Indirect costs are those that cannot be attributed to a specific product item and that arise when producing several types of products at once. For example, the cost of renting premises, business expenses, administration salaries, etc.

In order to correctly take into account indirect expenses, you need, firstly, to correctly configure the program, and secondly, to correctly reflect the expenses themselves in 1C 8.3 (Accounting). Let's look at step-by-step instructions for beginners.

Determination of indirect costs of an enterprise

Indirect costs are those expenses that are not directly included in the cost of production. products (provided works, services). In simple words, these expenses are associated specifically with the production and sale of goods, but:

Take our proprietary course on choosing stocks on the stock market → training course

- they are not directly included in the manufacture of products;

- and expenses are taken into account in the period in which they are directly incurred.

In fact, all expenses that are not direct, as well as non-operating according to the accounting policies in force at the enterprise, are recognized as indirect. For example, spending in the social sphere, on improving the skills of employees.

Important!

The entire amount of indirect expenses is included in the expenses of the corresponding current period. This is how they differ from direct costs.

Indirect expenses - expenses report. period, entirely attributed to expenses, which are taken into account when taxing profits. Direct expenses are divided at the end of the month between sold and unsold goods, WIP balances.

General business expenses and their recognition as indirect expenses

General services costs (OKhR) are taken into account per point. sch. 26 “Communal Farm. expenses". General business expenses include expenses (Chart of Accounts, Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000):

- administrative and managerial;

- rent for general use. premises;

- general maintenance personnel not involved in production. process;

- depreciation, repair of management OS, general utility. appointments;

- payment for services (consulting, auditing, etc.);

- other similar management. spending.

For example: management salaries, travel allowances, taxes, inventions, tests. They are often also called non-productive expenses. This name is quite justified: they are not directly associated with production or other core activities, but they are necessary for the normal operation of any enterprise.

This is a key feature according to which certain expenses are classified as general indirect expenses.

General production expenses

General production costs (OPR) are taken into account per point. sch. 25 “General production. expenses". This account displays information about expenses for the organization, maintenance, management of basic and auxiliary equipment. production The following are included in the OPR (Chart of Accounts, Order of the Ministry of Finance of the Russian Federation No. 94n):

- operation, maintenance of equipment;

- depreciation transfers, repairs, insurance of fixed assets, property involved in production. process;

- maintenance of premises (heating, lighting, rent, etc.);

- remuneration of employees involved in production, etc.

The main share of these costs falls on general workshop expenses for management and expenses for the use and maintenance of equipment. For example, repairs, operation of equipment, transport, buildings, experiments, research.

Business expenses

An account is allocated for them in the Chart of Accounts. 44 “Sale expenses” (see Order of the Ministry of Finance of the Russian Federation No. 94n). Commercial costs include:

- packaging, packaging in warehouses;

- transportation, loading;

- commission fees;

- maintenance of premises for storing products during their sale;

- advertising on radio, TV, etc.;

- payment for sellers;

- entertainment expenses;

- other similar expenses.

That is, these are actually all the costs associated with the sale of finished goods and arising in the process of their sale.

Classification of costs for organizing and preparing production

Indirect expenses

(for organization, preparation of production)

|

| |

| General production group: | General economic group: | |

| a) general shop management costs: maintenance of the production management apparatus. divisions; by production management ; for pre-preparation and organization of production; depreciation of structures, production inventory; to create adequate working conditions; on personnel training and vocational guidance; MBP wear, etc. | b) costs of maintaining and operating equipment: depreciation of equipment and transport; current repair (maintenance) of equipment; energy costs for equipment; auxiliary services equipment maintenance industries; wages and mandatory social security contributions for workers servicing equipment; for intra-factory movement of materials, manufactured products, semi-finished products; wear of MBP, etc.; etc. expenses associated with the operation of equipment | administrative and management expenses; technical costs and production management; on supply and sales activities; payment for services provided to other organizations; maintenance and repair of structures and equipment; expenses for maintaining the workforce (recruitment, training of managers, education, etc.); generally obligatory fees, taxes and other deductions in accordance with the law, etc. |

Classification

Depending on sales (production) volumes, variable and fixed costs are distinguished. The first ones change in proportion to the number of products manufactured, services provided, and work performed. Fixed costs exist regardless of production volume. This category includes some taxes, security payments, depreciation, rental payments, management salaries, and so on. Costs may be overhead or indirect. This classification is carried out according to the connection between costs and the technological process. Depending on the level of aggregation, costs can be single-element or complex. There are also direct and indirect production costs.

Methods for allocating indirect costs

Indirect expenses are subject to distribution initially - by areas of activity, and then, within these areas - by types of products produced. The optimal division of expenses in this way allows you to accurately determine the cost of production. lines, as well as types of products.

This fact is significant when determining the pricing policy for the purposes of creating a product range and selling goods. In practice, the following three main distribution methods are used.

