Employer reporting

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of December 28, 2017

What is the deadline for submitting calculations for insurance premiums for the 4th quarter of 2017? Do I need to fill out the old or new form? What new control ratios can be used to check the calculation and can this be done in a free program from the Federal Tax Service? Does the HR officer, together with the accountant, need to clarify the personal data of employees and check them with SZV-M? We will answer basic questions, look at specific examples and provide a sample of filling out the annual calculation of insurance premiums for 2021.

Who needs to submit an annual report for 2021

All policyholders must submit calculations of insurance premiums for the 4th quarter of 2021 to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs (IP).

Calculation of insurance premiums for the 4th quarter of 2021 must be completed and submitted to all policyholders who have insured persons, namely:

- employees under employment contracts;

- performers - individuals under civil contracts (for example, contracts for construction or provision of services);

- the general director, who is the sole founder.

The calculation must be sent to the Federal Tax Service, regardless of whether the activity was carried out during the reporting period (from January to December 2017) or not. If in 2021 an organization or individual entrepreneur had employees, but did not conduct business at all, did not make payments to individuals and had no movements on current accounts, then this does not cancel their obligation to submit accounts for the 4th quarter of 2021. In such a situation, you need to submit a zero calculation to the Federal Tax Service (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940).

The reporting period for calculating insurance premiums is the first quarter, half a year, nine months. The billing period is a calendar year - Article 423 of the Tax Code of the Russian Federation. Thus, it is more correct to call the calculation for the 4th quarter of 2021 an annual calculation for insurance premiums for 2021, and not a quarterly one. Moreover, many accountants know that many calculation indicators are formed on an accrual basis from the beginning of 2021, and not from the quarter. Therefore, at the end of the year, it is the annual DAM that is surrendered.

Calculation of insurance premiums: reporting deadlines

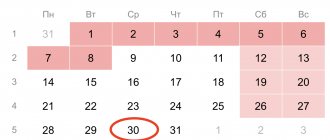

Now the deadlines for submitting the DAM are regulated by the Federal Tax Service, namely paragraph 7 of Article 431 of the Tax Code of the Russian Federation. According to the provisions of the Tax Code, the report will need to be submitted to the regulatory authority no later than the 30th day of the month following the reporting period.

Based on the information presented in the table, it can be seen that the deadlines for submitting the DAM by legal entities this year have changed, and now they will not depend on how the report is presented: on paper or electronically. At the same time, if the company has 25 or more people on staff, the report must be provided only in electronic form (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Annual calculation form: new or old?

Fill out the calculation of insurance premiums according to the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. Use the new calculation form only for reporting for the 1st quarter of 2021.

The composition of the current calculation form is as follows:

- title page;

- sheet for individuals who do not have the status of an individual entrepreneur;

- section No. 1 (includes 10 applications);

- section No. 2 (with one application);

- Section No. 3 – contains personal information about insured persons for whom the employer makes contributions.

Organizations and individual entrepreneurs making payments to individuals must include in the calculation of insurance premiums for the 4th quarter of 2021 (clauses 2.2, 2.4 of the Procedure for filling out the calculation of insurance premiums):

| title page |

| section 1 |

| subsections 1.1 and 1.2 of Appendix 1 to section 1 |

| appendix 2 to section 1 |

| section 3 |

In this composition, the annual calculation for 2021 should be received by the Federal Tax Service, regardless of the activities carried out in the reporting period (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940). In addition, if there are certain grounds, payers of insurance premiums must also include other sections and appendices. Let us explain the composition of the calculation in the table:

| Calculation element | Who fills it out |

| Title page | Filled out by all organizations and individual entrepreneurs |

| Sheet “Information about an individual who is not an individual entrepreneur” | Formed by individuals who are not individual entrepreneurs if they did not indicate their TIN in the calculation |

| Section 1, subsections 1.1 and 1.2 of appendices 1 and 2 to section 1, section 3 | Fill out all organizations and individual entrepreneurs that paid income to individuals from January 1 to December 31, 2021 |

| Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 | Organizations and individual entrepreneurs transferring insurance premiums at additional rates |

| Appendices 5 – 8 to section 1 | Organizations and individual entrepreneurs applying reduced tariffs (for example, conducting preferential activities on the simplified tax system) |

| Appendix 9 to section 1 | Organizations and individual entrepreneurs that, from January 1 to December 31, 2021, paid income to foreign employees or stateless employees temporarily staying in the Russian Federation |

| Appendix 10 to section 1 | Organizations and individual entrepreneurs that paid income to students working in student teams from January 1 to December 31, 2017 |

| Appendices 3 and 4 to section 1 | Organizations and individual entrepreneurs that paid hospital benefits, child benefits, etc. from January 1 to December 31, 2021 (that is, related to compensation from the Social Insurance Fund or payments from the federal budget) |

| Section 2 and Appendix 1 to Section 2 | Heads of peasant farms |

How to fill out the annual calculation: sequence

Start filling out the calculation for the 4th quarter of 2021 with the cover page. Then create section 3 for each employee you had in the 4th quarter. After this, fill out the Appendices to Section 1. And last but not least, Section 1 itself. In it you will summarize the data.

Reporting methods

- Individuals are hired under an employment contract.

The actual recipient of such contributions is the Pension Fund of Russia, the administrator (to whom contributions are transferred and who collects them in the prescribed manner) from 2021 is the Federal Tax Service.

The actual recipient is the FSS. He is also the administrator of contributions for injuries; the rest is collected, as in the case of pension contributions, by the Federal Tax Service.

The actual recipient is the Pension Fund, the administrator is the Federal Tax Service.

- They order work or services from individuals under civil contracts.

Within the framework of such legal relations, which are under the jurisdiction of the Civil Code of the Russian Federation, the employer must pay contributions only for pension and health insurance programs. However, the payment of social contributions for injuries can be regulated by a civil contract (Clause 1, Article 20.1 of the Law “On Compulsory Social Insurance” dated July 24, 1998 No. 125-FZ).

The payer of these contributions submits the following reports:

- unified payment (for contributions for pension, social, except for contributions to injury, medical programs) to the Federal Tax Service;

- calculation of 4-FSS (for social contributions for injuries) in the FSS;

- forms SZV-STAZH, SZV-M, ODV-1 (for pension programs) in the Pension Fund of the Russian Federation.

Let us now study the deadlines for submitting these reports to government agencies.

- Single calculation (from now on actual deadlines are indicated, taking into account holidays and weekends):

- until January 30, 2018 - for 2021;

- before 05/03/2018 - for the 1st quarter of 2021;

- until July 30, 2018 - for the first half of 2021;

- until October 30, 2018 - for 9 months of 2021.

- Calculation 4-FSS:

| Paper form submission deadline | Deadline for submitting the report electronically | Reporting period |

| 22.01.2018 | 25.01.2018 | 2017 |

| 20.04.2018 | 25.04.2018 | 1st quarter 2021 |

| 20.07.2018 | 25.07.2018 | Half year 2021 |

| 22.10.2018 | 25.10.2018 | 9 months of 2021 |

- Form SZV-M:

| Term | Reporting period (month) |

| 15.01.2018 | December 2021 |

| 15.02.2018 | January 2021 |

| 15.03.2018 | February 2021 |

| 16.04.2018 | March 2021 |

| 15.05.2018 | April 2021 |

| 15.06.2018 | May 2021 |

| 16.07.2018 | June 2021 |

| 15.08.2018 | July 2021 |

| 17.09.2018 | August 2021 |

| 15.10.2018 | September 2021 |

| 15.11.2018 | October 2021 |

| 17.12.2018 | November 2021 |

- Forms SZV-STAZH, EDV-1:

- before 03/01/2018 - for 2021;

- within 3 days after receiving the employee’s application for retirement.

