Blocking a current account does not allow you to freely manage the money on it. There may be several reasons for a bank to freeze operations, and the most common of them are related to violations of tax laws.

A timely response to the bank’s actions will allow you to avoid many problems associated with the suspension of account transactions. In the article we will talk about how to unblock a current account depending on the reasons and we will analyze the sequence of actions of the account owner in such situations.

The tax office blocked the account: causes and consequences

The right of the Federal Tax Service of Russia to block the current account of an organization is defined in Article 76 of the Tax Code of the Russian Federation, which contains an exhaustive list of reasons why banking operations can be temporarily suspended:

- the legal entity was late in submitting a tax return to the Federal Tax Service by 10 working days from the date of expiration of its submission (clause 1, clause 3, article 76 of the Tax Code of the Russian Federation);

- the tax agent did not submit the calculation in Form 6-NDFL to the Federal Tax Service within 10 working days from the date of expiration of its submission (clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- the taxpayer did not comply with the request of the tax service to pay taxes, insurance contributions, penalties or fines (clause 2 of Article 76 of the Tax Code of the Russian Federation);

- a taxpayer who, by virtue of the requirements of the Tax Code of the Russian Federation, is obliged to submit reports in electronic form, did not submit to the tax service an electronic receipt for the receipt of a document received from the Federal Tax Service in electronic form within 6 days from the date of its receipt (clause 2, clause 3, article 76 Tax Code of the Russian Federation).

As follows from the letter of the Ministry of Finance dated 04/21/2015 N 03-02-08/22548, such documents include requirements for the submission of documents and for the provision of explanations, as well as notifications of summoning representatives of the organization to the tax office.

In addition, operations on the account may be suspended for the reasons specified in paragraph 10 of Article 101 of the Tax Code of the Russian Federation. If the Federal Tax Service decides that the organization does not comply with the decision that was made based on the results of a desk or on-site audit, due to the fact that the total value of its property, according to accounting data, is less than the amount of arrears, penalties and fines. However, in this case, before blocking the account, the Federal Tax Service must make a decision on interim measures in the form of a ban on the alienation (pledge) of all property of such a legal entity.

It must be said right away that the Pension Fund, the Social Insurance Fund and Rosstat do not have the right to block the bank accounts of organizations and individual entrepreneurs. The same as the Federal Tax Service in all other cases of violations of tax legislation, such as untimely provision of advance payments or balance sheets. There is no right to take this measure even if a calculation of insurance premiums is not provided. True, officials intend to change this point in the near future: the corresponding bill is already under consideration.

Let's look at how to unblock a bank account blocked by the tax authorities, an organization or an individual entrepreneur in different situations in more detail.

Deadlines for unblocking in case of tax arrears and its repayment

In accordance with paragraph 8 of Art. 76 of the Tax Code no later than the next day after receiving information about the collection of tax arrears, the head or deputy head of the Federal Tax Service Inspectorate makes a decision to cancel the suspension of transactions on the account. After this, it must be sent to the bank in the manner established by Bank of Russia Regulation No. 440-P dated November 6, 2014.

The communication schedule (appendix to regulation 440-P) determines the date and time the credit institution receives a decision from the fiscal department. In all cases, the decision is executed immediately after verification if it is received from 9:00 to 16:00 (on Friday - before 15:00).

Thus, the period for unblocking an account after paying taxes or other mandatory payments and penalties should not exceed three working days. In this case, the period is calculated from the day when the Federal Tax Service received information from the bank or from the taxpayer.

Blocking a current account for late submission of a declaration

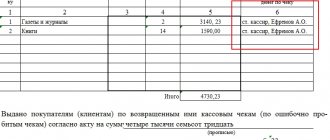

If a taxpayer is delayed in submitting any of the declarations provided for by the Tax Code of the Russian Federation for more than 10 days, the Federal Tax Service has the right to restrict all transactions on his bank accounts. This is provided for by paragraph 3 of Article 76 of the Tax Code of the Russian Federation, as well as paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Tax officials have this right only in relation to failure to submit tax returns; late submission of all other reports does not lead to such consequences. The account is blocked completely; its owner cannot manage it in full. The law exclusively allows payments related to labor relations and the payment of taxes and fees. Data on such payments and their order are given in the table.

