Institutions and organizations provide financial assistance to employees, former employees, as well as members of their families on various grounds. At the same time, it is important to document such payments, as well as their taxation. We will talk about the features of these payments in the article.

According to Art. 144 of the Labor Code of the Russian Federation, wage systems (including tariff wage systems) for employees of state and municipal institutions are established:

- in federal government institutions - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation;

- in state institutions of the constituent entities of the Russian Federation - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of the constituent entities of the Russian Federation;

- in municipal institutions - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of constituent entities of the Russian Federation and regulatory legal acts of local governments.

The Government of the Russian Federation can establish basic salaries (basic official salaries), basic wage rates for professional qualification groups. At the same time, remuneration systems are established taking into account, in particular, the approximate provisions on the remuneration of employees of institutions by type of economic activity, approved by federal government bodies and institutions - the main managers of federal budget funds (clause “e” of clause 2 of Government Decree of the Russian Federation N 583 ).

From the above rules it follows that if there is financial opportunity, the institution has the right to prescribe in a local regulatory act the payment of financial assistance for one reason or another and issue it to employees. However, remember that material assistance is a social service provided to employees to support them and improve their standard of living (GOST R 52495-2005 “Social services to the population. Terms and definitions”, approved by Order of Rostekhregulirovaniya dated December 30, 2005 N 532-st). In this case, material assistance can be provided in the form of cash, food, sanitation and hygiene products, child care products, clothing, shoes and other essential items, fuel, as well as special vehicles, technical means for the rehabilitation of disabled people and people in need in outside care. As practice shows, most often material assistance is provided in the form of cash.

Who can count on receiving financial support

This type of support provided by organizations has a special focus - to financially support an employee who is in a difficult financial situation.

Since the main purpose of assistance is to provide the necessary material conditions to solve the employee’s financial problems, such a payment does not depend in any way on the employee’s own achievements; any employee who finds himself in a difficult situation can receive it.

Financial assistance is social and exclusively individual in nature, therefore it is accrued only upon the application of the employee, to which he attaches documents confirming the occurrence of circumstances that led to the need for this payment.

Please note that material support is not taken into account when calculating an employee’s average earnings, which is important when providing him with vacation or maternity benefits.

Application of regional coefficients

In accordance with Art. 315-317 of the Labor Code of the Russian Federation for persons working in the regions of the Far North and equivalent areas, the use of regional coefficients and percentage increases in wages, the amount of which is established by the Government of the Russian Federation, is provided. Let us note that similar norms exist in Art. 10 and 11 of the Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas.” However, the acts provided for by the above norms have not been issued, and therefore previously published legal acts of federal government bodies of the Russian Federation or government bodies of the former USSR that do not contradict the Labor Code of the Russian Federation (Part 1 of Article 423 of the Labor Code of the Russian Federation) are applied. Accordingly, one should be guided by the Explanation approved by Resolution of the Ministry of Labor of the Russian Federation No. 49.

According to clause 1 of the Explanation, percentage bonuses for persons working in the regions of the Far North, equivalent areas, in the southern regions of Eastern Siberia, the Far East, and coefficients (regional, for work in high mountain areas, for work in desert and waterless areas) established to the wages of persons working in areas with unfavorable natural and climatic conditions are accrued on actual earnings, including remuneration for long service, paid monthly, quarterly or in a lump sum.

In addition, according to paragraph 19 of the Instruction on the procedure for providing social guarantees and compensation to persons working in the regions of the Far North and in areas equated to the regions of the Far North, in accordance with current regulations, approved by Order of the Ministry of Labor of the RSFSR dated November 22, 1990 N 2, The salary for which bonuses are calculated does not include payments based on wage coefficients, average earnings, one-time remuneration for length of service, remuneration based on the results of work for the year, financial assistance, as well as payments that are of a one-time incentive nature and are not conditional. wage system.

Since material assistance cannot be recognized as actual earnings, it is not possible to assign a regional coefficient to it.

List of grounds for making payments to an employee

Grounds for providing financial assistance to employees

The current labor and civil legislation does not regulate the procedure and reasons for which financial assistance is accrued by the employer, therefore the circumstances upon the occurrence of which this type of financial support is paid are determined only by the organization itself in local regulations developed by the employer.

Thus, the grounds for receiving financial assistance may be listed in the relevant Regulations or collective agreement. Also, some organizations stipulate such grounds directly in the employment contract or in the Regulations on bonuses.