Must be submitted electronically:

- reports to the Pension Fund of the Russian Federation, if the policyholder employs 25 or more people (Clause 2, Article 8 of the Law “On Personalized Accounting” dated 04/01/1996 No. 27-FZ);

- form 4-FSS and a single calculation if the policyholder employs more than 25 people (clause 1, article 24 of law No. 125-FZ, clause 10, article 431 of the Tax Code of the Russian Federation).

We have selected excellent electronic reporting services for you!

Note that the 4-FSS calculation is submitted in 2021 using a relatively new form (first used since reporting for 9 months of 2017). It will be useful to study its features.

- Unified calculation of insurance premiums:

- a fine of 5% of the calculated contributions for the reporting period for each of the following full or partial months until the calculation is submitted or until the fine reaches 30% of the contributions (minimum fine - 1,000 rubles, clause 1 of Art. 119 of the Tax Code of the Russian Federation);

- a fine of 300–500 rubles. to an official (for example, the head of a company or individual entrepreneur as an employer, clause 2 of article 15.33 of the Administrative Code).

- Forms SZV-M, SZV-STAZH, ODV-1 or submission of data from reporting documents with errors:

- a fine of 500 rubles. for each unsubmitted or incorrect document for an employee (Article 17 of the Law “On Accounting” dated April 1, 1996 No. 27-FZ);

- a fine of 300–500 rubles. to an official.

- 4-FSS calculations:

- a fine determined by a similar formula as in the case of failure to submit a single payment (however, its amount is based on contributions for 3 months within the reporting period);

- a fine of 300–500 rubles. to an official.

- Electronic reporting, when required:

- fine for reporting not in the form to the Pension Fund of the Russian Federation - in the amount of 1,000 rubles;

- fine for reporting not in the form to the Social Insurance Fund, Federal Tax Service - 200 rubles.

Let us note that there is always a chance to reduce fines from government agencies by up to several dozen times in court if the sanctions are very large (resolution of the 13th Arbitration Court of Appeal dated March 30, 2017 No. A56-68844/2016).

Employers (customers of work and services under a contract) submit insurance reports to the Federal Tax Service, Social Insurance Fund and Pension Fund. In cases provided by law - in electronic form. There are fines for failure to submit reports on time and for submitting them incorrectly.

Samples and examples of filling out the annual calculation for 2017

Most policyholders will fill out insurance premium calculations for the 4th quarter of 2021 electronically using special accounting software services (for example, 1C). In this case, the calculation is generated automatically based on the data that the accountant enters into the program. However, in our opinion, it is advisable to understand some principles of calculation formation in order to avoid mistakes. We will comment on the features of filling out the most common sections, and also provide examples and samples.

This might also be useful:

- Insurance premiums for injuries in 2021

- Insurance premiums for individual entrepreneurs “for themselves” in 2021

- Which OKVED code should be indicated in the reporting for 2021?

- New BCCs for pension contributions 2021

- New BCCs for medical contributions for 2021

- KBC for insurance premiums for 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Title page

On the title page of the calculation of insurance premiums for the 4th quarter of 2017, you must, in particular, indicate the following indicators:

Reporting period

In the “Calculation (reporting) period (code)” field, indicate the code of the billing (reporting) period from Appendix No. 3 to the Procedure for filling out the calculation of insurance premiums. There are four possible values in total

- 21 – for the first quarter;

- 31 – for half a year;

- 33 – in nine months;

- 34 – per year.

Therefore, in the annual calculation of insurance premiums for 2017, the reporting period code will be “34”.

Federal Tax Service code

In the field “Submitted to the tax authority (code)” - indicate the code of the tax authority to which the calculation of insurance premiums is submitted. You can find out the value for a specific region on the Federal Tax Service website using the official service.

https://service.nalog.ru/addrno.do

Performance venue code

As this code, show a digital value indicating the ownership of the Federal Tax Service to which the DAM is submitted for the 4th quarter of 2017.

How to fill out an adjustment

The updated calculation includes only those sections of the calculation and appendices to them that were previously submitted by the payer to the tax authority (with the exception of Section 3).

You only need to fill out other sections and appendices if additions are made to them.

When filling out the “Adjustment number” field in the updated calculation for the corresponding billing (reporting) period, the adjustment number is indicated (for example, “1—”, “2—” and so on).

