Russian entrepreneurs began installing new cash registers in 2021, but only in 2021 did some businessmen have the opportunity to return part of the funds spent on automating the operation of a retail outlet. At the end of November 2021, Law No. 349-FZ came into force, regulating the receipt of cash register deductions for private individuals on UTII and PSN and providing for corresponding amendments to 54-FZ.

Entrepreneurs can return 18,000 ₽ (for each unit of equipment) for installing a cash register. To return this amount, a number of mandatory conditions must be met. Below we will look in detail at how to get a UTII deduction for an online cash register and look at the exact cases in which it is due.

Cash desks for individual entrepreneurs on UTII. We will install and register in 1 day.

Leave a request and receive a consultation within 5 minutes.

Tax deduction for the purchase of cash registers: mandatory requirements

The benefit does not apply to all cash registers: there are conditions that must be observed.

- Firstly, a tax deduction is provided only for cash registers included in the official register of the Federal Tax Service.

- Secondly, the cash register must be registered, otherwise the money spent on it will not be returned.

If you combined UTII and PSN, then you could receive a tax deduction for an online cash register using only one mode.

UTII deduction when purchasing an online cash register

When purchasing an online cash register for UTII, a tax deduction cannot be obtained for the period that preceded the registration of the cash register. The tax amount is reduced when calculated for tax periods of previous years, but not earlier than the period in which the device was registered. If the UTII amount is less than the deduction for the online cash register, then you can transfer the balance to the following periods until the end of 2021.

Tax deduction on cash registers for PSN

For individual entrepreneurs on PSN, the tax amount is reduced for periods that began in 2021 and ended after registration of the cash register. If costs exceed the limit, the balance is taken into account when calculating taxes for subsequent periods. And if the tax amount is less than the costs, you can reduce the patent from other types of activities if a cash register is used for them.

Modern cash register: basic concepts and definitions

Cash register with online transfer of data to the tax office - this concept appeared in the latest edition of the law on cash register equipment dated May 22, 2003 No. 54-FZ.

The short name for the new generation of cash register technology, which has become widespread, is online cash register. The modern version of the cash register differs from its predecessors in several ways:

- All companies and individual entrepreneurs (with rare exceptions) are required to apply it from 07/01/2017, and from 07/01/2018 - UTII payers and entrepreneurs on PSN who work with cash.

Who has the right not to use the online cash register, read here.

Find out who has the right to use the updated car from 07/01/2019 here.

- Instead of ECLZ, the cash register should be equipped with a special memory module - a fiscal drive, which has advanced functions (information encryption, its protection, etc.).

- The cash desk must be equipped with equipment that allows real-time transmission of fiscal information to tax authorities through a fiscal data operator (FDO).

See also “How to choose an online cash register or a fiscal drive for it?”.

With the introduction of online cash registers, taxpayers are forced to bear additional costs:

- for the purchase of modern cash registers or re-equipment of existing models;

- payment for OFD and Internet services;

- connecting the cash register and setting it up.

In order to partially compensate for the costs associated with the purchase of an online cash register for certain categories of taxpayers, the Government of the Russian Federation has prepared a special offer for them - we will talk about this in the next section.

Tax deduction for cash registers: frequently asked questions

Is a tax deduction possible for an online cash register for individual entrepreneurs using the simplified tax system?

Only in the case when the individual entrepreneur combines the simplified tax system and UTII / PSN. Then you can offset the costs of those cash desks that are used for imputation or patent. Companies and entrepreneurs using a simplified system are not provided with a cash deduction.

How to get a full tax deduction for online cash registers?

The full amount of the deduction established by law is 18,000 rubles for each cash register. It will not be possible to return money beyond this amount, even if the CCP was more expensive.

Responsibility for non-compliance with the law regarding the use of online cash registers

For non-compliance with the law and the lack of an online cash register, significant fines are provided for both legal entities and individual entrepreneurs:

| Person who has violated the law | Amount of administrative fine (RUB) |

| Lack or non-use of online cash register | |

| Executive | 25-50% of the amount received without using an online cash register (minimum 10,000 rubles) |

| Legal entity or individual entrepreneur | 75-100% of the amount received without using an online cash register (minimum 30,000 rubles) |

| Repeated failure to use the online cash register (the proceeds exceed 1,000,000 rubles) | |

| Executive | Suspension from position for up to 1 year |

| Legal entity or individual entrepreneur | Suspension of company activities for up to 90 days |

| Using an online cash register that does not meet the requirements for online cash registers | |

| Executive |

|

| Legal entity or individual entrepreneur |

|

| Violation of the rules for working with the online cash register (registration deadlines, registration conditions, etc.) | |

| Executive |

|

| Legal entity or individual entrepreneur |

|

When should you not use UTII?

