Payment of one-time assistance to an employee in difficult or joyful life situations that require additional expenses is the right of the employer. Such a social guarantee is formalized by an order for the provision of material assistance. Payments are not stated directly in the Labor Code of the Russian Federation, and the legislation does not contain a unified form of the document - the company develops it independently.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

How to draw up an order for financial assistance

In this article we will analyze the situation when an employee needs financial assistance. You probably already know that any decision of a manager is formalized in an administrative document: an order or directive. Payment of financial assistance is also made on the basis of an approved order. Of course, in small companies with a small turnover, you can get by with the director’s approval of the employee’s application. However, in most cases it is better to formalize the decision with an order for the payment of financial assistance.

The form of the order is not established; you can use your own form, which is used to formalize management decisions. Next, let's look at a sample order for the payment of financial assistance to an employee.

The most important

- An order to provide one-time financial assistance is issued based on the employee’s application.

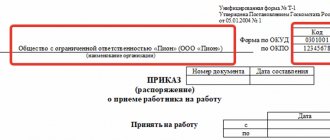

- There is no unified order form; each company develops and uses its own form. Form T-11(a) may be used. The order must contain a clear indication of the financial assistance provided, otherwise personal income tax will have to be paid on the entire amount.

- If several orders are issued for one-time financial assistance to the same employee for the same reason, only the first payment is recognized by the regulatory authorities as financial assistance exempt from personal income tax.

Order to provide financial assistance (sample)

Due to the fact that there is no approved form of the order, it is drawn up in any form. You must use the form that is used in your company as an element of personnel document flow. As with any order, in the document for the provision of financial assistance you must indicate the basis or reason. For example, in connection with marriage, in connection with a difficult financial situation, in connection with the birth of a child, etc.

Don't forget to indicate the basic parameters in your order:

- name of the employer indicating the organizational and legal form;

- place, number, date of registration of the order;

- reference to LNA or regulatory document;

- basis for providing assistance;

- position and full name of the employee assigned to support;

- amount and terms of payment;

- attachment – supporting documents.

You take the reason for indicating in the order from the employee’s statement. So that you don’t have any questions, we have prepared for you an order for the payment of financial assistance (sample), which you can download and fill out when issuing financial assistance to your employees.

Results

As you can see, an order to provide financial assistance to an employee of an organization does not have an approved form, but its publication must comply with the internal rules established by the enterprise. In addition, the document must not contradict current legislation. That is why, in the absence of practice in issuing such acts, it is advisable to use a clearly competent sample when drawing it up to avoid legal errors.

Sources:

- Tax Code of the Russian Federation

- Labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How else can you apply for financial assistance?

If your company provides for the payment of financial assistance when an employee goes on vacation, then there may not be an order to assign financial support. In your internal local act, you can provide that the basis for paying financial assistance for vacation will be an order to provide annual leave for a period of at least 14 calendar days. You can also specify the frequency of payments. That is, for example, an employee can receive payment for vacation only once a calendar year. If an employee does not take his required vacation this year, he loses his right to additional payment. In this way, you will also encourage your workaholics to rest as they should.

Your employer may decide to provide financial assistance to all employees, regardless of their financial status. This is not prohibited by law. Now it is very important to provide assistance for the purchase of drugs for the prevention and treatment of ARVI, and personal protective equipment. All companies are required to provide their employees with personal protective equipment in the workplace. However, during a raging pandemic, it is necessary to protect yourself outside of work. This can be organized by issuing material assistance in cash or in kind (masks, gloves, disinfectants).

In some cases, financial support is not provided, but the employer can provide it

As already mentioned, the law does not oblige the director of an enterprise to help employees financially. This is always his personal decision.

Cash can be assigned to an employee in different situations, but most often the reasons for support are the following.

- Difficult financial situation.

- Natural disasters or emergency circumstances. In this case, it is necessary to provide the organization with certificates from the police or other departments to confirm the amount of damage.

- Family circumstances. If an employee applies to receive funds on this basis, you must provide supporting documents to the organization (child’s birth certificate, etc.).

- Serious illness of an employee or a member of his family. Such an illness implies loss of ability to work for more than two months or disability. To receive money, you will need a VKK certificate.

- Anniversary date.

- Need for wellness. This support can be expressed in full or partial payment by the organization of the cost of treatment or a trip to a sanatorium.

- The need to improve living conditions. Such payments are intended to help the employee purchase housing or renovate it. In this situation, the employee must provide the company with papers confirming his status as needing improved living conditions and receipts for expenses incurred.

