200 thousand rubles.

- other expenses – 200 thousand rubles.

Compared to the same period last year, these costs increased by 15 percent, including:

- material costs – by 10%;

- labor costs – by 4%;

- other expenses – by 1%.

From these indicators it is clear that the increase in the company’s expenses was mainly associated with an increase in prices for materials and raw materials necessary for the production of our products. In addition, it is worth noting that the company, in order to motivate its employees, increased wage costs.

Also, due to the market situation and the level of competition, the Company was unable to implement the planned increase in prices for the goods sold.

In connection with the above, it can be argued that the loss is a consequence of objective reasons.

Next, you can include a description of the further development of the enterprise in the explanations for tax losses. An example of such a description:

Currently, the management of the enterprise is already conducting negotiations, the purpose of which is to attract new buyers and customers, and is also considering the issue of improving the products, which will increase the income of the enterprise several times. The company plans to achieve a positive financial result based on the results of 2015.

Reasons for requesting clarification from the tax office

When conducting a desk inspection, the inspector has the right to request written explanations from the organization about the identified discrepancies. Clause 3 of Article 88 of the Tax Code of the Russian Federation indicates the main reasons when it is necessary to give an explanation of what happened:

| There are errors in the report | The inspector may send a notice and ask for clarification or provide updated tax reporting. |

| In the updated declaration, the amounts are much lower than in the original document | An employee of a government agency may suspect the company of deliberately understating the tax base and will require written explanations of the changes made. |

| The income statement reflects losses | If the company’s accountant knows that the company is incurring losses, then it is better to prepare a message in advance about the factors that influenced the current situation. |

The company's management must send a reasoned response to the request within 5 days from receipt of the notification.

Responsibility

No matter how much tax officials intimidate with financial sanctions, it will not be possible to hold people accountable for failure to provide explanations.

- according to Art. 126 of the Tax Code of the Russian Federation cannot be a reason for a fine when requesting clarification, since this is not a requirement to provide documents;

- Article 129.1 of the Tax Code of the Russian Federation cannot be applied, since this is not a counter-check;

- According to Article 19.4 of the Code of Administrative Offences, it is impossible to bring to administrative liability, since this article is applicable only in case of failure to appear at the inspection when called.

But, in any case, it is better to check and find out why the discrepancies appeared. Perhaps this will help to detect an accountant's mistake when drawing up the report.

Explanation of discrepancies regarding 6-NDFL

Quarterly, the accounting department submits Form 6-NDFL to the Federal Tax Service, which indicates information about income and withheld tax amounts for each employee.

What to do if tax authorities ask for clarification on inaccuracies in the report? To get started you need:

- check all indicators reflected in the form;

- check the indicated figures with other reports with which the tax office is reconciling;

- specify the amount of the transferred tax;

- if it turns out that there is no error, then you need to send a logical explanation; if an error is discovered, send a clarifying report.

If it turns out that there is an error in the personal income tax information, the company may be fined for inaccurate provision of information in the amount of 500 rubles. for each document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). The company is released from liability if the error was identified independently and corrected. Therefore, every accountant should know the rules for preparing all types of reporting in order to avoid mistakes.

What is the liability for delay in transmission of the declaration?

If the documentation is not transferred within the established period, then you should try to transfer it to the inspection as soon as possible, since it is possible to avoid the accrual of a fine.

Important! If taxes have already been paid, and the taxpayer is late in submitting a tax return, then there is a possibility that he will not have to pay a fine due to the lack of corpus delicti.

Sample tax return according to the simplified tax system.

Amounts of fines

For various violations related to the submission of documentation, the usual punishment is imposed, represented by fines. Their size depends on who is the taxpayer:

- individuals pay 5% of the tax amount if they do not submit the document to the tax authorities on time;

- Individual entrepreneurs and LLCs pay 1 thousand rubles if they did not submit the declaration on time, but paid the tax, and if the tax is not paid or only a partial amount is transferred, then officials are required to pay an additional 300 to 500 rubles.

Thus, every taxpayer must take care to transfer documentation to the inspectorate in accordance with the deadlines specified in the legislation.

