Overpayments under one contract are asked to be transferred to payments to another

The decision on conservation is always made by either the customer or the investor. Where can I read about the offer “please consider. "? What is this - “please count.”?

I would also read that we are talking about offsets, if, of course, the contractor has an obligation to return the advance. Does she exist? Or should there be? and what circumstances prevent unilateral termination of the contract?! The decision on conservation is always made by either the customer or the investor.

And who always pays the contractor for smoking bamboo despite the proper performance of his duties? Your answer is interesting in the absence of an agreement in this top) consider the money paid under the 1st agreement as paid under the 2nd and a response letter with confirmation. If possible, could you qualify such actions: are these changes to the agreement or what? If possible, could you qualify such actions: are these changes to the contract or what?

There was a question - is it possible to set off the money if both parties agree. That is, in fact, the buyer made an advance payment for two contracts, but mistakenly indicated only one contract in the payment instructions.

You can pretend that you received the “wrong” advance.

But then the buyer will need to write a letter to correct the payment order. To correct this error, the buyer must send a letter to the seller notifying about the change in the purpose of payment in the advance payment order. After this, it will be considered that part of the advance was originally received under another agreement.

Keep in mind that such clarification of the payment purpose can only be done if: a little time has passed since the payment was made. What documents will you need to deal with an overpayment to a supplier? A statement of reconciliation of settlements with the counterparty. When is the document useful? Most often, an overpayment from a buyer occurs if the parties change the terms of the contract or terminate it. If there are disagreements with the counterparty regarding the transferred amounts, you cannot do without a reconciliation report.

Let me explain.

The seller and buyer draw up a payment reconciliation report jointly. To get results faster, draw up such a document yourself with data from your accounting and send it to the seller. https://youtu.be/https://www.youtube.com/watch?v=eXfiKtKvk50

Accounting

The offset of claims is reflected by writing off the corresponding amounts of receivables and payables. To do this, it is necessary to make an entry in the debit of account 60 “Settlements with suppliers and contractors” in correspondence with account 62 “Settlements with buyers and customers” for the amount of debt on mutual claims.

In some cases, account 76 “Settlements with various debtors and creditors” is used (for example, in relation to lease agreements). If the amounts of receivables and payables coincide, no additional payment is made by the participants in the offset. In the opposite situation, the party with a large debt is obliged to pay the difference to the other party.

Accounting entries for the netting operation: Debit of account 41 “Goods”; Credit to account 60 “Settlements with suppliers and contractors” - for the cost of purchased goods; Debit account 19 “VAT on purchased assets”; Credit to account 60 “Settlements with suppliers and contractors” – for the amount of VAT on goods, works and services received;

Debit of account 62 “Settlements with buyers and customers”; Credit to account 90 “Sales” subaccount 1 “Revenue” – for the amount of proceeds from the sale of goods, works, services; Debit account 90 “Sales” subaccount 3 “VAT”; Credit to account 68 “Calculations for taxes and fees” – for the amount of accrued VAT on revenue; Debit account 90 “Sales” subaccount 2 “Cost of sales”;

Credit to accounts 41 “Goods”, 43 “Finished products”, 20 “Main production” - for the actual cost of goods sold, finished products, work, subaccount 2 “Cost of sales”; Credit to account 44 “Sales expenses” - for the amount of expenses for sale; Debit of account 60 “Settlements with suppliers and contractors”;

Credit to account 62 “Settlements with buyers and customers” - when closing the debt of mutual claims on the basis of an act of offset of mutual claims; Debit account 68 “Calculations for taxes and fees”; Credit to account 19 “VAT on acquired assets” - VAT on goods, works, and services received is written off to reimburse the amount of repaid debt from the budget at the time of signing the act of offset of mutual claims;

We invite you to familiarize yourself with: Sample forwarder driver liability agreement

conclusions

The form of offset of claims is relevant for situations where one of the parties has a shortage of funds and can serve as a solution for various situations. Sometimes it is used for internal optimization within a holding. We recommend using netting in cases where there are homogeneous supplies, long-term relationships, no funds and both parties agree.

Firmmaker, August 2017Elena Zhitushkina (Karpova)When using the material, a link is required

Letter and acceptance of the amount against another agreement

If one party does not agree to offset the claims, the initiating organization has the right to go to court. Reservations about taxes and VAT VAT is calculated based on the amounts of debts of both organizations that will be written off. It is written in a separate line in the contract.

Failure to comply with this requirement will result in proceedings with the tax authorities. The amount of this tax is determined based on the market value of the credited services or goods.

Those who use the cash method report income on their taxes that is equal to the amount of debt written off. The basis will be an act or statement of mutual offsets. At the same time, an expense equal to the written off debt of the taxpayer to the partner is displayed. This can be done through a specialized program or using a personal account on the Federal Tax Service website if you have an electronic signature. Download the new application form for credit in 2021 (valid from 2021) How to correctly fill out the new application form in 2021 Let's look at how to offset the amount of overpaid tax using the new application form. This form must be used starting March 31, 2021.

Filling out the document begins with a header in which you need to enter the applicant’s TIN and KPP codes. If the form is submitted by an organization, then two empty boxes must be crossed out in the TIN field.

If an entrepreneur does this, then the checkpoint field is completely crossed out. The page number in the document is written next to it.

Contents: Important In the organization and individual entrepreneur form, fill out only page 1.

The second is intended for individuals who are not entrepreneurs.

Info There is no procedure for filling out the form, but in general the rules for displaying data in it are intuitive. In addition, there are some explanations at the end of the form. Application for offset of overpaid tax: sample The sample we provided is also relevant for 2021.

Methods of filing an application You can submit an application to offset the overpayment to the tax office in one of 3 ways:

Instructions for drawing up a netting act in 2021

When drawing up the act, it is recommended to adhere to the standard structure of such documents:

- The “cap” is filled in at the top. The essence of drawing up the act is indicated here. It is also necessary to note the city in which the organization drawing up the document is registered. The date of registration is noted.

- Below is information about the parties. Their legal form, passport details and position of managers or other responsible employees are noted.