Section 3 is included in the corrective form if there are employees in respect of whom clarifications (additions) were made.

When filling out line 010 in the updated calculation for the corresponding billing (reporting) period, the adjustment number is indicated (for example, “1—”, “2—” and so on). In this case, you need to fill out all the fields of the form, both those that require adjustment and those that do not require adjustment.

Section 3: Personalized employee data

Section 3 “Personalized information about insured persons” as part of the calculation of insurance premiums for the 4th quarter of 2021 must be filled out for all insured persons for October, November and December 2017, including in whose favor payments were accrued for January - December 2017 within the framework of labor relations and civil contracts. Subsection 3.1 of Section 3 shows the personal data of the insured person - the recipient of the income: Full name, Taxpayer Identification Number, SNILS, etc.

In subsection 3.2 of Section 3, provide information on the amounts of payments calculated in favor of the individual, as well as information on accrued insurance contributions for compulsory pension insurance. Here is an example of filling out section 3.

Payments to an employee - a citizen of the Russian Federation and accrued contributions to compulsory pension insurance for the 4th quarter of 2021.

| Index | October | november | December | 4th quarter |

| All payments | 28 000 | 28 181,45 | 28 000 | 84 181,45 |

| Non-taxable payments | – | 4 602,90 | – | 4 602,90 |

| Contribution base | 28 000 | 23 578,55 | 28 000 | 79 578,55 |

| Contributions to OPS | 6 160 | 5 187,28 | 6 160 | 17 507,28 |

Under these conditions, section 3 of the calculation of insurance premiums for the 4th quarter of 2021 will look like this:

Please note that for persons who did not receive payments for the last three months of the reporting period (October, November and December), subsection 3.2 of section 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums).

Employees who left in the previous reporting period

Include dismissed employees in the total number of insured persons (column 1 of line 010 of subsection 1.1 of appendix 1 to section 1). Show employees who quit in the previous quarter in subsection 3.1 of the calculation of insurance premiums. You have not accrued payments to such employees in the last three months, so do not fill out subsection 3.2 for them.

Copies of section 3 of the calculation must be given to employees. The period is five calendar days from the date when the person applied for such information. Give each person a copy of Section 3, which contains information only about them. If you submit calculations in electronic formats, you will need to print paper copies. Give the extract from Section 3 to the person also on the day of dismissal or termination of the civil contract. The extract must be prepared for the entire period of work starting from January 2021.

Check SNILS

Some Federal Tax Service Inspectors, before submitting calculations for insurance premiums for the 4th quarter of 2021, sent out information messages about changes in the technology for receiving reports. Such messages note that settlements will not be considered accepted if information about individuals does not match the data in the Federal Tax Service databases. Problems may arise, for example, with SNILS, date and place of birth. Here is the text of such an information message:

Dear taxpayers (tax agents)!

Please note that the algorithm for accepting calculations for insurance premiums has been changed (in accordance with the order of the Federal Tax Service of Russia dated 10.10.2016 No. ММВ-7-11 / [email protected] “On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format submission of calculations for insurance premiums in electronic form").

In case of unsuccessful identification of insured individuals reflected in section 3 “Personalized information about insured persons”, a refusal to accept the Calculation will be generated.

Previously, when a single violation was detected - unsuccessful identification of insured individuals from section 3, a Notification of clarification was automatically generated (in this case, the calculation was considered accepted).

In order to avoid refusal to accept Calculations for insurance premiums due to a discrepancy between the information on the persons indicated in the calculation and the information available with the tax authority, we recommend that you verify the personal data of individuals indicated in the calculation (full name, date of birth, place of birth, Taxpayer Identification Number, passport details , SNILS) for the purpose of presenting outdated data in the calculation. Also, similar data must be verified with the information contained in the information resources of the Pension Fund of the Russian Federation for unambiguous identification of the SNILS of the insured individual.