At the same time, this is not an entirely correct approach, since the type of payment in question does not depend on the employee’s labor achievements and is a social support measure.

Application for financial assistance and its sample, memo (memorandum)

In order for the employer to learn that an event has occurred in the employee’s life that may serve as a basis for payment of financial assistance, the employee needs to notify him about it. Notification is made on the basis of an application.

The application form is not fixed by law, but can be provided in a local act or collective agreement. The legislation also does not contain any requirements for the application.

A sample of such a document might look like this:

To the Director of Iris LLC

Petrov T.N.

From senior manager

Karpova T. G.

Statement

I ask you to provide me with financial assistance in the amount of 5,000 rubles. due to the need to purchase medications to treat detected kidney disease.

Attachment: a copy of the conclusion of the medical commission of the BUZ "Moscow City Clinic" dated 07/12/2020 No. 127-ZK, a copy of the prescription dated 07/12/2020 No. 129571, issued by doctor R.V. Anisimova.

07/12/2020 Karpov T. G. /Karpov/

The application is submitted in 2 copies. One copy is marked with the date of delivery and the signature of the person to whom the application was transferred, and the second copy is transferred to the employer.

The second way to notify the employer of the occurrence of a certain event related to the need to pay financial assistance is a memo, drawn up, for example, by the employee’s immediate supervisor.

A sample memo might look like this:

To the Director of Iris LLC

Petrov T.N.

From the head of the sales department

Ignatieva T.V.

Service memo

I would like to bring to your attention that on July 12, 2020, senior manager Karpov T.G. gave birth to a child - a daughter, Karpova V.T. I ask you to consider the possibility of providing Karpov T.G. with financial assistance in the amount of 5,000 rubles.

Ignatiev T.V. /Ignatiev/ 07/12/2020

Amount and types of assistance provided

Amount and types of financial assistance to employees

This type of financial support, such as material assistance, can be divided into the following types:

- one-time (one-time) and periodic (depending, respectively, on the accrual periods);

- monetary (rubles) or material (goods, food, etc.);

- targeted (related to certain circumstances that arose for the employee) and non-targeted (does not require a specific purpose supported by documents, and is therefore limited to a limited amount).

The amount of financial assistance can only be established directly by the head of the organization and determined based on the specific case and financial capabilities of the organization.

Material financial support can be paid from funds that are profits received when the company carries out its activities. The decision on the need to accrue cash benefits in an organization is made directly by management.

At the same time, it is necessary to pay attention that this type of social support cannot necessarily be provided in monetary form. According to the local regulations of the organization that regulate this issue, financial assistance can be provided with necessary items or goods. Also, at the discretion of management, financial assistance can be provided by providing any services free of charge or paying bills for these services.

Tax principles

The amount of financial assistance is not limited; it can be determined for the entire organization by issuing Regulations, or each case can be considered separately. Often, when paying, they are guided by the maximum amount of assistance that is not subject to taxes.

Income tax

No financial assistance can be taken into account as part of expenses that reduce the income tax base.

The only exception is payment for vacation if it is stipulated by a collective or employment agreement, is set as a percentage of wages and depends on the quality of the employee’s performance of his duties. Such material assistance is a labor expense and reduces the tax base (for more details, see Letter of the Ministry of Finance of Russia No. 03-03-06/1/43912 dated September 2, 2014).

Insurance premiums

Federal Law No. 212-FZ dated July 24, 2009 establishes a list of types of financial assistance for which insurance premiums are not calculated:

- payments to victims of emergencies and terrorist attacks to compensate them for material losses or for treatment;

- assistance related to the death of family members;

- at the birth, adoption of a child, taking him into guardianship, if the payment is less than 50,000 rubles;

- other types of financial assistance, paid once and not exceeding 4,000 rubles.

All other types of financial assistance, according to the Pension Fund and the Social Insurance Fund, are subject to insurance contributions .

Both parents can use the limit of 50,000 rubles when applying for assistance for the birth of a child, but the limit remains the same for each. At the birth or adoption of several children, the limit is maintained for each of them, i.e., at the birth of two children, insurance premiums will not be subject to 100,000 rubles. for each of the parents. Basis - Letter of the Ministry of Labor of Russia dated November 20, 2013 No. 17-3/1926.

Personal income tax

According to the Tax Code, personal income tax is levied on all income, both in cash and in kind.

The list of income that is not subject to personal income tax includes:

- Amounts paid on the death of an employee or an employee who retires.