- The text indicates the regulation, charter or other document on the basis of which the manager takes his position.

- Then information is entered about the contracts on the basis of which the debts arose. The amounts of mutual debts must be indicated not only in numbers, but also in words.

- Next, you need to write that the parties mutually agree to such repayment of debts, and accordingly, do not have any claims against each other.

- It is imperative to note whether this is a partial or full offset. If the debtor agrees to pay the balance, this must also be stated. The period during which he must transfer the specified amount is also indicated.

- The final stage of filling out the document is affixing signatures. You need to write the manager's name, position and signature with a transcript.

Settlement agreement between organizations - sample

> > January 06, 2021 you can download on our website - must comply with a strict list of civil law requirements.

Let us study the main nuances of drawing up such an agreement.

Settlement is an agreement between the parties to civil legal relations on the mutual termination of certain obligations to the established extent. For example, if the contractor performed work for the customer, while the customer delivered goods to the contractor, then each party can exempt itself from paying for the obligations performed by the other party in exchange for the fact that the other party, in turn, will also not pay for the fulfilled first obligation.

Legally, such a condition can be enshrined in an offset agreement for the provision of services (or supply of goods). It is important that (Article 410 of the Civil Code of the Russian Federation):

- the obligations had a sign of homogeneity;

- the deadline for fulfillment of obligations at the time of offset has arrived (exceptions - if it is not specified, is subject to a separate indication, or there are grounds not to comply with this condition by law).

Offsetting cannot be carried out if (Article 411 of the Civil Code of the Russian Federation):

- the conclusion of a netting agreement is expressly prohibited by law or agreement.

- the obligation of either party has expired;

- the obligation of any of the parties is related to compensation for harm to health, lifelong maintenance, payment of alimony;

Settlement can be legally established not only in an agreement, but also unilaterally - through a statement of offset drawn up by any of the parties to the transaction.

But in this case, the party drawing up the application must, if necessary, be ready to prove in court that:

- the application was clearly received by the counterparty;

- the counterparty had no objections to the offset.

Drawing up a bilateral agreement on mutual settlement has such disadvantages, and many companies use it.

How to properly arrange with a counterparty to set off the excess amount received against another agreement

Yes, you should agree with the counterparty on the issue of offsetting the excess amount received against another agreement.

If there is no disagreement with the counterparty regarding the amounts paid, in order to offset the overpayment against another transaction, the partner should send a letter with a request to offset the money against other supplies. Write the letter on your company letterhead. In the letter, specify under which specific agreement the overpayment arose and in what amount.

At the same time, indicate what you expect from the seller - for him to offset other agreements. Provide the number and date of the contract to which you are asking to transfer the overpayment.

It is better to put live signatures and stamps on the document, send it by mail or deliver it with a courier.

The rationale for this position is given below in the materials of the Glavbukh System version for commercial organizations. Article: What papers to send to the supplier to return or offset the overpayment How this article will help: We will tell you what steps to take if you want to return the money overpaid to the seller or offset it against future contracts.

What it will protect you from: From confusion with payments if you terminate the contract or change its terms. It is rare that the seller, having learned about an overpayment under the contract, is ready to return the money simply on the grounds that the buyer asked for it over the phone. Typically, in order to sort out payments, partners have to reconcile accounts, exchange letters, or even enter into an agreement to change prices.

We have listed below common situations when a buyer may experience overpayments.

Reasons why a company may overpay in settlements with a counterparty 1.

The buyer made a mistake in the payment order. This is the simplest situation of all. An overpayment occurs if the buyer mistakenly transferred more than he should have.* 2. The supplier delays delivery of goods already paid for. The buyer can refuse the goods in accordance with Article 511 of the Civil Code of the Russian Federation.

Provided that this is not prohibited by the contract. 3. The seller provided low-quality goods for which he had previously received an advance payment.

Settlement. Basic rules of mutual offset. Circular netting.

The parties' demands must be counterclaims . The occurrence of requirements means that the obligations of the parties are mutual, i.e. the composition of their parties coincides, and the parties simultaneously participate in two obligations. In this case, a person who is a debtor in one obligation is a creditor in another. Debt repayment occurs according to the scheme: “You owe me, and I owe you.” If several organizations are involved in mutual settlement, the scheme is slightly modified: “You owe me, I owe him, and he owes you.” Only the basic principle of mutual offset operations remains unchanged: there is a counter or circular mutual debt, which is extinguished by circular offset. The parties carrying out the offset do not have the right to pay off a claim that is presented to one of the participants in the offset transaction from the outside, that is, by another organization not participating in this transaction for the offset of claims.

The demands must be valid and not disputed by the parties . This means that the parties to the offset must have the claims in respect of which the offset is made. For example, if a creditor has assigned the right to claim a debt to a third party, then he has no right to set off with the debtor after that, since he is no longer a creditor of the debtor. Indisputability means that at the time of the statement of offset, the specified requirements are not disputed by any of the parties. If there is a dispute regarding one of the requirements for offset, then offset will not be performed.

Counterclaims must be uniform in content. Claims with one subject of obligation arising from similar legal relations are recognized as homogeneous. The subject of any contract is understood as a thing, work or service, or the performance of certain actions that, by virtue of the contract, the debtor must transfer, perform, provide or perform to the creditor. In other words, the requirements must have the same subject. An example of homogeneity of requirements: the parties are obliged to transfer funds to each other for goods supplied by one party and work performed by the other party. In this case, the parties have similar obligations to pay for goods supplied and work performed. The subject of the obligations of the parties is also the same - money. An example of heterogeneity of claims: one party has arrears in payment for goods purchased under a sales contract. The second party under the contract must perform work for the first. Such obligations will be counter-obligations, but not homogeneous, since monetary claims arose under one contract, and obligations to perform work under the other. Consequently, it is impossible to pay off mutual claims by offset in this case. Materials from arbitration practice confirm that demands for the transfer of an advance payment for property under one contract and for the collection of penalties for shortfall in delivery of products under another cannot be homogeneous (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 3, 1996 N 779/96). Here we should touch upon the problem of netting obligations expressed in different currencies. For example, under one agreement the obligation is expressed in rubles, and under another - in US dollars. Experts express different opinions about the possibility of such an offset, since heterogeneity in this case arises not by type, but by currency of obligations. To remove all questions regarding such offset, you can draw up an additional agreement between the partners on changing the currency of obligations, and then offset mutual claims.