| Payment | Payment order |

| According to executive documents on compensation for harm caused to life and health, and on the collection of alimony | First of all |

| According to executive documents on the payment of severance pay, wages under employment contracts and remuneration to the authors of the results of intellectual activity | Second stage |

| Transferring salaries to employees (as well as receiving cash for issuing them) | Third stage |

| On instructions from the Federal Tax Service to transfer debts on taxes and fees to the budget and on instructions from the Pension Fund of the Russian Federation or the Social Insurance Fund to transfer insurance contributions | |

| According to enforcement documents providing for the satisfaction of other monetary claims (for example, compensation for material damage) | Fourth stage |

| For the payment of taxes, fees, insurance premiums, as well as penalties for their late payment and fines for violation of tax legislation and legislation on compulsory social insurance | Fifth stage |

Sequence of actions when unlocking

What to do if your current account is blocked and you don’t know the reason? In this case, you will need to follow these steps:

- find out the reason for suspending operations on the account (to do this, contact the bank. If the account is blocked by the tax authorities, then it is worth asking for the date, as well as the number of the basis document. Next, contact the desk audit department at the Federal Tax Service, provide the details of the decision to clarify the reason for blocking the account);

- If the tax authority informed you of the reason for the blocking, then you need to eliminate it to activate the current account. For example, you can pay the tax and provide a copy of the receipt to the Federal Tax Service to speed up the process. As soon as the funds arrive at the tax office, your account will be available for its intended use within 24 hours. If the reason was the absence of a tax return, then it can be submitted through specialized electronic services.

How to unblock a current account blocked by the tax office

If operations on bank accounts are suspended, it is necessary to act promptly, since the inability to fully use financial resources paralyzes the economic activities of an organization or entrepreneur. There is a common horror story among lawyers and tax agents that it is very difficult to remove restrictions and cannot be done without the help of specialists. In reality, everything is quite simple. It is important to respond adequately to the situation and act consistently and without panic.

The scheme of actions for each of the reasons for introducing restrictions is similar. Because it only involves three important steps. The result directly depends on the speed and accuracy of all actions.

Step 1. Finding out the reason why restrictive measures were introduced

In the bank branch where the current account is opened, you need to find out on the basis of which decision of the Federal Tax Service the operations were suspended. Employees of the credit institution must provide the date and number of this document. After this, you need to go to the Federal Tax Service and use the details of the decision to clarify who made it and why. Most often, the decision reaches the addressee through specialized communication channels a little later than it does to the bank. Finding out the reason for such measures will reduce the time to solve the problem.

Step 2. Eliminate the cause

When the reason why such unpleasant consequences occurred is known, it needs to be eliminated quickly. If there was a tax arrear, it must be paid off. If there was a delay with the declaration, the report must be sent to the Federal Tax Service. If there is no electronic receipt, it must be transferred, simultaneously fulfilling all the requirements from the document to which it concerned. The Federal Tax Service must be notified of the elimination of the reasons as soon as possible.

If restrictive measures are related to failure to submit a report or submission of it in the wrong format (on paper instead of TKS), then you need to arrange a connection to one of the special communication operators to submit reports electronically.

Step 3. Informing the Federal Tax Service about the elimination of the violation

Typically, unlocking occurs within 24 hours after the inspection receives money from the budget or the required reports or documents. To guarantee, you can exchange electronic documents with the Federal Tax Service (for example, you have a personal key or the organization uses the services of special intermediaries) and inform the inspectorate that the violation has been eliminated. Article 76 of the Tax Code of the Russian Federation establishes the following maximum terms for removing seizure from taxpayer accounts:

- in case of arrears - on the next business day after receiving a bank statement on payment of tax and penalties on demand;

- in the absence of a declaration - on the next business day after the submission of the declaration or calculation of 6-NDFL or documents confirming their submission earlier in time;

- in the absence of a receipt for acceptance of electronic documents - on the next business day after the receipt is transferred to the Federal Tax Service and the requested documents are submitted.

Before the introduction of specialized electronic communication channels, unblocking accounts took longer, because the decision of the Federal Tax Service was delivered to the bank by couriers. Currently, taxpayers are not involved in relations between the Federal Tax Service and banks, and data exchange takes a matter of minutes. By the way, if the bank’s financial monitoring has blocked the account of a legal entity for other reasons, for example, for suspicion of money laundering or terrorist financing, this instruction will not help and the algorithm of actions will be different.