- Financial assistance to an employee (working or retired) due to the death of a member of his family. Family members include the employee's spouse, children and parents. According to Letter of the Ministry of Finance of Russia dated November 14, 2012 No. 03-04-06/4-318, payments in connection with the death of an employee’s sister or brother will not be subject to personal income tax if they lived together with the employee and ran a joint household.

- Assistance related to terrorist attacks within the Russian Federation or emergency situations. An important exception: financial assistance issued in connection with a terrorist attack or emergency does not have to be one-time to be exempt from personal income tax.

- Amounts of financial assistance paid at the birth of a child or his adoption or taking into guardianship, if they do not exceed 50,000 rubles. In this case, personal income tax is not charged on either one or several payments that do not exceed the established limit in total. In contrast to insurance contributions, 50,000 rubles are given for each child, but so that the amount of payments to both parents does not exceed the limit (Letter of the Federal Tax Service of the Russian Federation dated November 28, 2013 No. BS-4-11/21330). In this regard, it is necessary to obtain documentary evidence of whether payments were made to the second parent. Usually this is form 2-NDFL or a work book, a certificate from the employment center if the second parent is unemployed.

- Other types of financial assistance, if their amount for the reporting period does not exceed 4,000 rubles.

An example of calculating personal income tax when paying financial assistance: in connection with the birth of a child to an employee of an enterprise with a salary of 70,000 rubles.

in January 2021, financial assistance was provided in the amount of 30,000 rubles. A certificate was provided that the employee’s wife had already received assistance in the amount of 25,000 rubles. In the same month, the employee received a gift for the birth of a child in the amount of 10,000 rubles. The total amount of his income for January was 110,000 rubles. (70 + 30 + 10).

In this case, 25,000 of financial assistance (50 – 25) and 4,000 of the cost of the gift are not subject to personal income tax. The taxable amount will be 81,000 rubles. (70 + (30 – 25) + (10 – 4)). Total personal income tax for January will be 10,348 rubles. ((81000 – 1400) * 13%, where 1400 is the standard deduction for the first child).

Documents that must be provided to the employee

As noted above, the procedure for paying such monetary benefits as financial assistance is fixed in the internal regulatory documents of the organization.

To receive financial support, an employee must submit an application addressed to the head of the enterprise, which must reflect the reasons for receiving this type of payment, as well as attach the relevant documents.

Let's take a closer look at what documents you will need to present to your manager in each of the above situations.

The need for expensive treatment:

- a doctor's note;

- agreement for the provision of paid services with the clinic;

- documents confirming payment for medications;

- prescriptions certified by the signature and seal of the attending physician;

- documents about the need for expensive treatment.

Significant monetary damage:

- Documents that confirm the fact of the situation and were issued by an authorized organization.

- A copy of the certificate of material damage, certified by the relevant authority.

Wedding, birth of a child:

- marriage certificate (copy);

- birth certificate (copy).

Death of close relatives:

- Death certificate (copy).

- A document that can be used to confirm relationship with the deceased.

Other difficult life situations:

- single mother's certificate;

- document confirming the presence of disability;

- documents confirming another difficult situation of the employee.

Is it possible to receive financial assistance without documents?

Receiving financial assistance without documents is possible only if the decision is made by the employer on his own initiative. If the initiator of the request for the transfer of financial assistance amounts is an employee, the application is a mandatory document. In the event that an employee’s immediate superior requests payment of financial assistance, an official memo is a mandatory document.

The decision to issue financial assistance can be made by the employer without documents proving the occurrence of a particular event in the employee’s life. Their presence, as a general rule, is not necessary (unless otherwise stated in a local act or collective agreement). At the same time, the employer may refuse payment due to the lack of proof of the occurrence in the employee’s life of an event that is cited as the basis for payment of financial assistance.

Procedure for consideration of the application

Employee application for financial assistance

In the process of considering an employee’s personal application with a request to pay financial assistance, the head of the organization endorses a document indicating further actions - to satisfy this application or to refuse social benefits.

After approval of the employee’s application, an order is prepared to transfer cash or other payment to the employee. The manager's order must indicate, among other things, the basis, amount and timing of payment of the support provided, and the source of this payment.

The order, due to the absence of a legal requirement for the execution of this document, is issued in a free form developed and applied by a specific organization, and is also registered in the internal document flow journal.