The parties have the right to offset only those obligations that have already become due . You can only offset an obligation that was not fulfilled on time and turned into debt. In accordance with the law, if an obligation provides for or allows you to determine the day of its execution or the period of time during which it must be fulfilled, then the obligation is subject to execution on this day or at any time within this period (clause 1 of Article 314 of the Civil Code of the Russian Federation) . Thus, it is possible to present a counterclaim for offset only after the deadline for fulfilling the obligation, but not earlier. The deadline for fulfilling obligations is usually specified in the contract. The following claims may be repaid:

- the deadline for which has arrived;

- the deadline for fulfillment of which was not specified (in this case, the obligation is fulfilled within a reasonable time in accordance with paragraph 2 of Article 314 of the Civil Code of the Russian Federation);

- the execution period of which is determined by the moment of demand.

In addition, it is impossible to set off an obligation under a contract whose performance has not been started by either party. In this case, the obligations of the parties remain solely on paper and do not turn into debt. Only mutual debts can be offset. For example, a supplier, having a debt to an enterprise under one contract, delivered goods to this enterprise under another contract, but the payment period for the goods for this enterprise has not yet arrived; the supplier’s unilateral statement to terminate the obligation by offset is not valid. After all, the payment period for the goods for the enterprise has not yet arrived, and for the debt to the enterprise under the first contract, it can accrue, for example, interest to the counterparty until the moment when the enterprise must pay for the goods under the second contract. The Civil Code of the Russian Federation allows for both full and partial repayment of mutual claims during offset. This means that the amount of obligations of the parties may be different. In such a situation, offset should be carried out for the amount of the smallest debt. The party whose debt turns out to be greater will have a portion of the obligation not repaid by offset. Currently, current regulatory documents imply some freedom in organizing accounting at an enterprise. This allows the company to generate accounting information taking into account the specifics of its activities, making it more reliable. The procedure for generating this information is regulated by an order on the accounting policy of the organization, in which the assessment of accounts receivable from customers and the assessment of accounts payable are subject to disclosure. When offsetting a counter monetary claim, the provisions of Art. 319 of the Civil Code of the Russian Federation. Having received a notification about the offset of part of the claims, you need to remember the rules for fulfilling monetary obligations. Unless otherwise provided by the contract, if the counter monetary claim is insufficient to completely terminate the obligation, the creditor's costs of obtaining performance must first be repaid by offset, then interest, and the remainder - the principal amount of the debt. This is important to consider if there is principal, interest and late fees.

The claims to be offset must not relate to those claims for which offset is not permissible . Obligations that cannot be accepted against mutual claims are listed in Art. 411 of the Civil Code of the Russian Federation. This is a debt for which the statute of limitations has expired (three years from the date of its occurrence), claims for compensation for harm caused to life or health, obligations for alimony and lifelong maintenance. In addition, a prohibition on repaying a particular obligation by offset may be provided for by an agreement or by law. For example, clause 2 of Art. 90 of the Civil Code of the Russian Federation provides for the inadmissibility of offsetting claims against a limited liability company under the obligation to make a contribution to the authorized capital. The same restriction is provided for joint-stock companies when paying for shares (clause 2 of Article 99 of the Civil Code of the Russian Federation). In other cases, the parties have the right to set off based on the provisions of Art. 410 of the Civil Code of the Russian Federation. Mutual transactions are divided according to the number of participants into bilateral and multilateral.

- Bilateral offsets can be carried out between two parties by agreement of both parties or at the request of one of them. The latter is sometimes called unilateral netting. Multilateral offset is not netting in its pure form, since Art. 410 of the Civil Code of the Russian Federation requires the presence of a homogeneous counterclaim. Therefore, tax authorities often express the opinion that multilateral offset is illegal and refuse to consider VAT paid in such a transaction.

- A multilateral set-off should be viewed as an agreement under which a “circular debt” is settled between three or more participants. This operation is based on the scheme: “ Circular debt - circular offset ”. Circular debt is a relationship between a group of organizations in which a creditor of one participant is a debtor of another participant, which, in turn, along the chain leads to the receivables of the last participant to the first. Multilateral offset occurs on the basis of an agreement signed by all participants, which reflects agreement to repay the resulting circular debt. In a multilateral offset, it is very important to comply with all procedural issues. It is necessary to determine whether all persons participating in the offset scheme are linked to each other by contractual relations, i.e. are debtors and creditors to each other; in relation to which party there is a right of claim of the other party, which is extinguished by offset.

Since the title of the document “Deed of Settlement” does not accurately reflect the nature of the transaction carried out on its basis, it is more advisable to use a more neutral name, for example, “Debt Repayment Agreement” or “Debt Repayment Agreement” (in other words, the word “netting” is excluded from the title "). As for the legality of such an agreement, as is known, clause 2 of Art. 421 of the Civil Code of the Russian Federation provides for “freedom of contract,” that is, the parties can enter into an agreement, both provided for and not provided for by law or other legal acts. Therefore, an agreement to pay off a circular debt (even if this agreement is incorrectly called a “Deed of Settlement”) is legal. It was concluded by the parties based on their interests, and the law does not prohibit its implementation. The fact that the conclusion of such agreements is not a violation of the law is stated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 20, 2000 in case No. 7222/99. Another type of offset of claims is in court by filing a counterclaim. In Art. 132 of the Arbitration Procedural Code of the Russian Federation dated July 24, 2002 N 95-FZ states that the defendant, before the arbitration court of first instance adopts a judicial act that ends the consideration of the case on the merits, has the right to present a counterclaim to the plaintiff for consideration together with the original claim.

A counterclaim is accepted by the arbitration court if:

- the counterclaim is aimed at offsetting the original claim;

- satisfaction of the counterclaim excludes, in whole or in part, satisfaction of the original claim;

- there is a mutual connection between the counterclaim and the original claim and their joint consideration will lead to a faster and more correct consideration of the case.