Direct cost allocation method

This is the most labor-intensive and simplified option for distributing indirect expenses. Used more often in production. enterprises with main and auxiliary production facilities. It is used when the prod. responsibility centers do not provide reciprocal services.

Its essence is that the costs of service (auxiliary) divisions (more precisely, for each of them) are attributed directly to production. However, other servicing cost centers do not participate in this process.

Important!

The method gives deviations in determining the cost of different types of products.

Step-by-step (sequential) method of cost distribution

Necessary for use when non-production. divisions provide mutual services. Allows you to take into account counter expenses. divisions. Expenses are distributed step by step (in stages). They start with a division that provides more services than it consumes. They are divided into main and auxiliary units. Next, they take the next division and, by analogy, distribute expenses, etc. The process implies:

- Division of all costs across all divisions (taking into account all expenses of the divisions).

- Definition of basic unit. time (time for repairs, S warehouse in sq. m., etc.), using which the consumption of these services by other departments is determined.

- Cost sharing is non-productive. divisions into production cost centers based on the selected distribution base. Each auxiliary unit is taken into account once during such division.

Compared to the previous one, the step-by-step method is considered more labor-intensive, but also gives a more accurate result on the cost of individual types of products.

Mutual cost sharing method (two-way)

Optimal for use in the presence of intra-company exchange (bilateral connections) between non-producers. divisions. The distribution of expenses can be schematically displayed as follows:

- Selecting a distribution base.

- Calculation of relationships between segments that participate in the distribution.

- Calculation of non-manufactured costs. divisions.

- Adjustment of this (point 3) calculation in connection with bilateral consumption of services.

- Division of expenses taking into account adjustments by responsibility centers.

“Manual” application of this method is possible if there are two non-pronouncements. divisions.

Write-off to fin. result

It is quite acceptable to attribute indirect (especially when it comes to general business) expenses directly to the cost of sales or write off using the direct costing method. The article indicates the type of placement – “For financial results”.

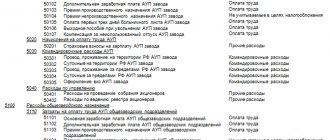

Fig. 1 Write-off of expenses for financial results

This is the simplest option that does not require additional settings: closing the month will automatically result in expenses being entered into account 90.

Free expert consultation

Pavel Aleksanyan

Project manager

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

Example of distribution of indirect costs (formula, table)

Let's distribute indirect expenses using the two-way method described above. The initial conditional data is given in the table below. The distribution base is direct spending.

| Divisions providing services | Service consumers | Total | ||

| stock | repair shop | basics shop | ||

| Warehouse (direct expenses, c.u. / share in the total amount, %) | – | 870 USD /44.1% | 1100 USD /55,8% | 870+1100=1970 |

| Repair shop (direct expenses, c.u./share in the total amount,%) | 650 USD /37,1% | – | 1100 USD /62,8% | 650+1100=1750 |

Calculation of non-productive expenses. divisions and correction of the calculation taking into account bilateral consumption of services is carried out using the indicators STRTS (adjusted expenses of the repair shop) and STS (adjusted expenses of the warehouse):

STRTS=870+0.41*STS (1)

STS=650+0.37*STRTS (2)

Determination of the values of STRTS and STS is carried out in the following way:

STRTS= 870+0.41*(650+0.37*STRTS)

STRTS=870+266+0.15STRTS

0.85 STRTS=1136

STRC=1336 USD

Accordingly, STS=650+0.37*STRTS=650+0.37*1336=1144 cu.

Distribution of non-produced the costs obtained by calculation taking into account the correction are shown in the table below.

| Unproduced divisions | Prod. divisions - basics. shop | Total values |

| Stock | 1336*62,8%=839 | Total distributed: 1389 (839+550) |

| Repair shop | 987*55,8%=550 | Direct expenses:1100 Total spend: 2489 (1389+1100) |

Scale base

In management analysis, it should be understood as a specific interval of sales/production volume, within which costs have a clearly defined behavior. For example, an enterprise has a machine park of 10 units at its disposal. 1 million products are produced annually. Depreciation on fixed assets is 500 thousand rubles. Management decided to double production volume. For this purpose, an additional 10 machines were put into operation. The scale base up to this point was 0-1 million products. After increasing the machine park, it became 1-2 million.

Accounting and methods for distributing overhead costs

ODA distribution is carried out by:

- Proportional to the selected basic indicator characterizing the results of the enterprise’s activities (used in complex production, when identification of products is possible at a specific stage of production).

- By maintaining separate accounting of ODA for each individual type of product (in this case, expenses are reflected in sub-accounts opened for account 25).

When using one or another method, take into account the actual working conditions at the enterprise. This is due to the fact that technologies and production within the same industry often differ significantly.

The principle of cost sharing (both ODA and, in fact, OHR) presupposes:

- Selecting a distribution object (for example, types of products).

- Determination of the distribution base.

- Calculation of the distribution rate (coefficient).

- Division of indirect expenses by objects taking into account the rate.

