Why establish rules for accounting for income and expenses?

The rules in force in both accounting (BU) and tax (TA) accounting provide for the division of income and, accordingly, associated expenses:

- for those related to the main (ordinary) activities of the organization, which serve as the main source of revenue from sales;

- other (non-operating).

This division, despite the enumeration in legislative acts of certain types of activities classified as one or another group, is quite conditional. For example, renting out property can be both the main and other types of activity. Therefore, each specific organization should establish in its accounting policies which types of its activities it considers to be the main ones and which other (non-operating) ones. Expenses related to the relevant types of activities will also be distributed in relation to income.

Concept of a report comparing VAT and Income Tax indicators

- During the analysis, we compare data from regulated reports. Moreover, the report includes the latest adjustment declarations

- Program credentials are used to calculate allowed differences

- Indicators are calculated in full rubles

- “Allowed differences” are divided into two groups:

- Carryover differences (differences in the moment of income recognition)

- Constant differences

is zero.

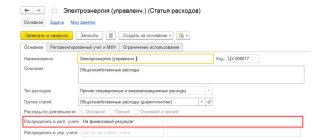

Expense breakdowns required for accounting policies

Cost analytics are also developed by the organization independently. It should be carried out not only in relation to each of the departments, but also by type, item and element of expenditure. By type, expenses in accounting will be divided:

- to direct ones, collected on accounts 20, 23, 29 depending on the importance of production (main, auxiliary, servicing);

- invoices, divided into general production (account 25), general economic (account 26), commercial (account 44);

- others (account 91).

Read more about the features of accounting for overhead costs in the article “Procedure for accounting for overhead costs in accounting.”

For each type of expense, you should develop your own directory of items, detailing it to the extent necessary to quickly obtain from the accounting data the information necessary for drawing up all the necessary reports. For direct costs, the directory will be quite simple, consisting of several articles, and it can be made uniform for all accounts on which these costs are formed. But the lists of items for accounts 25, 26, 44 and 91 are quite voluminous, multi-stage, and are developed separately for each account. All created directories must be included as an appendix in the accounting policy.

The last step in detailing the directories of cost items should be the correlation of the elements of cost items with their relationship to the issue of acceptance for the purpose of accounting for income tax. This will make it possible not only to highlight and classify the types of expenses involved in calculating the income tax base, but also to reflect those elements for which differences will arise between accounting accounting and NU.

A directory of cost items containing data on the correlation of cost elements allocated in the accounting system with the types of expenses involved in calculating the income tax base can serve as a decoding that will reflect the expenses accepted in the accounting system as direct or indirect.

For information on what should be reflected in the accounting policies for accounting purposes, read the material “PBU 1/2008 “Accounting Policies of the Organization” (nuances).”

Blog of a practicing accountant and legal analyst

Continuation. Read the beginning: Tax accounting. “Ingredients”, Tax accounting. "Recipe".

There will be as many registers of this type as there are types of income in the current period, in particular, these could be:

Register of income accounting for the current period by type of income “revenue from the sale of goods (works, services) of own production.” To generate it, select the report of the same name (Tax accounting - Registers for generating reporting data - Register of income accounting for the current period) and through the “Settings” (button) on the “Types of income” tab, select the necessary one. What was obtained (in my opinion) requires improvement, because... does not provide comprehensive information about the procedure for forming the tax base.

There are no questions about the form itself (everything said below can be attributed not only to the register included in the title of the article, but also to all tax registers generated in 1C as reports): it is quite ascetic, nothing superfluous, only those details that are mentioned in the register of the same name in the recommendations of the Ministry of Taxes of Russia dated December 19, 2001 (by the way, there is nothing newer). But “filling in” the details causes a perplexed exclamation to the developers: why? Why, with such an abundance of information in the bowels of 1C, is data displayed in the register in such a minimal amount that without referring to the primary document, it is not clear what business transaction is being discussed even to the accountant himself who entered this information into the program? Let me explain with an example of the Integrated Automation :

Details “Name of accounting object”. In my understanding, the “accounting object” in this case is a business transaction, and there should be something like “goods shipped/work performed/services provided to the counterparty Romashka LLC” according to the consignment note/Act No. X dated 00.00.00 " In the register generated by the program, the information in this detail does not contain any mention of the counterparty and the primary document. This method of forming a register can not only confuse the inspector, but also complicate the work of the accountant himself when checking data during the preparation of reports.

A “good” (informative) register, in my opinion, should look like this (header and signature omitted):

| Date of operation | Type of income | Name of the accounting object | Amount, rub.kop. |

| 02.04.2012 | Revenue from sales of goods (works, services) of own production | Air conditioner repair. LLC “Romashka”, act b/n dated 04/02/12 | 10 000,00 |

| 15.05.2012 | Revenue from sales of goods (works, services) of own production | Air conditioner maintenance. LLC “Vasilek”, act b/n dated 05.15.12 | 5 000,00 |

TOTAL by register: 15,000.00

Register of income accounting for the current period by type of income “revenue from the sale of purchased goods” . We form and supplement similarly to the previous one.