What mistakes should not be made in the RSV

We have already written that starting this year, the DAM is accepted according to new rules. In particular, the list of critical errors has expanded. In the following table we have collected form fields, errors in which will become an obstacle to passing the DAM.

Table 4. Critical data of the DAM form

| Information you can't go wrong | Fields |

| the amount of payments and other remuneration for each of the last three months of the reporting or billing period | 210 |

| the basis for calculating pension contributions within the limit for the same months | 220 |

| the amount of calculated pension contributions within the limit for the same months | 240 |

| base for calculating pension contributions at an additional tariff for each of the last three months of the reporting or billing period | 280 |

| the amount of calculated pension contributions at the additional tariff for the same months | 290 |

| Relationships that must be fulfilled | |

| line 061 in columns 3–5 of appendix 1 of section 1 of the calculation must coincide with the amounts of lines 240 of section 3 for each month, respectively | |

| the totals for columns 280, 290 must correspond to the data in line 300 | |

| the totals for columns 210, 220 and 240 must correspond to the data in line 250 | |

| Note. The summary data in the listed lines for all individuals must correspond to the summary data in subsections 1.1 and 1.3 of the calculation. | |

Important! In addition, the report will not be accepted if false personal data identifying the insured persons (full name, SNILS, INN) is provided.

If payment is not accepted

If the DAM contains critical errors, the Federal Tax Service must send a notification to the policyholder the next day. The following deadlines are allotted for correction:

- when submitting the DAM in electronic form - 5 days from the date of sending the electronic notification;

- when submitted on paper - 10 days from the date of sending the notice on paper.

If the policyholder manages to correct himself within this time frame, there will be no fine.

Appendix No. 3 to section 1: benefits costs

In Appendix 3 to Section 1 as part of the annual DAM for 2021, record information on expenses for the purposes of compulsory social insurance (if such information is not available, then the Appendix is not filled out, since it is not mandatory).

In this application, show only benefits from the Social Insurance Fund accrued in 2021. The date of payment of the benefit and the period for which it was accrued do not matter. For example, reflect a benefit accrued at the end of December and paid in January in the calculation for the year. Reflect sick leave benefits, which are open in December and closed in January, only in calculations for the 1st quarter of 2021.

Benefits at the expense of the employer for the first three days of illness of the employee should not appear in Appendix 3. Enter all data into this application on an accrual basis from the beginning of 2021 (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

As for the filling example, the lines of Appendix 3 to Section 1 should be formed as follows:

| In column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation). |

| In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation): – in lines 010 – 031 and 070 – the number of days for which benefits were accrued at the expense of the Social Insurance Fund; – in lines 060 – 062 – the number of monthly child care benefits. For example, if you paid benefits to two employees throughout the year, enter 24 in line 060; – in lines 040, 050 and 090 – the number of benefits. |

Here is a sample of the reflection of benefits as part of the calculation for the 4th quarter of 2021. In 2021 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for October, November, December, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles;

- total benefits accrued - 44,439.90 rubles. (RUB 22,902.90 + RUB 21,537.00).

Benefits exceeded assessed contributions

Write down the difference between accrued benefits and insurance premiums in line 120 of section 1 and in column 2 of line 090 of Appendix 2. In column 1 of line 090, enter sign 2, and in line 110 of section 1, enter zero. Enter the amounts for each of the last three months in the appropriate subrows.

Where to report to branches

The calculation is submitted at its location if a separate division (SU) is authorized to accrue payments to individuals.

The fact that the branch has its own current account and separate balance sheet does not matter.

A settlement at its location is not provided if the OP does not make payments.

Part 2 Chapter 34 Article 431 Clause 11 of the Tax Code of the Russian Federation and Article 11 of the Federal Law of December 15, 2001 No. 167-FZ, as amended on December 14, 2015.

Contributions to pensions and medicine: subsections 1.1 – 1.2 of Appendix 1 to section. 1

Appendix 1 to section 1 of the calculation includes 4 blocks:

| № | Block |

| 1 | subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” |

| 2 | subsection 1.2 “Calculation of insurance premiums for compulsory health insurance” |

| 3 | subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation” |

| 4 | subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations” |

In line 001 “Payer tariff code” of Appendix 1 to section 1, indicate the applicable tariff code.