The distribution base is an indicator that more accurately links ODA and the volume of production. Such a base can be:

- man-hours worked;

- accrued salary basis. prod. workers;

- machine hours;

- hourly tariff rates;

- volume of products produced, etc.

The selected distribution base is subject to confirmation in the accounting policy.

Important!

Organizations independently determine the method of distribution of indirect expenses and consolidate it in their accounting policies. The chosen method should not contradict the norms of PBU 10/99 (Order of the Ministry of Finance of the Russian Federation No. 33n dated 05/06/1999).

The applied method of distribution of ODA should be simple, not labor-intensive and indicate the most approximate result of distribution in relation to actual expenses for the corresponding type of product. Economists consider the most reasonable distribution to be proportional to the basics. salary and using standards. rates. Therefore, we will consider them further in detail.

Distribution is proportional to the number of products produced

More suitable for food and metallurgical enterprises. The distribution base is the quantity of products produced (kg, meters, pieces, etc.). The method is not used for products that do not have a uniform basis for measuring quantity. Selected products must have the same cost and selling price.

Proportional to the amount of direct costs

The distribution of expenses is made in proportion to the cost of the basics. materials and bases. production salaries workers consumed for the product. That is, in proportion to the expenses associated with the production of certain types of products, which are included directly in the cost of goods.

Proportional to the costs of processing

Processing costs are shop expenses for processing basic materials. materials and raw materials into finished products. These expenses are determined for each processing stage (i.e., processing stage), distributing them by calculating the types of production. products at the same stage. This method of distribution is typical for the most part in chemical enterprises.

At predetermined shop rates

The workshop rate is calculated (set) separately for each workshop with the choice of its own distribution base. The calculation is carried out by dividing the workshop's ODP by the size of the distribution base.

At the general rate, expenses for each workshop are written off as the relevant data becomes available. But only when performance indicators across workshops do not differ significantly.

Proportional to machine hours worked

This method is usually used when the main production factor is equipment. The time spent on machines is the dominant factor influencing the amount of indirect expenses. The more the machines have worked, the higher the share of expenses for the use and maintenance of equipment as part of indirect expenses. They are the ones who form the distributed expenses.

Proportional to materials used

In the case under consideration, the cost of the basics can be taken as the base. materials (OM). In this case, rates are used for the distribution of overhead costs (OCR) as a percentage of the cost of used OM.

In general, the materials actually consumed are distributed among the types of products in proportion to their consumption according to the norm.

Proportional to basic salary

Sequencing:

- Determination of wage amounts for production. workers on the basis of accounting documentation (minus additional payments provided for by the piecework-bonus form of remuneration).

- Determination of the share of production. expenses made in fact to the allocated amount of wages production. workers.

- Calculation of the amount of production. expenses (counted as the cost of goods): multiplying the calculation. rates on the amount of wages for the manufacture of relevant types of products.

- Calculation of expenses per unit. goods: dividing the resulting amount of spending by the number of manufactured products.

Proportional to estimated or standard rates

The essence of the method:

- Equipment is divided according to identical technologies. groups with different content costs.

- They carry out calculations by item and find out the standard. the amount of part of the expenses associated with the use and maintenance of equipment for 1 worker. hour (in groups).

- Po is non-mechanized. operations find out expenses for 1 slave. hour.

- The standard is taken as one. amount of expenses per 1 worker. hour of equipment for group 1. In relation to it, the given coefficients are calculated for the remaining groups.

- The operating hours of the equipment are calculated in groups for individual manufactured products and on the basis of technology. documents.

- Calculate the estimated spending rate for the product. To do this, the recalculated reduced machine hours for individual products are multiplied by the standard. expenses for work hour (to the group taken as 1).

Tax Code of the Russian Federation

In Art. 271-273 ch. 25 for entities paying income tax, two options are provided for determining income and costs:

- Accrual method. It is considered universal and can be used in all cases.

- Cash method. This option is convenient in some cases, but has its limitations.

According to Art. 318, paragraph 1 of the Tax Code, payers using the accrual method are required to divide costs into indirect and direct. This is due to different conditions for their recognition in tax reporting. Let's take a closer look at what indirect costs are and what applies to them.

Results

The list of indirect costs in the UE is an element necessary primarily for the company itself.

The presence of such an “expenses” list in the UE allows you to correctly formulate the cost of production, calculate taxes, as well as protect your expenses before the tax authorities during audits and have a strong argument in case of litigation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

No profit

If no income was received during the reporting period, then the company can recognize only indirect expenses. Direct costs included in the balance of unsold products cannot be used in profit calculations. If the company has not sold anything, then, accordingly, it has no direct costs. As for indirect expenses, they are not tied to the revenue received and cannot be taken into account in the current period. At the same time, if a specific cost does not generate direct income, this does not mean that it is unreasonable. It is enough that it is necessary to carry out the activity, the result of which will be the profit received. Indirect costs, therefore, can be taken into account in reducing the tax base even when the revenue has not yet been received. This refers to income in the current period.