In accordance with clauses 2.1, 2.2 of Article 346.26 of the Tax Code of the Russian Federation, UTII has no right to be used by organizations and individual entrepreneurs in the following cases:

- carrying out activities within the framework of a simple partnership agreement (joint activity agreement) or a property trust management agreement;

- carrying out activities by taxpayers classified as the largest (Article 83 of the Tax Code of the Russian Federation);

- the average number of employees for the previous calendar year exceeds 100 people;

- the share of participation of other organizations is more than 25 percent (exception: organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, organizations of consumer cooperation, business societies, the only founders of which are consumer societies and their unions);

- educational, health and social security institutions in terms of business activities for the provision of public catering services, if the provision of public catering services is an integral part of the functioning of these institutions and these services are provided directly by these institutions;

- carrying out types of business activities in terms of providing services for the transfer of temporary possession and (or) for use of gas stations and gas filling stations.

How to calculate the amount of UTII payable?

When calculating UTII, the physical indicator specified in clause 3 of Article 346.29 of the Tax Code of the Russian Federation is used. In addition, the following coefficients are used:

- K1 – deflator coefficient

- K2 – correction factor

K1 for the next calendar year is established by the Ministry of Economic Development of the Russian Federation.

K2 is determined by municipalities for an indefinite period.

If local authorities do not apply a reduced tax rate, then the amount of UTII must be calculated at a rate of 15% .

So, to calculate UTII, first of all, we determine the tax base for the reporting quarter:

NB = PM * (FP1 + FP2 + FP3) * K1 * K2

NB – tax base for UTII for the quarter

PM – basic profitability per month

FP1, FP2, FP3 – physical indicator for 1, 2 and 3 months, respectively

Having determined the tax base for UTII for the quarter, you can calculate the amount of UTII using the formula:

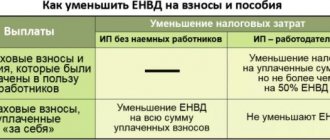

UTII = NB * 15% – SV

NB – tax base for UTII for the quarter

SV – insurance premiums

Why was the benefit introduced?

An online cash register is a technology for business and entrepreneurship, designed for issuing checks to buyers or consumers of enterprise services. Its peculiarity is that it works via Internet connection. This allows you to instantly send transaction data directly to the Federal Tax Service. Every business representative must work with such equipment according to current legislation. This is stated in 54-FZ adopted by our government.

The modern market is filled with similar products that have different form factors, sizes and purposes. For example, manufacturers offer stationary online and mobile cash registers. Stationary cash registers come in compact sizes and limited functionality. They are intended mostly for small businesses. For large companies, terminal systems are presented that are large in size and capable of round-the-clock operation. Mobile online cash registers are used primarily by entrepreneurs who sell goods or provide services not only in the office, but also in any convenient place where Internet access is available.

Purchasing such a device incurs certain costs. An individual entrepreneur must not only purchase equipment, which must be registered with the tax authorities, perform the necessary software settings, and so on. If the organization’s staff does not have the necessary technical knowledge, it is necessary to attract a specialist who will take money for his services. The state can compensate for such costs with such an opportunity for an entrepreneur as a tax deduction.

On the one hand, this opportunity creates a more trusting atmosphere in the relationship between private business and the state, because the government allows compensation for the costs of purchasing equipment. On the other hand, such a benefit can stimulate the development of an enterprise in terms of technical support. Staff who work with cash registers connected to the Internet develop awareness of modern technologies for companies.

When can UTII be used?

According to paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation, the following organizations have the right to apply a single tax on imputed income:

| Kind of activity | Explanation |

| Provision of services | · domestic services; · veterinary services; · repair, maintenance and washing services for motor vehicles; · provision of temporary possession of parking spaces for motor vehicles, storage of motor vehicles in paid parking lots; · cargo transportation*; · passenger transportation*; · temporary accommodation and accommodation (the total area of premises for temporary accommodation and accommodation is no more than 500 square meters); · transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have a customer service area; · transfer for temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities |

| Retail | · through shops and pavilions with a sales floor area of no more than 150 square meters for each trade facility; · through the objects of a stationary trading network that does not have trading floors, as well as objects of a non-stationary trading network. |

| Catering services | · carried out through public catering facilities with an area of the customer service area of no more than 150 square meters for each public catering facility; · through public catering facilities that do not have a customer service area |

| Advertising activity | · using advertising structures; using external and internal surfaces of vehicles |

* provided that the fleet size is no more than 20 vehicles intended for the provision of services.