In the annual calculation for the 4th quarter of 2021, you need to include as many appendices 1 to section 1 (or individual subsections of this appendix) as tariffs were applied during 2021 (from January to December inclusive). Let us explain the features of filling out the required subsections.

Subsection 1.1: pension contributions

Subsection 1.1 is a mandatory block. It contains the calculation of the taxable base for pension contributions and the amount of insurance contributions for pension insurance. Let us explain the indicators of the lines of this section:

- line 010 – total number of insured persons;

- line 020 – the number of individuals from whose payments you calculated insurance premiums in the reporting period (from January to December 2017);

- line 021 – the number of individuals from line 020 whose payments exceeded the maximum base for calculating pension contributions;

- line 030 – amounts of accrued payments and rewards in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not included here;

- in line 040 reflect: the amount of payments not subject to pension contributions (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is reflected within the limits determined by paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

- on line 061 - from a base that does not exceed the limit (RUB 876,000);

Record the data in subsection 1.1 as follows: provide data from the beginning of 2021, as well as for the last three months of the reporting period (October, November and December 2021).

Example: An organization using the general regime charges contributions at basic rates. It employs 10 people.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions: – to OPS | 249 634 | 65 264,76 | 64 292,04 | 70 733,74 | 449 924,54 |

| – on compulsory medical insurance | 57 869,70 | 15 129,56 | 14 904,06 | 16 397,37 | 104 300,69 |

Subsection 1.2: medical contributions

Subsection 1.2 is a mandatory section. It contains the calculation of the taxable base for health insurance premiums and the amount of insurance premiums for health insurance. Here is the principle of forming strings:

- line 010 – total number of insured persons for 12 months of 2017.

- line 020 - the number of individuals from whose payments you calculated insurance premiums;

- line 030 – amounts of payments in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not shown on line 030;

- on line 040 – amounts of payments: not subject to insurance contributions for compulsory health insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation.

Subsection 1.3 – fill out if you pay insurance premiums for compulsory pension insurance at an additional rate. And subsection 1.4 - if from January 1 to December 31, 2021, you transferred insurance contributions for additional social security for members of flight crews of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.

DAM for the 1st quarter of 2021: features of filling out and submitting, common errors

After all, the object of taxation with insurance premiums for payers, unless otherwise provided by Art. 420 of the Tax Code of the Russian Federation, payments and other remuneration in favor of individuals subject to compulsory social insurance are recognized (clause 1 of Article 420 of the Tax Code of the Russian Federation). Separately Art. 422 of the Tax Code of the Russian Federation provides for exceptions, that is, payments that are not subject (exempt) to insurance premiums. In particular, these include monthly benefits for child care up to 1.5 years.

More to read: Refuse Chernobyl status and receive compensation for it

The personal data reflected in section 3 “Personalized information about insured persons” of the calculation is clarified on the basis of notifications received from tax authorities: about clarification of the calculation, about refusal to accept it, that the calculation is considered not submitted, or requests for explanations.

Contributions for disability and maternity: Appendix No. 2 to Section 1

Appendix 2 to Section 1 calculates the amount of contributions for temporary disability and in connection with maternity. The data is shown in the following context: total from the beginning of 2021 to December 31, as well as for October, November and December 2021. In field 001 of Appendix No. 2, you must indicate the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity:

- “1” – direct payments of insurance coverage (if there is a pilot social insurance project in the region);

- “2” – offset system of insurance payments (when the employer pays benefits and then receives the necessary compensation (or offset) from the Social Insurance Fund).

If there is no FSS pilot project in your region, then you have the right to reduce mandatory social contributions for benefits. Show the total amounts in line 090 of Appendix 2 to Section 1. These figures will always be positive, even if the benefits exceeded insurance contributions to the Social Insurance Fund.