If the taxpayer is late in filing reports

If a person who must submit reports has missed the deadline, he should submit them as soon as possible, since if he has already paid the tax, then there is an opportunity to avoid punishment.

If a company misses deadlines, then the tax inspectorate may apply not only fines to it, but may even freeze the organization’s accounts, but the company must be warned about this in advance.

Find out the procedure for submitting tax reports to OSNO in this article.

What other actions may result in liability?

In addition to late submission, there may be other errors that lead to the need to pay sanctions. These include:

- errors in the document;

- lack of important information or even entire sheets;

- presence of inaccurate data.

Important! If the violations are related only to the illiteracy of the taxpayer, then it is advisable to submit the declaration as early as possible so that there is an opportunity to correct the documents.

The fine is issued even if it is necessary to submit a zero declaration, so the company does not have to pay tax, and the amount will be equal to 1 thousand rubles.

The declaration can be submitted online on the Federal Tax Service website.

What fines are imposed for individuals

If an individual is late in submitting a declaration, then for each month of delay a penalty of 5% of the tax amount is assessed, but this fine cannot be less than 1 thousand rubles. or more than 30% of the tax amount.

If there are any tax arrears, then an additional fine equal to 1/5 of the tax amount is assessed.

Explanation of low wages

In Russia, the process of legalizing wages is underway. The rule has been established that workers for their work must receive no less than the minimum wage approved at the state level. At the same time, in the regions of the Far North or equivalent areas, wages should be calculated taking into account increasing factors.

If the inspector discovers that in the submitted calculation the workers’ wages are below the maximum value, then he has the right to demand an explanation of the discrepancies.

Reasonable reasons for this situation may be:

- due to the difficult situation of the organization, employees were transferred to part-time work, the salary was calculated based on the time actually worked;

- if the employee went on vacation, then this circumstance can be pointed out. Often employees go on vacation for a long period of time, receive vacation pay in one month, and the subsequent period remains without accruals or they are insignificant;

- There may be another situation, for example, a person got sick, issued a sick leave, and handed it over to the accounting department for payment later;

- If tax officials ask to explain the reasons for the discrepancy in wages from industry indicators, then they can write that workers receive according to the minimum wage level. But it is not possible to increase the amount, since the company is still young and production volumes are insignificant.

What can lead to losses

Lack of income and losses of organizations is not such a rare occurrence as it might seem to an uninitiated person. They can be associated with a variety of circumstances. They can be caused by a general financial crisis, a decline in demand for products (including due to seasonal factors), an excess of expenses over profits (for example, when purchasing expensive equipment, major repair work, etc.), problems in production , ineffective company management, re-profiling of the enterprise and development of new markets and many other reasons.

Late payment of tax, explanation from the Federal Tax Service

For such reasons, inspectors rarely request clarification; they have the right to send a demand for payment of the relevant tax after the expiration of the regulated period for payment.

What to do if the tax authorities asked to indicate the reasons for the delay in paying taxes?

| Cause | Explanation |

| Technical reason | The company's management may discover that the tax was calculated correctly, but when paying, incorrect details were indicated in the payment documents, for example, in KBK or OKTMO. |

In this case, you will need to write an application to clarify the payment. If it passes by the current date, and not the actual date of payment, you will have to pay a penalty for late payment.

| There is a discrepancy between the period of accrual and payment of personal income tax | In paragraph 6. Article 226 of the Tax Code of the Russian Federation stipulates that the taxpayer must transfer the amount the next day after payment of wages. In cases where the salary is transferred on the last day of the reporting quarter, and the tax is transferred in the next period, you will need to explain the situation. But this fact is not a violation of the law. |

When there is a reason not to submit documents (information)

SITUATION 1. The requirement to submit documents is sent bypassing your inspection

It's rare these days, but it does happen. Tax officials conducting an audit or other activities in relation to your counterparty are trying to speed up the process of obtaining the information they need. Therefore, they send the request to you immediately. You don't have to do it. And the tax authorities will not be able to fine you for this. After all, you are not obliged to submit documents to “foreign” inspectors. 3, 4 tbsp. 93.1 Tax Code of the Russian Federation. The refusal can be issued as follows.