How to apply for financial assistance from the founder

The Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ requires that all receipts to the organization’s current account and cash desk, including gratuitous assistance, be documented.

The most common method of gratuitous assistance is the conclusion of a gift agreement or gratuitous financial assistance between the one who contributes money and the one who receives it.

Also, the founder can use funds to increase the authorized capital, but in this case, his share must be increased (naturally, except in the case when the company has one founder), and the assistance can no longer be considered gratuitous. In this case, registration occurs in the following way:

- An application is drawn up indicating the amount and conditions for its contribution to the authorized capital.

- Other owners express their consent and decide to make amendments to the company's charter.

- All changes (re-registration of shares) must be made within 6 months after the decision is made.

In any case, before providing assistance, the founder must agree on this at a general meeting (or make a decision individually, if there is only one founder).

Agreement on gratuitous financial assistance from the founder: sample

The agreement is drawn up in writing, in two copies - one for each party.

In order for a document to be drawn up to qualify as a contract of gift or gratuitous assistance, it must contain the following features:

- The subject of the contract must be specified as precisely as possible. The monetary amount is indicated in numbers and words.

- The fact of gratuitousness. That is, it must be indicated that assistance is provided only unilaterally; the receiving party should not have any obligations.

The agreement on gratuitous assistance of the founder, a sample of filling, can be viewed below.

Grounds for drawing up an order for the provision of financial assistance

An employee interested in receiving funds must draw up a written application addressed to the director and attach to it certificates confirming the facts that formed the basis of the request.

The reason for providing documents is related to the requirements of Art. 217, 422 Tax Code of the Russian Federation. These articles contain a list of situations when tax is not charged on such payments. What is in the interests of both the employee and the head of the company.

The amount of financial assistance is set by the employer independently. Much in this matter depends on the capabilities of the organization. It is also worth saying that such support can be provided not only to the employee, but also to former employees, and even members of their families.

Basic recommendations

When reflecting financial assistance in accounting, various entries are accepted depending on the purpose and documentary basis. If the support is enshrined in contracts and regulations and is intended for a targeted solution to a difficult life situation, then it is reflected in the credit of account 70.

In the absence of support provided in the regulatory documentation, the payment amounts are accrued in the debit of account 73 and credit of 91. If assistance is provided to former employees or relatives of a deceased employee, then it should be reflected in the debit of account 76 and credit of account 91.

Sample document

There is no legally approved sample for drawing up an order for financial assistance. The legislator gives the enterprise the right to independently develop the form of the document. The only condition is that the order meets the principles of office work. That is, the order must be issued on the company’s letterhead.

The company form requires:

- full and short name of the organization;

- addresses (legal and postal);

- contact information (phone, email);

- TIN;

- logo;

- document numbers and dates.

If the organization does not have a letterhead, the HR specialist must write down all the required details in the upper right corner.

The order must contain the number and date of preparation in accordance with the log of personnel orders. The number and date are followed by the name of the order “On providing financial assistance to an employee.”

The following describes the reason for the payment of monetary support. After the word “I order” the amount, terms of payment, personal data of the recipient, and details of the foundation document are indicated. The order is completed by a decoding of the position, the signature of the manager and the stroke itself.

Amounts of assistance for 2021

The employer can independently determine the amount of financial assistance in regulations. However, it is recommended to take into account that amounts up to 4,000 rubles paid in one billing period are not subject to personal income tax or insurance contributions.

If financial assistance is not specified in regulations, then up to 4,000 rubles it may also be tax-free. If the established threshold is exceeded, financial assistance is subject to personal income tax and insurance contributions. The legislator believes that the following are not subject to taxation:

- payments as one-time compensation for damage from natural disasters or terrorist attacks;

- due to the death of an employee’s family member;

- upon the birth of a child to an employee, with the condition that the amount of payments does not exceed 50,000 rubles.

Financial assistance for the death of family members is separately stipulated. It is not subject to taxation if these are first-degree family members according to the Family Code of the Russian Federation, that is, parents, spouses, children.

If the deceased relative was a grandmother, grandfather, brother, sister, aunt, uncle, etc., only 4,000 rubles are exempt.

Which unified form is suitable as a sample. Contents of the order

Most of the unified forms used in personnel matters are approved by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms...” dated January 05, 2004 No. 1. However, this document is not suitable for preparing an order for the provision of material support, since it does not contain the necessary form.