Unblocking an account in case of late filing of a tax return

If for some reason you did not submit your declaration according to the established deadlines, the tax service has the right to block the estimated deadline. She can do this 10 days after the reporting period expires.

This right of the Federal Tax Service applies exclusively to the declaration . The absence of other documents is not a reason for blocking a bank account.

It is important to understand that in the described case, your account will be frozen for the entire amount. For example, if according to the declaration you only need to pay 60,000 rubles, but you have 1,000,000 rubles in your account, then you will not be able to freely dispose of the entire amount.

All transactions on the account are blocked, except for those that are transfers to the tax office and other payments, the priority of which is higher than tax ones. As soon as you properly prepare a declaration, submit it to the Federal Tax Service and pay the tax (if necessary), the account can be used freely.

How to unblock a current account

So, we figured out how to find out about the blocking of a bank account by decision of the Federal Tax Service. To restore expense transactions, you must first find out the reason. If it is known, then all that remains is to comply with the requirements of the tax authorities: submit a declaration or report, pay the arrears or fine, send a receipt for acceptance of the Federal Tax Service’s request, ensure that information is received via the TKS.

The time frame for canceling a decision to suspend operations is short - no later than one day from the date the inspectorate receives information about compliance with the requirements. At the same time, the procedure can be speeded up if you personally bring to the Federal Tax Service a statement that the payment to the budget has been made. The application is written in free form, attaching copies of payment documents. The same should be done with reporting. There is no need to send the declaration by mail, because in this case its receipt by the tax office will be delayed.

Why is Rosfinmonitoring blocking?

There is a special authorized body for supervision in the financial sector - Rosfinmonitoring. This service operates in accordance with the provisions of Federal Law No. 115-FZ of August 7, 2001 “On Combating Income Laundering and the Financing of Terrorism.” The banks themselves must comply with this law; it is for violations discovered during an audit of their activities that many of these institutions have lost their license over the past few years.

As judicial practice 115-FZ shows, Rosfinmonitoring applies strict sanctions to those who arouse suspicion by their manner of doing business. What might attract the attention of this service? Such situations are when:

- the identity of the director is suspicious, his status may hint at a nominee if several companies are registered under him;

- Questionable payments are often made using inappropriate details and activity codes;

- it is not possible to establish the location of the organization due to the absence of a legal address, or this address falls under the criteria for mass registration;

- the company did not transmit information to the bank about changes in the constituent documentation;

- a businessman often withdraws money from his account, but does not pay taxes by non-cash payment, or the share of these payments is extremely small compared to the total turnover;

- there is no variety in the description of the purpose of operations if the same basis is present;

- the entrepreneur makes transfers to persons who are accomplices of terrorists.

All banks are afraid of the Rosfinmonitoring service, so it is easier for them to apply harsh sanctions against several of their clients who are suspicious than to take a risk and lose their licenses.

What to do if the tax office is dragging its feet on unlocking your account?

Despite the fact that unblocking an account should be done promptly when the violations that caused it are eliminated, in reality this procedure can take a week or even more. The tax authorities have many means to make life more difficult for taxpayers.

In some cases, companies may face illegal demands from inspectors:

- They may require the taxpayer to go through supposedly mandatory procedures to unfreeze the account.

- Sometimes a requirement is made to conduct a desk audit.

- There are often situations when the taxpayer is required to go through many different offices with the so-called “runner” - a bypass sheet that all officials listed on it will have to endorse.

- A condition may be set for the transition exclusively to electronic reporting in cases where it is not mandatory.

Don't you want to get into a similar situation? Follow the materials in our section “Account blocking” . The most up-to-date information and competent explanations from experts will help you be legally savvy and defend the interests of your company in a difficult situation.

Account blocking under Federal Law 115

One fine day, a businessman may discover that his account is blocked. What to do in this case, is it possible to get your money and how to make payments with counterparties?

The reasons for freezing an account are dubious transactions that are carried out on your account. For example, you have deposited a large amount into your account in small payments over a long period of time or, conversely, you are constantly withdrawing large limits. Banks do not like such transactions and are often grounds for blocking.