Set-off cannot be carried out in court if the defendant raises objections to the claim, because then the requirement of indisputability will be violated. If the court finds the defendant’s counterclaim to be justified and satisfies the substantive and legal conditions for offset established by law, it will offset it with the original claim. According to the Arbitration Procedure Code of the Russian Federation, if the initial and counterclaims are fully or partially satisfied, the operative part of the decision indicates the amount to be recovered as a result of offset (clause 5 of Article 170 of the Arbitration Procedure Code of the Russian Federation). The parties conducting offset of mutual claims must correctly draw up documents for this operation. All business transactions carried out by the organization must be documented with supporting documents, which serve as primary accounting documents and on the basis of which accounting is carried out (clause 12 of the Regulations on accounting and reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n

Primary accounting documents must contain the following mandatory details:

- name of the document (form), form code;

- date of compilation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- business transaction indicators (in physical and monetary terms);

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution, their personal signatures with transcripts.

The list of required document details is listed in Art. 9 of the Federal Law of November 21. 96 N 129-FZ “On Accounting”. The basis for offset is mutual debt. The chart of accounts for accounting financial and economic activities establishes that organizations must maintain analytical accounting for accounts 60 “Settlements with suppliers and contractors” and 62 “Settlements with buyers and customers” in the context of each presented invoice, and when making payments in the order of scheduled payments - according every supplier, contractor, buyer and customer. At the same time, the construction of analytical accounting should ensure the possibility of obtaining the necessary data on settlement documents in the context of the due dates of their payment.

To accept for accounting transactions to offset mutual obligations between legal entities, the following documents must be available:

- main agreements between the parties to offset obligations;

- certificates of work performed with the final payment amount for each of the contracts, invoices for shipment and receipt of products (goods) and other documents confirming the facts of fulfillment of obligations under contracts;

- acts of reconciliation of the amounts of accrued payables and receivables from the parties;

- a document confirming the consent of the parties to offset mutual obligations.

The last document, according to the Civil Code, must be drawn up in the form of a statement or an additional agreement on the offset of mutual obligations, that is, be unilateral or bilateral in nature.

The application or agreement must be in writing . The form of the document is arbitrary. The date of the offset is the day the parties sign an official document on the implementation of the offset. Data from primary documents, after they have been verified (in form and content) and accepted for accounting, are grouped and recorded in a certain order. The documents in which this stage of accounting work is carried out are called accounting registers. Accounting registers are tables of a certain form, built in accordance with the economic grouping of data on property and sources of formation, and serve to reflect business transactions on accounting accounts.

Statements are accounting registers . They are opened, as a rule, for a month to maintain and summarize homogeneous accounting information. The statements are intended for analytical and synthetic accounting and serve as combined registers. After filling out the turnover sheets for the accounts, fill out the balance sheet and other forms of financial statements.

The forms of financial statements that reflect information on accounting for settlements using unreliable means are: “Balance Sheet (Form No. 1)” and “Profit and Loss Statement (Form No. 2).”

The purchase ledger and sales ledger are tax accounting registers . Buyers maintain a purchase ledger to record invoices issued by sellers in order to determine the amount of value added tax to be deducted (refunded) in the prescribed manner. Invoices received from sellers are subject to registration in the purchase book in chronological order as payment is made (including in cash) and the goods purchased (work performed, services rendered) are taken into account. In case of partial payment for registered goods (work performed, services rendered), an invoice is registered in the purchase book for each amount transferred to the seller in the order of partial payment, indicating the invoice details for the goods purchased (work performed, services rendered) and Each amount is marked “partial payment”.

Sellers maintain a sales book intended for registering invoices (control tapes of cash register equipment, strict reporting forms for the sale of goods (performance of work, provision of services) to the population), compiled by the seller when performing transactions recognized as objects that are subject to value added tax , including those not subject to taxation (exempt from taxation). Invoices issued by sellers when selling goods (performing work, providing services) to organizations and individual entrepreneurs for cash are subject to registration in the sales book. Registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises. In the case of partial payment for shipped goods (work performed, services rendered), when adopting an accounting policy for tax purposes, as funds are received, the seller registers an invoice in the sales book for each amount received as a partial payment, indicating the invoice details - invoices for these shipped goods (work performed, services rendered) and a note for each amount “partial payment”.

The purchase book and sales book must be bound together, and their pages numbered and sealed . Control over the correct maintenance of the purchase book and sales book is carried out by the head of the organization or his authorized person. The purchase ledger is kept by the buyer and the sales ledger is kept by the supplier for a full 5 years from the date of last entry. It is allowed to maintain a purchase book and a sales book in electronic form. In this case, after the expiration of the tax period, but no later than the 20th day of the month following the expired tax period, the purchase book and the sales book are printed, the pages are numbered, laced and sealed. Invoices that have erasures and erasures are not subject to registration in the purchase book and sales book. Corrections made to invoices must be certified by the signature of the manager and the seal of the seller, indicating the date the correction was made.

Also, buyers keep a log of original invoices received from sellers , in which they are stored, and sellers keep a log of invoices issued to buyers, in which their second copies are stored. Buyers keep a record of invoices as they are received from sellers, and sellers keep a record of invoices issued to buyers in chronological order. Log books for invoices received and issued must be bound and their pages numbered.

The organization must regularly conduct an inventory of payments . The procedure and timing of the inventory is determined by the manager. As a rule, before starting an inventory, acts of reconciliation of settlements with other organizations are drawn up. This is an independent stage - the stage of identifying mutual debt and drawing up a reconciliation report. It is better to draw it up so that the entries in the accounting records of the participants are identical in the future and there are no disagreements.

There is no special form for the statement of reconciliation of calculations, so it is drawn up in any form. The act is drawn up for each debtor and creditor in 2 copies:

- the first copy remains in the accounting department;

- the second copy is sent to the organization with which the reconciliation was made.

The act is kept in the organization’s archives for 5 years.