You can issue the corresponding order in free form, taking into account the need for it to contain the following standard details:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- Business name;

- place and date of document preparation;

- Title of the document;

- text of the order;

- a list of documents that caused the order to be drawn up;

- signature and seal of the company;

- information about familiarization with the contents of the order, if the established practice at the enterprise requires this.

The procedure for filling out a specific form is determined based on the practice available at the enterprise. Taking into account the fact that the details of most orders issued at the enterprise are standard, it is advisable to make the form itself by analogy with already accepted documents.

General concepts and design

Financial support is provided to an employee who finds himself in a difficult situation. It is necessary to focus attention on this circumstance, since in practice an organization can issue financial assistance to all employees in honor of an upcoming holiday, for example, for the New Year. In fact, such support is ambiguous. There are cases when judicial authorities classified it as a one-time holiday bonus.

Material support can be considered as an additional condition for improving the financial situation of an employee. This is how financial assistance for vacations became widespread. This type of service is not targeted, since there is no certainty where the employee will spend the funds received.

The employer may, at his own discretion, come to the rescue of the employee in any situation that does not fall under the category of emergency.

If the organization does not provide for documentation in the contract or regulation on social guarantees, then the basis is the resolution of the management on the employee’s application. This type of financial assistance is paid exclusively from profits.

Upon receipt of the employee’s application and copies of evidentiary documents, the employer checks the basis and amount of the requested amount with the regulations adopted by the enterprise. If management decides to satisfy an employee’s request, the HR department writes a corresponding order.

Based on the order, the organization’s accounting department, in turn, after checking the presence of all the necessary documents, issues money to the employee through the cash register or to a bank card.

How often can you count on financial support?

The company helps the employee financially when special circumstances arise. These are non-production payments that do not depend on the organization’s performance and individual employee results. Therefore, they are not of a compensatory or incentive nature and are not considered an element of remuneration. Their main goal is to create the necessary financial conditions to solve the difficulties encountered by the employee. Such payments cannot be regular.

The frequency of financial support depends on how often he needs financial assistance and on the financial situation of the enterprise. A company employee can apply for such payments at any time. Whether they will be provided, in what situation, and to what extent, depends only on the decision of management.

Financial assistance agreement between legal entities: sample

It is worth mentioning separately about the agreement when assistance is provided by one legal entity to another. In this case, a gift agreement cannot be made - it may be considered void.

This follows from the provisions of Article 575 of the Civil Code of the Russian Federation, which prohibits gift agreements between legal entities if the subject of the agreement (including funds) is valued at more than 3,000 rubles.

In this case, you can use the following methods:

- Conclude a free financing agreement.

- Conclude an agreement on an interest-free loan, and then not claim it and write off overdue payments (Article 415 of the Civil Code of the Russian Federation). Borrowed funds are not taxed, as are interest savings, but the forgiven loan amount, which forms non-operating income for the borrower, is subject to taxation. A tax base is not formed when funds are received from a founder who owns at least 50% of the borrower's authorized capital.

- Contribute funds to increase the authorized capital. In this case, the organization that contributed the money must increase its share in the authorized capital.

The founder has the right to provide financial assistance to his company. The law does not establish a list of purposes for which this money can be spent. In accordance with the law, funds received must be documented. If the founder who contributed the assistance is an individual, then a gift agreement can be concluded with him. In cases where assistance is provided by another organization, it cannot be formalized by donation. In some cases, the amount of money contributed free of charge by the founder is not taxed.

Documents and reasons for drawing up

Financial assistance should include:

- collective agreement;

- employment contract;

- local regulatory act of the organization on social guarantees for employees.

If the amount and purpose of financial support are not specified in labor and collective agreements, then the organization is obliged to develop an internal regulatory act - a provision on social guarantees. The document guarantees to employees the procedure for assigning benefits and its amount.

It should be noted that financial assistance is not the responsibility of the company, so the management each time makes a decision individually on a specific case.

For this purpose, the organization issues an order for financial assistance. The basis for it is a regulatory act or agreement adopted by the company.

Before issuing an order, the employee must apply to management for assistance. The employee writes a statement in free form, in which he indicates the reason for the difficult financial situation.

The employee must attach copies of documents proving the occurrence of circumstances requiring financial assistance to the application. In case of burial of family members - a death certificate, a document confirming relationship. In the case of the birth of a child - a birth certificate.

If we are talking about emergency situations, then a certificate from control authorities about the loss of property. A marriage certificate is provided when paying wedding expenses.