Negative amounts of accrued contributions as part of the calculation of insurance premiums for the 4th quarter of 2021 should not be recorded. After all, officials from the Pension Fund of the Russian Federation will not be able to distribute the amounts with a minus to the individual personal accounts of employees.

Inspectorate of the Federal Tax Service

Sometimes benefits costs exceed accrued medical premiums. Some accountants record this difference in line 090 of Appendix No. 2 to Section 1 of the calculation with a minus sign. However, this is wrong. In such a situation, specify the line 090 attribute:

- “1” if the amount in line 090 is greater than or equal to 0;

- "2" if the amount is less than 0.

If you send to the Federal Tax Service a calculation of insurance premiums for the 4th quarter of 2021 with negative values, then you will need to submit an updated report (letters from the Federal Tax Service dated August 23, 2021 No. BS-4-11/16751, dated August 24, 2021 No. BS- 4-11/16793).

Some accountants do not pay attention to such filling rules. And they show negative contribution amounts with code 1. This error should be corrected:

| In line 090 of Appendix 2 to Section 1, enter the positive values of the amounts with code 2. Check that lines 110-123 of Section 1 also contain positive numbers. |

Let’s assume that there are 10 people in the organization; the organization accrues and pays benefits to them itself. The amounts of payments, contributions to VNiM and benefits accrued from the Social Insurance Fund for all employees for 2017 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions to VNiM | 32 906,30 | 8 603,08 | 8 474,86 | 9 323,99 | 59 308,23 |

| Benefits from the Social Insurance Fund | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

Line indicator 090 of Appendix 2 to section. 1 is equal to:

- in column 2 – 14,868.33 rubles. (RUB 59,308.23 – RUB 44,439.90);

- in column 4 – 262.03 rubles. (RUB 26,401.93 – RUB 26,139.90);

- in column 6 – 1,424.08 rubles. (RUB 8,603.08 – RUB 7,179);

- in column 8 – -3,307.04 rub. (RUB 8,474.86 – RUB 11,781.90);

- in column 10 – RUB 2,144.99. (RUB 9,323.99 – RUB 7,179).

Section 1: Summary Data

In section 1 of the annual calculation for 2021, reflect the general indicators for the amounts of insurance premiums payable. The part of the document in question consists of lines from 010 to 123, which indicate OKTMO, the amount of pension and medical contributions, contributions for temporary disability insurance and some other deductions. Also in this section you will need to indicate the BCC by type of insurance premiums and the amount of insurance premiums for each BCC that are accrued for payment for 2021.

Pension contributions

On line 020, indicate the KBK for contributions to compulsory pension insurance. On lines 030–033 - show the amount of insurance contributions for compulsory pension insurance, which must be paid to the above BCC:

- on line 030 – for the reporting period on an accrual basis (from January to December inclusive);

- on lines 031-033 – for the last three months of the billing (reporting) period (October, November and December).

Medical fees

On line 040, indicate the BCC for contributions to compulsory health insurance. On lines 050–053 – distribute the amounts of insurance premiums for compulsory health insurance that must be paid:

- on line 050 - for the reporting period (2017) on an accrual basis (that is, from January to December);

- on lines 051 – 053 for the last three months of the reporting period (October, November and December).

Pension contributions at additional rates

On line 060, indicate the BCC for pension contributions at additional tariffs. On lines 070 – 073 – amounts of pension contributions at additional tariffs:

- on line 070 – for 2021 (from January 1 to December 31);

- on lines 071 – 073 for the last three months of the reporting period (October, November and December).

If there were no payments for additional tariffs, then enter zeros.

Additional social security contributions

On line 080, indicate the BCC for contributions to additional social security. On lines 090–093 – the amount of contributions for additional social security:

- on line 090 – for 2021 (for 12 months) on an accrual basis (from January to December inclusive);

- on lines 091 – 093 for the last three months of the reporting period (October, November and December).

Social insurance contributions

On line 100, indicate the BCC for contributions to compulsory social insurance in case of temporary disability and in connection with maternity. On lines 110 – 113 – the amount of contributions for compulsory social insurance:

- on line 110 - for the entire year 2021 on an accrual basis (from January to December inclusive);

- on lines 111 – 113 for the last three months of the billing (reporting) period (that is, for October, November and December).