How is financial assistance paid? Consolidation of the payment procedure in local acts of the organization

Part 2 art. 5 of the Labor Code of the Russian Federation stipulates that labor relations can be regulated in various ways, in particular, through the adoption of collective agreements, agreements or local acts. Regarding the procedure for paying financial assistance, the following options are possible:

- a collective agreement is adopted regulating the procedure for paying financial assistance;

- a local act is approved, which sets out the procedure and grounds for payments;

- this issue is generally ignored (which also does not contradict the law).

The procedure for adopting local acts is enshrined in Art. 8 Labor Code of the Russian Federation. The right to their acceptance by the employer is established by Part 1 of Art. 22 Labor Code of the Russian Federation. They may also establish the rights and obligations of the employer and workers, as follows from the provisions of Art. 20 Labor Code of the Russian Federation.

It is possible that such rights and obligations may also be established regarding the need for payment by the employer and the possibility of employees receiving amounts of financial assistance. At the same time, compliance with the local act adopted at the enterprise is mandatory for both parties to the labor relationship.

A local act is an administrative document drawn up by the employer, therefore, when adopting it, the company’s management, as a rule, focuses on its rights, but not its obligations. This is understandable, since it is unprofitable to force yourself into a framework by prescribing obligations to pay amounts of financial assistance to employers. It is much more profitable from the manager’s point of view to leave this issue vague, without fixing specific obligations, but nevertheless leaving the possibility of payments at his own discretion.

In this regard, workers who want to consolidate the procedure for paying financial assistance will achieve more effective results if they initiate a negotiation procedure with the aim of adopting a collective agreement.

Features of the design of the Regulations on financial assistance

The possibility of making financial assistance payments to employees from the employer is provided, as mentioned above, by the local regulations of a particular organization.

The current legislation does not regulate the procedure for approving this document, therefore the Regulations on financial assistance (hereinafter referred to as the Regulations) are drawn up in free form in compliance with the requirements of Art. 8 of the Labor Code of the Russian Federation. At the same time, if there is a trade union body in the organization, coordination with it for the approval of the Regulations is mandatory.

Results

In conclusion, let's summarize some results:

- There is no legislative concept of financial assistance for the treatment of an employee;

- Based on the norms of tax law and the positions of domestic judicial authorities, such payment should not be made within the framework of labor relations (but follow from the collective agreement);

- regardless of whether there is proof of medical expenses, assistance in the amount of up to 4,000 rubles per year is not taxed and insurance premiums are not charged;

- the payment initiative can come both from the employee (this requires his application) and from the employer himself (in this case, one order is sufficient);

- the form of application and order is free, but they must contain a justification for the reason for payment and a description of the needs for treatment, in addition, they must be carried out in accordance with the internal rules of office work and have the necessary details;

- Payment can be made not only for medical treatment, but also for medications necessary for the employee in accordance with doctor’s prescriptions.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sources of payments

The source of financial support can be not only the enterprise where the employee is employed, but also the state. State assistance will include financial assistance to large families .

In addition, such support will be considered regional, since the amount of payment will depend on the region of residence of a large family. So, for example, a resident of Moscow upon the birth of a third child under 30 years of age is paid 10 subsistence minimums immediately .

To receive targeted financial assistance, it is necessary to conclude an agreement, and he will be provided with support in training or starting his own business. Help can also be provided in running a private farm.

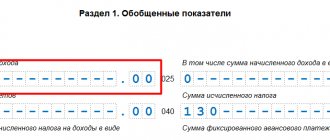

Reflection in 2-NDFL

Any payments to an employee of an organization must be reflected in 2-NDFL. Accordingly, the financial support provided will also be reflected in this certificate. At the same time, it will be reflected in 2 subgroups: limited, but not taxable, and one that is not limited .

Financial assistance up to 4,000 rubles will be shown under income code 2760 and at the same time under deduction code 503. As for assistance for the birth of a child, which is not taxed in amounts up to 50,000 rubles, it will be reflected in the certificate under income code 2762 and deduction code 504. You also need to remember that financial assistance that is not subject to taxation is not subject to reflection in personal income tax.

Taxation of financial aid in the amount of 4000 rubles

Whatever the tax system to which the organization belongs, the tax base is always calculated taking into account the assistance provided . However, the tax legislation in force in 2021 provides for the use of a deduction established at 4,000 rubles (enshrined in clause 28 of Article 217 of the Tax Code of the Russian Federation).

As a result of applying this benefit, the employee will be paid more wages by the amount of tax of 13% of these same 4,000 rubles, respectively, and this amount will not be transferred to the budget. Each employee can use this benefit only once a year . If financial assistance exceeds this amount, tax will be withheld from the difference .