Since the reconciliation report is an accounting document, and the head of the enterprise and the chief accountant are responsible for maintaining accounting records, they must sign it. At the same time, the court accepts as evidence reconciliation acts signed only by the chief accountants of the parties. The next stage of the procedure will be the repayment of mutual debt - signing an act of offset, sending a letter in the case of unilateral offset, signing an agreement in the case of multilateral offset. So, on the basis of the statement of reconciliation of calculations, an application for offsetting mutual claims can be prepared. This is done if the organization has both receivables and payables to the same enterprise (for example, when the supplier is also the buyer of your organization’s goods).

The application is made in 2 copies:

- the first copy is transferred to the accounting department;

- the second - to the enterprise with which the offset is made.

The application is kept in the organization’s archives for 5 years.

The inventory results are reflected in the inventory report of settlements with buyers, suppliers and other debtors (creditors) (form N INV-17) and a special certificate (appendix to form N INV-17). Form No. INV-17 was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The act is drawn up in 2 copies:

- the first copy is transferred to the accounting department;

- the second copy remains with the inventory commission.

The inventory is carried out by the commission on the basis of primary accounting documents, as well as acts of reconciliation of payments between the organization and other enterprises. The commission must determine the timing of receivables and payables and the possibility of their repayment. The personnel of permanent and working inventory commissions is approved by the head of the organization. The document on the composition of the commission (order, resolution, instruction) is registered in the book of control over the implementation of orders to conduct an inventory. The inventory commission includes representatives of the organization’s administration, accounting employees, and other specialists (engineers, economists, technicians). The inventory commission may include representatives of the organization’s internal audit service and independent audit organizations. The absence of at least one member of the commission during the inventory serves as grounds for declaring the inventory results invalid.

The act states:

- accounting accounts on which the debt is recorded;

- amounts of debt agreed and not agreed upon with debtors (creditors);

- amounts of debt for which the statute of limitations has expired.

The statute of limitations is 3 years from the date the debt arose. If the inventory reveals a debt with an expired statute of limitations, then it is written off from the organization’s balance sheet by order of the manager. To do this, the accountant must make the following entries: Debit 91-2 “Other expenses” - Credit 62 “Settlements with buyers and customers” - accounts receivable with an expired statute of limitations are written off; Debit 63 “Reserves for doubtful debts” - Credit 62 “Settlements with buyers and customers” - accounts receivable are written off, for which a reserve for doubtful debts was previously created; Debit 60 “Settlements with suppliers and contractors” - Credit 91-1 “Other income” - accounts payable are written off. The act is stored in the organization’s archives for 5 years. During this time, the written-off debt should be listed on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss.”

A certificate drawn up on a standard form is attached to the inventory report. Its form was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 N 88. The certificate indicates:

- details of each debtor or creditor of the organization;

- the reason and date of the debt;

- amount of debt.

The certificate is drawn up in one copy and stored in the organization’s archives for 5 years.

For the purpose of accounting for settlements with the budget for value added tax (VAT), it is necessary to comply with the requirement to highlight the tax amount as a separate line in the primary documents drawn up when conducting mutual offset transactions (application for offset, act of reconciliation of calculations, act of offset of mutual claims). Only in this case will the buyer be able to present the VAT paid to the supplier for deduction from the budget. This requirement is contained in Article 172 of the Tax Code of the Russian Federation [2[. In accounting, the offset operation is reflected in the same accounting entry for both parties: Debit 60 “Settlements with suppliers and contractors” - K 62 “Settlements with buyers and customers” - mutual claims are offset. Thus, according to E.V. Orlova, a mutual offset transaction is a unilateral transaction and can be carried out by either party with appropriate notification to the other party, provided that there are no disagreements on the subject of offset. According to N.N. Shishkoedova, Associate Professor of the Department of Accounting and Auditing at the Kurgan Socio-Economic Institute, the advantages of mutual offset are as follows:

- firms get rid of increased attention from tax authorities: the Tax Code does not allow them to control the prices of transactions with the subsequent offset of mutual debts;

- the likelihood of errors when calculating taxes is significantly reduced, since, unlike barter, taxation and accounting of transactions with offsets are quite simple;

- with an offset scheme, there are no discrepancies between accounting and tax accounting and no permanent tax assets and liabilities are formed, which greatly simplifies the work of an accountant;

- in case of offset, the buyer can fully deduct the “input” VAT.

Based on the foregoing, it is concluded that mutual offset is a profitable type of non-cash means of payment.

RAA Law

Free legal consultation by phone

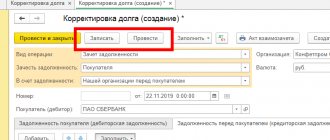

VAT calculations when offsetting an advance received under another agreement

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

11/29/2016 subscribe to our channel

The Tax Code gives the seller the right, when changing the terms of the contract or terminating it and returning advance payments, to deduct the VAT calculated and paid on the advance payment. In the article, 1C experts, using the example of “1C: Accounting 8” edition 3.0, talk about the procedure for reflecting VAT calculations, including the formation of a tax return, when receiving an advance payment for the supply of goods and claiming tax deductions when offsetting the amount of the received advance payment against an advance payment under another agreement.

We recommend reading: Personal income tax from winnings in the drawing

In accordance with the terms of the contract, the buyer can make full or partial prepayment for goods (work, services), property rights. According to subparagraph 2 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, on the day of receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the moment of determining the tax base for VAT arises, and the tax base is determined based on the amount of payment received from taking into account tax (clause

1 tbsp. 154 of the Tax Code of the Russian Federation). Upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights realized on the territory of the Russian Federation, the taxpayer is obliged to present to the buyer of these goods (work, services), property rights the amount of VAT calculated in the manner established by paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause 1 of Article 168 of the Tax Code of the Russian Federation). The seller must issue an invoice to the buyer for the amount of the prepayment received no later than five calendar days (clause

3 tbsp. 168 of the Tax Code of the Russian Federation). The invoice is filled out in accordance with Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137

“On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”

(hereinafter referred to as Resolution No. 1137).