Read the continuation:

Tax accounting. "Stages of preparation." Register of income accounting for the current period (part 2)

What transcripts are needed for the tax authorities?

All of the above lists are needed, first of all, by the organization itself to streamline the accounting process. But they will also serve as the material that will justify the decisions taken by the accounting department and NU on accounting issues.

In particular, for NU purposes it is necessary to determine a list of expenses classified as direct. If an organization wants to avoid the formation of difficult-to-control differences between accounting and accounting records, then in addition to direct production costs, it will also include general production costs (i.e., those that are necessarily included in the cost price for accounting purposes). In this case, all other expenses collected in accounting on accounts 26 and 44 will become indirect for the purposes of accounting.

The moment at which these expenses are written off depends on what type of expenses you classify as certain expenses. Indirect ones can reduce the tax base for profit in the period to which they relate, and direct ones can be written off only in the period when the goods in the cost of which these expenses are taken into account are sold.

If you have access to ConsultantPlus, check whether you have correctly defined the type of expenses in tax accounting. If you don't have access, get a free trial of online legal access.

The tax inspectorate, when checking the validity of the formation of data on expenses in the profit declaration, may request a breakdown of the division of expenses in tax accounting into direct and indirect. For the option when general production expenses are also included as direct expenses, the breakdown of direct expenses will be the lists of items related to accounts 20, 23, 29 and 25. And the breakdown of indirect costs will be the lists of items for accounts 26 and 44.

We bring to your attention a version of such a decoding, compiled for indirect costs allocated for NU purposes, based on the directory of cost items for account 26.

Non-operating expenses

Non-operating expenses in the total amount are shown on line 200 of Appendix No. 2 to sheet 02 of the declaration. At the same time, on lines 201 - 206, it is necessary to separately disclose some types of costs. In particular, line 201 reflects the amount of interest on debt obligations of any type, and line 205 - the amount of fines, penalties and other sanctions for violation of contractual or debt obligations, causing damage.

Note! We do not show losses equated to non-operating expenses on line 200. Line 300 is intended for them. Moreover, for line 301 of them we separately show the amount of losses from previous years identified in the current reporting (tax) period, and for line 302 - the amount of written off bad debts that were not covered by the reserve for doubtful debts.

Let us note that if bankruptcy proceedings have been opened against the debtor, his debt for profit tax purposes is recognized as bad only after it is excluded from the Unified State Register of Legal Entities. This is stated in the Letter of the Ministry of Finance dated June 6, 2021 N 03-03-06/1/32678.

It is obvious that lines 301 and 302 provide a far from complete breakdown of all possible non-operating expenses. After all, these also include losses from natural disasters, emergency situations, expenses in the form of shortages of material assets in production and warehouses, at trading enterprises in the absence of the perpetrators, as well as losses from theft, the perpetrators of which have not been identified (with documentary evidence of the absence guilty persons by an authorized government body). So the sum of the values of lines 301 and 302 cannot in any way be greater than the total amount of losses reflected on line 300.

Example 2. Let us present non-operating expenses and losses equivalent to those, taken into account by Gvozdika LLC in the first half of 2021, in the form of the following table:

| Type of consumption | I quarter 2021 | II quarter 2021 | Total for the first half of 2021 |

| Contractual penalty | 40,000 rub. | 120,000 rub. | 160,000 rub. |

| Bad debt recognized as such in connection with the liquidation of the debtor (no reserve was created in tax accounting) | 175,000 rub. | 175,000 rub. | |

| Interest on debt obligations | 23,000 rub. | 21,000 rub. | 44,000 rub. |

The appendix to sheet 02 of the declaration for the first half of 2021 will be filled out as follows (fragments):

Lines 400 - 403 of the Appendix to sheet 02 of the declaration for the first half of 2016 are filled out if errors (distortions) relating to previous tax periods were discovered in the reporting period, leading to excessive payment of tax. The total amount is shown in line 403 and is deciphered separately for the three previous years on lines 401 - 403. And the indicator on line 400 is taken into account when forming the indicator on line 100 of sheet 02 of the declaration, that is, when calculating the tax base.

Results

Decisions made by an organization regarding its accounting policies (both according to accounting and legal accounting) are enshrined in an internal document. Appendices to this document include, in particular, lists of items for the accounting accounts used in accounting. If these lists contain a comparison with the types of expenses involved in calculating the income tax base, then they can be used as transcripts reflecting the division of expenses into direct and indirect for tax purposes.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.