Cosmos LLC

Ufa, lane Rossiyskiy, 66b INN 0276603129/KPP 027601001

Inspections of the Federal Tax Service of Russia for the city of Elektrostal 144000, Elektrostal, Bolnichny proezd, 3

In response to your request dated May 22, 2012 No. 15/1058 in connection with the on-site tax audit of Krug LLC (TIN 5053513901/KPP 505301001), we inform you that it is impossible to fulfill it, since the procedure for requesting documents established by clause 3 and clause 4 art. 93.1 Tax Code of the Russian Federation.

SITUATION 2. The basis for which documents are required from you is the conduct of a tax return in relation to your counterparty

Take your time and check with the counterparty whether he is actually undergoing verification. If he does not confirm this information, you can refuse the tax authorities. And if you are fined for failure to provide documents, go to court. For example, one of the courts declared the fine unlawful Resolution of the Federal Antimonopoly Service of September 6, 2011 No. A72-8582/2010, in particular, because the tax authorities requested documents in connection with the GNP, although the audit itself began only 7 months later.

But we advise you to be especially careful. After all, at the time you receive a request, the counterparty may not yet know that he has an inspection scheduled. Or he may deliberately mislead you, for example, if in his accounting he did not reflect your relationship with him completely reliably. If you are one hundred percent sure that the counterparty does not carry out GNP, your refusal to the tax authorities may look like this.

In response to your request for the submission of documents dated 06/07/2012 No. 09/9431 in connection with the on-site tax audit of Krug LLC (TIN 5053513901/KPP 505301001), we inform you that it is impossible to fulfill it, since during a telephone conversation with the general director of the LLC “Circle” by Peskov Yu.A. It turned out that the decision to conduct an on-site inspection was not handed over to the officials of this organization and the VNP is not currently being carried out in relation to Krug LLC, and therefore, the above requirement does not comply with the provisions of paragraph 1 of Art. 93.1 Tax Code of the Russian Federation.

SITUATION 3: You are asked to provide information about a transaction that cannot be identified based on the request

When asking you for information about your relationship with a counterparty without ordering an inspection from him, tax authorities must indicate what specific transaction they are interested in. 2, 3 tbsp. 93.1 Tax Code of the Russian Federation. But in practice it often happens that they do not reflect this, but simply indicate the period for which they want to receive information. Then you can write a similar letter to the tax authorities.

In response to your request for information dated 06/07/2012 No. 09/9431 in connection with the implementation of tax control measures in relation to Krug LLC (TIN 5053513901/KPP 505301001), we inform you that it is impossible to fulfill it, since information is requested on relationships for the period from 2009 to 2011 and it is impossible to determine for which specific transaction information needs to be provided.

And if the tax authorities fine you for this, the courts will be on your side. Resolution of the Federal Antimonopoly Service of the Moscow Region dated April 30, 2009 No. KA-A40/3266-09; FAS ZSO dated December 29, 2010 No. A27-4698/2010.

SITUATION 4. A desk audit of your counterparty’s declarations is being carried out, and you have been asked for documents for a period exceeding the tax (reporting) period for the declaration

For example, tax authorities check, as part of a desk audit, your counterparty’s VAT return for the first quarter of 2012. However, during a counter audit, they ask you to submit invoices issued during the period from 2010 to the first quarter of 2012, because, according to the Ministry of Finance , there is no restriction in the legislation on the period for which documents can be requested. Letter of the Ministry of Finance dated November 23, 2009 No. 03-02-07/1-519. If your transactions with the audited counterparty are “clean”, give the tax authorities documents for the period for which they are asking. If you don’t want to submit all the documents, check with your counterparty which of the invoices issued to him relate to the period that is being audited office-wise, and submit them exactly. Resolution of the Federal Antimonopoly Service of the Federal Antimonopoly Service dated 08/09/2010 No. A68-13557/09. When submitting documents in part, you can supplement your cover letter with the following entry.