Offsetting and tax accounting: nuances

Tax accounting of legal relations for the offset of obligations is characterized by the fact that:

1. The fact of signing a netting agreement between organizations does not change the composition of the VAT tax base. It does not matter if, for example, the company received an advance from the counterparty on account of future deliveries, and it was set off under an agreement to offset obligations, while goods or services were not delivered to the counterparty.

2. Carrying out offset does not change the composition of the tax base for income tax, since under the accrual method, income and expenses under the agreement with the counterparty will be recognized before offset. Under the cash method, income and expenses will be determined based on the fact of offset.

3. With the simplification, the situation is similar to that observed with the cash method of accounting for income and expenses by the payer on the OSN. Income and expenses are recognized by the company using the simplified tax system only upon the fact of offsetting obligations with the counterparty.

You can download a sample netting agreement between legal entities on our website using the link below.

Letter to offset overpayment to supplier. sample, form 2021

SAMPLE LETTER ABOUT SETTLEMENT OF OVERPAYMENT ON AN ACCOUNT ON THE ORGANIZATION’S LETTERHEAD _______20____

To the Accounting Department of Public Press Capital LLC, please credit the overpayment to invoice No. _____ dated ___.__.06.

in the amount of _________ rubles, including VAT 18% - _______ rubles (payment order No._____ dated __.__.06 in the amount of __________ rubles.

incl. VAT 18% _______rub.) in partial payment of invoice No. _____ dated ___.___.06, the remaining funds in the amount of __________rub.

towards subsequent work. General Director (signature) signature transcript Chief Accountant (signature) signature transcript More details ON THE ORGANIZATION'S LETTERHEAD _______200...g.

To the bank Bank of the payer's organization According to payment order No. _____ dated ___.___.__________. for the amount of _________ rubles, the recipient of the payment is considered Public Press Capital LLC TIN 7725144901. Our bank details: DETAILS OF THE PAYER'S ORGANIZATION INN Account No. K/s No. BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature M.P.

More details SAMPLE LETTER ABOUT AN ERROR IN APPOINTING A PAYMENT ON THE ORGANIZATION'S LETTERHEAD __________200...g.

To the Accounting Department of Public Press Capital LLC In payment order No. ____ dated _________________ 20__. an error was made in the purpose of payment in the amount of _____________________ rubles. It should read: “for printed products on invoice No. ___ dated____, incl.

VAT 18% -_____rub.” further in the text. Our bank details: DETAILS OF YOUR ORGANIZATION INN Account No. Account No. BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature More details ON THE ORGANIZATION'S LETTERHEAD ______200...g. To the accounting department of Public Press Capital LLC, please return the overpayment on account No. ……… dated ………… in the amount of ………………… rub.

Agreement on offset of funds (sample)

→ → Update: July 4, 2021

(paid ……… item No. _____ in the amount of ………… rub.). Our bank details: TIN R/s in (name of bank) account BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature M.P. More details ON THE ORGANIZATION'S LETTERHEAD _______200...g.

On the territory of the Russian Federation, there are several legal ways to terminate the obligations of the parties. One of the most common methods is offset of debt amounts.

At the same time, it can be drawn up either by agreement or by a letter on the offset of funds, a sample of which is available for review at the link below.

The provisions of domestic acts of lawmaking allow for the termination of mutual monetary obligations both by making settlements and by conducting mutual offsets, as well as by other methods described in the Civil Code of the Russian Federation. In the case of using the offset option for fulfilling requirements, the parties to economic legal relations must take into account that:

- the deadline for execution by the time the described transaction is completed must have occurred.

- all terminated obligations of the parties must be homogeneous (for example, monetary claims);

It is important to note that the requirements of Russian legislative acts allow for the offset of funds:

- by agreement of the parties.

- unilaterally based on an application or letter from the counterparty;

In any case, the offset must comply with the requirements of the Civil Code of Russia. Ignoring this provision may call into question the legality of terminating mutual obligations in the described manner and lead to the agreement being declared invalid.

The netting agreement, like the letter of netting of funds, must contain the following information:

- Full name of the counterparties' managers;

- names of the parties to the relationship to be terminated;

- a description of the grounds for the emergence of initial mutual claims, their size and deadlines for execution;

- details and signatures.

- an indication of the fact of termination of counterclaims in whole or in part, reflecting the amounts of funds subject to offset;

In accordance with the established practice of signing treaties and other agreements establishing

Introductory information

Civil legislation will allow the “maneuvers” described above with payment only if the documents are completed correctly.

Firstly, well-drafted documents will protect the organization from disputes (including litigation) with counterparties. Order an electronic statement and check the counterparty in “Kontur.Focus”

Secondly¸ documents are necessary for tax purposes (this is required by Article 252 of the Tax Code of the Russian Federation, which regulates the procedure for accounting for expenses), and for the purposes of proper accounting (this is recalled by the article of the Federal Law of 06.12.11 No. 402-FZ “On Accounting” ). Thirdly, documenting a transaction is important for management accounting purposes, since it allows the management and shareholders (participants, beneficiaries) of the company to have a correct idea of what is happening in it.

Letter to supplier about transfer of payment sample

» In the event that the transfer of an advance from one contract to another is carried out as a result of termination of the contract or a change in its conditions, i.e. the first of the above conditions established in paragraph. 2 clause 5 art. 171 of the Tax Code of the Russian Federation, then in order to apply a VAT deduction, the second condition must be met - the return of the advance to the counterparty.

Extreme case If the supplier somehow failed to fulfill his obligations (delivery of the goods was not complete, there was inadequate quality, unacceptable delay, etc.), then one letter about offset of the overpayment to the supplier will not be enough. The organization will have to change the terms of the existing contract or terminate it altogether.

How long is the letter stored and where is it registered? All business correspondence must go through the journal of outgoing documentation.

It notes the main content of the letter, its number and date.

This way you can confirm the existence of the paper if legal proceedings are subsequently held on this issue.

As for the storage period, for letters of this kind it is 5 years. This is due to the fact that it is directly related to the business relationship with the supplier of goods or services. Drawing up an application for tax offset from one BCC to another is an inevitable part of the procedure for correcting an error in the work of an accountant when transferring a tax or other payment to the state budget.

First fill out the form:

- details of the applicant - his name, TIN, OGRN, address, etc.

- addressee, i.e. the name and number of the tax authority to which the application will be submitted;

Then the main section states:

- amount (in numbers and words);

- new KBK.

- new payment purpose (if necessary);

- number of the article of the Tax Code of the Russian Federation, in accordance with which this application is being drawn up;

- the tax for which the incorrect payment occurred;

- KBK number;

Finally, the document is dated and the applicant signs it. Bring it to the tax office

What to include in the agreement

There is no unified template for an advance agreement, so it can be drawn up arbitrarily in writing.

The document will need to include:

- Place and date of conclusion.

- FULL NAME. and passport details of the parties to the agreement.

- Data about the object of sale (address, technical parameters, cost).

- The amount of the advance, the method of its transfer and a note that it is included in the cost of the object.

- Form of advance payment (cash or transfer).

- Deadlines (before signing the main contract).

- The procedure and timing for the return of the advance if the transaction does not take place, and penalties for failure of the transaction.

- Bank details of the parties when making non-cash payments.

- Signatures of the parties to the transaction.

If there are several owners of the property being sold, the agreement must be signed by each owner.

If the advance payment is made in cash, then the fact of transfer by the seller of the receipt must be reflected in the agreement.

When drawing up this agreement, you must pay attention to the following points in the document:

- Advance amount. The amount of the prepayment cannot be fixed. To determine it, it is necessary to perform calculations based on the actual price of the object being sold, and usually, as agreed by the parties to the transaction, it is 1-2% of the cost of the monetary policy of the object.

- Procedure for transfer of advance payment. In this paragraph it is necessary to display how the prepayment will be made (by opening a safe deposit box, by bank transfer or in cash). It is also necessary to display the deadline for transferring the advance payment to the Seller, as well as the fact of drawing up a receipt for the transfer of the advance payment.

- Responsibility for failure to agree. Here it is necessary to display in detail the sanctions imposed on the guilty party for breaking the agreement, since it is this point that can become the basis for resolving disputes between the parties to the transaction.

Letter to offset overpayment to supplier

6773 A letter to offset the overpayment to the supplier is very useful if, under any agreement with a counterparty, there is a larger difference in payment for services or goods. FILES Overpayment between counterparties can occur for a number of reasons:

- If the supplier has delayed a delivery for which funds have already been transferred. If the agreement between organizations does not stipulate otherwise, then the recipient in this case may refuse to accept the goods altogether. This is clearly stated in Article 511 of the Civil Code of the Russian Federation, paragraph 3.

- Refusal by the buyer of a product due to its low quality (defects, etc.). If the supplier in this case has already been paid an advance, then an overpayment arises (Article 523 of the Civil Code of the Russian Federation).

- The simplest of situations. Due to an error by an accountant or other person responsible for transferring funds, more money was transferred to the supplier’s account than it should have been.

- The agreement under which the funds were transferred was terminated by one of the parties. In this case, there is, of course, no talk of offset by future supplies or services.

Before drawing up a letter about the offset of the overpayment, you need to make sure that the calculations by the organization’s accounting department were made correctly.

To do this, the supplier is asked to draw up a bilateral reconciliation report. This will allow you to reach a common opinion regarding the amount of the overpayment. Typically, this kind of paper is printed on the organization’s letterhead.

On their upper part are the company details. If a business letter is printed on a regular A4 sheet without notes, then at the very top you must indicate the name and basic information of the organization that is sending the message. The letter must contain:

- Date of signing.

- The amount of overpayment. It must be clearly known to both parties.

- Title of the paper.

- To which account the payment was made (link with document number and date).

- Information about the addressee. Full name of the head of the supplier’s organization, his position, the name of the company itself.

- Document Number. It is needed for subsequent accounting and recording of outgoing documentation.

How to make offsets under different agreements with one counterparty?

A scenario is possible in which a company’s counterparty has obligations to it (or it to the counterparty) under two different agreements. This is not of fundamental importance from the point of view of the possibility of mutual offset. The main thing is to consistently set out in the agreement the procedure for mutual offset of the parties’ claims with references to different agreements, and to correctly reflect the financial component.

How to make offsets between contracts of one counterparty comply with legal requirements? The main thing here is to make sure that the content of the legal relationship does not imply any obstacles to the offset of claims from the point of view of the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

Thus, an obstacle to the offset of claims under several contracts with a counterparty may be the heterogeneity of obligations reflected in different contracts. For example, if one agreement is drawn up in rubles, and the other in foreign currency. In this case, netting between contracts of one counterparty will not be possible.

Legal questions and answers

We recommend reading: How much money will we lose when issuing a ticket?

Letter to offset funds from another organization Current legislation (Art.

313 of the Civil Code of the Russian Federation) provides for the possibility of fulfillment of an obligation by a third party. So, for example, if the debtor organization lacks money, the debtor can ask another organization to pay the creditor for him. Receiving payment is beneficial to the lender, but difficulties often arise in processing such payment.

Fulfillment of the obligation to pay for another person is possible in two cases:

- At the request of the debtor, if the nature of the obligation does not imply that the debtor is obligated to fulfill the obligation personally.

- In the event that a third party is in danger of losing his property.

Results

If two business entities have mutual homogeneous obligations (for example, to pay for goods or services supplied in the same currency), then such obligations can be canceled by drawing up a netting agreement. Such a document must comply with the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

You can learn more about the procedure for netting commercial obligations in the following articles:

- “The procedure for netting under the simplified tax system “income””;

- “How to deduct VAT when netting in 2021 (nuances).”

Letter of Settlement

Copyright: photobank Lori According to the Civil Code, it is possible for companies to terminate the obligations of the parties.

One of the most common methods is to offset debt amounts. Under what conditions is it possible to carry out offsets, in what form should a letter be drawn up, in what cases is it impossible to carry out the procedure - let’s take a closer look. In order for debt obligations to be repaid by offsetting mutual claims, certain conditions must be met:

- As a general rule, claims must be valid (depending on the timing of their repayment) and undisputed;

- The claims that are planned to be offset should not be among those claims that cannot be offset. Claims that cannot be offset: for compensation for harm caused to life or health, for the collection of alimony, for maintenance for life, and in other cases provided for by law or contract.

- The claims must be counter-claims, that is, the participants in the offset must simultaneously have debts to each other;

- The requirements must be uniform. In this case, homogeneity means the same method of repaying obligations. However, it is worth keeping in mind that by agreement of the parties, the contract may stipulate the termination of obligations with heterogeneous requirements (for example, obligations may be expressed in different currencies);

Settlement of debt claims is recognized as valid depending on their maturity dates, which:

- or are not specified in any way in the terms of the contract;

- or determined by the moment of demand.

- or have already occurred according to the terms of the contract;

According to civil law, the possibility of terminating an obligation by offsetting a counterclaim of a similar nature arises when the relevant document is sent to one of the parties.

This document can be drawn up in the form of a letter to the counterparty, an agreement on netting, an application for netting, or in another form.

Offsetting under a simplified taxation system

Entrepreneurs using the simplified taxation system should be most attentive to such transactions. The result will be entered in the “income” column, which means it will increase the taxable amount. Tax authorities often insist on carrying out offsets so that unclosed transactions are closed faster, but the manager has the right to independently decide whether to carry them out or not. Know and use your rights to avoid unnecessary costs in the process of economic activity.

Letter to transfer payment to another contract

0 Analytical accounting of settlements with suppliers or customers is usually carried out, at a minimum, in terms of contracts. Accordingly, payment is made according to contracts or invoices issued under a specific agreement.

The payer indicates where exactly the payment is to be credited in the payment order in field 24 “Purpose of payment” or in his notification sent immediately after payment (if, say, the purpose of payment simply states “for goods”) (). A situation is possible when, after payment, the payer wants to transfer the payment amount in whole or in part to another agreement. We will tell you how to arrange such a transfer in our material.

Payment is transferred to another agreement, for example, when the payer transferred a larger amount under the agreement than it should have. Or, say, an advance made under one contract wants to be split into two contracts.

The procedure for offsetting the amount of an overpayment under a specific agreement or payment for which the purpose of the payment has not been specified may be provided for in an agreement between the counterparties.

Otherwise, as a rule, a letter is drawn up allocating the payment amount to a specific agreement. Indeed, without such a letter, the recipient, in general, has the right to offset the payment against the obligation, the due date of which will occur earlier (,).

And even more so, you cannot do without a letter when the payer wants to transfer payment from one contract to another and such payment was not unnecessary. Unless otherwise provided by the agreement between the parties, the recipient of the money may refuse to “transfer” payment by letter. However, as a rule, the payer is not usually denied such “maneuvers” if the creditor’s property interests are not violated.

After all, it is unlikely that the supplier will want to transfer the payment received under the expired contract to the advance payment under the new contract, if after the advance payment has been “passed over” to him, the payer wants to receive, in fact, the next batch of goods on credit. But if, say, the payer wants to transfer payment from one contract to another, and at the same time

Deadlines

The advance payment period lasts until the conclusion of the main contract for the object and full settlement with the Seller.

This period is provided to the parties to the agreement to prepare the necessary documents and carry out formalities for the acquisition of the property. For ordinary transactions, this period is 3-4 weeks, for transactions involving the preliminary sale of another object (to raise money) - 6-8 weeks. By agreement of the parties, the terms may vary, up to 12 months.

If, at the time specified in the agreement, the main DPA is not concluded, two options are allowed:

- Sign a re-agreement with different terms.

- Terminate the agreement and return the advance to the buyer (unless the agreement specifies penalties for the parties).

Settlement without problems

The article from the magazine “MAIN BOOK” is relevant as of June 19, 2015. Yu.V.

Kapanina, certified tax consultant

The court decisions mentioned in the article can be found: When a company and its counterparty have mutual debts, they can simplify and speed up their settlements through offset. This will allow you to avoid sending money “you to me, I to you” and thereby save on bank commissions. You will learn about the nuances of netting, the preparation of related documents and the reflection of this operation in accounting from our article.

Offsetting counterclaims is a way of terminating (in whole or in part) already existing mutual obligations.

The amounts of mutual debt very rarely coincide; usually the debt of one party is greater than the debt of the other.

Then offset is made for the smaller amount. And the party whose debt was greater will have part of the obligation remaining unpaid. Settlement of obligations is possible only if the following conditions are met.

Requirements are considered homogeneous when they have the same subject and can be compared.

Let's say that monetary claims expressed in one currency are homogeneous. For example, one party has a debt to pay for work performed, and the other has a debt to repay the loan, while each party owes the other money, which means that such obligations can be offset.

The courts consider it possible, for example, to set off claims for payment of the customer’s debt for work performed and for payment of a penalty for the contractor’s violation of deadlines for completing work, because, despite their different legal nature, these claims are monetary, that is, homogeneous.

In principle, the parties can agree on the offset of heterogeneous claims, for example, when the debt of one party is expressed in rubles, and the other - in foreign currency.

But then the companies need to agree on the rate at which the foreign currency debt will be converted into rubles. At the time of offset, the payment deadline for each claim under the contract must already have arrived.

A few illustrative examples

Imagine that you rent an office in a building. The lease agreement has come to an end and you have decided not to renew it. At the same time, the premises were renovated, a split system was installed, and parquet flooring was laid. All this was done at the expense of your company with the consent of the owner of the building. After termination of the lease, either the owner is obliged to reimburse your repair costs, or payment may be stipulated by offset in the agreement for part of the lease payments.

The contractor demanded money from the customer for the work performed. However, he had a loan from a bank, and this same customer acted as a guarantor. Since the contractor did not pay interest on the use of the money, the customer paid for it. As a result, it is possible to offset the cost of work and the amount of loan funds paid.

In the problem we have a borrower and a debtor, as well as a person who owes some money to the first debtor. They have no reciprocal demands. That is, the chain is vertical. The first person lent money to the second, the second to the third. There can be no talk of any netting agreement, since the opponent has no counterclaims.