On lines 120–123, indicate the amount of excess social insurance expenses incurred:

- on line 120 – for 12 months of 2021

- on lines 121–123 – October, November and December 2021.

If there were no excess expenses, then enter zeros in this block.

Deadlines for submitting reports on insured persons to regulatory authorities in 2021

And also, policyholders, in accordance with the amendments made to Article 11 of the Federal Law on Personalized Accounting No. 27-FZ, annually no later than March 1 of the year following the reporting year must submit to the Pension Fund information about the length of service for each insured person working for them. Policyholders will have to submit SZV-STAZH for the first time by 03/01/2020 for 2021.

- January 16, 2021 for December 2021;

- February 15 for January 2021;

- March 15 for February 2021;

- April 16 (since April 15 is a Sunday) for March 2020;

- May 15 for April 2021;

- June 15 for May 2021;

- July 16 (July 15 - Sunday) for June 2021;

- August 15 for July 2021;

- September 17 for August 2021;

- October 15 for September 2021;

- November 15 for October 2021;

- December 17 for November 2021.

25 Jul 2021 stopurist 636

Share this post

- Related Posts

- Sample resume without work experience for an accountant

- Studying at a vocational school is included in the length of service for calculating a pension

- How to pay the state fee to replace a driver’s license for public services

- How much does a cube of hot water cost by meter 2021 in Tomsk

Checking the calculation using control ratios

If you have compiled a calculation of insurance premiums for the 4th quarter of 2017 and are submitting it to the Federal Tax Service, then keep in mind that controllers will check it for compliance with control ratios. At the same time, updated ratios are applied from the reporting for the 4th quarter of 2021. The controls and formulas established for the acceptance of settlements were communicated to taxpayers in the letter of the Federal Tax Service of Russia dated December 13, 2021 No. GD-4-11/25417.

In this case, you can first check the generated file with the annual calculation for compliance with the specified control ratios. As reported on the official website of the tax department, a new functionality has been added to the “Legal Taxpayer” program that allows you to identify errors in the calculation of insurance premiums (https://www.nalog.ru/rn77/program/5961229/). The adjustment is related to the corresponding innovations of the Tax Code (paragraph 2, paragraph 7, article 431 of the Tax Code of the Russian Federation as amended by paragraph 78, article 2 of the Federal Law of November 27, 2021 No. 335-FZ).

Tax officials noted that from January 1, 2021, when accepting a calculation (updated calculation) for insurance premiums, the tax authority will monitor not only the discrepancy in information about the calculated amounts of insurance premiums for compulsory health insurance, but also the discrepancy in the following parameters:

- amounts of payments and other remuneration in favor of individuals;

- bases for calculating insurance premiums for compulsory health insurance within the established limit;

- bases for calculating insurance premiums for compulsory health insurance at an additional rate;

- amounts of insurance premiums for compulsory health insurance at an additional rate.

The calculation of insurance premiums is checked for compliance with the indicators from the 6-NDFL report. For example: The amount of accrued income subject to personal income tax, minus dividends (line 020 indicator minus the amount on line 025 of the calculation in Form 6-NDFL), must be greater than or equal to the amount of income on line 030 “Amount of payments and other remuneration calculated in favor of individuals » subsection 1.1 of Appendix 1 of the single calculation for the corresponding period.

Due dates for the DAM for the 1st quarter of 2021

DAM 1st quarter 2021 - the deadlines for submitting this report are subject to the uniform rules established by the Tax Code of the Russian Federation. However, for 2021, additional decisions have been made at the legislative level to postpone holidays, and this has an impact on the final date of the deadline.

But in 2021, the rules introduced specifically for this year by Decree of the Government of the Russian Federation dated October 14, 2020 No. 1250 with the aim of transferring rest days to optimize their use are also significant. Of the dates shifted according to this resolution for the DAM, formed for the 1st quarter, 2 weekend shifts are important: