Taxpaying companies that employ employees, in addition to basic tax reporting, are required to provide information on the accrued salaries of hired specialists, as well as on calculated taxes, fees and contributions for each individual. Such “salary” reporting has a huge number of nuances, features and reservations regarding filling out forms. We will tell you in our article how to correctly reflect financial assistance to an employee in the 6-NDFL report.

Let us immediately note that the current form, key rules and step-by-step instructions for filling out the 6-NDFL reporting form are provided in a separate material “How to fill out the updated 6-NDFL form. Complete Guide." Let us dwell on a special situation, how to reflect material assistance in 6-personal income tax.

Types and conditions for providing financial assistance

Current legislation does not prohibit an employer from providing financial assistance to its employees (hereinafter referred to as financial assistance). In paragraphs 2.2.2.1 section 2 GOST R 52495-2005, approved. Prospect of the Federal Agency for Technical Regulation and Metrology dated December 30, 2005 No. 532-st, contains a definition of material assistance (hereinafter referred to as financial assistance) as a socio-economic service consisting of providing clients with funds, food, sanitation products, etc. .

Financial assistance is one-time in nature and is paid at the request of the employee based on the order of the manager. It can be related, for example:

- with the birth of a child;

- with the death of an employee or a member of his family;

- with treatment;

- with damage caused by a natural disaster;

- with retirement due to disability or age.

Such payments are not included in wages, as they are not of an incentive or compensatory nature. They are aimed at supporting an employee in a difficult life situation.

What you need to know about financial assistance

Financial assistance is not only money paid to an employee in order to support him in a difficult life situation or in connection with a special date (anniversary, wedding, death of a close relative). Also, financial assistance can be provided in the form of work, services or goods (food, personal hygiene products, clothing, etc.).

However, the key characteristic of MP is its one-time and one-time nature. That is, the material is not part of the specialist’s salary and does not apply to incentive or compensation payments. The main goal of the MP is to support the citizen in connection with the current circumstances.

We discussed the basic concepts, as well as the key principles of taxation of this payment, in a separate article “Is financial assistance subject to personal income tax?”

Form 6-NDFL

All persons who are recognized as tax agents (Article 226, 226.1 of the Tax Code), starting from 01/01/2016, are required to submit quarterly Form 6-NDFL to the tax authorities at the place of registration (Federal Tax Order No. ММВ-7-11/ [email protected] ).

The calculation is compiled on an accrual basis, with the 1st section being formed on an accrual basis, and the 2nd section reflects only the information that corresponds to the quarter of the period for which the information is submitted.

The calculation form consists of:

- Title page.

- Section 1 “Generalized indicators”.

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Line 080 “Tax amount not withheld”

This line reflects the amount of personal income tax that cannot be withheld from the recipient of the income. For example:

- the employee received a gift worth more than 4,000 rubles, but subsequently did not receive income in cash;

- individuals receiving prizes during a promotion or drawing;

- payment to an individual of arrears of wages by court decision.

The amount in this line is indicated as a cumulative total. It is a mistake to write in this line the amount of calculated personal income tax from the salary for June, which employees will receive in July. This amount will appear in your 6-personal income tax within 9 months.

Author of the article: Yulia Khairulina

Create 6-NDFL in the web service for small businesses Kontur.Accounting. The system itself will fill out the help lines based on the accounting data. Easily keep records, pay salaries, send reports via the Internet, get advice from our experts. The first 14 days of work are free.

Features of accounting for material assistance in personal income tax

The possibility of issuing financial assistance must be taken into account in the regulations and documents of the organization: regulations on remuneration, collective agreement and (or) in the employment contract with the employee.

In personal income tax, financial assistance is considered as an economic benefit, which forms an object of taxation (Articles 208, 209, 210 of the Tax Code of the Russian Federation). But its social status allows it to exempt from taxation either certain types of financial assistance (Article 217 of the Tax Code of the Russian Federation), or certain amounts within the limit. For example:

- with the birth of a child - exempt from tax, but not more than 50,000 rubles. per child;

- with the death of an employee or a member of his family - exempt from tax;

- with damage caused by a natural disaster - exempt from tax;

- with retirement due to disability or age - exempt from tax, but not more than 4,000 rubles;

- on other grounds - exempt from tax, but not more than 4,000 rubles.

When the amount of assistance does not exceed 4,000 rubles

Separately, it is worth noting that when material assistance is exempted from income tax, the leading role is played not by the purpose of the payment, but by its amount. The legislation stipulates that in the case of payment of financial assistance in an amount not exceeding 4,000 rubles per recipient per year, income tax is not withheld from such income.

This could be a gift to an employee for some significant event or anniversary. The cases in which such assistance is provided to employees are determined at the discretion of the employer and are fixed in the local labor regulations of the enterprise, a collective or labor agreement.

But if financial assistance exceeds the threshold established by law, then the employer is obliged to withhold personal income tax from the excess amount.

For example, accountant Ivanova M.P. submitted a written statement to the director of the enterprise, in which she stated a request to provide her with financial assistance due to the need for treatment.

How to reflect financial assistance in 6-NDFL

In cases where the amount of financial assistance is not subject to taxation, the tax agent has the right not to reflect it in the calculation of 6-NDFL. And in payments that have a limit, you need to indicate the entire amount of financial assistance and the tax deduction attributable to it.

The date of receipt of income in the form of financial assistance is the day of payment of money, or the day of transfer of income in kind (clause 1 of Article 223 of the Tax Code of the Russian Federation).

Since such payment is usually made during the inter-payment period, on the basis of a separate payment document, financial assistance in 6-NDFL (Section 2) is reflected in separate lines 100, 110 and 120.

Results

Financial assistance is issued to individuals at their request with the consent of the company’s management.

When filling out 6-NDFL, the date of receipt of income and withholding of personal income tax is the day of payment of financial assistance, and the date of transfer of tax is the next working day. The part of financial assistance exempt from personal income tax is reflected as part of tax deductions. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection of material assistance in 6-NDFL: example of filling

Let’s assume that on July 21, 2017, due to the difficult financial situation of the employee, he was accrued and paid financial assistance in the amount of 5,000 rubles, of which 4,000 rubles are not taxable. (clause 28) Art. 217 of the Tax Code of the Russian Federation, deduction code 2760 “Financial assistance provided by employers to their employees” acc. from the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] ). In the 6-NDFL report, financial assistance, 4,000 rubles must be indicated in the tax deduction amount field.

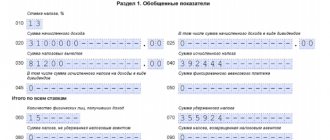

Step 1. In Form 6-NDFL (if there is no other data for the reporting period), in column 020, indicate the amount of financial assistance.

Step 2. In field 030, enter the limit value.

Step 3. In field 100, indicate the date when the financial aid was issued. In field 110 - when the tax is withheld (cannot be earlier than the previous number). In field 120 - the date of tax transfer. In the example, January 25 is Friday, so the tax is transferred on Monday, January 28.

The final form 6-NDFL will look like this.

Codes used when accounting for financial aid

Codes for income subject to personal income tax and deductions applied to them were approved by Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] The correspondence of income to one of these codes clearly indicates the need to reflect it in reporting on personal income tax . The absence of a code among the codes characterizing financial assistance paid in connection with the death of an employee (current or former) or a member of his family is additional confirmation that there is no need to include data on such payments in the Form 6-NDFL report.

For two other types of payments (taxable in full or in part), codes are provided in Order No. ММВ-7-11/ [email protected] . Among the income (Appendix No. 1 to Order No. ММВ-7-11/ [email protected] ) they correspond to the following codes:

- 2710 - for financial assistance, which has no restrictions on its non-taxable part;

- 2760 - for financial assistance paid to a current or former employee who has retired;

- 2762 - for financial assistance paid in connection with the birth, adoption of a child;

- 2790 - for financial assistance to persons who participated in the Second World War, worked during it or suffered during it.

For the last three types of assistance that have codes, deduction codes are provided (Appendix No. 2 to Order No. MMV-7-11 / [email protected] ):

- 503 - for financial assistance paid to a current or former employee who has retired;

- 508 - for financial assistance paid in connection with the birth, adoption of a child;

- 507 - for financial assistance to persons who participated in the Second World War, worked during it or suffered during it.

The presence of deduction codes makes it possible to reduce the amount of income arising from the payment of financial assistance, which is characterized by a non-taxable limit:

- for its entire amount, if the non-taxable limit is not exceeded;

- by the amount of the limit if the payment amount exceeded this limit.

In the first case, the tax accompanying the payment will be zero.

Personal income tax and types of financial assistance

The financial assistance that employers provide to their current or former employees in relation to the issue of taxation of personal income tax payments is divided into 3 types:

- the payment is not taxed regardless of its size;

- payment until it reaches a certain amount is tax-free;

- the entire payment is subject to tax.

Completely non-taxable include payments made as financial assistance in connection with the death of a current or former employee who has become a pensioner, or a family member of such employees (Clause 8 of Article 217 of the Tax Code of the Russian Federation).

A limitation in the form of a certain volume is established for financial assistance provided:

- to a current employee at the birth, adoption or adoption of each child in the first year of the relevant event - in the amount of 50 thousand rubles. for each child (clause 8 of article 217 of the Tax Code of the Russian Federation);

- for a current or former employee who has retired - the non-taxable amount of this amount is 4 thousand rubles. per year for each employee (clause 28 of article 217 of the Tax Code of the Russian Federation);

- persons who participated in the Second World War, worked during it or suffered during it are not subject to tax on an amount not exceeding 10 thousand rubles. per year for each recipient (clause 33 of article 217 of the Tax Code of the Russian Federation).

All other payments are subject to taxation from the first ruble. The above rules apply regardless of whether assistance is provided in cash or in kind.

The rate at which the tax on financial aid is calculated is 13% (Clause 1, Article 224 of the Tax Code of the Russian Federation).

Basic rules for filling out the report form

The general rules for filling out the report are standard:

- The report includes data on the amount of accrued wages, personal income tax amounts and deductions

- Marks, corrections, and the use of correction fluid are not allowed.

- The document cannot be printed using duplex printing. Each page is on its own sheet

- If the report is completed manually, then this must be done with a pen with blue or black ink.

- Information in the report is filled in for each OKTMO

- Empty cells in report fields are filled with dashes

Reflection in the report of financial assistance at the birth of a child

Let's take a closer look at what the 6NDFL report would look like if it reflected the amount of declared financial assistance. For a better understanding, we will show how to fill out the report lines only with aid amounts.

Let’s imagine that employee Smirnova received financial assistance for the birth of a child in May in the amount of 55,000 rubles. As you know, only 50,000 rubles are not subject to tax. Accordingly, personal income tax is 650 rubles.

| Section 1 | |

| Indicator/line | How to fill it out |

| Tax rate (line 010) | 13%, since Smirnova is a Russian citizen |

| Amount of income (line 020) | We indicate the total amount of accrued financial assistance: 55,000.00 rubles |

| Amount of deductions (line 030) | Here we write the non-taxable amount of financial assistance: 50,000.00 rubles |

| Amount of accrued tax (line 040) | The tax is calculated on the difference between the total accrued amount of financial assistance and its non-taxable part of 650.00 rubles |

| Number of persons who received income (line 060) | 1 |

| Amount of tax withheld (line 070) | 650.00 rubles |

| Section 2 | |

| Line | Meaning |

| Line 100 | 25.05.2018 |

| Line 110 | 25.05.2018 |

| Line 120 | 26.05.2018 |

| Line 130 | 55000,00 |

| Line 140 | 650,00 |

This is how this type of assistance is easily reflected in the report

Deadlines for submitting reports to the tax office

The deadline for submitting the report for 2021 will be reflected in the table.

| Report period | Submission deadline |

| 1st quarter 2021 | Until April 30, 2021 |

| 6 months 2021 | Until July 31, 2021 |

| 9 months of 2021 | Until October 31, 2021 |

| 12 months 2021 | Until April 1, 2021 |

As a general rule, if the last day of delivery falls on a non-working day, then it is transferred to the next working day. If possible, do not delay submitting the report.

Date of payment of assistance, withholding and transfer of tax

All indicators are given for convenience in the table:

| date | Cash payments | Payments in kind | Which line of the report shows |

| Date of receipt of income | Day of payment of funds to the employee | Day of distribution of assistance in kind (products, goods, services) | Page 100 |

| Tax withholding date | Personal income tax should be withheld on the day of payment | Personal income tax is withheld from funds paid for other payments, so the date of its withholding will be the day the income is issued to the employee in cash equivalent | Page 110 |

| Tax payment deadline | No later than the next day after the aid is issued to the employee | No later than the next day after the aid is issued to the employee | Page 120 |

Report 6NDFL: what is it and why?

The report form is established by law and approved by Order of the Federal Tax Service of Russia No. ММВ-7-11/450 dated October 14, 2015.

This report is submitted by all companies and entrepreneurs that have hired employees.

The report shows the amounts of accrued wages and personal income tax, as well as the timing within which these payments are made. The report is impersonal and is filled in with total amounts for the quarter.

The first section of the report is compiled on an accrual basis; the second section shows the amounts of accrued wages and transferred taxes for a specific, individual quarter.

Regarding the submission of the zero form, the following can be said. Back in 2016, the Federal Tax Service issued 2 letters on this matter:

- Letter of the Federal Tax Service No. BS-4-11/7928 dated May 4, 2016

- Letter of the Federal Tax Service No. BS-4-11/4901 dated March 23, 2016

According to these documents, there is no need to submit a zero 6NDFL report (which, by the way, is very logical).

If the tax office has questions, you can write a letter indicating that no remuneration was accrued or paid to employees during the reporting period.

The report can be filled out either manually or electronically. It is best and most convenient to fill out in a special program. This will help avoid unnecessary errors; in this case, the report form is always up to date. In addition, transmitting a report via telecommunication channels is much more convenient than visiting an inspection in person or sending it by mail. Transmission via the Internet takes very little time, it is possible to check the correctness of the entered information, the report form is always up to date, and notification of the submission of the report arrives quickly.

Reflection of financial assistance in the event of a natural disaster or emergency in the report

Let’s imagine that citizen Petrov received financial assistance in July in the event of a natural disaster in the amount of 80,000 rubles.

| Section 1 | |

| Indicator/line | How to fill it out |

| Tax rate (line 010) | 13%, since Petrov is a Russian citizen |

| Amount of income (line 020) | We indicate the total amount of accrued financial assistance: 80,000.00 rubles |

| Amount of deductions (line 030) | Here we write the non-taxable amount of financial assistance: 80,000.00 rubles |

| Amount of accrued tax (line 040) | – |

| Number of persons who received income (line 060) | 1 |

| Amount of tax withheld (line 070) | – |

| Section 2 | |

| Line | Meaning |

| Line 100 | 15.07.2018 |

| Line 110 | 15.07.2018 |

| Line 120 | 16.07.2018 |

| Line 130 | 80000,00 |

| Line 140 | – |

As you can see, if an employee receives assistance on this basis, then it is completely non-taxable.

Tax withholding date for financial assistance

The next column of the form is 110. In it you inform the Federal Tax Service about when the personal income tax was withdrawn from the specified financial assistance. If it was presented in the form of money, then the percentage must be withheld before payment, on the day the amount is issued to the employee.

If the support was expressed in the form of property and other things, then the tax is withheld on the nearest date of cash payment, for example, when paying an advance or salary for the second half of the month.

Another date from the report is the transfer of taxes to the state treasury. It's either the day of the hold or the next day.

Financial assistance is not subject to taxation

The Tax Code provides for cases when the employer does not withhold tax and does not reflect the following payments in Form 6-NDFL:

- one-time assistance to family members of a deceased employee;

- payments to persons affected by a natural disaster or emergency, as well as family members of the deceased;

- payments to victims of terrorist attacks on the territory of the country, as well as family members of the victims;

- one-time assistance upon retirement due to the death of a relative.