According to Federal Law 115, a credit institution has the right to freeze any account if it suspects that you are engaged in money laundering, that is, you are trying to carry out transactions that make illegally obtained funds legal.

It follows from the law that the blocking is carried out at the initiative of the bank. Each of them has a financial monitoring service that closely monitors transactions on the accounts of all clients. Most often, individual entrepreneurs and small businesses are subject to account freezes. It is their activity that involves frequent withdrawals and deposits of cash, which arouses the suspicions of banks.

True, credit institutions also employ people who can make mistakes. And often accounts are blocked without reason. For example, you are a law-abiding citizen, running a “correct” business and are in no way connected with criminal blockings. In this case, a claim for illegal blocking of your account by the bank will help.

However, the consequences of freezing even when drawing up such a document will be disappointing. You will have to prove that the transactions on the account are legal. To do this, you will need to provide all documents confirming this fact. They should reflect all amounts that passed through your account before the blocking. Only after carefully studying the documents provided do banks decide to unfreeze the client’s account.

Reasons for blocking under 115 Federal Law

Let's take a closer look at the reasons for account blocking. The legislation gives banks this right if there are the following reasons:

- if one of the counterparties is a terrorist (their base is located in any bank. And even if you did not know who you were dealing with, then blocking definitely cannot be avoided);

- when carrying out transactions worth more than 600,000 rubles (this is the limit that raises suspicions in Rosfinmonitoring. It doesn’t matter whether you withdraw money, deposit it or transfer it to someone);

- the parties to the transaction conduct operations on behalf of wanted persons;

- the bank has suspicions that the documents you submitted to confirm the legality of the transaction carried out on the account are real;

- The Federal Tax Service became interested in your account and instructed the bank to freeze the account (the tax office also monitors transactions on bank client accounts);

- if a large number of money transfers are made from an organization to individuals.

What if the Federal Tax Service is wrong?

It happens that a decision to block a current account is made without any real reason. Technical failures or errors by Federal Tax Service employees may result in the organization or individual entrepreneur whose account has been blocked failing to fulfill its obligations. For example, a loan payment was not made on time or payment deadlines to a supplier were missed.

If, as a result of illegal blocking of the current account, the taxpayer suffered losses, then he has the right to recover them from the Federal Tax Service on the basis of Article 103 of the Tax Code of the Russian Federation. Moreover, you can demand compensation not only for direct losses, but also for lost profits.

For example, in case No. A60-46155/2018, which was considered by the Arbitration Court of the Sverdlovsk Region on January 25, 2019, the organization’s current account was blocked due to arrears of 1 kopeck! At the same time, the debt arose due to the fault of the inspection itself, which assigned the payment to another KBK. The organization planned to transfer 77 million rubles from the current account to the deposit, which is impossible to do if it is blocked. The lost interest on this amount for 7 days amounted to 73,835 rubles, which the court collected from the Federal Tax Service.

In addition, Article 76 of the Tax Code of the Russian Federation obliges the tax authority to pay interest to an organization or individual entrepreneur at the Central Bank refinancing rate if it turns out that the decision to block was made illegally or the deadline for lifting the seizure of the account was violated.

Why is the bank blocking?

All banks in our country are subordinate to the Central Bank. They are required to comply with federal laws, orders and guidelines. One of the most recent legislative acts is the Central Bank Methodological Recommendations No. 4-MR dated 02/02/2017. They were created to identify and stop dubious transactions that are used by unscrupulous individuals for the purpose of:

- evasion of taxes and other obligatory payments;

- withdrawal of funds abroad;

- laundering (legalization) of funds earned by criminal means;

- providing financial support to terrorism.

Each bank has its own security service, which monitors all customer transactions, identifying dubious transactions among them. Particular attention is paid to transfers of amounts in large and especially large amounts (from 600 thousand rubles and 1.5 million rubles, respectively). To identify suspicious clients, bank employees focus on the following signs:

- if the share of taxes and other obligatory payments paid is less than 0.9% of all expenditure transactions, or the person artificially inflates this figure;

- if an individual entrepreneur has a staff of employees, but wages are not transferred from the current account to them, accordingly, personal income tax is not withheld and insurance premiums are not paid, or the wage fund is so small that it does not correspond to the number of employees, the minimum wage and the subsistence level;

- the cash turnover is very high, compared to the maximum stated when opening the account, and the money is constantly written off without a balance;

- funds are written off for purposes other than their intended purpose, transactions are not typical of the businessman’s activities (no payments for rent, for housing and communal services, etc.).

Important! The bank considers all these criteria in aggregate and on a systematic basis. If a client pays to the budget at a time for a certain tax period an amount that is less than 0.9% of the total turnover, then his current account will not be blocked.

Sometimes the blocking of transactions initiated by the bank in 2021 is due to a reason that the client cannot influence in any way: the revocation of the license by the Central Bank. Many people have faced this problem over the past three years, especially clients of small credit institutions. In this regard, only reliable banks, which value their reputation rather than the number of clients, can provide at least some bank guarantees to fund holders.

What operations are available for a blocked account?

When an account is frozen, it is wrong to assume that it is completely unavailable. Individual payments can be made. Firstly, this concerns tax payments. No one will object to transfers to the budget, so you can safely make payments on taxes, fees, and also to pay off tax debts. Payments to the Social Insurance Fund or Pension Fund are also available.

Secondly, you can take advantage of the Civil Code rules on the order of payments and, thanks to this, make separate transfers from the company’s account. It should be noted here that not all banks always agree to a meeting, since employees are not aware of these legal subtleties. In this case, it is necessary to either verbally convey your right to make these payments, or, if the situation is advanced, you can write a statement and have payments written off, for example, under a writ of execution (alimony, severance pay, compensation, etc.).

In some cases, it is possible to achieve a transfer from the current account and salaries of employees. The fact is that the suspension does not apply to payments, the order of which precedes the order of settlements from budgets. Salaries of employees are included in the third priority. Since this same line also includes payments to the budget, which are collected at the request of the inspector and extra-budgetary funds, it turns out that these are equivalent payments.

If the bank refuses to write off wages, but allows taxes to be deducted, point out to it the failure to fully comply with Art. 855 of the Civil Code of the Russian Federation. You can also contact the Central Bank regarding illegal actions of the bank itself. Please note that the balance in the account minus the amount of tax debt is enough to pay salaries to employees. In this case, the bank is obliged to transfer wages to your employees in full and without restrictions. Other payments cannot be made, since they fall out of this order.

Reason No. 1: Failure to comply with the tax requirement to pay tax (clause 2 of Article 76 of the Tax Code of the Russian Federation).

Each declaration and tax calculation undergoes a desk audit and, within 3 months, the Federal Tax Service can issue a tax payment requirement. The requirement is set:

- or via TCS (telecommunication channels)

- or by registered mail

Regardless of the method of sending, after 6 days the Request is considered received. Further, the Legislator gives us another 8 days to repay the debt (clause 4 of Article 69 of the Tax Code of the Russian Federation).

If the Requirement is not fulfilled, the head of the tax inspectorate or his deputy has the right to make a Decision to suspend transactions on the accounts. It should be understood and taken into account that the Federal Tax Service immediately blocks all current accounts of the organization, but within the amount of unpaid tax specified in the request.

For example , the amount of the tax claim is 10 thousand rubles, and the funds in each of the 3 available current accounts exceed the blocked amount. This means that the amount of 10 thousand rubles will be blocked on each of the 3 current accounts. The balance on current accounts exceeding 10 thousand rubles can be used by the organization to pay off any current obligations. But there is an obvious inconvenience - the amount of the Demand is 10 thousand rubles, and in total, 30 thousand rubles are blocked for three current accounts. What if we are talking about millions of blocked rubles? The company's activities may simply be paralyzed. In this case, the taxpayer can unblock excessively blocked accounts by writing an application to the Federal Tax Service with a corresponding request, proving that one (or more) of his current accounts has the required amount. The application must indicate account numbers, BIC and current account balances, as well as attach bank statements confirming these balances. This will speed up the unlocking process, because... The tax office will not need to request information from the bank.

Also, I would like to draw your attention to the fact that blocking an account due to non-payment of tax does not in itself mean immediate debiting of funds. Whether there is money or not, the bank will not write off the funds until it receives a collection order issued on the basis of the Decision to hold the taxpayer accountable. The decision is made by the head of the Federal Tax Service or his deputy, and only it and his “Collection Order” instrument provide grounds for writing off funds. The decision is made no later than 2 months from the date of issuance of the Request for Tax Payment.